InflaRx (Nasdaq: IFRX), a clinical-stage biopharmaceutical company

developing anti-inflammatory therapeutics by targeting the

complement system, announced today financial results for the year

ending December 31, 2019.

“The Company underwent significant changes in

2019 and has selected a compelling set of high unmet medical need

indications for its lead drug candidate IFX-1,” said Prof. Niels C.

Riedemann, Chief Executive Officer and Founder of InflaRx. “The

Company has also provided new evidence supporting the activity of

IFX-1 in neutrophil-driven skin diseases, which continue to be a

clear focus. With our current cash position and future value

inflection points, we believe InflaRx is well positioned to weather

the current global environment.”

Prof. Riedemann continued, “With the recently

initiated trial in severe progressed COVID-19 pneumonia, our

Company is making a strong contribution to help identify potential

treatment options for patients during this global pandemic, which

is based on several years of in-house research on the role of

C5a-driven lung injury and viral pneumonia.”

Corporate and

R&D highlights – 2019 through

early 2020

Corporate

- Entered into a clinical collaboration agreement with Merck

& Co, Inc., Kenilworth, NJ, USA (known as MSD outside the US

and Canada) to evaluate the combination of IFX-1 and Merck’s

anti-PD-1 therapy, KEYTRUDA® (pembrolizumab) in patients with an

undisclosed tumor type. Under the terms of the agreement, InflaRx

will conduct a Phase IIa clinical study with two IFX-1 arms,

including one with KEYTRUDA®. KEYTRUDA® is a registered

trademark of Merck Sharp & Dohme Corp., Whitehouse Station, New

Jersey, U.S.A, a subsidiary of Merck & Co., Inc., Kenilworth,

NJ, USA.

- Hired senior executives for key positions – Jordan Zwick

(formerly of Bausch Health) as Global Head of Business Development

and Corporate Strategy and Dr. Korinna Pilz as Global Head of

Clinical Research and Development (>20 years of clinical

development experience in different pharmaceutical companies,

including Roche, Bayer, Boehringer Ingelheim and others).

- Expanding research and development activities supported by

growth in number of employees to 45 as of December 31, 2019 (up

from 38 in 2018).

Lead product candidate, IFX-1, first-in-class

anti-human complement factor C5a antibody

Hidradenitis Suppurativa (HS)

- On June 5, 2019, the Company announced top-line results of the

international SHINE Phase IIb study, investigating the safety and

efficacy of IFX-1 in patients suffering from moderate to severe

Hidradenitis Suppurativa (HS). The randomized, double-blind,

placebo-controlled, multicenter study enrolled a total of 179

patients in four active dose arms and a placebo arm at over 40

sites in 9 countries in North America and Europe. The primary

endpoint of the trial was not met, which was a dose response

signal, assessed by HiSCR1 at week 16. The primary statistical

analysis by multiple-comparison procedure modelling (MCP-mod)

showed no significant dose response, but the IFX-1 treatment was

well tolerated.

- On July 18, 2019 the Company published a post-hoc analysis

demonstrating additional signals of efficacy for the IFX-1 high

dose group compared to the placebo group within the initial phase

of the SHINE study, including reductions in all combined

inflammatory lesions, on draining fistula and on the International

Hidradenitis Suppurativa Severity Score 4 (IHS4), which scores all

inflammatory lesions. IHS4 was developed by an international

expert group to score severity and track treatment response,

although the score has not been utilized as a primary endpoint in

late stage clinical studies in HS. The IHS4 weighs the most

fluctuating lesions: inflammatory nodules (1 point), less than

abscesses (2 points) or draining fistulas (4 points).

- On November 6, 2019, the Company reported positive results from

the open label extension (OLE) part of the international SHINE

Phase IIb study. The data were from a snapshot analysis at the end

of the overall 9-month study treatment period (week 40). A total of

156 patients entered the 6-month OLE period upon completion of the

16-week initial phase of the SHINE study. Overall, patients

completing the OLE period showed a sustained improvement in

inflammatory lesion count at week 40 compared to baseline counts of

the OLE treatment group on day 1 of the SHINE study.

