IBEX Limited (“ibex”), a leading global provider of outsourced

CX solutions, today announced financial results for the fourth

quarter and fiscal year ended June 30, 2020.

“Fiscal year 2020 was a milestone year for ibex–delivering

record revenues surpassing $400 million, growing net income from

continuing operations and increasing Adjusted EBITDA to over $50

million,” commented Bob Dechant, chief executive officer of ibex.

“We continue to be focused on helping the world’s leading brands

connect with their customers in unique and innovative ways, with

particular focus on technology-led digital solutions. We also won

important new logos with new economy and blue chip clients, and

reported 100% client retention. Based on our expected revenue

growth and robust pipeline, we are confident in our ability to

accelerate additional customer wins, expand geographically and

deliver solid cash flow in 2021.”

Fiscal Year

2020 Financial

Highlights:

Revenue

- Revenue increased 10% to $405.1 million, compared to $368.4

million in the prior year.

Net Income / (Loss)

From

Continuing

Operations

- Net income from continuing operations increased to $7.8

million, compared to a net loss from continuing operations of $4.5

million in the prior year.

- Net income / (loss) from continuing operations margin increased

to 1.9%, compared to (1.2)% in the prior year.

- Non-GAAP adjusted net income from continuing operations

increased to $15.6 million, compared to $1.8 million in the prior

year.

Adjusted EBITDA

- Non-GAAP adjusted EBITDA from continuing operations increased

to $54.1 million, compared to $36.3 million in the prior year.

- Non-GAAP adjusted EBITDA from continuing operations margin

increased to 13.4%, compared to 9.9% in the prior year.

Earnings Per Share

- IFRS fully diluted earnings per share was $0.00 in fiscal years

2020 and 2019.*

- Non-GAAP pro forma adjusted earnings per share increased to

$0.84, compared to $0.10 in the prior year.

Cash Flow, Balance

Sheet, and Capital Expenditures

- Cash flow from operations increased to $51.7 million, compared

to $2.2 million in the prior year.

- Non-GAAP free cash flow increased to $25.6 million, compared to

an outflow of $2.5 million in the prior year.

- Non-GAAP net debt decreased to $84.1 million, compared to

$109.4 million in the prior year.

- Capital expenditures were $16.9 million, or 4.2% of revenue,

compared to $9.7 million, or 2.6% of prior year revenue.

Fourth

Quarter 2020 Financial

Highlights:

Revenue

- Revenue of $100.9 million was minimally impacted by COVID-19,

and increased 14.7% compared to the prior year quarter.

Net Income / (Loss)

From

Continuing

Operations

- Net loss from continuing operations decreased to $3.8 million,

compared to a net loss from continuing operations of $4.6 million

in the prior year quarter.

- Net loss from continuing operations margin decreased to (3.8)%,

compared to (5.3)% in the prior year quarter.

- Non-GAAP adjusted net income from continuing operations

increased to $2.6 million, compared to a non-GAAP adjusted net loss

from continuing operations of $1.4 million in the prior year

quarter.

Adjusted EBITDA

- Non-GAAP adjusted EBITDA from continuing operations increased

to $13.5 million, compared to $7.4 million in the prior year

quarter.

- Non-GAAP adjusted EBITDA from continuing operations margin

increased to 13.4%, compared to 8.4% in the prior year

quarter.

Earnings Per Share

- IFRS fully diluted earnings per share was $0.00 in the fourth

quarter of fiscal years 2020 and 2019.*

- Non-GAAP pro forma adjusted earnings per share increased to

$0.14, compared to ($0.07) in the prior year quarter.

* IFRS fully diluted earnings per share does not reflect the

recapitalization that occurred in connection with ibex’s initial

public offering.

Fiscal Year

2020 Business

Highlights:

- Added 24 new customer logos

- Top three client concentration decreased to 43.7% from 50.6% in

the prior year

- Launched the Wave X Purpose Built Technology Suite enabling

highly customized CX solutions

- Digital business increased to 30% of our overall revenue to

$119.6 million

- New Economy revenue increased by 35% compared to prior

year

- Non-voice revenue increased by 42% compared to prior year

- Increased our nearshore and offshore footprint by opening three

new sites and adding 1,730 workstations in the Philippines and 843

in nearshore sites, boosting our non-US capacity by 35% over prior

year

- Expanded our digital marketing and on-line customer acquisition

solutions by adding the Healthcare, Financial Services and Utility

industries to our portfolio

2021 Business

Outlook

IBEX Limited expects full year 2021 revenue of $431 million to

$435 million and Adjusted EBITDA from continuing operations of

$59.5 million to $61 million.

