UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 40-F

☐ Registration statement pursuant to Section 12 of the Securities Exchange Act of 1934

or

☒ Annual report pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934

For the fiscal year ended March 31, 2021

Commission File Number 001-40398

HIVE BLOCKCHAIN TECHNOLOGIES LTD.

(Exact Name of the Registrant as Specified in its Charter)

|

British Columbia, Canada

(Province or Other Jurisdiction of Incorporation or Organization

|

7374

(Primary Standard Industrial Classification Code)

|

N/A

(I.R.S. Employer Identification No.)

|

Suite 855 - 789 West Pender Street

Vancouver, BC

V6C 1H2

604-664-1078

(Address and Telephone number of Registrant's principal executive offices)

Corporation Service Company

19 West 44th Street, Suite 200

New York, NY 10036,

(Name, address (including zip code) and telephone number (including area code) of agent for service in the United States)

Copies to:

Jonathan Gardner, Esq.

Kavinoky Cook LLP

726 Exchange Street, Suite 800

Buffalo, New York 14210

Securities to be registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol

|

Name of each exchange on which registered

|

|

Common Shares

|

HIVE

|

The Nasdaq Stock Market LLC

|

Securities to be registered pursuant to Section 12(g) of the Act: None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

For annual reports, indicate by check mark the information filed with this form:

|

☒Annual Information Form

|

☒ Audited Annual Financial Statements

|

Indicate by check mark whether the Registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports); and (2) has been subject to such filing requirements for the past 90 days.

☒ Yes ☐ No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

☒ Yes ☐ No

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 12b-2 of the Exchange Act.

Emerging growth company ☒

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management's assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

EXPLANATORY NOTE

Hive Blockchain Technologies Ltd. (the "Company", the "Registrant", "we" or "us") is a Canadian issuer that is permitted, under the multijurisdictional disclosure system adopted in the United States, to prepare this Annual Report on Form 40-F (this "Annual Report") pursuant to Section 13 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), in accordance with Canadian disclosure requirements, which are different from those of the United States. The Company is a "foreign private issuer" as defined in Rule 3b-4 under the Exchange Act and Rule 405 under the Securities Act of 1933, as amended. Equity securities of the Company are accordingly exempt from Sections 14(a), 14(b), 14(c), 14(f) and 16 of the Exchange Act pursuant to Rule 3a12-3 thereunder.

CAUTIONARY NOTE REGARDING FORWARD LOOKING STATEMENTS

This annual report on Form 40-F contains forward-looking statements that are based on current expectations, estimates, forecasts and projections about us, our future performance, the market in which we operate, our beliefs and our Management's assumptions. In addition, other written or oral statements that constitute forward-looking statements may be made by us or on our behalf. Words such as "expects", "anticipates", "targets", "goals", "projects", "intends", "plans", "believes", "seeks", "estimates", variations of such words and similar expressions are intended to identify such forward-looking statements. These statements are not guarantees of future performance and involve certain risks, uncertainties and assumptions that are difficult to predict or assess. Therefore, actual outcomes and results may differ materially from what is expressed or forecast in such forward-looking statements. Any investment in our common shares involves a high degree of risk. You should carefully consider the following information about these risks, together with the other information contained in this annual report before you decide to invest in our common shares. In particular, each of the following risks may materially and adversely affect our business objective, plan of operation and financial condition. These risks may cause the market price of our common shares to decline, which may cause you to lose all or a part of the money you invested in our common shares.

• our ability to achieve and maintain profitability, which depends to a large degree on factors we cannot control, including the value of cryptocurrencies, our electricity costs, the availability of equipment and the related supply chain for graphics processing chips and regulatory changes;

• high volatility in the value of cryptocurrencies generally and in the value of Bitcoin and Ethereum particularly, and the effect of such volatility on our ability to operate profitably;

• changes in the regulatory and legal environments in the countries and Canadian Provinces in which we operate may lead to future challenges to operating our business or may subject our business to added costs with the result that some or all of our operating facilities become less profitable or unprofitable altogether;

• Changes in United States tax laws may impose burdensome reporting or regulation on our operations;

• risks related to our failure to continue to obtain financing on a timely basis and on acceptable terms;

• our ability to keep pace with technology changes and competitive conditions;

• other risks and uncertainties related to our business plan and business strategy; and

• the impact on the world economy of coronavirus ("COVID-19").

