HOOKIPA Pharma Inc. (NASDAQ: HOOK, ‘HOOKIPA’), a company developing

a new class of immunotherapies based on its proprietary arenavirus

platform, today reported business highlights and financial results

for the third quarter of 2022.

“We’re proud of our steady momentum and the

external validation of our arenaviral technology over the past few

months. Securing our Roche collaboration to develop HB-700 for

KRAS-mutated cancers was a key recent achievement, and we’re

pleased to move our prostate cancer product candidate, HB-300,

toward the clinic following FDA clearance,” said Joern Aldag, Chief

Executive Officer at HOOKIPA. “With our cash position and upfront

cash proceeds from the Roche collaboration, we are positioned to

fund multiple clinical readouts in 2023 and 2024, including from

our Phase 2 HB-200 program in combination with pembrolizumab.”

Business Highlights and Recent

Developments

- In the Phase 2 study of HB-200 in

combination with pembrolizumab for patients with HPV16+

metastatic/recurrent head and neck cancer in the first- and

second-line settings, enrollment is ongoing.More than 20 patients

have been dosed, including those in the safety run-in who received

lower doses than the recommended Phase 2 dose. As of today, only a

small number of patients have received the recommended Phase 2 dose

of HB-200 with pembrolizumab. More time and additional imaging

assessments are required to mature the dataset and inform the next

phase of development. HOOKIPA will provide a comprehensive data

update in the first half of 2023.

- In October, HOOKIPA announced a

strategic collaboration and licensing agreement with Roche to

develop HB-700 for KRAS-mutated cancers and a second undisclosed

novel arenaviral immunotherapy candidate. The Roche collaboration

represents the first oncology licensing agreement for HOOKIPA.

Under the terms of the agreement, HOOKIPA received $25 million in

upfront cash, with an additional $15 million payment if Roche

exercises the option to add an additional product candidate, and

potential future milestone payments up to approximately $930

million for both programs, plus tiered royalties.

- In July, HOOKIPA announced that the

U.S. Food and Drug Administration accepted HOOKIPA’s

investigational New Drug Application for HB-300 for the treatment

of metastatic castration-resistant prostate cancer. A Drug Master

File also was accepted, reducing cycle time between completion of

preclinical studies and clinical entry of HOOKIPA’s pipeline

projects.

- Following the submission of the

clinical trial application (IND equivalent) for HB-400, a Hepatitis

B therapeutic, in 2022, HOOKIPA expects the first patient to be

dosed in a Phase 1 clinical trial during 2023.

Upcoming Milestones

- First patient enrolled in HB-300 Phase 1 study (prostate

cancer) expected in the first quarter of 2023

- Phase 2 HB-200 data in combination with pembrolizumab in the

first- and second-line setting for HPV16+ head and neck cancer

expected in the first half of 2023

- Randomized Phase 2 HB-200 study in combination with

pembrolizumab in the first-line setting for HPV16+ head and neck

cancer expected to launch in 2023 (Fast Track

designation)

- Phase 2 HB-101 data for the prevention of Cytomegalovirus (CMV)

in kidney transplant recipients expected in the first half of

2023

- HB-400 Hepatitis B therapeutic (Gilead-led): first patient

dosed 2023

Third Quarter 2022 Financial

Results

Cash Position: HOOKIPA’s cash,

cash equivalents and restricted cash as of

September 30, 2022 was $100.7 million compared to

$66.9 million as of December 31, 2021. The increase

was primarily attributable to funds resulting from the amended and

restated Gilead collaboration agreement and the follow-on financing

in March 2022, partly offset by cash used in operating

activities.

HOOKIPA’s cash position as of September 30; 2022

does not include a $25.0 million upfront payment that the

Company is entitled to receive under the strategic collaboration

and licensing agreement signed with Roche in October 2022 and up to

$30.0 million from the issuance of common stock that Gilead is

required to purchase at the discretion of the Company pursuant to

the terms of a stock purchase agreement signed in February

2022.

