Infinera Corporation (NASDAQ: INFN) today released financial

results for its fourth quarter and fiscal year ended December 26,

2020.

GAAP revenue for the quarter was $353.5 million compared to

$340.2 million in the third quarter of 2020 and $384.6 million in

the fourth quarter of 2019.

GAAP gross margin for the quarter was 35.7% compared to 31.8% in

the third quarter of 2020 and 29.0% in the fourth quarter of 2019.

GAAP operating margin for the quarter was (1.9)% compared to (7.9)%

in the third quarter of 2020 and (15.8)% in the fourth quarter of

2019.

GAAP net loss for the quarter was $(9.9) million, or $(0.05) per

share, compared to $(35.9) million, or $(0.19) per share, in the

third quarter of 2020, and $(66.6) million, or $(0.37) per share,

in the fourth quarter of 2019.

Non-GAAP revenue for the quarter was $354.4 million compared to

$341.2 million in the third quarter of 2020 and $386.5 million in

the fourth quarter of 2019.

Non-GAAP gross margin for the quarter was 37.6% compared to

35.2% in the third quarter of 2020 and 35.2% in the fourth quarter

of 2019. Non-GAAP operating margin for the quarter was 6.6%

compared to 2.2% in the third quarter of 2020 and 2.3% in the

fourth quarter of 2019.

Non-GAAP net income for the quarter was $26.3 million, or $0.13

per share, compared to a net income of $4.2 million, or $0.02 per

share, in the third quarter of 2020, and $6.4 million, or $0.03 per

share, in the fourth quarter of 2019.

GAAP revenue for the year was $1,355.6 million compared to

$1,298.9 million in 2019. GAAP gross margin for the year was 30.2%

compared to 25.1% in 2019. GAAP operating margin for the year was

(11.4)% compared to (27.0)% in 2019. GAAP net loss for the year was

$(206.7) million, or $(1.10) per share, compared to $(386.6)

million, or $(2.16) per share, in 2019.

Non-GAAP revenue for the year was $1,359.7 million compared to

$1,316.6 million in 2019. Non-GAAP gross margin for the year was

33.8% compared to 33.6% in 2019. Non-GAAP operating margin for the

year was (0.5)% compared to (6.3)% in 2019. Non-GAAP net loss for

the year was $(36.1) million, or $(0.19) per share, compared to

$(107.3) million, or $(0.60) per share, in 2019.

A further explanation of the use of non-GAAP financial

information and a reconciliation of each of the non-GAAP financial

measures to the most directly comparable GAAP financial measure can

be found at the end of this press release.

“We ended the year with another quarter of strong performance

marked by solid execution across the board. Fourth quarter non-GAAP

revenue was in line with our outlook, with non-GAAP gross margin

and non-GAAP operating margin coming in above the guidance range.

Further, we generated free cash flow in the quarter,” said David

Heard, Infinera CEO. “I am encouraged by the financial progress,

operational improvements, and technology innovation delivered by

the Infinera team in 2020. We believe our team’s focused execution

in 2020 positions us well towards achieving our target business

model.”

Financial Outlook

Infinera's outlook for the quarter ending March 27, 2021 is as

follows:

- GAAP revenue is expected to be $329

million +/- $10 million. Non-GAAP revenue is expected to be $330

million +/- $10 million.

- GAAP gross margin is expected to be

32.5% +/- 150 bps. Non-GAAP gross margin is expected to be 35.5%

+/- 150 bps.

- GAAP operating expenses are expected to

be $144 million +/- $2.0 million. Non-GAAP operating

expenses are expected to be $123 million +/- $2.0

million.

- GAAP operating margin is expected to be

(11.5)% +/- 200 bps. Non-GAAP operating margin is expected to be

(2.0)% +/- 200 bps.

Fourth Quarter 2020 Investor Slides Available

Online

Investor slides reviewing Infinera's fourth quarter of 2020

financial results will be furnished to the Securities and Exchange

Commission (SEC) on a Current Report on Form 8-K and published on

Infinera's Investor Relations website at investors.infinera.com

prior to the fourth quarter of 2020 earnings conference call.

Analysts and investors are encouraged to review these slides prior

to participating in the conference call webcast.

Conference Call Information

Infinera will host a conference call for analysts and investors

to discuss its results for the fourth quarter of 2020 and its

outlook for the first quarter of 2021 today at 5:00 p.m. Eastern

Time (2:00 p.m. Pacific Time). Interested parties may join the

conference call by dialing 1-866-373-6878 (toll free) or

1-412-317-5101 (international). A live webcast of the conference

call will also be accessible from the Events section of Infinera’s

website at investors.infinera.com. Replay of the audio webcast will

be available at investors.infinera.com approximately two hours

after the end of the live call.

Contacts:

Media:Anna VueTel. +1 (916) 595-8157avue@infinera.com

Investors:Amitabh Passi, Head of Investor

Relationsapassi@infinera.com

Michael Bowen, ICR, Inc.Tel. +1 (203)

682-8299Michael.Bowen@icrinc.com

Marc P. Griffin, ICR, Inc.Tel. +1 (646)

277-1290Marc.Griffin@icrinc.com

About Infinera

Infinera is a global supplier of innovative networking solutions

that enable carriers, cloud operators, governments, and enterprises

to scale network bandwidth, accelerate service innovation, and

automate network operations. The Infinera end-to-end packet-optical

portfolio delivers industry-leading economics and performance in

long-haul, submarine, data center interconnect, and metro transport

applications. To learn more about Infinera, visit www.infinera.com,

follow us on Twitter @Infinera, and read Infinera's latest blog

posts at www.infinera.com/blog.

Forward-Looking Statements

This press release contains certain forward-looking statements

within the meaning of Section 27A of the Securities Act of 1933 and

Section 21E of the Securities Exchange Act of 1934. Forward-looking

statements generally relate to future events or Infinera's future

financial or operating performance. In some cases, you can identify

forward-looking statements because they contain words such as

"anticipate," "believe," "could," "estimate," "expect," "intend,"

"may," "should," "will," and "would" or the negative of these words

or similar terms or expressions that concern Infinera's

expectations, strategy, priorities, plans or intentions. Such

forward-looking statements in this press release include, without

limitation, Infinera's positioning for achievement of its target

business model and Infinera's financial outlook for the first

quarter of 2021. These forward-looking statements are based on

estimates and information available to Infinera as of the date

hereof and are not guarantees of future performance; actual results

could differ materially from those stated or implied due to risks

and uncertainties. The risks and uncertainties that could cause

Infinera’s results to differ materially from those expressed or

implied by such forward-looking statements include the effect of

the COVID-19 pandemic on Infinera’s business, results of

operations, financial condition, stock price and personnel; the

effect of global and regional economic conditions on Infinera’s

business, including effects on purchasing decisions by customers;

