CAUTIONARY

NOTE ON FORWARD-LOOKING STATEMENTS

Certain

statements and other information set forth in this prospectus supplement and the accompanying prospectus may relate to future

events and expectations, and as such constitute “forward-looking statements” within the meaning of Section 21E of

the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and Section 27A of the Securities Act of 1933,

as amended (the “Securities Act”). Our forward-looking statements include, but are not limited to, statements regarding

our business strategy, plans and objectives and our expected or contemplated future operations, results, financial condition,

beliefs and intentions. In addition, any statements that refer to projections, forecasts or other characterizations or predictions

of future events or circumstances, including any underlying assumptions on which such statements are expressly or implicitly based,

are forward-looking statements. The words “anticipate”, “believe”, “continue”, “can”,

“could”, “estimate”, “expect”, “intend”, “may”, “might”,

“plan”, “possible”, “potential”, “predict”, “project”, “scheduled”,

“seek”, “should”, “would” and similar expressions, among others, and negatives expressions

including such words, may identify forward-looking statements.

Our

forward-looking statements reflect our current expectations about our future results, performance, liquidity, financial condition,

prospects and opportunities, and are based upon information currently available to us, our interpretation of what we believe to

be significant factors affecting our business and many assumptions regarding future events. Actual results, performance, liquidity,

financial condition, prospects and opportunities could differ materially from those expressed in, or implied by, our forward-looking

statements. This could occur as a result of various risks and uncertainties, including the following:

●

the persistence of the ongoing global coronavirus (COVID-19) pandemic on our business with respect to the potential duration and

frequency of the various Government-ordered emergency measures including travel restrictions, social distancing and/or shelter

in place orders and closure of retail and leisure, resurgences in various regions and appearances of new variants requiring ongoing

reinstitution of such Government-ordered emergency measures;

●

government regulation of our industries;

●

our ability to compete effectively in our industries;

●

the effect of evolving technology on our business;

●

our ability to renew long-term contracts and retain customers, and secure new contracts and customers;

●

our ability to maintain relationships with suppliers;

●

our ability to protect our intellectual property;

●

our ability to protect our business against cybersecurity threats;

●

our ability to successfully grow by acquisition as well as organically;

●

fluctuations due to seasonality;

●

our ability to attract and retain key members of our management team;

●

our need for working capital;

●

our ability to secure capital for growth and expansion;

●

changing consumer, technology and other trends in our industries;

●

our ability to successfully operate across multiple jurisdictions and markets around the world;

changes

in local, regional and global economic and political conditions; and

●

other factors.

In

light of these risks and uncertainties, and others discussed in this prospectus supplement, there can be no assurance that any

matters covered by our forward-looking statements will develop as predicted, expected or implied. Readers should not place undue

reliance on any forward-looking statements. Except as expressly required by the federal securities laws, we undertake no obligation

to publicly update or revise any forward-looking statements, whether as a result of new information, future events, changed circumstances

or any other reason. We advise you to carefully review the reports and documents we file from time to time with the SEC.

PROSPECTUS

SUPPLEMENT SUMMARY

This

summary contains selected information about us and this offering. Because this is a summary, it may not contain all the information

that may be important to you. You should read this entire prospectus supplement and the accompanying prospectus carefully, including,

but not limited to, the information set forth under our consolidated financial statements and the schedules and related notes,

“Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations”

included in our Annual Report on Form 10-K for the fiscal year ended December 31, 2020 filed with the SEC on March 29, 2021 (as

amended by Amendment No. 1 on Form 10-K/A filed with the SEC on May 10, 2021), our Quarterly Report on Form 10-Q for the three

months ended March 31, 2021 filed with the SEC on May 14, 2021, both of which are incorporated by reference herein, and the other

information incorporated by reference into this prospectus supplement and the accompanying prospectus.

Overview

We

are a global gaming technology company, supplying content, platform and other products and services to online and land-based regulated

lottery, betting and gaming operators worldwide through a broad range of distribution channels, predominantly on a business-to-business

basis. We provide end-to-end digital gaming solutions (i) on our own proprietary and secure network, which accommodates a wide

range of devices, including land-based gaming machine terminals, mobile devices and online computer applications and (ii) through

third party networks. Our content and other products can be found through the consumer-facing portals of our interactive customers

and, through our land-based customers, in licensed betting offices, adult gaming centers, pubs, bingo halls, airports, motorway

service areas and leisure parks.

Our

customer base includes regulated operators of lotteries, licensed sports bookmakers, gaming and bingo halls, casinos and regulated

online operators, adult gaming centers, pubs, holiday parks, and motorway service areas. Some of our key customers include William

Hill, SNAI, Sisal, Lottomatica, Betfred, Paddy Power and Betfair (each part of Flutter Entertainment), Genting, bet365, Sky Bet,

Fortuna, the Greek Organisation of Football Prognostics, Entain, the Pennsylvania Lottery, Bourne Leisure, Stonegate, Mitchells

& Butler, Marstons, Greene King, JD Wetherspoon, Parkdean Resort, Centre Parcs Resorts and Novomatic. Geographically, 70%

of our revenues (excluding $42.2 million of VAT-related revenue remitted to us by two of our major UK customers, to which we were

entitled because of a UK tax ruling, which created a rebate of value added tax that had otherwise been incorrectly applied to

certain gaming machines in their estate in the past) for the year ended December 31, 2020 were generated from our UK operations,

with the remainder generated from Italy, Greece and the rest of the world.

Our

products are designed to operate within applicable gaming and lottery regulations and our customers are regulated gaming or lottery

operators or are otherwise licensed to operate our products.

We

conduct business across different jurisdictions of which United Kingdom, Italy and Greece have historically contributed the most

significant recurring revenues. We are licensed or certified (as applicable) by the Gambling Commission in the United Kingdom,

and by the Hellenic Gaming Commission in Greece, and registered with L’Agenzia delle dogane e dei Monopoli in Italy. We

are licensed by regulators in other jurisdictions such as the Malta Gaming Authority, Licensing Authority of Gibraltar, the Alderney

Gambling Control Commission, the Belgian Commission, Autorité Des Marchés Financiers (Quebec) and we hold licenses

with the states of New Jersey, Illinois, Saskatchewan, Michigan and West Virginia. We are currently in the process of applying

for licensure in Pennsylvania and Alberta, where we expect to benefit from any future market growth.

Certain

product and company names referred to herein are trademarks™ or registered® trademarks of their respective holders.

Product

Overview

We

currently operate in four business segments: Gaming, Leisure, Virtual Sports and Interactive, as further described below.

Gaming

Segment

Our

Gaming segment supplies gaming terminals as well as gaming software and games for the terminals provided to betting offices, casinos,

gaming halls and high street adult gaming centers. It utilizes our Server Based Gaming (“SBG”) technology to supply

products to our customers’ global land-based gaming venues. SBG products offer an extensive portfolio of games through digital

terminals. Our games are currently deployed through more than 31,500 digital terminals. Because our SBG products are fully digital,

they interact with a central server and are provided on a “distributed” basis, which allows us to access a wide geographic

footprint through internet and proprietary networks.

Our

SBG game portfolio includes a broad selection of popular omni-channel slots titles including the CenturionTM game family and Super

Hot FruitsTM (featuring the Sizzling Hot SpinsTM game family). These games offer customers a wide range

of volatilities, return-to-player and other special features, which we collectively refer to as “game math.” We also

offer a range of more traditional casino games through our SBG network, such as roulette, blackjack and numbers games.

