Current Report Filing (8-k)

November 10 2021 - 7:09AM

Edgar (US Regulatory)

0000870826

false

0000870826

2021-11-05

2021-11-05

0000870826

us-gaap:CommonStockMember

2021-11-05

2021-11-05

0000870826

imbi:XNYSMember

imbi:SeniorNotes8.50PercentDue2026Member

2021-11-05

2021-11-05

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event

reported): November 5, 2021

iMedia

Brands, Inc.

(Exact name of registrant as specified in its

charter)

|

Minnesota

|

|

001-37495

|

|

41-1673770

|

(State

or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS

Employer

Identification No.)

|

6740 Shady Oak Road

Eden Prairie, Minnesota 55344-3433

(Address of principal executive offices)

(952) 943-6000

(Registrant’s telephone number, including

area code)

Not applicable

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

¨

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, $0.01 par value

|

IMBI

|

The Nasdaq Stock Market, LLC

|

|

8.50% Senior Notes due 2026

|

IMBIL

|

The Nasdaq Stock Market, LLC

|

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ¨

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any

new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

|

|

Item 1.01

|

Entry into a Material Definitive Agreement

|

The information included in Item 2.03 below is incorporated by reference into this Item 1.01.

|

|

Item 2.01

|

Completion of Acquisition or Disposition of Assets

|

On November 5, 2021, iMedia Brands, Inc. (the

“Company”) and its wholly-owned subsidiary iMedia&123tv Holding GmbH (the “Subsidiary”) completed

the previously announced acquisition (the “Acquisition”) of all of the issued and outstanding equity interests of 123tv

Invest GmbH and 123tv Holding GmbH (collectively with their direct and indirect subsidiaries, the “1-2-3.tv Group”)

from Emotion Invest GmbH & Co. KG, BE Beteiligungen Fonds GmbH & Co. geschlossene Investmentkommanditgesellschaft and

Iris Capital Fund II (collectively, the “Sellers”) pursuant to the Sale and Purchase Agreement, dated September 22,

2021, among the Company, the Subsidiary, and the Sellers (the “Purchase Agreement”).

At the closing of the Acquisition (the “Closing”),

the Company acquired 1-2-3.tv Group from the Sellers for an aggregate purchase price of EUR 80.0 million ($93.0 million based on the November

5, 2021 exchange rate) (the “Enterprise Value”). The Company also paid to the Sellers EUR 3.3 million ($3.8 million

based on the November 5, 2021 exchange rate) for the 1-2-3.tv Group’s cash on-hand as of July 31, 2021 and EUR 2.9 million ($3.4

million based on the November 5, 2021 exchange rate) for the 1-2-3.tv Group’s excess working capital above the 1-2-3.tv Group’s

trailing twelve-month average as of July 31, 2021. The Enterprise Value consideration consisted of the payment to the Sellers of EUR

62.0 million in cash at the Closing ($72.1 million based on the November 5, 2021 exchange rate) and the Company entering into the previously

announced vendor loan agreement in the principal amount of EUR 18.0 million ($20.9 million based on the November 5, 2021 exchange rate) (the

“Vendor Loan Agreement”).

The foregoing descriptions of the Purchase Agreement

and the Acquisition do not purport to be complete and are qualified in their entirety by reference to the Purchase Agreement, a copy of

which was filed as Exhibit 2.1 to the Current Report on Form 8-K filed by the Company on September 22, 2021 and which is incorporated

herein by reference.

|

|

Item 2.03

|

Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant

|

On November 5, 2021, concurrent with the Closing,

the Company entered into the previously announced Vendor Loan Agreement with certain Sellers pursuant

to which a portion of the purchase price for the Acquisition was paid in the form of a vendor loan (the “Vendor Loan”).

The Vendor Loan has a EUR 18.0 million principal amount ($20.9 million based on the November 5, 2021 exchange rate), with EUR 9.0

million ($10.5 million based on the November 5, 2021 exchange rate) payable on each of the first

and second anniversaries of the issuance date. The Vendor Loan bears interest at a rate equal to 8.5% per annum, payable semi-annually

commencing on the six-month anniversary of the Closing.

