Securities Registration Statement (s-1/a)

January 30 2023 - 4:03PM

Edgar (US Regulatory)

As filed with the Securities and Exchange Commission

on January 30, 2023.

Registration No. 333-269001

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 2

TO

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES

ACT OF 1933

Ideanomics, Inc.

(Exact name of registrant as specified in our charter)

| Nevada |

7380 |

20-1778374 |

(State or other jurisdiction of

incorporation or organization) |

(Primary Standard Industrial

Classification Code Number) |

(I.R.S. Employer Identification Number) |

1441 Broadway, Suite 5116

New York, NY 10018

(212) 206-1216

(Address, including zip code, and telephone number,

including

area code, of registrant’s principal executive

offices)

Alfred P. Poor

Chief Executive Officer

1441 Broadway, Suite 5116

New York, NY 10018

(212) 206-1216

(Name, address, including zip code, and telephone

number, including

area code, of agent for service)

Copies to:

William N. Haddad, Esq.

Venable LLP

1270 Avenue of the Americas, 24th Floor

New York, NY 10020

(212) 503-9812

Approximate date of commencement of proposed

sale to the public: from time to time after the effective date of this registration statement.

If any of the securities being

registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of

1933 check the following box: x

If this Form is filed

to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following

box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective

amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration

statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective

amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration

statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether

the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging

growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting

company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act:

| Large accelerated filer |

¨ |

Accelerated filer |

x |

| |

|

|

|

| Non-accelerated filer |

¨ |

Smaller reporting company |

¨ |

| |

|

Emerging growth company |

¨ |

If an emerging growth company,

indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ¨

The registrant hereby amends

this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further

amendment that specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of

the Securities Act of 1933 or until the registration statement shall become effective on such date as the Securities and Exchange Commission,

acting pursuant to said Section 8(a), may determine.

EXPLANATORY NOTE

Ideanomics, Inc.

(the “Company”) is filing this Amendment No. 2 to its Registration Statement on Form S-1 (File No. 333-269001)(the

“Registration Statement”) to (i) file the consents of BF Borgers CPA PC

and Grassi & Co, CPAs, P.C. filed herewith as Exhibits 23.1 and 23.2, respectively, in order to update the consent previously

filed with the Registration Statement, and (ii) to correct the check mark on the cover page of the Registration Statement that

the Company is an “accelerated filer.” Accordingly, this Amendment No. 2 consists only of the facing page, this explanatory

note, Item 16(a) of Part II of the Registration Statement, the signature page to the Registration Statement and the

filed exhibits. The remainder of the Registration Statement is unchanged and has therefore been omitted.

PART II—INFORMATION NOT REQUIRED

IN PROSPECTUS

Item 16. Exhibits and Financial Statement Schedules.

| (a) | The following exhibits are filed as part of this registration statement: |

| Exhibit

No. |

|

Description |

| 2.1 |

|

Agreement

and Plan of Merger by and among Ideanomics, Inc. and the stockholders of Wireless Advanced Vehicle Electrification, Inc. [incorporated

by reference to Exhibit 10.1 to the Company’s Current Report on Form 8-K (File No. 001-35561) filed on January 19, 2021] |

| |

|

|

| 2.2 |

|

Agreement

and Plan of Merger by and among the Company, US Hybrid Corporation, USH Merger Corp. and Dr. Gordon Abas Goodarzi [incorporated by

reference to Exhibit 10.1 to the Company’s Current Report on Form 8-K (File No. 001-35561) filed on May 14, 2021] |

| |

|

|

| 2.3 |

|

Agreement

and Plan of Merger by and among the Company, Solectrac, SolectracMerger Corp. and certain other securityholders [incorporated by

reference to Exhibit 10.1 to the Company’s Current Report on Form 8-K (File No. 001-35561) filed on June 17, 2021] |

| |

|

|

| 2.4 |

|

Agreement

and Plan of Merger, dated August 30, 2021, by and among Ideanomics, Inc., Longboard Merger Corp., Via Motors International, Inc.

and Shareholder Representative Services LLC [incorporated by reference to Exhibit 2.1 to the Company’s Current Report on Form

8-K (File No. 001-35561) filed on September 3, 2021] |

| |

|

|

| 2.5 |

|

Amendment

No. 1 to Agreement and Plan of Merger by and among the Company, Longboard Merger Corp., Via Motors International, Inc., and Shareholder

Representative Services LLC [incorporated by reference to Exhibit 10.1 to the Company’s Current Report on Form 8-K (File No.

