IES Holdings Terminates NOL Rights Plan

May 10 2021 - 8:00AM

IES Holdings, Inc. (or “IES” or the “Company”) (NASDAQ: IESC) today

announced that its Board of Directors has approved an amendment to

the Company’s Tax Benefit Protection Plan (the “NOL Rights Plan”)

to accelerate the expiration date of the NOL Rights Plan to May 21,

2021, effectively terminating the plan as of that date. The NOL

Rights Plan, which was previously set to expire on December 31,

2021, was intended to preserve the availability of IES’s federal

net operating loss carryforwards (“NOLs”) by deterring an

acquisition of the Company's stock in excess of a threshold amount

that could trigger an “ownership change” within the meaning of the

Internal Revenue Code. Shareholders are not required to take any

action in connection with the termination of the NOL Rights Plan.

Jeff Gendell, Chairman and Chief Executive

Officer of IES, said, “In reaching the decision to terminate the

NOL Rights Plan, the Board considered a variety of factors,

including our substantial NOL utilization in recent years and the

timeframe in which we expect to utilize our remaining NOLs, as well

as shareholder feedback on implementing best corporate governance

practices. We believe that the tax savings we expect to generate as

we use our remaining NOLs will further enhance our already strong

financial position and help support our growth strategy.”

Separately, IES has posted an updated investor presentation on

its website, which can be found at

www.ies-co.com/presentations.

About IES Holdings, Inc.

IES is a holding company that owns and manages operating

subsidiaries that design and install integrated electrical and

technology systems and provide infrastructure products and services

to a variety of end markets, including data centers, residential

housing, and commercial and industrial facilities. Our more than

5,000 employees serve clients across the United States. For more

information about IES, please visit www.ies-co.com.

Company Contact:

Tracy McLauchlin,Chief Financial OfficerIES Holdings, Inc.(713)

860-1500

Investor Relations Contact:

Robert Winters or Ross CollinsAlpha IR

Group312-445-2870IESC@alpha-ir.com

Certain statements in this release may be deemed

"forward-looking statements" within the meaning of Section 27A of

the Securities Act of 1933 and Section 21E of the Securities

Exchange Act of 1934, all of which are based upon various estimates

and assumptions that the Company believes to be reasonable as of

the date hereof. In some cases, you can identify forward-looking

statements by terminology such as "may," "will," "could," "should,"

"expect," "plan," "project," "intend," "anticipate," "believe,"

"seek," "estimate," "predict," "potential," "pursue," "target,"

"continue," the negative of such terms or other comparable

terminology. These statements involve risks and uncertainties that

could cause the Company's actual future outcomes to differ

materially from those set forth in such statements. Such risks and

uncertainties include, but are not limited to, the impact of the

COVID-19 outbreak or future epidemics on our business, including

the potential for job site closures or work stoppages, supply chain

disruptions, construction delays, reduced demand for our services,

or our ability to collect from our customers; the ability of our

controlling shareholder to take action not aligned with other

shareholders; the possibility that certain tax benefits of our net

operating losses may be restricted or reduced in a change in

ownership or a change in the federal tax rate; the potential

recognition of valuation allowances or write-downs on deferred tax

assets; the inability to carry out plans and strategies as

expected, including our inability to identify and complete

acquisitions that meet our investment criteria in furtherance of

our corporate strategy, or the subsequent underperformance of those

acquisitions; competition in the industries in which we operate,

both from third parties and former employees, which could result in

the loss of one or more customers or lead to lower margins on new

projects; fluctuations in operating activity due to downturns in

levels of construction or the housing market, seasonality and

differing regional economic conditions; and our ability to

successfully manage projects, as well as other risk factors

discussed in this document, in the Company's annual report on Form

10-K for the year ended September 30, 2020 and in the Company’s

other reports on file with the SEC. You should understand that such

risk factors could cause future outcomes to differ materially from

those experienced previously or those expressed in such

forward-looking statements. The Company undertakes no obligation to

publicly update or revise any information, including information

concerning its controlling shareholder, net operating losses,

borrowing availability, or cash position, or any forward-looking

statements to reflect events or circumstances that may arise after

the date of this release.

Forward-looking statements are provided in this

press release pursuant to the safe harbor established under the

Private Securities Litigation Reform Act of 1995 and should be

evaluated in the context of the estimates, assumptions,

uncertainties, and risks described herein.

General information about IES Holdings, Inc. can

be found at http://www.ies-co.com under "Investor Relations." The

Company's annual report on Form 10-K, quarterly reports on Form

10-Q and current reports on Form 8-K, as well as any amendments to

those reports, are available free of charge through the Company's

website as soon as reasonably practicable after they are filed

with, or furnished to, the SEC.

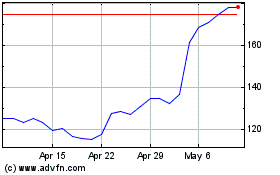

IES (NASDAQ:IESC)

Historical Stock Chart

From Mar 2024 to Apr 2024

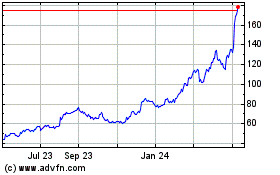

IES (NASDAQ:IESC)

Historical Stock Chart

From Apr 2023 to Apr 2024