false

0001433607

0001433607

2024-10-07

2024-10-07

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): October 7, 2024

InspireMD,

Inc.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-35731

|

|

26-2123838 |

(State

or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS

Employer

Identification No.) |

4

Menorat Hamaor St.

Tel

Aviv, Israel |

|

6744832 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

Registrant’s

telephone number, including area code: (888) 776-6804

(Former

name or former address, if changed since last report.)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock, $0.0001 par value per share |

|

NSPR |

|

The

Nasdaq Capital Market |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

7.01. Regulation FD Disclosure.

On

October 7, 2024, InspireMD, Inc. (the “Company”) issued a press release titled “InspireMD Announces Approval of Investigational

Device Exemption (IDE) Application for CGUARDIANS II Pivotal Study of the CGuard Prime 80cm Carotid Stent System”. A copy of the

press release is furnished herewith as Exhibit 99.1 to this Current Report on Form 8-K and incorporated by reference in this Item 7.01.

In

accordance with General Instruction B.2 of Form 8-K, the information in this Current Report on Form 8-K that is furnished pursuant to

this Item 7.01, including Exhibit 99.1, shall not be deemed to be “filed” for the purposes of Section 18 of the Securities

Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, and shall

not be incorporated by reference into any registration statement or other document filed under the Securities Act of 1933, as amended,

or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item

8.01. Other Events.

On

October 7, 2024, the Company announced that the U.S. Food and Drug Administration (FDA) has approved the Company’s Investigational

Device Exemption (IDE) Application to initiate the CGUARDIANS II pivotal study of its CGuard Prime 80cm Carotid Stent System during transcarotid

revascularization (TCAR) procedures.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

INSPIREMD,

INC. |

| |

|

|

| Date:

October 7, 2024 |

By: |

/s/

Craig Shore |

| |

Name: |

Craig

Shore |

| |

Title: |

Chief

Financial Officer |

Exhibit

99.1

InspireMD

Announces Approval of Investigational Device Exemption (IDE) Application for CGUARDIANS II Pivotal Study of the CGuard Prime 80cm Carotid

Stent System

Miami,

Florida — October 7, 2024 – InspireMD, Inc. (Nasdaq: NSPR), developer of the CGuard™ Embolic Prevention Stent System

(EPS) for the prevention of stroke, today announced that the U.S. Food and Drug Administration (FDA) has approved the company’s

Investigational Device Exemption (IDE) Application to initiate the CGUARDIANS II pivotal study of its CGuard Prime 80cm Carotid Stent

System during transcarotid revascularization (TCAR) procedures.

In

February 2024, InspireMD announced that Patrick Geraghty, M.D., professor of surgery and radiology, section of vascular surgery at Washington

University School of Medicine in St. Louis, MO, and Patrick Muck, M.D., program director and chief of vascular surgery at Good Samaritan

Hospital in Cincinnati, OH, have agreed to act as lead investigators for the trial.

Marvin

Slosman, Chief Executive Officer of InspireMD, stated, “The approval of our CGUARDIANS II IDE is an important milestone and a significant

step forward in our mission to serve the broadest range of physician and patient needs with a comprehensive set of tools that can deliver

our best-in-class carotid stent system, CGuard Prime, for both CAS and TCAR procedures. The CGUARDIANS II study is intended to facilitate

approval of the use of CGuard Prime in an optimized TCAR version and indication.”

“In

parallel, we continue to advance development of our comprehensive next generation TCAR Neuroprotection System, SwitchGuard NPS. Each

of these initiatives helps pave the way, once approved, for us to initiate commercial sales and strive for market leadership in the United

States. Our mission to improve stroke prevention and carotid disease management with our CGuard platforms continues as we build our company

toward U.S. expansion and global success. Additionally, as we previously announced, we are thrilled to have Dr. Patrick Geraghty and

Dr. Patrick Muck as co-principal investigators for the study, as well as a world class group of investigators committed to the trial’s

success,” Mr. Slosman concluded.

About

InspireMD, Inc.

InspireMD

seeks to utilize its proprietary MicroNet® technology to make its products the industry standard for carotid stenting by providing

outstanding acute results and durable, stroke-free long-term outcomes. InspireMD’s common stock is quoted on the Nasdaq under the

ticker symbol NSPR.

We

routinely post information that may be important to investors on our website. For more information, please visit www.inspiremd.com.