001-35561) filed on May 23, 2022] |

| |

|

|

| 2.6 |

|

Amendment

No. 2 to Agreement and Plan of Merger by and among the Company, Longboard Merger Corp., Via Motors International, Inc., and Shareholder

Representative Services LLC [incorporated by reference to Exhibit 10.1 to the Company’s Current Report on Form 8-K (File No.

001-35561) filed on June 16, 2022] |

| |

|

|

| 3.1 |

|

Articles

of Incorporation of the Company, as amended to date [incorporated by reference to Exhibit 3.1 to the Company’s Annual Report

on Form 10-K (File No. 001-35561) filed on March 30, 2012] |

| |

|

|

| 3.2 |

|

Second

Amended and Restated Bylaws, adopted on January 31, 2014 [incorporated by reference to Exhibit 3.1 to the Company’s Current

Report on Form 8-K (File No. 001-35561) filed on February 6, 2014] |

| |

|

|

| 3.3 |

|

Amendment

No. 1 to the Second Amended and Restated Bylaws, adopted on March 26, 2015 [incorporated by reference to Exhibit 3.3 to the Company’s

Annual Report on Form 10-K (File No. 001-35561) filed on March 30, 2015] |

| |

|

|

| 3.4 |

|

Amendment

No. 2 to the Second Amended and Restated Bylaws, adopted on November 20, 2015. [incorporated by reference to Exhibit 3.3 to the Company’s

Current Report on Form 8-K (File No. 001-35561) filed on November 24, 2015] |

| |

|

|

| 3.5 |

|

Amendment

No. 3 to the Second Amended and Restated Bylaws, adopted November 10, 2021 [incorporated by reference to Exhibit 3.1 to the Company’s

Quarterly Report on Form 10-Q (File No. 001-35561) filed on November 23, 2021] |

| |

|

|

| 3.6 |

|

Certificate

of Designation of Series A Preferred Stock [incorporated by reference to Exhibit 3.2 to the Company’s Quarterly Report on Form

10-Q (File No. 001-35561) filed on August 23, 2010] |

| |

|

|

| 3.7 |

|

Certificate

of Designation of Series B Preferred Stock, as corrected by Certificate of Correction [incorporated by reference to Exhibit 3.7 to

the Company’s Annual Report on Form 10-K (File No. 001-35561) filed on September 2, 2022] |

| 3.8 |

|

Certificate

of Designation of Series C Preferred Stock [incorporated by reference to Exhibit 4.2 to the Company’s Current Report on Form

8-K (File No. 001-35561) filed on August 31, 2012] |

| |

|

|

| 3.9 |

|

Certificate

of Designation of Series D 4% Convertible Preferred Stock [incorporated by reference to Exhibit 4.1 to the Company’s Current

Report on Form 8-K (File No. 001-35561) filed on July 11, 2013] |

| |

|

|

| 3.10 |

|

Certificate

of Designation of Series E Convertible Preferred Stock [incorporated by reference to Exhibit 4.1 to the Company’s Current Report

on Form 8-K (File No. 001-35561) filed on February 6, 2014] |

| |

|

|

| 3.11 |

|

Certificate

of Withdrawal of Designation relating to the Series B Preferred Stock, filed with the Secretary of State of Nevada on November 16,

2022 [incorporated by reference to Exhibit 3.1 to the Company’s Current Report on Form 8-K (File No. 001-35561) filed on November

18, 2022] |

| |

|

|

| 3.12 |

|

Certificate

of Withdrawal of Designation relating to the Series C Preferred Stock, filed with the Secretary of State of Nevada on November 16,

2022 [incorporated by reference to Exhibit 3.2 to the Company’s Current Report on Form 8-K (File No. 001-35561) filed on November

18, 2022] |

| |

|

|

| 3.13 |

|

Certificate

of Withdrawal of Designation relating to the Series D Preferred Stock, filed with the Secretary of State of Nevada on November 16,

2022 [incorporated by reference to Exhibit 3.3 to the Company’s Current Report on Form 8-K (File No. 001-35561) filed on November

18, 2022] |

| |

|

|

| 3.14 |

|

Certificate

of Withdrawal of Designation relating to the Series E Preferred Stock, filed with the Secretary of State of Nevada on November 16,

