Impinj, Inc. Announces Proposed Private Offering of $75 Million of Convertible Senior Notes Due 2026

December 10 2019 - 4:03PM

Business Wire

Impinj, Inc. (“Impinj”) (Nasdaq: PI) today announced its

intention to offer, subject to market conditions and other factors,

$75 million aggregate principal amount of Convertible Senior Notes

due 2026 (the “notes”) in a private offering (the “offering”) to

qualified institutional buyers pursuant to Rule 144A promulgated

under the Securities Act of 1933, as amended (the “Securities

Act”). Impinj also expects to grant the initial purchasers of the

notes a 13-day option to purchase up to an additional $11.25

million aggregate principal amount of the notes.

The notes will be senior, unsecured obligations of Impinj, and

will bear interest payable semi-annually in arrears. The notes will

be convertible into cash, shares of Impinj’s common stock or a

combination thereof, at Impinj’s election. The interest rate,

conversion rate and other terms of the notes are to be determined

upon pricing of the offering.

In connection with the pricing of the notes, Impinj expects to

enter into privately negotiated capped call transactions with one

or more of the initial purchasers and/or their respective

affiliates and/or other financial institutions (the “option

counterparties”). The capped call transactions will cover, subject

to anti-dilution adjustments, the number of shares of common stock

underlying the notes sold in the offering. The capped call

transactions are generally expected to reduce potential dilution to

Impinj’s common stock upon any conversion of the notes and/or

offset any cash payments Impinj is required to make in excess of

the principal amount of converted notes, as the case may be, with

such reduction and/or offset subject to a cap.

Impinj has been advised that, in connection with establishing

their initial hedges of the capped call transactions, the option

counterparties or their respective affiliates expect to purchase

shares of Impinj’s common stock and/or enter into various

derivative transactions with respect to the common stock

concurrently with or shortly after the pricing of the notes. This

activity could increase (or reduce the size of any decrease in) the

market price of Impinj’s common stock or the notes at that time. In

addition, Impinj expects that the option counterparties or their

respective affiliates may modify their hedge positions by entering

into or unwinding various derivatives with respect to the common

stock and/or by purchasing or selling shares of the common stock or

other securities of Impinj in secondary market transactions

following the pricing of the notes and prior to the maturity of the

notes (and are likely to do so following any conversion, repurchase

or redemption of the notes, to the extent Impinj exercises the

relevant election under the capped call transactions). This

activity could also cause or avoid an increase or a decrease in the

market price of the common stock or the notes, which could affect

the ability of noteholders to convert the notes and, to the extent

the activity occurs following a conversion or during any

observation period related to a conversion of the notes, it could

affect the number of shares and value of the consideration that

noteholders will receive upon conversion of the notes.

Impinj intends to use a portion of the net proceeds of the

offering of the notes to pay the cost of the capped call

transactions. If the initial purchasers exercise their option to

purchase additional notes, Impinj expects to use a portion of the

net proceeds from the sale of such additional notes to enter into

additional capped call transactions with the option counterparties.

Impinj intends to use approximately $24.0 million of the net

proceeds from the offering to prepay and terminate its senior

credit facility. Impinj intends to use the remainder of the net

proceeds from the offering for general corporate purposes.

The notes will only be offered to qualified institutional buyers

pursuant to Rule 144A promulgated under the Securities Act by means

of a private offering memorandum. Neither the notes nor the shares

of Impinj’s common stock potentially issuable upon conversion of

the notes, if any, have been, or will be, registered under the

Securities Act or the securities laws of any other jurisdiction,

and unless so registered, may not be offered or sold in the United

States except pursuant to an applicable exemption from such

registration requirements.

This announcement is neither an offer to sell nor a solicitation

of an offer to buy any of these securities and shall not constitute

an offer, solicitation or sale in any jurisdiction in which such

offer, solicitation or sale is unlawful.

About Impinj

Impinj wirelessly connects billions of everyday items such as

apparel, medical supplies, automobile parts, luggage and food to

consumer and business applications such as inventory management,

patient safety, asset tracking and item authentication. The Impinj

platform uses RAIN RFID to deliver timely information about these

items to the digital world, thereby enabling the Internet of

Things.

Cautionary Language Concerning Forward-Looking

Statements

This release contains forward-looking statements within the

meaning of Section 27A of the Securities Act and Section 21E of the

Securities Exchange Act of 1934, as amended, and the Private

Securities Litigation Reform Act of 1995, including but not limited

to, statements regarding the proposed terms of the notes, the

timing and size of the notes offering, the granting of a 13-day

option to purchase additional notes, the extent, and potential

effects, of capped call transactions, the potential dilution to

Impinj’s common stock, the conversion price for the notes and the

expected use of the proceeds from the sale of the notes, and other

statements contained in this press release that are not historical

facts. These forward-looking statements are made as of the date

they were first issued and were based on current expectations,

estimates, forecasts and projections as well as the beliefs and

assumptions of management. Words such as “expect,” “anticipate,”

“should,” “believe,” “hope,” “target,” “project,” “goals,”

“estimate,” “potential,” “predict,” “may,” “will,” “might,”

“could,” “intend,” “shall” and variations of these terms or the

negative of these terms and similar expressions are intended to

identify these forward-looking statements. Forward-looking

statements are subject to a number of risks and uncertainties, many

of which involve factors or circumstances that are beyond Impinj’s

control. Impinj’s actual results could differ materially from those

stated or implied in forward-looking statements due to a number of

factors, including but not limited to, risks detailed in Impinj’s

filings and reports with the Securities and Exchange Commission

(“SEC”), as well as other filings and reports that may be filed by

Impinj from time to time with the SEC. In particular, the following

factors, among others, could cause results to differ materially

from those expressed or implied by such forward-looking statements:

the market for Impinj’s products may develop more slowly than

expected or than it has in the past; quarterly and annual operating

results may fluctuate more than expected; Impinj faces intense

competition in its market; weakened global economic conditions may

adversely affect its industry or customers; changes in foreign

exchange rates; general political or destabilizing events,

including war, conflict or acts of terrorism; Impinj’s average

selling prices and gross margins may decline and adversely impact

its financial performance; Impinj may be unable to adequately

protect its intellectual property; changes to the regulatory regime

for Impinj’s products and services may harm its business; and other

risks and uncertainties. Past performance is not necessarily

indicative of future results. Impinj anticipates that subsequent

events and developments will cause its views to change. Impinj

undertakes no intention or obligation to update or revise any

forward-looking statements, whether as a result of new information,

future events or otherwise. These forward-looking statements should

not be relied upon as representing Impinj’s views as of any date

subsequent to the date of this press release.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20191210006023/en/

Jill West Sr. Director, Marketing Communications Impinj, Inc.

+1-206-834-1110

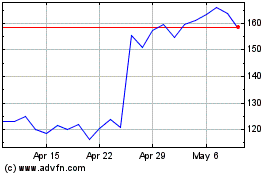

Impinj (NASDAQ:PI)

Historical Stock Chart

From Mar 2024 to Apr 2024

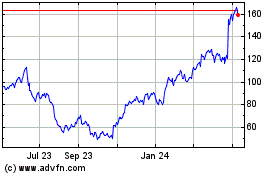

Impinj (NASDAQ:PI)

Historical Stock Chart

From Apr 2023 to Apr 2024