|

Prospectus Supplement

|

Filed Pursuant to Rule 424(b)(2)

|

|

(To Prospectus Dated January 19, 2021)

|

Registration No. 333-252230

|

CALCULATION OF REGISTRATION

FEE

Title of Each Class of Securities

to be Registered

|

|

Amount

to be Registered

|

|

|

Proposed Maximum

Offering Price

Per Unit

|

|

|

Proposed Maximum

Aggregate Offering

Price

|

|

|

Amount of

Registration Fee(1)

|

|

|

4% Convertible Note Due 2022

|

|

$

|

75,000,000

|

|

|

|

100.00

|

%

|

|

$

|

75,000,000

|

|

|

$

|

6,952.50

|

|

(1) Calculated in accordance with

Rule 457(r) under the Securities Act of 1933, as amended.

PROSPECTUS SUPPLEMENT

$75,000,000

Ideanomics, Inc.

4% Convertible Note Due 2022

Pursuant to this prospectus

supplement and the accompanying prospectus, Ideanomics, Inc. (the “Company”, “we” or “us”)

is offering $75,000,000 aggregate principal amount (the “Principal”) of our 4% convertible notes due 2022 (the “Note”)

directly to YA II PN, Ltd. (the “Investor”) (and this prospectus supplement also relates to the shares of common stock

that are issuable upon exercise of the Note) (the “Offering”). We will receive $75,000,000 from this Offering.

The

Note has a fixed conversion price of $1.88 (the “Conversion Price). The Conversion Price is not subject to adjustment except for

subdivisions or combinations of common stock. The Principal and the interest payable under the Note will mature on October 24, 2022 (the

“Maturity Date), unless earlier converted or redeemed by the Company.

At

any time before the Maturity Date, the Investor may convert the Note at their option into shares of our common stock at a fixed conversion

price of $1.88.

The

Company shall redeem in cash (a “Mandatory Redemption”) $8,333,333.33 in Principal, plus accrued and unpaid Interest on the

outstanding Principal (the “Mandatory Redemption Amount”) each month during the term of this Note beginning on February 1,

2022 and continuing on each successive calendar month (each, a “Redemption Date”). The amounts of any conversions made by

the Investor or any Optional Redemptions (as defined below) made by the Company contemporaneous with or prior to any Redemption Date

shall have the effect of reducing the Mandatory Redemption Amount of payments coming due (in chronological order beginning with the nearest

Redemption Date).

The

Company has the right, but not the obligation, to redeem (“Optional Redemption”) a portion or all amounts outstanding under

this Note prior to the Maturity Date at a cash redemption price equal to the Principal to be redeemed, plus accrued and unpaid interest,

if any; provided that the Company provides Investor with at least 15 business days’ prior written notice of its desire to

exercise an Optional Redemption and the volume weighted average price of the Company’s common stock over the 10 Business Days’

immediately prior to such redemption notice is less than the Conversion Price. The Investor may convert all or any part of the Note after

receiving a redemption notice, in which case the redemption amount shall be reduced by the amount so converted.

No

public market currently exists for the notes, and we do not intend to apply to list the notes on any securities exchange or for quotation

on any inter-dealer quotation system.

This prospectus supplement

and the accompanying prospectus also cover the sale of the shares issuable to YA upon the conversion of the Note. For additional

information on the methods of sale that may be used by YA, see the section entitled “Plan of Distribution” on page S-18.

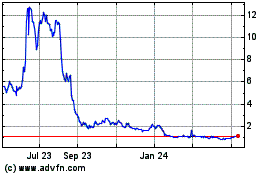

Our Common Stock is listed

on the Nasdaq Capital Market under the symbol “IDEX”. On October 22, 2021, the closing price of our Common Stock was $1.87

per share. As of the date of this prospectus, none of the other securities that we may offer by this prospectus is listed on any national

securities exchange or automated quotation system.

The securities offered

by this prospectus involve a high degree of risk. See “Risk Factors” beginning on page S-15, in addition to Risk Factors

contained in the applicable prospectus supplement.

Neither the Securities

and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus

is truthful or complete. Any representation to the contrary is a criminal offense.

This prospectus supplement is dated October 25,

2021

Table of Contents

You should rely only on the information contained

or incorporated by reference in this prospectus supplement and the accompanying prospectus. We have not authorized anyone to provide you

with information different from that contained or incorporated by reference into this prospectus supplement or the accompanying prospectus.

If any person does provide you with information that differs from what is contained or incorporated by reference in this prospectus supplement

or the accompanying prosepctus, you should not rely on it. No dealer, salesperson or other person is authorized to give any information

or to represent anything not contained in this prospectus supplement or the accompanying prospectus. You should assume that the information

contained in this prospectus supplement and the accompanying prospectus is accurate only as of the date on the front of the document and

that any information contained in any document we have incorporated by reference is accurate only as of the date of the document incorporated

by reference, regardless of the time of delivery of this prospectus supplement, the accompanying prospectus or any sale of a security.

These documents are not an offer to sell or a solicitation of an offer to buy these securities by anyone in any jurisdiction in which

such offer or solicitation is not authorized, or in which the person is not qualified to do so or to any person to whom it is unlawful

to make such offer or solicitation.

ABOUT THIS PROSPECTUS SUPPLEMENT

This

prospectus supplement and the accompanying prospectus are part of a “shelf” registration statement on Form S-3 (File No.

333-252230) that we filed with the Securities and Exchange Commission (the “SEC” or the “Commission”) on

January 19, 2021. Under this shelf registration process, we may, from time to time, sell any combination of the securities described

in the accompanying prospectus in one or more offerings.

This prospectus supplement

provides specific details regarding the issuance of $75,000,000 principal amount of a 4% convertible note due 2022 (the “Note”).

To the extent there is a conflict between the information contained in this prospectus supplement and accompanying prospectus, you should

rely on the information in this prospectus supplement. Generally, when we refer to this prospectus supplement, we are referring to both

parts of this document combined together with all documents incorporated by reference. This prospectus supplement, the accompanying prospectus

and the documents we incorporate by reference herein and therein include important information about us and our common stock, and other

information you should know before investing. You should read this prospectus supplement, the accompanying prospectus and the documents

incorporated by reference in this prospectus supplement and the accompanying prospectus before making an investment decision. You should

also read and consider the information in the documents referred to in the sections of this prospectus supplement entitled “Where

You Can Find More Information” and “Incorporation of Certain Documents by Reference.”

This document is in two parts.

The first part is this prospectus supplement, which describes the specific terms of this offering and also adds to and updates information

contained in the accompanying prospectus and the documents incorporated by reference into this prospectus supplement and the accompanying

prospectus. The second part is the accompanying prospectus, which gives more general information about the shares of our common stock

and other securities we may offer from time to time under our shelf registration statement, some of which does not apply to the common

stock offered by this prospectus supplement. To the extent there is a conflict between the information contained in this prospectus supplement

and accompanying prospectus, you should rely on the information in this prospectus supplement. Generally, when we refer to this prospectus

supplement, we are referring to both parts of this document combined together with all documents incorporated by reference. This prospectus

supplement, the accompanying prospectus and the documents we incorporate by reference herein and therein include important information

about us and our common stock, and other information you should know before investing. You should read this prospectus supplement, the

accompanying prospectus and the documents incorporated by reference in this prospectus supplement and the accompanying prospectus before

making an investment decision. You should also read and consider the information in the documents referred to in the sections of this

prospectus supplement entitled “Where You Can Find More Information” and “Incorporation of Certain Documents by Reference.”

