iMedia Announces New Lenders & Expanded $108.5 Million Debt Financing to Accelerate Growth

August 05 2021 - 6:00AM

iMedia Brands, Inc. (“iMedia” or the “Company”) (Nasdaq: IMBI)

announces that on July 30, 2021, the Company closed on a new $108.5

million debt financing comprising a revolving credit facility from

Siena Lending Group and a term note from GreenLake Asset

Management.

The new revolving credit facility led by Siena

provides an $80.0 million commitment. The $28.5 million term note

provided by GreenLake is backed by iMedia’s owned real estate,

which includes its corporate headquarters and production studios

located in Eden Prairie, MN, as well as its warehouse and

fulfillment center centrally located in Bowling Green, KY. Both the

revolving credit facility and term note have three-year terms.

Commenting on the Company’s new lending partners

and expanded debt facility, Tim Peterman, CEO of iMedia Brands,

said: “Success is driven by strong partners who trust each other.

We at iMedia are fortunate to partner with Dave Grende, Siena’s

CEO, and Peter Chang, GreenLake’s CEO. They are the right strategic

lending partners for iMedia to finance its next chapter.”

D.A. Davidson & Co. served as exclusive

financial advisor to the Company in arranging and placing the

financing.

About iMedia Brands, Inc.

iMedia Brands, Inc. (Nasdaq: IMBI) is a leading

interactive media company that owns a growing portfolio of

lifestyle television networks, consumer brands, online marketplaces

and media commerce services that together position the Company as a

leading single-source partner to television advertisers and

consumer brands seeking to entertain and transact with customers

using interactive video.

About Siena Lending Group

Siena Lending Group is a leading independent

asset-based lender (ABL) lender and a portfolio company of Business

Development Corporation of America, an affiliate of Benefit Street

Partners L.L.C. (“BSP”). BSP, a leading credit-focused

alternative asset management firm with over $32 billion in assets

under management as of June 30, 2021, is a wholly-owned subsidiary

of Franklin Resources, Inc. Siena is headquartered in Stamford, CT

and was co-founded by President and CEO David Grende. For

further information, please visit

https://www.sienalending.com/.

About GreenLake Asset

Management

GreenLake Asset Management LLC is a direct

lender and alternative asset manager founded in 2008, focused on

delivering superior fixed income products in commercial real

estate. Headquartered in South Pasadena, CA, GreenLake

provides creative and flexible real estate capital solutions

nationwide.

About D.A. Davidson

D.A. Davidson Companies is an employee-owned

financial services firm offering a range of financial services and

advice to individuals, corporations, institutions and

municipalities nationwide. Founded in 1935 and headquartered in

Montana, with corporate offices in Denver, Los Angeles, Portland

and Seattle, the company has approximately 1,400 employees and

offices in 28 states. D.A. Davidson & Co. is a subsidiary

of D.A. Davidson Companies.

Safe Harbor Statement under the Private

Securities Litigation Reform Act of 1995

This release contains statements, estimates,

projections, guidance or outlooks that constitute “forward-looking”

statements as defined under U.S. federal securities laws.

Generally, the words “believe,” “expect,” “intend,” “estimate,”

“anticipate,” “plan,” “project,” “should” and similar expressions

identify forward-looking statements, which generally are not

historical in nature. These statements may contain information

about our prospects, including anticipated show, event, or product

line launches, and involve risks and uncertainties. We caution that

actual results could differ materially from those that management

expects, depending on the outcome of certain factors.

Contacts:

Media:press@imediabrands.com(800) 938-9707

Investors:Gateway Investor

RelationsCody SlachIMBI@gatewayir.com(949) 574-3860

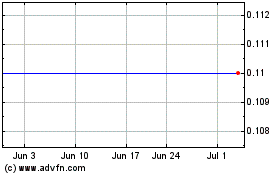

iMedia Brands (NASDAQ:IMBI)

Historical Stock Chart

From Mar 2024 to Apr 2024

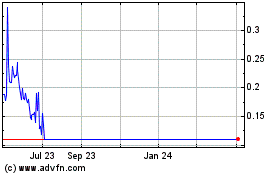

iMedia Brands (NASDAQ:IMBI)

Historical Stock Chart

From Apr 2023 to Apr 2024