Revenue: Revenue was

$2.2 million for the three months ended

September 30, 2022, compared to $3.9 million for the

three months ended September 30, 2021. The decrease was

primarily due to lower cost reimbursements received under the

Collaboration Agreement with Gilead as Hookipa neared completion of

HBV program assets in preparation for Gilead to progress with a

Phase 1 clinical trial. The main parts of the $4.0 million

milestone payment and the $15.0 million initiation fee

received in the three months ended March 31, 2022,

remained recorded as deferred revenue to be recognized in future

accounting periods.

Research and Development

Expenses: HOOKIPA’s research and development expenses were

$18.3 million for the three months ended

September 30, 2022, compared to $20.7 million for

the three months ended September 30, 2021. The decrease

for the three months ended September 30, 2022, compared

to the three months ended September 30, 2021, was

primarily driven by lower manufacturing expenses for our HB-200 and

Gilead partnered programs, a decrease in laboratory consumables,

and a decrease in personnel-related expenses including stock-based

compensation that was partially offset by an increase in training

and recruitment expenses.

General and Administrative

Expenses: General and administrative expenses for the

three months ended September 30, 2022, were

$4.9 million, compared to $4.3 million for the three

months ended September 30, 2021. The increase was

primarily due to an increase in professional and consulting fees

and an increase in training and recruitment expenses that was

partially offset by a decrease in personnel-related expenses and a

decrease in other expenses. The decrease in personnel-related

expenses resulted from decreased stock compensation expenses, that

was partially offset by a growth in headcount along with increased

salaries in our general and administrative functions.

Net Loss: HOOKIPA’s net loss

was $18.3 million for the three months ended

September 30, 2022, compared to a net loss of

$20.0 million for the three months ended

September 30, 2021. This decrease was primarily due to a

decrease in research and development expenses.

HOOKIPA Pharma Inc. Consolidated

Statements of Operations (Unaudited) (In

thousands, except share and per share data)

| |

Three months ended September 30, |

|

Nine months ended September 30, |

| |

2022 |

|

2021 |

|

2022 |

|

2021 |

|

Revenue from collaboration and licensing |

$ |

2,230 |

|

|

$ |

3,874 |

|

|

$ |

6,421 |

|

|

$ |

14,553 |

|

| Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

|

(18,286 |

) |

|

|

(20,698 |

) |

|

|

(51,053 |

) |

|

|

(60,434 |

) |

|

General and administrative |

|

(4,937 |

) |

|

|

(4,342 |

) |

|

|

(14,935 |

) |

|

|

(13,746 |

) |

|

Total operating expenses |

|

(23,223 |

) |

|

|

(25,040 |

) |

|

|

(65,988 |

) |

|

|

(74,180 |

) |

| Loss from operations |

|

(20,993 |

) |

|

|

(21,166 |

) |

|

|

(59,567 |

) |

|

|

(59,627 |

) |

| Total interest, other income

and taxes, net |

|

2,713 |

|

|

|

1,126 |

|

|

|

6,963 |

|

|

|

5,197 |

|

| Net loss |

$ |

(18,280 |

) |

|

$ |

(20,040 |

) |

|

$ |

(52,604 |

) |

|

$ |

(54,430 |

) |

| Net loss per share — basic and

diluted |

|

(0.25 |

) |

|

|

(0.61 |

) |

|

|

(0.83 |

) |

|

|

(1.66 |

) |

Condensed Balance Sheets (Unaudited)(In

thousands)

| |

As of |

|

As of |

| |

September 30, |

|

December 31, |

| |

2022 |

|

2021 |

|

Cash, cash equivalents and restricted cash |

$ |

100,676 |

|

$ |

66,912 |

| Total assets |

|

151,526 |

|

|

126,045 |

| Total liabilities |

|

38,178 |

|

|

36,453 |

| Total stockholders’