The foregoing descriptions of the Vendor Loan Agreement

and Vendor Loan do not purport to be complete and are qualified in their entirety by reference to the Vendor Loan Agreement, a copy of

which was filed as Exhibit 10.1 to the Current Report on Form 8-K filed by the Company on September 22, 2021 and which is incorporated

herein by reference.

|

Item 7.01

|

Regulation FD Disclosure

|

On November 9, 2021, the Company issued a

press release in connection with the disclosures made in Items 1.01, 2.01, and 2.03 of this Current Report on

Form 8-K. The full text of the press release is furnished herewith as

Exhibit 99.1 and is incorporated by reference into this Item 7.01.

|

Item 9.01

|

Financial Statements and Exhibits

|

(a) Financial

Statements of Business Acquired

The financial statements required by this item

were previously filed as Exhibits 99.2 and 99.3 to the Current Report on Form 8-K filed by the Company on September 22, 2021 and are incorporated

herein by reference.

(b) Pro

Forma Financial Information

The financial statements required by this item

were previously filed as Exhibit 99.4 to the Current Report on Form 8-K filed by the Company on September 22, 2021 and are incorporated

herein by reference.

(d) Exhibits

The following exhibits are being filed or furnished,

as applicable, with this Current Report on Form 8-K:

|

Exhibit No.

|

|

Description

|

|

2.1

|

|

Sale and Purchase Agreement Relating to 1-2-3.tv Group, dated September 22, 2021 between Emotion Invest GmbH & Co. KG, BE Beteiligungen Fonds GmbH & Co. geschlossene Investmentkommanditgesellschaft, Iris Capital Fund II, SCUR-Alpha 1359 GmbH and the Company (incorporated by reference to Exhibit 2.1 of the Current Report on Form 8-K filed by the Company on September 22, 2021)

|

|

10.1

|

|

Form of Vendor Loan Agreement among SCUR-Alpha 1359 GmbH (to be renamed iMedia&123tv Holding GmbH) (as borrower), iMedia Brands, Inc. and 1-2-3.tv GmbH (as guarantors) and Emotion Invest GmbH & Co. KG, BE Beteiligungen Fonds GmbH & Co. geschlossene Investmentkommanditgesellschaft and Iris Capital Fund II (incorporated by reference to Exhibit 10.1 of the Current Report on Form 8-K filed by the Company on September 22, 2021)

|

|

23.1

|

|

Consent

of Mazars GmbH & Co. KG (incorporated by reference to Exhibit 23.1 of the Current Report on Form 8-K filed by the Company

on September 22, 2021)

|

|

99.1

|

|

Press Release dated November 10, 2021 related to Closing of Acquisition

|

|

99.2

|

|

The historical audited financial statements of 123tv Beteiligungs GmbH for the years ended December 31, 2020 and 2019 (incorporated by reference to Exhibit 99.2 of the Current Report on Form 8-K filed by the Company on September 22, 2021)

|

|

99.3

|

|

Financial Statements of 123tv Beteiligungs GmbH for the six months ended June 30, 2021 and June 30, 2020 (incorporated by reference to Exhibit 99.3 of the Current Report on Form 8-K filed by the Company on September 22, 2021)

|

|

99.4

|

|

Unaudited pro forma condensed combined balance sheet as of July 31, 2021 and unaudited pro forma condensed combined statements of operations for the six months ended July 31, 2021 and for the year ended January 31, 2021 (incorporated by reference to Exhibit 99.4 of the Current Report on Form 8-K filed by the Company on September 22, 2021)

|

|

104

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

Date: November 10, 2021

|

iMedia Brands, Inc.

|

|

|

|

|

|

|

By:

|

/s/ Timothy A. Peterman

|

|

|

|

Timothy A. Peterman

Chief Executive Officer

|

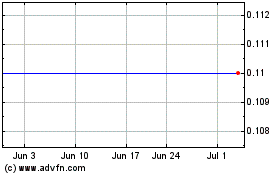

iMedia Brands (NASDAQ:IMBI)

Historical Stock Chart

From Mar 2024 to Apr 2024

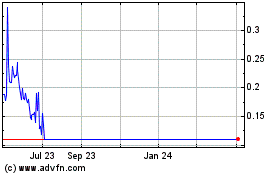

iMedia Brands (NASDAQ:IMBI)

Historical Stock Chart

From Apr 2023 to Apr 2024