- In Q1 2020, the Company requested an FDA End of Phase II

meeting to discuss the path forward for a pivotal program with

IFX-1 in HS. The meeting has been scheduled for mid-year.

ANCA-associated vasculitis (AAV)

- Since October 2018, 19 patients have been recruited in the

randomized, triple-blind, placebo-controlled US Phase II IXPLORE

study with IFX-1 in patients with AAV. The main objective of the

study is to evaluate the efficacy and safety of two dose regimens

of IFX-1 in patients with moderate to severe AAV when dosed on top

of standard of care, which includes treatment with high dose

glucocorticoids. The trial originally planned to enroll

approximately 36 patients at centers in the US. Based on a blinded

interim analysis and assessment of the potential impact of the

COVID-19 pandemic, the Company has decided to stop the study and

read out the existing results earlier than initially planned as

part of a strategy to align and streamline the US and EU AAV

development program.

- In May 2019, the Company initiated a randomized, double-blind,

placebo-controlled European Phase II IXCHANGE study with IFX-1 in

patients with AAV. The main objective of the study is to evaluate

the efficacy and safety of IFX-1 in patients with moderate to

severe AAV. The primary endpoint of the study is a 50% reduction in

Birmingham Vasculitis Activity Score (BVAS) at week 16. The study

was originally planned to enroll approximately 80 patients at about

60 sites in up to 12 European countries and Russia. The study is

being conducted in two parts. In Part 1, patients are being

randomized to receive either IFX-1 plus a reduced dose of

glucocorticoids or placebo plus a standard dose of glucocorticoids.

Patients in both arms receive the standard of care dosing of

immunosuppressive therapy (rituximab or cyclophosphamide). In Part

2 of the study, patients will be randomized to receive either IFX-1

plus placebo glucocorticoids or placebo plus a standard dose of

glucocorticoids (both on top of standard of care immunosuppressive

therapy with rituximab or cyclophosphamide). The first part of the

study has been fully enrolled. After analyzing the impact of

COVID-19 on the study, a blinded interim analysis of Part 1 has

been completed. Based on the analysis, the Company intends to

continue with Part 2 of the study but decrease the number of

enrolled patients.

Pyoderma Gangraenosum (PG)

- In February 2019, the Company received approval from Health

Canada to initiate an open label Phase IIa exploratory study with a

plan to enroll 18 patients with moderate to severe PG. The

objectives of this study are to evaluate the safety and efficacy of

IFX-1 in this patient population.

- In February 2020, the Company announced positive initial data

from the first 5 patients dosed in this Phase IIa open label study.

Of these 5 initial patients dosed with IFX-1, 2 patients achieved

complete closure of the target ulcer and complete healing of all

other PG ulcers. The drug was well tolerated and no drug-related

severe adverse events (SAEs) have been recorded to date in the

study. The study continues to enroll patients with the addition of

two higher dose cohorts.

COVID-19 Pneumonia

- In March 2020, the Company initiated a Phase II clinical

development program with IFX-1 in COVID-19 patients with severely

progressed pneumonia and enrolled the first patient at the

Amsterdam University Medical Centers in the Netherlands. Additional

centers have since been opened in the Netherlands. In the study,

patients are being randomized to two treatment arms - either Arm A,

best supportive care and IFX-1, or Arm B, best supportive care

alone. The primary endpoint is the relative percentage change from

baseline to day 5 in the Oxygenation Index (PaO2 / FiO2). After all

patients have been treated in the first part of the trial, an

interim analysis will be performed to assess the clinical benefit

of the treatment using the assessed clinical parameters in order to

potentially adapt the confirmatory second part of the study.

Part 1 is fully enrolled with 30 patients as of April 24,

2020.

2019 financial

highlights

Research and development

expenses increased by €19.6 million to €44.6 million in

2019, from €25.0 million in 2018. This increase was primarily

attributable to a €20.9 million increase in clinical research and

manufacturing organizations (CRO and CMO) costs related to IFX-1 in

connection with the Phase IIb clinical trial in patients with HS,

the Phase II clinical program in patients with AAV, the Phase II

clinical program in patients with PG, the preparation of a Phase II

clinical program in oncology as well as with the ongoing

manufacturing activities for clinical trial-related material. In

addition, there was a €1.8 million decrease in employee-related

costs mainly due to a €2.6 million anticipated decrease in expenses

related to non-cash share-based compensation.