We

distribute games to devices through different game management systems (“GMS”), each tailored to a specific operator

or sector. Our CORETM GMS is designed for distributed street-gaming sectors and uses the Company’s cabinets in

combination with gaming content from the Company, as well as a wide portfolio of content from independent game developers. CORE-CONNECT

is our American Gaming Association G2S standard-based video lottery terminal (“VLT”) GMS, currently deployed in the

Greek VLT sector and North America. Our SBG products comply with all requirements in the UK (B2/B3), Italy (‘6B), Greece

(G2S) and Illinois (G2S).

Our

SBG terminals in the United Kingdom account for a material portion of all SBG terminal placements, and we offer over 150 games

for play across this portfolio. We are also a material supplier to customers in Greece and Italy. Over the past two years, we

have grown our business in North America where we have sold products in Illinois and to the Western Canada Lottery Corporation.

We offer SBG terminals such as the Flex4k curved screen, EclipseTM, ValorTM, OptimusTM, BlazeTM

and Sabre HydraTM, each offering a different size terminal, graphics, technology and price proposition.

Leisure

Segment

We

are a supplier of gaming terminals and amusement machines to the Leisure and Hospitality sectors and one of the largest operators

of “pay to play” gaming terminals and amusement machines in the UK. As of December 31, 2020, we supplied and operated

over 11,600 gaming terminals and 7,000 pool tables, prize vending and jukeboxes located in pubs, bingo halls, bowling centers,

family entertainment centers and adult gaming centers. We also service approximately 2,200 gaming terminals under maintenance

only contracts. The increasing majority of gaming terminals we operate are server based, allowing us to distribute content supplied

by our “in house” design studios as well as some of the most popular content titles from our strategic partners.

In

addition, we also supply and operate approximately 9,300 amusement machines and 2,200 gaming terminals in family entertainment

centers and adult gaming centers located in holiday parks, bowling centers and other entertainment venues. These include virtual

reality simulators and arcade games, redemption and skill with prize games, basketball, air hockey and cue sports. Commercial

arrangements across our Leisure segment are typically structured as either revenue participations or fixed fee rental agreements.

Our

customers in this segment include the vast majority of recognizable brands that participate in the geographies and sectors in

which we operate. These customers include large pub operators JD Wetherspoons, Stonegate Pub Company, Marstons PLC, Greene King,

Mitchells and Butler, Punch Taverns, Whitbread and Star Pubs and Bars (Heineken). In the Bingo sector, we supply gaming terminals

and services to Buzz Bingo and Mecca. We supply gaming terminals and services to transport hub operators, Moto and Welcome Break

and major airports including Heathrow. We also operate our own adult gaming centers under the Quicksilver brand in Extra Motorway

Services. We have commercial joint ventures with holiday park operators Parkdean Resorts and Bourne Leisure across their Haven

and Warner Hotels brands, where we supply machines and trained staff to manage and operate gaming machines and non-gaming machines.

Virtual

Sports Segment

Our

Virtual Sports business designs, develops, markets and distributes ultra-high-definition games that create an always-on sports

wagering experience in betting shops, other locations and online. Our Virtual Sports product comprises a complex software and

networking package that provides fixed odds wagering on an ultra-high definition computer rendering of a simulated sporting event,

such as soccer, football or basketball. Players can bet on the simulated sporting event, in both a streaming and on-demand environment,

overcoming the relative infrequency of live sporting events. We have developed this product using an award-winning TV and film

graphics team with advanced motion capture techniques.

We

believe we are one of the most innovative suppliers of Virtual Sports gaming products in the world. We offer a wide range of sports

and numbers games to approximately 32,000 retail venues as well as through various online websites. Our products are installed

in over 35 gaming jurisdictions worldwide, including the UK, Italy, Greece, Morocco, and the U.S.

Our

Virtual Sports game portfolio includes titles such as V-Play Soccer, V-Play Football, V-Play Basketball, Virtual Grand National

and V-Play NFLA, as well as greyhounds, other horse racing products, tennis, motor racing, cycling, cricket, speedway, golf and

darts. We have also licensed the use of images of certain sports brands in our games, including with the NFL Alumni. We also entered

into a partnership with the UK Jockey Club to create the Virtual Grand National, which has aired on live UK television since 2017.

Our

customers are many of the largest operators in lottery, gaming and betting worldwide. We are contracted to supply Virtual Sports

to mobile and online operators in the United Kingdom, the U.S. states of Nevada, Pennsylvania and New Jersey; Gibraltar and other

regulated EU sectors, including Italy, Greece and Poland; and other jurisdictions such as Turkey and Morocco. Virtual Sports can

be adapted to function in sports betting, lottery, or gaming environments and is therefore available to a wide range of customers

in both public and private implementations.

The

Virtual Sports events are capable of being offered to millions of our customers’ customers, through land-based, online and

mobile platforms, many of them available 24 hours per day, 7 days per week, and often concurrently within the same location or

interactive platform. We have multiple hosting solutions capable of fulfilling the product delivery needs of our customers including

our proprietary Virtual Plug and Play end to end online and mobile turnkey solutions. In addition, a cloud-based solution is available

to customers who require an XML sportsbook integration that is fully hosted and operated by the Company.

Our

Virtual Sports products are typically offered to operators on a participation basis, whereby we receive a portion of the gaming

revenues generated, plus an upfront software license fee. With our participation-driven business model, our Virtual Sports segment

produces approximately 94% of total revenue on a recurring basis under long-term contracts for which our standard term is three

years in duration. We have successfully renewed all of our key Virtual Sports contracts expiring over the last three years.

Interactive

Segment

Our

Interactive business uses offerings from our Gaming and Virtual Sports segments, as well as interactive-only content, via remote

gaming servers to allow online gaming operators to use our games and content online and on mobile devices worldwide. Our interactive

content includes a wide range of premium random number generated casino content from feature-rich bonus games to European-style

casino free spins and table games incorporating well-known first and third-party brands including 20p RouletteTM, Jagr’s

Super SlotTM, Super Hot FruitsTM and Reel King MegawaysTM. The Company releases several new titles

per month and new games can be seamlessly deployed to the full estate of operators and aggregators through its proprietary Virgo

RGS™. Games are available on over 170 websites across much of regulated Europe including the UK, Gibraltar, Malta, Spain,

Sweden, Italy, Germany, Greece and Belgium as well as in New Jersey. We expect to next go live in Michigan and West Virginia.

The

Company’s Virgo RGS™ is integrated with a number of best known casino brands, including William Hill, Entain, bet365,

Flutter, 888, Kindred, Gamesys, BetFred, Rank, Leo Vegas, OPAP and Stoiximan. We are also now live with six North American operators:

Bet MGM, Draft Kings, Caesars, Resorts, Mohegan, Unibet and Golden Nugget and with Loto Quebec in Canada.

For

more information about our business segments and their performance, please refer to our Annual Report on Form 10-K for the fiscal

year ended December 31, 2020 filed with the SEC on March 29, 2021 (as amended by Amendment No. 1 on Form 10-K/A filed with the

SEC on May 10, 2021) and our Quarterly Report on Form 10-Q for the three months ended March 31, 2021 filed with the SEC on May

14, 2021, which are incorporated by reference into this prospectus supplement.

