As filed with the Securities and Exchange Commission on February

12, 2021

Registration No. 333-253072

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Amendment No. 1

to

FORM S-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Inspired Entertainment, Inc.

(Exact name of registrant as specified

in its charter)

|

Delaware

|

|

47-1025534

|

(State or other jurisdiction of

incorporation or organization)

|

|

(I.R.S. Employer

Identification Number)

|

250 West 57th Street, Suite 415

New York, New York

(646) 565-3861

(Address, including zip code, and telephone

number, including area code, of registrant’s principal executive offices)

A. Lorne Weil, Executive

Chairman

Inspired Entertainment, Inc.

250 West 57th Street,

Suite 415

New York, New York

10107

(646) 565-3861

(Name, address, including zip code, and

telephone number, including area code, of agent for service)

Copies to:

Douglas Ellenoff, Esq.

Jeffrey W. Rubin, Esq.

Ellenoff Grossman & Schole LLP

1345 Avenue of Americas

New York, NY 10105

(212) 370-1300

Fax: (212) 370-7889

Approximate date of commencement of proposed

sale to the public: From time to time after the effective date of this Registration Statement.

If

the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please

check the following box: ☐

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415

under the Securities Act of 1933, as amended, other than securities offered only in connection with dividend or interest reinvestment

plans, check the following box: ☒

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please

check the following box and list the Securities Act registration statement number of the earlier effective registration statement

for the same offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and

list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If

this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become

effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If

this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register

additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following

box. ☐

Indicate by check mark whether the Registrant

is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth

company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting

company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer

|

☐

|

Accelerated filer

|

☐

|

|

Non-accelerated filer

|

☒

|

Smaller reporting company

|

☒

|

|

|

|

Emerging growth company

|

☐

|

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

CALCULATION OF REGISTRATION FEE

|

Title of Each Class of Securities to be Registered

|

|

Amount

to be

Registered(1)(2)

|

|

|

Proposed

Maximum

Aggregate

Offering

Price per

Security(1)(2)

|

|

|

Proposed

Maximum

Aggregate

Offering

Price(2)

|

|

|

Amount of

Registration

Fee(4)

|

|

|

Common Stock, par value $0.0001 per share(3)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Preferred Stock, par value $0.0001 per share(3)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Debt Securities(3)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Warrants

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Rights

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Units

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

|

|

|

|

|

|

|

|

|

|

$

|

300,000,000

|

|

|

$

|

32,730

|

(2)

|

|

(1)

|

Such indeterminate number or amount of debt securities, common stock, preferred stock, warrants and units to purchase any combination of the foregoing securities, and rights, as may from time to time be issued at indeterminate prices, with an aggregate initial offering price not to exceed $300,000,000. In addition, pursuant to Rule 416 of the Securities Act, the shares being registered hereunder include such indeterminate number of shares of common stock and preferred stock as may be issuable with respect to the shares being registered hereunder as a result of stock splits, stock dividends, or similar transactions. Securities registered hereunder may be sold separately or together in any combination with other securities registered hereunder.

|

|

(2)

|

Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(o) under the Securities Act of 1933, as amended (the “Securities Act”). Pursuant to Rule 457(o) under the Securities Act and General Instruction II.D. of Form S-3, the table does not specify by each class information as to the amount to be registered or proposed maximum offering price per unit.

|

|

(3)

|

Subject to footnote (1), there are also being registered hereunder an indeterminate principal amount or number of shares of debt securities, preferred stock or common stock that may be issued upon conversion of, or in exchange for, debt securities or preferred stock registered hereunder or upon exercise of warrants registered hereunder, as the case may be.

|

The Registrant hereby amends this Registration

Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment

which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a)

of the Securities Act of 1933 or until this Registration Statement shall become effective on such date as the Commission, acting

pursuant to said Section 8(a), may determine.

Explanatory Note: This Amendment No. 1 is being filed to

replace the “Use of Proceeds” section as previously filed.

The information in this prospectus

is not complete and may be changed. We may not sell the securities until the Registration Statement filed with the Securities

and Exchange Commission, of which this prospectus is a part, is effective.

SUBJECT TO

COMPLETION, DATED February 12, 2021

PROSPECTUS

$300,000,000

|

Common Stock

|

|

Preferred Stock

|

|

Debt Securities

|

|

Warrants

|

|

Rights

|

|

Units

|

We may offer and sell from time to time,

in one or more series, any one of the following securities of our company, for total gross proceeds up to $300,000,000:

|

|

●

|

common stock;

|

|

|

|

|

|

|

●

|

preferred stock;

|

|

|

|

|

|

|

●

|

secured or unsecured debt securities consisting of notes, debentures or other evidences of indebtedness which may be senior debt securities, senior subordinated debt securities or subordinated debt securities, each of which may be convertible into equity securities;

|

|

|

|

|

|

|

●

|

warrants to purchase our securities;

|

|

|

|

|

|

|

●

|

rights to purchase any of the foregoing securities; or

|

|

|

|

|

|

|

●

|

units comprised of, or other combinations of, the foregoing securities.

|

We will provide specific terms of these offerings

and securities in one or more supplements to this prospectus. We may also authorize one or more free writing prospectuses to be

provided to you in connection with these offerings. The prospectus supplement, and any documents incorporated by reference, may

also add, update or change information contained in this prospectus. You should read this prospectus, the applicable prospectus

supplement, any documents incorporated by reference and any related free writing prospectus carefully before buying any of the

securities being offered.

We may offer and sell these securities to

or through one or more underwriters, dealers and agents, or directly to purchasers, on a continuous or delayed basis.

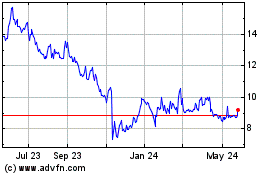

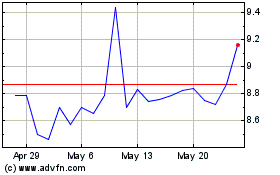

Our common stock is traded on The NASDAQ

Capital Market under the symbol “INSE.” The last reported sale price of our common stock on The NASDAQ Capital Market

on February 11, 2021 was $7.62 per share.

Investing in our securities involves a

high degree of risk. You should review carefully the risks and uncertainties described under the heading “Risk Factors”

contained in the applicable prospectus supplement and in any related free writing prospectus, and under similar headings in the

other documents that are incorporated by reference into this prospectus or any prospectus supplement before making a decision to

purchase our securities.

Neither the Securities and Exchange Commission

nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful

or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is ,

2021.

TABLE OF CONTENTS

You should rely only on the information

we have provided or incorporated by reference in this prospectus or in any prospectus supplement. We have not authorized anyone

to provide you with information different from that contained or incorporated by reference in this prospectus or in any prospectus

supplement.

