iMedia Announces Accretive Acquisition of Synacor’s Portal & Advertising Business Segment

August 03 2021 - 6:00AM

iMedia Brands, Inc. (“iMedia” or the “Company”) (Nasdaq: IMBI)

announced that on July 30, 2021, the Company closed on the

acquisition of Synacor’s Portal and Advertising business segment.

Financial terms were not disclosed.

This acquisition is another example of iMedia’s

strategy to leverage its interactive video expertise and national

television promotional power, as well as its merchandising,

customer solutions and fulfillment capabilities, to build unique

media commerce services that the Company believes will accelerate

its timeline to become the leading single-source partner to

advertisers seeking to use interactive video to drive growth in the

online and OTT ecosystems. In 2019, iMedia acquired Float Left, a

leader in building and managing OTT applications and services for

media companies across all major OTT and CTV devices, including

Roku, Amazon Firestick, Apple TV and Samsung Smart TVs.

Synacor Portal and Advertising, which iMedia has

renamed to Media Commerce Services (MCS), creates and manages

end-to-end, white-label digital home-page platforms for domestic

multichannel video programming distributors (MVPDs) and internet

service providers (ISPs). MCS monetizes these platforms with

advertising and shares the advertising revenue with the respective

publisher. MCS also offers various advertising solutions to

additional online publishers, which includes MCS’s proprietary

monetization platform that unifies supply-side-platforms (SSPs) and

demand-side platforms (DSPs) and manages online publishers’

advertising sales operations.

iMedia expects this transaction to be accretive

and expects MCS to generate at least $40 million in profitable

revenue over the next twelve months. iMedia will be focused on

competing for share in both the emerging $9+ billion OTT

advertising marketplace, as well as the $200+ billion online

advertising marketplace, against other digital services companies

like Squarespace, Shopify and GoDaddy.

Commenting on this acquisition, Tim Peterman,

CEO of iMedia, said: “The management team we are acquiring is

strong and their advertising technology services are compelling. We

know their MVPD and ISP customers well and are excited about the

growth possibilities of empowering this team to leverage iMedia’s

assets to create differentiated service offerings. I want to thank

Synacor’s CEO, Himesh Bhise, for his partnership in completing this

transaction and look forward to continued product partnerships with

Synacor in the future.”

“iMedia will be a good fit for our talented

Portal and Advertising team, and the combination will be beneficial

for our MVPD, ISP and Publisher customers,” said Synacor CEO Himesh

Bhise. “Synacor is now a pure-play, cloud-oriented software

company, even more focused on growing and investing in our

high-performance Cloud ID Identity Management and Zimbra

Collaboration platforms.”

Lake Street Capital Markets, LLC served as

financial advisor to the Company for the transaction.

About iMedia Brands, Inc.

iMedia Brands, Inc. (Nasdaq: IMBI) is a leading

interactive media company that owns a growing portfolio of

lifestyle television networks, consumer brands, online marketplaces

and media commerce services that together position the Company as a

leading single-source partner to advertisers and consumer brands

seeking to entertain and transact with customers using interactive

video.

About Synacor

Synacor, Inc. is a cloud-based software and

services company serving global video, internet and communications

providers, device manufacturers, governments and enterprises.

Synacor’s mission is to enable its customers to better engage with

their consumers. Its customers use Synacor’s technology platforms

and services to scale their businesses and extend their subscriber

relationships. Synacor has built its brand on email and

collaboration platforms and cloud-based identity management, and

also managed portals and advertising solutions. For more

information, visit www.synacor.com.

About Lake Street Capital

Lake Street Capital Markets is a

research-powered boutique investment bank focused on high-growth

industries including technology, consumer, healthcare and

clean-tech to serve institutional and issuer clients raise. Since

founding our firm in 2012, we have completed over 200 investment

banking transactions and helped raise more than $9 billion of

growth capital for our clients.

