Current Report Filing (8-k)

October 15 2021 - 4:07PM

Edgar (US Regulatory)

0001280776

false

0001280776

2021-10-14

2021-10-14

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

October 14, 2021

IMMUNIC, INC.

(Exact name of registrant as specified in its

charter)

|

Delaware

|

001-36201

|

56-2358443

|

(State or other jurisdiction

of incorporation)

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

1200 Avenue of the Americas, Suite 200

New York, NY 10036

USA

(Address of principal executive offices)

Registrant’s telephone number, including

area code: (332) 255-9818

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of exchange on which registered

|

|

Common Stock, par value $0.0001

|

IMUX

|

The Nasdaq Stock Market LLC

|

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§ 240.12b2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. Yes ☐ No ☐

|

|

Item 5.02

|

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of

Certain Officers.

|

On October 14, 2021, the board

of directors (the “Board”) of Immunic, Inc. (the “Company”) appointed Patrick Walsh as the Chief Business Officer,

effective October 14, 2021.

Mr. Walsh joins Immunic from

Akebia Therapeutics, Inc., where he served as Vice President of Business Development and completed an array of strategic transactions,

including multiple partnerships, in-licenses, non-dilutive financings, and a merger. Mr. Walsh was previously in Corporate Development

at AVEO Oncology, during which time he worked on all aspects of business development. Earlier in his career, he was a consultant to life

science companies with Capgemini SE and was on the healthcare investment banking team at Leerink Partners (now SVB Leerink). Mr. Walsh

holds both an M.S. in molecular, cellular and developmental biology and an MBA from the University of Michigan and a B.A. in biology and

economics from Colby College.

On October 14, 2021, the Company

entered into an employment agreement with Mr. Walsh (the “Walsh Employment Agreement”). Pursuant to the Walsh Employment

Agreement, Mr. Walsh will receive a base annual salary of $380,000, a signing bonus of $60,000, and an award of options to purchase 120,000

shares of Company common stock. Mr. Walsh is also eligible each year for a target bonus of at least 35% of his base salary, reimbursement

for certain expenses, and customary insurance and benefits programs of the Company. The initial term of the Walsh Employment Agreement

lasts until December 31, 2022, and automatically extends for successive one-year terms, unless either party provides 90 days’ notice

of nonrenewal.

If Mr. Walsh’s

employment is terminated by the Company without Cause or by him for Good Reason (each as defined in the Walsh Employment Agreement),

he is entitled to (i) twelve months’ base salary, (ii) any accrued but unpaid annual bonus for the fiscal year ended prior to

termination, and (iii) reimbursement of certain COBRA premiums. Additionally, 33% of his outstanding equity awards will vest and

become exercisable. If such termination occurs within 3 months prior to or 12 months after a change of control, 100% of his

outstanding equity awards will vest and become exercisable.

The preceding summary does not

purport to be complete and is qualified in its entirety by reference to the Walsh Employment Agreement, which is filed as Exhibit 10.1

to this Current Report on Form 8-K and is incorporated herein by reference.

|

|

Item 9.01

|

Financial Statements and Exhibits

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

|

Dated: October 15, 2021

|

Immunic, Inc.

|

|

|

|

|

|

|

By:

|

/s/ Daniel Vitt

|

|

|

|

Daniel Vitt

|

|

|

|

Chief Executive Officer

|

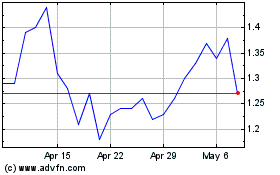

Immunic (NASDAQ:IMUX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Immunic (NASDAQ:IMUX)

Historical Stock Chart

From Apr 2023 to Apr 2024