This prospectus and any prospectus supplement

is an offer to sell only the securities offered hereby, but only under circumstances and in jurisdictions where it is lawful to

do so.

You should assume that the information

contained in this prospectus and in any prospectus supplement is accurate only as of their respective dates and that any information

we have incorporated by reference is accurate only as of the date of the document incorporated by reference, regardless of the

time of delivery of this prospectus or any prospective supplement or any sale of securities.

ABOUT THIS PROSPECTUS

This prospectus is part of a

registration statement on Form S-3 that Inspired Entertainment, Inc. (“we,” “us,” or the “Company”) we filed with the

Securities and Exchange Commission, or the SEC, utilizing a “shelf” registration process. Under this shelf

registration process, we may offer and sell, either individually or in combination, in one or more offerings, any combination

of the securities described in this prospectus, for total gross proceeds of up to $300,000,000. This prospectus provides you

with a general description of the securities we may offer. Each time we offer securities under this prospectus, we will

provide a prospectus supplement that will contain more specific information about the terms of that offering. We may also

authorize one or more free writing prospectuses to be provided to you that may contain material information relating to these

offerings. The prospectus supplement and any related free writing prospectus that we may authorize to be provided to you may

also add, update or change any of the information contained in this prospectus or in the documents that we have incorporated

by reference into this prospectus.

We may deliver a prospectus supplement with

this prospectus, to the extent appropriate, to update the information contained in this prospectus. The prospectus supplement may

also add, update or change information included in this prospectus. You should read both this prospectus and any applicable prospectus

supplement, together with additional information described below under the captions “Where You Can Find More Information”

and “Incorporation of Certain Information by Reference.”

No offer of these securities will be made

in any jurisdiction where the offer is not permitted.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING

STATEMENTS

This prospectus and any accompanying prospectus

supplement and the documents we have filed or will file with the SEC that are or will be incorporated by reference into this prospectus

and the accompanying prospectus supplement contain forward-looking statements, within the meaning of Section 27A of the Securities

Act and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), that involve risks

and uncertainties. Any statements contained, or incorporated by reference, in this prospectus and any accompanying prospectus that

are not statements of historical fact may be forward-looking statements. When we use the words “anticipate,” “believe,”

“could,” “estimate,” “expect,” “intend,” “may,” “plan,”

“predict,” “project,” “will” and other similar terms and phrases, including references to assumptions,

we are identifying forward-looking statements. Forward-looking statements involve risks and uncertainties which may cause our actual

results, performance or achievements to be materially different from those expressed or implied by forward-looking statements.

Our forward-looking statements reflect our

current expectations about our future results, performance, liquidity, financial condition, prospects and opportunities, and are

based upon information currently available to us, our interpretation of what we believe to be significant factors affecting our

business and many assumptions regarding future events. Actual results, performance, liquidity, financial condition, prospects and

opportunities could differ materially from those expressed in, or implied by, our forward-looking statements. This could occur

as a result of various risks and uncertainties, including the following:

|

|

●

|

the effect and impact of the ongoing global coronavirus

(COVID-19) pandemic on our business with respect to the potential duration of the pandemic, the various Government-ordered emergency

measures including travel restrictions, social distancing and/or shelter in place orders and closure of retail venues and the

remediation plans put in place by each Government to potentially mitigate these effects, the detail, scope and application of

which are still largely unknown;

|

|

|

●

|

our ability to compete effectively in our industries;

|

|

|

●

|

the effect of evolving technology on our business;

|

|

|

●

|

our ability to renew long-term contracts and retain customers,

and secure new contracts and customers;

|

|

|

●

|

our ability to maintain relationships with suppliers;

|

|

|

●

|

our ability to protect our intellectual property;

|

|

|

●

|

our ability to protect our business against cybersecurity

threats;

|

|

|

●

|

government regulation of our industries;

|

|

|

●

|

our ability to successfully grow by acquisition as well

as organically;

|

|

|

●

|

fluctuations due to seasonality;

|

|

|

●

|

our ability to attract and retain key members of our management

team;

|

|

|

●

|

our need for working capital;

|

|

|

●

|

our ability to secure capital for growth and expansion;

|

|

|

●

|

changing consumer, technology and other trends in our industries;

|

|

|

●

|

our ability to successfully operate across multiple jurisdictions

and markets around the world;

|

|

|

●

|

changes in local, regional and global economic and political

conditions; and

|

In light of these risks and uncertainties,

and others discussed in this prospectus there can be no assurance that any matters covered by our forward-looking statements will

develop as predicted, expected or implied. Readers should not place undue reliance on any forward-looking statements. Except as

expressly required by the federal securities laws, we undertake no obligation to publicly update or revise any forward-looking

statements, whether as a result of new information, future events, changed circumstances or any other reason. We advise you to

carefully review the reports and documents we file from time to time with the SEC.

INFORMATION ABOUT

THE COMPANY

We are a global gaming technology company,

supplying content, platform and other products and services to online and land-based regulated lottery, betting and gaming operators

worldwide through a broad range of distribution channels, predominantly on a business-to-business basis. We provide end-to-end

digital gaming solutions (i) on our own proprietary and secure network, which accommodates a wide range of devices, including land-based

gaming machine terminals, mobile devices and online computer applications and (ii) through third party networks. Our content and

other products can be found through the consumer-facing portals of our interactive customers and, through our land-based customers,

in licensed betting offices, adult gaming centers, pubs, bingo halls, airports, motorway service areas and leisure parks.

Our principal executive offices are located

at 250 West 57th Street, Suite 415, New York, New York 10107, and our telephone number is (646) 565-3861. Our website is www.inseinc.com.

The information found on our website is not part of this prospectus.

RISK FACTORS

We have included discussions of the risks,

uncertainties and assumptions under the heading “Risk Factors” included in our Annual Report on Form 10-K for the year

ended December 31, 2019 and our Quarterly Report on Form 10-Q for the quarter ended September 30, 2020, which risk factors

are incorporated by reference into this prospectus. See “Where You Can Find More Information” for an explanation

of how to get a copy of this report. Additional risks related to our securities may also be described in a prospectus supplement

and in any related free writing prospectus that we may authorize to be provided to you.

Investing in our securities involves a

high degree of risk. Before deciding whether to invest in our securities, you should carefully consider the risk factors we

describe in any prospectus supplement and in any related free writing prospectus that we may authorize to be provided to you or

in any report incorporated by reference into this prospectus or such prospectus supplement, including our Annual Report on Form

10-K for the year ended December 31, 2019, our Quarterly Reports on Form 10-Q for the quarterly periods ended March 31, 2020,

June 30, 2020, and September 30, 2020 and our Forms 8-K that are incorporated by reference into this prospectus or such prospectus

supplement after the date of this prospectus. Although we discuss key risks in those risk factor descriptions, additional

risks not currently known to us or that we currently deem immaterial also may impair our business. Our subsequent filings

with the SEC may contain amended and updated discussions of significant risks. We cannot predict future risks or estimate

the extent to which they may affect our financial performance.