equity |

|

113,348 |

|

|

89,592 |

About HOOKIPAHOOKIPA Pharma

Inc. (NASDAQ: HOOK) is a clinical-stage biopharmaceutical company

focused on developing novel immunotherapies, based on its

proprietary arenavirus platform, which are designed to mobilize and

amplify targeted T cells and thereby fight or prevent serious

disease. HOOKIPA’s replicating and non-replicating technologies are

engineered to induce robust and durable antigen-specific CD8+ T

cell responses and pathogen-neutralizing antibodies. HOOKIPA’s

pipeline includes its wholly owned investigational arenaviral

immunotherapies targeting Human Papillomavirus 16-positive cancers,

prostate cancers, and other undisclosed programs. HOOKIPA is

collaborating with Roche on an arenaviral immunotherapeutic for

KRAS-mutated cancers. In addition, HOOKIPA aims to develop

functional cures of HBV and HIV in collaboration with Gilead.

Find out more about HOOKIPA online

at www.hookipapharma.com.

For further information, please contact:

|

Media |

Investors |

| Instinctif Partners |

Matt Beck |

| hookipa@instinctif.com |

Executive Director - Investor Relations |

| +44 (0) 7457 2020 |

matthew.beck@hookipapharma.com |

| |

+1 917 209 6886 |

Forward Looking

StatementsCertain statements set forth in this press

release constitute “forward-looking” statements within the meaning

of the Private Securities Litigation Reform Act of 1995, as

amended. Forward-looking statements can be identified by terms such

as “believes,” “expects,” “plans,” “potential,” “would” or similar

expressions and the negative of those terms. Such forward-looking

statements involve substantial risks and uncertainties that could

cause HOOKIPA’s research and clinical development programs, future

results, performance or achievements to differ significantly from

those expressed or implied by the forward-looking statements. Such

risks and uncertainties include, among others, the uncertainties

inherent in the drug development process, including HOOKIPA’s

programs’ early stage of development, the process of designing and

conducting preclinical and clinical trials, the regulatory approval

processes, the timing of regulatory filings, the challenges

associated with manufacturing drug products, HOOKIPA’s ability to

successfully establish, protect and defend its intellectual

property, risks relating to business

interruptions resulting from the coronavirus (COVID-19) disease

outbreak or similar public health crises, the impact of COVID-19 on

the enrollment of patients and timing of clinical results, and

other matters that could affect the sufficiency of existing cash to

fund operations. HOOKIPA undertakes no obligation to update or

revise any forward-looking statements. For a further description of

the risks and uncertainties that could cause actual results to

differ from those expressed in these forward-looking statements, as

well as risks relating to the business of the company in general,

see HOOKIPA’s quarterly report on Form 10-Q for the quarter ended

September 30, 2022, which is available on the Security and

Exchange Commission’s website at www.sec.gov and HOOKIPA’s

website at www.hookipapharma.com.

Investors and others should note that we

announce material financial information to our investors using our

investor relations website (https://ir.hookipapharma.com/), SEC

filings, press releases, public conference calls and webcasts. We

use these channels, as well as social media, to communicate with

our members and the public about our company, our services and

other issues. It is possible that the information we post on social

media could be deemed to be material information. Therefore, we

encourage investors, the media, and others interested in our

company to review the information we post on the U.S. social media

channels listed on our investor relations website.

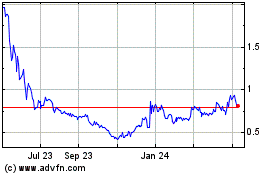

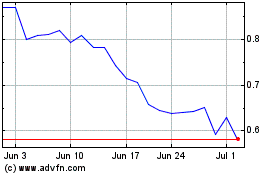

HOOKIPA Pharma (NASDAQ:HOOK)

Historical Stock Chart

From Mar 2024 to Apr 2024

HOOKIPA Pharma (NASDAQ:HOOK)

Historical Stock Chart

From Apr 2023 to Apr 2024