InMed Pharmaceuticals Reports Third Quarter Fiscal 2021 Financial Results

May 13 2021 - 7:30AM

InMed Pharmaceuticals Inc. (“InMed” or the

“Company”) (NASDAQ:INM), a clinical-stage company developing

pharmaceutical-based drug candidates and leading the way in the

clinical development of cannabinol (“CBN”), today reported

financial results for the third quarter of fiscal year 2021

(“3Q21”) which ended March 31, 2021.

The Company will be hosting a conference call to

present the 3Q21 results, as follows:

Conference Call &

Webcast*:Thursday, May 13, 2021 at 8:00 AM Pacific Time,

11:00 AM Eastern TimeUS/CANADA Participant Toll-Free Dial-In

Number: +1 (855) 605-1745US/CANADA Participant International

Dial-In Number: +1 (914) 987-7959Conference ID:

3186833Webcast: https://edge.media-server.com/mmc/p/ajuejmko(*Webcast

replay available for 90 days)

The Company’s 10-Q including financial

statements and related MD&A for the third quarter ending March

31, 2021 are available at www.inmedpharma.com, www.sedar.com and at

www.sec.gov.

“In the third quarter of fiscal 2021,

significant progress was made in InMed’s INM-755 therapeutic

program and IntegraSynTM manufacturing approach, resulting in the

announcement of important milestones shortly after the quarter’s

end,” said InMed President and Chief Executive Officer, Eric A.

Adams. “The submission of Clinical Trial Applications in several

countries, seeking permission to begin a Phase 2 safety and

efficacy clinical trial in Epidermolysis Bullosa patients and the

achievement of a commercially viable yield using the IntegraSynTM

manufacturing approach bring us one step closer to delivering new

therapeutic alternatives to patients who may benefit from

cannabinoid-based pharmaceutical drugs. In addition to our R&D

advances this past quarter, we continue to explore business

development opportunities as a potential avenue to build the

Company and accelerate our programs.”

Research & Development

Update:

INM-755 for the Treatment of

Epidermolysis Bullosa (“EB”):

- On April 28,

2021, InMed announced that it had filed Clinical Trial Applications

(“CTAs”) in Austria, Israel and Serbia as

part of a Phase 2 clinical trial of INM-755 (cannabinol) cream in

Epidermolysis Bullosa (“EB”). Since then, additional CTAs for

755-201-EB (the ‘201 study) have been submitted to National

Competent Authorities (“NCAs”) and Ethics Committees (“ECs”)

in France and Germany. We also expect to file CTAs in

Greece and Italy in the coming weeks. Responses from the

NCAs and ECs are expected throughout July and August 2021;

timing will vary slightly by country due to differences in local

procedures. The ‘201 study is designed to enroll up to 20 patients,

conservatively within 10-12 months, and will take place at 10

pre-qualified clinical sites in the above-mentioned countries. All

four subtypes of inherited EB, being EB Simplex, Dystrophic EB,

Junctional EB, and Kindler Syndrome, are eligible for this study in

which InMed will evaluate the safety of INM-755 (cannabinol) cream

and its preliminary efficacy in treating symptoms and healing

wounds over a 28-day period. The study will use a within-patient,

double-blind design whereby matched index areas will be randomized

to INM-755 (cannabinol) cream or vehicle cream as a control.

IntegraSynTM:

- On April 26,

2021, InMed announced that its IntegraSynTM cannabinoid

manufacturing approach had achieved a level of 2g/L cannabinoid

yield, a milestone that signals commercial viability and supports

advancement to large-scale production in the coming months. Having

achieved a 2g/L yield level, InMed will now focus on manufacturing

scale-up to larger batch sizes while continuing process and enzyme

optimization, targeting increased cannabinoid yield and further

reducing the overall cost of goods. In parallel, the Company

continues to prepare the manufacturing process to be Good

Manufacturing Practice (GMP)-ready for pharmaceutical quality

production. The next stage of large-scale production is to produce

a batch with a target output of one kilogram of the selected

cannabinoid in 2H2021 via a GMP-ready process.