You should rely only on the

information contained in or incorporated by reference into this prospectus supplement or contained in or incorporated by reference into

this prospectus supplement or the accompanying prospectus to which we have referred you. Neither we nor the Investor have authorized anyone

to provide you with information that is different. If anyone provides you with different or inconsistent information, you should not rely

on it. We do not, and the Investor does not, take responsibility for, and can provide no assurances as to, the reliability of any information

that others provide you. The information contained in, or incorporated by reference into, this prospectus supplement and contained in,

or incorporated by reference into, the accompanying prospectus is accurate only as of the respective dates thereof, regardless of the

time of delivery of this prospectus supplement and the accompanying prospectus or of any sale of securities.

We are offering to sell, and

are seeking offers to buy, the securities described herein only in jurisdictions where such offers and sales are permitted. The distribution

of this prospectus supplement and the accompanying prospectus and the offering of the shares of common stock in certain states or jurisdictions

or to certain persons within such states and jurisdictions may be restricted by law. Persons outside the United States who come into possession

of this prospectus supplement and the accompanying prospectus must inform themselves about and observe any restrictions relating to the

offering of the shares of common stock and the distribution of this prospectus supplement and the accompanying prospectus outside the

United States. This prospectus supplement and the accompanying prospectus do not constitute, and may not be used in connection with, an

offer to sell, or a solicitation of an offer to buy, any securities offered by this prospectus supplement and the accompanying prospectus

by any person in any state or jurisdiction in which it is unlawful for such person to make such an offer or solicitation. Unless the context

otherwise requires, references to “we,” “our,” “us,” “IDEX” or the “Company”

in this prospectus supplement mean Ideanomics, Inc., a Nevada corporation, on a consolidated basis with its wholly-owned subsidiaries,

as applicable.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING

STATEMENTS

This prospectus supplement

and the documents and information incorporated by reference in this prospectus supplement include forward-looking statements within the

meaning of Section 27A of the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange

Act”). These statements are based on our management’s beliefs and assumptions and on information currently available to our

management. Such forward-looking statements include those that express plans, anticipation, intent, contingency, goals, targets or future

development and/or otherwise are not statements of historical fact.

All statements in this prospectus

supplement and the documents and information incorporated by reference in this prospectus supplement that are not historical facts are

forward-looking statements. We may, in some cases, use terms such as “anticipates,” “believes,” “could,”

“estimates,” “expects,” “intends,” “may,” “plans,” “potential,”

“predicts,” “projects,” “should,” “will,” “would” or similar expressions or

the negative of such items that convey uncertainty of future events or outcomes to identify forward-looking statements.

Forward-looking statements

are made based on management’s beliefs, estimates and opinions on the date the statements are made and we undertake no obligation

to update forward-looking statements if these beliefs, estimates and opinions or other circumstances should change, except as may be required

by applicable law. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee

future results, levels of activity, performance or achievements.

PROSPECTUS SUPPLEMENT SUMMARY

Overview

Ideanomics, Inc. (“Ideanomics” or

the “Company”) (Nasdaq: IDEX) was incorporated in the State of Nevada on October 19, 2004. From 2010 through 2017, our primary

business activities were providing premium content video on demand (“VOD”) services, with primary operations in the PRC, through

our subsidiaries and variable interest entities (“VIEs”) under the brand name You-on-Demand (“YOD”). We closed

the YOD business during 2019.

Starting in early 2017, the Company transitioned

its business model to become a next-generation financial technology (“fintech”) company. The Company built a network of businesses,

operating principally in the trading of petroleum products and electronic components that the Company believed had significant potential

to recognize benefits from blockchain and artificial intelligence (“AI”) technologies including enhancing operations, addressing

cost inefficiencies, improving documentation and standardization, unlocking asset value and improving customer engagement. During 2018,

the Company ceased operations in the petroleum products and electronic components trading businesses and disposed of the businesses during

2019. As we looked to deploy fintech solutions in late 2018 and into 2019, we identified a unique opportunity in the Chinese Electric

Vehicle (“EV”) industry to facilitate large scale conversion of fleet vehicles from internal combustion engines to EV. This

led us to establish our Mobile Energy Global (“MEG”) business unit. Fintech continues to be a sector of interest to us as

we look to invest in and develop businesses that can improve the financial services industry, particularly as it relates to deploying

blockchain and AI technologies.

Principal Products or Services and Their Markets

Overview

Ideanomics Mobility

Ideanomics Mobility is driving EV adoption by

assembling a synergistic ecosystem of subsidiaries and investments across the 3 key pillars of EV: Vehicles, Charging, and Energy. These

three pillars provide the foundation for Ideanomics Mobility’s planned offering of unique business solutions such as Charging as

a Service (“CaaS”) and Vehicle as a Service (“VaaS”).

Each operating company within Ideanomics Mobility

offers its own unique products and participates in a shared services ecosystem fulfilling Ideanomics’ Sales-to-Financing-to-Charging

(“S2F2C”) model, with centralized supply chain operations and marketing expertise designed to accelerate growth and business

opportunities across the group.

The combination of products from within its subsidiaries

and investments, coupled with Ideanomics Mobility’s shared services, will provide the Company with the opportunity to bring to market

unique business solutions intended to drive commercial fleet electrification such as Charging-as-a-Service and Vehicle-as-a-Service. These

solutions offer fleet operators an opportunity to benefit from an OpEx-driven model which lowers the barrier to entry for the adoption

of zero emissions fleets.

The Company believes that the EV market is poised

for rapid growth. Bloomberg NEF estimates that global commercial EV sales will reach 1.2 million units in 2023. The global EV charging

infrastructure market is expected to grow at a compound annual growth rate of 33.4% from 2021 to 2028 to $144.97 billion. President Biden’s

administration is supportive of EV with a goal to achieve a 100% clean-energy economy and states such as California have accelerated timelines

to phase out internal combustion engine (“ICE”) vehicles.

Ideanomics Mobility’s mission is to leverage

its ecosystem of synergistic operating companies to generate efficiencies and increase business opportunities across the group. With a

diverse commercial EV product offering, the company plans to use EV and EV battery sales and financing solutions to attract commercial

fleet operators that will generate large scale demand for energy. The Company operates as an end-to-end solutions provider for the procurement,

financing, charging and energy management needs for fleet operators of commercial EV. Ideanomics Mobility focuses on commercial EV rather

than passenger personal EV, as commercial EV is on an accelerated adoption path when compared to consumer EV adoption – which is

expected to take between ten to fifteen years. We focus on four distinct commercial vehicle types with supporting income streams: 1) Closed-area

heavy commercial, in sectors such as Mining, Airports, and Sea Ports 2) Last-mile delivery light commercial 3) Buses and Coaches 4) Taxis.

The vehicle financing solutions (such as purchase or leasing) would generate fee-based revenues whereas the charging and energy management

would yield recurring revenue streams.

Ideanomics Mobility’s revenues are generated

from its S2F2C operating model. The Company’s planned EV revenues will come from the sale of EVs under our Medici Motor Works and

Treeletrik brands outside of the China and within China through our MEG operating units sale of other manufacturers vehicles and batteries.

The Company’s presence in the China market

creates a deep knowledge of the logistics and supply chain for the manufacture of EVs, batteries and related components; this in turn

enables the sourcing of high quality components at competitive prices for the Company’s operations outside of China.

Within the Ideanomics Mobility business unit there

are four operating companies:

Mobile Energy Global (“MEG”)

The Company’s MEG business operates in China

where government clean air regulations and subsidy programs provide a strong impetus for the adoption of commercial EV. The Company competes

in China using its S2F2C. Using this model the Company helps the customer find the best vehicle for its needs and earns fees for every

completed sale; revenue is derived from the spread between group buying of vehicles and price sold, fees for the arrangement of financing,

and payments from subsequent charging and energy management.