2022 [incorporated by reference to Exhibit 3.4 to the Company’s Current Report on Form 8-K (File No. 001-35561) filed on November

18, 2022] |

| |

|

|

| 3.15 |

|

Certificate

of Designation of Series B Convertible Preferred Stock, filed with the Secretary of State of Nevada on November 17, 2022 [incorporated

by reference to Exhibit 3.5 to the Company’s Current Report on Form 8-K (File No. 001-35561) filed on November 18, 2022] |

| |

|

|

| 4.1 |

|

Warrant

To Purchase Common Stock dated as of November 14, 2022, issued to Acuitas Capital, LLC [incorporated by reference to Exhibit 10.2

to the Company’s Current Report on Form 8-K (File No. 001-35561) filed on November 18, 2022] |

| |

|

|

| 5.1# |

|

Opinion

of Sherman & Howard L.L.C. |

| |

|

|

| 10.1 |

|

Amended

and Restated 2010 Equity Incentive Plan [incorporated by reference to Exhibit 10.1 to the Company’s Current Report on Form

8-K (File No. 001-35561) filed on November 28, 2022] |

| |

|

|

| 10.2 |

|

Forms

of Stock Option Agreement [Incorporated by reference to Exhibit 4.9 to the Company’s Registration Statement on Form S-8 (File

No. 001-35561) filed on January 28, 2020] |

| |

|

|

| 10.3 |

|

Form

of Restricted Stock Grant Agreement [Incorporated by reference to Exhibit 4.10 to the Company’s Registration Statement on Form

S-8 (File No. 001-35561) filed on January 28, 2020] |

| |

|

|

| 10.4 |

|

Strategic

Cooperation agreement between Qingdao Chengyang Xingyang Development and Investment Co., Ltd., Beijing Seven Star Global Culture

Development Co., Ltd. and Ideanomics [incorporated by reference to Exhibit 10.2 to the Company’s Report on Form 10-Q (File

No. 001-35561) filed on May 11, 2020] |

| |

|

|

| 10.5 |

|

Standby

Equity Distribution Agreement, dated as of September 4, 2020, by and between Ideanomics, Inc. and YA II PN, Ltd [incorporated by

reference to Exhibit 10.1 to the Company’s Report on Form 8-K (File No. 001-35561) filed on September 10, 2020] |

| |

|

|

| 10.6† |

|

Employment

Agreement, dated August 5, 2020, by and between the Company and Mr. Conor J. McCarthy [incorporated by reference to Exhibit 10.6

to the Company’s Report on Form 10-Q (File No. 001-35561) filed on August 11, 2020] |

| 10.7† |

|

Employment

Agreement, dated July 31, 2020, by and between the Company and Mr. Alfred P. Poor [incorporated by reference to Exhibit 10.7 to the

Company’s Report on Form 10-Q (File No. 001-35561) filed on August 11, 2020] |

| |

|

|

| 10.8 |

|

Stock

Purchase Agreement, by and among Ideanomics, Timios Holding Corp. and the stockholders of Timios Holding Corp [incorporated by reference

to Exhibit 10.1 to the Company’s Report on Form 8-K (File No. 001-35561) filed on November 12, 2020] |

| |

|

|

| 10.9 |

|

An

automobile sales contract between the Company and Meihao Travel (Hangzhou) Automobile Technology Co., Ltd. [incorporated by reference

to Exhibit 10.142 to the Company’s Annual Report on Form 10-K (File No. 001-35561) filed on March 31, 2021] |

| |

|

|

| 10.10 |

|

Payment

agreement among the Company, Meihao Travel (Hangzhou) Automobile Technology Co., and BYD (HK) Co., Ltd. [incorporated by reference

to Exhibit 10.143 to the Company’s Annual Report on Form 10-K (File No. 001-35561) filed on March 31, 2021] |

| |

|

|

| 10.11 |

|

Stock

purchase agreement, dated October 2, 2020, between the Company and Solectrac, Inc. [incorporated by reference to Exhibit 10.144 to

the Company’s Annual Report on Form 10-K (File No. 001-35561) filed on March 31, 2021] |

| |

|

|

| 10.12 |

|

Shareholder

agreement, dated October 20, 2020, by and among Solectrac, Inc. and each of the shareholders [incorporated by reference to Exhibit