Financing Activity

and Results of Operations (expressed in US Dollars):

- On February 5,

2021, the Company announced that it had entered into definitive

agreements with certain institutional investors to raise aggregate

gross proceeds of approximately $4.5 million and on February 16,

2021, the Company announced that it had closed the private

placement. Under the terms of the private placement, an aggregate

of 1,050,000 units were purchased, each unit comprised of one

common share and 0.66 of a warrant to purchase one common share, at

a placement price of $4.25 per unit. The warrants have an exercise

price of $4.85, are exercisable six months following issuance, and

have a term of five and one half years following issuance. After

the placement agent fees and estimated offering expenses payable by

the Company, the Company received net proceeds of approximately

$4.0 million.

- On April 27,

2021, InMed announced that, based on the strong trading data on the

Nasdaq, it had provided written notice to the Toronto Stock

Exchange (the "TSX") regarding the voluntary delisting of its

common shares. InMed’s common shares will continue to be listed and

tradable on the Nasdaq under “INM”. The Company believes that the

trading volume of its shares on the TSX no longer justified the

expense and administrative efforts associated with maintaining this

dual listing. InMed’s common shares were delisted from the TSX at

the close of trading on May 7, 2021.

- For the three

and nine months ended March 31, 2021, the Company recorded a net

loss of $3.1 million and $6.9 million, or $0.41 and $1.11 per

share, compared with a net loss of $2.0 million and $7.3 million,

or $0.39 and $1.40 per share, for the three and nine months ended

March 31, 2020.

- Research and

development expenses were $1.8 million for 3Q21, compared with $1.3

million for the three months ended March 31, 2020. The increase in

research and development and patents expenses was primarily due to

increased spend on the INM-755 program, including the preparation

during this period for the planned commencement of a Phase 2 trial.

For the nine months ended March 31, 2021, research and development

expenses totaled $3.6 million, compared with $4.8 million for the

same period in fiscal 2020. The reduction in research and

development and patents expenses was primarily due to decreased

spending on the integrated cannabinoid manufacturing program and

the INM-755 program, including decreased purchases of the active

pharmaceutical ingredients used in INM-755 clinical trials. In

addition, share-based payments were lower for the nine months ended

March 31, 2021.

- The Company

incurred general and administrative expenses of $1.3 million for

3Q21, compared with $0.9 million for the three months ended March

31, 2020. For the nine months ended March 31, 2021, general and

administrative expenses totaled $2.9 million, compared with $2.7

million for the same period in fiscal 2020. The increase results

from a combination of changes including substantially higher

insurance fees, offset by lower share-based payments and lower

legal costs associated with negotiating contracts and other matters

in the current period and certain current year legal costs being

capitalized to equity.

- The Company

also incurred non-cash, share-based payments in connection with the

grant of stock options, of $0.2 million for each of 3Q21 and the

three months ended March 31, 2020. For the nine months ended March

31, 2021, non-cash, share-based payments totaled $0.4 million

compared with $0.8 million for the comparable period in fiscal

2020. Share-based payments amounts are included within research and

development expenses and general and administrative expenses.

- At March 31,

2021, the Company's cash, cash equivalents and short-term

investments were $9.5 million, which compares to $5.8 million at

June 30, 2020. The increase in cash, cash equivalents and

short-term investments during the nine months to March 31, 2021,

was primarily the result of the November 16, 2020 public offering

and the February 16, 2021 private placement partially offset by

cash outflows from operating activities.

- At March 31,

2021, the Company's total issued and outstanding shares were

8,050,707. Including outstanding stock options and warrants, as at

March 31, 2021, the Company had 11,415,228 shares on a fully

diluted basis. During the three and nine months ending March 31,

2021, the weighted average number of common shares was 7,549,040

and 6,277,824, which is used for the calculation of loss per share

for the respective interim periods.