Infinera’s future capital needs and its ability to generate the

cash flow or otherwise secure the capital necessary to make

anticipated capital expenditures; Infinera's ability to service its

debt obligations and pursue its strategic plan; delays in the

development and introduction of new products or updates to existing

products; market acceptance of Infinera’s end-to-end portfolio;

Infinera's reliance on single and limited source suppliers;

fluctuations in demand, sales cycles and prices for products and

services, including discounts given in response to competitive

pricing pressures, as well as the timing of purchases by Infinera's

key customers; the effect that changes in product pricing or mix,

and/or increases in component costs, could have on Infinera’s gross

margin; Infinera’s ability to respond to rapid technological

changes; aggressive business tactics by Infinera’s competitors; the

effects of customer consolidation; our ability to identify, attract

and retain qualified personnel; the impacts of foreign currency

fluctuations; Infinera’s ability to protect its intellectual

property; claims by others that Infinera infringes their

intellectual property; impacts of the recent presidential

administration change in the United States; war, terrorism, public

health issues, natural disasters and other circumstances that could

disrupt the supply, delivery or demand of Infinera's products; and

other risks and uncertainties detailed in Infinera’s SEC filings

from time to time. More information on potential factors that may

impact Infinera’s business are set forth in Infinera's periodic

reports filed with the SEC, including its Annual Report on Form

10-K for the year ended on December 28, 2019 as filed with the SEC

on March 4, 2020, and its Quarterly Report on Form 10-Q for the

quarter ended September 26, 2020 as filed with the SEC on November

5, 2020, as well as subsequent reports filed with or furnished to

the SEC from time to time. These reports are available on

Infinera’s website at www.infinera.com and the SEC’s website at

www.sec.gov. Infinera assumes no obligation to, and does not

currently intend to, update any such forward-looking

statements.

Use of Non-GAAP Financial Information

In addition to disclosing financial measures prepared in

accordance with U.S. Generally Accepted Accounting Principles

(GAAP), this press release and the accompanying tables contain

certain non-GAAP financial measures, including measures that

exclude acquisition-related deferred revenue, other customer

related charges, stock-based compensation expenses, amortization of

acquired intangible assets, acquisition and integration costs,

acquisition-related inventory adjustments, restructuring and

related costs, COVID-19 related costs, litigation charges,

amortization of debt discount on Infinera’s convertible senior

notes, gain/loss on non-marketable equity investments, and income

tax effects. For a description of these non-GAAP financial measures

and a reconciliation to the most directly comparable GAAP financial

measures, please see the section titled “GAAP to Non-GAAP

Reconciliations” below.

Infinera has included forward-looking non-GAAP information in

this press release, including an estimate of certain non-GAAP

financial measures for the first quarter of 2021 that exclude

acquisition-related deferred revenue adjustments, stock-based

compensation expenses, amortization of acquired intangible assets,

acquisition and integration costs related to Infinera's acquisition

of Coriant, and restructuring and related expenses. Please see the

section titled “GAAP to Non-GAAP Reconciliation of Financial

Outlook” below on specific adjustments.

Infinera believes these adjustments are appropriate to enhance

an overall understanding of its underlying financial performance

and also its prospects for the future and are considered by

management for the purpose of making operational decisions. In

addition, these results are the primary indicators management uses

as a basis for its planning and forecasting of future periods. The

presentation of this additional information is not meant to be

considered in isolation or as a substitute for revenue, gross

margin, operating expenses, operating margin, and net income (loss)

prepared in accordance with GAAP. Non-GAAP financial measures are

not based on a comprehensive set of accounting rules or principles

and are subject to limitations.

A copy of this press release can be found on the Investor

Relations page of Infinera’s website at investors.infinera.com.

Infinera and the Infinera logo are trademarks or registered

trademarks of Infinera Corporation. All other trademarks used or

mentioned herein belong to their respective owners.

Infinera CorporationCondensed

Consolidated Statements of Operations(In

thousands, except per share

data)(Unaudited)

| |

|

|

|

| |

Three Months Ended |

|

Twelve Months Ended |

| |

December 26,2020 |

|

December 28,2019 |

|

December 26,2020 |

|

December 28,2019 |

| Revenue: |

|

|

|

|

|

|

|

|

Product |

$ |

267,226 |

|

|

|

$ |

307,861 |

|

|

|

$ |

1,045,551 |

|

|

|

$ |

1,011,488 |

|

|

|

Services |

86,299 |

|

|

|

76,706 |

|

|

|

310,045 |

|

|

|

287,377 |

|

|

|

Total revenue |

353,525 |

|

|

|

384,567 |

|

|

|

1,355,596 |

|

|

|

1,298,865 |

|

|

| Cost of revenue: |

|

|

|

|

|

|

|

|

Cost of product |

178,153 |

|

|

|

213,536 |

|

|

|

751,465 |

|

|

|

735,059 |

|

|

|

Cost of services |

44,724 |

|

|

|

38,543 |

|

|

|

160,118 |

|

|

|

146,916 |

|

|

|

Amortization of intangible assets |

4,611 |

|

|

|

8,437 |

|

|

|

29,247 |

|

|

|

32,583 |

|

|

|

Acquisition and integration costs |

— |

|

|

|

7,238 |

|

|

|

1,828 |

|

|

|

28,449 |

|

|

|

Restructuring and related |

(106 |

) |

|

|

5,407 |

|

|

|

4,146 |

|

|

|

29,935 |

|

|

|

Total cost of revenue |

227,382 |

|

|

|

273,161 |

|

|

|

946,804 |

|

|

|

972,942 |

|

|

| Gross profit |

126,143 |

|

|

|

111,406 |

|

|

|

408,792 |

|

|

|

325,923 |

|

|

| Operating expenses: |

|

|

|

|

|

|

|

|

Research and development |

64,728 |

|

|

|

68,632 |

|

|

|

265,634 |

|

|

|

287,977 |

|

|

|

Sales and marketing |

32,145 |

|

|

|

37,979 |

|

|

|

129,604 |

|

|

|

151,423 |

|

|

|

General and administrative |

24,336 |

|

|

|

30,014 |

|

|

|

112,240 |

|

|

|

126,351 |

|

|

|

Amortization of intangible assets |

4,745 |

|

|

|

6,617 |

|

|

|

18,581 |

|

|

|

27,280 |

|

|

|

Acquisition and integration costs |

(265 |

) |

|

|

11,011 |

|

|

|

13,346 |

|

|

|

42,271 |

|

|

|

Restructuring and related |

7,230 |

|

|

|

18,024 |

|

|

|

24,586 |

|

|

|

40,851 |

|

|

|

Total operating expenses |

132,919 |

|

|

|

172,277 |

|

|

|

563,991 |

|

|

|

676,153 |

|

|

| Loss from operations |

(6,776 |

) |

|

|

(60,871 |

) |

|

|

(155,199 |

) |

|

|

(350,230 |

) |

|

| Other income (expense), net: |

|

|

|

|

|

|

|

|

Interest income |

33 |

|

|

|

59 |

|

|

|

118 |

|

|

|

1,139 |

|

|

|

Interest expense |

(12,853 |

) |

|

|

(8,946 |

) |

|

|

(46,728 |

) |

|

|

(31,657 |

) |

|

|

Other income (loss), net |

10,777 |

|

|

|

3,001 |

|

|

|

1,121 |

|

|

|

(2,907 |

) |

|

|

Total other income (expense), net |

(2,043 |

) |

|

|

(5,886 |

) |

|

|

(45,489 |

) |

|

|

(33,425 |

) |

|

| Loss before income taxes |

(8,819 |

) |

|

|

(66,757 |

) |

|

|

(200,688 |

) |

|

|

(383,655 |

) |

|

| Provision for/(benefit from)