General and administrative

expenses decreased by €0.3 million to €12.5 million in

2019, from €12.8 million in 2018. This decrease was primarily

attributable to a €1.6 million decrease in employee-related costs

associated with a €2.6 million anticipated decrease in non-cash

share-based compensation, partially offset by €1.0 million higher

personnel expense due to new hires. Legal, consulting and audit

fees and other expenses increased by €0.2 million to €2.2 million

in 2019, from €2.0 million in 2018, the increase being mainly

attributable to higher consulting costs. The increase in other

expenses of €1.1 million is primarily related to higher D&O

insurance costs, IT and office expenses.

Net financial result decreased

by €4.2 million to €3.5 million in 2019, from €7.7 million in 2018.

This change was mainly attributable to lower foreign exchange

gains, which decreased by €4.8 million, partially offset by

interest on marketable securities, which increased by €0.6

million.

Net loss for the year 2019 was

€53.3 million or €2.05 per common share, compared to €29.8 million

or €1.19 per common share for the year 2018. On December 31, 2019,

the Company’s total funds available were €115.8

million, mostly composed of cash and cash equivalents (€33.1

million) and marketable securities (€81.9 million).

Net cash used in operating

activities increased to €43.2 million in 2019, from €21.5

million in 2018, mainly due to the increase in research and

development expenditures and higher personnel costs, excluding

stock-based compensation.Additional information regarding these

results is included in the notes to the consolidated financial

statements as of December 31, 2019 and “ITEM 18. Financial

statements,” which will be included in InflaRx’s Annual Report on

Form 20-F as filed with the U.S. Securities and Exchange Commission

on April 29, 2020.