Table 1: Condensed consolidated interim

balance sheets (unaudited):

| InMed

Pharmaceuticals Inc. |

|

|

| CONDENSED

CONSOLIDATED INTERIM BALANCE SHEETS (unaudited) |

|

| As at March 31, 2021 and June

30, 2020 |

|

|

|

Expressed in U.S. Dollars |

|

|

|

|

March 31, |

|

June 30, |

|

|

|

2021 |

|

2020 |

|

|

|

|

|

|

ASSETS |

$ |

|

$ |

|

|

Current |

|

|

|

Cash and cash equivalents |

9,454,113 |

|

5,805,809 |

|

|

Short-term investments |

45,765 |

|

42,384 |

|

|

Accounts receivable |

70,300 |

|

45,344 |

|

|

Prepaids and other assets |

1,326,526 |

|

418,920 |

|

|

Total current assets |

10,896,704 |

|

6,312,457 |

|

|

|

|

|

|

Non-Current |

|

|

|

Property and equipment, net |

347,892 |

|

403,485 |

|

|

Intangible assets, net |

1,085,748 |

|

1,086,655 |

|

|

Other assets |

14,655 |

|

- |

|

|

Total Assets |

12,344,999 |

|

7,802,597 |

|

|

|

|

|

| LIABILITIES

AND SHAREHOLDERS' EQUITY |

|

|

|

Current |

|

|

|

Accounts payables and accrued liabilities |

1,635,477 |

|

1,607,303 |

|

|

Current portion of lease obligations |

78,818 |

|

68,965 |

|

|

Total current liabilities |

1,714,295 |

|

1,676,268 |

|

|

|

|

|

|

Non-current |

|

|

|

Lease obligations |

216,234 |

|

248,011 |

|

|

Total Liabilities |

1,930,529 |

|

1,924,279 |

|

|

|

|

|

| Shareholders'

Equity |

|

|

|

Common shares, no par value, unlimited authorized shares: |

|

|

|

8,050,707 (June 30, 2020 - 5,220,707) issued and outstanding |

60,587,417 |

|

53,065,240 |

|

|

Additional paid-in capital |

21,292,201 |

|

17,764,333 |

|

|

Accumulated deficit |

(71,593,717 |

) |

(64,649,381 |

) |

|

Accumulated other comprehensive income (loss) |

128,569 |

|

(301,874 |

) |

|

Total Shareholders' Equity |

10,414,470 |

|

5,878,318 |

|

|

Total Liabilities and Shareholders'

Equity |

12,344,999 |

|

7,802,597 |

|

Table 2: Condensed consolidated interim

statements of operations and comprehensive loss

(unaudited):