10.145 to the Company’s Annual Report on Form 10-K (File No. 001-35561) filed on March 31, 2021] |

| |

|

|

| 10.13 |

|

Convertible

Debenture between the Company and YA II PN, Ltd, dated January 4, 2021 in the principal amount of $37,500,000 [incorporated by reference

to Exhibit 10.1 to the Company’s Current Report on Form 8-K (File No. 001-35561) filed on January 8, 2021] |

| |

|

|

| 10.14 |

|

Convertible

Debenture between the Company and YA II PN, Ltd, dated January 15, 2021 in the principal amount of $37,500,000 [incorporated by reference

to Exhibit 10.1 to the Company’s Current Report on Form 8-K (File No. 001-35561) filed on January 22, 2021] |

| |

|

|

| 10.15 |

|

Convertible

Promissory Note between the Company and Slk EV Cayman LP, dated January 28, 2021 in the principal amount of $15,000,000 [incorporated

by reference to Exhibit 10.1 to the Company’s Current Report on Form 8-K (File No. 001-35561) filed on February 1, 2021] |

| |

|

|

| 10.16 |

|

Convertible

Debenture between the Company and YA II PN, Ltd, dated January 28, 2021 in the principal amount of $65,000,000 [incorporated by reference

to Exhibit 10.2 to the Company’s Current Report on Form 8-K (File No. 001-35561) filed on February 1, 2021] |

| |

|

|

| 10.17 |

|

Simple

Agreement for Future Equity between the Company and Technology Metals Market Limited, dated January 28, 2021 in the principal amount

of £1,500,000 [incorporated by reference to Exhibit 10.1 to the Company’s Current Report on Form 8-K (File No. 001-35561)

filed on February 3, 2021] |

| |

|

|

| 10.18 |

|

Convertible

Debenture between the Company and YA II PN, Ltd, dated February 8, 2021 in the principal amount of $80,000,000 [incorporated by reference

to Exhibit 10.1 to the Company’s Current Report on Form 8-K (File No. 001-35561) filed on February 12, 2021] |

| |

|

|

| 10.19 |

|

Sales

Agreement by and between Ideanomics, Inc. and Roth Capital Partners, LLC, dated as of February 26, 2021 [incorporated by reference

to Exhibit 10.1 to the Company’s Current Report on Form 8-K (File No. 001-35561) filed on March 1, 2021] |

| |

|

|

| 10.20 |

|

Investment

Agreement between the Company and Energica Motor Company, dated March 3, 2021 [incorporated by reference to Exhibit 10.1 to the Company’s

Current Report on Form 8-K (File No. 001-35561) filed on March 4, 2021] |

| |

|

|

| 10.21 |

|

Employment

Agreement, effective April 5, 2021, with Kristin Helsel [incorporated by reference to Exhibit 99.1 to the Company’s Current

Report on Form 8-K (File No. 001-35561) filed on April 5, 2021] |

| 10.22 |

|

Agent

Agreement between Tree Technologies SDN BHD and PT Pasifik Sakti Enjinring, dated April 14, 2021 [incorporated by reference to Exhibit

10.1 to the Company’s Current Report on Form 8-K (File No. 001-35561) filed on April 14, 2021] |

| |

|

|

| 10.23 |

|

Stock

Purchase Agreement between the Company and FNL Technologies, Inc., dated April 20, 2021 [incorporated by reference to Exhibit 10.1

to the Company’s Current Report on Form 8-K (File No. 001-35561) filed on April 26, 2021] |

| |

|

|

| 10.24 |

|

Standby

Equity Distribution Agreement, dated as of June 11, 2021, by and between Ideanomics, Inc. and YA II PN, Ltd. [incorporated by reference

to Exhibit 10.1 to the Company’s Current Report on Form 8-K (File No. 001-35561) filed on June 11, 2021] |

| |

|

|

| 10.25 |

|

Controlled

Equity Offering Sales Agreement by and between Ideanomics, Inc. and Cantor Fitzgerald & Co. dated as of August 12, 2021 [incorporated

by reference to Exhibit 10.1 to the Company’s Current Report on Form 8-K (File No. 001-35561) filed on August 13, 2021] |

| |

|

|

| 10.26 |

|

Form

of Voting and Support Agreement, dated August 30, 2021 [incorporated by reference to Exhibit 10.1 to the Company’s Current

