As filed with the U.S. Securities and Exchange Commission on September 7, 2022

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-3

REGISTRATION STATEMENT

Under

THE SECURITIES ACT OF 1933

HighPeak Energy, Inc.

(Exact name of registrant as specified in its charter)

|

Delaware

|

|

(State or other jurisdiction of incorporation or organization)

|

| |

|

84-3533602

|

|

(I.R.S. Employer Identification No.)

|

421 W. 3rd Street, Suite 1000

Fort Worth, Texas 76102

(817) 850-9200

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Jack Hightower

Chief Executive Officer

421 W. 3rd Street, Suite 1000

Fort Worth, Texas 76102

(817) 850-9200

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Sarah K. Morgan

Jackson A. O’Maley

Vinson & Elkins L.L.P.

845 Texas Avenue, Suite 4700

Houston, Texas 77002

(713) 758-2222

Approximate date of commencement of proposed sale to the public: From time to time after this registration statement becomes effective.

If the only securities being registered on this form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ☐

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box: ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer ☐

|

Accelerated filer ☐

|

|

Non-accelerated filer ☒

|

Smaller reporting company ☒

|

| |

Emerging growth company ☒

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective on such date as the U.S. Securities and Exchange Commission acting pursuant to said Section 8(a), may determine.

Subject to completion, dated September 7, 2022

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the U.S. Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

PROSPECTUS

HighPeak Energy, Inc.

Up to 7,455,493 Shares of Common Stock by the Selling Stockholders

The selling stockholders may offer and sell up to an aggregate 7,455,493 shares of our common stock, par value $0.0001 per share (“common stock”), from time to time in one or more offerings. This prospectus provides you with a general description of the securities. We will not receive any proceeds from the sale of our common stock by the selling stockholders.

The selling stockholders may offer and sell shares of our common stock from time to time. The selling stockholders may offer and sell shares of our common stock at prevailing market prices, at prices related to such prevailing market prices, at negotiated prices or at fixed prices. If any underwriters, dealers or agents are involved in the sale of any of the shares, their names and any applicable purchase price, fee, commission or discount arrangement between or among them will be set forth, or will be calculable from the information set forth, in any applicable prospectus supplement. See the sections of this prospectus entitled “About this Prospectus” and “Plan of Distribution” for more information. No shares may be sold without delivery of this prospectus and any applicable prospectus supplement describing the method and terms of the offering of such shares. You should carefully read this prospectus and any applicable prospectus supplement before you invest in our common stock.

We are registering up to 7,455,493 shares of common stock, of which (i) up to 3,522,117 of these shares of common stock are being registered for resale by certain selling stockholders (the “Hannathon Selling Stockholders”) pursuant to registration rights (the “Hannathon Registration Rights”) granted pursuant to that certain registration rights agreement, dated as of June 27, 2022, by and among HighPeak Energy, Inc. (“HighPeak Energy”), Hannathon Petroleum, LLC (“Hannathon”) and the other parties signatory thereto (the “Hannathon Registration Rights Agreement”), in connection with acquisitions of certain crude oil and natural gas properties in Howard County, Texas, collectively, from Hannathon and certain other third party private sellers set forth therein (collectively with Hannathon, the “Hannathon Parties”) pursuant to a purchase and sale agreement, dated as of April 26, 2022 (the “Hannathon Acquisition”), by and among the Hannathon Parties, HighPeak Energy and HighPeak Energy Assets, LLC, a wholly owned subsidiary of ours (“HighPeak Assets” and, together with HighPeak Energy, the “HighPeak Parties”) and (ii) up to 3,933,376 of these shares of common stock are being registered for resale by investors in recent private placements (the “PIPE Selling Stockholders” and, together with the Hannathon Selling Stockholders, the “selling stockholders”) pursuant to (a) certain registration rights (the “PIPE Registration Rights”) granted in connection with the issuance of our common stock in a private placement (the “Private Placement”) pursuant to multiple subscription agreements (the “subscription agreements”), each dated as of the date thereof, by and between HighPeak Energy and the purchaser party thereto and (b) that certain registration rights agreement, dated as of August 21, 2020, by and among HighPeak Energy, HighPeak Pure Acquisition, LLC, HighPeak Energy, LP, HighPeak Energy II, LP and certain other securityholders named therein (the “HighPeak Registration Rights Agreement” and such registration rights, the “HighPeak Registration Rights”). See “Description of Securities—Registration Rights” for additional information.

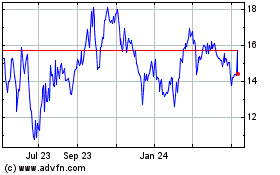

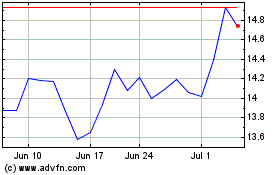

Our common stock is traded on the Nasdaq Global Market (the “Nasdaq”) under the symbol “HPK.” On September 2, 2022, the closing price of our common stock was $26.35.

We are an “emerging growth company” as that term is used in the Jumpstart Our Business Startups Act of 2012, and, as such, have elected to avail ourselves of certain reduced public company reporting requirements for this prospectus and future filings.

You should read carefully this prospectus, the documents incorporated by reference in this prospectus and any prospectus supplement before you invest. See “Risk Factors” beginning on page 4 of this prospectus for information on certain risks related to the purchase of our securities.

The selling stockholders may sell the securities directly to or through underwriters or dealers, and also to other purchasers or through agents. The names of any underwriters or agents that are included in a sale of securities to you, and any applicable commissions or discounts, will be stated in any accompanying prospectus supplement. In addition, the underwriters, if any, may over-allot a portion of the securities

Neither the U.S. Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is September 7, 2022.

TABLE OF CONTENTS

| |

Page

|

| |

|

|

ABOUT THIS PROSPECTUS

|

ii

|

|

WHERE YOU CAN FIND MORE INFORMATION

|

iii

|

|

DOCUMENTS INCORPORATED BY REFERENCE

|

1

|

|

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

|

2

|

|

ABOUT HIGHPEAK ENERGY, INC.

|

3

|

|

RISK FACTORS

|

4

|

|

USE OF PROCEEDS

|

5

|

|

DESCRIPTION OF SECURITIES

|

6

|

|

SELLING STOCKHOLDERS

|

10

|

|

PLAN OF DISTRIBUTION

|

12

|

|

LEGAL MATTERS

|

15

|

|

EXPERTS

|

15

|

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement that we have filed with the U.S. Securities and Exchange Commission (the “SEC”) using a “shelf” registration process. Under this shelf registration process, the selling stockholders named herein may use this prospectus to offer and sell up to an aggregate of 7,455,493 shares of our common stock described in this prospectus from time to time in one or more offerings. This prospectus provides you with a general description of the securities that are registered hereunder that may be offered by the selling stockholders. Each time the selling stockholders offers the securities, we and the selling stockholders will provide you with a prospectus supplement that will describe, among other things, the terms of the offering.

Any prospectus supplement may add, update, or change information contained in this prospectus. Additional information, including the historical and pro forma financial statements and the notes thereto, is incorporated in this prospectus by reference to our reports filed with the SEC. Therefore, before you invest in our securities, you should carefully read this prospectus and any prospectus supplement relating to the securities offered to you together with the additional information incorporated by reference in this prospectus and any prospectus supplement (including the documents described under the heading “Where You Can Find More Information” and “Documents Incorporated by Reference” in both this prospectus and any prospectus supplement).