| InMed

Pharmaceuticals Inc. |

|

|

|

|

| CONDENSED

CONSOLIDATED INTERIM STATEMENTS OF OPERATIONS AND COMPREHENSIVE

LOSS (unaudited) |

|

| For the three and nine months

ended March 31, 2021 and 2020 |

|

|

|

|

|

Expressed in U.S. Dollars |

|

|

|

|

|

|

Three Months Ended |

Nine Months Ended |

|

|

March 31 |

March 31 |

|

|

2021 |

|

2020 |

|

2021 |

|

2020 |

|

|

|

$ |

|

$ |

|

$ |

|

$ |

|

| Operating

Expenses |

|

|

|

|

|

Research and development and patents |

1,772,593 |

|

1,274,913 |

|

3,621,697 |

|

4,843,656 |

|

|

General and administrative |

1,333,725 |

|

902,289 |

|

2,918,067 |

|

2,661,545 |

|

|

Amortization and depreciation |

27,421 |

|

27,113 |

|

92,218 |

|

85,572 |

|

|

Total operating expenses |

3,133,739 |

|

2,204,315 |

|

6,631,982 |

|

7,590,773 |

|

|

|

|

|

|

|

|

Other Income (Loss) |

|

|

|

|

|

Interest income |

3,797 |

|

26,330 |

|

11,192 |

|

125,231 |

|

|

Finance expense |

- |

|

- |

|

(360,350 |

) |

- |

|

|

Unrealized gain on derivative warrants liability |

- |

|

- |

|

242,628 |

|

- |

|

|

Foreign exchange gain (loss) |

28,467 |

|

153,927 |

|

(205,824 |

) |

142,677 |

|

|

Net loss for the period |

(3,101,475 |

) |

(2,024,058 |

) |

(6,944,336 |

) |

(7,322,865 |

) |

|

|

|

|

|

|

|

Other Comprehensive Loss |

|

|

|

|

|

Foreign currency translation (loss) gain |

- |

|

(717,510 |

) |

430,443 |

|

(685,834 |

) |

|

Total comprehensive loss for the

period |

(3,101,475 |

) |

(2,741,568 |

) |

(6,513,893 |

) |

(8,008,699 |

) |

|

|

|

|

|

|

| Net loss per

share for the year |

|

|

|

|

|

Basic and diluted |

(0.41 |

) |

(0.39 |

) |

(1.11 |

) |

(1.40 |

) |

| Weighted

average outstanding common shares |

|

|

|

|

|

Basic and diluted |

7,549,040 |

|

5,220,707 |

|

6,277,824 |

|

5,220,707 |

|

Table 3: Condensed consolidated interim

statements of cash flows (unaudited):

| InMed

Pharmaceuticals Inc. |

|

|

| CONDENSED

CONSOLIDATED INTERIM STATEMENTS OF CASH FLOWS (unaudited) |

| For the nine months ended

March 31, 2021 and 2020 |

|

|

|

Expressed in U.S. Dollars |

|

|

|

|

2021 |

|

2020 |

|

|

|

|

|

| Cash provided

by (used in): |

$ |

|

$ |

|

|

|

|

|

| Operating

Activities |

|

|

| Net loss for the period |

(6,944,336 |

) |

(7,322,865 |

) |

| Items not requiring cash: |

|

|

|

Amortization and depreciation |

92,218 |

|

85,572 |

|

|

Share-based compensation |

389,343 |

|

838,304 |

|

|

Non-cash lease expense |

88,620 |

|

63,130 |

|

|

Loss on disposal of assets |

- |

|

2,331 |

|

|

Received interest income on short-term investments |

159 |

|

80,819 |

|

|

Unrealized gain on derivative warrants liability |

(242,628 |

) |

- |

|

|

Unrealized gain on foreign exchange |

(571 |

) |

- |

|

| Payments on lease

obligations |

(66,537 |

) |

(48,865 |

) |

|

Finance expense |

360,350 |

|

- |

|

| Changes in non-cash working

capital: |

|

- |

|

|

Prepaids and other assets |

(1,192,936 |

) |

72,428 |

|

|

Other non-current assets |

(14,161 |

) |

- |

|

|

Accounts receivable |

(18,183 |

) |

29,704 |

|

|

Accounts payable and accrued liabilities |

(235,892 |

) |

223,369 |

|

|

Total cash used in operating

activities |

(7,784,554 |

) |

(5,976,073 |

) |

| |

|

|

| Investing

Activities |

|

|

|

Maturity of short-term investments |

- |

|

3,876,269 |

|

|

Purchase of short-term investments |

- |

|

(43,619 |

) |

|

Proceeds on disposal of property and equipment |

- |

|

546 |

|

|

Purchase of property and equipment |

- |

|

(43,496 |

) |

|

Total cash provided by investing

activities |

- |

|

3,789,700 |

|

| |

|

|

| Financing

Activities |

|

|

|

Shares issued for cash |

12,472,500 |

|

- |

|

|

Share issuance costs |

(1,534,602 |

) |

- |

|

|

Total cash provided by financing

activities |

10,937,898 |

|

- |

|

| Effects of

foreign exchange on cash and cash

equivalents |

494,960 |

|

(682,210 |

) |

| Increase

(decrease) in cash during the period |

3,648,304 |

|

(2,868,583 |

) |

|

Cash and cash equivalents beginning of the

period |

5,805,809 |

|

9,837,213 |

|

|

Cash and cash equivalents end of the

period |

9,454,113 |

|

6,968,630 |

|

About InMed: InMed

Pharmaceuticals is a clinical-stage company developing a pipeline

of cannabinoid-based pharmaceutical drug candidates, initially

focused on the therapeutic benefits of cannabinol (CBN) in diseases

with high unmet medical need. The Company is dedicated to

delivering new therapeutic alternatives to patients that may

benefit from cannabinoid-based pharmaceutical drugs. For more

information, visit www.inmedpharma.com.