Conference Call and

Webcast InformationIBEX Limited will host a

conference call and live webcast to discuss its fourth quarter and

fiscal year 2020 financial results at 4:30 p.m. Eastern Time today,

September 24, 2020. To access the conference call, dial (833)

614-1408 for the U.S. or Canada, or for international callers (914)

987-7129 and provide conference ID 5273769. The webcast will be

available live on the Investors section of ibex's website

at: https://investors.ibex.co/.

An audio replay of the call will also be available to investors

beginning at approximately 6:30 p.m. Eastern Time on September 24,

2020, until 7:30 p.m. Eastern Time on October 1, by dialing (855)

859-2056 for the U.S. or Canada, or for international callers,

(404) 537-3406 and entering passcode 5273769. In addition, an

archived webcast will be available on the Investors section of

ibex's website at: https://investors.ibex.co/.

Financial Information

While the financial figures included in this press release have

been computed in accordance with International Financial Reporting

Standards (“IFRS”) as issued by the International Accounting

Standards Board (“IASB”) applicable to interim periods for the

fourth quarter and applicable to financial statements for the

fiscal year, this announcement does not contain sufficient

information to constitute an interim financial report as defined in

International Accounting Standards 34, “Interim Financial

Reporting” nor a financial statement as defined by International

Accounting Standards 1 “Presentation of Financial Statements.” The

financial information in this press release has not been audited.

Results for the fourth quarter of fiscal year 2020 and 2019 were

calculated based on the difference between our unaudited results

for fiscal year 2020 and 2019, respectively, and our

previously-reported results for the nine months ended March 31,

2020 and 2019, respectively. Our independent registered

public accounting firm, BDO LLP, has not audited, reviewed,

compiled, or performed any procedures with respect to our results

for the fourth quarter of fiscal year 2020 or 2019.

Non-GAAP Financial

Measures

We provide non-GAAP financial measures in addition to reported

IFRS results prepared in accordance with IFRS. Management believes

these measures help illustrate underlying trends in ibex's business

and uses the non-GAAP financial measures to establish budgets and

operational goals, for managing ibex's business and evaluating its

performance. We anticipate that we will continue to report both

IFRS and certain non-GAAP financial measures in our financial

results. Because ibex's non-GAAP financial measures are not

calculated according to IFRS, these measures are not comparable to

IFRS and may not necessarily be comparable to similarly described

non-GAAP measures reported by other companies within ibex's

industry. Consequently, our non-GAAP financial measures should not

be evaluated in isolation or replace comparable IFRS measures, but,

rather, should be considered together with our unaudited

consolidated statements of financial position, unaudited

consolidated statements of profit or loss and other comprehensive

income, and unaudited consolidated statements of cash flows

presented herein and prepared in accordance with IFRS issued by

IASB.

In this earnings release, we are introducing “adjusted net

income / (loss) from continuing operations,” which we define as net

income / (loss) from continuing operations before the effect of the

following items: non-recurring expenses (including litigation and

settlement expenses, costs related to COVID-19, and expenses

related to our initial public offering), impairment, other income,

fair value adjustment related to the Amazon warrant, share-based

payments, and foreign exchange gains or losses. We believe these

items are not reflective of our long-term performance. We use

adjusted net income / (loss) from continuing operations internally

to understand what we believe to be the recurring nature of our net

income / (loss) from continuing operations and as a basis to

calculate a pro forma adjusted earnings per share now that our

initial public offering has been consummated. We also believe that

adjusted net income / (loss) from continuing operations is widely

used by investors, securities analysts and other interested parties

as a supplemental measure of profitability.

ibex is not providing a quantitative reconciliation of

forward-looking non-GAAP adjusted EBITDA from continuing operations

to the most directly comparable IFRS measure because it is unable

to predict with reasonable certainty the ultimate outcome of

certain significant items without unreasonable effort. These items

include, but are not limited to, non-recurring expenses, fair value

adjustments, share-based compensation expense, and impairment of

assets. These items are uncertain, depend on various factors, and

could have a material impact on IFRS reported results for the

guidance period.