Tree Technologies Sdn. Bhd. (“Tree Technologies”)

Tree Technologies is headquartered in Kuala Lumpur,

Malaysia and through its Treeletrik brand sells EV bikes, scooters, and batteries throughout the ASEAN region. Two-wheel bikes and scooters

form a large part of the transport infrastructure in the ASEAN region; according to Deloitte Consulting, there were 13.7 million motor

bikes sold in the six major ASEAN countries in 2019. Environmental regulations in the ASEAN region help accelerate the adoption of EV

bikes. The Company has also started to import Treeletrik brand EV bikes into the United States.

Medici Motor Works

Medici Motor Works plans to sell its own brand

vehicles in the United States, Latin America and Europe. Presently, the Company is working with manufacturers based in China to design

and build trucks, buses and closed-area vehicles for mining, airports and seaports.

Solectrac, Inc. (“Solectrac”)

On June 11, 2021, Ideanomics entered into an agreement and plan of merger (the “Agreement”) and acquired 78.6% of privately held Soletrac, Inc. (“Solectrac”)

for an aggregate purchase price of $18,078,000 in cash as consideration (the “Transaction”), subject to customary purchase

price adjustments set forth in the Agreement. Ideanomics now owns 100% of Soletrac. Solectrac is a California-based

manufacturer, and distributor of premium zero-emission electric tractors that use clean renewable sources of energy, furthering the mission

to reduce commercial fleet greenhouse gas emissions.

According to Research And Markets, the global

agricultural tractor market is currently valued at $75 billion, with the North American agricultural tractor market expected to reach

$20 billion by 2023. The largest segment for agricultural tractors is the below-40HP segment, where Solectrac's initial three models address

the broad needs of the market. Its tractors are specifically designed to serve the needs of community-based farms, vineyards, orchards,

equestrian arenas, greenhouses, and hobby farms.

Founded in 2012 to take electric tractors into

commercial production, Solectrac was incorporated as a California Benefit Corp in 2019. It has received grants from the Indian U.S. Science

and Technology Fund and the National Science Foundation. In 2020, Solectrac received the World Alliance Solar Impulse Efficient Solutions

label from the Solar Impulse Foundation. The label was awarded for being one of the one thousand most efficient and profitable solutions

that can transition society to being economically viable while being environmentally sustainable.

Recent Developments Since December 31, 2020

On

September 15, 2021 (the “Effective Date”), the Company entered into a Framework Agreement (the “Framework Agreement”)

with Energica Motor Company S.p.A., a joint stock company incorporated under the laws of Repubic of Italy (“Energica”), CRP

Meccanica S.r.l., a limited liability company incorporated under the laws of Republic of Italy (“CRP Meccanica”), Maison ER

& Cie S.a., a limited liability company incorporated under the laws of Luxembourg (“Maison”), CRP Technology S.r.l., a

limited liability company incorporated under the laws of the Republic of Italy (“CRP Technology”), Andrea Vezzani (“Vezzani”),

Giampiero Testoni (“Testoni” and, together with CRP Meccanica, Maison, CRP Technology and Vezzani, the “Founders”

and each a “Founder”). Ideanomics, Energica and the Founders, are herein referred to collectively, as the “Parties”

and each a “Party”. Ideanomics currently owns 20% of the Energica ordinary shares which are outstanding.

Ideanomics

expects to launch, by acting in concert with the Founders, a voluntary and conditional public tender offer (the “Tender

Offer”) for (i) the approximately 11,107,505 ordinary shares which are in Energica’s public float for an aggregate purchase

price of approximately €35,544,016 (the “Public Float Shares”) traded on AIM Italia, a multilateral trading facility

organized and managed by Borsa Italiana (“AIM Italia”) and (ii) the one-third of the ordinary shares owned by the Founders

which consist of 2,529,731 shares held by CRP Meccanica and 2,091,940 shares held by CRP Technology (the “CRP Shares”, together

with the Public Float Shares, the “Tender Shares”) (for a whole amount of 4,621,671 shares or approximately €15,000,000

aggregate purchase price) aimed at obtaining the delisting of Energica’s ordinary shares from AIM Italia (the “Delisting”),

with a view to increase and maximize the value of Energica in line with its growth and development goals. The Parties have agreed that

Energica’s governance in the event of a successful completion of the Tender Offer will be governed by a separate shareholders agreement

(the “Shareholders Agreement”) to be entered into by the parties to the Shareholders Agreement.

The

Tender Offer, among other things, is subject to the following terms and conditions: (a) the Tender Offer shall be a voluntary offer for

the Tender Shares traded on AIM Italia; and on all 1,037,400 warrants admitted to trading on the AIM Italia and due to expire on October

15, 2021 (the “Energica Warrants 2016-2021”), to the extent such warrants are not expired, at a price: (i) per each

Tender Share equal to the price of €3.20 per share, to be offered by Ideanomics in the Tender Offer (the “Offer Price”);

and (ii) per Energica Warrants 2016-2021 equal to €0.10; (b) the Offer Price will be paid by Ideanomics on each date on which the

Offer Price will be paid to Energica shareholders that have tendered their shares to the Tender Offer, including, if applicable, in the

context of the squeeze out procedures (the “Payment Date”) for each Tender Share tendered to the Tender Offer; and (c) acceptances

of the Tender Offer by shareholders of Energica of a minimum aggregate number of Tender Shares such as to allow Ideanomics in concert

with the Founders, to hold at the end of the period of duration of the Tender Offer to be agreed between Ideanomics and Commissione

Nazionale per le Società e la Borsa, or Consob, as possibly extended (the “Offer Period”) at least 90% of the overall

Energica voting rights (“Minimum Acceptance Level Condition”), it being understood that if the Tender Offer does not reach

an aggregate of 90% then Ideanomics will not be required to close the purchase of any of the Tender Shares; (d) that, between the Effective

Date and the Payment Date, the corporate bodies of Energica do not carry out or undertake to carry out acts or transactions that may cause

a significant deterioration, even prospectively, compared to the situation as of the date of the financial statements as of December 31,

2020, in the capital, assets, operating, business and financial results and/or activity of Energica; (e) that Energica or the Founders

respectively do not resolve or cause to resolve, and in any event do not execute or undertake to execute, any acts or transactions that

may conflict with the pursuit of the objectives of the Tender Offer, even if such acts or transactions have been authorized by the ordinary

or extraordinary shareholders’ meeting of Energica; and (f) the non-occurrence of extraordinary circumstances or events at a national

or international level that entail or may entail material adverse changes in the political, financial, economic, currency, regulatory

or market situation having prejudicial effects on the Tender Offer or on the capital, financial, or economic situation of Energica with

respect to the Tender Offer, compared to that resulting as at the date of the financial statements as of December 31, 2020 and no facts

or situations relating to Energica, not known to the market, have arisen which would have the effect of materially prejudicing the business

of Energica or its financial, asset, economic situation, compared to that resulting as at the date of the financial statements as of December

31, 2020.