Our

Strategy

We

seek to deliver innovative and differentiated products that provide value to our customers and exciting experiences to their players

in multiple jurisdictions throughout the world while achieving long-term growth in revenues, profit and cash flow. We place great

emphasis on developing creative solutions, in terms of game content and play, that deliver and sustain superior performance through

operators across interactive and location-based channels. Our technology often allows us to update our games and operating software

remotely, keeping pace with evolving requirements in game play, security, technology and regulations. We seek to achieve these

goals as we:

|

|

●

|

Extend

our positions in each of the sectors in which we operate by developing new content and products, which can often be utilized

across multiple distribution channels.

|

|

|

|

|

|

|

●

|

Continue

to invest in content and technology in order to grow our existing customers’ revenues and penetrate new customers in

our existing markets.

|

|

|

|

|

|

|

●

|

Add

new customers by expanding into underpenetrated markets.

|

|

|

|

|

|

|

●

|

Pursue

targeted mergers and acquisitions to expand our product portfolio and distribution footprint.

|

For

more information about our strategy and strategic priorities, please refer to our Annual Report on Form 10-K for the fiscal year

ended December 31, 2020 filed with the SEC on March 29, 2021 (as amended by Amendment No. 1 on Form 10-K/A filed with the SEC

on May 10, 2021) and our Quarterly Report on Form 10-Q for the three months ended March 31, 2021 filed with the SEC on May 14,

2021, which are incorporated by reference into this prospectus supplement.

Key

Factors Affecting Business Performance

We

generate revenue in four principal ways: (i) on a participation basis, (ii) on a fixed rental fee basis, (iii) through product

sales and (iv) through software license fees. Participation revenue generally includes a right to receive a share of our customers’

gaming revenue, typically as a share of net win but sometimes as a share of the handle or “coin in”. Under our participation

agreements, payments made to us are calculated based upon a percentage of the net win, which is the amount of earnings generated

from end-users playing the gaming machines, after adjusting for player winnings and relevant gaming taxes. Product sales include

the sale of new SBG terminals and associated parts to gaming and betting operators. Software license revenues are principally

related to our Virtual Sports product and to license sales of our SBG platform.

We

evaluate our business performance, resource allocation and capital spending on an operating segment level, where possible. We

use the operating results and identified assets of each operating segment to make prospective operating decisions. Although our

revenues and cost of sales (excluding depreciation and amortization) are reported exclusively by segment, we include an unallocated

column in our financial statements for certain expenses, including depreciation and amortization as well as selling, general and

administrative expenses. Unallocated balance sheet line items include items that are a shared resource and therefore not allocated

between operating segments.

For

information about our revenues, operating results, assets, liabilities and cash flows, see our consolidated financial statements

and the section entitled “Management’s Discussion and Analysis of Financial Condition and Results of Operations”

included in our Annual Report on Form 10-K for the fiscal year ended December 31, 2020 filed with the SEC on March 29, 2021 (as

amended by Amendment No. 1 on Form 10-K/A filed with the SEC on May 10, 2021) and our Quarterly Report on Form 10-Q for the three

months ended March 31, 2021 filed with the SEC on May 14, 2021.

Our

Competitive Strengths

We

believe key factors that give us a competitive edge over other players in the gaming technology space include:

|

|

●

|

Established

Presence across multiple Product Verticals

|

|

|

|

|

|

|

●

|

Highly

and Increasingly More Diversified Business Underpinned by Longstanding Customer Relationships

|

|

|

|

|

|

|

●

|

Substantial

Recurring Revenue Supported by Long-Term Participation-Based Contracts

|

|

|

|

|

|

|

●

|

Proprietary

Technology and Track-Record of Strong Content Development

|

|

|

|

|

|

|

●

|

Attractive

Economic Model to Drive Strong Performance Post COVID-19

|

|

|

|

|

|

|

●

|

Positioned

To Benefit From Key Market Trends

|

|

|

|

|

|

|

●

|

Proven

and Experienced Management Team

|

For

more information about our competitive strengths, please refer to our Annual Report on Form 10-K for the fiscal year ended December

31, 2020 filed with the SEC on March 29, 2021 (as amended by Amendment No. 1 on Form 10-K/A filed with the SEC on May 10, 2021)

and our Quarterly Report on Form 10-Q for the three months ended March 31, 2021 filed with the SEC on May 14, 2021, which are

incorporated by reference into this prospectus supplement.

Corporate

Information

We

are headquartered in the United States, with principal operating facilities located in the United Kingdom, India and Italy. We

are a Delaware corporation with principal executive offices located at 250 West 57th Street, Suite 415 New York, New York 10107,

United States. Our telephone number is +1 (646) 565-3861 and our website is www.inseinc.com. The information contained

on, or that may be accessed through our website (or any other website referenced herein) is not part of, and is not incorporated

into, this prospectus supplement.

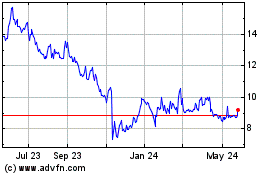

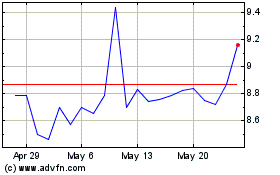

The

Company is publicly listed on the NASDAQ and had an equity market capitalization of approximately $241.7 million as of May 24,

2021 (based upon a closing stock price of $10.41 on that date).

COVID-19

Update

Governments

in certain of the jurisdictions in which our land-based customers operate have either (i) provided guidance as to the potential

timing for reopening land-based venues in such jurisdictions or (ii) reopened land-based venues with certain restrictions. As

of April 12, 2021, in the United Kingdom, licensed betting offices in England have reopened with certain restrictions including

operating two of four gaming machines per venue, limited dwell time of 15 minutes, as well as a maximum of two visits per day

per patron and an 8:00pm curfew. These restrictions remained in place until May 17, 2021. Gaming machines in pubs, holiday parks,

motorway services, Scottish betting offices and adult gaming centers across the United Kingdom opened on May 17, 2021 with social

distancing restrictions in place. It is currently anticipated that any social distancing restrictions will remain in place in

the United Kingdom until June 21, 2021. Furthermore, betting offices in Wales have reopened with certain social distancing restrictions

in place.

Recent

Developments

On

May 20, 2021 the Company closed a private offering of £235.0 million aggregate principal amount of 7.875% senior secured

notes due 2026 (the “Senior Secured Notes”). The Senior Secured Notes were issued by Inspired Entertainment (Financing)

plc (the “Issuer”), a wholly owned finance subsidiary of the Company, and guaranteed by the Company and certain of

its English and U.S. subsidiaries. The Company used the proceeds from the offering of the Senior Secured Notes (i) to repay its

existing £145.8 million senior secured term loan facility and €93.1 million senior secured term loan facility and accrued

interest thereon, (ii) to pay fees, commissions and expenses incurred in connection with the refinancing, and (iii) to close-out

derivative contracts entered into in connection with the existing term loan facilities. The Company intends to use the balance

of the proceeds for general corporate purposes. On May 20, 2021, in connection with the issuance of the Senior Secured Notes,

the Company, the Issuer and certain subsidiaries of the Company entered into a Super Senior Revolving Facility Agreement with

certain lenders, pursuant to which the lenders agreed to provide a secured revolving facility loan in an original principal amount

of £20 million (the “RCF Loans”). The RCF Loans will terminate on November 20, 2025.