About

ibex

ibex helps the world’s preeminent brands more effectively engage

their customers with services ranging from customer support,

technical support, inbound/outbound sales, business intelligence

and analytics, digital demand generation, and CX surveys and

feedback analytics.

Forward Looking Statements

In addition to historical information, this release contains

“forward-looking statements” within the meaning of the Private

Securities Litigation Reform Act of 1995. In some cases, you can

identify forward-looking statements by terminology such as

“believe,” “may,” “will,” “estimate,” “continue,” “anticipate,”

“intend,” “should,” “plan,” “expect,” “predict,” “potential,” or

the negative of these terms or other similar expressions. These

statements include, but are not limited to, statements regarding

our future financial and operating performance, including our

outlook and guidance, and our strategies, priorities and business

plans. Our expectations and beliefs regarding these matters may not

materialize, and actual results in future periods are subject to

risks and uncertainties that could cause actual results to differ

materially from those projected. Factors that could impact our

actual results include: developments relating to COVID-19; the

Frontier restructuring and its proceedings under Chapter 11 of the

United States Bankruptcy Code; our ability to attract new business

and retain key clients; our ability to enter into multi-year

contracts with our clients at appropriate rates; the potential for

our clients or potential clients to consolidate; our clients

deciding to enter into or further expand their insourcing

activities; our ability to operate as an integrated company under

the IBEX brand; our ability to manage portions of our business that

have long sales cycles and long implementation cycles that require

significant resources and working capital; our ability to manage

our international operations, particularly in Pakistan and the

Philippines and increasingly in Jamaica and Nicaragua; our ability

to comply with applicable laws and regulations, including those

regarding privacy, data protection and information security; our

ability to manage the inelasticity of our labor costs relative to

short-term movements in client demand; our ability to realize the

anticipated strategic and financial benefits of our relationship

with Amazon; our ability to recruit, engage, motivate, manage and

retain our global workforce; our ability to anticipate, develop and

implement information technology solutions that keep pace with

evolving industry standards and changing client demands; our

ability to maintain and enhance our reputation and brand; and other

factors discussed under the heading “Risk Factors” in our final

prospectus filed with the U.S. Securities and Exchange Commission

(the “SEC”) on August 10, 2020, our annual report on Form 20-F to

be filed with the SEC and any other risk factors we include in

subsequent reports on Form 6-K. Because of these uncertainties, you

should not make any investment decisions based on our estimates and

forward-looking statements. Except as required by law, we undertake

no obligation to publicly update any forward-looking statements for

any reason after the date of this press release whether as a result

of new information, future events or otherwise.