Please also read carefully the section above

entitled “Cautionary Note Regarding Forward-Looking Statements.”

USE OF PROCEEDS

We intend to use the net proceeds from the sale of any securities

offered under this prospectus for general corporate purposes unless otherwise indicated in the applicable prospectus supplement.

General corporate purposes may include the acquisition of companies or businesses, repayment and refinancing of debt, working

capital and capital expenditures. We have not determined the amount of net proceeds to be used specifically for such purposes.

As a result, management will retain broad discretion over the allocation of net proceeds.

DESCRIPTION OF CAPITAL STOCK AND SECURITIES

WE MAY OFFER

General

The following description of the material

provisions of our capital stock (which includes a description of securities we may offer pursuant to the registration statement

of which this prospectus, as the same may be supplemented, forms a part) does not purport to be complete and is based on and qualified

by our Second Amended and Restated Certificate of Incorporation (the “Charter”), our Bylaws, and our Warrant Agreement

dated October 24, 2014 between the Company and Continental Stock Transfer & Trust Company (“Warrant Agreement”)

each of which is incorporated by reference as an exhibit to our Annual Report on Form 10-K for the fiscal year ended December 31,

2019. The summary below is also qualified by reference to provisions of the Delaware General Corporation Law (“DGCL”).

Our authorized capital stock consists of

50,000,000 shares, consisting of 49,000,000 shares of common stock, $0.0001 par value per share, and 1,000,000 shares of preferred

stock, $0.0001 par value per share. As of the date of this prospectus, our outstanding capital stock consists of 23,218,323 shares

of common stock, and no shares of preferred stock. These figures do not include securities that may be issued upon exercise or

vesting of our outstanding derivative securities including our warrants and our awards of restricted stock units under our equity

incentive plans.

We, directly or through agents, dealers or

underwriters designated from time to time, may offer, issue and sell, together or separately, up to $300,000,000 in the aggregate

of:

|

|

●

|

common stock;

|

|

|

|

|

|

|

●

|

preferred stock;

|

|

|

|

|

|

|

●

|

secured or unsecured debt securities consisting of notes, debentures or other evidences of indebtedness which may be senior debt securities, senior subordinated debt securities or subordinated debt securities, each of which may be convertible into equity securities;

|

|

|

|

|

|

|

●

|

warrants to purchase our securities;

|

|

|

|

|

|

|

●

|

rights to purchase our securities; or

|

|

|

|

|

|

|

●

|

units comprised of, or other combinations of, the foregoing securities.

|

We may issue the debt securities as exchangeable

for or convertible into shares of common stock, preferred stock or other securities. The preferred stock may also be exchangeable

for and/or convertible into shares of common stock, another series of preferred stock or other securities. The debt securities,

the preferred stock, the common stock and the warrants are collectively referred to in this prospectus as the “securities.”

When a particular series of securities is offered, a supplement to this prospectus will be delivered with this prospectus, which

will set forth the terms of the offering and sale of the offered securities.

Common Stock

As of February 11, 2021, there were 23,218,323

shares of Common Stock issued and outstanding. The outstanding shares of Common Stock are duly authorized, validly issued, fully

paid and non-assessable.

Voting Power

Except as otherwise required by law or as

provided in any certificate of designation for any series of Preferred Stock, the holders of Common Stock possess all the voting

power for the election of our directors and all other matters requiring stockholder action. Holders of Common Stock are entitled

to one vote per share held of record on matters to be voted on by stockholders.

Dividends

Holders of Common Stock will be entitled

to receive such dividends, if any, as may be declared from time to time by our board of directors in its discretion out of funds

legally available therefor and shall share equally on a per share basis in such dividends and distributions, provided that such

holder is not an Unsuitable Person (as defined below).

Liquidation, Dissolution and Winding-Up

In the event of our voluntary or involuntary

liquidation, dissolution, distribution of assets or winding-up, the holders of our Common Stock will be entitled to receive an

equal amount per share of all of our assets of whatever kind available for distribution to stockholders, after the rights of our

creditors and the rights of holders of Preferred Stock, if any, have been satisfied.

Preemptive or Other Rights

There are no sinking fund provisions applicable

to the Common Stock. Our stockholders have no preemptive or other subscription rights.

Preferred Stock

Our board of directors has the authority

to issue up to an aggregate of 1,000,000 shares of Preferred Stock in one or more series, and to fix the designations, preferences,

rights, qualifications, limitations and restrictions thereof or thereon, without any further vote or action by the stockholders.

No shares of Preferred Stock are outstanding at February 11, 2021.

You should refer to the prospectus supplement

relating to the series of preferred stock being offered for the specific terms of that series, including:

|

|

●

|

the title of the series and the number of shares in the

series;

|

|

|

●

|

the price at which the preferred stock will be offered;

|

|

|

●

|

the dividend rate or rates or method of calculating the rates, the dates on which the dividends will be payable, whether or

not dividends will be cumulative or noncumulative and, if cumulative, the dates from which dividends on the preferred stock being

offered will cumulate;

|

|

|

●

|

the voting rights, if any, of the holders of shares of

the preferred stock being offered;

|

|

|

●

|

the provisions for a sinking fund, if any, and the provisions for redemption, if applicable, of the preferred stock being offered,

including any restrictions on the foregoing as a result of arrearage in the payment of dividends or sinking fund installments;

|

|

|

●

|

the liquidation preference per share;

|

|

|

●

|

the terms and conditions, if applicable, upon which the preferred stock being offered will be convertible into our common stock,

including the conversion price, or the manner of calculating the conversion price, and the conversion period;

|

|

|

●

|

the terms and conditions, if applicable, upon which the preferred stock being offered will be exchangeable for debt securities,

including the exchange price, or the manner of calculating the exchange price, and the exchange period;

|

|

|

●

|

any listing of the preferred stock being offered on any

securities exchange;

|

|

|

●

|

a discussion of any material federal income tax considerations applicable to the preferred stock being offered;

|

|

|

●

|

the relative ranking and preferences of the preferred stock being offered as to dividend rights and rights upon liquidation,

dissolution or the winding up of our affairs;

|

|

|

●

|

any limitations on the issuance of any class or series of preferred stock ranking senior or equal to the series of preferred

stock being offered as to dividend rights and rights upon liquidation, dissolution or the winding up of our affairs; and

|

|

|

●

|

any additional rights, preferences, qualifications, limitations

and restrictions of the series.

|

Upon issuance, the shares of preferred stock

will be fully paid and nonassessable, which means that its holders will have paid their purchase price in full and we may not require

them to pay additional funds.