The

Offering

|

Selling

Stockholder:

|

The

Landgame Trust (Evan Davis, Trustee)(1)

|

|

|

|

|

Common

Stock Offered by Selling Stockholder:

|

5,406,633

shares (or 6,217,628 if the underwriters’ Over-Allotment Option to purchase up to an additional 810,995 shares is exercised

in full)

|

|

|

|

|

Common

Stock to be Outstanding after this Offering:

|

23,218,323

shares.

|

|

|

|

|

Use

of Proceeds:

|

The

Selling Stockholder will receive the proceeds from this offering. We will not receive any of the proceeds from the sale of

shares of Common Stock by the Selling Stockholder. See “Use of Proceeds” beginning on page S-13 and “Selling

Stockholder” beginning on page S-13 in this prospectus supplement for more information. Notwithstanding the foregoing,

in the event that all of the shares offered pursuant to this prospectus supplement are disposed of in this offering, Landgame

S.à r.l. will be entitled to receive any and all proceeds received on account of the sale of such shares, together

with all previous sales of shares of Common Stock originally held by The Landgame Trust (net of all expenses incurred),

up to the cost basis of Landgame S.à r.l in such shares (which is an amount equal to $10.00 per share) and any proceeds

in excess of this cost basis will be disbursed to the Company. In the event that the Company receives any such excess proceeds,

we intend to use such proceeds for general corporate purposes.

|

|

|

|

|

Risk

Factors:

|

See

“Risk Factors” beginning on page S-10 in this prospectus supplement, the accompanying prospectus and the

documents incorporated by reference for a discussion of some of the factors you should carefully consider before deciding

to invest in our Common Stock.

|

|

|

|

|

Listing:

|

Our

common stock is listed on NASDAQ under the ticker symbol “INSE.”

|

|

|

|

|

Mandatory

Redemption of Securities from Certain Investors:

|

Any

of our securities owned or controlled by an “Unsuitable Person” (defined as a person who (i) is determined by

a gaming authority to be unsuitable to own or control any securities, or unsuitable to be connected or affiliated with a person

engaged in gaming activities in a gaming jurisdiction; (ii) causes the Company or any of its affiliated companies to lose

or to be threatened with the loss of any gaming license; or (iii) in the sole discretion of the board of directors of the

Company (the “Board”), is deemed likely to jeopardize the Company’s or any affiliated company’s application

for, receipt of approval for, right to the use of or entitlement to, any gaming license) or an affiliate of an Unsuitable

Person shall be subject to redemption by the Company, out of funds legally available therefor, by action of the Board, to

the extent required by the gaming authority making the determination of unsuitability or to the extent deemed necessary or

advisable by the board of directors. For a further description of the Company’s redemption powers and procedures, see

“Description of Capital Stock” in the accompanying prospectus.

|

|

(1)

|

See

“Selling Stockholder” beginning on page S-13 of this prospectus supplement for additional information about

the Selling Stockholder.

|

|

|

|

|

(2)

|

The

number of shares of Common Stock outstanding will not change as a result of this offering (including if the underwriters exercise

their Over-Allotment Option). The number of shares of Common Stock to be issued and outstanding after the completion of this offering

(including if the underwriters exercise their Over-Allotment Option) is based on 23,218,323 shares of Common Stock issued and outstanding

as of May 24, 2021.

|

Unless

otherwise indicated, all references in this prospectus supplement to the number and percentages of shares of Common Stock outstanding

do not give effect to, as of May 24, 2021:

|

|

●

|

5,539,615

shares issuable upon the exercise of 11,079,230 private placement warrants issued in connection with our initial public offering

and in connection with our initial business combination (the “Private Placement Warrants”). Each Private Placement

Warrant entitles its holder to purchase one-half of one share of the Company’s common stock at an exercise price of

$11.50 per whole share;

|

|

|

|

|

|

|

●

|

3,999,950

shares issuable upon the exercise of 7,999,900 warrants originally issued as part of units in our initial public offering

(the “Public Warrants”). Each Public Warrant entitles its holder to purchase one-half of one share of the Company’s

common stock at an exercise price of $5.75 per half share;

|

|

|

|

|

|

|

●

|

624,116

shares subject to outstanding restricted stock awards;

|

|

|

|

|

|

|

●

|

4,314,814

shares subject to outstanding restricted stock unit awards;

|

|

|

|

|

|

|

●

|

2,371,799

shares available for new grants under the Company’s equity incentive plan; and

|

|

|

|

|

|

|

●

|

467,751

shares available for purchase under the Company’s employee stock purchase plan.

|

In

addition, unless we specifically state otherwise, all information in this prospectus supplement assumes no exercise by the underwriters

of their Over-Allotment Option.

RISK

FACTORS

Investing

in our Common Stock involves a high degree of risk. Before deciding whether to invest in our Common Stock, you should consider

carefully the risks described below and discussed under the section captioned “Risk Factors” contained in our

most recent Quarterly Report on Form 10-Q filed with the SEC on May 14, 2021, our Annual Report on Form 10-K filed with the SEC

on March 29, 2021 (as amended by Amendment No. 1 to our Annual Report on Form 10-K/A filed with the SEC on May 10, 2021), and

in our other filings that are incorporated by reference in this prospectus supplement and the accompanying prospectus in its entirety,

together with the other information in this prospectus supplement, the accompanying prospectus, and the documents incorporated

by reference, and in any free writing prospectus that we have authorized for use in connection with this offering. The risks described

in these documents are not the only ones we face, but those that we consider to be material. Additional risks and uncertainties

that we are unaware of, or that we currently believe are not material, may also become important factors that adversely affect

our business. Past financial performance may not be a reliable indicator of future performance, and historical trends should not

be used to anticipate results or trends in future periods. If any of these risks actually occur, our business, financial condition,

results of operations or prospects could be adversely effected. This could cause the trading price of our Common Stock to decline,

resulting in a loss of all or part of your investment. Please also carefully read “Cautionary Note Regarding Forward-Looking

Statements” in this prospectus supplement.

As

disclosed in our Annual Report on 10-K filed with the SEC on March 29, 2021 (as amended by Amendment No. 1 to our Annual Report

on Form 10-K/A filed with the SEC on May 10, 2021) under the section titled “Risk Factors,” our business and

results of operations may continue to be negatively affected by the COVID-19 pandemic. In addition, to the extent the ongoing

COVID-19 pandemic adversely affects our business and results of operations, it may also have the effect of heightening many of

the other risks and uncertainties described in the “Risk Factors” section in our Annual Report on Form 10-K

filed with the SEC on March 29, 2021 (as amended by Amendment No. 1 to our Annual Report on Form 10-K/A filed with the SEC on

May 10, 2021), which may materially and adversely affect our business and results of operations.

U.S.

FEDERAL TAX CONSIDERATIONS FOR NON-U.S. STOCKHOLDERS

The

following is a general discussion of the material U.S. federal income and certain estate tax consequences of the ownership and

disposition of shares of our Common Stock by a Non-U.S. Stockholder (as defined herein) that purchases shares of our Common Stock

during this offering. For purposes of this discussion, a “Non-U.S. Stockholder” is a beneficial owner of our Common

Stock that is or is treated for U.S. federal income tax purposes as:

●

an individual who is neither a citizen nor a resident of the United States;

●

a corporation created or organized under the laws of a jurisdiction other than the United States, any state thereof or the

District of Columbia;

●

an estate, other than an estate the income of which is subject to U.S. federal income taxation regardless of its source;

or

●

a trust, other than a trust (i) the administration of which is subject to the primary supervision of a court within the

United States and which has one or more U.S. persons who have the authority to control all substantial decisions of the

trust, or (ii) that has a valid election in effect under applicable U.S. Treasury regulations to be treated as a United

States person (within the meaning of Section 7701(a)(30) of the U.S. Internal Revenue Code of 1986, as amended (the

“Code”)).

This

discussion does not address the U.S. federal tax consequences to an entity treated as a partnership for U.S. federal income tax

purposes or to persons investing through such an entity. If an entity treated as a partnership holds our Common Stock, the tax

treatment of a partner will generally depend on the status of the partner and the activities of the partnership. A partner in

a partnership considering an investment in our Common Stock should consult its own tax advisors as to the U.S. federal income

and estate tax consequences of being a partner in a partnership that owns or disposes of our Common Stock.