Media Contact: Rosemary

Hanratty, Senior Director of Marketing, ibex, 412.539.7099,

rosemary.hanratty@ibex.co

IR Contact: Brinlea Johnson, The Blueshirt

Group, 415.269.2645, brinlea@blueshirtgroup.com

IBEX

LimitedUnaudited Consolidated

Statements of Financial Position

|

US$ in thousands |

|

June 30, 2020 |

|

June 30, 2019 |

|

Assets |

|

|

|

|

|

Non-current assets |

|

|

|

|

|

Goodwill |

|

$ |

11,832 |

|

|

$ |

11,832 |

|

|

Other intangible assets |

|

|

2,781 |

|

|

|

2,928 |

|

|

Property and equipment |

|

|

84,588 |

|

|

|

82,309 |

|

|

Investment in joint venture |

|

|

331 |

|

|

|

227 |

|

|

Deferred tax asset |

|

|

2,223 |

|

|

|

2,517 |

|

|

Warrant asset |

|

|

2,611 |

|

|

|

3,316 |

|

|

Other assets |

|

|

4,834 |

|

|

|

3,398 |

|

|

Total non-current assets |

|

$ |

109,200 |

|

|

$ |

106,527 |

|

| |

|

|

|

|

|

Current assets |

|

|

|

|

|

Trade and other receivables |

|

|

62,579 |

|

|

|

71,134 |

|

|

Due from related parties |

|

|

1,587 |

|

|

|

1,768 |

|

|

Cash and cash equivalents |

|

|

21,870 |

|

|

|

8,873 |

|

|

Total current assets |

|

$ |

86,036 |

|

|

$ |

81,775 |

|

|

Total assets |

|

$ |

195,236 |

|

|

$ |

188,302 |

|

| |

|

|

|

|

|

Equity and liabilities |

|

|

|

|

|

Equity attributable to owners of the

parent |

|

|

|

|

|

Share capital |

|

$ |

12 |

|

|

$ |

12 |

|

|

Additional paid-in capital |

|

|

96,207 |

|

|

|

96,207 |

|

|

Other reserves |

|

|

29,456 |

|

|

|

29,585 |

|

|

Accumulated deficit |

|

|

(109,527 |

) |

|

|

(117,176 |

) |

|

Total equity |

|

$ |

16,148 |

|

|

$ |

8,628 |

|

| |

|

|

|

|

|

Non-current liabilities |

|

|

|

|

|

Deferred revenue |

|

$ |

434 |

|

|

$ |

753 |

|

|

Lease liabilities |

|

|

62,044 |

|

|

|

58,602 |

|

|

Borrowings |

|

|

3,782 |

|

|

|

7,184 |

|

|

Deferred tax liability |

|

|

117 |

|

|

|

147 |

|

|

Other non-current liabilities |

|

|

7,058 |

|

|

|

1,607 |

|

|

Total non-current liabilities |

|

$ |

73,435 |

|

|

$ |

68,293 |

|

| |

|

|

|

|

|

Current liabilities |

|

|

|

|

|

Trade and other payables |

|

$ |

53,213 |

|

|

$ |

46,890 |

|

|

Income tax payables |

|

|

3,087 |

|

|

|

1,467 |

|

|

Lease liabilities |

|

|

12,668 |

|

|

|

10,632 |

|

|

Borrowings |

|

|

27,476 |

|

|

|

41,835 |

|

|

Deferred revenue |

|

|

3,470 |

|

|

|

4,388 |

|

|

Due to related parties |

|

|

5,739 |

|

|

|

6,169 |

|

|

Total current liabilities |

|

$ |

105,653 |

|

|

$ |

111,381 |

|

|

Total liabilities |

|

$ |

179,088 |

|

|

$ |

179,674 |

|

|

Total equity and liabilities |

|

$ |

195,236 |

|

|

$ |

188,302 |

|

| |

|

|

|

|

IBEX

LimitedUnaudited Consolidated

Statements of Profit or Loss and Other Comprehensive

Income

|

|

Quarter ended |

|

Year ended |

|

US$ in thousands |

June 30, 2020 |

|

June 30, 2019 |

|

June 30, 2020 |

|

June 30, 2019 |

|

Revenue |

$ |

100,880 |

|

|

$ |

87,915 |

|

|

$ |

405,135 |

|

|

$ |

368,380 |

|

| |

|

|

|

|

|

|

|

| Payroll and

related costs |

|

69,009 |

|

|

|

63,098 |

|

|

|

276,255 |

|

|

|

254,592 |

|

| Share-based

payments |

|

478 |

|

|

|

48 |

|

|

|

359 |

|

|

|

4,087 |

|

| Reseller

commission and lead expenses |

|

3,724 |

|

|

|

4,839 |

|

|

|

17,328 |

|

|

|

27,877 |

|

| Depreciation

and amortization |