income taxes |

1,105 |

|

|

|

(163 |

) |

|

|

6,035 |

|

|

|

2,963 |

|

|

| Net loss |

$ |

(9,924 |

) |

|

|

$ |

(66,594 |

) |

|

|

$ |

(206,723 |

) |

|

|

$ |

(386,618 |

) |

|

| Net loss per common share: |

|

|

|

|

|

|

|

|

Basic |

$ |

(0.05 |

) |

|

|

$ |

(0.37 |

) |

|

|

$ |

(1.10 |

) |

|

|

$ |

(2.16 |

) |

|

|

Diluted |

$ |

(0.05 |

) |

|

|

$ |

(0.37 |

) |

|

|

$ |

(1.10 |

) |

|

|

$ |

(2.16 |

) |

|

| Weighted average shares used in

computing net loss per common share: |

|

|

|

|

|

|

|

|

Basic |

195,655 |

|

|

|

180,864 |

|

|

|

188,216 |

|

|

|

178,984 |

|

|

|

Diluted |

195,655 |

|

|

|

180,864 |

|

|

|

188,216 |

|

|

|

178,984 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Infinera CorporationGAAP to Non-GAAP

Reconciliations(In thousands, except percentages

and per share data)(Unaudited)

| |

|

|

|

| |

Three Months Ended |

|

Twelve Months Ended |

| |

December26, 2020 |

|

|

|

September26, 2020 |

|

|

|

December28, 2019 |

|

|

|

December26, 2020 |

|

|

|

December28, 2019 |

|

|

| Reconciliation of

Revenue: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| U.S. GAAP as reported |

$ |

353,525 |

|

|

|

|

|

$ |

340,211 |

|

|

|

|

|

$ |

384,567 |

|

|

|

|

|

$ |

1,355,596 |

|

|

|

|

|

$ |

1,298,865 |

|

|

|

|

| Acquisition-related deferred

revenue adjustment(1) |

892 |

|

|

|

|

|

1,037 |

|

|

|

|

|

1,891 |

|

|

|

|

|

4,089 |

|

|

|

|

|

9,631 |

|

|

|

|

| Other customer related

charges(2) |

— |

|

|

|

|

|

— |

|

|

|

|

|

— |

|

|

|

|

|

— |

|

|

|

|

|

8,100 |

|

|

|

|

| Non-GAAP as adjusted |

$ |

354,417 |

|

|

|

|

|

$ |

341,248 |

|

|

|

|

|

$ |

386,458 |

|

|

|

|

|

$ |

1,359,685 |

|

|

|

|

|

$ |

1,316,596 |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Reconciliation of

Gross Profit: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

U.S. GAAP as reported |

$ |

126,143 |

|

|

|

35.7 |

% |

|

$ |

108,276 |

|

|

|

31.8 |

% |

|

$ |

111,406 |

|

|

|

29.0 |

% |

|

$ |

408,792 |

|

|

|

30.2 |

% |

|

$ |

325,923 |

|

|

|

25.1 |

% |

| Acquisition-related deferred

revenue adjustment(1) |

892 |

|

|

|

|

|

1,037 |

|

|

|

|

|

1,891 |

|

|

|

|

|

4,089 |

|

|

|

|

|

9,631 |

|

|

|

|

| Other customer related

charges(2) |

— |

|

|

|

|

|

— |

|

|

|

|

|

— |

|

|

|

|

|

— |

|

|

|

|

|

8,100 |

|

|

|

|

| Stock-based

compensation(3) |

1,742 |

|

|

|

|

|

1,878 |

|

|

|

|

|

1,752 |

|

|

|

|

|

7,785 |

|

|

|

|

|

6,449 |

|

|

|

|

| Amortization of acquired

intangible assets(4) |

4,611 |

|

|

|

|

|

7,287 |

|

|

|

|

|

8,437 |

|

|

|

|

|

29,247 |

|

|

|

|

|

32,583 |

|

|

|

|

| Acquisition and integration

costs(5) |

— |

|

|

|

|

|

43 |

|

|

|

|

|

7,238 |

|

|

|

|

|

1,828 |

|

|

|

|

|

28,449 |

|

|

|

|

| Acquisition-related inventory

adjustments(6) |

— |

|

|

|

|

|

— |

|

|

|

|

|

— |

|

|

|

|

|

— |

|

|

|

|

|

1,778 |

|

|

|

|

| Restructuring and

related(7) |

(106 |

) |

|

|

|

|

1,504 |

|

|

|

|

|

5,407 |

|

|

|

|

|

4,146 |

|

|

|

|

|

29,935 |

|

|

|

|

| COVID-19 related costs(8) |

— |

|

|

|

|

|

— |

|

|

|

|

|

— |

|

|

|

|

|

3,641 |

|

|

|

|

|

— |

|

|

|

|

| Non-GAAP as adjusted |

$ |

133,282 |

|

|

|

37.6 |

% |

|

$ |

120,025 |

|

|

|

35.2 |

% |

|

$ |

136,131 |

|

|

|

35.2 |

% |

|

$ |

459,528 |

|

|

|

33.8 |

% |

|

$ |

442,848 |

|

|

|

33.6 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Reconciliation of

Operating Expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| U.S. GAAP as reported |

