Illumina Battles U.S., European Antitrust Enforcers on Grail Deal

May 28 2021 - 9:29AM

Dow Jones News

By Brent Kendall in Washington and Daniel Michaels in Brussels

Life-sciences company Illumina Inc. is facing a labyrinth of

antitrust hurdles on two continents as it seeks to save its planned

$7.1 billion acquisition of Grail Inc., which is developing an

early-stage cancer-detection test.

The deal, announced last September, could have important

ramifications for cancer care and the future of both companies. It

also has become something of a test for U.S. and European antitrust

enforcers as they focus more on whether acquisitions of leading

startups could slow innovation.

The U.S. Federal Trade Commission sued the companies in March to

block the deal. Since then, the European Union has added an element

of intrigue by invoking a new policy to claim a say on whether the

combination of the two U.S.-based companies moves forward.

A hearing Friday in San Diego could determine the course of U.S.

legal proceedings. Illumina has separately mounted a legal campaign

overseas contesting the EU's jurisdiction.

San Diego-based Illumina develops and sells next-generation

genetic-sequencing machines and the chemicals used in them. Grail,

based in Menlo Park, Calif., was founded by Illumina and spun off

in 2017. It has been developing liquid biopsy tests that examine

blood samples for genetic signs of cancer, a product that, if

successful, could have a significant impact in healthcare. Illumina

says buying Grail back would allow it to scale up operations and

expand access to the tests more quickly.

The FTC sees the deal differently, arguing it could harm

competition in the testing market. Other cancer-test developers --

Grail's competitors -- have no choice but to use Illumina's

instruments, the FTC alleged in its complaint, putting Illumina in

a position to impede their efforts and "cause substantial harm to

U.S. consumers, who would experience reduced innovation, as well as

potentially higher costs and reduced choice and quality for these

lifesaving products."

The commission voted 4-0 to bring the lawsuit, with Democrats

and Republicans supporting it.

Illumina denies the allegations and says it would offer

cancer-testing labs equal and fair access to sequencing. It has

pushed for quick legal proceedings in a San Diego federal court

that is set to begin considering on Aug. 9 whether to issue a

preliminary injunction blocking the deal. But the FTC says those

proceedings aren't appropriate right now, because the European

developments mean Illumina can't close the transaction anyway.

Illumina is urging the U.S. court to keep the case on track,

alleging the FTC is attempting to kill the deal through "procedural

gamesmanship" instead of trying to prove its case.

Any material delay in the schedule "would make it nearly

impossible for any court to make an informed decision regarding the

fate of what defendants believe is a pro-competitive lifesaving

transaction," lawyers for Illumina and Grail said in a Wednesday

court filing.

The terms of the transaction expire in September but can be

extended until December.

The FTC has a unique two-track system for challenging mergers.

It can bring a case in its in-house court system, a process

disliked by defendant companies, but the agency has to go to a

federal judge if it wants an injunction to block the deal in the

meantime.

The in-house trial on Illumina-Grail is set to begin Aug. 24,

and the FTC says those proceedings will continue. Illumina, like

past companies in its position, is most focused on the federal

court proceedings, hoping that a win there would undercut the FTC's

in-house trial, a process the company says is too slow.

The European Commission, the executive arm of the EU, wouldn't

have been able to review the Illumina transaction under its

traditional criteria that focus on issues related to revenue and

market share. Under a new policy announced in March, the commission

can now review a merger at individual countries' request on the

grounds that it would affect trade between states and be a

significant threat to competition.

Six countries -- France, Belgium, Greece, Iceland, the

Netherlands and Norway -- made such a request for the Illumina

deal, making it a test case for the new approach. The company has

filed suit in the General Court of the European Union, arguing

there is no European jurisdiction because Grail has no active

business activities there.

A European Commission spokeswoman said the EU antitrust enforcer

has asked Illumina to notify it formally of the transaction. She

declined to comment on Illumina's statements about the EU

review.

The change in European policy marks an effort by the commission

to adapt its antitrust enforcement to a fast-changing marketplace

where companies can expand with great speed, including through the

acquisition of pivotal smaller businesses, the commission has said.

Its March policy guidance changes nothing in the letter of the law

but fundamentally changes how it is interpreted.

Potential red flags for merger review now include almost any

deal done by a tech giant; almost any deal in a highly innovative

sector, such as pharmaceuticals; a deal that might trigger

complaints from third parties; and high-price acquisitions of

companies with little revenue.

"It raises a lot of questions and uncertainty," said Salomé

Cisnal de Ugarte, a partner at law firm Hogan Lovells in Brussels.

"It can affect every transaction."

Write to Brent Kendall at brent.kendall@wsj.com and Daniel

Michaels at daniel.michaels@wsj.com

(END) Dow Jones Newswires

May 28, 2021 09:14 ET (13:14 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

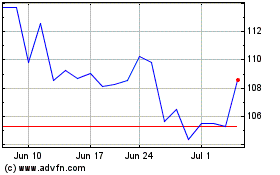

Illumina (NASDAQ:ILMN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Illumina (NASDAQ:ILMN)

Historical Stock Chart

From Apr 2023 to Apr 2024