Pursuant

to the Shareholders Agreement, within 15 business days from the Delisting, Ideanomics will subscribe to the convertible notes issued by

Energica for an amount up to €8,000,000, for a duration of 60 months, at an annual interest rate of 8.00% consistent with the financial

needs of Energica as provided by the First Annual Business Plan 2022, each Annual Business Plan and the Three Year Capital Plan (“Additional

Financing”). Energica will have the right to call tranches of up to €1,000,000 with a 30-day notice, or of a different size

and timing as agreed upon by the parties to the Shareholders Agreement. Energica agreed to reimburse the interest starting from the expiry

of the first year from subscription of the convertible notes on a monthly basis. At the maturity date, principal and outstanding interests

of the convertible notes shall be reimbursed in cash by Energica or converted into Energica share, at Ideanomics’s discretion, at

a conversion price of €3.20 per share.

The

parties to the Shareholders Agreement have also agreed to take all actions within their respective power, including, without limitation,

by voting their shares of Energica and causing their respective affiliates to vote their shares of Energica, required to cause the board

of directors of Energica (“Board”) to consist of five (5) individuals designated in writing by the parties in accordance

with the Shareholders Agreement. Ideanomics shall have the right to designate three (3) members of the Board, including the Vice Chairman,

and CRP Meccanica shall have the right to designate two (2) members of the Board, including the Chariman of the Board and the chief executive

officer. Certain material actions require the consent of holders of at least ninety percent (90%) of the share capital of Enerica, including

changes in By-laws, liquidation and mergers, demergers and other changes in corporate form.

The

Energica Shareholders agreed not to transfer, directly or indirectly, any shares held by each of them in the share capital of Energica

until the expiry of the 12th month from the execution of the Shareholders Agreement. Once the aforesaid lock-up period has

expired, the transfer by one shareholder of shares of capital stock of Energica are subject to preemptive rights of the other shareholders.

Subject to such preemptive rights, and following the lock-up period, should an Energica Shareholders (the “Tagged Shareholders”),

receive, and intend to accept, an offer to sell to a bona fide third party that is not Ideanomics, Energica and the Founders or a related

party or affiliate of Ideanomics, Energica and the Founders, their interest in Energica, in whole or in part (the “Shares on Sale”),

the other Energica Shareholders (the “Tag-Along Shareholders”) shall be entitled to sell the shares held by the same in the

share capital of Energica (the “Tag-Along Right”) at the same price and conditions offered to the Tagged Shareholders in accordance

with the provisions of the Shareholders Agreement.

The

Shareholders Agreement will remain valid and in force for the earlier of five (5) years from the date of execution of the Shareholders

Agreement or an initial public offering on a recognized stock exchange to be identified and determined in agreement by the parties (“Qualifying

IPO”), or any other liquidity event, such as a trade sale of Energica shares (jointly with the Qualifying IPO, a “Liquidity

Event”).

On

August 30, 2021, the Company entered into an Agreement and Plan of Merger (the “Merger Agreement”) with Longboard Merger

Corp. (“Merger Sub”), VIA Motors International, Inc. (“VIA”) and Shareholder Representative Services LLC, in its

capacity as Stockholders’ Representative, whereby, at the effective time, Merger Sub will merge with and into VIA (the “Merger”),

with VIA being the surviving corporation of such merger and Ideanomics being the owner of 100% of the issued and outstanding equity of

VIA. The total aggregate consideration payable in connection with this transaction is equal to $630,000,000, consisting of an upfront

payment at the closing of the transaction of $450,000,000 and an earnout payment of up to $180,000,000 payable before December 31, 2026,

subject to fulfillment of certain conditions (such payments together, the “Merger Consideration”). The Merger Consideration

is subject to customary purchase price adjustments set forth in the Merger Agreement and is payable in shares of common stock of Ideanomics.

The Merger Agreement contains termination rights for each of Ideanomics and VIA and the completion of the Merger is subject to satisfaction

or waiver of certain customary closing conditions, including the receipt of the required approvals from the Company’s stockholders

and VIA stockholders.

Since December 31, 2020 the

Company has completed a number of transactions that have expanded the scope of the Company’s EV activities.

U.S. Hybrid

On May 12,

2021, Ideanomics entered into an agreement to acquire U.S. Hybrid Corporation (“US Hybrid”). Founded in 1999, and headquartered

in Torrance, California, U.S. Hybrid has been providing innovative solutions including components, drive trains, and fuel cells to medium

and heavy-duty commercial fleet operators. U.S. Hybrid designs, manufactures, and markets integrated power conversion systems for battery

electric, fuel cell, and hybrid vehicles, as well as systems for renewable energy generation and storage. The company has been leading

the clean-tech revolution by offering integrated power conversion components and integrated motor drives, motors and controllers, distributed

energy management systems, and DC-DC boost converters - equipment that is vital to the growth of the broader EV industry. In addition

to its relationships with leading original equipment manufacturers, U.S. Hybrid has delivered projects for the private and public sectors,

including the defense industry and governmental customers.

U.S. Hybrid

has reliably demonstrated proven powertrain technology, along with DC-DC converters which possess high efficiency ratings and fast dynamic

response capabilities. U.S. Hybrid enjoys long-term commercial relationships in various industries including Commercial, Defense and Aerospace,

and Transit/Municipal for its battery electric vehicle, fuel cell energy, and hybrid platforms.

The acquisition

of U.S. Hybrid brings to Ideanomics the application of U.S.-built technology, for use in its own vehicles, and significantly extends the

company's capabilities in zero-emission transportation. U.S. Hybrid will continue to service its existing customer base, and Ideanomics

will assist them in scaling their business operations within the Ideanomics Mobility business division. U.S. Hybrid operates from locations

in California, Connecticut, and Massachusetts.

WAVE

On January 15, 2021 acquired

100% of privately held Wireless Advanced Vehicle Electrification, Inc. (“WAVE”).

Founded in 2011, and headquartered

in Salt Lake City, Utah, WAVE is a leading provider of inductive (wireless) charging solutions for medium and heavy-duty EVs. Embedded

in roadways and depot facilities, the WAVE system automatically charges vehicles during scheduled stops. The hands-free WAVE system eliminates

battery range limitations and enables fleets to achieve driving ranges that match that of internal combustion engines.

Deployed since 2012, WAVE

has demonstrated the capability to develop and integrate high-power charging systems into heavy-duty EVs from leading commercial EV manufacturers.

With commercially available wireless charging systems up to 250kW and higher power systems in development, WAVE provides custom fleet

solutions for mass transit, logistics, airport and campus shuttles, drayage fleets, and off-road vehicles at ports and industrial sites.

Wireless charging systems offer several compelling

benefits over plug-in-based charging systems, including reduced maintenance, improved health and safety, and expedited energy connection

and are important to the deployment of autonomous driving vehicles. Furthermore, wireless in-route charging enables greater route lengths

or smaller batteries while also maintaining battery life, thereby reducing costs for fleet operators. WAVE customers include what is currently

the largest EV bus system in the U.S., the Antelope Valley Transit Authority, and its partnerships include Kenworth, Gillig, BYD, Complete

Coach Works and the Department of Energy.

Energica Motor Company, S.P.A. (“Energica”)

On March 3, 2021 the Company

purchased 20% of Energica, the world’s leading manufacturer of high-performance electric motorcycles and the sole manufacturer of

the FIM Enel MotoE™ World Cup. Energica has combined zero emission EV technology with the pedigree of high-performance mobility

synonymous with Italy’s Motor Valley to create a range of exceptional products for the high-performance motorcycle market. To support

its products, it has developed proprietary EV battery and DC fast-charging in-house that has applications and synergies with Ideanomics’

broader interests in the global EV sector.