Although we believe that the assumptions on which our forward-looking statements are based are reasonable, any of those assumptions could prove to be inaccurate, and as a result, the forward-looking statements based on those assumptions also could be inaccurate. In light of these and other uncertainties, the inclusion of a projection or forward-looking statement in this annual report should not be regarded as a representation by us that our plans and objectives will be achieved. These forward-looking statements apply only as of the date of this annual report. We assume no duty and do not undertake to update the forward-looking statements.

Applicable risks and uncertainties include, but are not limited to, those identified: under the heading "Risk Management" in each of the Registrant's Management's Discussion & Analysis for the year ended March 31, 2021 attached hereto as Exhibit 99.3 and under the heading "Risk Factors" in the Registrant's Annual Information Form for the year ended March 31, 2021, attached hereto as Exhibit 99.1, and all of the foregoing incorporated herein by reference, and in other filings that the Registrant has made and may make with applicable securities authorities in the future. Additionally, the safe harbor provided in Section 21E of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), and Section 27A of the Securities Act of 1933, as amended (the "Securities Act"), applies to forward-looking information provided pursuant to "Off-Balance Sheet Arrangements" and "Tabular Disclosure of Contractual Obligations" in this annual report. Except as required by applicable law, the Registrant does not intend, and undertakes no obligation, to update any forward-looking statements to reflect, in particular, new information or future events, or otherwise.

DIFFERENCES IN UNITED STATES AND CANADIAN REPORTING PRACTICES

The Registrant is permitted, under a multijurisdictional disclosure system adopted by the United States, to prepare this report in accordance with Canadian disclosure requirements, which are different from those of the United States. The Registrant prepares its consolidated financial statements, which are filed with this report on Form 40-F in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board, and the audit is subject to Canadian auditing and auditor independence standards.

CURRENCY

Unless otherwise indicated, all amounts in this annual report are in United States dollars.

ANNUAL INFORMATION FORM

The Registrant's Annual Information Form for the year ended March 31, 2021 is attached as Exhibit 99.1 to this Annual Report on Form 40-F and is incorporated by reference herein.

AUDITED ANNUAL FINANCIAL STATEMENTS

The Registrant's audited annual consolidated financial statements for the years ended March 31, 2021 and 2020, including the report of the independent registered public accounting firm with respect thereto, are attached as Exhibit 99.2 to this Annual Report on Form 40-F and are incorporated by reference herein.

MANAGEMENT'S DISCUSSION AND ANALYSIS

The Registrant's Management's Discussion and Analysis for the year ended March 31, 2021 is attached as Exhibit 99.3 to this Annual Report on Form 40-F and is incorporated by reference herein.

DISCLOSURE CONTROLS AND PROCEDURES

As of the end of the period covered by this Annual Report, the Registrant carried out an evaluation, under the supervision of the Registrant's Chief Executive Officer and Chief Financial Officer, of the effectiveness of the Registrant's disclosure controls and procedures (as defined in Rules 13a-15(e) and 15d-15(e) of the Exchange Act). Based upon that evaluation, the Registrant's Chief Executive Officer and Chief Financial Officer have concluded that, as of the end of the period covered by this Annual Report, the Registrant's disclosure controls and procedures are effective to ensure that information required to be disclosed by the Registrant in reports that it files or submits under the Exchange Act is (i) recorded, processed, summarized and reported within the time periods specified in Securities and Exchange Commission (the "Commission") rules and forms, and (ii) accumulated and communicated to the Registrant's management, including its principal executive officer and principal financial officer, to allow timely decisions regarding required disclosure.

While the Company's principal executive officer and principal financial officer believe that the Company's disclosure controls and procedures provide a reasonable level of assurance that they are effective, they do not expect that the Company's disclosure controls and procedures or internal control over financial reporting will prevent all errors or fraud. A control system, no matter how well conceived or operated, can provide only reasonable, not absolute, assurance that the objectives of the control system are met.

MANAGEMENT'S ANNUAL REPORT ON INTERNAL CONTROL OVER FINANCIAL REPORTING

This annual report does not include a report of management's assessment regarding internal control over financial reporting or an attestation report of the company's registered public accounting firm due to a transition period established by rules of the Securities and Exchange Commission for newly public companies.