You should rely only on the information contained in or incorporated by reference in this prospectus or any prospectus supplement. Neither we nor the selling stockholders have authorized any other person to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. The selling stockholders will not make an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should not assume that the information incorporated by reference or provided in this prospectus or any prospectus supplement is accurate as of any date other than the date on the front of those documents.

Unless the context otherwise requires, throughout this prospectus and any applicable prospectus supplement, the words “we,” “us,” “our,” the “Company” or “HighPeak Energy” refer to HighPeak Energy, Inc., the term “securities” refers to the shares of our common stock registered hereunder and the term “selling stockholders” refers to the Hannathon Selling Stockholders and the PIPE Selling Stockholders, collectively.

WHERE YOU CAN FIND MORE INFORMATION

We have filed a registration statement with the SEC under the Securities Act of 1933, as amended (the “Securities Act”), that registers the offer and sale of the securities covered by this prospectus. The registration statement, including the exhibits attached thereto and incorporated by reference therein, contains additional relevant information about us. In addition, we file annual, quarterly and other reports and other information with the SEC. The SEC maintains a website that contains reports, proxy and information statements and other information regarding issuers that file electronically with the SEC. Our SEC filings are available on the SEC’s website at www.sec.gov.

We make available free of charge on or through our website, www.highpeakenergy.com, our filings with the SEC pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) as soon as reasonably practicable after we electronically file such material with, or furnish it to, the SEC. We make our website content available for information purposes only. Information contained on our website is not incorporated by reference into this prospectus and does not constitute a part of this prospectus.

DOCUMENTS INCORPORATED BY REFERENCE

The SEC allows us to “incorporate by reference” the information we have filed with the SEC. This means that we can disclose important information to you without actually including the specific information in this prospectus by referring you to other documents filed separately with the SEC. The information incorporated by reference is an important part of this prospectus. Information that we later provide to the SEC, and which is deemed to be “filed” with the SEC, will automatically update information previously filed with the SEC, and may update or replace information in this prospectus and information previously filed with the SEC.

We incorporate by reference the documents listed below and any filings we make with the SEC under Sections 13(a), 13(c), 14, or 15(d) of the Exchange Act (excluding information deemed to be furnished and not filed with the SEC), after the date on which the registration statement was initially filed with the SEC (including all such documents that we may file with the SEC after the date the registration statement was initially filed and prior to the effectiveness of the registration statement) until all offerings under the registration statement of which this prospectus forms a part are completed or terminated:

| |

●

|

our Quarterly Reports on Form 10-Q for the quarters ended March 31, 2022 filed on May 16, 2022 and June 30, 2022 filed on August 8, 2022;

|

| |

●

|

our Current Reports on Form 8-K filed on February 9, 2022, February 14, 2022, February 22, 2022, April 27, 2022, June 1, 2022, June 23, 2022, June 30, 2022, August 19, 2022, August 24, 2022, September 6, 2022 and September 6, 2022;

|

These reports contain important information about us, our financial condition and our results of operations.

You may obtain copies of any of the documents incorporated by reference in this prospectus from the SEC through the SEC’s website at www.sec.gov, which contains reports, proxy and information statements and other information regarding issuers that file electronically with the SEC. Our filings with the SEC, including Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and amendments to those reports, are available free of charge on our website at www.highpeakenergy.com as soon as reasonably practicable after they are electronically filed with, or furnished to, the SEC. We will provide to each person, including any beneficial owner, to whom this prospectus is delivered, a copy of any or all of the information that has been incorporated by reference in this prospectus but not delivered with the prospectus. You may request a copy of any document incorporated by reference in this prospectus (including exhibits to those documents specifically incorporated by reference in this prospectus), at no cost, by writing or telephoning us at:

HighPeak Energy, Inc.

Attention: Investor Relations

421 W. 3rd Street, Suite 1000

Fort Worth, Texas 76012

(817) 850-9200

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

The information in this prospectus includes “forward-looking statements” within the meaning of Section 27A of the Securities Act, and Section 21E of the Exchange Act. All statements other than statements of historical facts included or incorporated by reference in this prospectus, including, without limitation, statements regarding HighPeak Energy’s future financial position, business strategy, budgets, projected revenues, projected costs, and plans and objectives of management for future operations, are forward-looking statements. Such forward-looking statements are based on the beliefs of management, as well as assumptions made by, and information currently available to, HighPeak Energy’s management. In addition, forward-looking statements generally can be identified by the use of forward-looking terminology such as “believes,” “plans,” “expects,” “anticipates,” “forecasts,” “intends,” “continue,” “may,” “will,” “could,” “should,” “future,” “potential,” “estimate,” or the negative of such terms and similar expressions as they relate to HighPeak Energy are intended to identify forward-looking statements which are generally not historical in nature. The forward-looking statements are based on HighPeak Energy’s current expectations, assumptions, estimates and projections about HighPeak Energy and the industry in which HighPeak Energy operates. Although HighPeak Energy believes that the expectations and assumptions reflected in the forward-looking statements are reasonable as and when made, they involve risks and uncertainties that are difficult to predict and, in many cases, beyond HighPeak Energy’s control. In addition, HighPeak Energy may be subject to currently unforeseen risks that may have a materially adverse effect on it. Accordingly, no assurances can be given that the actual events and results will not be materially different from the anticipated results described in the forward-looking statements. Readers are cautioned not to place undue reliance on forward-looking statements, which speak only as of the date hereof. HighPeak Energy undertakes no duty to publicly update these statements except as required by law. Important factors that could cause actual results to differ materially from HighPeak Energy’s expectations include, but are not limited to, HighPeak Energy’s assumptions about:

| |

●

|

the market prices of crude oil, natural gas liquids (“NGL”), natural gas, and other products or services;

|

| |

●

|

political instability or armed conflict in crude oil or natural gas producing regions, such as the ongoing war between Russia and Ukraine;

|

| |

●

|

the supply and demand for crude oil, NGL, natural gas, and other products or services;

|

| |

●

|

the integration of acquisitions, including the Alamo Acquisitions and the Hannathon Acquisition;

|

| |

●

|

the availability of capital resources;

|

| |

●

|

production and reserve levels;

|

| |

●

|

drilling risks;

|

| |

●

|

the length, scope and severity of the ongoing coronavirus disease (“COVID-19”) pandemic, including the effects of related public health concerns and the impact of continued actions taken by governmental authorities and other third parties in response to the pandemic and its impact on commodity prices, supply and demand considerations and storage capacity;

|

| |

●

|

economic and competitive conditions;

|

| |

●

|

capital expenditures and other contractual obligations;

|

| |

●

|

weather conditions;

|

| |

●

|

inflation rates;

|

| |

●

|

the availability of goods and services and supply chain issues;

|

| |

●

|

legislative, regulatory or policy changes;

|

| |

●

|

cyber-attacks;

|

| |

●

|

occurrence of property acquisitions or divestitures;

|

| |

●

|

the securities or capital markets and related risks such as general credit, liquidity, market and interest-rate risks; and

|

| |

●

|

other factors disclosed under risks and uncertainties, including those described under the heading “Risk Factors” included in our most recent Annual Report on Form 10-K for the year ended December 31, 2021, as supplemented by our Quarterly Reports on Form 10-Q for the quarters ended March 31, 2022 and June 30, 2022.

|

All subsequent written and oral forward-looking statements attributable to HighPeak Energy, or persons acting on its behalf, are expressly qualified in their entirety by the cautionary statements. Except as required by law, HighPeak Energy assumes no duty to update or revise its forward-looking statements based on changes in internal estimates or expectations or otherwise.