Any preferred stock terms selected by our

board of directors could decrease the amount of earnings and assets available for distribution to holders of our common stock or

adversely affect the rights and power, including voting rights, of the holders of our common stock without any further vote or

action by the stockholders. The rights of holders of our common stock will be subject to, and may be adversely affected by, the

rights of the holders of any preferred stock that may be issued by us in the future. The issuance of preferred stock could also

have the effect of delaying or preventing a change in control of our company or make removal of management more difficult.

Gaming and Regulatory Matters – Unsuitable Persons

Our Charter provides the Company with the

ability to restrict securities ownership by persons (“Unsuitable Person”) who fail to comply with informational or

other regulatory requirements under applicable gaming laws, who are found unsuitable to hold the Company’s securities by

gaming authorities or who could by holding the Company’s securities cause the Company or any affiliate to fail to obtain,

maintain, renew or qualify for a license, contract, franchise or other regulatory approval from a gaming authority.

Specifically, pursuant to our Charter, we

may redeem the shares of capital stock owned or controlled by a stockholder or its affiliates to the extent required by the relevant

gaming authority making a determination of unsuitability, or to the extent our board of directors determines, in its sole discretion,

that a person is likely to jeopardize the Company’s or any affiliate’s application for, receipt of, approval for, right

to the use of, or entitlement to, any gaming license. The redemption price would be determined either by the gaming authority making

the finding of unsuitability, or if such gaming authority does not require a certain price to be paid, by our board of directors,

which would determine the price based on the fair value of the securities to be redeemed; provided, however, that the price per

share represented by the redemption price shall in no event be in excess of the closing sales price per share of the Company’s

shares on the principal national securities exchange on which such shares are then listed on the trading date on the day before

we notify the holder of such redemption. The redemption price may be paid in cash, by promissory note, or both as required pursuant

to the terms established by the applicable gaming authority and, if there are no such terms, as we elect.

Warrants

As of February 11, 2021, there were 19,079,130

warrants outstanding exercisable for 9,539,565 shares of Common Stock, consisting of 7,999,900 of our public stockholders’

warrants (“Public Warrants”) and 11,079,230 of our private placement warrants (“Private Warrants”).

Public Warrants

The Company’s Public Warrants were

originally issued as part of the units sold in the Company’s IPO. Pursuant to the terms of the Warrant Agreement, each such

warrant entitles the registered holder to purchase one-half of one share of our Common Stock at a price of $5.75 (or $11.50 per

whole share), subject to adjustment as discussed below. Such warrants may be exercised only for a whole number of shares of our

Common Stock. The Public Warrants became exercisable on January 23, 2017 and will expire five years after the completion of our

Business Combination, at 5:00 p.m., New York City time on December 23, 2021, or earlier upon redemption or liquidation.

We will not be obligated to deliver any

shares of Common Stock pursuant to the exercise of a Public Warrant and will have no obligation to settle such warrant exercise

unless a registration statement under the Securities Act with respect to the shares of Common Stock underlying such warrants is

then effective and a prospectus relating thereto is current, subject to our satisfying our obligations described below with respect

to registration. No such warrant will be exercisable, and we will not be obligated to issue any shares to holders seeking to exercise

their Public Warrants, unless the issuance of the shares upon such exercise is registered and qualified under the securities laws

of the state of the exercising holder, unless exemptions therefrom are available. In the event that the conditions in the two immediately

preceding sentences are not satisfied with respect to a Public Warrant, the holder of such warrant will not be entitled to exercise

such warrant and such warrant may have no value and may expire worthless. In no event will we be required to net cash settle any

Public Warrant.

We will use our best efforts to maintain

the effectiveness of a registration statement, and a current prospectus relating thereto, until the expiration or redemption of

the Public Warrants in accordance with the provisions of the Warrant Agreement. Notwithstanding the above, if our Common Stock

is at the time of any exercise of a Public Warrant not listed on a national securities exchange such that it satisfies the definition

of a “covered security” under Section 18(b)(1) of the Securities Act, we may, at our option, require holders of Public

Warrants who exercise their warrants to do so on a “cashless basis” in accordance with Section 3(a)(9) of the Securities

Act and, in the event we so elect, we will not be required to file or maintain in effect a registration statement or qualify the

underlying shares under state blue sky laws.

We may call the Public Warrants for redemption:

|

|

●

|

in

whole and not in part;

|

|

|

●

|

at

a price of $0.01 per warrant;

|

|

|

●

|

upon

not less than 30 days’ prior written notice of redemption (the “30-day redemption period”) to each warrant holder;

and

|

|

|

●

|

if,

and only if, the reported last sale price of the Common Stock equals or exceeds $24.00 per share for any 20 trading days within

a 30-trading day period ending on the third trading day prior to the date we send the notice of redemption to the warrant holders.

|

If and when the Public Warrants become redeemable

by us, we may exercise our redemption right even if we are unable to register the underlying securities for sale or qualify then

under applicable state securities laws.

We have established the last of the redemption

conditions discussed above to prevent a redemption call unless there is, at the time of the call, a significant premium to the

warrant exercise price. If the foregoing conditions are satisfied and we issue a notice of redemption of the Public Warrants, each

warrant holder will be entitled to exercise his, her or its warrant prior to the scheduled redemption date. However, the price

of the Common Stock may fall below the $24.00 redemption trigger price as well as the warrant exercise price of $5.75 per one-half

of one share ($11.50 per whole share) after the redemption notice is issued.

If we call the Public Warrants for redemption

as described above, our management will have the option to require holders that wish to exercise their warrants to do so on a “cashless

basis.” In determining whether to require holders to exercise their warrants on a “cashless basis,” our management

will consider, among other factors, our cash position, the number of warrants that are outstanding and the dilutive effect on our

stockholders of issuing the maximum number of shares of Common Stock issuable upon the exercise of our warrants. If our management

takes advantage of this option, all holders of warrants would pay the exercise price by surrendering their warrants for that number

of shares of Common Stock equal to the quotient obtained by dividing (x) the product of the number of shares of Common Stock underlying

the warrants, multiplied by the difference between the exercise price of the warrants and the “fair market value” (defined

below), by (y) the fair market value. The “fair market value” shall mean the average reported last sale price of the

Common Stock for the 10 trading days ending on the third trading day prior to the date on which the notice of redemption is sent

to the holders of warrants. If our management takes advantage of this option, the notice of redemption will contain the information

necessary to calculate the number of shares of Common Stock to be received upon exercise of the warrants, including the fair market

value in such case. If we call our warrants for redemption and our management does not take advantage of this option, the initial

purchasers of the private placement warrants and their permitted transferees would still be entitled to exercise their Private

Warrants for cash or on a cashless basis using the same formula described above.