Silk EV Cayman LP (“Silk”)

On January 28, 2021, the Company invested $15.0

million in Silk EV via a promissory note. Silk is an Italian engineering and design services company that has recently partnered with

FAW to form a new company (Silk-FAW) to produce fully electric, luxury vehicles for the Chinese and Global auto markets. Silk-FAW has

exclusive rights to develop Hongqi-S brand high-end electric sports cars. The Hongqi brand is the most well-known luxury auto brand in

China. Silk-FAW vehicles are being designed in Italy’s Motor Valley and is attracting talent from the luxury and high-performance

auto market. Partnering with Silk provides access to Silk-FAW’s Innovation Centers providing us insight into technological advancements

and all best-in-breed technology evaluated at those centers to support the development of high-performance sportscars (battery tech, power

management systems, high performance motors).

Ideanomics Capital

Ideanomics Capital is the Company's fintech business

unit, which focuses on leveraging technology and innovation to improve efficiency, transparency, and profitability for the financial services

industry.

Technology Metals Market Limited (“TM2”)

TM2 is a London based digital commodities issuance

and trading platform for technology metals. It connects institutional investors, proprietary traders and retail investors with metals

suppliers – miners, refiners, recyclers and mints. The platform focuses specifically on new metals that currently don’t have

an active trading marketplace, such as rhodium, lithium, cobalt, rhenium, etc. The Company’s ownership interest in TM2 provides

valuable data and insight into the global technology metals market, which is critical to the future of the Cleantech and EV industries.

TM2 connects both pillars of Cleantech and Fintech. The types of metals and materials traded on the TM2 platform are critical to Cleantech

(for EV battery production, energy storage systems, solar cells, etc.,) while the Fintech platform is innovative in representing these

commodities which do not exist on traditional exchanges.

On January 28, 2021, the Company entered into

a simple agreement for future equity with TM2 pursuant to which Ideanomics invested $2.1 million. This investment is a follow-on investment

further the Company’s prior investment of $1.2 million in stock-based consideration in December 2019.

Delaware Board of Trade (“DBOT”)

The Delaware Board of Trade (“DBOT”)

is a broker dealer that also operates an Alternative Trading System (“ATS”), presently DBOT is not trading; the business remains

in full regulatory compliance. Recent developments have pointed to increased recognition of digital securities’ relevance in regulated

global capital markets. As well, regulatory easing of certain restrictions such as the threshold for private securities (Reg A+), along

with good demand for products such as pre-IPO issuance, provide good tailwind for the broker dealers business. The Company has filed a

continuing membership application for private placement activities in the primary markets. The Company believes that growing demand for

private placements, along with increased attention in digital securities, provide a favorable environment for DBOT’s future growth.

Timios

On January 8, 2021 the Company acquired 100% of

privately-held Timios Holdings Corp. ("Timios"). Timios, a nationwide title and escrow services provider, which has been expanding

in recent years through offering innovative and freedom-of-choice-friendly solutions for real estate transactions. The products include

residential and commercial title insurance, closing and settlement services, as well as specialized offerings for the mortgage process

industry.

Ideanomics expects that Timios will become one

of the cornerstones of Ideanomics Capital. Timios combines difficult to obtain local and state licenses, a knowledgeable and experienced

team, and a scalable platform to deliver best-in-class services through both centralized processing and localized branch networks. Ideanomics

will assist Timios in scaling its business in various ways, including referring client acquisitions and product innovation.

Founded in 2008 by real estate industry veteran

Trevor Stoffer, Timios' vision is to bring transparency to real estate transactions. The company offers title and settlement, appraisal

management, and real-estate-owned (“REO”) title and closing services in 44 states and currently serves more than 280 national

and regional clients.

Non-Core Assets

The Company has identified a number of business

units that it considers non-core and is evaluating strategies for divesting these assets. The non-core assets are Grapevine, a marketing

and ecommerce platform focused on influencer marketing, and FinTech Village a 58-acre development site in West Hartford, Connecticut.

On January 28, 2021, the Company’s Board

of Directors accepted an offer of $2.75 million for Fintech Village, and subsequently signed a non-binding sale contract on March 15,

2021. The Company believes that Fintech Village met the criteria for held for sale classification on January 28, 2021.

Sources and Availability of Raw Materials

The Company’s Tree Technologies business

located in Malaysia and its WAVE business located in Utah, United States, (acquired in the first quarter of 2021 – see “Recent

Developments” section) assemble and manufacture motor bikes and inductive charging systems respectively. These businesses depend

on a ready supply of components that are sourced domestically and internationally and any interruption to the supply of components could

have an adverse impact on the Company’s results. The Company’s suppliers that manufacture EVs and batteries depend on a ready

supply of raw materials and components, consequently a shortage of raw materials or components could adversely impact their manufacturing

process and, potentially, impact the Company’s revenues as it may not be able to complete orders that it had received. The Company

may also be adversely impacted if global logistic and supply chains are interrupted.

Seasonality

The Company expects that orders and sales will

be influenced by the amount and timing of budgeted expenditure by its customers. Typically, the Company would expect to see higher sales

at the start of the year when companies start executing on their capital programs and at the end of the year when companies are spending

any surplus or uncommitted budget before the new budget cycle commences. The Company’s operating businesses are in the early stage

of their development and consequently do not have sufficient trading histories to project seasonal buying patterns with any degree of

confidence.

Working Capital Requirements

As the Company expands its business the need for

working capital will continue to grow. From time to time the Company’s MEG operating division in China has the opportunity to purchase

a large number of vehicles at a favorable price, the terms of the purchase contract frequently require the Company to pay some or all

of the cost in advance of the delivery of the vehicles with the resultant need to commit material amounts of working capital. The Company’s

Tree Technologies subsidiary requires working capital to support the assembly of EV motor bikes and scooters for the ASEAN market. The

Company acquired WAVE and Solectrac in the first quarter of 2021 (see the “Recent Developments” section), both of these businesses

will require working capital to fund the purchase of components for the assembly of wireless charging systems and electric tractors, respectively.

The Company will continue to raise both debt and equity capital to support the working capital needs of these businesses and its U.S.

Head Office functions.

Trade marks, Patents and Licenses

The Company’s Intelligenta business operates

under a license granted by Seasail Ventures Limited (“Seasail”). The license does not have a stated term.

Customer Concentration

The Company is in the process of building out

its Ideanomics Mobility unit and has not yet reached a stage of development where the loss of any single customer would have a material

adverse effect on the Company.

Reliance on Government Contracts

The Company does not contract directly with the

government of the PRC, however it does have investments, partnerships and agreements with the State Own Entities (“SOE”) described

above. Additionally, the rate at which commercial fleets convert to EV is heavily influenced by federal and provincial policies in the

PRC as they relate to clean air and adoption of EV technology. Consequently, the Company’s results may be adversely impacted by

changes in regulations in the PRC.

Competitive Business Conditions, Competitive Position in the Industry

and Methods of Competition

Ideanomics Mobility

Purchasers of commercial vehicles have the choice

between traditional ICE vehicles and EVs and this is likely to continue for at least the next five years and possibly longer. The most

important drivers for the development of the commercial fleet EV market are federal and provincial regulations relating to clean air and

electronic vehicles including subsidies and incentives to help owners of fleets of commercial vehicles to convert from combustion engines

to EV. The speed at which fleet operators convert to EV is highly correlated with government regulations, targets and related subsidies

and incentives. If the governments, or municipalities, change the regulations, targets, incentives or subsidies then the rate at which

fleet operators convert their vehicles to EV could slow down which in turn may lead to lower revenues for the Company. Additionally, the

rate, and form in which, the commercial fleet EV market develops is dependent upon technological developments in battery and charging

systems; deployment of the charging infrastructure to support widespread commercial EV use and the development of new financing and lending

structures that address the different collateral and resale values of the battery and vehicle versus internal combustion engine vehicles.