Additionally, we caution you that reserve engineering is a process of estimating underground accumulations of crude oil, NGL and natural gas that cannot be measured in an exact way. The accuracy of any reserve estimate depends on the quality of available data, the interpretation of such data and price and cost assumptions made by reserve engineers. In addition, the results of drilling, testing and production activities may justify revisions of estimates that were made previously. If significant, such revisions could change the schedule of any further production and development drilling. Accordingly, reserve estimates may differ significantly from the quantities of crude oil, NGL and natural gas that are ultimately recovered.

ABOUT HIGHPEAK ENERGY, INC.

HighPeak Energy is a Delaware corporation and is an independent crude oil and natural gas company engaged in the acquisition, development and production of crude oil, NGL and natural gas reserves. The Company’s assets are primarily located in Howard and Borden Counties, Texas, which lie within the northeastern part of the crude oil-rich Midland Basin. The Company holds two significant contiguous land positions with the northern position referred to as the Flat Top area and the southern position referred to as the Signal Peak area.

HighPeak Energy focuses on the Midland Basin and specifically the Howard and Borden Counties area of the Midland Basin. Over the last eight decades the Howard and Borden Counties area of the Midland Basin was partially developed with vertical wells using conventional methods, and has recently experienced significant redevelopment activity in the Lower Spraberry and Wolfcamp A formations utilizing modern horizontal drilling technology, with some operators having additional success developing the Middle Spraberry, Jo Mill, Wolfcamp B and Wolfcamp D formations, through the use of modern, high-intensity hydraulic fracturing techniques, decreased frac spacing, increased proppant usage and increased lateral lengths. Our interpretation of available IHS Markit data shows that Howard and Borden Counties have a high crude oil mix percentage. The high margins driven by higher crude oil percentages, has encouraged a high level of drilling activity since 2016 through August 2022 and resulted in significant production growth compared with other counties in the Midland Basin. The Company’s assets include certain rights, title and interests in crude oil and natural gas assets located primarily in Howard and Borden Counties, Texas, which lie within the northeastern part of the crude oil-rich Midland Basin.

Our principal executive offices are located at 421 W 3rd Street, Fort Worth, Texas 76102, and our telephone number is (817) 850-9200. Our website address is www.highpeakenergy.com. The information on our website is not part of this prospectus.

Implications of Being an Emerging Growth Company

We are an “emerging growth company” as defined in the Jumpstart Our Business Startups Act enacted in April 2012. As a result, we may take advantage of reduced reporting requirements that are otherwise applicable to public companies, including delaying auditor attestation of internal control over financial reporting, providing only two years of audited financial statements and related Management’s Discussion and Analysis of Financial Condition and Results of Operations, and reducing executive compensation disclosures.

We will remain an emerging growth company until the earlier to occur of (1) the last day of the fiscal year (a) following the fifth anniversary of the completion of our business combination, which will be August 21, 2025, (b) in which we have total annual gross revenue of at least $1.07 billion, or (c) in which we are deemed to be a “large accelerated filer” under the rules of the SEC, which means the market value of our common stock that is held by non-affiliates exceeds $700 million as of the prior June 30th and (2) the date on which we have issued more than $1.0 billion in non-convertible debt during the prior three-year period.

We have elected to take advantage of certain of the reduced disclosure obligations in the registration statement of which this prospectus is a part and may elect to take advantage of other reduced reporting requirements in future filings. Additionally, we are subject to an extended transition period for complying with new or revised accounting standards. As a result, the information that we provide to our stockholders may be different than what you might receive from other public reporting companies in which you hold equity interests.

RISK FACTORS

An investment in our securities involves a significant degree of risk. Before you invest in our securities, you should carefully consider those risk factors included in our most recent Annual Report on Form 10-K, any subsequently filed Quarterly Reports on Form 10-Q and any subsequently filed Current Reports on Form 8-K, each of which is incorporated herein by reference, and those risk factors that may be included in any applicable prospectus supplement, together with all of the other information included in this prospectus, any prospectus supplement and the documents we incorporate by reference, in evaluating an investment in our securities. If any of these risks were actually to occur, our business, financial condition or results of operations could be materially adversely affected. Additional risks not presently known to us or that we currently believe are immaterial may also significantly impair our business operations and financial condition. Please read “Cautionary Note Regarding Forward-Looking Statements.”

USE OF PROCEEDS

Regarding the 7,455,493 shares of our common stock being offered in this prospectus, we will (i) not receive any of the proceeds from the sale of the 3,522,117 shares of our common stock being offered by the Hannathon Selling Stockholders, and (ii) receive an aggregate $85 million in proceeds from the 3,933,376 shares of our common stock being offered by the PIPE Selling Stockholders that will be used for general corporate purposes.

Pursuant to the subscription agreements, the HighPeak Registration Rights Agreement and the Hannathon Registration Rights Agreement, the Company is required to pay all offering fees and expenses in connection with the registration of the selling stockholders’ shares of common stock. We have agreed to indemnify the selling stockholders against certain liabilities under the Securities Act.

DESCRIPTION OF SECURITIES

The following description of our common stock is not complete and may not contain all the information you should consider before investing in our common stock. This description is a summary of certain provisions contained in, and is qualified in its entirety by reference to, our amended and restated certificate of incorporation (the “A&R Charter”), and our amended and restated bylaws (the “Bylaws”).

Authorized and Outstanding Common Stock

The A&R Charter authorizes the issuance of 600,000,000 shares of our common stock and 10,000,000 shares of preferred stock, par value $0.0001 per share. The outstanding shares of our common stock are duly authorized, validly issued, fully paid and non-assessable. Common stockholders of record are entitled to one vote for each share held on all matters to be voted on by stockholders. As of the date of this prospectus, there were 113,160,067 shares of our common stock issued and outstanding.

Common Stock

Please see our registration statement on Form 8-A12B (File No. 001-39464) filed August 19, 2020, as amended by the Amendment No. 1 on Form 8-A12B/A filed on August 20, 2020, including any amendments or reports that we may file in the future for the purpose of updating such description, including Exhibit 4.4 to our Annual Report on Form 10-K for the fiscal year ended December 31, 2020, filed with the SEC on March 15, 2021, each of which is incorporated by reference herein, for a description of our common stock.

Transfer Agent and Registrar

The transfer agent for HighPeak Energy’s common stock is Continental Stock Transfer & Trust Company (“Continental”). HighPeak Energy has agreed to indemnify Continental in its role as transfer agent, its agents and each of its stockholders, directors, officers and employees against all liabilities, including judgments, costs and reasonable counsel fees that may arise out of acts performed or omitted for its activities in that capacity, except for any liability due to any gross negligence, willful misconduct or bad faith of the indemnified person or entity.