A holder of a Public Warrant may notify

us in writing in the event the holder elects to be subject to a requirement that such holder will not have the right to exercise

such warrant, to the extent that after giving effect to such exercise, such person (together with such person’s affiliates),

to the warrant agent’s actual knowledge, would beneficially own in excess of 9.8% (or such other amount as such holder may

specify) of the shares of Common Stock outstanding immediately after giving effect to such exercise.

If the number of outstanding shares of Common

Stock is increased by a stock dividend payable in shares of Common Stock, a split of shares of common stock or other similar event,

then, on the effective date of such stock dividend, split or similar event, the number of shares of Common Stock issuable on exercise

of each Public Warrant will be increased in proportion to such increase in the outstanding shares of Common Stock. A rights offering

to holders of Common Stock entitling holders to purchase shares of Common Stock at a price less than the fair market value will

be deemed to be a stock dividend of a number of shares of Common Stock equal to the product of (i) the number of shares of Common

Stock actually sold in such rights offering (or issuable under any other equity securities sold in such rights offering that are

convertible into or exercisable for Common Stock) multiplied by (ii) one minus the quotient of (x) the price per share of Common

Stock paid in such rights offering divided by (y) the fair market value. For these purposes: (i) if the rights offering is for

securities convertible into or exercisable for Common Stock, in determining the price payable for Common Stock, there will be taken

into account any consideration received for such rights, as well as any additional amount payable upon exercise or conversion,

and (ii) fair market value means the volume weighted average price of Common Stock as reported during the 10 trading day period

ending on the trading day prior to the first date on which the shares of Common Stock trade on the applicable exchange or in the

applicable market, regular way, without the right to receive such rights.

In addition, if we, at any time that the

Public Warrants are outstanding and unexpired, pay a dividend or make a distribution in cash, securities or other assets to the

holders of Common Stock on account of such shares of Common Stock (or other shares of our capital stock into which the warrants

are convertible), other than (a) as described above, or (b) certain ordinary cash dividends, then the warrant exercise price will

be decreased, effective immediately after the effective date of such event, by the amount of cash or the fair market value of any

securities or other assets paid on each share of Common Stock in respect of such event.

If the number of outstanding shares of our

Common Stock is decreased by a consolidation, combination, reverse stock split or reclassification of shares of Common Stock or

other similar event, then, on the effective date of such consolidation, combination, reverse stock split, reclassification or similar

event, the number of shares of Common Stock issuable on exercise of each Public Warrant will be decreased in proportion to such

decrease in outstanding shares of Common Stock.

Whenever the number of shares of Common

Stock purchasable upon the exercise of the Public Warrants is adjusted, as described above, the warrant exercise price will be

adjusted by multiplying the warrant exercise price immediately prior to such adjustment by a fraction (x) the numerator of which

will be the number of shares of Common Stock purchasable upon the exercise of the warrants immediately prior to such adjustment,

and (y) the denominator of which will be the number of shares of Common Stock so purchasable immediately thereafter.

In case of any reclassification or reorganization

of the outstanding shares of our Common Stock (other than those described above or that solely affect the par value of such shares

of Common Stock), or in the case of any merger or consolidation of us with or into another corporation (other than a consolidation

or merger in which we are the continuing corporation and which does not result in any reclassification or reorganization of our

outstanding shares of Common Stock), or in the case of any sale or conveyance to another corporation or entity of the assets or

other property of us as an entirety or substantially as an entirety in connection with which we are dissolved, the holders of the

Public Warrants will thereafter have the right to purchase and receive, upon the basis and upon the terms and conditions specified

in the warrants and in lieu of the shares of our Common Stock immediately theretofore purchasable and receivable upon the exercise

of the rights represented thereby, the kind and amount of shares of stock or other securities or property (including cash) receivable

upon such reclassification, reorganization, merger or consolidation, or upon a dissolution following any such sale or transfer,

that the holder of the warrants would have received if such holder had exercised their warrants immediately prior to such event.

However, if such holders were entitled to exercise a right of election as to the kind or amount of securities, cash or other assets

receivable upon such consolidation or merger, then the kind and amount of securities, cash or other assets for which each warrant

will become exercisable will be deemed to be the weighted average of the kind and amount received per share by such holders in

such consolidation or merger that affirmatively make such election, and if a tender, exchange or redemption offer has been made

to and accepted by such holders under circumstances in which, upon completion of such tender or exchange offer, the maker thereof,

together with members of any group (within the meaning of Rule 13d-5(b)(1) under the Exchange Act) of which such maker is a part,

and together with any affiliate or associate (within the meaning of Rule 12b-2 under the Exchange Act) of such maker and any members

of any such group of which any such affiliate or associate is a part, own beneficially (within the meaning of Rule 13d-3 under

the Exchange Act) more than 50% of the outstanding shares of Common Stock, the holder of a warrant will be entitled to receive

the highest amount of cash, securities or other property to which such holder would actually have been entitled as a stockholder

if such warrant holder had exercised the warrant prior to the expiration of such tender or exchange offer, accepted such offer

and all of the Common Stock held by such holder had been purchased pursuant to such tender or exchange offer, subject to adjustments

(from and after the consummation of such tender or exchange offer) as nearly equivalent as possible to the adjustments provided

for in the Warrant Agreement. Additionally, if less than 70% of the consideration receivable by the holders of Common Stock in

such a transaction is payable in the form of Common Stock in the successor entity that is listed for trading on a national securities

exchange or is quoted in an established over-the-counter market, or is to be so listed for trading or quoted immediately following

such event, and if the registered holder of the warrant properly exercises the warrant within thirty days following public disclosure

of such transaction, the warrant exercise price will be reduced as specified in the Warrant Agreement based on the per share consideration

minus the Black Scholes value (as defined in the Warrant Agreement) of the warrant.

The Public Warrants were issued in registered

form under the Warrant Agreement with Continental Stock Transfer & Trust Company, as warrant agent, and us. You should review

a copy of the Warrant Agreement for a complete description of the terms and conditions applicable to the warrants. The Warrant

Agreement provides that the terms of the warrants may be amended without the consent of any holder to cure any ambiguity or correct

any defective provision, but requires the approval by the holders of at least 65% of the then outstanding Public Warrants to make

any change that adversely affects the interests of the registered holders of Public Warrants.

The warrants may be exercised upon surrender

of the warrant certificate on or prior to the expiration date at the offices of the warrant agent, with the exercise form on the

reverse side of the warrant certificate completed and executed as indicated, accompanied by full payment of the exercise price

by certified or official bank check payable to us (or on a cashless basis, if applicable), for the number of warrants being exercised.