$ |

132,919 |

|

|

|

|

|

$ |

135,193 |

|

|

|

|

|

$ |

172,277 |

|

|

|

|

|

563,991 |

|

|

|

|

|

$ |

676,153 |

|

|

|

|

| Stock-based

compensation(3) |

11,177 |

|

|

|

|

|

10,185 |

|

|

|

|

|

9,321 |

|

|

|

|

|

41,676 |

|

|

|

|

|

36,330 |

|

|

|

|

| Amortization of acquired

intangible assets(4) |

4,745 |

|

|

|

|

|

4,696 |

|

|

|

|

|

6,617 |

|

|

|

|

|

18,581 |

|

|

|

|

|

27,280 |

|

|

|

|

| Acquisition and integration

costs(5) |

(265 |

) |

|

|

|

|

1,045 |

|

|

|

|

|

11,011 |

|

|

|

|

|

13,346 |

|

|

|

|

|

42,271 |

|

|

|

|

| Restructuring and

related(7) |

7,230 |

|

|

|

|

|

6,679 |

|

|

|

|

|

18,024 |

|

|

|

|

|

24,586 |

|

|

|

|

|

40,851 |

|

|

|

|

| Litigation charges(9) |

— |

|

|

|

|

|

— |

|

|

|

|

|

— |

|

|

|

|

|

— |

|

|

|

|

|

4,100 |

|

|

|

|

| Non-GAAP as adjusted |

$ |

110,032 |

|

|

|

|

|

$ |

112,588 |

|

|

|

|

|

$ |

127,304 |

|

|

|

|

|

$ |

465,802 |

|

|

|

|

|

$ |

525,321 |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Reconciliation of

Income/(Loss) from Operations: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| U.S. GAAP as reported |