Certain Anti-Takeover Provisions of Delaware Law and HighPeak Energy’s A&R Charter and Bylaws

HighPeak Energy is subject to the provisions of Section 203 of the Delaware General Corporation Law (“DGCL”) regulating corporate takeovers. This statute prevents certain Delaware corporations, under certain circumstances, from engaging in a “business combination” with:

| |

●

|

a stockholder who owns 15% or more of HighPeak Energy’s outstanding voting stock (otherwise known as an “interested stockholder”);

|

| |

●

|

an affiliate of an interested stockholder; or

|

| |

●

|

an associate of an interested stockholder, for three years following the date that the stockholder became an interested stockholder.

|

A “business combination” includes a merger or sale of more than 10% of HighPeak Energy’s assets. However, the above provisions of Section 203 do not apply if:

| |

●

|

the board of directors of HighPeak Energy (the “Board”) approves the transaction that made the stockholder an “interested stockholder,” prior to the date of the transaction;

|

| |

●

|

after the completion of the transaction that resulted in the stockholder becoming an interested stockholder, that stockholder owned at least 85% of HighPeak Energy’s voting stock outstanding at the time the transaction commenced, other than statutorily excluded shares of voting common stock; or

|

| |

●

|

on or subsequent to the date of the transaction, the business combination is approved by the Board and authorized at a meeting of HighPeak Energy’s stockholders, and not by written consent, by an affirmative vote of at least two-thirds of the outstanding voting stock not owned by the interested stockholder.

|

HighPeak Energy’s authorized but unissued voting common stock and preferred stock are available for future issuances without stockholder approval and could be utilized for a variety of corporate purposes, including future offerings to raise additional capital, acquisitions and employee benefit plans. The existence of authorized but unissued and unreserved voting common stock and preferred stock could render more difficult or discourage an attempt to obtain control of HighPeak Energy by means of a proxy contest, tender offer, merger or otherwise.

Written Consent by Stockholders

HighPeak Energy’s A&R Charter provides that prior to the first date in which HighPeak Pure Acquisition, LLC, HighPeak Energy, LP, HighPeak Energy II, LP, HighPeak Energy, LLC and Jack Hightower and each of their respective affiliates and certain permitted transferees (collectively, the “HighPeak Group”) no longer collectively beneficially owns more than 50% of the outstanding HighPeak Energy voting securities, HighPeak Energy stockholders may take action by written consent of the holders of not less than the minimum number of votes that would be necessary to authorize or take such action at a meeting at which all shares entitled to vote thereon were present and voted. Before such time, any action required or permitted to be taken by HighPeak Energy’s stockholders that is approved in advance by the Board may be effected without a meeting, without prior notice and without a vote of stockholders, if a consent or consents in writing, setting forth the action so taken, is or are signed by the holders of outstanding stock having not less than the minimum number of votes that would be necessary to authorize or take such action at a meeting at which all shares entitled to vote thereon were present and voted. If any such action by written consent is taken then HighPeak Energy will notify its stockholders of the same.

Special Meeting of Stockholders

The Bylaws provide that special meetings of its stockholders may be called only by a majority vote of the Board, by HighPeak Energy’s President or by HighPeak Energy’s Chairman.

Advance Notice Requirements for Stockholder Proposals and Director Nominations

The Bylaws provide that stockholders seeking to bring business before HighPeak Energy’s annual meeting of stockholders, or to nominate candidates for election as directors at HighPeak Energy’s annual meeting of stockholders, must provide timely notice of their intent in writing. To be timely, a stockholder’s notice will need to be received by the Company’s secretary at HighPeak Energy’s principal executive offices not later than the close of business on the ninetieth (90th) day nor earlier than the close of business on the one hundred twentieth (120th) day prior to the anniversary date of the immediately preceding annual meeting of stockholders. Pursuant to Rule 14a-8 of the Exchange Act, proposals seeking inclusion in HighPeak Energy’s Annual Proxy Statement must comply with the notice periods contained therein. The Bylaws also specify certain requirements as to the form and content of a stockholders’ meeting. These provisions may preclude HighPeak Energy’s stockholders from bringing matters before HighPeak Energy’s annual meeting of stockholders or from making nominations for directors at HighPeak Energy’s annual meeting of stockholders.

Exclusive Forum

The A&R Charter provides that a stockholder bringing a claim subject to Article 8 of the A&R Charter will be required to bring that claim in the Court of Chancery in the State of Delaware, subject to the Court of Chancery in the State of Delaware having personal jurisdiction over the defendants. The forum selection provision is not intended to apply to claims arising under the Securities Act or the Exchange Act. To the extent the provision could be constructed to apply to such claims, there is uncertainty as to whether a court would enforce such provision in connection with such claims. The A&R Charter also provides that any person or entity purchasing or otherwise acquiring any interest in shares of our capital stock will be deemed to have notice of, and to have consented to, the provisions of Article 8 of the A&R Charter. Stockholders will not be deemed, by operation of Article 8 of the A&R Charter alone, to have waived claims arising under the federal securities laws and the rules and regulations promulgated thereunder. The enforceability of similar exclusive forum provisions in other companies’ certificates of incorporation has been challenged in legal proceedings, and it is possible that, in connection with one or more actions or proceedings described above, a court could rule that this provision in the A&R Charter is inapplicable or unenforceable.

If any action the subject matter of which is within the scope of the forum selection provision described in the preceding paragraph is filed in a court other than the Court of Chancery (or, if the Court of Chancery does not have jurisdiction, another state court or a federal court located within the State of Delaware) (a “Foreign Action”) in the name of any stockholder, such stockholder shall be deemed to have consented to (i) the personal jurisdiction of the state and federal courts located within the State of Delaware in connection with any action brought in any such court to enforce the forum selection provision (a “Foreign Enforcement Action”) and (ii) having service of process made upon such stockholder in any such Foreign Enforcement Action by service upon such stockholder’s counsel in the Foreign Action as agent for such stockholder.

Rule 144

Pursuant to Rule 144, a person who has beneficially owned restricted shares of HighPeak Energy’s voting common stock for at least six months would be entitled to sell their securities provided that (i) such person is not deemed to have been one of HighPeak Energy’s affiliates at the time of, or at any time during the three months preceding, a sale and (ii) HighPeak Energy is subject to the Exchange Act periodic reporting requirements for at least three months before the sale and has filed all required reports under Section 13 or 15(d) of the Exchange Act during the twelve months (or such shorter period as HighPeak Energy was required to file reports) preceding the sale.

Persons who have beneficially owned restricted shares of HighPeak Energy’s voting common stock for at least six months but who are HighPeak Energy’s affiliates at the time of, or at any time during the three months preceding, a sale, would be subject to additional restrictions, by which such person would be entitled to sell within any three-month period only a number of securities that does not exceed the greater of:

| |

●

|

1% of the total number of shares of such securities then-outstanding; or

|

| |

●

|

the average weekly reported trading volume of such securities during the four calendar weeks preceding the filing of a notice on Form 144 with respect to the sale.

|

Sales by HighPeak Energy’s affiliates under Rule 144 are also limited by manner of sale provisions and notice requirements and to the availability of current public information about us.