The warrant holders do not have the rights or privileges of holders of Common Stock nor any voting rights until they exercise their

warrants and receive shares of Common Stock. After the issuance of shares of Common Stock upon exercise of the warrants, each holder

will be entitled to one vote for each share held of record on all matters to be voted on by stockholders.

No fractional shares will be issued upon

exercise of the Public Warrants. If, upon exercise of the warrants, a holder would be entitled to receive a fractional interest

in a share, we will, upon exercise, round down to the nearest whole number the number of shares of Common Stock to be issued to

the warrant holder.

Private Warrants

The Company’s Private Warrants are

identical to the Public Warrants sold in the IPO, including as to exercise price, exercisability and exercise period, except that,

if held by the initial private placement purchasers or their permitted assigns, they (a) may be exercised for cash or on a cashless

basis; and (b) are not subject to being called for redemption. If the Private Warrants are held by holders other than the

initial private placement purchasers or their permitted transferees, the Private Warrants will be redeemable by us and exercisable

by the holders on the same basis as the Public Warrants.

If holders of the Private Warrants elect

to exercise them on a cashless basis, they would pay the exercise price by surrendering their warrants for that number of shares

of Common Stock equal to the quotient obtained by dividing (x) the product of the number of shares of Common Stock underlying the

warrants, multiplied by the difference between the exercise price of the warrants and the “fair market value” (defined

below) by (y) the fair market value. The “fair market value” shall mean the average reported last sale price of the

Common Stock for the 10 trading days ending on the third trading day prior to the date on which the notice of warrant exercise

is sent to the warrant agent.

Certain Anti-Takeover Provisions of Our Charter and Bylaws

and Certain Provisions of Delaware Law

The Company’s Charter and Bylaws contain

provisions that could have the effect of delaying or preventing changes in control or changes in our management without the consent

of our board of directors. These provisions include:

|

|

●

|

no

cumulative voting in the election of directors, which limits the ability of minority stockholders to elect director candidates;

|

|

|

●

|

the

exclusive right of our board of directors to elect a director to fill a vacancy created by the expansion of the board of directors

or the resignation, death, or removal of a director with or without cause by stockholders, which prevents stockholders from being

able to fill vacancies on our board of directors;

|

|

|

●

|

the

ability of our board of directors to determine whether to issue shares of our Preferred Stock and to determine the price and other

terms of those shares, including preferences and voting rights, without stockholder approval, which could be used to significantly

dilute the ownership of a hostile acquirer;

|

|

|

●

|

limiting

the liability of, and providing indemnification to, our directors and officers;

|

|

|

●

|

specifying

the Court of Chancery of the State of Delaware as the exclusive forum for adjudication of disputes;

|

|

|

●

|

controls

over the procedures for the conduct and scheduling of stockholder meetings; and

|

|

|

●

|

advance

notice procedures that stockholders must comply with in order to nominate candidates to our board of directors or to propose matters

to be acted upon at a stockholders’ meeting, which may discourage or deter a potential acquirer from conducting a solicitation

of proxies to elect the acquirer’s own slate of directors or otherwise attempting to obtain control of the Company.

|

These provisions, singly or together, could

delay hostile takeovers and changes in control of the Company or changes in our board of directors and management.

As a Delaware corporation, we are also subject

to provisions of Delaware law, including Section 203 of the DGCL, which prevents some stockholders holding more than 15% of our

outstanding Common Stock from engaging in certain business combinations without approval of the holders of substantially all of

our outstanding Common Stock. Any provision of our Charter or Bylaws, or Delaware law that has the effect

of delaying or deterring a change in control could limit the opportunity for our stockholders to receive a premium for their shares

of our Common Stock and could also affect the price that some investors are willing to pay for our Common Stock.

Rule 144

Rule 144 is not available for the resale

of securities initially issued by shell companies (other than business combination related shell companies) or any issuer, such

as the Company, that has been at any time previously a shell company. However, Rule 144 also includes an important exception to

this prohibition if the following conditions are met:

|

|

●

|

the issuer of the securities that was formerly a shell

company has ceased to be a shell company;

|

|

|

●

|

the issuer of the securities is subject to the reporting requirements of Section 13 or 15(d) of the Exchange Act;

|

|

|

●

|

the issuer of the securities has filed all Exchange Act reports and material required to be filed, as applicable, during the

preceding 12 months (or such shorter period that the issuer was required to file such reports and materials), other than Form 8-K

reports; and at least one year has elapsed from the time that the issuer filed current Form 10-type information with the SEC, which

in the case of the Company was filed promptly after completion of the Business Combination.

|

As a result of the foregoing, Rule 144 was

not available for the resale of our securities until one year after the filing of the Form 10 information included in the 8-K that

the Company filed with the SEC with respect to the Business Combination on December 30, 2016.

Under Rule 144, a person who has beneficially

owned restricted shares of our common stock or warrants for at least six months may be entitled to sell such shares, provided that

such person is not deemed to have been one of our affiliates at the time of, or at any time during the three months preceding,

a sale; and we are subject to the Exchange Act periodic reporting requirements for at least three months before the sale and have

filed all required reports under Section 13 or 15(d) of the Exchange Act during the 12 months (or such shorter period as we were

required to file reports) preceding the sale.

Persons who have beneficially owned restricted

shares of our common stock or warrants for at least six months but who are our affiliates at the time of, or at any time during

the three months preceding, a sale, would be subject to additional restrictions, by which such person would be entitled to sell

within any three-month period only a number of shares that does not exceed the greater of:

|

|

●

|

1% of the total number of shares of common stock then outstanding,

or

|

|

|

●

|

the average weekly reported trading volume of the common stock during the four calendar weeks preceding the filing of a notice

on Form 144 with respect to the sale.

|

Sales by our affiliates under Rule 144 are

also limited by manner of sale provisions, notice requirements and requirements as to the availability of current public information

about us.

Debt Securities

As used in this prospectus, the term “debt

securities” means the debentures, notes, bonds and other evidences of indebtedness that we may issue from time to time. The

debt securities will either be senior debt securities, senior subordinated debt or subordinated debt securities. We may also issue

convertible debt securities. Debt securities issued under an indenture (which we refer to herein as an Indenture) will be entered

into between us and a trustee to be named therein. It is likely that convertible debt securities will not be issued under an Indenture.

The Indenture or forms of Indentures, if

any, will be filed as exhibits to the registration statement of which this prospectus is a part. The statements and descriptions

in this prospectus or in any prospectus supplement regarding provisions of the Indentures and debt securities are summaries thereof,

do not purport to be complete and are subject to, and are qualified in their entirety by reference to, all of the provisions of

the Indentures (and any amendments or supplements we may enter into from time to time which are permitted under each Indenture)

and the debt securities, including the definitions therein of certain terms.