$ |

(6,776 |

) |

|

|

(1.9 |

)% |

|

$ |

(26,917 |

) |

|

|

(7.9 |

)% |

|

$ |

(60,871 |

) |

|

|

(15.8 |

)% |

|

$ |

(155,199 |

) |

|

|

(11.4 |

)% |

|

$ |

(350,230 |

) |

|

|

(27.0 |

)% |

| Acquisition-related deferred

revenue adjustment(1) |

892 |

|

|

|

|

|

1,037 |

|

|

|

|

|

1,891 |

|

|

|

|

|

4,089 |

|

|

|

|

|

9,631 |

|

|

|

|

| Other customer related

charges(2) |

— |

|

|

|

|

|

— |

|

|

|

|

|

— |

|

|

|

|

|

— |

|

|

|

|

|

8,100 |

|

|

|

|

| Stock-based

compensation(3) |

12,919 |

|

|

|

|

|

12,063 |

|

|

|

|

|

11,073 |

|

|

|

|

|

49,461 |

|

|

|

|

|

42,779 |

|

|

|

|

| Amortization of acquired

intangible assets(4) |

9,356 |

|

|

|

|

|

11,983 |

|

|

|

|

|

15,054 |

|

|

|

|

|

47,828 |

|

|

|

|

|

59,863 |

|

|

|

|

| Acquisition and integration

costs(5) |

(265 |

) |

|

|

|

|

1,088 |

|

|

|

|

|

18,249 |

|

|

|

|

|

15,174 |

|

|

|

|

|

70,720 |

|

|

|

|

| Acquisition-related inventory

adjustments(6) |

— |

|

|

|

|

|

— |

|

|

|

|

|

— |

|

|

|

|

|

— |

|

|

|

|

|

1,778 |

|

|

|

|

| Restructuring and

related(7) |

7,124 |

|

|

|

|

|

8,183 |

|

|

|

|

|

23,431 |

|

|

|

|

|

28,732 |

|

|

|

|

|

70,786 |

|

|

|

|

| COVID-19 related costs(8) |

— |

|

|

|

|

|

— |

|

|

|

|

|

— |

|

|

|

|

|

3,641 |

|

|

|

|

|

— |

|

|

|

|

| Litigation charges(9) |

— |

|

|

|

|

|

— |

|

|

|

|

|

— |

|

|

|

|

|

— |

|

|

|

|

|

4,100 |

|

|

|

|

| Non-GAAP as adjusted |

$ |

23,250 |

|

|

|

6.6 |

% |

|

$ |

7,437 |

|

|

|

2.2 |

% |

|

$ |

8,827 |

|

|

|

2.3 |

% |

|

$ |

(6,274 |

) |

|

|

(0.5 |

)% |

|

$ |

(82,473 |

) |

|

|

(6.3 |

)% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

| |

Three Months Ended |

|

Twelve Months Ended |

| |

December26, 2020 |

|

September26, 2020 |

|

December28, 2019 |

|

December26, 2020 |

|

December28, 2019 |

| Reconciliation of Net

Income/ (Loss): |

|

|

|

|

|

|

|

|

|

| U.S. GAAP as reported |

$ |

(9,924 |

) |

|

|

$ |

(35,896 |

) |

|

|

$ |

(66,594 |

) |

|

|

$ |

(206,723 |

) |

|

|

(386,618 |

) |

|

| Acquisition-related deferred

revenue adjustment(1) |

892 |

|

|

|

1,037 |

|

|

|

1,891 |

|

|

|

4,089 |

|

|

|

9,631 |

|

|

| Other customer related

charges(2) |

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

8,100 |

|

|

| Stock-based

compensation(3) |

12,919 |

|

|

|

12,063 |

|

|

|

11,073 |

|

|

|

49,461 |

|

|

|

42,779 |

|

|

| Amortization of acquired

intangible assets(4) |

9,356 |

|

|

|

11,983 |

|

|

|

15,054 |

|

|

|

47,828 |

|

|

|

59,863 |

|

|

| Acquisition and integration

costs(5) |

(265 |

) |

|

|

1,088 |

|

|

|

18,249 |

|

|

|

15,174 |

|

|

|

70,720 |

|

|

| Acquisition-related inventory

adjustments(6) |

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

1,778 |

|

|

| Restructuring and

related(7) |

7,124 |

|

|

|

8,183 |

|

|

|

23,431 |

|

|

|

28,732 |

|

|

|

70,786 |

|

|

| COVID-19 related costs(8) |

— |

|

|

|

— |

|

|

|

— |

|

|

|

3,641 |

|

|

|

— |

|

|

| Litigation charges(9) |

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

4,100 |

|

|

| Amortization of debt

discount(10) |

6,910 |

|

|

|

6,741 |

|

|

|

4,567 |

|

|

|

25,349 |

|

|

|

17,612 |

|

|

| Gain/Loss on non-marketable

equity investment(11) |

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(1,009 |

) |

|

| Income tax effects(12) |

(691 |

) |

|

|

(991 |

) |

|

|

(1,268 |

) |

|

|

(3,688 |

) |

|

|

(5,037 |

) |

|

|

Non-GAAP as adjusted |

$ |

26,321 |

|

|

|

$ |

4,208 |

|

|

|

$ |

6,403 |

|

|

|

$ |

(36,137 |

) |

|

|

$ |

(107,295 |

) |

|

| |

|

|

|

|

|

|

|

|

|

| Net Income/(Loss) per

Common Share - Basic and Diluted: |

|

|

|

|

|

|

|

|

|

| U.S. GAAP as reported |

$ |

(0.05 |

) |

|

|

$ |

(0.19 |

) |

|

|

$ |

(0.37 |

) |

|

|

$ |

(1.10 |

) |

|

|

$ |

(2.16 |

) |

|

| Non-GAAP as adjusted(13) |

$ |

0.13 |

|

|

|

$ |

0.02 |

|

|

|

$ |

0.03 |

|

|

|

$ |

(0.19 |

) |

|

|

$ |

(0.60 |

) |

|

| |

|

|

|

|

|

|

|

|

|

| Weighted Average Shares Used in

Computing Net Loss per Common Share - Basic and Diluted: |

|

|

|

|

|

|

|

|

|

| Basic |

195,655 |

|

|

|

189,589 |

|

|

|

180,864 |

|

|

|

188,216 |

|

|

|

178,984 |

|

|

| Diluted(14) |

203,259 |

|

|

|

195,868 |

|

|

|

186,349 |

|

|

|

188,216 |

|

|

|

178,984 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) |

Business combination accounting principles require Infinera to

write down to fair value its maintenance support contracts assumed

in Infinera's acquisition of Coriant, which closed during the

fourth quarter of 2018. The revenue for these support contracts is

deferred and typically recognized over a period of time after the

Coriant acquisition, so Infinera's GAAP revenue for a period of

time after the acquisition will not reflect the full amount of

revenue that would have been reported if the acquired deferred

revenue was not written down to fair value. The non-GAAP adjustment

eliminates the effect of the deferred revenue write-down.

Management believes these adjustments to revenue from support

contracts assumed in the Coriant acquisition are useful to

investors as an additional means to reflect revenue trends in

Infinera's business. |

| |

|

| (2) |

Other customer-related charges

include one-time benefits and charges that are not directly related

to Infinera’s ongoing or core business results. During the second

quarter of 2019, Infinera agreed to reimburse a customer for

certain expenses incurred by them in connection with a network

service outage that occurred during the fourth quarter of fiscal

2018. Management has excluded the impact of this charge in arriving

at Infinera's non-GAAP results because it is non-recurring, and

management believes that this reimbursement is not indicative of

ongoing operating performance. |

| |

|

| (3) |

Stock-based compensation expense

is calculated in accordance with the fair value recognition

provisions of Financial Accounting Standards Board Accounting

Standards Codification Topic 718, Compensation – Stock Compensation

effective January 1, 2006. The following table summarizes the

effects of stock-based compensation related to employees and

non-employees (in thousands): |

| |

|

|

|

|

| |

|

Three Months Ended |

|

Twelve Months Ended |

| |

|

December26, 2020 |

|

September26, 2020 |

|

December28, 2019 |

|

December26, 2020 |

|

December28, 2019 |

|

Cost of revenue |

|

$ |

1,742 |

|

|

$ |

1,878 |

|

|

$ |

1,752 |

|

|

$ |

7,785 |

|

|

$ |

6,449 |

|

|

Total Cost of revenue |

|

1,742 |

|

|

1,878 |

|

|

1,752 |

|

|

7,785 |

|

|

6,449 |

|

| Research and development |

|

4,501 |

|

|

4,209 |

|

|

3,574 |

|

|

16,863 |

|

|

17,457 |

|

| Sales and marketing |

|

2,771 |

|

|

2,706 |

|

|

2,578 |

|

|

10,907 |

|

|

8,413 |

|

| General and

administration |

|

3,905 |

|

|

3,270 |

|

|

3,169 |

|

|

13,906 |

|

|

10,460 |

|

|

Total Operating expenses |

|

$ |

11,177 |

|

|

$ |

10,185 |

|

|

$ |

9,321 |

|

|

$ |

41,676 |

|

|

$ |

36,330 |

|

|

Total stock-based compensation expense |

|

$ |

12,919 |

|

|

$ |

12,063 |

|

|

$ |

11,073 |

|

|

$ |

49,461 |

|

|

$ |

42,779 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(4) |

Amortization of acquired

intangible assets consists of developed technology, trade names,

customer relationships and backlog acquired in connection with the

Coriant acquisition. Amortization of acquired intangible assets

also consists of amortization of developed technology, trade names

and customer relationships acquired in connection with the

Transmode AB acquisition. U.S. GAAP accounting requires that

acquired intangible assets are recorded at fair value and amortized

over their useful lives. As this amortization is non-cash, Infinera

has excluded it from its non-GAAP gross profit, operating expenses

and net income measures. Management believes the amortization of

acquired intangible assets is not indicative of ongoing operating

performance and its exclusion provides a better indication of

Infinera's underlying business performance. |

| |

|

| (5) |

Acquisition and integration costs

consist of legal, financial, IT, manufacturing-related costs,

employee-related costs and professional fees incurred in connection

with the Coriant acquisition. These amounts have been adjusted in

arriving at Infinera's non-GAAP results because management believes

that these expenses are non-recurring, not indicative of ongoing

operating performance and their exclusion provides a better

indication of Infinera's underlying business performance. |

| |

|

|

(6) |

Business combination accounting

principles require Infinera to measure acquired inventory at fair

value. The fair value of inventory reflects the acquired company’s

cost of manufacturing plus a portion of the expected profit margin.

The non-GAAP adjustment to Infinera's cost of sales excludes the

amortization of the acquisition-related step-up in carrying value

for units sold in the quarter. Additionally, in connection with the

Coriant acquisition, cost of sales excludes a one-time adjustment

in inventory as a result of renegotiated supplier agreements that

contained unusually higher than market pricing. Management believes

these adjustments are useful to investors as an additional means to

reflect ongoing cost of sales and gross margin trends of Infinera's

business. |

|

|

|

|

(7) |

Restructuring and related costs

are primarily associated with the reduction of operating costs, the

closure of Infinera's Berlin, Germany site, the reduction of

headcount at Infinera's Munich, Germany site and other sites, and

Coriant's historical restructuring plan associated with its early

retirement plan. In addition, this includes accelerated

amortization on operating lease right-of-use assets due to the

cessation of use of certain facilities. Management has excluded the

impact of these charges in arriving at Infinera's non-GAAP results

as they are non-recurring in nature and its exclusion provides a

better indication of Infinera's underlying business

performance. |

|

|

|

|

(8) |

COVID-19 related costs consist of

higher replacement costs associated with certain warranty parts

customers were unable to return for repair due to logistics issues

and mobility issues related to COVID-19 public health mandates and

restrictions. In addition, Infinera needed to source certain key

components from an alternate supplier at substantially higher cost

in order to fulfill delivery commitments in the normal course of

business. Management has excluded these expenses from non-GAAP

financial measures because they were caused by atypical

circumstances during the COVID-19 pandemic, as their exclusion

provides a better indication of Infinera's underlying business

performance. |

|

|

|

|

(9) |

Litigation charges are associated

with the preliminary settlement of a litigation matter agreed to

during the quarter ended June 29, 2019. Management has excluded the

impact of this charge in arriving at Infinera's non-GAAP results

because it is non-recurring and management believes that this

expense is not indicative of ongoing operating performance. |

|

|

|

|

(10) |

Under GAAP, certain convertible

debt instruments that may be settled in cash on conversion are

required to be separately accounted for as liability (debt) and

equity (conversion option) components of the instrument in a manner

that reflects the issuer's non-convertible debt borrowing rate.