Restrictions on the Use of Rule 144 by Shell Companies or Former Shell Companies

Rule 144 is not available for the resale of securities initially issued by shell companies (other than business combination related shell companies) or issuers that have been at any time previously a shell company. However, Rule 144 also includes an important exception to this prohibition if the following conditions are met:

| |

●

|

the issuer of the securities that was formerly a shell company has ceased to be a shell company;

|

| |

●

|

the issuer of the securities is subject to the reporting requirements of Section 13 or 15(d) of the Exchange Act;

|

| |

●

|

the issuer of the securities has filed all Exchange Act reports and materials required to be filed, as applicable, during the preceding twelve months (or such shorter period that the issuer was required to file such reports and materials), other than Current Reports on Form 8-K; and

|

| |

●

|

at least one year has elapsed from the time that the issuer filed current Form 10 type information with the SEC reflecting its status as an entity that is not a shell company.

|

Registration Rights

This registration statement is being filed pursuant to our obligations under the PIPE Registration Rights, HighPeak Registration Rights and the Hannathon Registration Rights, each discussed in greater detail below. In accordance with the terms of the PIPE Registration Rights, HighPeak Registration Rights and the Hannathon Registration Rights, we have agreed to pay all fees and expenses with respect to the filing hereof.

Private Placement Registration Rights

During the period between August 22, 2022 and September 2, 2022, in connection with the Private Placement, we entered into multiple subscription agreements with the PIPE Selling Stockholders for the sale of 3,933,376 shares of common stock for $85 million. Pursuant to such subscription agreements, certain PIPE Selling Stockholders, not party to the HighPeak Registration Rights Agreement, were granted the PIPE Registration Rights, pursuant to which, we agreed to, among other things, file with the SEC a shelf registration statement registering for resale the shares acquired by certain PIPE Selling Stockholders and to use commercially reasonable efforts to have such shelf registration statement declared effective as soon as practicable after the filing thereof. Additionally, certain PIPE Selling Stockholders are party to the HighPeak Registration Rights Agreement, and agreed in their individual subscription agreements, that the shares they acquired thereby would be registrable securities pursuant to the HighPeak Registration Rights granted under the HighPeak Registration Rights Agreement. Pursuant to the HighPeak Registration Rights Agreement, we agreed to use our commercially reasonable efforts to file and maintain effective with the SEC one or more shelf registration statements as necessary to register for resale any such registrable securities thereunder.

Hannathon Registration Rights

On June 27, 2022, the HighPeak Parties completed the Hannathon Acquisition with the Hannathon Parties, pursuant to which we issued 3,522,117 shares of our common stock, in combination with cash, as consideration for the Hannathon Acquisition. In connection with the Hannathon Acquisition, we granted Hannathon Registration Rights, whereby we agreed to, among other things, file with the SEC a shelf registration statement registering for resale the shares of our common stock issued as partial consideration in connection with the closing of the Hannathon Acquisition to satisfy our obligation under the Hannathon Registration Rights Agreement to use our commercially reasonable efforts to maintain an effective shelf registration statement for the holders.

Listing of Securities

HighPeak Energy’s common stock is listed for trading on the Nasdaq under the symbols “HPK.”

SELLING STOCKHOLDERS

This prospectus covers the offering for resale, from time to time, in one or more offerings, of up to 7,455,493 shares of common stock by the selling stockholders of which (i) up to 3,522,117 shares of our common stock are being offered by the Hannathon Selling Stockholders in connection with the Hannathon Acquisition and (ii) up to 3,933,376 shares of our common stock are being offered by the PIPE Selling Stockholders in connection with the Private Placement, and are collectively subject to the registration rights granted pursuant thereto. See “Description of Securities—Registration Rights,” for more information. The selling stockholders acquired these shares of common stock in the ordinary course of business and at the time of the Hannathon Acquisition or the Private Placement did not have any arrangement or understanding with any person to distribute these shares of common stock.

The percent of beneficial ownership for the selling stockholders is based on 113,160,067 shares of our common stock outstanding as of the date of this prospectus. Beneficial ownership is determined in accordance with the rules of the SEC. These rules generally attribute beneficial ownership of securities to persons who possess sole or shared voting or dispositive power with respect to such securities. Except as otherwise indicated, all persons listed below have sole voting and dispositive power with respect to the shares of our common stock beneficially owned by them. Unless otherwise noted, the mailing address of each listed beneficial owner is 421 W. 3rd Street, Suite 1000, Fort Worth, Texas 76102.

The following table sets forth the number of shares of our common stock being offered by the selling stockholders, including their donees, pledgees, transferees or other successors-in-interest. The following table also sets forth the number of shares of common stock known to us, based upon written representations by the selling stockholders, to be beneficially owned by the selling stockholders as of the date of this prospectus. The selling stockholders are not making any representation that any shares of our common stock covered by this prospectus will be offered for sale. The selling stockholders may sell all, some or none of the shares of common stock covered by this prospectus and reserves the right to accept or reject, in whole or in part, any proposed sale of the shares of our common stock. Please read “Plan of Distribution” for additional information.

| |

|

|

Shares Beneficially Owned

Prior to the Offering

|

|

Shares

Offered

|

|

Shares Beneficially Owned

After the Offering

|

|

Selling Stockholder

|

|

|

Number(2)

|

|

% (1)

|

|

Hereby |

|

Number

|

|

% (1)

|

|

Jack Hightower (3)(4)(5)(6)(7)

|

|

|

91,492,319

|

|

80.9%

|

|

462,749

|

|

91,029,570

|

|

80.4%

|

|

John Paul DeJoria Family Trust (8)(9)

|

|

|

13,313,744

|

|

11.8%

|

|

2,313,744

|

|

11,000,000

|

|

9.7%

|

|

PIPE Employee Stockholders (10)

|

|

|

220,969

|

|

*

|

|

220,969

|

|

—

|

|

—

|

|

PIPE Other Investors (11)

|

|

|

935,914

|

|

*

|

|

935,914

|

|

—

|

|

—

|

|

Hannathon Stockholders Group 1 (12)

|

|

|

1,058,098

|

|

*

|

|

1,058,098

|

|

—

|

|

—

|

|

Hannathon Stockholders Group 2 (13)

|

|

|

653,593

|

|

*

|

|

653,593

|

|

—

|

|

—

|

|

Hannathon Stockholders Group 3 (14)

|

|

|

951,605

|

|

*

|

|

951,605

|

|

—

|

|

—

|

|

Hannathon Stockholders Group 4 (15)

|

|

|

858,821

|

|

*

|

|

858,821

|

|

—

|

|

—

|

|

*

|

Represents beneficial ownership of less than one percent (1%) of shares outstanding.

|

|

(1)

|

As of September 7, 2022, there were 113,160,067 shares of our common stock outstanding.

|

|

(2)

|

Represents the number of shares of our common stock being registered on behalf of the selling stockholders pursuant to this registration statement in connection with the Private Placement and Hannathon Acquisition, respectively.

