Current Report Filing (8-k)

October 20 2020 - 7:19AM

Edgar (US Regulatory)

0001280776

false

0001280776

2020-10-19

2020-10-19

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event

reported): October 19, 2020

IMMUNIC, INC.

(Exact name of registrant as specified

in its charter)

|

Delaware

|

001-36201

|

56-2358443

|

(State or other jurisdiction

of incorporation)

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

1200 Avenue of the Americas, Suite 200

New York, NY 10036

USA

(Address of principal executive offices)

Registrant’s telephone number,

including area code: 49 89 250079460

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of exchange on which registered

|

|

Common Stock, par value $0.0001

|

IMUX

|

The Nasdaq Stock Market LLC

|

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§ 240.12b2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. Yes ☐

No ☐

Item 1.01 Entry into a Material Definitive

Agreement.

On October 19, 2020, Immunic, Inc.

(the “Company”) and Immunic AG, its wholly-owned subsidiary, entered into a Finance Contract (the “Loan

Agreement”) with the European Investment Bank (“EIB”), pursuant to which EIB agreed to provide Immunic

AG with a term loan in an aggregate amount of up to €24.5 million to support the development of Immunic’s lead asset,

IMU-838, in moderate coronavirus disease 2019 (“COVID-19”), to be made available to be drawn in three tranches, with

the second and third tranches subject to the completion of certain pre-defined milestones. The Company has the right to defer payment

of principal and interest on the first and second tranches until five years after the respective borrowing dates, at which point

such tranches must be repaid in full. The third tranche is repayable in annual installments commencing one year after its respective

borrowing date and must be repaid in full no later than five years after such date. Any outstanding borrowings under the Loan Agreement

will accrue interest as provided in the Loan Agreement.

From January 1, 2021 until December

31, 2030, the Company and Immunic AG are also obligated to pay EIB a very low single digit percentage of their revenue, as set

forth in the Loan Agreement, subject to certain conditions and limitations tied to the total amount drawn under the Loan Agreement

and subject to a cap of €8.6 million if only the first tranche is drawn and subject to a cap of €30 million if the full

loan amount is drawn. The Loan Agreement also includes certain prepayment penalties that may be triggered by certain prepayments

prior to the maturity date.

The Company will guarantee Immunic AG’s

obligations to EIB pursuant to a Guarantee Agreement to be executed by the Company, Immunic AG and EIB (the “Guarantee

Agreement”, and together with the Loan Agreement, the “Agreements”).

The foregoing description of the Agreements

does not purport to be complete and is qualified in its entirety by reference to the full text of the Agreements, which are filed

as exhibits to this Current Report on Form 8-K. The Agreements have been included to provide investors and stockholders with information

regarding their terms. The descriptions are not intended to provide any other factual information about the Company or the other

parties thereto. The Agreements contain representations and warranties the parties thereto made to, and solely for the benefit

of, the other parties thereto. Accordingly, investors and stockholders should not rely on the representations and warranties as

characterizations of the actual state of facts, since information concerning the subject matter of the representations and warranties

may change after the date of the Agreements, which subsequent information may or may not be fully reflected in the Company’s

public disclosures.

Item 2.03 Creation of a Direct Financial

Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The disclosure set forth in Item 1.01 above

is hereby incorporated by reference into this Item 2.03 as if fully set forth herein.

Item 7.01. Regulation FD Disclosure.

On October 20, 2020, the Company issued a

press release announcing the execution of the Agreements with EIB. The press release is attached as Exhibit 99.1 to this Current

Report on Form 8-K and is incorporated herein by reference.

The information in Item 7.01 of this Current

Report on Form 8-K and Exhibit 99.1 attached hereto is being furnished and shall not be deemed “filed” for the purposes

of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that Section. The

information in Item 7.01 of this Current Report shall not be incorporated by reference into any registration statement or other

document filed with the Securities and Exchange Commission, whether filed before or after the date hereof regardless of any general

incorporation language in any such filing, unless the registrant expressly sets forth in such filing that such information is to

be considered “filed” or incorporated by reference therein.

Item 9.01. Financial Statements and Exhibits

* Certain confidential portions of this exhibit have been redacted

from the publicly filed document because such portions are (i) not material and (ii) would be competitively harmful if publicly

disclosed.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act

of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

|

Dated: October 19, 2020

|

Immunic, Inc.

|

|

|

|

|

|

By:

|

/s/ Daniel Vitt

|

|

|

|

Daniel Vitt

|

|

|

|

Chief Executive Officer

|

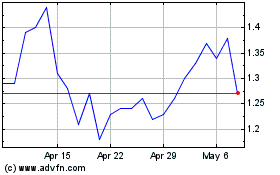

Immunic (NASDAQ:IMUX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Immunic (NASDAQ:IMUX)

Historical Stock Chart

From Apr 2023 to Apr 2024