Report on Form 8-K (File No. 001-35561) filed on September 3, 2021] |

| |

|

|

| 10.27 |

|

Secured

Convertible Promissory Note issued by VIA Motors International, Inc. to Ideanomics, Inc. [incorporated by reference to Exhibit 10.2

to the Company’s Current Report on Form 8-K (File No. 001-35561) filed on September 3, 2021] |

| |

|

|

| 10.28 |

|

Convertible

Debenture between the Company and YA II PN, Ltd, dated October 25, 2021 in the principal amount of $75,000,000 [incorporated by reference

to Exhibit 10.1 to the Company’s Current Report on Form 8-K (File No. 001-35561) filed on October 29, 2021] |

| |

|

|

| 10.29 |

|

Framework

Agreement, dated September 15, 2021 [incorporated by reference to Exhibit 10.3 to the Company’s Quarterly Report on Form 10-Q

(File No. 001-35561) filed on November 23, 2021] |

| |

|

|

| 10.30 |

|

Shareholders

Agreement, dated September 15, 2021 [incorporated by reference to Exhibit 10.4 to the Company’s Quarterly Report on Form 10-Q

(File No. 001-35561) filed on November 23, 2021] |

| |

|

|

| 10.31 |

|

Employment

Agreement of Robin Mackie, dated as of August 29, 2021 [incorporated by reference to Exhibit 10.5 to the Company’s Quarterly

Report on Form 10-Q (File No. 001-35561) filed on November 23, 2021] |

| |

|

|

| 10.32 |

|

Subscription

Agreement dated as of July 26, 2021, and entered into between the Company and the MDI Keeper’s Fund, L.P. [incorporated by

reference to Exhibit 10.7 to the Company’s Quarterly Report on Form 10-Q (File No. 001-35561) filed on November 23, 2021] |

| |

|

|

| 10.33 |

|

Investment

Agreement relating to PRETTL Electronics Automotive GmbH [incorporated by reference to Exhibit 10.8 to the Company’s Quarterly

Report on Form 10-Q (File No. 001-35561) filed on November 23, 2021] |

| |

|

|

| 10.34 |

|

Shareholders’

Agreement relating to PRETTL Electronics Automotive GmbH [incorporated by reference to Exhibit 10.9 to the Company’s Quarterly

Report on Form 10-Q (File No. 001-35561) filed on November 23, 2021] |

| |

|

|

| 10.35 |

|

Shareholders

Agreement, dated December 29, 2021 [incorporated by reference to Exhibit 10.1 to the Company’s Current Report on Form 8-K (File

No. 001-35561) filed on December 29, 2021] |

| |

|

|

| 10.36 |

|

Amendment

No. 1 to Secured Convertible Promissory Note by and between the Company and VIA Motors International, Inc. [incorporated by reference

to Exhibit 10.2 to the Company’s Current Report on Form 8-K (File No. 001-35561) filed on May 23, 2022] |

| |

|

|

| 10.37 |

|

Secured

Promissory Note No. 1 issued by VIA Motors International, Inc. dated as of May 20, 2022 [incorporated by reference to Exhibit 10.3

to the Company’s Current Report on Form 8-K (File No. 001-35561) filed on May 23, 2022] |

| 10.38 |

|

Amendment

No. 1 to Secured Convertible Promissory Note No. 1 issued by VIA Motors International, Inc. dated as of June 17, 2022 [incorporated

by reference to Exhibit 10.1 to the Company’s Current Report on Form 8-K (File No. 001-35561) filed on July 18, 2022] |

| |

|

|

| 10.39 |

|

Amendment

No. 2 to Secured Convertible Promissory Note issued by VIA Motors International, Inc. dated as of June 17, 2022 [incorporated by

reference to Exhibit 10.2 to the Company’s Current Report on Form 8-K (File No. 001-35561) filed on July 18, 2022] |

| |

|

|

| 10.40 |

|

Amendment

No. 3 to Secured Convertible Promissory Note issued by VIA Motors International, Inc. dated as of July 12, 2022 [incorporated by

reference to Exhibit 10.3 to the Company’s Current Report on Form 8-K (File No. 001-35561) filed on July 18, 2022] |

| |

|

|

| 10.41 |

|

Amendment

No. 2 to Secured Convertible Promissory Note No. 1 issued by VIA Motors International, Inc. dated as of July 19, 2022 [incorporated