In

addition, this discussion does not address the U.S. federal tax consequences to the Selling Stockholder or to any holder of our

Common Stock that is not a Non-U.S. Stockholder.

This

summary assumes that our Common Stock is held as a capital asset (generally, property held for investment). This summary is of

a general nature and thus does not address all of the U.S. federal income and estate tax considerations that might be relevant

to a Non-U.S. Stockholder in light of its particular circumstances or to a Non-U.S. Stockholder subject to special treatment under

U.S. federal tax laws (such as banks, insurance companies, dealers in securities or other Non-U.S. Stockholders that generally

mark their securities to market for U.S. federal income tax purposes, foreign governments, international organizations, tax-exempt

entities, “controlled foreign corporations,” “passive foreign investment companies,” regulated investment

companies, real estate investment trusts, certain former citizens or residents of the United States, or Non-U.S. Stockholders

that hold our Common Stock as part of a straddle, conversion transaction or constructive sale transaction or that purchase or

sell our Common Stock as part of a wash sale for U.S. federal tax purposes). Furthermore, this summary does not discuss any aspects

of U.S. federal gift, Medicare, state, local or non-U.S. taxation. In addition, this discussion does not address the alternative

minimum tax consequences of holding our Common Stock. This summary is based on current provisions of the Code, U.S. Treasury regulations

promulgated or proposed thereunder, judicial opinions, published positions of the U.S. Internal Revenue Service (the “IRS”)

and other applicable authorities, all of which are subject to change or differing interpretation, possibly with retroactive effect.

Each prospective purchaser of our Common Stock is advised to consult its own tax advisor with respect to the U.S. federal, state,

local and non-U.S. tax consequences of purchasing, owning and disposing of our Common Stock. No assurance exists that the IRS

will not challenge any of the tax consequences described herein, and we have not obtained, nor do we intend to obtain, an opinion

of counsel with respect to the U.S. federal income or estate tax consequences to a Non-U.S. Stockholder of owning and disposing

of our Common Stock.

PROSPECTIVE

INVESTORS CONSIDERING THE PURCHASE OF OUR COMMON STOCK SHOULD CONSULT THEIR OWN TAX ADVISORS CONCERNING THE APPLICATION OF U.S.

FEDERAL TAX LAWS TO THEIR PARTICULAR SITUATIONS AS WELL AS ANY CONSEQUENCES ARISING UNDER THE LAWS OF ANY OTHER TAXING JURISDICTION

AND ANY APPLICABLE TAX TREATY.

Distributions

If

we make distributions on our Common Stock, the distributions will be dividends for U.S. federal income tax purposes to the extent

paid from current or accumulated earnings and profits. To the extent distributions exceed our current and accumulated earnings

and profits, they will constitute a return of capital that will first reduce a Non-U.S. Stockholder’s basis in our Common

Stock (determined separately for each share), but not below zero, and then will be treated as gain from the sale of stock (as

discussed further below).

Any

dividend paid to a Non-U.S. Stockholder with respect to our Common Stock generally will be subject to withholding tax at a 30%

rate (or such lower rate specified by an applicable income tax treaty). Generally, a Non-U.S. Stockholder must certify as to its

eligibility for reduced withholding under an applicable income tax treaty on a properly completed IRS Form W-8BEN or IRS Form

W-8BEN-E, as applicable. A Non-U.S. Stockholder that does not timely provide the applicable withholding agent with the certification,

but that qualifies for a reduced treaty rate, may obtain a refund of any excess amounts withheld by timely filing an appropriate

claim for refund with the IRS. Non-U.S. Stockholders should consult their own tax advisors regarding their possible entitlement

to benefits under a tax treaty.

If,

however, the Non-U.S. Stockholder provides a valid IRS Form W-8ECI, certifying that the dividend is effectively connected with

the Non-U.S. Stockholder’s conduct of a trade or business within the United States (and, if an income tax treaty applies,

the gain is attributable to a permanent establishment or fixed base maintained by such Non-U.S. Stockholder in the United States),

and otherwise complies with applicable certification requirements, the dividend will not be subject to the withholding described

above. Instead, the dividend will be subject to U.S. federal income tax in the manner described below under “Effectively

Connected Income.”

Sale,

Exchange or Other Taxable Disposition of Our Common Stock

Except

as otherwise discussed below, a Non-U.S. Stockholder generally will not be subject to U.S. federal income tax on any gain realized

upon a sale, exchange or other taxable disposition of our Common Stock unless (i) such gain is effectively connected with the

Non-U.S. Stockholder’s conduct of a U.S. trade or business (and, if an income tax treaty applies, the gain is attributable

to a permanent establishment or fixed base maintained by such Non-U.S. Stockholder in the United States), (ii) the Non-U.S. Stockholder

is an individual who is present in the United States for a period or periods aggregating 183 days or more during the year in which

such sale, exchange or other taxable disposition occurs and certain other conditions are met, or (iii) we are or have been a “United

States real property holding corporation” (“USRPHC”) for U.S. federal income tax purposes at any time during

the shorter of (x) the five-year period ending on the date of such sale, exchange or other disposition and (y) such Non-U.S. Stockholder’s

holding period with respect to our Common Stock, and, provided that our Common Stock is regularly traded on an established securities

market within the meaning of applicable U.S. Treasury regulations, such Non-U.S. Stockholder has held, directly or constructively,

at any time during said period, more than 5% of our Common Stock. We do not believe that we are or will become a USRPHC; however,

there can be no assurance in that regard.

Gain

described in clause (i) immediately above will be subject to U.S. federal income tax in the manner described below under “Effectively

Connected Income.” A Non-U.S. Stockholder described in clause (ii) immediately above will be subject to tax at a 30% rate

(or such lower rate specified by an applicable income tax treaty) on the net gain derived from the sale, exchange or other taxable

disposition, which may be offset by U.S.-source capital losses of the Non-U.S. Stockholder during the taxable year.

Effectively

Connected Income

Any

dividend with respect to, or gain recognized upon a sale, exchange or other taxable disposition of, our Common Stock that is effectively

connected with a trade or business carried on by a Non-U.S. Stockholder within the United States (and, if an income tax treaty

applies, that is attributable to a permanent establishment or fixed base maintained by such Non-U.S. Stockholder in the United

States) will be subject to U.S. federal income tax, based on the Non-U.S. Stockholder’s net effectively connected income,

generally in the same manner as if the Non-U.S. Stockholder were a U.S. person for U.S. federal income tax purposes. If a dividend

or gain is effectively connected with a U.S. trade or business of a Non-U.S. Stockholder that is a corporation for U.S. federal

income tax purposes, such corporate Non-U.S. Stockholder may also be subject to a “branch profits tax” on its effectively

connected earnings and profits (subject to certain adjustments) at a 30% rate (or such lower rate as may be specified by an applicable

income tax treaty). Non-U.S. Stockholders should consult their own tax advisors regarding any applicable tax treaties that may

provide for different rules.

FATCA

Withholding

Under

legislation commonly known as “FATCA,” a U.S. federal 30% withholding tax generally will be imposed on dividends with

respect to shares of our Common Stock paid to (i) a foreign financial institution (as defined in Section 1471(d)(4) of the Code

and the U.S. Treasury regulations promulgated thereunder), unless the foreign financial institution (a) enters into an agreement

with the U.S. Treasury Department to collect and disclose certain information regarding its U.S. account holders (including certain

account holders that are foreign entities that have U.S. owners) and satisfies certain other requirements or (b) is deemed to

be compliant with the requirements of FATCA, including pursuant to an intergovernmental agreement, and (ii) certain other non-U.S.

entities, unless the entities provide the payor with certain information regarding certain of their direct and indirect U.S. owners,

or certify that they have no such U.S. owners, and comply with certain other requirements. All Non-U.S. Stockholders generally

will be required to furnish certifications (generally on an IRS Form W-8BEN, IRS Form W-8BEN-E or IRS Form W-8ECI) or other documentation

to establish an exemption from withholding under FATCA. Even if a Non-U.S. Stockholder provides such certification, FATCA withholding

will still apply where our Common Stock is held through a non-U.S. broker (or other non-U.S. intermediary) that is not FATCA compliant.