In addition to its directly owned operations the

Company operates through a network of investment arrangements, partnerships and formal and informal alliances; consequently, its competitive

position could be adversely impacted if one of the members of the alliance was not able to meet the demand for its products, decides not

to continue to cooperate with the Company, or goes out of business.

Ideanomics Capital

The Company’s Ideanomics Capital business

unit operates in sectors that are undergoing rapid change.

DBOT is a broker dealer that also operates an

ATS. In April 2020 the Company ceased trading OTC equities, terminated the employees assigned to DBOT and the services needed to operate

the business. The Company has continued to maintain DBOT’s regulatory licenses and required regulatory capital. The Company has

applied for regulatory approval to broker digital securities and tokens, this is a nascent market which the Company believes has good

long-term potential.

Preferred

Stock

The Company has a multi-tiered capital structure

that includes Series A Preferred Stock.

Ranking.

With respect to rights upon liquidation, winding-up or dissolution, the Series A Preferred Stock ranks senior to our common stock

and pari passu with any other series of our preferred stock established by our board of directors.

Voting.

The holders of the Series A Preferred Stock are entitled to ten (10) votes for each one (1) share of common stock that

is issuable upon conversion of a share of Series A Preferred Stock (each of the 7,000,000 shares of Series A Preferred Stock

is convertible into 0.1333333 shares of Common Stock, or a total of 9,333,330 votes). Except as required by law, all shares of Series A

Preferred Stock and all shares of common stock shall vote together as a single class.

Conversion.

Each share of Series A Preferred Stock is convertible, at any time at the option of the holder, into ten (10) fully

paid and nonassessable shares of common stock, subject to adjustment as provided in the Certificate of Designation.

Dividends.

The Series A Preferred Stock is only entitled to receive dividends when and if declared by our board of directors.

Liquidation.

Upon the occurrence of a liquidation event, the holders of the Series A Preferred Stock then outstanding will be entitled

to receive, out of the assets of the Company available for distribution to its stockholders, an amount equal to $0.50 per share, as may

be adjusted from time to time, plus all accrued, but unpaid dividends, before any payment shall be made or any assets distributed to

the holders of common stock or any other class or series of stock issued by the Company not designated as ranking senior to or pari

passu with the Series A Preferred Stock in respect of the right to participate in distributions or payments upon a liquidation

event. For purposes of the Certificate of Designation, a “liquidation event” means any liquidation, dissolution or winding

up of the Company, either voluntary or involuntary, and upon the election of the holders of a majority of the then outstanding Series A

Preferred Stock shall be deemed to be occasioned by, or to include, (i) the acquisition of the Company by another entity by means

of any transaction or series of related transactions (including, without limitation, any reorganization, merger, consolidation, or other

transaction in which control of the Company is transferred, but, excluding any merger effected exclusively for the purpose of changing

the domicile of the Company) unless the Company’s stockholders of record as constituted immediately prior to such acquisition or

sale will, immediately after such acquisition or sale (by virtue of securities issued as consideration for the Company’s acquisition

or sale or otherwise) hold at least 50% of the voting power of the surviving or acquiring entity or (ii) a sale of all or substantially

all of the assets of the Company.

Corporate Information

Ideanomics, Inc. (formerly China Broadband, Inc.,

Seven Stars Cloud Group, Inc. and WeCast) was incorporated in Nevada on October 19, 2004 pursuant to a reorganization of a California

entity formed in 1988. Prior to January 2007 we were a blank check shell company. On January 23, 2007, we acquired CB Cayman,

which at the time was a party to the cooperation agreement with our PRC-based WFOE, in a reverse acquisition transaction. Our principal

executive offices are located at 1441 Broadway, Suite 5116, New York, NY 10018, and our telephone number is (212) 206-1216. Our

corporate website address is www.ideanomics.com. Information contained on or accessible through our website is not a part of this prospectus

supplement, and the inclusion of our website address in this prospectus supplement is an inactive textual reference only.

THE OFFERING

|

Notes

|

|

$75,000,000 aggregate principal amount of 4% convertible notes due 2021

|

|

|

|

|

|

Purchaser

|

|

YA II PN, Ltd. pursuant to the Convertible Note dated October 25, 2021

|

|

|

|

|

|

Fixed Conversion Price for the Note

|

|

The Note is convertible into shares of common stock at a fixed conversion price $1.88 share at any time prior to October 24, 2022 unless redeemed earlier. The conversion price is not subject to adjustment except for subdivisions or combinations of common stock.

|

|

|

|

|

|

Proceeds

|

|

$75,000,000

|

|

|

|

|

|

Interest

|

|

4% per annum

|

|

|

|

|

|

Ranking

|

|

The Note will be a subordinated unsecured obligation and will be effectively subordinated to our existing and future secured indebtedness and structurally subordinated to all existing and future indebtedness and other liabilities, including trade payables

|

|

|

|

|

|

Payment

|

|

The

Company shall redeem in cash $8,333,333.33 in principal (each a “Mandatory Redemption Date”), plus accured and unpaid Interest

on the outstanding Principal each month during the term of this Note beginning on February 1, 2022 and continuing on each successive

calendar month (each a “Redemption Date”). The amounts of any conversions made by the Investor or any Optional Redemptions

(as defined below) made by the Company contemporaneous with or prior to any Redemption Date shall have the effect of reducing the Mandatory

Redemption Amount of payments coming due (in chronological order beginning with the nearest Redemption Date).

|

|

Maturity

|

|

October 24, 2022, unless earlier redeemed or converted.

|

|

|

|

|

|

Use of Proceeds

|

|

We intend to use the net proceeds from the sale of the securities under this prospectus for general corporate purposes, including for general working capital purposes, which may include the repayment of outstanding debt and investment and acquisition activities.

|

|

|

|

|

|

Optional Redemption

|

|

The Company has the right, but not the obligation, to redeem a portion or all amounts outstanding under this Note prior to the Maturity Date at a cash redemption price equal to the Principal to be redeemed, plus accrued and unpaid interest, if any provided that the Company provides Investor with at least 15 business days’ prior written notice of its desire to exercise an Optional Redemption and the volume weighted average price of the Company’s common stock over the 10 Business Days’ immediately prior to such redemption notice is less than the Conversion Price. The Investor may convert all or any part of the Note after receiving a redemption notice, in which case the redemption amount shall be reduced by the amount so converted.

|

|

Public Market

|

|

The notes are a new class of securities for which no public market currently exists. We do not intend to apply to list the notes on any securities exchange or for quotation on any inter-dealer quotation system. Accordingly, a liquid market for the notes may never develop.

|

|

|

|

|

|

Symbol for our common stock on the Nasdaq Capital Market

|

|

“IDEX”

|

|

|

|

|

|

Risk Factors

|

|

Investing in the notes involves risks. See “Risk Factors.”

|

|

|

|

|

|

Resale

|

|

This prospectus supplement and the accompanying prospectus also cover the resale of shares issued to YA II PN, Ltd. upon the conversion of the Note. See “Plan of Distribution” on page S-18.

|

RISK FACTORS

Investing in our securities involves a high

degree of risk. Before making an investment decision, you should consider carefully the risks, uncertainties and other factors described

in our most recent Annual Report on Form 10-K, as supplemented and updated by subsequent quarterly reports on Form 10-Q and

current reports on Form 8-K that we have filed or will file with the Commission, which are incorporated by reference into this prospectus

supplement and accompanying prospectus. In addition to carefully reading the risk factors described in our most recent Annual Report on

Form 10-K, as supplemented and updated by subsequent quarterly reports on Form 10-Q and current reports on Form 8-K that

we have filed or will file with the Commission, you should carefully consider the following additional risk factors.