|

6,012 |

|

|

|

5,203 |

|

|

|

24,472 |

|

|

|

20,895 |

|

| Other

operating costs |

|

22,391 |

|

|

|

17,004 |

|

|

|

67,208 |

|

|

|

54,124 |

|

|

Income / (loss) from operations |

|

(734 |

) |

|

|

(2,277 |

) |

|

|

19,513 |

|

|

|

6,805 |

|

| |

|

|

|

|

|

|

|

| Finance

expenses |

|

(2,238 |

) |

|

|

(2,251 |

) |

|

|

(9,428 |

) |

|

|

(7,709 |

) |

|

Income / (loss) before taxation |

|

(2,972 |

) |

|

|

(4,528 |

) |

|

|

10,085 |

|

|

|

(904 |

) |

| |

|

|

|

|

|

|

|

| Income tax

expense |

|

(833 |

) |

|

|

(119 |

) |

|

|

(2,315 |

) |

|

|

(3,615 |

) |

| Net

income / (loss) from continuing operations |

|

(3,805 |

) |

|

|

(4,647 |

) |

|

|

7,770 |

|

|

|

(4,519 |

) |

| Net income

on discontinued operation, net of tax |

|

- |

|

|

|

8,568 |

|

|

|

- |

|

|

|

15,484 |

|

| Net

income / (loss) for the year |

|

(3,805 |

) |

|

|

3,921 |

|

|

|

7,770 |

|

|

|

10,965 |

|

| |

|

|

|

|

|

|

|

|

Other comprehensive income / (loss) |

|

|

|

|

|

|

|

| Item that

will not be subsequently reclassified to profit or loss |

|

|

|

|

|

|

|

|

Actuarial (loss) / gain on retirement benefits |

|

(184 |

) |

|

|

109 |

|

|

|

(184 |

) |

|

|

109 |

|

| Item that

will be subsequently reclassified to profit or loss |

|

|

|

|

|

|

|

|

Foreign currency translation adjustment |

|

(211 |

) |

|

|

(64 |

) |

|

|

(248 |

) |

|

|

(316 |

) |

|

Cash flow hedge - changes in fair value |

|

(518 |

) |

|

|

- |

|

|

|

(518 |

) |

|

|

- |

|

| |

|

(913 |

) |

|

|

45 |

|

|

|

(950 |

) |

|

|

(207 |

) |

|

Total comprehensive income / (loss) |

$ |

(4,718 |

) |

|

$ |

3,966 |

|

|

$ |

6,820 |

|

|

$ |

10,758 |

|

| |

|

|

|

|

|

|

|

| Loss

per share from continuing operations attributable to the ordinary

equity holders of the parent |

|

|

|

|

|

|

|

| Basic loss

per share |

$ |

- |

|

|

$ |

- |

|

|

$ |

- |

|

|

$ |

- |

|

| |

|

|

|

|

|

|

|

| Diluted loss

per share |

$ |

(0.29 |

) |

|

$ |

(0.37 |

) |

|

$ |

- |

|

|

$ |

(0.36 |

) |

| |

|

|

|

|

|

|

|

| Loss

per share attributable to the ordinary equity holders of the

parent |

|

|

|

|

|

|

|

| Basic loss

per share |

$ |

- |

|

|

$ |

- |

|

|

$ |

- |

|

|

$ |

- |

|

| |

|

|

|

|

|

|

|

| Diluted loss

per share |

$ |

- |

|

|

$ |

- |

|

|

$ |

- |

|

|

$ |

- |

|

| |

|

|

|

|

|

|

|

IBEX

LimitedUnaudited Consolidated

Statements of Cash Flows

| |

Quarter ended |

|

Year ended |

|

US$ in thousands |

June 30, 2020 |

|

June 30, 2019 |

|

June 30, 2020 |

|

June 30, 2019 |

|

CASH FLOWS FROM OPERATING ACTIVITIES |

|

|

|

|

|

|

|

|

Income / (loss) before taxation |

$ |

(2,972 |

) |

|

$ |

5,325 |

|

|

$ |

10,085 |

|

|

$ |

19,410 |

|

|

Adjustments for: |

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

6,012 |

|

|

|

5,498 |

|

|

|

24,472 |

|

|

|

21,805 |

|

|

Amortization of warrant asset |

|

154 |

|

|

|

178 |

|

|

|

705 |

|

|

|

643 |

|

|

Foreign currency translation loss |

|

(444 |

) |

|

|

(602 |

) |

|

|

(195 |

) |

|

|

78 |

|

|

Share warrants |

|

2,506 |

|

|

|

1 |

|

|

|

3,138 |

|

|

|

(364 |

) |

|

Phantom expense |

|

166 |

|

|

|

33 |

|

|

|

(31 |

) |

|

|

(300 |

) |

|

Share-based payments |

|

312 |

|

|

|

30 |

|

|

|

390 |

|

|

|

5,262 |