General

Unless otherwise specified in a prospectus

supplement, the debt securities will be direct secured or unsecured obligations of our company. The senior debt securities will

rank equally with any of our other unsecured senior and unsubordinated debt. The subordinated debt securities will be subordinate

and junior in right of payment to any senior indebtedness.

We may issue debt securities from time to

time in one or more series, in each case with the same or various maturities, at par or at a discount. Unless indicated in a prospectus

supplement, we may issue additional debt securities of a particular series without the consent of the holders of the debt securities

of such series outstanding at the time of the issuance. Any such additional debt securities, together with all other outstanding

debt securities of that series, will constitute a single series of debt securities under the applicable Indenture and will be equal

in ranking.

Should an indenture relate to unsecured indebtedness,

in the event of a bankruptcy or other liquidation event involving a distribution of assets to satisfy our outstanding indebtedness

or an event of default under a loan agreement relating to secured indebtedness of our company or its subsidiaries, the holders

of such secured indebtedness, if any, would be entitled to receive payment of principal and interest prior to payments on the senior

indebtedness issued under an Indenture.

Prospectus Supplement

Each prospectus supplement will describe

the terms relating to the specific series of debt securities being offered. These terms will include some or all of the following:

|

|

●

|

the title of debt securities and whether they are subordinated, senior subordinated or senior debt securities;

|

|

|

|

|

|

|

●

|

any limit on the aggregate principal amount of debt securities of such series;

|

|

|

|

|

|

|

●

|

the percentage of the principal amount at which the debt securities of any series will be issued;

|

|

|

|

|

|

|

●

|

the ability to issue additional debt securities of the same series;

|

|

|

|

|

|

|

●

|

the purchase price for the debt securities and the denominations of the debt securities;

|

|

|

|

|

|

|

●

|

the specific designation of the series of debt securities being offered;

|

|

|

|

|

|

|

●

|

the maturity date or dates of the debt securities and the date or dates upon which the debt securities are payable and the rate or rates at which the debt securities of the series shall bear interest, if any, which may be fixed or variable, or the method by which such rate shall be determined;

|

|

|

|

|

|

|

●

|

the basis for calculating interest if other than 360-day year or twelve 30-day months;

|

|

|

|

|

|

|

●

|

the date or dates from which any interest will accrue or the method by which such date or dates will be determined;

|

|

|

|

|

|

|

●

|

the duration of any deferral period, including the maximum consecutive period during which interest payment periods may be extended;

|

|

|

|

|

|

|

●

|

whether the amount of payments of principal of (and premium, if any) or interest on the debt securities may be determined with reference to any index, formula or other method, such as one or more currencies, commodities, equity indices or other indices, and the manner of determining the amount of such payments;

|

|

|

|

|

|

|

●

|

the dates on which we will pay interest on the debt securities and the regular record date for determining who is entitled to the interest payable on any interest payment date;

|

|

|

|

|

|

|

●

|

the place or places where the principal of (and premium, if any) and interest on the debt securities will be payable, where any securities may be surrendered for registration of transfer, exchange or conversion, as applicable, and notices and demands may be delivered to or upon us pursuant to the applicable Indenture;

|

|

|

|

|

|

|

●

|

the rate or rates of amortization of the debt securities;

|

|

|

|

|

|

|

●

|

if we possess the option to do so, the periods within which and the prices at which we may redeem the debt securities, in whole or in part, pursuant to optional redemption provisions, and the other terms and conditions of any such provisions;

|

|

|

|

|

|

|

●

|

our obligation or discretion, if any, to redeem, repay or purchase debt securities by making periodic payments to a sinking fund or through an analogous provision or at the option of holders of the debt securities, and the period or periods within which and the price or prices at which we will redeem, repay or purchase the debt securities, in whole or in part, pursuant to such obligation, and the other terms and conditions of such obligation;

|

|

|

|

|

|

|

●

|

the terms and conditions, if any, regarding the option or mandatory conversion or exchange of debt securities;

|

|

|

|

|

|

|

●

|

the period or periods within which, the price or prices at which and the terms and conditions upon which any debt securities of the series may be redeemed, in whole or in part at our option and, if other than by a board resolution, the manner in which any election by us to redeem the debt securities shall be evidenced;

|

|

|

|

|

|

|

●

|

any restriction or condition on the transferability of the debt securities of a particular series;

|

|

|

|

|

|

|

●

|

the portion, or methods of determining the portion, of the principal amount of the debt securities which we must pay upon the acceleration of the maturity of the debt securities in connection with any event of default if other than the full principal amount;

|

|

|

●

|

the currency or currencies in which the debt securities will be denominated and in which principal, any premium and any interest will or may be payable or a description of any units based on or relating to a currency or currencies in which the debt securities will be denominated;

|

|

|

|

|

|

|

●

|

provisions, if any, granting special rights to holders of the debt securities upon the occurrence of specified events;

|

|

|

|

|

|

|

●

|

any deletions from, modifications of or additions to the events of default or our covenants with respect to the applicable series of debt securities, and whether or not such events of default or covenants are consistent with those contained in the applicable Indenture;

|

|

|

|

|

|

|

●

|

any limitation on our ability to incur debt, redeem stock, sell our assets or other restrictions;

|

|

|

|

|

|

|

●

|

the application, if any, of the terms of the applicable Indenture relating to defeasance and covenant defeasance (which terms are described below) to the debt securities;

|

|

|

|

|

|

|

●

|

what subordination provisions will apply to the debt securities;

|

|

|

|

|

|

|

●

|

the terms, if any, upon which the holders may convert or exchange the debt securities into or for our common stock, preferred stock or other securities or property;

|

|

|

|

|

|

|

●

|

whether we are issuing the debt securities in whole or in part in global form;

|

|

|

|

|

|

|

●

|

any change in the right of the trustee or the requisite holders of debt securities to declare the principal amount thereof due and payable because of an event of default;

|

|

|

|

|

|

|

●

|

the depositary for global or certificated debt securities, if any;

|

|

|

|

|

|

|

●

|

any material federal income tax consequences applicable to the debt securities, including any debt securities denominated and made payable, as described in the prospectus supplements, in foreign currencies, or units based on or related to foreign currencies;

|

|

|

|

|

|

|

●

|

any right we may have to satisfy, discharge and defease our obligations under the debt securities, or terminate or eliminate restrictive covenants or events of default in the Indentures, by depositing money or U.S. government obligations with the trustee of the Indentures;

|

|

|

|

|

|

|

●

|

the names of any trustees, depositories, authenticating or paying agents, transfer agents or registrars or other agents with respect to the debt securities;