Risks Related to this Offering

We have broad discretion in the use of the net proceeds of this

offering and may not use them effectively.

We intend to use the net proceeds

from this offering for general corporate purposes, which may include the repayment of outstanding debt and investment and acquisition

activities. However, our management will have broad discretion in the application of the net proceeds from this offering and could spend

the proceeds in ways that do not improve our results of operations or enhance the value of our common stock. The failure by management

to apply these funds effectively could result in financial losses that could have a material adverse effect on our business, cause the

price of our common stock to decline and delay the development of our product candidates.

You may experience future dilution as a result of this or future

offerings, and the issuance and sale of common stock hereunder may depress our stock price.

Shares issued pursuant to

the conversion of the Note will have a dilutive impact on our existing shareholders. In order to raise additional capital, we may in the

future offer additional shares of our common stock or other securities convertible into or exchangeable for our common stock at prices

that may not be the same as the price per share in this offering. We may sell shares or other securities in any other offering at a price

per share that is less than the price per share paid by investors in this offering, and investors purchasing shares or other securities

in the future could have rights superior to existing stockholders. The price per share at which we sell additional shares of our common

stock, or securities convertible or exchangeable into common stock, in future transactions may be higher or lower than the price per share

paid by investors in this offering. Additionally, such sales could cause the market price of our common stock to decline. If we obtain

funds through a credit facility or through the issuance of debt or preferred securities, these securities would likely have rights senior

to your rights as a common shareholder, which could impair the value of our common stock.

We have never paid dividends on our capital stock and we do not

anticipate paying dividends in the foreseeable future.

We have never paid dividends

on any of our capital stock and currently intend to retain any future earnings to fund the growth of our business. Any determination to

pay dividends in the future will be at the discretion of our board of directors and will depend on our financial condition, operating

results, capital requirements, general business conditions and other factors that our board of directors may deem relevant. As a result,

capital appreciation, if any, of our common stock will be the sole source of gain for the foreseeable future.

Sales of a substantial number of shares of our common stock in

the public market could cause our stock price to fall.

Sales of a substantial number

of shares of our common stock in the public market or the perception that these sales might occur could depress the market price of our

common stock and could impair our ability to raise capital through the sale of additional equity securities. We are unable to predict

the effect that sales may have on the prevailing market price of our common stock. In addition, the sale of substantial amounts of our

common stock could adversely impact its price. The sale or the availability for sale of a large number of shares of our common stock in

the public market could cause the price of our common stock to decline.

Our

common stock may become the target of a “short squeeze.”

In 2021, the securities of

several companies have increasingly experienced significant and extreme volatility in stock price due to short sellers of common stock

and buy-and-hold decisions of longer investors, resulting in what is sometimes described as a “short squeeze.” Short squeezes

have caused extreme volatility in those companies and in the market and have led to the price per share of those companies to trade at

a significantly inflated rate that is disconnected from the underlying value of the company. Sharp rises in a company’s stock price

may force traders in a short position to buy the shares to avoid even greater losses. Many investors who have purchased shares in those

companies at an inflated rate face the risk of losing a significant portion of their original investment as the price per share has declined

steadily as interest in those shares have abated. We may be a target of a short squeeze, and investors may lose a significant portion

or all of their investment if they purchase our shares at a rate that is significantly disconnected from our underlying value.

Risks Related to Our Business

Investing in our securities

involves a high degree of risk. Before making an investment decision, you should consider carefully the risks, uncertainties and other

factors described in our most recent Annual Report on Form 10-K, as supplemented and updated by subsequent quarterly reports on Form 10-Q

and current reports on Form 8-K that we have filed or will file with the SEC, which are incorporated by reference into this prospectus

supplement.

Our business, affairs, prospects,

assets, financial condition, results of operations and cash flows could be materially and adversely affected by these risks. For more

information about our SEC filings, please see “Where You Can Find More Information.”

We are currently, and may in the future

be, subject to substantial litigation, investigations and proceedings that could cause us to incur significant legal expenses and result

in harm to our business.

Shareholder Class Actions and Derivative Litigation

On

July 19, 2019, a purported class action, now captioned Rudani v. Ideanomics, et al. Inc., was filed in the United States District

Court for the Southern District of New York against the Company and certain of its current and former officers and directors. The Amended

Complaint alleges violations of Section 10(b) and 20(a) of the Securities Exchange Act of 1934. Among other things, the Amended Complaint

alleges purported misstatements made by the Company in 2017 and 2018. As part of a mediation, the parties reached a settlement in principle

for $5.0 million. The settlement agreement has been preliminarily approved by the Court and is subject to final court approval.

On June 28, 2020, a purported securities class

action, captioned Lundy v. Ideanomics et al. Inc., was filed in the United State District Court for the Southern District of New

York against the Company and certain current officers and directors of the Company. Additionally, on July 7, 2020, a purported securities

class action captioned Kim v. Ideanomics, et al, was filed in the Southern District of New York against the Company and certain

current officers and directors of the Company. Both cases alleged violations of Section 10(b) and 20(a) of the Securities Exchange Act

of 1934 arising from certain purported misstatements by the Company beginning in June 2020 regarding its MEG division. On November 4,

2020, the Lundy and Kim actions were consolidated and is now titled “In re Ideanomics, Inc. Securities Litigation.”

In December 2020, the Court appointed Rene Aghajanian as lead plaintiff and an amended complaint was filed in February 2021, alleging

violations of Section 10(b) and 20(a) of the Securities Exchange Act of 1934 arising from certain purported misstatements by the Company

beginning in March 2020 regarding its MEG division. The defendants filed a motion to dismiss on May 6, 2021 that remains pending. While

the Company believes that this action is without merit, there can be no assurance that the Company will prevail. The Company cannot currently

estimate the possible loss or range of losses, if any, that it may experience in connection with this litigation.

On July 10, 2020, the Company was named as a nominal

defendant, and certain of its former officers and directors were named as defendants, in a shareholder derivative action filed in the

United States District Court for the Southern District of New York, captioned Toorani v. Ideanomics, et al. The Complaint alleges

violations of Section 14(a) of the Securities Exchange Act of 1934, breach of fiduciary duties, unjust enrichment, abuse of control, gross

mismanagement, and corporate waste and seeks monetary damages and other relief on behalf of the Company. Additionally, on September 11,

2020, the Company was named as a nominal defendant, and certain of its former officers and directors were named as defendants, in a shareholder

derivative action filed in the United States District Court for the Southern District of New York, captioned Elleisy, Jr. v. Ideanomics,

et al, alleging violations and allegations similar to the Toorani litigation. On October 10, 2020, the Court in the Elleisy

and Toorani, consolidated these two actions. Additionally, on October 27, 2020, the Company was named as a nominal defendant, and

certain of its former officers and directors were named as defendants, in a shareholder derivative action filed in the United States District

Court for the District of Nevada, captioned Zare v. Ideanomics, et al, alleging violations and allegations similar to the Toorani

and Elleisy litigation. The Company and certain of the defendants, including the Company, have reached a settlement in principle

in which the Company has agreed to certain corporate governance and internal procedure reforms and is not expected to have a material

financial impact on the Company. The settlement in principle is subject to finalization and approval of the Court.

SEC Investigation

As previously reported, the

Company is subject to an investigation by the SEC and continues to respond to various information and requests from the SEC. The Company

is fully cooperating with the SEC’s requests and cannot predict the outcome of this investigation.