by reference to Exhibit 10.1 to the Company’s Current Report on Form 8-K (File No. 001-35561) filed on July 25, 2022] |

| |

|

|

| 10.42 |

|

Amendment

No. 3 to Secured Promissory Note No. 1 issued by VIA Motors International, Inc. dated as of August 15, 2022 [incorporated by reference

to Exhibit 10.1 to the Company’s Current Report on Form 8-K (File No. 001-35561) filed on August 19, 2022] |

| |

|

|

| 10.43 |

|

Amendment

No. 4 to Secured Convertible Promissory Note issued by VIA Motors International, Inc. dated as of August 15, 2022 [incorporated by

reference to Exhibit 10.2 to the Company’s Current Report on Form 8-K (File No. 001-35561) filed on August 19, 2022] |

| |

|

|

| 10.44 |

|

Amendment

Agreement by and between the Company and YA II PN, LTD. dated as of August 29, 2022 [incorporated by reference to Exhibit 10.1 to

the Company’s Current Report on Form 8-K (File No. 001-35561) filed on August 31, 2022] |

| |

|

|

| 10.45 |

|

Amendment

and Restated Convertible Debenture dated as of August 29, 2022 [incorporated by reference to Exhibit 10.2 to the Company’s

Current Report on Form 8-K (File No. 001-35561) filed on August 31, 2022] |

| |

|

|

| 10.46 |

|

Escrow

Agreement by and among the Company, YA II PN, LTD., and Transfer Online, Inc. dated as of August 30, 2022 [incorporated by reference

to Exhibit 10.3 to the Company’s Current Report on Form 8-K (File No. 001-35561) filed on August 31, 2022] |

| |

|

|

| 10.47 |

|

Standby

Equity Purchase Agreement, dated as of September 1, 2022, by and between Ideanomics, Inc. and YA II PN, Ltd. [incorporated by reference

to Exhibit 10.1 to the Company’s Current Report on Form 8-K (File No. 001-35561) filed on September 2, 2022] |

| |

|

|

| 10.48 |

|

Amendment

No. 5 to Secured Convertible Promissory Note issued by VIA Motors International, Inc. dated as of September 7, 2022 [incorporated

by reference to Exhibit 10.1 to the Company’s Current Report on Form 8-K (File No. 001-35561) filed on September 13, 2022] |

| |

|

|

| 10.50 |

|

Amended

and Restated Standby Equity Purchase Agreement, dated as of September 14, 2022, by and between Ideanomics, Inc. and YA II PN, Ltd.

[incorporated by reference to Exhibit 10.1 to the Company’s Current Report on Form 8-K (File No. 001-35561) filed on September

16, 2022] |

| |

|

|

| 10.51 |

|

Separation

Agreement, dated September 16, 2022, by and between the Company and Mr. Conor J. McCarthy. [incorporated by reference to Exhibit

10.1 to the Company’s Current Report on Form 8-K (File No. 001-35561) filed on September 20, 2022] |

| |

|

|

| 10.52 |

|

Employment

Agreement, dated September 16, 2022, by and between the Company and Mr. Stephen Johnston. [incorporated by reference to Exhibit 10.2

to the Company’s Current Report on Form 8-K (File No. 001-35561) filed on September 20, 2022] |

| 10.53 |

|

Amendment

No. 6 to Secured Convertible Promissory Note issued by VIA Motors International, Inc. dated as of September 12, 2022 [incorporated

by reference to Exhibit 10.1 to the Company’s Current Report on Form 8-K (File No. 001-35561) filed on September 22, 2022] |

| |

|

|

| 10.54 |

|

Amendment

No. 7 to Secured Convertible Promissory Note issued by VIA Motors International, Inc. dated as of September 16, 2022 [incorporated

by reference to Exhibit 10.2 to the Company’s Current Report on Form 8-K (File No. 001-35561) filed on September 22, 2022] |

| |

|

|

| 10.55 |

|

Amendment

No. 8 to Secured Convertible Promissory Note issued by VIA Motors International, Inc. dated as of September 28, 2022 [incorporated

by reference to Exhibit 10.1 to the Company’s Current Report on Form 8-K (File No. 001-35561) filed on October 3, 2022] |

| |

|

|

| 10.56 |

|

Secured

Debenture Purchased Agreement dated October 25, 2022 [incorporated by reference to Exhibit 10.1 to the Company’s Current Report

on Form 8-K (File No. 001-35561) filed on October 26, 2022] |

| |

|

|

| 10.57 |

|

Secured

Convertible Debenture dated October 25, 2022 [incorporated by reference to Exhibit 10.2 to the Company’s Current Report on