Safe Harbor Statement under the Private

Securities Litigation Reform Act of 1995

This document may contain certain

“forward-looking statements” within the meaning of the Private

Securities Litigation Reform Act of 1995. Any statements contained

herein that are not statements of historical fact, including

statements regarding the expected revenue and profitability

performance of the Company’s Media Commerce Services business are

forward-looking. The Company often use words such as anticipates,

believes, estimates, expects, intends, seeks, predicts, hopes,

should, plans, will and similar expressions to identify

forward-looking statements. These statements are based on

management's current expectations and accordingly are subject to

uncertainty and changes in circumstances. Actual results may vary

materially from the expectations contained herein due to various

important factors, including (but not limited to): variability in

consumer preferences, shopping behaviors, spending and debt levels;

the general economic and credit environment, including COVID-19;

interest rates; seasonal variations in consumer purchasing

activities; the ability to achieve the most effective product

category mixes to maximize sales and margin objectives; competitive

pressures on sales and sales promotions; pricing and gross sales

margins; the level of cable and satellite distribution for the

Company’s programming and the associated fees or estimated cost

savings from contract renegotiations; the Company’s ability to

establish and maintain acceptable commercial terms with third-party

vendors and other third parties with whom the Company has

contractual relationships, and to successfully manage key vendor

and shipping relationships and develop key partnerships and

proprietary and exclusive brands; the ability to manage operating

expenses successfully and the Company’s working capital levels; the

ability to remain compliant with the Company’s credit facilities

covenants; customer acceptance of the Company’s branding strategy

and its repositioning as a video commerce Company; the ability to

respond to changes in consumer shopping patterns and preferences,

and changes in technology and consumer viewing patterns; changes to

the Company’s management and information systems infrastructure;

challenges to the Company’s data and information security; changes

in governmental or regulatory requirements; including without

limitation, regulations of the Federal Communications Commission

and Federal Trade Commission, and adverse outcomes from regulatory

proceedings; litigation or governmental proceedings affecting the

Company’s operations; significant events (including disasters,

weather events or events attracting significant television

coverage) that either cause an interruption of television coverage

or that divert viewership from its programming; disruptions in the

Company’s distribution of its network broadcast to customers; the

Company’s ability to protect its intellectual property rights; our

ability to obtain and retain key executives and employees; the

Company’s ability to attract new customers and retain existing

customers; changes in shipping costs; expenses related to the

actions of activist or hostile shareholders; the Company’s ability

to offer new or innovative products and customer acceptance of the

same; changes in customer viewing habits of television programming;

and the risks identified under Item 1A(Risk Factors) in the

Company’s most recently filed Form 10-K and any additional risk

factors identified in its periodic reports since the date of such

Form 10-K. More detailed information about those factors is set

forth in the Company’s filings with the Securities and Exchange

Commission, including its annual report on Form 10-K, quarterly

reports on Form 10-Q, and current reports on Form 8-K. Investors

are cautioned not to place undue reliance on forward-looking

statements, which speak only as of the date of this announcement.

the Company’s is under no obligation (and expressly disclaim any

such obligation) to update or alter its forward-looking statements

whether as a result of new information, future events or

otherwise.

Contacts:

Media:press@imediabrands.com(800) 938-9707

Investors:Gateway Investor

RelationsCody SlachIMBI@gatewayir.com(949) 574-3860

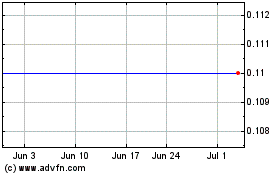

iMedia Brands (NASDAQ:IMBI)

Historical Stock Chart

From Mar 2024 to Apr 2024

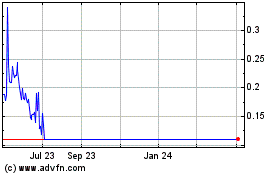

iMedia Brands (NASDAQ:IMBI)

Historical Stock Chart

From Apr 2023 to Apr 2024