Current Report Filing (8-k)

October 29 2021 - 4:07PM

Edgar (US Regulatory)

0000837852

false

0000837852

2021-10-25

2021-10-25

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

October 25, 2021

IDEANOMICS, INC.

(Exact name of registrant as specified

in its charter)

|

Nevada

|

20-1778374

|

|

(State or other jurisdiction

|

(IRS Employer

|

|

of incorporation)

|

Identification No.)

|

001-35561

(Commission File Number)

1441 Broadway, Suite 5116, New York, NY 10018

(Address of principal executive offices)

(Zip Code)

212-206-1216

(Registrant’s telephone number, including

area code)

N/A

(Former name or former address, if changed

since last report.)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

¨

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading symbol(s)

|

Name of each exchange on which registered

|

|

Common stock, $0.001 par value per share

|

IDEX

|

The

Nasdaq Stock Market

|

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 1.01 Entry into

a Material Definitive Agreement.

Convertible

Debenture Financing

On

October 25, 2021 (the “Effective Date”), Ideanomics, Inc. (the “Company”) entered

into a convertible debenture (the “Note”), dated October 25, 2021 with the YA II PN, Ltd. (the “Investor”)

with a principal amount of $75,000,000 (the “Principal”). The Note has a fixed conversion price of $1.88

(the “Conversion Price”). The Conversion Price is not subject to adjustment except for subdivisions or

combinations of common stock. The Principal and the interest payable under the Note will mature on October 24, 2022 (the “Maturity

Date”), unless earlier converted or redeemed by the Company. Interest shall accrue on the outstanding Principal at an annual

rate equal to 4%; provided that such interest rate shall be increased to 18% upon an Event of Default (as defined in the Note). At any

time before the Maturity Date, the Investor may convert the Note at its option into up to 39,893,617 shares (excluding additional shares

issuable upon accrued interest) of the Company’s common stock at a fixed conversion price of $1.88. The Investor shall not have

the right to convert any portion of the Note to the extent that after giving effect to such conversion, the Investor, would beneficially

own in excess of 4.99% of the number of shares of common stock outstanding immediately after giving effect to such conversion. Since the

Investor will not be obligated to report to the Company the number of shares of common stock it may hold at the time of conversion, unless

the conversion at issue would result in the issuance of shares of common stock in excess of 4.99% of the then outstanding shares of common

stock without regard to any other shares which may be beneficially owned by the Investor, the Investor shall have the authority, responsibility

and obligation to determine whether the beneficial ownership restriction contained in the Note will limit any particular conversion thereunder

and to the extent that the Investor determines that the beneficial ownership limitation contained in the Note applies, the determination

of which portion of the Principal amount of the Note is convertible shall be the responsibility and obligation of the Investor. The Company

shall redeem in cash (a “Mandatory Redemption”) $8,333,333.33 in Principal, plus accrued and unpaid Interest

on the outstanding Principal (the “Mandatory Redemption Amount”) each month during the term of the Note beginning

on February 1, 2022 and continuing on each successive calendar month (each, a “Redemption Date”). The amounts

of any conversions made by the Investor or any Optional Redemption (as defined below) made by the Company contemporaneous with or prior

to any Redemption Date shall have the effect of reducing the Mandatory Redemption Amount of payments coming due (in chronological order

beginning with the nearest Redemption Date). The Company has the right, but not the obligation, to redeem (“Optional Redemption”)

a portion or all amounts outstanding under this Note prior to the Maturity Date at a cash redemption price equal to the Principal to be

redeemed, plus accrued and unpaid interest, if any; provided that the Company provides Investor with at least 15 business

days’ prior written notice of its desire to exercise an Optional Redemption and the volume weighted average price of the Company’s

common stock over the 10 business days’ immediately prior to such redemption notice is less than the Conversion Price. The Investor

may convert all or any part of the Note after receiving a redemption notice, in which case the redemption amount shall be reduced by the

amount so converted. No public market currently exists for the Note, and the Company does not intend to apply to list the Note on any

securities exchange or for quotation on any inter-dealer quotation system. The Note contains customary events of default, indemnification

obligations of the Company, and other obligations and rights of the parties.

The

Note was offered pursuant to the Company’s effective registration statement on Form S-3ASR (Registration Statement No.

333-252230) previously filed with the SEC and a prospectus supplement thereunder (the “Registration

Statement”). A prospectus supplement relating to the offering of the securities has been filed with the SEC and is

available on the SEC’s website at http://www.sec.gov. The prospectus supplement also covers the resale of

shares issuable to the Investor upon the conversion of the Note. Prior to the Effective Date, the Investor did not own any shares of

the Company’s common stock. After the Effective Date, and assuming the Investor converts the Note, the Investor will own up to

39,893,617 shares (excluding additional shares issuable upon accrued interest) of the Company’s common stock, or 7.63 % of the

Company’s common stock outstanding, subject to the beneficial ownership limitation described above. Immediately after the

consummation of the secondary offering by the Investor, the Investor will own zero shares of the Company’s common stock. The

Investor is a fund managed by Yorkville Advisors Global, LP (“Yorkville LP”). Yorkville Advisors Global

II, LLC (“Yorkville LLC”) is the General Partner of Yorkville LP. All investment decisions for the

Investor are made by Yorkville LLC’s President and Managing Member, Mr. Mark Angelo. The Investor’s business address is

1012 Springfield Avenue, Mountainside, NJ 07092.

The

foregoing description of the Note is qualified in its entirety by reference to the full text of the Note, a copy of which is filed herewith

as Exhibit 10.1 to this Current Report on Form 8-K (this “8-K”) and is incorporated by reference herein.

Item 2.03 Creation

of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The

information pertaining to the Note discussed in Item 1.01 of this 8-K is incorporated herein by reference in its entirety.

Item 8.01 Other Events.

The information set forth in the second paragraph

of Item 1.01 of this 8-K is incorporated herein by reference in its entirety.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

|

|

Ideanomics, Inc.

|

|

|

|

|

|

Date: October 29, 2021

|

By:

|

/s/ Alfred Poor

|

|

|

|

Alfred Poor

|

|

|

|

Chief Executive Officer

|

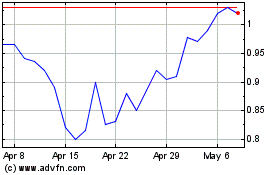

Ideanomics (NASDAQ:IDEX)

Historical Stock Chart

From Mar 2024 to Apr 2024

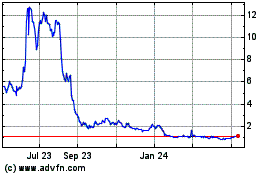

Ideanomics (NASDAQ:IDEX)

Historical Stock Chart

From Apr 2023 to Apr 2024