Form 8-K (File No. 001-35561) filed on October 26, 2022] |

| |

|

|

| 10.58 |

|

Pledge

Agreement dated October 25, 2022 [incorporated by reference to Exhibit 10.3 to the Company’s Current Report on Form 8-K (File

No. 001-35561) filed on October 26, 2022] |

| |

|

|

| 10.59 |

|

Option

Agreement dated October 25, 2022 [incorporated by reference to Exhibit 10.4 to the Company’s Current Report on Form 8-K (File

No. 001-35561) filed on October 26, 2022] |

| |

|

|

| 10.60 |

|

Amendment

No. 9 to Secured Convertible Promissory Note issued by VIA Motors International, Inc. dated as of October 27, 2022 [incorporated

by reference to Exhibit 10.1 to the Company’s Current Report on Form 8-K (File No. 001-35561) filed on October 28, 2022] |

| |

|

|

| 10.61 |

|

Amendment

No. 10 to Secured Convertible Promissory Note issued by VIA Motors International, Inc. dated as of November 2, 2022 [incorporated

by reference to Exhibit 10.1 to the Company’s Current Report on Form 8-K (File No. 001-35561) filed on November 4, 2022] |

| |

|

|

| 10.62 |

|

Amendment

No. 4 to the Secured Promissory Note No. 1 issued by VIA Motors International, Inc. dated as of October 28, 2022 [incorporated by

reference to Exhibit 10.1 to the Company’s Current Report on Form 8-K (File No. 001-35561) filed on November 10, 2022] |

| |

|

|

| 10.63 |

|

Securities

Purchase Agreement dated as of November 14, 2022, by and between the Company and Acuitas Capital, LLC [incorporated by reference

to Exhibit 10.1 to the Company’s Current Report on Form 8-K (File No. 001-35561) filed on November 18, 2022] |

| |

|

|

| 10.64 |

|

Registration

Rights Agreement dated as of November 14, 2022, by and between the Company and Acuitas Capital, LLC [incorporated by reference to

Exhibit 10.3 to the Company’s Current Report on Form 8-K (File No. 001-35561) filed on November 18, 2022] |

| |

|

|

| 10.65 |

|

Amendment

No. 11 to Secured Convertible Promissory Note issued by VIA Motors International, Inc. dated as of December 6, 2022 [incorporated

by reference to Exhibit 10.1 to the Company’s Current Report on Form 8-K (File No. 001-35561) filed on December 12, 2022] |

| |

|

|

| 10.66 |

|

Amendment

No. 5 to Secured Promissory Note No. 1 issued by VIA Motors International, Inc. dated as of December 6, 2022 [incorporated by reference

to Exhibit 10.2 to the Company’s Current Report on Form 8-K (File No. 001-35561) filed on December 12, 2022] |

| |

|

|

| 10.67 |

|

Amendment

No. 12 to Secured Convertible Promissory Note issued by VIA Motors International, Inc. dated as of December 19, 2022 [incorporated

by reference to Exhibit 10.1 to the Company’s Current Report on Form 8-K (File No. 001-35561) filed on December 19, 2022] |

| 10.68 |

|

Promissory

Note between Ideanomics, Inc. and Tillou Management and Consulting LLC, dated December 13, 2022. [incorporated by reference to Exhibit

10.2 to the Company’s Current Report on Form 8-K (File No. 001-35561) filed on December 19, 2022] |

| |

|

|

| 10.69 |

|

Pledge

Agreement between Ideanomics, Inc. and Tillou Management and Consulting LLC, dated December 13, 2022. [incorporated by reference

to Exhibit 10.3 to the Company’s Current Report on Form 8-K (File No. 001-35561) filed on December 19, 2022] |

| |

|

|

| 10.70 |

|

Subordination

Agreement among Ideanomics, Inc., Tillou Management and Consulting LLC and YA PN II, dated December 13, 2022. [incorporated by reference

to Exhibit 10.4 to the Company’s Current Report on Form 8-K (File No. 001-35561) filed on December 19, 2022] |

| |

|

|

| 10.71 |

|

Subordination

Agreement among Ideanomics, Inc., Tillou Management and Consulting LLC and YA PN II, dated December 13, 2022. [incorporated by reference