Our results of operations in the future

could be adversely impacted by the COVID-19 pandemic, and the duration and extent to which it will impact our results of operations remain

uncertain.

In December 2019, a novel

strain of coronavirus, termed COVID-19, was reported to have surfaced in Wuhan, China, which has and is continuing to spread throughout

China and other parts of the world, including the United States. In March 2020 the World Health Organization characterized the outbreak

as a “pandemic”, and the pandemic has been declared a National Emergency by the United States Government. The

growth of the COVID-19 pandemic has created significant volatility and uncertainty and economic disruption. The extent to

which the COVID-19 pandemic impacts our business, operations, financial results and financial condition will depend on numerous evolving

factors that are uncertain and cannot be predicted, including: an economic downturn that could

affect demand for electric vehicle supply equipment and related services; the duration and scope of the pandemic; government,

business and individuals’ actions taken in response; the effect on our partners, customers and the demand for our services and products;

disruptions to the global supply chain; our ability to sell and provide our services and products, including as a result of travel restrictions

and people working from home; disruptions to our operations resulting from the illness of any of our employees; restrictions or disruptions

to transportation, including reduced availability of ground or air transport; the ability of our customers to pay for our services and

products; and any closures of our, our partners’, our suppliers’ and our customers’ facilities. In addition, the impact

of COVID-19 on macroeconomic conditions may impact the proper functioning of financial and capital markets, foreign currency exchange

rates, commodity and energy prices, and interest rates. Any of these events could amplify the other risks and uncertainties described

in our Annual Report on Form 10-K for the fiscal year ended December 31, 2019 and could materially adversely affect our business,

financial condition, results of operations and/or stock price.

Our business, affairs, prospects,

assets, financial condition, results of operations and cash flows could be materially and adversely affected by these risks. For more

information about our SEC filings, please see “Where You Can Find More Information.”

USE

OF PROCEEDS

We intend to use the net proceeds

from the sale of the securities under this prospectus supplement, if any, for general corporate purposes, including for general working

capital purposes, which may include the repayment of debt and investment and acquisition activities.

DESCRIPTION OF SECURITIES WE ARE OFFERING

The material terms and provisions

of our common stock are described under the caption “Description of Common Stock” on page 14 of the accompanying prospectus.

PLAN OF DISTRIBUTION

On October 25, 2021, we entered

into the Note with the Investor. In addition to our issuance of the Note to YA, this prospectus supplement and the accompanying prospectus

also covers the sale of the shares of common stock issuable to YA upon the conversion of the Note. We have agreed in the Note to provide

customary indemnification to YA. It is possible that our shares may be sold by YA in one or more of the following manners:

|

|

·

|

ordinary brokerage transactions and transactions in which the broker solicits purchasers;

|

|

|

·

|

a block trade in which the broker or dealer so engaged will attempt to sell the shares as agent, but may position and resell a portion of the block as principal to facilitate the transaction;

|

|

|

·

|

to a broker-dealer as principal and resale by the broker-dealer for its account; or

|

|

|

·

|

a combination of any such methods of sale.

|

YA and any unaffiliated broker-dealer will be

subject to liability under the federal securities laws and must comply with the requirements of the Exchange Act, including without limitation,

Rule 10b-5 and Regulation M under the Exchange Act. These rules and regulations may limit the timing of purchases and sales of common

stock by YA or any unaffiliated broker-dealer. Under these rules and regulations, YA and any unaffiliated broker-dealer:

|

|

·

|

may not engage in any stabilization activity in connection with our securities;

|

|

|

·

|

must furnish each broker which offers shares of our common stock covered by the prospectus supplement and accompanying prospectus that are a part of our Registration Statement with the number of copies of such prospectus supplement and accompanying prospectus which are required by each broker; and

|

|

|

·

|

may not bid for or purchase any of our securities or attempt to induce any person to purchase any of our securities other than as permitted under the Exchange Act.

|

|

|

·

|

These restrictions may affect the marketability of the common shares by YA and any unaffiliated broker-dealer.

|

LEGAL MATTERS

Certain legal matters with

respect to the validity of the issuance of the securities offered hereby have been passed upon for us by Sherman Howard LLC, Las Vegas,

Nevada.

EXPERTS

The consolidated balance sheets

of Ideanomics, Inc. as of December 31, 2020 and 2019, and the related consolidated statements of operations, comprehensive loss, equity,

and cash flows for each of the two years in the period ended December 31, 2020, and related notes (collectively referred to as the “financial

statements”), have been audited by B F Borgers CPA PC, independent registered public accounting firm, as stated in their report,

which includes explanatory paragraphs as to the Company’s ability to continue as a going concern, which is incorporated herein by

reference. Such financial statements have been incorporated herein by reference in reliance on the report of such firm given upon their

authority as experts in accounting and auditing.

WHERE YOU CAN FIND MORE INFORMATION

We file annual, quarterly

and special reports, along with other information with the Commission. Our SEC filings are available to the public over the Internet at

the SEC’s website at http://www.sec.gov. You may also read and copy any document we file at the SEC’s Public Reference Room

at 100 F Street, NE, Washington, D.C. 20549. Please call the Commission at 1-800-SEC-0330 for further information on the Public Reference

Room.

This prospectus supplement

is part of a registration statement on Form S-3 that we filed with the Commission to register the securities offered hereby under the

Securities Act of 1933, as amended. This prospectus supplement does not contain all of the information included in the registration statement,

including certain exhibits and schedules. You may obtain the registration statement and exhibits to the registration statement from the

Commission at the address listed above or from the Commission’s internet site.

INCORPORATION OF CERTAIN DOCUMENTS BY REFERENCE

This prospectus supplement

is part of a registration statement filed with the SEC. The SEC allows us to “incorporate by reference” into this prospectus

supplement the information that we file with them, which means that we can disclose important information to you by referring you to those

documents. The information incorporated by reference is considered to be part of this prospectus supplement, and information that we file

later with the SEC will automatically update and supersede this information. The following documents are incorporated by reference and

made a part of this prospectus supplement (other than with respect to information furnished under Item 2.02 or Item 7.01 of any Form 8-K

and exhibits furnished on such form that are related to such items unless such Form 8-K expressly provides to the contrary):

|

|

·

|

our Annual Report on Form 10-K for the fiscal year ended December 31, 2020, filed with the SEC on March 31, 2021;

|

|

|

|

|

|

|

·

|

our Quarterly Reports on Form 10-Q for the quarterly periods ended March 31, 2021 and June 30, 2021, filed with the SEC on May 17, 2021 and August 16, 2021, respectively.

|

|

|

|

|

|

|

·

|

our Current Reports on Form 8-K or 8-K/A, as applicable, filed with the SEC on each of January 8, 2021, January 8, 2021, January 19, 2021, January 22, 2021, February 1, 2021, February 3, 2021, February 12, 2021, March 1, 2021, March 4, 2021, March 22, 2021, April 5, 2021, April 6, 2021, April 14, 2021, April 26, 2021, May 14, 2021, June 11, 2021, June 11, 2021, June 17, 2021, July 29, 2021, July 30, 2021, August

4, 2021, August 13, 2021, August 30, 2021, September 2, 2021, September 3, 2021, September 10, 2021, September 21, 2021, and September 27, 2021, to the extent the information in such reports is filed and not furnished.

|

|

|

|

|

|

|

·

|

the description of our common stock which is registered under Section 12 of the Exchange Act, in our registration statement on Form 8-A, filed with the SEC on May 29, 2012, including any amendment or reports filed for the purposes of updating this description; and

|

|

|

|

|

|

|

·

|