ATTESTATION REPORT OF THE REGISTERED PUBLIC ACCOUNTING FIRM

The Registrant qualifies as an "emerging growth company" under Section 3 of the Exchange Act, as a result of enactment of the Jumpstart Our Business Startups Act (the "JOBS Act"). Under the JOBS Act, "emerging growth companies" are exempt from Section 404(b) of the Sarbanes-Oxley Act of 2002, which generally requires that a public company's registered public accounting firm provide an attestation report relating to management's assessment of internal control over financial reporting. The Registrant qualifies as an "emerging growth company" and therefore has not included in, or incorporated by reference into, this Annual Report such an attestation report as of the end of the period covered by this Annual Report.

NOTICES PURSUANT TO REGULATION BTR

None.

AUDIT COMMITTEE

Identification of the Audit Committee

The Board of Directors has a separately designated standing Audit Committee established for the purpose of overseeing the accounting and financial reporting processes of the Company and audits of the financial statements of the Company in accordance with Section 3(a)(58)(A) of the Exchange Act and Rule 5602(c) of the NASDAQ Stock Market Rules. As of the date of this Annual Report, the Company's Audit Committee is comprised of Marcus New, Dave Perrill and Frank Holmes. Mr. New and Mr. Perrill are considered independent based on the criteria for independence prescribed by Rule 10A-3 of the Exchange Act and Rule 5605(a)(2) of the NASDAQ Stock Market Rules. Mr. Holmes, by virtue of his position as Chief Executive Officer of the Company, is not considered independent. Mr. Holmes serves as a member of our audit committee pursuant to the exemption from such independence requirements set forth in SEC Rule 10A-3(b)(1)(iv)(2). We believe that the Company's reliance on such exemption does not materially adversely affect the ability of the audit committee to act independently.

The Board of Directors has also determined that each member of the Audit Committee is financially literate, meaning each such member has the ability to read and understand a set of financial statements that present a breadth and level of complexity of the issues that can reasonably be expected to be raised by the Company's financial statements.

Audit Committee Financial Expert

The Board of Directors has determined that Marcus New qualifies as a financial expert (as defined in Item 407(d)(5)(ii) of Regulation S-K under the Exchange Act) and Rule 5605(c)(2)(A) of the NASDAQ Stock Market Rules; and (ii) is independent (as determined under Exchange Act Rule 10A-3 and Rule 5605(a)(2) of the NASDAQ Stock Market Rules).

The SEC has indicated that the designation or identification of a person as an audit committee financial expert does not make such person an "expert" for any purpose, impose any duties, obligations or liability on such person that are greater than those imposed on members of the audit committee and the board of directors who do not carry this designation or identification, or affect the duties, obligations or liability of any other member of the audit committee or board of directors.

CODE OF ETHICS

The Company has adopted a Code of Business Conduct and Ethics that applies to directors, officers and employees of, and consultants to, the Company (the "Code"). The Code is posted on the Company's website at https://www.hiveblockchain.com. The Code meets the requirements for a "code of ethics" within the meaning of that term in General Instruction 9(b) of Form 40-F.

All waivers of the Code with respect to any of the employees, officers or directors covered by it will be promptly disclosed as required by applicable securities rules and regulations. Since adopted by the Company, and until March 31, 2021, the Company did not waive or implicitly waive any provision of the Code with respect to any of the Company's principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions.

PRINCIPAL ACCOUNTANT FEES AND SERVICES

The following table sets out the fees billed to the Registrant by Davidson & Company LLP for professional services rendered for the fiscal period ended March 31, 2021 and March 31, 2020. During this period, Davidson & Company LLP was the Registrant's only external auditor.

|

(in Canadian dollars)

|

Year ended

March 31, 2021

|

Year ended

March 31, 2020

|

|

Audit Fees

|

CAD$ 250,000.00

|

CAD$ 192,824.00

|

|

Audit-Related Fees

|

CAD$ 50,610

|

CAD$ Nil

|

|

Tax Fees

|

CAD$ Nil

|

CAD$ Nil

|

|

All Other Fees

|

CAD$ 30,366

|

CAD$ Nil

|

|

Total Fees Paid

|

CAD$ 330,976

|

CAD$ 192,824

|

PRE-APPROVAL OF AUDIT SERVICES PROVIDED BY INDEPENDENT AUDITOR

The audit committee pre-approves all audit services to be provided to the Company by its independent auditors. The audit committee sets forth its pre-approval and/or confirmation of services authorized by the audit committee in the minutes of its meetings.