Under certain circumstances, a Non-U.S. Stockholder may be eligible for refunds or credits of the tax.

Current

provisions of the Code and U.S. Treasury regulations that govern FATCA treat gross proceeds from the sale or other disposition

of instruments that can produce U.S.- source dividends (such as our Common Stock) as subject to FATCA withholding after December

31, 2018. However, under proposed U.S. Treasury regulations (the preamble to which specifies that taxpayers are permitted to rely

on them pending finalization), such gross proceeds are not subject to FATCA withholding.

Non-U.S.

Stockholders are encouraged to consult with their own tax advisors regarding the possible implications of FATCA on their investment

in shares of our Common Stock, including the potential applicability of any intergovernmental agreements entered into between

the United States and countries in which such applicable Non-U.S. Stockholders are resident or maintain a branch.

Information

Reporting and Backup Withholding

Annual

reporting to the IRS and to each Non-U.S. Stockholder will be required as to the amount of dividends paid to such Non-U.S. Stockholder

and the amount, if any, of tax withheld with respect to such dividends. This information may also be made available to the tax

authorities in the Non-U.S. Stockholder’s country of residence. Dividends generally are not subject to “backup withholding”

if the Non-U.S. Stockholder properly certifies as to its non-U.S. status (usually by completing an IRS Form W-8BEN, IRS Form W-8BEN-E

or IRS Form W-8ECI).

The

payment of the proceeds of the sale, exchange or other disposition of our Common Stock to or through the U.S. office of a broker

will be subject to both backup withholding (currently at a rate of 24%) and information reporting unless the Non-U.S. Stockholder

certifies its non-U.S. status on IRS Form W-8BEN, IRS Form W-8BEN-E or IRS Form W-8ECI or otherwise establishes an exemption.

Information reporting requirements, but generally not backup withholding, will also generally apply to payments of the proceeds

of a sale, exchange or other disposition of our Common Stock by non-U.S. offices of U.S. brokers or non-U.S. brokers with certain

types of relationships to the United States unless the Non-U.S. Stockholder certifies its non-U.S. status or otherwise establishes

an exemption. Certain Non-U.S. Holders (including corporations) are not subject to backup withholding and information reporting

requirements.

Backup

withholding is not an additional tax. Any amounts withheld under the backup withholding rules from payments made to a Non-U.S.

Stockholder may be refunded or credited against such Non-U.S. Stockholder’s U.S. federal income tax liability, if any, provided

that the required information is timely furnished to the IRS.

Estate

Tax

A

Non-U.S. Stockholder who is an individual should note that shares of our Common Stock (i) owned and held by such individual or

(ii) otherwise includible in such individual’s gross estate for U.S. federal estate tax purposes (for example, where such

shares are owned and held by a trust funded by such individual and with respect to which the individual has retained certain interests

or powers), generally will be, absent an applicable treaty, treated as U.S.-situs property subject to U.S. federal estate tax.

Accordingly, Non-U.S. Stockholders who are individuals may be subject to U.S. federal estate tax on all or a portion of the value

of our Common Stock owned, directly or indirectly, at the time of their death. Prospective investors who are non-resident alien

individuals (or entities includible in such an individual’s gross estate for U.S. federal estate tax purposes) are urged

to consult their own tax advisors concerning the potential U.S. federal estate tax consequences of owning our Common Stock.

USE

OF PROCEEDS

We

will not be selling any shares of Common Stock in this offering and will not receive any proceeds from the sale of the shares offered

pursuant to this prospectus supplement. The Selling Stockholder will receive all of the proceeds from the sale of the shares of Common

Stock offered by this prospectus supplement. We will be reimbursed by Landgame S.à r.l. for all reasonable and documented

out-of-pocket costs, expenses and fees reasonably incurred in connection with this offering. The Selling Stockholder is responsible

for any underwriting discounts or selling commissions and brokerage fees related to the offer and sale of their shares. For information

about the Selling Stockholder, see “Selling Stockholder” beginning on page S-13 of this prospectus supplement.

Notwithstanding

the foregoing, in the event that all of the shares offered pursuant to this prospectus supplement are disposed of in this offering,

Landgame S.à r.l. will be entitled to receive any and all proceeds received on account of the sale of such shares, together

with all previous sales of shares of Common Stock originally held by The Landgame Trust (net of all expenses incurred), up to

the cost basis of Landgame S.à r.l in such shares (which is an amount equal to $10.00 per share) and any proceeds in excess

of this cost basis will be disbursed to the Company. In the event that the Company receives any such excess proceeds, we intend

to use such proceeds for general corporate purposes.

DILUTION

Because

we will not be selling any shares of Common Stock in this offering, the offering will not result in any dilution of equity ownership

to existing stockholders.

SELLING

STOCKHOLDER

The

following table sets forth (i) the number of shares of our Common Stock beneficially owned by the Selling Stockholder prior to this offering,

as of May 24, 2021, based on the Company’s records, the public filings of the Selling Stockholder and information previously

furnished to us by the Selling Stockholder, (ii) the number of shares of Common Stock being offered by the Selling Stockholder, including

its donees, pledgees, transferees or other successors-in-interest, pursuant to this prospectus supplement and (iii) the number of shares

of our Common Stock beneficially owned by the Selling Stockholder after this offering. The Selling Stockholder is not making any representation

that any shares covered by this prospectus supplement will be offered for sale. The Selling Stockholder reserves the right to accept

or reject, in whole or in part, any proposed sale of shares. For purposes of the table below, we assume that (i) the 5,406,633 shares

offered hereunder are sold as contemplated herein and (ii) that the underwriters do not exercise their Over-Allotment Option to purchase

any additional shares of Common Stock within 30 days of the date of this prospectus supplement.

Beneficial

ownership is determined in accordance with the rules of the SEC and includes voting or investment power with respect to shares

of Common Stock and the right to acquire such voting or investment power within 60 days through the exercise of any option, warrant

or other right. Unless otherwise indicated below, to our knowledge, the Selling Shareholder named in the table has sole voting

and investment power with respect to the shares of Common Stock beneficially owned by it. Except as described in the footnotes

to the following table and under “Material Relationship with Landgame S.à r.l.” below, none of the persons

named in the table has held any position or office or had any other material relationship with us or our affiliates during the

three years prior to the date of this prospectus supplement. The inclusion of any shares of Common Stock in this table does not

constitute an admission of beneficial ownership for the person named below.