|

|

Allowance of expected credit losses |

|

123 |

|

|

|

184 |

|

|

|

224 |

|

|

|

343 |

|

|

Share of profit from investment in joint venture |

|

(119 |

) |

|

|

(39 |

) |

|

|

(533 |

) |

|

|

(351 |

) |

|

(Gain) / loss on disposal of fixed assets |

|

63 |

|

|

|

(99 |

) |

|

|

(10 |

) |

|

|

(140 |

) |

|

Provision for defined benefit scheme |

|

(13 |

) |

|

|

129 |

|

|

|

121 |

|

|

|

129 |

|

|

Impairment on intangibles |

|

777 |

|

|

|

- |

|

|

|

777 |

|

|

|

163 |

|

|

Finance costs |

|

2,239 |

|

|

|

3,747 |

|

|

|

9,429 |

|

|

|

13,383 |

|

|

Decrease / (Increase) in trade and other receivables |

|

888 |

|

|

|

(1,992 |

) |

|

|

9,042 |

|

|

|

(18,019 |

) |

|

Increase in renewal receivables |

|

- |

|

|

|

(15,290 |

) |

|

|

- |

|

|

|

(35,022 |

) |

|

Increase in prepayments and other assets |

|

(35 |

) |

|

|

(167 |

) |

|

|

(1,435 |

) |

|

|

(173 |

) |

|

Increase in trade and other payables and other liabilities |

|

12,027 |

|

|

|

13,130 |

|

|

|

7,106 |

|

|

|

8,997 |

|

|

Cash generated from operations |

|

21,684 |

|

|

|

10,066 |

|

|

|

63,285 |

|

|

|

15,844 |

|

|

Interest paid |

|

(2,239 |

) |

|

|

(3,784 |

) |

|

|

(9,429 |

) |

|

|

(13,054 |

) |

|

Income taxes paid |

|

(1,379 |

) |

|

|

(260 |

) |

|

|

(2,137 |

) |

|

|

(588 |

) |

|

Net cash inflow from operating activities |

$ |

18,066 |

|

|

$ |

6,022 |

|

|

$ |

51,719 |

|

|

$ |

2,202 |

|

|

|

|

|

|

|

|

|

|

|

CASH FLOWS FROM INVESTING ACTIVITIES |

|

|

|

|

|

|

|

|

Purchase of property and equipment |

$ |

(264 |

) |

|

$ |

(2,910 |

) |

|

$ |

(4,283 |

) |

|

$ |

(5,612 |

) |

|

Purchase of other intangible assets |

|

(497 |

) |

|

|

(78 |

) |

|

|

(982 |

) |

|

|

(622 |

) |

|

Return on investment from joint venture |

|

(309 |

) |

|

|

- |

|

|

|

- |

|

|

|

96 |

|

|

Proceed from sale of assets |

|

- |

|

|

|

109 |

|

|

|

- |

|

|

|

188 |

|

|

Cash adjustment from sale of subsidiary to parent company |

|

- |

|

|

|

(3,554 |

) |

|

|

- |

|

|

|

(3,554 |

) |

|

Capital repayment from joint venture |

|

430 |

|

|

|

144 |

|

|

|

430 |

|

|

|

420 |

|

|

Net cash outflow from investing activities |

$ |

(640 |

) |

|

$ |

(6,289 |

) |

|

$ |

(4,835 |

) |

|

$ |

(9,084 |

) |

|

|

|

|

|

|

|

|

|

|

CASH FLOWS FROM FINANCING ACTIVITIES |

|

|

|

|

|

|

|

|

Proceeds from line of credit |

$ |

20,042 |

|

|

$ |

36,515 |

|

|

$ |

127,567 |

|

|

$ |

168,674 |

|

|

Repayments of line of credit |

|

(24,633 |

) |

|

|

(36,349 |

) |

|

|

(142,118 |

) |

|

|

(162,851 |

) |

|

Proceeds from borrowings |

|

- |

|

|

|

2,284 |

|

|

|

1,000 |

|

|

|

36,617 |

|

|

Repayment of borrowings |

|

(3,227 |

) |

|

|

(2,192 |

) |

|

|

(8,033 |

) |

|

|

(6,081 |

) |

|

Repayment of related party loans |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(1,200 |

) |

|

Principal payments on lease obligations |

|

(3,227 |

) |

|

|

(2,895 |

) |

|

|

(12,162 |

) |

|

|

(10,535 |

) |

|

Repayment private placement notes |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(14,500 |

) |

|

Dividend distribution |

|

- |

|

|

|

(1,600 |

) |

|

|

(121 |

) |

|

|

(1,600 |

) |

|

Payment of senior preferred shares |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(5,972 |