OFF-BALANCE SHEET TRANSACTIONS

The Registrant does not have any off-balance sheet transactions that have or are reasonably likely to have a current or future effect on the Registrant's financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that are material to investors.

TABULAR DISCLOSURE OF CONTRACTUAL OBLIGATIONS

At March 31, 2021, the Registrant had the following contractual obligations outstanding:

Contractual

Obligations

|

|

Payments due by period

|

|

|

Total

|

Less than 1 year

|

1-3 years

|

3-5 years

|

More than 5

years

|

|

Long Term Debt Obligations

|

$37,242,656

|

$4,396,191

|

$11,873,642

|

$8,731,828

|

$12,240,995

|

|

Capital Finance Lease Obligations

|

$Nil

|

$Nil

|

$Nil

|

$Nil

|

$Nil

|

|

Operating Lease Obligations

|

$3,063,839

|

$1,910,712

|

$1,153,127

|

$Nil

|

$Nil

|

|

Purchase Obligations

|

$44,589,100

|

$44,589,100

|

$Nil

|

$Nil

|

$Nil

|

|

Other Long Term Liabilities Reflected on the Company's Balance Sheet under the GAAP of the primary financial statements

|

$Nil

|

$Nil

|

$Nil

|

$Nil

|

$Nil

|

|

Total

|

$84,895,595

|

$50,896,003

|

$13,026,769

|

$8,731,828

|

$12,240,995

|

NASDAQ CORPORATE GOVERNANCE PRACTICES

The Company is a "foreign private issuer" as defined in Rule 3b-4 under the Exchange Act and its common shares are listed on the Toronto Stock Exchange and Nasdaq. Nasdaq Marketplace Rule 5615(a)(3) permits a foreign private issuer to follow its home country practices in lieu of certain requirements in of the Nasdaq Listing Rules. A foreign private issuer that follows home country practices in lieu of certain corporate governance provisions of the Nasdaq Listing Rules must disclose each Nasdaq corporate governance requirement that it does not follow and include a brief statement of the home country practice the issuer follows in lieu of the NASDAQ corporate governance requirement(s), either on its website or in its annual filings with the SEC. A description of the significant ways in which the Company's corporate governance practices differ from those followed by domestic companies pursuant to the applicable NASDAQ Listing Rules is available on the Company's website at https://hiveblockchain.com.

UNDERTAKINGS

The Registrant undertakes to make available, in person or by telephone, representatives to respond to inquiries made by the Commission staff, and to furnish promptly, when requested to do so by the Commission staff, information relating to: the securities registered pursuant to this Form 40-F; the securities in relation to which the obligation to file an annual report on Form 40-F arises; or transactions in said securities.

CONSENT TO SERVICE OF PROCESS

The Registrant has previously filed with the SEC an Appointment of Agent for Service of Process and Undertaking on Form F-X in connection with its Common Shares.

SIGNATURES

Pursuant to the requirements of the Exchange Act, the Registrant certifies that it meets all of the requirements for filing on Form 40-F and has duly caused this Annual Report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

HIVE BLOCKCHAIN TECHNOLOGIES LTD

|

|

|

|

|

|

|

|

/s/ Darcy Daubaras

|

|

|

|

Name:

|

Darcy Daubaras

|

|

|

|

Title:

|

Chief Financial Officer

|

|

Date: September 23, 2021

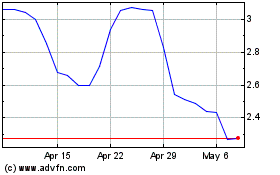

HIVE Digital Technologies (NASDAQ:HIVE)

Historical Stock Chart

From Mar 2024 to Apr 2024

HIVE Digital Technologies (NASDAQ:HIVE)

Historical Stock Chart

From Apr 2023 to Apr 2024