Our

calculation of the percentage of beneficial ownership is based on 23,218,323 shares of Common Stock outstanding as of May 24,

2021.

|

|

|

Shares Beneficially Owned

Prior to the Offering(3)

|

|

|

Number of Shares Available Pursuant to this Prospectus

|

|

|

Shares Beneficially

Owned After the

Offering

|

|

|

Name of Selling Stockholder

|

|

Number

|

|

|

%

|

|

|

Supplement(4)

|

|

|

Number(4)

|

|

|

%(4)

|

|

|

The Landgame Trust (Evan Davis, Trustee) (1)(2)

|

|

|

6,217,628

|

|

|

|

26.78

|

%

|

|

|

5,406,633

|

|

|

|

810,995

|

|

|

|

3.49

|

%

|

|

(1)

|

The

shares are held in a trust for the benefit of Landgame S.à r.l., pursuant to a trust agreement dated December 23, 2020,

between Landgame S.à r.l. and Evan Davis, as trustee. Each of Mr. Davis, Landgame S.à r.l., Vitruvian I Luxembourg

S.à r.l, VIP I Nominees Limited and Vitruvian Partners LLP may be deemed to beneficially own or otherwise exercise

dispositive powers with respect to the shares held in The Landgame Trust. Mr. Davis is party to a voting agreement with the

Company dated December 23, 2020 which provides that the shares held by The Landgame Trust will be voted at meetings of the

Company’s stockholders in proportion to the votes of all other stockholders of the Company represented in person or

by proxy at the meeting (i.e., mirror voting).

|

|

|

|

|

(2)

|

Reflects

shares issued as consideration in connection with the acquisition of Inspired Gaming Group by Hydra Industries Acquisition

Corp. on December 23, 2016.

|

|

|

|

|

(3)

|

Derivative

securities such as warrants and RSUs that are exercisable or convertible into shares of common stock within 60 days of the

date as of which information is provided in this table are deemed to be beneficially owned and outstanding for purposes of

computing the ownership of the person holding such securities but are not deemed to be outstanding for purposes of computing

the ownership of any other person. The shares that were issued pursuant to grants of restricted stock under our 2016 Long-Term

Incentive Plan are included in the outstanding shares of common stock (such shares carry voting rights but remain subject

to vesting requirements including based on satisfaction of stock price performance targets).

|

|

|

|

|

(4)

|

Assumes

that the underwriters do not exercise their Over-Allotment Option to purchase any additional shares of Common Stock. If the

underwriters exercise their Over-Allotment Option in full, the total shares to be sold in the offering will be 6,217,628.

|

If

all the shares of Common Stock offered by this prospectus supplement are sold and the underwriters exercise their Over-Allotment

Option in full, then after this offering the Selling Stockholder has advised us that it will no longer hold a beneficial ownership

in any shares of our Common Stock.

Material

Relationship with Landgame S.à r.l.

In

the past we had a material relationship with Landgame S.à r.l. Landgame S.à r.l. had the right to designate directors

to the Company’s Board under a Stockholders Agreement until December 23, 2020 when it entered into a termination agreement

with respect thereto in connection with its agreement to transfer legal title of its shares to The Landgame Trust pursuant to

a trust agreement dated December 23, 2020. In addition, in connection with the trust agreement, the trustee entered into a voting

agreement with the Company, which provides that the trustee shall vote shares held by The Landgame Trust, or authorize a proxy

or proxies to vote such shares, in proportion to the votes of all other stockholders of the Company represented in person or by

proxy at each meeting of the stockholders of the Company (i.e., mirror voting).

UNDERWRITERS

The

Selling Stockholder is offering the shares of Common Stock described in this prospectus supplement through underwriters. We, the

Selling Stockholder and Landgame S.à r.l. intend to enter into an underwriting agreement with the underwriters. Under the

terms and subject to the conditions in the underwriting agreement, the underwriters named below have agreed to purchase and the

Selling Stockholder has agreed to sell to them the number of shares indicated below:

|

|

|

Number of Shares

|

|

|

Name

|

|

|

|

|

|

B. Riley Securities, Inc.

|

|

|

3,514,311

|

|

|

Macquarie Capital (USA) Inc.

|

|

|

756,929

|

|

|

Craig-Hallum Capital Group LLC

|

|

|

378,464

|

|

|

Roth Capital Partners, LLC

|

|

|

378,464

|

|

|

Union Gaming Securities, LLC

|

|

|

378,464

|

|

|

|

|

|

|

|

|

Total

|

|

|

5,406,633

|

|

The

underwriters are offering the shares of Common Stock subject to their acceptance of the shares from the Selling Stockholder. The

underwriting agreement provides that the obligation of the underwriters to pay for and accept delivery of the shares of Common

Stock offered by this prospectus supplement are subject to the approval of certain legal matters by its counsel and to certain

other conditions. The underwriters are obligated to take and pay for all of the shares of Common Stock offered by this prospectus

supplement if any such shares are taken. However, the underwriters are not required to take or pay for the shares covered by the

underwriter’s Over-Allotment Option described below.

The

Selling Stockholder has also granted the underwriters an Over-Allotment Option to buy up to 810,995 additional shares of its Common

Stock. The underwriters may exercise this Over-Allotment Option at any time and from time to time during the 30-day period from

the date of this prospectus supplement. If any additional shares of Common Stock are purchased from the Selling Stockholder, the

underwriters will offer the additional shares of Common Stock owned by the Selling Stockholder on the same terms as those on which

the shares are being offered.

The

underwriters initially propose to offer part of the shares of Common Stock directly to the public at the offering price listed

on the cover page of this prospectus supplement and part to certain dealers at a price that represents a concession not in excess

of $ per share under the public offering price. After the initial offering

of the shares of Common Stock, the offering price and other selling terms may from time to time be varied by the underwriters.

Sales of Common Stock made outside of the United States may be made by affiliates of the underwriters.

In connection with this offering, the underwriters

or their affiliates may purchase shares in the offering to be held for investment purposes. Any such purchases will be made at

the public offering price.

We expect that delivery of the shares will be

made against payment therefor on or about the business day in the United States following the date of pricing of the common shares (this

settlement cycle being referred to as “T+ ”). Under Rule 15c6-1 of the Exchange Act, trades in the

secondary market are required to settle in two business days, unless the parties to any such trade expressly agree otherwise. Accordingly,

purchasers who wish to trade their common shares on the date of pricing of the offering will be required, by virtue of the fact that

the common shares initially will settle in T+ , to specify an alternate settlement cycle at the time of any such

trade to prevent a failed settlement. Purchasers of the common shares who wish to trade their common shares on the date of pricing should

consult their own advisor.

Commissions

and Expenses

The

following table shows the per share and total public offering price, underwriting discounts and commissions, and proceeds before

expenses to the Selling Stockholder, assuming no exercise or full exercise of the option to purchase additional shares of Common

Stock by the underwriters. These amounts are shown assuming both no exercise and full exercise of the underwriter’s Over-Allotment

Option (i.e. to purchase up to an additional 810,995 shares of Common Stock).

|

|

|

|

|

|

Total

|

|

|

|

|

Per

Share

|

|

|

No

Exercise

|

|

|

Full

Exercise

|

|

|

Public

offering price

|

|

$

|

|

|

|

$

|

|

|

|

$

|

|

|

|

Underwriting

discounts and commissions to be paid by the Selling Stockholder

|

|

$

|

|

|

|

$

|

|

|

|

$

|

|

|

|

Proceeds,

before expenses, to the Selling Stockholder

|

|

$

|

|

|

|

$

|

|

|

|

$

|

|

|

We

estimate that the total expenses of the offering will be

approximately $750,000. We will be reimbursed by Landgame S.à r.l. for all reasonable and documented out-of-pocket costs,

expenses and fees reasonably incurred in connection with this offering. Landgame S.à r.l. has agreed to pay

out-of-pocket, accountable, bona fide expenses actually incurred by the underwriters in the offering in an amount not to

exceed $150,000 for fees and disbursements of counsel to the underwriters.

Our

Common Stock is listed on NASDAQ under the ticker symbol “INSE.”