InflaRx N.V. and

subsidiaryConsolidated Statements

of Comprehensive Loss for the Years Ended December 31, 2019,

2018 and 2017

|

in € |

2019 |

|

2018 |

|

2017 |

| |

|

|

|

| Operating

Expenses |

|

|

|

|

Research and development expenses |

(44,582,136 |

) |

|

(25,028,554 |

) |

|

(14,414,628 |

) |

| General and administrative

expenses |

(12,501,048 |

) |

|

(12,786,869 |

) |

|

(5,138,498 |

) |

| Total Operating

Expenses |

(57,083,184 |

) |

|

(37,815,422 |

) |

|

(19,553,126 |

) |

| Other income |

400,253 |

|

|

303,860 |

|

|

115,525 |

|

| Other expenses |

(85,242 |

) |

|

(4,802 |

) |

|

(7,644 |

) |

| Operating

Result |

(56,768,173 |

) |

|

(37,516,364 |

) |

|

(19,445,245 |

) |

| Finance income |

6,220,320 |

|

|

10,432,695 |

|

|

130,032 |

|

| Finance expenses |

(2,706,964 |

) |

|

(2,730,964 |

) |

|

(4,922,535 |

) |

| Net Financial

Result |

3,513,355 |

|

|

7,701,731 |

|

|

(4,792,503 |

) |

| Loss for the

Period |

(53,254,817 |

) |

|

(29,814,634 |

) |

|

(24,237,748 |

) |

| |

|

|

|

| Share

Information |

|

|

|

| Weighted average number of

shares outstanding |

26,004,519 |

|

|

25,095,027 |

|

|

9,410,524 |

|

| Loss per share in euro

(basic/diluted) |

(2.05 |

) |

|

(1.19 |

) |

|

(2.58 |

) |

| |

|

|

|

|

|

|

|

|

| Loss for the

Period |

(53,254,817 |

) |

|

(29,814,634 |

) |

|

(24,237,748 |

) |

| Other comprehensive income

that may be reclassified to profit or loss in subsequent

periods: |

|

|

|

| Exchange differences on

translation of operations in foreign currency |

2,177,033 |

|

|

50,196 |

|

|

— |

|

| Total Comprehensive

Loss |

(51,077,785 |

) |

|

(29,764,438 |

) |

|

(24,237,748 |

) |

| |

InflaRx N.V. and

subsidiaryConsolidated Statements

of Financial Position as of December 31, 2019 and

2018

|

in € |

2019 |

|

2018 |

| |

|

|

| ASSETS |

|

|

| Non-current

assets |

|

|

|

Property, plant and equipment |

1,413,297 |

|

|

624,668 |

|

| Intangible assets |

452,400 |

|

|

222,866 |

|

| Non-current other non-financial

assets |

452,217 |

|

|

— |

|

| Non-current financial assets |

272,614 |

|

|

207,444 |

|

| Total non-current

assets |

2,590,528 |

|

|

1,054,979 |

|

| Current

assets |

|

|

| Current other non-financial

assets |

3,500,884 |

|

|

1,588,702 |

|

| Current financial assets |

82,353,867 |

|

|

101,184,240 |

|

| Cash and cash equivalents |

33,131,280 |

|

|

55,386,240 |

|

| Total current

assets |

118,986,031 |

|

|

158,159,183 |

|

| TOTAL

ASSETS |

121,576,558 |

|

|

159,214,161 |

|

| |

|

|

| EQUITY AND

LIABILITIES |

|

|

| Equity |

|

|

| Issued capital |

3,132,631 |

|

|

3,115,725 |

|

| Share premium |

211,006,606 |

|

|

211,021,835 |

|

| Other capital reserves |

25,142,213 |

|

|

18,310,003 |

|

| Accumulated deficit |

(134,362,006 |

) |

|

(81,107,188 |

) |

| Other components of

equity |

2,227,228 |

|

|

50,196 |

|

| Total

equity |

107,146,673 |

|

|

151,390,571 |

|

| Non-current

liabilities |

|

|

| Lease liabilities |

330,745 |

|

|

— |

|

| Provisions and Government

grants |

39,013 |

|

|

67,945 |

|

| Total non-current

liabilities |

369,758 |

|

|

67,945 |

|

| Current

liabilities |

|

|

| Lease liabilities |

515,203 |

|

|

— |

|

| Employee Benefits |

975,629 |

|

|

789,800 |

|

| Social securities, other tax and

non-financial liabilities |

105,634 |

|

|

308,533 |

|

| Trade and other payables |

12,413,662 |

|

|

6,657,312 |

|

| Provisions |

50,000 |

|

|

— |

|

| Total current

liabilities |

14,060,128 |

|

|

7,755,645 |

|

| Total

Liabilities |

14,429,886 |

|

|

7,823,590 |

|

| TOTAL EQUITY AND

LIABILITIES |

121,576,558 |

|

|

159,214,161 |

|

| |

InflaRx N.V. and

subsidiaryConsolidated Statements

of Changes in Shareholders’ Equity for the Years Ended December 31,

2019, 2018 and 2017

| in € |

Issued capital |

|

Share premium |

|

Other capital reserves |

|

Accumulated deficit |

|

Other components of equity |

|

Total equity |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance at January 1, 2017 |