Forward-looking

Statements

This

press release contains “forward-looking statements.” Forward-looking statements include, but are not limited to, statements

regarding InspireMD or its management team’s expectations, hopes, beliefs, intentions or strategies regarding the future. Such

statements may be preceded by the words “intends,” “may,” “will,” “plans,” “expects,”

“anticipates,” “projects,” “predicts,” “estimates,” “aims,” “believes,”

“hopes,” “potential”, “scheduled” or similar words. Examples of such statements include, but are

not limited to, statements relating to the C-GUARDIANS U.S. IDE clinical trial, including one-year results from such trial presented

at LINC 2024, the C-GUARDIANS II trial, including the timing of its commencement, as well as the timing and outcome of any subsequent

results, potential FDA approval, or potential launch or commercialization in the U.S. or elsewhere. Forward-looking statements are not

guarantees of future performance, are based on certain assumptions and are subject to various known and unknown risks and uncertainties,

many of which are beyond the company’s control, and cannot be predicted or quantified and consequently; actual results may differ

materially from those expressed or implied by such forward-looking statements. Such risks and uncertainties include, without limitation,

risks and uncertainties associated with our history of recurring losses and negative cash flows from operating activities, significant

future commitments and the uncertainty regarding the adequacy of our liquidity to pursue our complete business objectives, and substantial

doubt regarding our ability to continue as a going concern; our need to raise additional capital to meet our business requirements in

the future and such capital raising may be costly or difficult to obtain and could dilute our stockholders’ ownership interests;

market acceptance of our products; an inability to secure and maintain regulatory approvals for the sale of our products; negative clinical

trial results or lengthy product delays in key markets; our ability to maintain compliance with the Nasdaq listing standards; our ability

to generate revenues from our products and obtain and maintain regulatory approvals for our products; our ability to adequately protect

our intellectual property; our dependence on a single manufacturing facility and our ability to comply with stringent manufacturing quality

standards and to increase production as necessary; the risk that the data collected from our current and planned clinical trials may

not be sufficient to demonstrate that our technology is an attractive alternative to other procedures and products; intense competition

in our industry, with competitors having substantially greater financial, technological, research and development, regulatory and clinical,

manufacturing, marketing and sales, distribution and personnel resources than we do; entry of new competitors and products and potential

technological obsolescence of our products; inability to carry out research, development and commercialization plans; loss of a key customer

or supplier; technical problems with our research and products and potential product liability claims; product malfunctions; price increases

for supplies and components; insufficient or inadequate reimbursement by governmental and other third-party payers for our products;

our efforts to successfully obtain and maintain intellectual property protection covering our products, which may not be successful;

adverse federal, state and local government regulation, in the United States, Europe or Israel and other foreign jurisdictions; the fact

that we conduct business in multiple foreign jurisdictions, exposing us to foreign currency exchange rate fluctuations, logistical and

communications challenges, burdens and costs of compliance with foreign laws and political and economic instability in each jurisdiction;

the escalation of hostilities in Israel, which could impair our ability to manufacture our products; and current or future unfavorable

economic and market conditions and adverse developments with respect to financial institutions and associated liquidity risk. More detailed

information about the Company and the risk factors that may affect the realization of forward-looking statements is set forth in the

Company’s filings with the Securities and Exchange Commission (SEC), including the Company’s Annual Report on Form 10-K and

its Quarterly Reports on Form 10-Q. Investors and security holders are urged to read these documents free of charge on the SEC’s

web site at http://www.sec.gov. The Company assumes no obligation to publicly update or revise its forward-looking statements as a result

of new information, future events or otherwise.

Investor

Contacts:

Craig

Shore

Chief

Financial Officer

InspireMD,

Inc.

888-776-6804

craigs@inspiremd.com

Chuck

Padala, Managing Director

LifeSci

Advisors

646-627-8390

chuck@lifesciadvisors.com

investor-relations@inspiremd.com

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

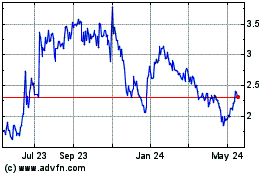

InspireMD (NASDAQ:NSPR)

Historical Stock Chart

From Nov 2024 to Dec 2024

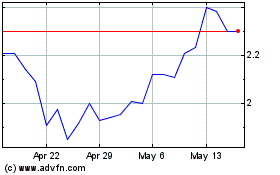

InspireMD (NASDAQ:NSPR)

Historical Stock Chart

From Dec 2023 to Dec 2024