| Investor Contact: |

| Edison Advisors for InMed Pharmaceuticals |

| Joe Green/Laine Yonker |

| T: |

+1.646.653.7030/+1.646.653.7035 |

| E: |

jgreen@edisongroup.com / lyonker@edisongroup.com |

Cautionary Note Regarding

Forward-Looking Information:

This news release contains “forward-looking

information” and “forward-looking statements” (collectively,

“forward-looking information”) within the meaning of applicable

securities laws. Forward-looking information is based on

management’s current expectations and beliefs and is subject to a

number of risks and uncertainties that could cause actual results

to differ materially from those described in the forward-looking

statements. Forward-looking information in this news release

includes statements about: leading the way in the clinical

development of cannabinol ("CBN"); developing a pipeline of

cannabinoid-based medications in diseases with high unmet medical

need; delivering new therapeutic alternatives to patients that may

benefit from cannabinoid-based medicines; filing additional

clinical trial applications in selected countries and the timing

thereof; patient enrollment and the timing thereof; exploring

business development opportunities as a potential avenue to build

the Company and accelerate InMed’s programs; anticipated responses

from regulatory authorities and ethics committees and the timing

thereof; anticipated enrollment and locations of clinical sites;

commercial viability of IntegraSyn™ and advancement to large-scale

production and the timing thereof; the focus of the Company on

manufacturing scale-up of IntegraSyn™ to larger batch sizes while

continuing process and enzyme optimization; IntegraSyn™ targeting

increased cannabinoid yield and reducing overall costs; the

preparation for IntegraSyn™ to be GMP-ready; and IntegraSyn™

targeting an output of one kilogram of the selected cannabinoid in

2H2021 via a GMP-ready process.

With respect to the forward-looking information

contained in this news release, InMed has made numerous

assumptions. While InMed considers these assumptions to be

reasonable, these assumptions are inherently subject to significant

business, economic, competitive, market and social uncertainties

and contingencies.

Additionally, there are known and unknown risk

factors which could cause InMed’s actual results, performance or

achievements to be materially different from any future results,

performance or achievements expressed or implied by the

forward-looking information contained herein. Known risk factors

include, among others: regulatory filings may not be filed or

approved on a timely basis, or at all; the outbreak and impact of

COVID-19 may worsen; preclinical and clinical testing may not

produce the desired results on a timely basis, or at all; cannabis

licensing/importing issues may delay our projected development

timelines; suitable partners may not be located; economic or market

conditions may worsen; our existing cash runway may not allow us to

complete our forthcoming significant milestones; the development of

IntegraSyn™ for the production of pharmaceutical-grade cannabinoids

as well as a pipeline of medications targeting diseases with high

unmet medical needs may not be as successful as desired, if at all.

A more complete discussion of the risks and uncertainties facing

InMed is disclosed in InMed’s filings with the Security and

Exchange Commission and the most recent Annual Information Form and

other continuous disclosure filed with Canadian securities

regulatory authorities on SEDAR at www.sedar.com.

All forward-looking information herein is

qualified in its entirety by this cautionary statement, and InMed

disclaims any obligation to revise or update any such

forward-looking information or to publicly announce the result of

any revisions to any of the forward-looking information contained

herein to reflect future results, events or developments, except as

required by law.

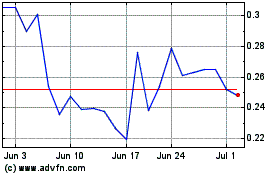

InMed Pharmaceuticals (NASDAQ:INM)

Historical Stock Chart

From Mar 2024 to Apr 2024

InMed Pharmaceuticals (NASDAQ:INM)

Historical Stock Chart

From Apr 2023 to Apr 2024