31,428 |

|

— |

|

|

1,325,006 |

|

(27,054,806 |

) |

|

8,839 |

|

|

(25,689,533 |

) |

| Loss for the Period |

— |

|

— |

|

|

— |

|

(24,237,748 |

) |

|

— |

|

|

(24,237,748 |

) |

| Exchange differences on

translation of operations in foreign currency |

— |

|

— |

|

|

— |

|

— |

|

|

— |

|

|

— |

|

| Total Comprehensive

Loss |

— |

|

— |

|

|

— |

|

(24,237,748 |

) |

|

— |

|

|

(24,237,748 |

) |

| Transactions with owners

of the Company |

|

|

|

|

|

|

|

|

Contributions |

|

|

|

|

|

|

|

| Issue of common shares |

848,175 |

|

90,055,312 |

|

|

— |

|

— |

|

|

— |

|

|

90,903,488 |

|

| Transaction costs |

— |

|

(9,114,770 |

) |

|

— |

|

— |

|

|

— |

|

|

(9,114,770 |

) |

| Equity-settled share-based

payment |

— |

|

— |

|

|

4,550,105 |

|

— |

|

|

— |

|

|

4,550,105 |

|

| Total

Contributions |

848,175 |

|

80,940,542 |

|

|

4,550,105 |

|

— |

|

|

— |

|

|

86,338,823 |

|

| Changes in ownership

interests |

|

|

|

|

|

|

|

| Reorganization |

1,977,849 |

|

80,698,025 |

|

|

350,242 |

|

— |

|

|

— |

|

|

83,026,115 |

|

| Liquidation of a Subsidiary |

— |

|

— |

|

|

— |

|

— |

|

|

(8,839 |

) |

|

(8,839 |

) |

| Total changes in

ownership interests |

1,977,849 |

|

80,698,025 |

|

|

350,242 |

|

— |

|

|

(8,839 |

) |

|

83,017,276 |

|

| Total transactions with

owners of the Company |

2,826,024 |

|

161,638,566 |

|

|

4,900,347 |

|

— |

|

|

(8,839 |

) |

|

169,356,099 |

|

| Balance at December

31, 2017 |

2,857,452 |

|

161,638,566 |

|

|

6,225,353 |

|

(51,292,555 |

) |

|

— |

|

|

119,428,816 |

|

| Loss for the period |

— |

|

— |

|

|

— |

|

(29,814,634 |

) |

|

— |

|

|

(29,814,634 |

) |

| Exchange differences on

translation of operations in foreign currency |

— |

|

— |

|

|

— |

|

— |

|

|

50,196 |

|

|

50,196 |

|

| Total comprehensive

loss |

— |

|

— |

|

|

— |

|

(29,814,634 |

) |

|

50,196 |

|

|

(29,764,438 |

) |

| Transactions with

owners of the Company |

|

|

|

|

|

|

|

|

Contributions |

|

|

|

|

|

|

|

| Issue of common shares |

222,000 |

|

52,768,733 |

|

|

— |

|

— |

|

|

— |

|

|

52,990,733 |

|

| Transaction costs |

— |

|

(3,801,265 |

) |

|

— |

|

— |

|

|

— |

|

|

(3,801,265 |

) |

| Equity-settled share-based

payment |

— |

|

— |

|

|

12,084,651 |

|

— |

|

|

— |

|

|

12,084,651 |

|

| Share options exercised |

36,273 |

|

415,801 |

|

|

— |

|

— |

|

|

— |

|

|

452,074 |

|

| Total

Contributions |

258,273 |

|

49,383,269 |

|

|

12,084,651 |

|

— |

|

|

— |

|

|

61,726,193 |

|

| Total transactions

with owners of the Company |

258,273 |

|

49,383,269 |

|

|

12,084,651 |

|

— |

|

|

— |

|

|

61,726,193 |

|

| Balance at December

31, 2018 |

3,115,725 |

|

211,021,835 |

|

|

18,310,003 |

|

(81,107,188 |

) |

|

50,196 |

|

|

151,390,571 |

|

| Loss for the period |

— |

|

— |

|

|

— |

|

(53,254,817 |

) |

|

— |

|

|

(53,254,817 |

) |

| Exchange differences on

translation of operations in foreign currency |

— |

|

— |

|

|

— |

|

— |

|

|

2,177,033 |

|

|

2,177,033 |

|

| Total comprehensive

loss |

— |

|

— |

|

|

— |

|

(53,254,817 |

) |

|

2,177,033 |

|

|

(51,077,784 |

) |

| Transactions with

owners of the Company |

|

|

|

|

|

|

|

|

Contributions |

|

|

|

|

|

|

|

| Equity-settled share-based

payment |

— |

|

— |

|

|

6,832,210 |

|

— |

|

|

— |

|

|

6,832,210 |

|

| Share options exercised |

16,905 |

|

(15,229 |

