Revised Proxy Soliciting Materials (definitive) (defr14a)

May 17 2021 - 5:02PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. 1)

Filed by the

Registrant ☒ Filed by a Party other than the

Registrant ☐

Check the appropriate box:

|

|

|

|

|

☐

|

|

Preliminary Proxy Statement

|

|

|

|

|

☐

|

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

|

|

|

☒

|

|

Definitive Proxy Statement

|

|

|

|

|

☐

|

|

Definitive Additional Materials

|

|

|

|

|

☐

|

|

Soliciting Material Pursuant to §240.14a-12

|

INFINERA CORPORATION

(Name of registrant as specified in its charter)

(Name of person(s) filing proxy statement, if other than the registrant)

Payment of Filing Fee (Check the appropriate box):

|

|

|

|

|

|

|

|

|

|

☒

|

|

No fee required.

|

|

|

|

|

☐

|

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

|

|

|

|

|

(1)

|

|

Title of each class of securities to which transaction applies:

|

|

|

|

(2)

|

|

Aggregate number of securities to which transaction applies:

|

|

|

|

(3)

|

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing

fee is calculated and state how it was determined):

|

|

|

|

(4)

|

|

Proposed maximum aggregate value of transaction:

|

|

|

|

(5)

|

|

Total fee paid:

|

|

|

|

|

☐

|

|

Fee paid previously with preliminary materials.

|

|

|

|

|

☐

|

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement

number, or the Form or Schedule and the date of its filing.

|

|

|

|

|

|

|

|

(1)

|

|

Amount Previously Paid:

|

|

|

|

(2)

|

|

Form, Schedule or Registration Statement No.:

|

|

|

|

(3)

|

|

Filing Party:

|

|

|

|

(4)

|

|

Date Filed:

|

Explanatory Note

This Amendment No. 1 to Schedule 14A (this “Amendment”) is being filed to amend the definitive proxy statement (the “Proxy

Statement”) of Infinera Corporation filed with the Securities and Exchange Commission on April 8, 2021. This Amendment is being filed to supplement Appendix A of the Proxy Statement. Except as specifically discussed in this Explanatory

Note, this Amendment No. 1 does not otherwise modify or update any other disclosures in the Proxy Statement.

Infinera Corporation

Unaudited Reconciliations from GAAP to Non-GAAP

(In thousands)

|

|

|

|

|

|

|

Reconciliation of Free Cash Flow

|

|

|

Q4‘20

|

|

|

U.S. GAAP: Net cash provided by (used in) operating activities

|

|

$

|

52.2

|

|

|

Purchase of property and equipment, net

|

|

$

|

(11.9

|

)

|

|

Free Cash Flow

|

|

$

|

40.4

|

|

|

|

|

|

|

|

|

Reconciliation of Non-GAAP Net Income/(Loss) per Common

Share

|

|

|

Q4‘20

|

|

|

U.S. GAAP as reported

|

|

$

|

(0.05

|

)

|

|

Stock-based compensation expense

|

|

|

0.06

|

|

|

Amortization of acquired intangible assets

|

|

|

0.05

|

|

|

Restructuring and related costs

|

|

|

0.04

|

|

|

Amortization of debt discount on convertible senior notes

|

|

|

0.03

|

|

|

Non-GAAP as adjusted

|

|

$

|

0.13

|

|

|

|

|

|

|

|

|

Reconciliation of Non-GAAP Net Income/(Loss) from

Operations

|

|

|

Q4‘19

|

|

|

U.S. GAAP as reported

|

|

$

|

(60,871

|

)

|

|

Acquisition-related deferred revenue adjustment

|

|

|

1,891

|

|

|

Other customer related charges

|

|

|

—

|

|

|

Stock-based compensation expense

|

|

|

11,073

|

|

|

Amortization of acquired intangible assets

|

|

|

15,054

|

|

|

Acquisition and integration costs

|

|

|

18,249

|

|

|

Acquisition-related inventory adjustments

|

|

|

—

|

|

|

Restructuring and related costs

|

|

|

23,431

|

|

|

Litigation charges

|

|

|

—

|

|

|

Non-GAAP as adjusted

|

|

$

|

8,827

|

|

Non-GAAP financial measures are not based on a comprehensive set of accounting

rules or principles and are subject to limitations, including the inability to compare these measures to similar measures presented by other companies. The non-GAAP measures of free cash flow, non-GAAP net income/(loss) per common share and non-GAAP net income/(loss) from operations exclude various items, such as purchase of property and equipment, stock-based

compensation expense, amortization of acquired intangible assets, restructuring and related costs, amortization of debt discount on convertible senior notes, acquisition-related deferred revenue adjustment, other customer related charges,

acquisition and integration costs, acquisition-related inventory adjustments, and litigation charges. We believe that these adjustments are appropriate to enhance an overall understanding of our underlying financial performance. Free cash flow, non-GAAP net income/(loss) per common share and non-GAAP net income/(loss) from operations are considered by management for the purpose of making operational decisions,

benchmarking against peers, and evaluating performance. In the first quarter of fiscal 2021, the Company began excluding foreign exchange gains and losses from non-GAAP results. The presentation of non-GAAP financial measures is not meant to be considered in isolation or as a substitute for GAAP measures.

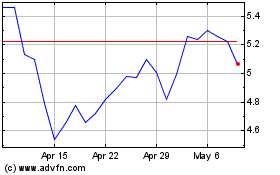

Infinera (NASDAQ:INFN)

Historical Stock Chart

From Mar 2024 to Apr 2024

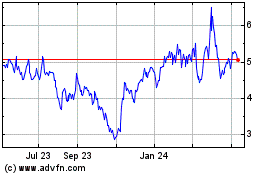

Infinera (NASDAQ:INFN)

Historical Stock Chart

From Apr 2023 to Apr 2024