Current Report Filing (8-k)

October 13 2020 - 5:25PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or Section 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October

9, 2020 (October 9, 2020)

Inspired Entertainment, Inc.

(Exact name of registrant as specified in its

charter)

|

Delaware

|

|

001-36689

|

|

47-1025534

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

|

250 West 57th Street, Suite 415

New York, New York

|

|

10107

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code: (646)

565-3861

Not Applicable

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation to the registrant under any of the following provisions:

|

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

|

|

|

|

|

|

|

Common stock, par value $0.0001 per share

|

|

INSE

|

|

The NASDAQ Stock Market LLC

|

Indicate by check mark whether the registrant is an emerging growth

company as defined in as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided

pursuant to Section 13(a) of the Exchange Act. ☐

|

|

Item 5.02

|

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

|

|

|

(a)

|

On October 9, 2020, Inspired Entertainment, Inc. (the “Company”) entered into a new employment agreement with A. Lorne Weil, the Company’s Executive Chairman. The new employment agreement will become effective retroactively to January 1, 2020, will, subject to the option set out below, terminate on December 31, 2024, and will replace the prior agreement between the Company and Mr. Weil dated January 16, 2017 (as amended on August 24, 2018).

|

Among other things, Mr. Weil’s new agreement:

|

|

●

|

eliminates provisions that provide that certain compensation or benefit arrangements with Mr. Weil will be no less favorable than the arrangements made by the Company with other executives of the Company;

|

|

|

●

|

provides for a fixed term of five-years, ending on December 31, 2024, with an optional one year extension subject to the mutual agreement of the Company and Mr. Weil, without severance if not renewed; as opposed to Mr. Weil’s current agreement, which does not have a fixed term and consequently would include severance if terminated by the Company;

|

|

|

●

|

reduces the amount due to Mr. Weil upon severance during the fixed term (except upon death);

|

|

|

●

|

retains Mr. Weil’s base annual salary of $750,000 per year;

|

|

|

●

|

increases Mr. Weil’s Target Bonus from 100% to 120%;

|

|

|

|

|

|

|

●

|

provides for an award to Mr. Weil of a Special Sign-On Equity Grant of one hundred thousand (100,000) RSUs (the “Special Sign-on Equity Grant”), which will vest on the earlier of his death, termination by the Company without cause, Change in Control Termination Event (as defined), or June 30, 2021.

|

|

|

|

|

|

|

●

|

Subject to stockholder approval to fund the grant, provides for a grant of 750,000 RSUs (the “Special Long-term Equity Grant, on the following terms:

|

|

O

|

|

Time Based RSUs

|

|

|

|

An aggregate of 250,000 RSUs are time-based RSUs, which shall vest as follows:

|

|

■

|

|

85,000 RSUs will vest subject to the Service Requirement (defined below) on December

31, 2022;

|

|

■

|

|

80,000 RSUs will vest subject to the Service Requirement on December 31, 2023; and

|

|

■

|

|

85,000 RSUs will vest subject to the Service Requirement on December 31, 2024.

|

|

|

|

|

|

|

|

“Service Requirement” means that the Executive remains employed by the Company pursuant to the agreement on

the vesting date.

|

|

O

|

|

Adjusted EBITDA Based RSUs

An aggregate of 250,000 RSUs shall be Adjusted EBITDA Based RSUs which may be earned based on the Company’s achievement of EBITDA Targets (as defined) and shall vest as described below. The Executive shall have the ability to earn 62,500 RSUs with respect to each of the calendar years 2021 through 2024 based on the Company achieving its annual Adjusted EBITDA targets (consistent with the Company’s STIP) (each target, the “EBITDA Target”), provided, however, that the proration of this award will begin upon achievement of 70% of the annual “Target” STIP Budget, as adjusted.. The first two years of such Adjusted EBITDA Based RSUs will vest if earned on December 31, 2022 and subsequent years will vest at the end of the year in which they are earned.

|

|

o

|

|

Stock Price Based RSUs

An aggregate of 250,000 RSUs shall be Stock Price Based RSUs, which shall be earned by meeting the stock price targets and the thresholds set forth in the agreement.

|

|

o

|

|

Special

provisions apply in the case of death or certain other events.