) |

|

— |

|

— |

|

|

— |

|

|

1,676 |

|

| Total

Contributions |

16,905 |

|

(15,229 |

) |

|

6,832,210 |

|

— |

|

|

— |

|

|

6,833,886 |

|

| Total transactions

with owners of the Company |

16,905 |

|

(15,229 |

) |

|

6,832,210 |

|

— |

|

|

— |

|

|

6,833,886 |

|

| Balance at December

31, 2019 |

3,132,631 |

|

211,006,606 |

|

|

25,142,213 |

|

(134,362,006 |

) |

|

2,227,228 |

|

|

107,146,673 |

|

InflaRx N.V. and

subsidiaryConsolidated Statements

of Cash Flows for the Years ended December 31, 2019, 2018 and

2017

|

in € |

2019 |

|

2018 |

|

2017 |

| |

|

|

|

| Operating

activities |

|

|

|

|

Loss for the period |

(53,254,817 |

) |

|

(29,814,634 |

) |

|

(24,237,748 |

) |

| Adjustments for: |

|

|

|

|

Depreciation & Amortization |

663,166 |

|

|

173,630 |

|

|

70,910 |

|

|

Net Financial Result |

(3,513,355 |

) |

|

(7,701,731 |

) |

|

4,792,503 |

|

|

Share based payment expense |

6,832,210 |

|

|

12,084,651 |

|

|

4,550,105 |

|

|

Other non-cash adjustments |

(307,849 |

) |

|

196,699 |

|

|

24,076 |

|

| Changes in: |

|

|

|

|

Other non-financial assets |

(2,364,399 |

) |

|

(893,602 |

) |

|

(522,818 |

) |

|

Current financial assets |

— |

|

|

(316,112 |

) |

|

89,599 |

|

|

Employee benefits |

235,500 |

|

|

494,837 |

|

|

132,305 |

|

|

Social securities, other tax and non-financial liabilities |

(209,948 |

) |

|

304,627 |

|

|

(30,024 |

) |

|

Trade and other payables |

5,734,795 |

|

|

2,243,137 |

|

|

2,912,740 |

|

| Interest received |

3,001,109 |

|

|

1,679,250 |

|

|

66,391 |

|

| Interest paid |

(20,903 |

) |

|

— |

|

|

— |

|

| Net cash flows from

operating activities |

(43,204,492 |

) |

|

(21,549,248 |

) |

|

(12,151,962 |

) |

| Investing

activities |

|

|

|

| Cash outflow from the purchase of

intangible assets, laboratory and office equipment |

(594,889 |

) |

|

(806,531 |

) |

|

(148,542 |

) |

| Cash outflow for the investment

in non-current other financial assets |

(75,543 |

) |

|

(209,705 |

) |

|

(18,481 |

) |

| Proceeds from the disposal of

non-current other financial assets |

— |

|

|

21,811 |

|

|

— |

|

| Proceeds from the disposal of

current financial assets or repayment of maturing securities |

103,559,395 |

|

|

7,990,204 |

|

|

— |

|

| Purchase of current &

non-current financial assets |

(82,547,409 |

) |

|

(106,445,120 |

) |

|

— |

|

| Net cash flows from

investing activities |

20,341,554 |

|

|

(99,451,341 |

) |

|

(167,023 |

) |

| Financing

activities |

|

|

|

| Proceeds from issuance of share

capital |

— |

|

|

52,990,733 |

|

|

90,903,488 |

|

| Transaction cost from issuance of

share capital |

— |

|

|

(3,801,265 |

) |

|

(9,114,770 |

) |

| Proceeds from exercise of share

options |

1,676 |

|

|

452,075 |

|

|

— |

|

| Proceeds from issuance of

preferred shares |

— |

|

|

— |

|

|

27,012,050 |

|

| Repayment of leasing debt |

(296,020 |

) |

|

— |

|

|

— |

|

| Net cash flows from

financing activities |

(294,344 |

) |

|

49,641,542 |

|

|

108,800,767 |

|

| Effect of exchange rate

changes |

902,321 |

|

|

3,461,399 |

|

|

(2,316,631 |

) |

| Net change in cash and

cash equivalents |

(22,254,960 |

) |

|

(71,357,047 |

) |

|

94,165,152 |

|

| Cash and cash equivalents at

beginning of period |

55,386,240 |

|

|

123,281,888 |

|

|

29,116,737 |

|

| Cash and cash equivalents

at end of period |

33,131,280 |

|

|

55,386,240 |

|

|

123,281,888 |

|

| |

|

|

|

About IFX-1:

IFX-1 is a first-in-class monoclonal anti-human

complement factor C5a antibody, which highly and effectively blocks

the biological activity of C5a and demonstrates high selectivity

towards its target in human blood. Thus, IFX-1 leaves the formation

of the membrane attack complex (C5b-9) intact as an important

defense mechanism, which is not the case for molecules blocking the

cleavage of C5. IFX-1 has been demonstrated to control the

inflammatory response driven tissue and organ damage by

specifically blocking C5a as a key “amplifier” of this response in

pre-clinical studies. IFX-1 is believed to be the first monoclonal

anti-C5a antibody introduced into clinical development.

Approximately 300 people have been treated with IFX-1 in clinical

trials, and the antibody has been shown to be well tolerated. IFX-1

is currently being developed for various indications, including

Hidradenitis Suppurativa, ANCA-associated vasculitis, Pyoderma

Gangraenosum and COVID-19 pneumonia.

About InflaRx N.V.:

InflaRx (Nasdaq: IFRX) is a clinical-stage

biopharmaceutical company focused on applying its proprietary

anti-C5a technology to discover and develop first-in-class, potent

and specific inhibitors of C5a. Complement C5a is a powerful

inflammatory mediator involved in the progression of a wide variety

of autoimmune and other inflammatory diseases. InflaRx was founded

in 2007, and the group has offices and subsidiaries in Jena and

Munich, Germany, as well as Ann Arbor, MI, USA. For further

information please visit www.inflarx.com.

Contacts:

InflaRx N.V.Jordan Zwick –

Global Head of Business Development & Corporate StrategyEmail:

jordan.zwick[at]inflarx.deTel: +1 917-338-6523

MC Services AGKatja Arnold,

Laurie Doyle, Andreas Jungfer Email: inflarx[at]mc-services.eu

Europe: +49 89-210 2280US: +1 339-832-0752

FORWARD-LOOKING STATEMENTS

This press release contains forward-looking

statements. All statements other than statements of historical fact

are forward-looking statements, which are often indicated by terms

such as “may,” “will,” “should,” “expect,” “plan,” “anticipate,”

“could,” “intend,” “target,” “project,” “estimate,” “believe,”

“predict,” “potential” or “continue” and similar expressions.

Forward-looking statements appear in a number of places throughout

this release and may include statements regarding our intentions,

beliefs, projections, outlook, analyses and current expectations

concerning, among other things, our ongoing and planned preclinical

development and clinical trials, the impact of the COVID-19

pandemic on the Company, the timing and our ability to commence and

conduct clinical trials, potential results from current or

potential future collaborations, our ability to make regulatory

filings, obtain positive guidance from regulators, and obtain and

maintain regulatory approvals for our product candidates, our

intellectual property position, our ability to develop commercial

functions, expectations regarding clinical trial data, our results

of operations, cash needs, financial condition, liquidity,

prospects, future transactions, growth and strategies, the industry

in which we operate, the trends that may affect the industry or us

and the risks, uncertainties and other factors described under the

heading “Risk Factors” in InflaRx’s periodic filings with the U.S.

Securities and Exchange Commission. These statements speak only as

of the date of this press release and involve known and unknown

risks, uncertainties and other important factors that may cause our

actual results, performance or achievements to be materially

different from any future results, performance or achievements

expressed or implied by the forward-looking statements. Given these

risks, uncertainties and other factors, you should not place undue

reliance on these forward-looking statements, and we assume no

obligation to update these forward-looking statements, even if new

information becomes available in the future, except as required by

law.

1 HiSCR response defined as: At least a 50%

reduction in total AN count (abscesses & inflammatory nodules)

with no increase in the number of abscesses from baseline and no

increase in the number of draining fistulas from baseline

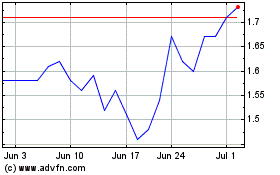

InflaRx NV (NASDAQ:IFRX)

Historical Stock Chart

From Mar 2024 to Apr 2024

InflaRx NV (NASDAQ:IFRX)

Historical Stock Chart

From Apr 2023 to Apr 2024