Current Report Filing (8-k)

October 18 2022 - 8:01AM

Edgar (US Regulatory)

false

0001792849

0001792849

2022-10-14

2022-10-14

0001792849

hpk:CommonStockCustomMember

2022-10-14

2022-10-14

0001792849

hpk:WarrantCustomMember

2022-10-14

2022-10-14

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): October 14, 2022

|

HighPeak Energy, Inc.

|

|

(Exact name of registrant as specified in its charter)

|

|

Delaware

|

001-39464

|

84-3533602

|

|

(State or other jurisdiction

of incorporation)

|

(Commission File Number)

|

(IRS Employer

Identification No.)

|

| |

|

|

|

421 W. 3rd St., Suite 1000

Fort Worth, Texas 76102

|

|

(address of principal executive offices) (zip code)

|

| |

|

|

|

(817) 850-9200

|

|

(Registrant’s telephone number, including area code)

|

Check the appropriate box below if the Form 8-K is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencements communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of Each Class

|

|

Trading Symbol(s)

|

|

Name of Each Exchange on Which Registered

|

|

Common Stock

|

|

HPK

|

|

The Nasdaq Stock Market LLC

|

|

Warrant

|

|

HPKEW

|

|

The Nasdaq Stock Market LLC

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 1.01

|

Entry into a Material Definitive Agreement.

|

On October 14, 2022 (the “Fifth Amendment Effective Date”), HighPeak Energy, Inc. (the “Company”), as borrower, Fifth Third Bank, National Association, as the existing administrative agent (the “Existing Agent”), Wells Fargo Bank, National Association, as the new administrative agent (the “New Agent”), the guarantors party thereto and the lenders party thereto entered into that certain Fifth Amendment to Credit Agreement (the “Credit Agreement Amendment”), which, upon effectiveness, amended that certain Credit Agreement, dated as of December 17, 2020 (as amended, restated, amended and restated, supplemented or otherwise modified by (i) that certain First Amendment to Credit Agreement, dated as of June 23, 2021, (ii) that certain Second Amendment to Credit Agreement, dated as of October 1, 2021, (iii) that certain Third Amendment to Credit Agreement, dated as of February 9, 2022, (iv) that certain Fourth Amendment to Credit Agreement, dated as of June 27, 2022 and (v) the Credit Agreement Amendment, (the “Credit Agreement”)), among the Company, Fifth Third Bank, National Association, as administrative agent, the guarantors party thereto and the lenders party thereto to, among other things, (i) increase the elected commitments to $525 million and the borrowing base to $550 million, (ii) require an additional borrowing base redetermination on or about December 1, 2022, (iii) modify the permitted dividends and distributions conditions such that minimum availability under the credit facility must be 25% percent (as opposed to 30% before giving effect to the Credit Agreement Amendment) and (iv) appoint the New Agent as the replacement administrative agent to replace the Existing Agent.

In addition, in connection with the Credit Agreement Amendment, to the extent the Company incurs any additional specified unsecured senior, senior subordinated or subordinated future indebtedness between the Fifth Amendment Effective Date and June 30, 2023, the Company’s obligation to reduce the borrowing base by an amount equal to 25% of the principal amount of such additional future indebtedness shall be waived. In connection with the Credit Agreement Amendment, the lenders waived two technical events of default existing with the Credit Agreement, as it existed prior to giving effect to the Credit Agreement Amendment, related to entering into and maintaining certain minimum hedges as of the fiscal quarters ending June 30, 2022 and September 30, 2022 and complying with the required current ratio as of the fiscal quarter ending September 30, 2022.

The foregoing description of the Credit Agreement Amendment is qualified in its entirety by reference to the Credit Agreement Amendment, a copy of which is attached hereto as Exhibit 10.1 and is incorporated by reference.

|

Item 2.03

|

Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

|

The information set forth under Item 1.01 above is hereby incorporated into this Item 2.03 by reference.

|

Item 7.01

|

Regulation FD Disclosure.

|

The Company issued a press release on October 18, 2022 announcing that on October 18, 2022 it had entered into the Credit Agreement Amendment. A copy of the press release is included as Exhibit 99.4 hereto and incorporated by reference.

The information furnished pursuant to this Item 7.01 shall not be deemed to be “filed” for purposes of Section 18 of the Securities Act and will not be incorporated by reference into any filing under the Securities Act, unless specifically identified therein as being incorporated therein by reference.

|

Item 9.01

|

Financial Statements and Exhibits.

|

|

Exhibit

Number

|

|

Description of Exhibit

|

|

10.1

|

|

Fifth Amendment To Credit Agreement, dated as of October 14, 2022, among HighPeak Energy, Inc., as Borrower, Fifth Third Bank, National Association, as the existing administrative agent, Wells Fargo Bank, National Association, as the new administrative agent, the guarantors party thereto and the lenders party thereto.

|

| |

|

|

|

99.1

|

|

|

| |

|

|

|

104

|

|

Cover Page Interactive Data File (embedded within Inline XBRL document).

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

HIGHPEAK ENERGY, INC.

|

| |

|

|

Date: October 18, 2022

|

|

| |

By:

|

/s/ Steven W. Tholen

|

| |

Name:

|

Steven W. Tholen

|

| |

Title:

|

Chief Financial Officer

|

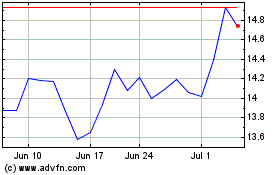

HighPeak Energy (NASDAQ:HPK)

Historical Stock Chart

From Mar 2024 to Apr 2024

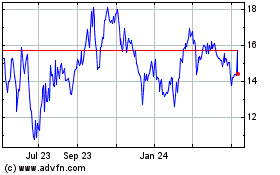

HighPeak Energy (NASDAQ:HPK)

Historical Stock Chart

From Apr 2023 to Apr 2024