) |

|

Net cash (outflow) / inflow from financing

activities |

$ |

(11,045 |

) |

|

$ |

(4,237 |

) |

|

$ |

(33,867 |

) |

|

$ |

2,552 |

|

|

|

|

|

|

|

|

|

|

|

Effects of exchange rate difference on cash and cash

equivalents |

|

18 |

|

|

|

(60 |

) |

|

|

(20 |

) |

|

|

(316 |

) |

|

Net increase / (decrease) in cash and cash equivalents |

$ |

6,399 |

|

|

$ |

(4,564 |

) |

|

$ |

12,997 |

|

|

$ |

(4,646 |

) |

|

Cash and cash equivalents at beginning of the period |

$ |

15,471 |

|

|

$ |

13,437 |

|

|

$ |

8,873 |

|

|

$ |

13,519 |

|

|

Cash and cash equivalents at end of the

period |

$ |

21,870 |

|

|

$ |

8,873 |

|

|

$ |

21,870 |

|

|

$ |

8,873 |

|

| |

|

|

|

|

|

|

|

IBEX

LimitedUnaudited Supplemental

Non-GAAP Information

|

Reconciliation of Net Income from continuing operations to

Adjusted EBITDA from continuing operations |

| |

|

|

|

|

|

|

|

|

| |

|

Quarter

ended June 30, |

|

Year ended

June 30, |

|

US$ in thousands |

|

|

2020 |

|

|

|

2019 |

|

|

|

2020 |

|

|

|

2019 |

|

| Net

income / (loss) from continuing operations |

|

$ |

(3,805 |

) |

|

$ |

(4,647 |

) |

|

$ |

7,770 |

|

|

$ |

(4,519 |

) |

| Finance

expense |

|

|

2,238 |

|

|

|

2,251 |

|

|

|

9,428 |

|

|

|

7,709 |

|

| Income tax

expense |

|

|

833 |

|

|

|

119 |

|

|

|

2,315 |

|

|

|

3,615 |

|

| Depreciation

and amortization |

|

|

6,012 |

|

|

|

5,203 |

|

|

|

24,472 |

|

|

|

20,895 |

|

|

EBITDA from continuing operations |

|

$ |

5,278 |

|

|

$ |

2,926 |

|

|

$ |

43,985 |

|

|

$ |

27,700 |

|

|

Non-recurring expenses |

|

|

5,085 |

|

|

|

4,239 |

|

|

|

6,482 |

|

|

|

4,239 |

|

|

Impairment |

|

|

777 |

|

|

|

- |

|

|

|

777 |

|

|

|

163 |

|

| Other

income |

|

|

(227 |

) |

|

|

(177 |

) |

|

|

(745 |

) |

|

|

(804 |

) |

| Fair value

adjustment |

|

|

2,506 |

|

|

|

1 |

|

|

|

3,138 |

|

|

|

(364 |

) |

| Share-based

payments |

|

|

478 |

|

|

|

48 |

|

|

|

359 |

|

|

|

4,087 |

|

| Foreign

exchange (gain) / loss |

|

|

(372 |

) |

|

|

349 |

|

|

|

151 |

|

|

|

1,274 |

|

|

Adjusted EBITDA from continuing operations |

|

$ |

13,525 |

|

|

$ |

7,386 |

|

|

$ |

54,147 |

|

|

$ |

36,295 |

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Reconciliation of Net income / (loss) from continuing