|

|

(3)

|

Includes shares beneficially owned by (i) HighPeak Pure Acquisition, LLC (“Sponsor”), of which this individual is a manager, (ii) HighPeak Energy Partners, LP (“HPEP I”), of which this individual has the number of votes necessary to constitute a majority of the total number of votes held by all of the managers of the general partner of HPEP I’s general partner and (iii) HighPeak Energy Partners II, LP (“HPEP II”), of which this individual has the number of votes necessary to constitute a majority of the total number of votes held by all of the managers of the general partner of HPEP II’s general partner, and, therefore, may be deemed to have voting and dispositive power over shares held by such entities. Mr. Hightower disclaims beneficial ownership of such shares except to the extent of his pecuniary interest therein.

|

|

(4)

|

Includes (i) 2,336 shares of common stock and (ii) 2,336 warrants to purchase shares of common stock, exercisable within sixty (60) days of the date hereof, beneficially owned by Mr. Hightower’s family member. Mr. Hightower disclaims beneficial ownership of such shares except to the extent of his pecuniary interest therein.

|

|

(5)

|

Includes (i) 6,847,495 shares issuable upon the exercise of stock options that have been vested as of the date hereof and (ii) 681,298 shares issuable upon the exercise of warrants exercisable within sixty (60) days of the date hereof.

|

|

(6)

|

Includes 1,385,500 shares of restricted common stock which vests on the earlier of November 4, 2024 or a change in control of the Company.

|

|

(7)

|

Includes 1,557,521 shares of common stock held by Mr. Hightower which are pledged to secure a bank loan.

|

|

(8)

|

Includes 5,500,000 shares of common stock and 5,500,000 warrants owned by The John Paul DeJoria Family Trust at the Closing of the business combination. The address of the John Paul DeJoria Family Trust is 109 West 7th Street, Suite 200, Georgetown, Texas 78626.

|

|

(9)

|

Includes 5,500,000 shares of common stock issuable upon the exercise of the warrants exercisable within sixty (60) days of the date hereof.

|

|

(10)

|

This group includes fifteen (15) PIPE Selling Stockholders that may be affiliated with HighPeak Energy as a result of their employment, including executive officers and certain directors, and business relationships with the HighPeak Group and its affiliates otherwise not listed above. Collectively, this group of selling stockholders is registering less than 1.0% of our common stock outstanding as of the date hereof.

|

|

(11)

|

This group includes approximately eleven (11) other PIPE Selling Stockholders not otherwise listed above. Collectively, this group of selling stockholders is registering less than 1.0% of our common stock outstanding as of the date hereof.

|

|

(12)

|

This group includes approximately two (2) Hannathon Selling Stockholders. Collectively, this group of selling stockholders is registering less than 1.0% of our common stock outstanding as of the date hereof.

|

|

(13)

|

This group includes approximately fourteen (14) other Hannathon Selling Stockholders. Collectively, this group of selling stockholders is registering less than 1.0% of our common stock outstanding as of the date hereof.

|

|

(14)

|

This group includes approximately twenty-nine (29) other Hannathon Selling Stockholders. Collectively, this group of selling stockholders is registering less than 1.0% of our common stock outstanding as of the date hereof.

|

|

(15)

|

This group includes approximately three (3) other Hannathon Selling Stockholders. Collectively, this group of selling stockholders is registering less than 1.0% of our common stock outstanding as of the date hereof.

|

Material Relationships with the Selling Stockholders

To our knowledge, none of the selling shareholders has, or during the three years prior to the date of this prospectus has had, any position, office or other material relationships with us or any of our affiliates, except that (i) Jack Hightower, our Chairman of the Board and Chief Executive Officer and the John Paul DeJoria Family Trust, an affiliate of ours, are each party to individual subscription agreements in connection with the Private Placement and the HighPeak Registration Rights Agreement which provides registration rights relating to the resale shares of common stock described above and (ii) Michael L. Hollis, our President and a member of our Board, Rodney L. Woodard, our Chief Operating Officer and Steven W. Tholen, our Chief Financial Officer, are each party to individual subscription agreements in connection with the Private Placement which provides registration rights relating to the resale shares of common stock described above.

Our material relationships with certain of the selling stockholders and their affiliates are set forth in “Certain Relationships and Related Party Transactions” our Definitive Proxy Statement on Schedule 14A filed with the SEC on April 20, 2022, which is incorporated herein by reference.

Any applicable prospectus supplement, amendment or other permissible disclosure document will also disclose whether any of the selling shareholders has held any position or office with, has been employed by or otherwise has had a material relationship with us during the three years prior to the date of the prospectus supplement.

PLAN OF DISTRIBUTION

This prospectus includes the registration for resale of up to 7,455,493 shares of our common stock by the selling stockholders of which (i) up to 3,522,117 shares of our common stock were issued in combination with cash as consideration in connection with the Hannathon Acquisition and (ii) up to 3,933,376 shares of our common stock were issued in connection with the completion of the Private Placement. As of the date of this prospectus, the selling stockholders have advised us that they do not currently have any plan of distribution. Unless the context otherwise requires, as used in this prospectus, “selling stockholders” includes the selling stockholders named in the table included in the section above entitled “Selling Stockholders” and donees, pledgees, transferees or other successors-in-interest selling securities received from the selling stockholders as a gift, pledge, partnership distribution or other transfer after the date of this prospectus.

The selling stockholders may offer and sell all or a portion of the securities covered by this prospectus from time to time, in one or more or any combination of the following transactions:

| |

●

|

on the Nasdaq, in the over-the-counter market or on any other national securities exchange on which our securities are listed or traded;

|

| |

●

|

in privately negotiated transactions;

|

| |

●

|

in underwritten transactions;

|

| |

●

|

in a block trade in which a broker-dealer will attempt to sell the offered securities as agent but may purchase and resell a portion of the block as principal to facilitate the transaction;

|

| |

●

|

through purchases by a broker-dealer as principal and resale by the broker-dealer for its account pursuant to this prospectus;

|

| |

●

|

in ordinary brokerage transactions and transactions in which the broker solicits purchasers;

|

| |

●

|

through the writing of options (including put or call options), whether the options are listed on an options exchange or otherwise;

|

| |

●

|

through the distribution of the securities by the selling stockholder to its partners, members or stockholders;

|

| |

●

|

in short sales entered into after the effective date of the registration statement of which this prospectus is a part; and

|

| |

●

|

“at the market” or through market makers or into an existing market for the securities.

|

The selling stockholders may sell the securities at prices then prevailing, related to the then prevailing market price or at negotiated prices. The offering price of the securities from time to time will be determined by us and by the selling stockholders and, at the time of the determination, may be higher or lower than the market price of our securities on the Nasdaq or any other exchange or market.