Lock-Up

Agreement

We,

all of our directors and executive officers, and the Selling Stockholder have agreed that, without the prior written consent of

B. Riley Securities, Inc., we and they will not, during the period ending 30 days after the date of this prospectus supplement

(the “restricted period”):

|

|

●

|

offer,

pledge, sell, contract to sell, sell any option or contract to purchase, purchase any option or contract to sell, grant any

option, right or warrant to purchase, lend or otherwise transfer or dispose of, directly or indirectly, any shares of common

stock or any securities convertible into or exercisable or exchangeable for shares of common stock;

|

|

|

|

|

|

|

●

|

enter

into any swap or other arrangement that transfers to another, in whole or in part, any of the economic consequences of ownership

of the common stock; or

|

|

|

|

|

|

|

●

|

with

respect to the Company, file any registration statement with the Securities and Exchange Commission relating to the offering

of any shares of common stock or any securities convertible into or exercisable or exchangeable for common stock;

|

whether

any such transaction described above is to be settled by delivery of common stock or such other securities, in cash or otherwise.

In addition, each such person other than the Company agrees that, without the prior written consent of B. Riley Securities, Inc.,

such person will not, during the restricted period, make any demand for, or exercise any right with respect to, the registration

of any shares of common stock or any security convertible into or exercisable or exchangeable for common stock.

The

restrictions described in the immediately preceding paragraph to do not apply to:

|

|

●

|

the

sale of shares to the underwriter;

|

|

|

|

|

|

|

●

|

the

registration on Form S-8 of the Company’s 2021 Omnibus Incentive Plan or an amendment of any Form S-8 of the Company;

|

|

|

|

|

|

|

●

|

the

issuance by the Company of shares of common stock upon the exercise of an option or a warrant or the conversion of a security

outstanding on the date of this prospectus supplement of which the underwriter has been advised in writing;

|

|

|

|

|

|

|

●

|

transactions

by any person other than the Company relating to shares of common stock or other securities acquired in open market transactions

after the completion of the offering of the shares; provided that no filing under Section 16(a) of the Exchange Act, is required

or voluntarily made in connection with subsequent sales of the common stock or other securities acquired in such open market

transactions;

|

|

|

|

|

|

|

●

|

(A)

transfers by any person other than the Company of shares of common stock or any securities convertible into common stock as

a bona fide gift, (B) distribution by any person other than the Company of shares of common stock or any security convertible

into common stock to limited partners or stockholders of such person or (C) the issuance by the Company of shares of common

stock in connection with the acquisition of another business, the merger of the Company with or into another company or a

similar transaction, provided that the aggregate number of shares of common stock issued pursuant to this clause (C) shall

not exceed 7.5% of the total number of outstanding shares of common stock issued and outstanding as of the date of this prospectus

supplement, provided that, in the case of any transfer or distribution pursuant to clause (A), (B) or (C), (i) each donee,

distributee, purchaser or recipient, as applicable, shall enter into a written agreement accepting the restrictions set forth

in the immediately preceding paragraph and this paragraph and (ii) no filing under Section 16(a) of the Exchange Act, reporting

a reduction in beneficial ownership of shares of common stock, is required or voluntarily made in respect of the transfer

or distribution during the restricted period;

|

|

|

●

|

the

negotiation and/or execution of any definitive agreement by the Company in connection with the acquisition of another business,

the merger of the Company with or into another company or a similar transaction pursuant to which the Company is, or may be,

required to issue any shares of its common stock, provided that (i) the consummation of such acquisition, merger or similar

transaction is subject to a condition that such acquisition, merger or similar transaction shall be put to a vote of the holders

of the Company’s capital stock entitled to vote generally in the election of the Company’s directors and shall

be approved by a majority of the votes cast by such holders and (ii) such agreement does not provide for the issuance, transfer

or disposition, directly or indirectly, of any shares of common stock during the restricted period;

|

|

|

|

|

|

|

●

|

grants

or issuances of securities pursuant to awards or in settlement thereof under the Company’s 2016 Long-Term Incentive

Plan, Second Long-Term Incentive Plan, Employee Stock Purchase Plan, 2021 Omnibus Incentive Plan or any other incentive compensation

plan of the Company in effect as of the date of this prospectus supplement and described in the accompanying prospectus; or

|

|

|

|

|

|

|

●

|

the

establishment of a trading plan pursuant to Rule 10b5-1 under the Exchange Act for the transfer of shares of common stock;

provided that (i) such plan does not provide for the transfer of common stock during the restricted period and (ii) to the

extent a public announcement or filing under the Exchange Act, if any, is required or voluntarily made regarding the establishment

of such plan, such announcement or filing shall include a statement to the effect that no transfer of common stock may be

made under such plan during the restricted period.

|

B.

Riley Securities, Inc., in its sole discretion, may release the common stock and other securities subject to the lock-up agreements

described above in whole or in part at any time.

Stabilization

In

order to facilitate the offering of the Common Stock, the underwriters may engage in transactions that stabilize, maintain or

otherwise affect the price of the Common Stock. Specifically, the underwriters may sell more shares than they are obligated to

purchase under the underwriting agreement, creating a short position. A short sale is covered if the short position is no greater

than the number of shares available for purchase by the underwriters under the Over-Allotment Option. The underwriters can close

out a covered short sale by exercising the Over-Allotment Option or purchasing shares in the open market. In determining the source

of shares to close out a covered short sale, the underwriters will consider, among other things, the open market price of shares

compared to the price available under the Over-Allotment Option. The underwriters may also sell shares in excess of Over-Allotment

Option, creating a naked short position. The underwriters must close out any naked short position by purchasing shares in the

open market. A naked short position is more likely to be created if the underwriters are concerned that there may be downward

pressure on the price of the Common Stock in the open market after pricing that could adversely affect investors who purchase

in this offering. As an additional means of facilitating this offering, the underwriters may bid for, and purchase, shares of

Common Stock in the open market to stabilize the price of the Common Stock. These activities may raise or maintain the market

price of the Common Stock above independent market levels or prevent or retard a decline in the market price of the Common Stock.

The underwriters are not required to engage in these activities and may end any of these activities at any time.

Indemnification

We,

the Selling Stockholder and the underwriters have agreed to indemnify each other against certain liabilities, including liabilities

under the Securities Act.

Electronic

Prospectus

A

prospectus in electronic format may be made available on websites maintained by the underwriters, or selling group members, if

any, participating in this offering. The underwriters may agree to allocate a number of shares of Common Stock for sale to their

online brokerage account holders.

Other

Relationships

The

underwriters and their affiliates are full service financial institutions engaged in various activities, which may include securities

trading, commercial and investment banking, financial advisory, investment management, investment research, principal investment,

hedging, financing, and brokerage activities. The underwriters and their affiliates have, from time to time, performed, and may

in the future perform, various financial advisory and investment banking services for us, for which they received or will receive

customary fees and expenses.

In

addition, in the ordinary course of their various business activities, the underwriters and their affiliates may make or hold

a broad array of investments and actively trade debt and equity securities (or related derivative securities) and financial instruments

(including bank loans) for their own account and for the accounts of their customers and may at any time hold long and short positions

in such securities and instruments. Such investment and securities activities may involve our securities and instruments. The

underwriters and theirs affiliates may also make investment recommendations or publish or express independent research views in

respect of such securities or instruments and may at any time hold, or recommend to clients that they acquire, long or short positions

in such securities and instruments.

Selling

Restrictions

Canada

(Alberta, British Columbia, Manitoba, Ontario and Québec Only)

Notice

to Prospective Investors in Canada

This

document constitutes an “exempt offering document” as defined in and for the purposes of applicable Canadian securities

laws. No prospectus has been filed with any securities commission or similar regulatory authority in Canada in connection with