operations to Adjusted net income / (loss) from continuing

operations |

|

|

|

|

|

|

|

|

|

|

| |

|

Quarter

ended June 30, |

|

Year ended

June 30, |

|

US$ in thousands |

|

|

2020 |

|

|

|

2019 |

|

|

|

2020 |

|

|

|

2019 |

|

| Net

income / (loss) from continuing operations |

|

$ |

(3,805 |

) |

|

$ |

(4,647 |

) |

|

$ |

7,770 |

|

|

$ |

(4,519 |

) |

|

Non-recurring expenses |

|

|

5,085 |

|

|

|

4,239 |

|

|

|

6,482 |

|

|

|

4,239 |

|

|

Impairment |

|

|

777 |

|

|

|

- |

|

|

|

777 |

|

|

|

163 |

|

| Other

income |

|

|

(227 |

) |

|

|

(177 |

) |

|

|

(745 |

) |

|

|

(804 |

) |

| Fair value

adjustment |

|

|

2,506 |

|

|

|

1 |

|

|

|

3,138 |

|

|

|

(364 |

) |

| Share-based

payments |

|

|

478 |

|

|

|

48 |

|

|

|

359 |

|

|

|

4,087 |

|

| Foreign

exchange (gain) / loss |

|

|

(372 |

) |

|

|

349 |

|

|

|

151 |

|

|

|

1,274 |

|

| Total

adjustments |

|

$ |

8,247 |

|

|

$ |

4,460 |

|

|

$ |

10,162 |

|

|

$ |

8,595 |

|

| Normalized

tax rate* |

|

|

22.9 |

% |

|

|

26.5 |

% |

|

|

22.9 |

% |

|

|

26.5 |

% |

| Tax impact

of adjustments |

|

|

(1,889 |

) |

|

|

(1,182 |

) |

|

|

(2,327 |

) |

|

|

(2,278 |

) |

| |

|

|

|

|

|

|

|

|

| Adjusted net

income / (loss) from continuing operations |

|

$ |

2,553 |

|

|

$ |

(1,369 |

) |

|

$ |

15,605 |

|

|

$ |

1,798 |

|

| |

|

|

|

|

|

|

|

|

| * The 2019

tax rate has been adjusted to remove the impact of the cancellation

of the legacy ESOP plan. |

| |

|

|

|

|

|

|

|

|

| Calculation

of pro forma adjusted earnings per share |

| |

| |

|

Quarter

ended June 30, |

|

Year ended

June 30, |

|

US$ in thousands |

|

|

2020 |

|

|

2019 |

|

|

|

2020 |

|

|

2019 |

|

| |

|

|

|

|

|

|

|

|

| Adjusted net

income / (loss) from continuing operations |

|

$ |

2,553 |

|

$ |

(1,369 |

) |

|

$ |

15,605 |

|

$ |

1,798 |

|

| Pro forma

fully diluted shares* |

|

|

18,680,377 |

|

|

18,680,377 |

|

|

|

18,680,377 |

|

|

18,680,377 |

|

| Pro forma

adjusted earnings / (loss) per share |

|

$ |

0.14 |

|

$ |

(0.07 |

) |

|

$ |

0.84 |

|

$ |

0.10 |

|

| |

|

|

|

|

|

|

|

|

| * Pro

forma fully diluted shares outstanding immediately following our

initial public offering in August 2020. |

|

|

| Calculation

of free cash flow |

| |

|

Year ended

June 30, |

|

US$ in thousands |

|

|

2020 |

|

|

|

2019 |

|

| |

|

|

|

|

| Net

cash inflow from operating activities |

|

$ |

51,719 |

|

|

$ |

2,202 |

|

| Add: Impact

of discontinued operations |

|

|

- |

|

|

|

13,396 |

|

| Less: |

|

|

|

|

| Capital

expenditures |

|

|

16,917 |

|

|

|

9,707 |

|

| Lease

payments on right-of-use assets |

|

|

9,147 |

|

|

|

8,411 |

|

| Free

cash flow |

|

$ |

25,655 |

|

|

$ |

(2,520 |

) |

| |

|

|

|

|

| |

|

|

|

|

| Calculation

of Net Debt |

| |

|

|

|

| US$ in

thousands |

June 30, 2020 |

|

June 30, 2019 |

|

Borrowings |

|

|

|

|

Current |

$ |

27,476 |

|

|

$ |

41,835 |

|

|

Non-Current |

|

3,782 |

|

|

|

7,184 |

|

| |

$ |

31,258 |

|

|

$ |

49,019 |

|

| Leases |

|

|

|

| Current |

|

12,668 |

|

|

|

10,632 |

|

|

Non-Current |

|

62,044 |

|

|

|

58,602 |

|

| |

$ |

74,712 |

|

|

$ |

69,234 |

|

| Total

Debt |

$ |

105,970 |

|

|

$ |

118,253 |

|

| Cash |

|

21,870 |

|

|

|

8,873 |

|

| Net

Debt |

$ |

84,100 |

|

|

$ |

109,380 |

|

| |

|

|

|

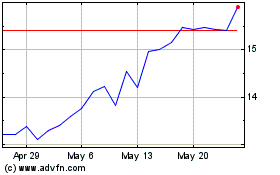

IBEX (NASDAQ:IBEX)

Historical Stock Chart

From Mar 2024 to Apr 2024

IBEX (NASDAQ:IBEX)

Historical Stock Chart

From Apr 2023 to Apr 2024