Filed Pursuant to Rule 424(b)(3)

Registration No. 333-258340

PROSPECTUS SUPPLEMENT NO. 12

(to prospectus dated August 10, 2021)

Up to 19,300,751 Shares of Class A Common Stock Issuable Upon the Exercise of Warrants Up to 77,272,414 Shares of Class A Common Stock Up to 8,014,500 Warrants to Purchase Class A Common Stock

This prospectus supplement is being filed to update and supplement the information contained in the prospectus dated August 10, 2021 (as supplemented or amended from time to time, the “Prospectus”), with the information contained in in our Current Report on Form 8-K, filed with the Securities and Exchange Commission (“SEC”) on June 14, 2022 (the “Current Report”) other than the information included in Item 7.01 and Exhibit 99.1, which was furnished not filed with the SEC. Accordingly, we have attached the Current Report to this prospectus supplement.

The Prospectus and this prospectus supplement relate to the issuance by us of up to an aggregate of 19,300,751 shares of Class A Common Stock, par value $0.0001 per share (“Class A Common Stock”), which consists of (i) up to 8,014,500 shares of Class A Common Stock that are issuable upon the exercise of 8,014,500 warrants (the “private placement warrants”) issued in a private placement in connection with the initial public offering of Decarbonization Plus Acquisition Corporation (“DCRB”) and upon the conversion of a working capital loan by the Sponsor (as defined in the Prospectus) to DCRB and (ii) up to 11,286,251 shares of Class A Common Stock that are issuable upon the exercise of 11,286,251 warrants originally issued in DCRB’s initial public offering. The Prospectus and this prospectus supplement also relate to the offer and sale from time to time by the selling securityholders named in the Prospectus, or their permitted transferees, of (i) up to 77,272,414 shares of Class A Common Stock (including up to 5,293,958 shares of Class A Common Stock issuable upon the satisfaction of certain triggering events (as described in the Prospectus) and up to 326,048 shares of Class A Common Stock that may be issued upon exercise of the Ardour Warrants (as defined in the Prospectus)) and (ii) up to 8,014,500 private placement warrants.

This prospectus supplement updates and supplements the information in the Prospectus and is not complete without, and may not be delivered or utilized except in combination with, the Prospectus, including any amendments or supplements thereto. This prospectus supplement should be read in conjunction with the Prospectus and if there is any inconsistency between the information in the Prospectus and this prospectus supplement, you should rely on the information in this prospectus supplement.

Our Class A Common Stock and warrants are traded on the Nasdaq Global Select Market under the symbols “HYZN” and “HYZNW,” respectively. On June 13, 2022 the closing price of our Class A Common Stock was $3.45 and the closing price for our public warrants was $0.72.

Investing in our securities involves risks that are described in the “Risk Factors” section beginning on page 7 of the Prospectus.

Neither the SEC nor any state securities commission has approved or disapproved of the securities to be issued under the Prospectus or determined if the Prospectus or this prospectus supplement is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus supplement is June 14, 2022.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________________________

FORM 8-K

___________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (date of earliest event reported): June 14, 2022

___________________________________

Hyzon Motors Inc.

(Exact name of registrant as specified in its charter)

___________________________________

| | | | | | | | |

| Delaware | 001-3962 | 82-2726724 |

(State or other jurisdiction of incorporation or organization) | (Commission File Number) | (I.R.S. Employer Identification Number) |

475 Quaker Meeting House Road Honeoye Falls, NY | | 14472 |

| (Address of principal executive offices) | | (Zip Code) |

(585)-484-9337 |

(Registrant's telephone number, including area code) |

| Not Applicable |

| (Former name or former address, if changed since last report) |

___________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| | | | | | | | |

Securities registered pursuant to Section 12(b) of the Act: |

Title of each class | Trading Symbol | Name of each exchange on which registered |

| Class A common stock, par value $.001 per share | HYZN | NASDAQ Capital Market |

| Warrants, each whole warrant exercisable for one share of Class A common stock at an exercise price of $11.50 per share | HYZNW | NASDAQ Capital Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 12b-2 of the Exchange Act.