Accordingly, for GAAP purposes, Infinera is required to amortize as

debt discount an amount equal to the fair value of the conversion

option that was recorded in equity as interest expense on the

$402.5 million in aggregate principal amount of its 2.125%

convertible debt issuance in September 2018 due September 2024 and

$200 million in aggregate principal amount of 2.50% convertible

debt issued in March 9, 2020 due March 2027. Interest expense has

been excluded from Infinera's non-GAAP results because management

believes that this non-cash expense is not indicative of ongoing

operating performance and its exclusion provides a better

indication of Infinera's underlying business performance. |

|

|

|

|

(11) |

Management has excluded the gain

on the sale related to non-marketable equity investments in

arriving at Infinera's non-GAAP results because it is

non-recurring, and management believes that this income is not

indicative of ongoing operating performance |

| |

|

|

(12) |

The difference between the GAAP

and non-GAAP tax provision is due to the net tax effects of the

purchase accounting adjustments, acquisition-related costs and

amortization of acquired intangible assets. |

|

|

|

|

(13) |

Non-GAAP EPS as adjusted did not

exclude the impact of foreign currency. Had the impact of foreign

currency been excluded for the three months ended December 26,

2020, September 26, 2020 and December 28, 2019, non-GAAP EPS as

adjusted would have been $0.08, loss of less than one cent, and

$0.02, respectively, and for the twelve months ended December 26,

2020 and December 28, 2019, non-GAAP EPS as adjusted would have

been $(0.19) and $(0.57), respectively. |

|

|

|

|

(14) |

The non-GAAP diluted shares

include the potentially dilutive securities from Infinera's

stock-based benefit plans excluded from the computation of dilutive

net loss per share attributable to common stockholders on a GAAP

basis because the effect would have been anti-dilutive. These

potentially dilutive securities are added for the computation of

diluted net income per share on a non-GAAP basis in periods when

Infinera has net income on a non-GAAP basis. During the three

months ended December 26, 2020, the Company included the dilutive

effects of the 2027 Notes in the calculation of diluted net income

per common share as the average market price was above the

conversion price of the Notes. The dilutive impact of the Notes was

based on the difference between the Company's average stock price

during the period and the conversion price of the Notes. |

Infinera CorporationCondensed

Consolidated Balance Sheets(In thousands, except

par values)(Unaudited)

| |

December 26,2020 |

|

December 28,2019 |

| ASSETS |

|

|

|

| Current assets: |

|

|

|

|

Cash |

$ |

298,014 |

|

|

|

$ |

109,201 |

|

|

|

Short-term restricted cash |

3,293 |

|

|

|

4,339 |

|

|

|

Accounts receivable, net of allowance for doubtful accounts of

$2,912 in 2020 and $4,005 in 2019 |

319,428 |

|

|

|

349,645 |

|

|

|

Inventory |

269,307 |

|

|

|

340,429 |

|

|

|

Prepaid expenses and other current assets |

171,831 |

|

|

|

139,217 |

|

|

|

Total current assets |

1,061,873 |

|

|

|

942,831 |

|

|

| Property, plant and equipment,

net |

153,133 |

|

|

|

150,793 |

|

|

| Operating lease right-of-use

assets |

68,851 |

|

|

|

68,081 |

|

|

| Intangible assets |

124,882 |

|

|

|

170,346 |

|

|

| Goodwill |

273,426 |

|

|

|

249,848 |

|

|

| Long-term restricted cash |

14,076 |

|

|

|

19,257 |

|

|

| Other non-current assets |

36,256 |

|

|

|

27,182 |

|

|

|

Total assets |

$ |

1,732,497 |

|

|

|

$ |

1,628,338 |

|

|

| LIABILITIES AND

STOCKHOLDERS’ EQUITY |

|

|

|

| Current liabilities: |

|

|

|

|

Accounts payable |

$ |

175,762 |

|

|

|

$ |

273,397 |

|

|

|

Accrued expenses and other current liabilities |

150,550 |

|

|

|

193,168 |

|

|

|

Accrued compensation and related benefits |

52,976 |

|

|

|

92,221 |

|

|

|

Short-term debt, net |

101,983 |

|

|

|

31,673 |

|

|

|

Accrued warranty |

19,369 |

|

|

|

21,107 |

|

|

|

Deferred revenue |

133,246 |

|

|

|

103,753 |

|

|

|

Total current liabilities |

633,886 |

|

|

|

715,319 |

|

|

| Long-term debt, net |

445,996 |

|

|

|

323,678 |

|

|

| Long-term financing lease

obligations |

1,383 |

|

|

|

2,394 |

|

|

| Accrued warranty,

non-current |

21,339 |

|

|

|

22,241 |

|

|

| Deferred revenue,

non-current |

29,810 |

|

|

|

36,067 |

|

|

| Deferred tax liability |

4,164 |

|

|

|

8,700 |

|

|

| Operating lease liabilities |

76,126 |

|

|

|

64,210 |

|

|

| Other long-term liabilities |

93,509 |

|

|

|

69,194 |

|

|

| Commitments and

contingencies |

|

|

|

| Stockholders’ equity: |

|

|

|

|

Preferred stock, $0.001 par valueAuthorized shares – 25,000 and no

shares issued and outstanding |

— |

|

|

|

— |

|

|

|

Common stock, $0.001 par value Authorized shares – 500,000 as of

December 26, 2020 and December 28, 2019 Issued and outstanding

shares – 201,397 as of December 26, 2020 and 181,134 as of

December 28, 2019 |

201 |

|

|

|

181 |

|

|

|

Additional paid-in capital |

1,965,245 |

|

|

|

1,740,884 |

|

|

|

Accumulated other comprehensive loss |

(11,898 |

) |

|

|

(34,639 |

) |

|

|

Accumulated deficit |

(1,527,264 |

) |

|

|

(1,319,891 |

) |

|

|

Total stockholders' equity |

426,284 |

|

|

|

386,535 |

|

|

|

Total liabilities and stockholders’ equity |

$ |

1,732,497 |

|

|

|

$ |

1,628,338 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Infinera CorporationCondensed