The selling stockholders may also sell our securities short and deliver these securities to close out its short positions, or loan or pledge the securities to broker-dealers that in turn may sell these securities. The shares may be sold directly or through broker-dealers acting as principal or agent, or pursuant to a distribution by one or more underwriters on a firm commitment or best-efforts basis. The selling stockholders may also enter into hedging transactions with broker-dealers. In connection with such transactions, broker-dealers of other financial institutions may engage in short sales of our securities in the course of hedging the positions they assume with us and with the selling stockholders. The selling stockholders may also enter into options or other transactions with broker-dealers or other financial institutions which require the delivery to such broker-dealer or other financial institution of securities offered by this prospectus, which securities such broker-dealer or other financial institution may resell pursuant to this prospectus (as supplemented or amended to reflect such transaction). The selling stockholders also may resell all or a portion of the securities in open market transactions in reliance upon Rule 144 under the Securities Act, provided that it meets the criteria and conforms to the requirements of that rule. In connection with an underwritten offering, underwriters or agents may receive compensation in the form of discounts, concessions or commissions from the selling stockholders or from purchasers of the offered securities for whom they may act as agents. In addition, underwriters may sell the securities to or through dealers, and those dealers may receive compensation in the form of discounts, concessions or commissions from the underwriters and/or commissions from the purchasers for whom they may act as agents. The selling stockholders and any underwriters, dealers or agents participating in a distribution of the securities may be deemed to be “underwriters” within the meaning of the Securities Act, and any profit on the sale of the securities by the selling stockholders and any commissions received by broker-dealers may be deemed to be underwriting commissions under the Securities Act.

The selling stockholders may agree to indemnify an underwriter, broker-dealer or agent against certain liabilities related to the sale of the securities, including liabilities under the Securities Act. The selling stockholders have advised us that they have not entered into any agreements, understandings or arrangements with any underwriters or broker-dealers regarding the sale of its securities. Upon our notification by the selling stockholders that any material arrangement has been entered into with an underwriter or broker-dealer for the sale of securities through a block trade, special offering, exchange distribution, secondary distribution or a purchase by an underwriter or broker-dealer, we will file a supplement to this prospectus, if required, pursuant to Rule 424(b) under the Securities Act, disclosing certain material information, including:

| |

●

|

the name of the selling stockholders (if other than as disclosed herein);

|

| |

●

|

the number of securities being offered;

|

| |

●

|

the terms of the offering;

|

| |

●

|

the names of the participating underwriters, broker-dealers or agents;

|

| |

●

|

any discounts, commissions or other compensation paid to underwriters or broker-dealers and any discounts, commissions or concessions allowed or reallowed or paid by any underwriters to dealers;

|

| |

●

|

the public offering price; and

|

| |

●

|

other material terms of the offering.

|

In addition, upon being notified by the selling stockholders that a donee, pledgee, transferee or other successor-in-interest intends to sell its securities, we will, to the extent required, promptly file a supplement to this prospectus to name specifically such person as selling a stockholder.

The selling stockholders are subject to the applicable provisions of the Exchange Act and the rules and regulations under the Exchange Act, including Regulation M. This regulation may limit the timing of purchases and sales of securities offered in this prospectus by the selling stockholders. The anti-manipulation rules under the Exchange Act may apply to sales of securities in the market and to the activities of the selling stockholders and their affiliates. Furthermore, Regulation M may restrict the ability of any person engaged in the distribution of the securities to engage in market-making activities for the particular securities being distributed for a period of up to five business days before the distribution. The restrictions may affect the marketability of the securities and the ability of any person or entity to engage in market-making activities for the securities.

In compliance with guidelines of the Financial Industry Regulatory Authority (“FINRA”), the maximum compensation or discount to be received by any FINRA member or independent broker or dealer may not exceed 8% of the aggregate amount of securities offered pursuant to this prospectus.

To the extent required, this prospectus may be amended and/or supplemented from time to time to describe a specific plan of distribution. Instead of selling the securities under this prospectus, the selling stockholders may sell the securities in compliance with the provisions of Rule 144 under the Securities Act, if available, or pursuant to other available exemptions from the registration requirements of the Securities Act.

LEGAL MATTERS

The validity of the issuance of the securities offered in this prospectus will be passed upon for us by Vinson & Elkins L.L.P., Houston, Texas. If certain legal matters in connection with an offering of the securities made by this prospectus and a related prospectus supplement are passed upon by counsel for the underwriters of such offering, that counsel will be named in the applicable prospectus supplement related to that offering.

EXPERTS

The consolidated balance sheets of HighPeak Energy, Inc. and its subsidiaries as of December 31, 2021 and 2020 (Successor Company), and the related consolidated statements of operations, changes in stockholders’ equity, and cash flows for the year ended December 31, 2021 and the period from August 22, 2020 through December 31, 2020 (Successor Company) and the consolidated statements of operations, changes in partners’ capital, and cash flows for the period from January 1, 2020 through August 21, 2020 (Predecessor Company) included in this prospectus have been audited by Weaver and Tidwell, L.L.P., independent registered public accounting firm, as stated in their report appearing herein and is included upon reliance of the report of such firm given upon their authority as experts in accounting and auditing.

The audited statements of revenues and direct operating expenses of the assets acquired in the Hannathon Acquisition for the years ended December 31, 2021 and 2020, have been audited by Whitley Penn, LLP, independent auditors, as stated in their report thereon, and incorporated herein by reference. Such financial statements are incorporated herein in reliance upon such report given on the authority of such firm as experts in accounting and auditing.

The information included herein regarding estimated quantities of proved reserves of the Company, the future net revenues from those reserves and their present value as of December 31, 2021, are based on the proved reserves report prepared by Cawley, Gillespie & Associates, Inc. These estimates are included herein in reliance upon the authority of such firm as an expert in these matters.

PART II

INFORMATION NOT REQUIRED IN PROSPECTUS

|

Item 14.

|

Other Expenses of Issuance and Distribution.

|

Set forth below are the expenses (other than underwriting discounts and commissions) expected to be incurred in connection with the offering of the securities registered hereby. Certain expenses disclosed below are to be borne by the Company.

|

SEC registration fee

|

|

$ |

16,836 |

|

|

Printing and engraving expenses

|

|

|

* |

|

|

Accounting fees and expenses

|

|

|

* |

|

|

Legal fees and expenses

|

|

|

* |

|

|

Transfer agent and registrar fees

|

|

|

* |

|

|

Miscellaneous

|

|

|

* |

|

|

Total

|

|

$ |

* |

|

|

*

|

To be provided by amendment.

|

|

Item 15.

|

Indemnification of Directors and Officers.

|

Section 145 of the DGCL authorizes a court to award, or a corporation’s board of directors to grant, indemnity to directors and officers in terms sufficiently broad to permit such indemnification under certain circumstances for liabilities, including reimbursement for expenses incurred, arising under the Securities Act.

HighPeak Energy’s A&R Charter provides for indemnification of its directors, officers, employees and other agents to the maximum extent permitted by the DGCL, and the Bylaws provide for indemnification of its directors, officers, employees and other agents to the maximum extent permitted by the DGCL. Further, the Bylaws permit HighPeak Energy to secure insurance on behalf of any officer, director or employee for any liability arising out of his or her actions regardless of whether Delaware law would permit indemnification. The Company has purchased a policy of directors’ and officers’ liability insurance that insures the Company’s directors and officers against the cost of defense, settlement or payment of a judgement in some circumstances and insures the Company against the Company’s obligations to indemnify the directors and officers.

These provisions may discourage stockholders from bringing a lawsuit against the Company’s directors for breach of their fiduciary duty. These provisions also may have the effect of reducing the likelihood of derivative litigation against directors and officers, even though such action, if successful, might otherwise benefit us and our stockholders. Furthermore, a stockholder’s investment may be adversely affected to the extent the Company pays the costs of settlement and damage awards against directors and officers pursuant to these indemnification provisions.