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01. Entry into a Material Agreement

On June 10, 2022, Hyzon Motors Inc. (the "Company"), through its majority-owned subsidiary and joint venture, Hyzon Motors Europe B.V., a private limited company registered in the Netherlands, entered into a Share Purchase and Transfer Agreement (the “Agreement”) with Orten Holding GmbH, a German limited liability company (“Orten”) and Mr. Robert Orten (“Mr. Orten”, together with Orten, the “Sellers”), whereby the Company agreed to purchase from the Sellers 100% of outstanding ownership interests in specified target companies owned by the Sellers, including Orten Betriebs GmbH and Orten Electric-Trucks GmbH, each a German limited liability company. Orten is a German leader in manufacturing of innovative truck and trailer bodies. The total purchase price is €24,250,000 in cash, approximately $25,900,000 in USD subject to customary purchase price adjustments.

The foregoing summary of the terms and conditions of the Agreement does not purport to be complete and is qualified in its entirety by reference to the complete text of the Agreement, a copy of which will be filed with the Company’s Quarterly Report on Form 10-Q for the quarter ending June 30, 2022.

Item 7.01. Regulation FD Disclosure.

On June 13, 2022, the Company issued a press release relating to the matters described above in Item 1.01. A copy of the press release is attached as Exhibit 99.1 and is incorporated herein by reference. The information in this Item 7.01 of Form 8-K and Exhibit 99.1 attached hereto are being furnished pursuant to Item 7.01 of Form 8-K and therefore shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such filing.

Item 9.01. Financial Statements and Exhibits

(d) Exhibits.

| | | | | | | | |

| Exhibit Number | | Description |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (formatted as inline XBRL and contained in Exhibit 101) |

| | |

| | |

| | |

| | |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| HYZON MOTORS INC. |

| | |

| Date: June 14, 2022 | By: | /s/ Samuel Chong |

| Name: | Samuel Chong |

| Title: | Chief Financial Officer |

Hyzon Motors to expand in Germany with acquisition of Orten Betriebs GmbH and Orten Electric-Trucks GmbH

–Through the transaction, Hyzon plans to establish operational footprint and customer access in attractive German Zero Emission truck market, including expansion of electrification and powertrain kit expertise & assembly capacity

–With almost one century of experience in the truck and trailer industry, the ORTEN Group is one of the pioneers for the electrification of new and used commercial diesel vehicles, supporting worldwide CO2 free mobility.

ROCHESTER, N.Y. – June 13, 2022 – Hyzon Motors (NASDAQ: HYZN), a global supplier of zero-emissions hydrogen and fuel cell powered commercial vehicles, announced today the signing of a definitive agreement to acquire ORTEN Betriebs GmbH and subsidiaries, and ORTEN Electric Trucks GmbH, German manufacturers of innovative truck and trailer bodies for the beverage industry (collectively, “ORTEN”). The transaction is expected to close in the fourth quarter, 2022.

The acquisition brings three fully-operational production facilities and a team of over 80 employees under the Hyzon umbrella. ORTEN’s employees are experienced in electrification, retrofitting, and bodybuilding, all critical elements of Hyzon’s FCEV build process. Additionally, ORTEN management has extensive, long-standing customer relationships across Germany.

Complementary product lines between Hyzon and ORTEN, in combination with ORTEN’s body and powertrain kits, provide a comprehensive solution for customers transitioning their fleets to zero emissions: vehicles up to 26 tons can be transitioned to ORTEN’s existing offering of battery electric vehicles, while the operational requirements of medium- and heavy-duty vehicles can be met with Hyzon’s FCEVs.

Germany is expected to be a major global market for zero-emission commercial vehicles in the coming years. The European Union recently announced a total ban on sales of combustion engine cars from 2035, and Germany offers various incentives to transition heavy vehicles off diesel, including some that provide subsidies for up to 80% of the additional investment costs of going electric compared to replacing vehicles with diesel equivalents; and even greater levels of subsidy for some public fleets.