Consolidated Statements of Cash Flows(In

thousands) (Unaudited)

| |

Twelve Months Ended |

| |

December 26,2020 |

|

December 28,2019 |

| Cash Flows from Operating

Activities: |

|

|

|

|

Net loss |

$ |

(206,723 |

) |

|

|

$ |

(386,618 |

) |

|

| Adjustments to reconcile net

loss to net cash used in operating activities: |

|

|

|

|

Depreciation and amortization |

100,140 |

|

|

|

119,824 |

|

|

|

Non-cash restructuring charges and related costs |

5,471 |

|

|

|

13,937 |

|

|

|

Amortization of debt discount and issuance costs |

28,115 |

|

|

|

19,162 |

|

|

|

Operating lease expense |

18,556 |

|

|

|

31,141 |

|

|

|

Stock-based compensation expense |

49,461 |

|

|

|

43,294 |

|

|

|

Other, net |

4,438 |

|

|

|

178 |

|

|

|

Changes in assets and liabilities: |

|

|

|

|

Accounts receivable |

32,150 |

|

|

|

(35,395 |

) |

|

|

Inventory |

71,424 |

|

|

|

(42,840 |

) |

|

|

Prepaid expenses and other assets |

(36,127 |

) |

|

|

(93,621 |

) |

|

|

Accounts payable |

(93,411 |

) |

|

|

83,272 |

|

|

|

Accrued liabilities and other expenses |

(107,704 |

) |

|

|

54,658 |

|

|

|

Deferred revenue |

21,910 |

|

|

|

25,658 |

|

|

|

Net cash used in operating activities |

(112,300 |

) |

|

|

(167,350 |

) |

|

| Cash Flows from Investing

Activities: |

|

|

|

|

Proceeds from sales of available-for-sale investments |

— |

|

|

|

1,499 |

|

|

|

Proceeds from sale of non-marketable equity investments |

— |

|

|

|

1,009 |

|

|

|

Proceeds from maturities of investments |

— |

|

|

|

25,085 |

|

|

|

Acquisition of business, net of cash acquired |

— |

|

|

|

(10,000 |

) |

|

|

Purchase of property and equipment, net |

(39,009 |

) |

|

|

(30,202 |

) |

|

|

Net cash used in investing activities |

(39,009 |

) |

|

|

(12,609 |

) |

|

| Cash Flows from Financing

Activities: |

|

|

|

|

Proceeds from issuance of common stock from at-the-market equity

offering, net of issuance costs of $3,380 |

92,916 |

|

|

|

— |

|

|

|

Proceeds from issuance of 2027 Notes |

194,500 |

|

|

|

— |

|

|

|

Proceeds from revolving line of credit |

55,000 |

|

|

|

48,125 |

|

|

|

Proceeds from short-term borrowings |

— |

|

|

|

24,310 |

|

|

|

Proceeds from mortgage payable |

— |

|

|

|

8,584 |

|

|

|

Repayment of revolving line of credit |

(8,000 |

) |

|

|

(20,000 |

) |

|

|

Repayment of third party manufacturing funding |

(5,346 |

) |

|

|

— |

|

|

|

Payment of debt issuance cost |

(2,455 |

) |

|

|

(273 |

) |

|

|

Repayment of mortgage payable |

(233 |

) |

|

|

(300 |

) |

|

|

Principal payments on financing lease obligations |

(1,587 |

) |

|

|

(163 |

) |

|

|

Payment of term license obligation |

(5,692 |

) |

|

|

— |

|

|

|

Proceeds from issuance of common stock |

17,072 |

|

|

|

12,053 |

|

|

|

Minimum tax withholding paid on behalf of employees for net share

settlement |

(2,013 |

) |

|

|

(426 |

) |

|

|

Net cash provided by financing activities |

334,162 |

|

|

|

71,910 |

|

|

| Effect of exchange rate

changes on cash and restricted cash |

(267 |

) |

|

|

(1,491 |

) |

|

| Net change in cash, cash

equivalents and restricted cash |

182,586 |

|

|

|

(109,540 |

) |

|

| Cash, cash equivalents and

restricted cash at beginning of period |

132,797 |

|

|

|

242,337 |

|

|

| Cash and restricted cash at

end of period(1) |

$ |

315,383 |

|

|

|

$ |

132,797 |

|

|

| |

|

|

|

| Supplemental

disclosures of cash flow information: |

|

|

|

|

Cash paid for income taxes, net |

$ |

5,039 |

|

|

|

$ |

16,944 |

|

|

|

Cash paid for interest |

$ |

15,638 |

|

|

|

$ |

9,564 |

|

|

| Supplemental schedule

of non-cash investing and financing activities: |

|

|

|

|

Unpaid debt issuance cost |

$ |

— |

|

|

|

$ |

2,493 |

|

|

|

Third-party manufacturer funding for transfer expenses

incurred |

$ |

— |

|

|

|

$ |

6,960 |

|

|

|

Transfer of inventory to fixed assets |

$ |

1,083 |

|

|

|

$ |

2,961 |

|

|

|

Property and equipment included in accounts payable and accrued

liabilities |

$ |

— |

|

|

|

$ |

3,838 |

|

|

|

Unpaid term licenses (included in accounts payable, accrued

liabilities and other long term liabilities) |

$ |

12,478 |

|

|

|

$ |

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

| (1) |

Reconciliation

of cash and restricted cash to the condensed consolidated balance

sheets: |

| |

|

|

|

| |

December 26,2020 |

|

December 28,2019 |

| |

|

|

|

| |

(In thousands) |

|

Cash |

$ |

298,014 |

|

|

$ |

109,201 |

|

| Short-term restricted

cash |

3,293 |

|

|

$ |

4,339 |

|

| Long-term restricted cash |

14,076 |

|

|

$ |

19,257 |

|

|

Total cash and restricted cash |

$ |

315,383 |

|

|

$ |

132,797 |

|

|

|

|

|

|

|

|

|

|

Infinera CorporationSupplemental

Financial Information(Unaudited)

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Q1'19 |

|

Q2'19 |

|

Q3'19 |

|

Q4'19 |

|

Q1'20 |

|

Q2'20 |

|

Q3'20 |

|

Q4'20 |

|

GAAP Revenue ($ Mil) |

|

$292.7 |

|

|

$296.3 |

|

|

$325.3 |

|

|

$384.6 |

|

|

$330.3 |

|

|

$331.6 |

|

|

$340.2 |

|

|

$353.5 |

|

| GAAP Gross Margin % |

|

22.7 |

% |

|

20.7 |

% |

|

26.7 |

% |

|

29.0 |

% |

|

23.3 |

% |

|

29.4 |

% |

|

31.8 |

% |

|

35.7 |

% |

| Non-GAAP Gross Margin

%(1) |

|

35.3 |

% |

|

30.7 |

% |

|

33.1 |

% |

|

35.2 |

% |

|

28.3 |

% |

|

33.8 |

% |

|

35.2 |

% |

|

37.6 |

% |

| Revenue

Composition: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Domestic % |

|

45 |

% |

|

45 |

% |

|

51 |

% |

|

52 |

% |

|

52 |

% |

|

50 |

% |

|

49 |

% |

|

36 |

% |

| International % |

|

55 |

% |

|

55 |

% |

|

49 |

% |

|

48 |

% |

|

48 |

% |

|

50 |

% |

|

51 |

% |

|

64 |

% |

| Customers >10% of

Revenue |

|

1 |

|

|

1 |

|

|

1 |

|

|

1 |

|

|

1 |

|

|

1 |

|

|

1 |

|

|

— |

|

| Cash Related

Information: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cash from Operations ($