to Exhibit 10.4 to the Company’s Current Report on Form 8-K (File No. 001-35561) filed on December 19, 2022] |

| |

|

|

| 21# |

|

List

of subsidiaries of the registrant |

| |

|

|

| 23.1* |

|

Consent

of BF Borgers CPA PC |

| |

|

|

| 23.2* |

|

Consent

of Grassi & Co, CPAs, P.C., Independent Registered Public Accounting Firm |

| |

|

|

| 23.3# |

|

Consent

of Sherman & Howard L.L.C. (included in Exhibit 5.1 hereto) |

| |

|

|

| 24.1# |

|

Power

of Attorney (included on the signature page to this Registration Statement on Form S-1) |

| |

|

|

| 99.1 |

|

Risk

Factors in connection with VIA Merger [incorporated by reference to Exhibit 99.1 to the Company’s Annual Report on Form 10-K

(File No. 001-35561) filed on September 2, 2022] |

| |

|

|

| 99.2# |

|

Opinion

of DaHui Lawyers |

| |

|

|

| 101.INS# |

|

XBRL

Instance Document |

| |

|

|

| 101.SCH# |

|

XBRL

Taxonomy Extension Schema Document |

| |

|

|

| 101.CAL# |

|

XBRL

Taxonomy Extension Calculation Linkbase Document |

| |

|

|

| 101.DEF# |

|

XBRL

Taxonomy Extension Definitions Linkbase Document |

| |

|

|

| 101.LAB# |

|

XBRL

Taxonomy Extension Label Linkbase Document |

| |

|

|

| 101.PRE# |

|

XBRL

Taxonomy Extension Presentation Linkbase Document |

| |

|

|

| 104# |

|

Cover

Page Interactive Data File (formatted as inline XBRL with applicable taxonomy extension information contained in Exhibits 101) |

| |

|

|

| 107# |

|

Filing

Fee Table |

# Previously

filed.

*

Filed herewith.

SIGNATURES

Pursuant

to the requirements of the Securities Act, the registrant has duly caused this registration statement to be signed on its behalf by the

undersigned, thereunto duly authorized, in the City of New York, State of New York, on January 30, 2023.

| |

|

IDEANOMICS, INC. |

| |

|

|

| |

By: |

/s/

Alfred P. Poor |

| |

|

Alfred

P. Poor |

| |

|

Chief

Executive Officer |

| |

|

|

| |

By: |

/s/

Stephen Johnston |

| |

|

Stephen

Johnston |

| |

|

Chief

Financial Officer |

Pursuant

to the requirements of the Securities Act of 1933, this registration statement has been signed by the following persons in the capacities

and on the dates indicated.

| Signature |

|

Title |

|

Date |

| |

|

|

|

|

| /s/

Alfred P. Poor |

|

|

|

|

| Alfred

P. Poor |

|

Chief

Executive Officer (Principal Executive Officer), Director |

|

January 30,

2023 |

| |

|

|

|

|

| /s/

Stephen Johnston |

|

|

|

|

| Stephen

Johnston |

|

Chief

Financial Officer (Principal Financial Officer) |

|

January 30,

2023 |

| |

|

|

|

|

| * |

|

|

|

|

| Shane

McMahon |

|

Chairman |

|

January 30,

2023 |

| |

|

|

|

|

| * |

|

|

|

|

| James

S. Cassano |

|

Director |

|

January 30,

2023 |

| |

|

|

|

|

| * |

|

|

|

|

| Jerry

Fan |

|

Director |

|

January 30,

2023 |

| *

By: |

/s/

Alfred P. Poor |

|

| |

Alfred

P. Poor |

|

| |

Attorney-in-fact |

|

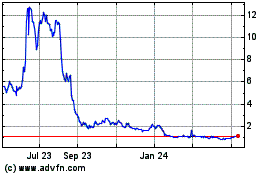

Ideanomics (NASDAQ:IDEX)

Historical Stock Chart

From Mar 2024 to Apr 2024

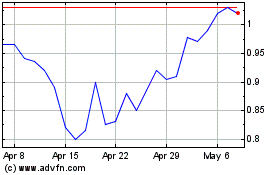

Ideanomics (NASDAQ:IDEX)

Historical Stock Chart

From Apr 2023 to Apr 2024