“We are proud to grow our team and our reach through such an esteemed and innovative provider of solutions in German logistics,” said Craig Knight, Hyzon Motors CEO. “We look forward to working with the ORTEN team to accelerate Germany’s move to zero emissions through hydrogen fuel cell technology, and to deepen the customer relationships ORTEN has in the beverage industry to include the potential of Hyzon FCEVs.”

“Looking back on a history of nearly 100 years of bringing innovative solutions to our commercial and municipal customers, we are happy and proud to join forces with Hyzon to build a better future”, adds Robert Orten, long term owner and CEO of the ORTEN group. “Being a first mover in the field of battery electric trucks, we now have the opportunity to scale up our proprietary electrification and body building know-how. I would like to express my gratitude to my employees, customers and suppliers and look forward to a successful cooperation with Hyzon.”

| | | | | | | | |

| | |

| Accelerating the | | |

| Energy Transition | | hyzonmotors.com |

About Hyzon Motors Inc.

Headquartered in Rochester, N.Y., with U.S. operations in the Chicago and Detroit areas, and international operations in the Netherlands, Singapore, Australia, Germany, and China, Hyzon is a leader in fuel cell electric mobility with an exclusive focus on the commercial vehicle market, and a near-term focus on back to base (captive fleet) operations. Utilizing its proven and proprietary hydrogen fuel cell technology, Hyzon aims to supply zero-emission heavy duty trucks and buses to customers in North America, Europe and around the world to mitigate emissions from diesel transportation, one of the single largest sources of carbon emissions globally. Hyzon is contributing to the escalating adoption of fuel cell electric vehicles through its demonstrated technology advantage, leading fuel cell performance and history of rapid innovation. Visit www.hyzonmotors.com.

Forward-Looking Statements

This press release includes “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements, other than statements of present or historical fact included in this press release, are forward-looking statements. When used in this press release, the words “could,” “should,” “will,” “may,” “believe,” “anticipate,” “intend,” “estimate,” “expect,” “project,” the negative of such terms and other similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain such identifying words. These forward-looking statements which include, but are not limited to, expected demand for and sales of Hyzon vehicles and the pace of adoption of hydrogen fuel cell electric vehicles, and the successful integration of Orten operations and expected benefits of the acquisition, and are based on management’s current expectations and assumptions about future events and are based on currently available information as to the outcome and timing of future events. Except as otherwise required by applicable law, Hyzon disclaims any duty to update any forward-looking statements, all of which are expressly qualified by the statements in this section, to reflect events or circumstances after the date of this press release. Hyzon cautions you that these forward-looking statements are subject to numerous risks and uncertainties, most of which are difficult to predict and many of which are beyond the control of Hyzon, including risks and uncertainties described in the “Risk Factors” section of Hyzon’s Annual Report on Form 10-K for the year ended December 31, 2021 filed with the U.S. Securities and Exchange Commission (the “SEC”) on March 30, 2022, our Amended Registration Statement on Form S-1 filed with the SEC on April 6, 2021, and other documents filed by Hyzon from time to time with the SEC. These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements. Hyzon gives no assurance that Hyzon will achieve its expectations.

Hyzon Motors’ contacts

For Media:

Eva Lindpaintner

Marketing

media@hyzonmotors.com

For investors:

Darla Rivera

Investor Relations

ir@hyzonmotors.com

| | | | | | | | |

| | |

| Accelerating the | | |

| Energy Transition | | hyzonmotors.com |

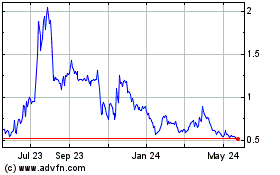

Hyzon Motors (NASDAQ:HYZN)

Historical Stock Chart

From Mar 2024 to Apr 2024

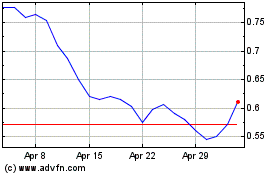

Hyzon Motors (NASDAQ:HYZN)

Historical Stock Chart

From Apr 2023 to Apr 2024