Mil) |

|

($56.2 |

) |

|

($63.8 |

) |

|

($37.2 |

) |

|

($10.2 |

) |

|

($91.5 |

) |

|

($36.6 |

) |

|

($36.4 |

) |

|

$52.2 |

|

| Capital Expenditures ($

Mil) |

|

$6.6 |

|

|

$9.2 |

|

|

$12.5 |

|

|

$2.7 |

|

|

$8.5 |

|

|

$10.5 |

|

|

$8.1 |

|

|

$11.9 |

|

| Depreciation &

Amortization ($ Mil) |

|

$31.0 |

|

|

$31.2 |

|

|

$29.0 |

|

|

$28.6 |

|

|

$25.4 |

|

|

$25.9 |

|

|

$22.9 |

|

|

$25.9 |

|

| DSOs |

|

83 |

|

|

80 |

|

|

80 |

|

|

83 |

|

|

75 |

|

|

79 |

|

|

78 |

|

|

82 |

|

| Inventory

Metrics: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Raw Materials ($ Mil) |

|

$82.5 |

|

|

$70.4 |

|

|

$47.2 |

|

|

$47.4 |

|

|

$50.0 |

|

|

$43.4 |

|

|

$39.3 |

|

|

$34.7 |

|

| Work in Process ($ Mil) |

|

$63.0 |

|

|

$59.5 |

|

|

$52.2 |

|

|

$48.8 |

|

|

$52.0 |

|

|

$50.9 |

|

|

$51.6 |

|

|

$55.8 |

|

| Finished Goods ($ Mil) |

|

$187.0 |

|

|

$208.9 |

|

|

$225.4 |

|

|

$244.1 |

|

|

$217.7 |

|

|

$193.9 |

|

|

$185.0 |

|

|

$178.8 |

|

| Total Inventory ($

Mil) |

|

$332.5 |

|

|

$338.8 |

|

|

$324.8 |

|

|

$340.3 |

|

|

$319.7 |

|

|

$288.2 |

|

|

$275.9 |

|

|

$269.3 |

|

| Inventory Turns(2) |

|

2.3 |

|

|

2.5 |

|

|

2.7 |

|

|

2.9 |

|

|

3.0 |

|

|

3.1 |

|

|

3.2 |

|

|

3.3 |

|

| Worldwide

Headcount |

|

3,708 |

|

|

3,632 |

|

|

3,557 |

|

|

3,261 |

|

|

3,302 |

|

|

3,209 |

|

|

3,074 |

|

|

3,050 |

|

| Weighted Average

Shares Outstanding (in thousands): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

176,406 |

|

|

178,677 |

|

|

179,988 |

|

|

180,864 |

|

|

182,024 |

|

|

185,596 |

|

|

189,589 |

|

|

195,655 |

|

| Diluted |

|

176,602 |

|

|

179,343 |

|

|

182,073 |

|

|

186,349 |

|

|

189,246 |

|

|

190,127 |

|

|

195,868 |

|

|

203,259 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) |

Non-GAAP adjustments include acquisition-related deferred revenue

and inventory adjustments, other customer related charges,

stock-based compensation expenses, amortization of acquired

intangible assets, acquisition and integration costs, restructuring

and related costs, and COVID-19 related costs. For a description of

this non-GAAP financial measure, please see the section titled

“GAAP to Non-GAAP Reconciliations” in this press release for a

reconciliation to the most directly comparable GAAP financial

measures. |

| |

|

| (2) |

Infinera calculates non-GAAP

inventory turns as annualized non-GAAP cost of revenue before

adjustments for restructuring and related costs, non-cash

stock-based compensation expense, and certain purchase accounting

adjustments, divided by the average inventory for the quarter. |

Infinera CorporationGAAP to Non-GAAP

Reconciliation of Financial Outlook(In millions,

except percentages and per share

data)(Unaudited)

The following amounts represent the midpoint of the expected

range:

| |

|

Q1'21 |

| |

|

Outlook |

| Reconciliation of

Revenue: |

|

|

|

U.S. GAAP |

|

$ |

329.0 |

|

|

| Acquisition-related deferred

revenue adjustment |

|

1.0 |

|

|

| Non-GAAP |

|

$ |

330.0 |

|

|

| |

|

|

| Reconciliation of Gross

Margin: |

|

|

| U.S. GAAP |

|

32.5 |

% |

|

| Acquisition-related deferred

revenue adjustment |

|

0.5 |

% |

|

| Stock-based compensation |

|

1.0 |

% |

|

| Amortization of acquired

intangible assets |

|

1.0 |

% |

|

| Restructuring and related

costs |

|

0.5 |

% |

|

| Non-GAAP |

|

35.5 |

% |

|

| |

|

|

| Reconciliation of

Operating Expenses: |

|

|

| U.S. GAAP |

|

$ |

144.0 |

|

|

| Stock-based compensation |

|

(14.0 |

) |

|

| Amortization of acquired

intangible assets |

|

(4.0 |

) |

|

| Restructuring and related

costs |

|

(2.0 |

) |

|

| Acquisition and integration

costs |

|

(1.0 |

) |

|

| Non-GAAP |

|

$ |

123.0 |

|

|

| |

|

|

| Reconciliation of

Operating Margin: |

|

|

| U.S. GAAP |

|

(11.5 |

)% |

|

| Acquisition-related deferred

revenue adjustment |

|

0.5 |

% |

|

| Stock-based compensation |

|

5.0 |

% |

|

| Amortization of acquired

intangible assets |

|

2.5 |

% |

|

| Acquisition and integration

costs |

|

0.5 |

% |

|

| Restructuring and related

costs |

|

1.0 |

% |

|

| Non-GAAP |

|

(2.0 |

)% |

|

| |

|

|

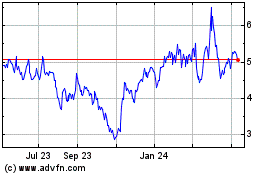

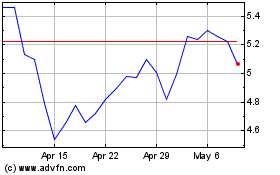

Infinera (NASDAQ:INFN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Infinera (NASDAQ:INFN)

Historical Stock Chart

From Apr 2023 to Apr 2024