|

|

|

|

|

|

|

●

|

to whom any interest on any debt security shall be payable, if other than the person in whose name the security is registered, on the record date for such interest, the extent to which, or the manner in which, any interest payable on a temporary global debt security will be paid if other than in the manner provided in the applicable Indenture;

|

|

|

|

|

|

|

●

|

if the principal of or any premium or interest on any debt securities is to be payable in one or more currencies or currency units other than as stated, the currency, currencies or currency units in which it shall be paid and the periods within and terms and conditions upon which such election is to be made and the amounts payable (or the manner in which such amount shall be determined);

|

|

|

|

|

|

|

●

|

the portion of the principal amount of any debt securities which shall be payable upon declaration of acceleration of the maturity of the debt securities pursuant to the applicable Indenture if other than the entire principal amount;

|

|

|

|

|

|

|

●

|

if the principal amount payable at the stated maturity of any debt security of the series will not be determinable as of any one or more dates prior to the stated maturity, the amount which shall be deemed to be the principal amount of such debt securities as of any such date for any purpose, including the principal amount thereof which shall be due and payable upon any maturity other than the stated maturity or which shall be deemed to be outstanding as of any date prior to the stated maturity (or, in any such case, the manner in which such amount deemed to be the principal amount shall be determined); and

|

|

|

|

|

|

|

●

|

any other specific terms of the debt securities, including any modifications to the events of default under the debt securities and any other terms which may be required by or advisable under applicable laws or regulations.

|

Unless otherwise specified in the applicable

prospectus supplement, the debt securities will not be listed on any securities exchange. Holders of the debt securities may present

registered debt securities for exchange or transfer in the manner described in the applicable prospectus supplement. Except as

limited by the applicable Indenture, we will provide these services without charge, other than any tax or other governmental charge

payable in connection with the exchange or transfer.

Debt securities may bear interest at a fixed

rate or a variable rate as specified in the prospectus supplement. In addition, if specified in the prospectus supplement, we may

sell debt securities bearing no interest or interest at a rate that at the time of issuance is below the prevailing market rate,

or at a discount below their stated principal amount. We will describe in the applicable prospectus supplement any special federal

income tax considerations applicable to these discounted debt securities.

We may issue debt securities with the principal

amount payable on any principal payment date, or the amount of interest payable on any interest payment date, to be determined

by referring to one or more currency exchange rates, commodity prices, equity indices or other factors. Holders of such debt securities

may receive a principal amount on any principal payment date, or interest payments on any interest payment date, that are greater

or less than the amount of principal or interest otherwise payable on such dates, depending upon the value on such dates of applicable

currency, commodity, equity index or other factors. The applicable prospectus supplement will contain information as to how we

will determine the amount of principal or interest payable on any date, as well as the currencies, commodities, equity indices

or other factors to which the amount payable on that date relates and certain additional tax considerations.

Warrants

We may issue warrants for the purchase of

our common stock, preferred stock or debt securities or any combination thereof. Warrants may be issued independently or together

with our common stock, preferred stock or debt securities and may be attached to or separate from any offered securities. To the

extent warrants that we issue are to be publicly-traded, each series of such warrants will be issued under a separate warrant agreement

to be entered into between us and a bank or trust company, as warrant agent. The warrant agent will act solely as our agent in

connection with such warrants. The warrant agent will not have any obligation or relationship of agency or trust for or with any

holders or beneficial owners of warrants.

We will file as exhibits to the registration

statement of which this prospectus is a part, or will incorporate by reference from a current report on Form 8-K that we file with

the SEC, forms of the warrant and warrant agreement, if any. The prospectus supplement relating to any warrants that we may offer

will contain the specific terms of the warrants and a description of the material provisions of the applicable warrant agreement,

if any. These terms may include the following:

|

|

●

|

the title of the warrants;

|

|

|

|

|

|

|

●

|

the price or prices at which the warrants will be issued;

|

|

|

|

|

|

|

●

|

the designation, amount and terms of the securities or other rights for which the warrants are exercisable;

|

|

|

|

|

|

|

●

|

the designation and terms of the other securities, if any, with which the warrants are to be issued and the number of warrants issued with each other security;

|

|

|

|

|

|

|

●

|

the aggregate number of warrants;

|

|

|

|

|

|

|

●

|

any provisions for adjustment of the number or amount of securities receivable upon exercise of the warrants or the exercise price of the warrants;

|

|

|

|

|

|

|

●

|

the price or prices at which the securities or other rights purchasable upon exercise of the warrants may be purchased;

|

|

|

|

|

|

|

●

|

if applicable, the date on and after which the warrants and the securities or other rights purchasable upon exercise of the warrants will be separately transferable;

|

|

|

|

|

|

|

●

|

a discussion of any material U.S. federal income tax considerations applicable to the exercise of the warrants;

|

|

|

|

|

|

|

●

|

the date on which the right to exercise the warrants will commence, and the date on which the right will expire;

|

|

|

|

|

|

|

●

|

the maximum or minimum number of warrants that may be exercised at any time;

|

|

|

|

|

|

|

●

|

information with respect to book-entry procedures, if any; and

|

|

|

|

|

|

|

●

|

any other terms of the warrants, including terms, procedures and limitations relating to the exchange and exercise of the warrants.

|

Exercise of Warrants. Each warrant

will entitle the holder of warrants to purchase the amount of securities or other rights, at the exercise price stated or determinable

in the prospectus supplement for the warrants. Warrants may be exercised at any time up to the close of business on the expiration

date shown in the applicable prospectus supplement, unless otherwise specified in such prospectus supplement. After the close of

business on the expiration date, if applicable, unexercised warrants will become void. Warrants may be exercised in the manner

described in the applicable prospectus supplement. When the warrant holder makes the payment and properly completes and signs the

warrant certificate at the corporate trust office of the warrant agent, if any, or any other office indicated in the prospectus

supplement, we will, as soon as possible, forward the securities or other rights that the warrant holder has purchased. If the

warrant holder exercises less than all of the warrants represented by the warrant certificate, we will issue a new warrant certificate

for the remaining warrants.

Rights

We may issue rights to purchase our securities.

The rights may or may not be transferable by the persons purchasing or receiving the rights. In connection with any rights offering,

we may enter into a standby underwriting or other arrangement with one or more underwriters or other persons pursuant to which

such underwriters or other persons would purchase any offered securities remaining unsubscribed for after such rights offering.

Each series of rights will be issued under a separate rights agent agreement to be entered into between us and one or more banks,

trust companies or other financial institutions, as rights agent, which we will name in the applicable prospectus supplement. The

rights agent will act solely as our agent in connection with the rights and will not assume any obligation or relationship of agency

or trust for or with any holders of rights certificates or beneficial owners of rights.

The prospectus supplement relating to any

rights that we offer will include specific terms relating to the offering, including, among other matters:

|