In addition, HighPeak Energy has entered into indemnification agreements with each of its directors and Section 16 officers. These agreements require us to indemnify these individuals to the fullest extent permitted under Delaware law and to advance expenses incurred as a result of any proceeding against them as to which they could be indemnified.

The following documents are filed as exhibits to this registration statement, including those exhibits incorporated herein by reference to a prior filing of HighPeak Energy, Inc. under the Securities Act or the Exchange Act as indicated in parentheses:

|

Exhibit

Number

|

|

Exhibits

|

|

1.1*

|

|

Form of Underwriting Agreement.

|

|

2.1#

|

|

Purchase and Sale Agreement, dated as of April 26, 2022, by and among HighPeak Energy, Inc., HighPeak Energy Assets, LLC, Hannathon Petroleum, LLC and the other sellers party thereto (incorporated by reference to Exhibit 2.1 to the Company’s Current Report on Form 8-K (File No. 001-39464) filed with the SEC on June 30, 2022).

|

|

3.1

|

|

Amended and Restated Certificate of Incorporation of HighPeak Energy, Inc. (incorporated by reference to Exhibit 3.1 to the Company’s Current Report on Form 8-K (File No. 001-39464) filed with the SEC on August 27, 2020).

|

|

3.2

|

|

Amended and Restated Bylaws of HighPeak Energy, Inc. (incorporated by reference to Exhibit 3.1 to the Company’s Current Report on Form 8-K (File No. 001-39464) filed with the SEC on November 9, 2020).

|

|

4.1#

|

|

Registration Rights Agreement, dated as of June 27, 2022, by and among HighPeak Energy, Inc., Hannathon Petroleum, LLC, the parties listed as signatories hetero in their capacities as holders of Registrable Securities, and any Transferees thereof which hold Registrable Securities (incorporated by reference to Exhibit 4.1 to the Company’s Current Report on Form 8-K (File No. 001-39464) filed with the SEC on June 30, 2022).

|

|

4.2

|

|

Registration Rights Agreement, dated as of August 21, 2020, by and among HighPeak Energy, Inc., HighPeak Pure Acquisition, LLC, HighPeak Energy, LP, HighPeak Energy II, LP, HighPeak Energy III, LP and certain other security holders named therein (incorporated by reference to Exhibit 4.4 to the Company’s Current Report on Form 8-K (File No. 001-39464) filed with the SEC on August 27, 2020).

|

|

10.1

|

|

Form of Subscription Agreement by and among HighPeak Energy, Inc. and Investors (incorporated by reference to Exhibit 10.1 to the Company’s Current Report on Form 8-K (File No. 001-39464) filed with the SEC on August 24, 2022).

|

|

5.1**

|

|

Opinion of Vinson & Elkins L.L.P. as to the legality of the securities being registered.

|

|

23.1**

|

|

Consent of Weaver and Tidwell, L.L.P., independent registered public accounting firm for HighPeak Energy, Inc.

|

|

23.2**

|

|

Consent of Whitley Penn, LLP, independent auditors for the assets acquired in the Hannathon Acquisition.

|

|

23.3**

|

|

Consent of Cawley, Gillespie & Associates, Inc.

|

|

23.4**

|

|

Consent of Vinson & Elkins L.L.P. (included as part of its opinion filed as Exhibit 5.1).

|

|

24.1**

|

|

Powers of Attorney (included on signatures pages of this registration statement).

|

|

99.1

|

|

Reserve Report of HighPeak Energy as of December 31, 2021 (incorporated by reference to Exhibit 99.2 to the Company’s Current Report on Form 8-K (File No. 001-39464) filed with the SEC on February 9, 2022).

|

|

107**

|

|

Calculation of Filing Fee Table.

|

|

*

|

To be filed by amendment.

|

|

**

|

Filed herewith.

|

|

#

|

Pursuant to Regulation S-K, Item 601(b)(2), the Exhibits and Schedules to the Purchase Agreement referenced in Exhibit 2.1 and Exhibit 4.1, respectively, above, as listed below, have not been filed. The Registrant agrees to furnish supplementally a copy of any omitted Exhibit or Schedule to the SEC upon request; provided, however, that the Registrant may request confidential treatment of omitted items.

Further, certain portions of these exhibits have been omitted and include a prominent statement on the first page that certain identified information has been excluded from the exhibit because it is both (i) not material and (ii) is the type that the registrant treats as private or confidential as required by Item 601(b)(2)(ii) of Regulation S-K. Information that was omitted has been noted in the exhibit with a placeholder identified by the mark “***” to indicate where omissions have been made.

|

The undersigned registrant hereby undertakes:

| |

(a)

|

To file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement:

|

| |

(i)

|

to include any prospectus required by Section 10(a)(3) of the Securities Act;

|

| |

(ii)

|

to reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the SEC pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than a 20% change in the maximum aggregate offering price set forth in the “Calculation of Registration Fee” table in the effective registration statement;

|

| |

(iii)

|

to include any material information with respect to the plan of distribution not previously disclosed in the registration statement or any material change to such information in the registration statement;

|

provided, however, that paragraphs (a)(i), (a)(ii) and (a)(iii) do not apply if the information required to be included in a post-effective amendment by those paragraphs is contained in reports filed with or furnished to the SEC by the registrant pursuant to Section 13 or 15(d) of the Exchange Act that are incorporated by reference in the registration statement, or is contained in a form of prospectus filed pursuant to Rule 424(b) that is part of the registration statement.

| |

(b)

|

That, for the purpose of determining any liability under the Securities Act, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

|

| |

(c)

|

To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

|

| |

(d)

|

That, for the purpose of determining liability under the Securities Act to any purchaser:

|

| |

(i)

|

each prospectus filed by the registrant pursuant to Rule 424(b)(3) shall be deemed to be part of the registration statement as of the date the filed prospectus was deemed part of and included in the registration statement; and

|

| |

(ii)

|

each prospectus required to be filed pursuant to Rule 424(b)(2), (b)(5) or (b)(7) as part of a registration statement in reliance on Rule 430B relating to an offering made pursuant to Rule 415(a)(1)(i), (vii) or (x) for the purpose of providing the information required by Section 10(a) of the Securities Act shall be deemed to be part of and included in the registration statement as of the earlier of the date such form of prospectus is first used after effectiveness or the date of the first contract of sale of securities in the offering described in the prospectus. As provided in Rule 430B, for liability purposes of the issuer and any person that is at that date an underwriter, such date shall be deemed to be a new effective date of the registration statement relating to the securities in the registration statement to which that prospectus relates, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof; provided, however, that no statement made in a registration statement or prospectus that is part of the registration statement or made in a document incorporated or deemed incorporated by reference into the registration statement or prospectus that is part of the registration statement will, as to a purchaser with a time of contract of sale prior to such effective date, supersede or modify any statement that was made in the registration statement or prospectus that was part of the registration statement or made in any such document immediately prior to such effective date.

|

The undersigned registrant hereby undertakes that, for purposes of determining any liability under the Securities Act each filing of the registrant’s annual report pursuant to Section 13(a) or 15(d) of the Exchange Act (and, where applicable, each filing of an employee benefit plan’s annual report pursuant to Section 15(d) of the Exchange Act) that is incorporated by reference in the registration statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.