|

|

|

|

Condition to Effectiveness of RSU Awards

|

|

|

|

|

|

|

|

The effectiveness of the RSU awards (other than the Special Sign-on Equity Grant), is

conditioned upon approval by the stockholders of the Company at the Company’s 2021 Annual Meeting of Stockholders or at

any other meeting of stockholders as the Board may determine. In the event the stockholders do not approve the shares necessary

to support the RSU awards, then the sections of the agreement providing for such awards will not become effective, but the remainder

of the agreement will remain in force. The failure to obtain such approval shall not be deemed to affect the authority of the

Compensation Committee or the Board with respect to discretionary matters relating to compensation of the Executive.

|

|

|

|

|

|

|

|

Reasons for the new agreement

|

|

|

|

|

|

|

|

As

previously reported, on 31 January 2020, the Compensation Committee previously entered into a new employment agreement with Mr.

Weil to replace the Executive Chairman’s original 2017 employment agreement as part of an ongoing effort to better align

executive compensation with stockholder interests and prevailing best practices. That agreement was subject to stockholder approval,

which was not sought because, on March 26, 2020, in light of the unprecedented situation the Company (and leisure sector generally)

experienced by reason of the Covid-19 pandemic, Mr. Weil withdraw from the new contract and continued his employment under

his 2017 agreement (as amended).

|

|

|

|

|

|

|

|

The Compensation Committee and Mr. Weil have now agreed to the terms of a new

agreement. In determining to approve the new agreement with Mr. Weil, the Compensation Committee of the Company’s

Board of Directors took into account the following factors:

|

|

●

|

|

The new agreement provides for a five-year term with an optional one year extension,

which supersedes the current agreement without a fixed term. The Compensation Committee was of the view that a fixed term agreement

is more conventional and will provide the Board the opportunity to consider Mr. Weil’s retention following the expiration

of the term.

|

|

●

|

|

The Special Sign-On Equity Grant was deemed by the Compensation Committee to be fair

and reasonable to the Company for the following reasons:

|

|

o

|

|

Mr. Weil served as Chairman of the Board and Chief Executive Officer of the entity

that became the Company from 2014 until December 2016 without receiving any cash or non-cash compensation for services rendered

to the Company, and funded a significant portion of the operations of the Company from his personal resources.

|

|

o

|

|

Mr. Weil’s ability to earn time-based RSUs is subject to his continued employment

by the Company. In addition, his entitlement to Adjusted EBITDA Based RSUs and Stock Price Based RSUs is tied to Company performance.

These are intended to provide Mr. Weil with a strong incentive to increase the Company’s metrics in a manner that will also

benefit stockholders, and thereby to align his performance with the interests of stockholders.

|

|

o

|

|

Mr. Weil has, since December 2016, served as Executive Chairman of the Company; following

the departure of the Company’s former Chief Executive Officer in May 2018, Mr. Weil has been responsible for operational

control of the Company and has served as its senior executive officer. Through his efforts, the Company has significantly expanded

its core business, completed a transformational acquisition of the Gaming Technology Group of Novomatic UK Ltd., completed renegotiation

of the Company’s financing, and navigated the impact of the pandemic on the business. All of these activities added

significant value in assisting the Company strategically and positioning it for future growth.

|

|

(b)

|

|

The summary

of the October 2020 employment agreement with Mr. Weil described above is qualified in its entirety by reference to the employment

agreement, which is annexed as an exhibit to this Report on Form 8-K.

|

Item 9.01. Financial

Statements and Exhibits

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

October 13, 2020

|

Inspired Entertainment, Inc.

|

|

|

|

|

|

|

By:

|

/s/ Carys Damon

|

|

|

|

Name: Carys Damon

|

|

|

|

Title: General Counsel

|

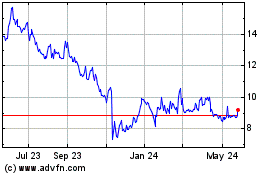

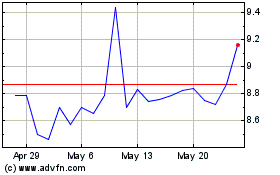

Inspired Entertainment (NASDAQ:INSE)

Historical Stock Chart

From Mar 2024 to Apr 2024

Inspired Entertainment (NASDAQ:INSE)

Historical Stock Chart

From Apr 2023 to Apr 2024