Current Report Filing (8-k)

October 05 2021 - 9:03AM

Edgar (US Regulatory)

0001657853

false

0000047129

false

8-K

2021-10-04

false

false

false

false

false

8501 Williams Road

Estero

Florida

301-7000

0001657853

2021-10-04

2021-10-04

0001657853

htz:TheHertzCorprationMember

2021-10-04

2021-10-04

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

|

Co-Registrant CIK

|

0000047129

|

|

Co-Registrant Amendment Flag

|

false

|

|

Co-Registrant Form Type

|

8-K

|

|

Co-Registrant DocumentPeriodEndDate

|

2021-10-04

|

|

Co-Registrant Written Communications

|

false

|

|

Co-Registrant Solicitating Materials

|

false

|

|

Co-Registrant PreCommencement Tender Offer

|

false

|

|

Co-Registrant PreCommencement Issuer Tender Offer

|

false

|

|

Co-Registrant Emerging Growth Company

|

false

|

|

|

8501 Williams Road

|

|

|

Estero

|

|

|

Florida 33928

|

|

|

239 301-7000

|

|

|

|

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT

REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of

earliest event reported) October 5, 2021 (October 4, 2021)

HERTZ

GLOBAL HOLDINGS, INC.

THE HERTZ CORPORATION

(Exact name of registrant

as specified in its charter)

|

Delaware

|

|

001-37665

|

|

61-1770902

|

|

Delaware

|

|

001-07541

|

|

13-1938568

|

|

(State or other jurisdiction of incorporation)

|

|

(Commission File

Number)

|

|

(I.R.S. Employer Identification No.)

|

8501 Williams Road

Estero,

Florida 33928

239 301-7000

(Address, including Zip Code, and

telephone number, including area code,

of registrant's principal executive offices)

Not Applicable

Not Applicable

(Former name, former address and

former fiscal year, if changed since last report.)

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨ Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

Title of Each Class

|

|

Trading

Symbol(s)

|

|

Name

of Each Exchange

on which Registered

|

|

Hertz Global Holdings, Inc.

|

|

Common Stock par value $0.01 per share

|

|

HTZZ

|

|

*

|

|

The Hertz Corporation

|

|

None

|

|

None

|

|

None

|

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of

the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

¨

* Hertz Global Holdings, Inc.’s common

stock trades on the over-the-counter market under the symbol HTZZ.

ITEM 5.02 DEPARTURE OF DIRECTORS OR CERTAIN OFFICERS; ELECTION OF

DIRECTORS; APPOINTMENT OF CERTAIN OFFICERS; COMPENSATORY ARRANGEMENTS OF CERTAIN OFFICERS.

Appointment of New Interim Chief Executive Officer

On October

4, 2021, the Board of Directors (the “Board”) of Hertz Global Holdings, Inc. (the “Company”) appointed

Mark Fields as the Company’s interim Chief Executive Officer (“Interim CEO”) effective as of October 5, 2021 while the

Company conducts a search for a permanent Chief Executive Officer, and in that capacity he will serve as the Company’s principal

executive officer. Mr. Fields is a current member of the Board and will remain as a director following his appointment as Interim CEO,

but as of October 5, 2021 he will no longer serve on the audit committee of the Board.

Mr. Fields will serve

on an “at-will” basis until a permanent Chief Executive Officer is chosen. Following the date that a new permanent Chief Executive

Officer begins employment with the Company, Mr. Fields will remain employed by the Company to provide transition services for a period

of up to two (2) weeks. His last day of employment following this transition period is referred to below as the “Employment End

Date”.

Mr. Fields will receive

a base salary of $62,500 per week. Additionally, Mr. Fields will be entitled to receive an RSU grant covering 500,000 shares of the Company’s

common stock (the “Interim CEO Award”). The shares covered by the Interim CEO Award will vest as follows: (A) if the Employment

End Date occurs within 90 days of Mr. Fields’s start date as Interim Chief Executive Officer, 50% of the shares under the Interim

CEO Award will vest on the Employment End Date and the remainder will be forfeited, and (B) if the Employment End Date occurs after

the 90th day following his employment start date, 100% of the shares under the Interim CEO Award will vest on the earlier of

(x) the six-month anniversary of his start date and (y) the Employment End Date. The terms of the Interim CEO Award will be subject to

the provisions of the Company’s new omnibus equity incentive plan once adopted by the Board and the form of award agreement.

On October 4, 2021, Mr.

Fields and the Company entered into an offer letter containing the terms described above. The foregoing summary of the offer letter is

qualified in its entirety by the full text of such document, which is attached as Exhibit 10.1 to this Current Report on Form 8-K.

Appointment of

Chief Operating Officer

On October 4, 2021, Paul E. Stone resigned as

Chief Executive Officer of the Company, and also resigned from the Board, in each case effective October 5, 2021.

The Board separately appointed Mr. Stone as the

Company’s Chief Operating Officer effective October 5, 2021, and he will also continue in his role as President of the Company.

Mr. Stone will serve on an “at-will”

basis, and either the Company or Mr. Stone may terminate the employment relationship at any time, with or without reason.

Mr. Stone will continue to receive a base salary

of $1,000,000 per year and his target annual bonus for calendar year 2021 will remain 140% of his base salary. Further, provided that

Mr. Stone is employed with the Company as of March 1, 2022, he will be entitled to a lump-sum payment of (x) $2,000,000, plus (y)

an amount that represents the employer-paid portion of his monthly group health insurance premiums, multiplied by twenty-four (24) (the

“Transition Bonus”), subject to execution of a release of claims. If Mr. Stone is terminated without cause or resigns for

good reason prior to March 1, 2022, he will be entitled to receive the Transition Bonus as severance, subject to execution of a release

of claims, and he will also remain eligible to receive an annual bonus for calendar year 2021 based on the Company’s actual performance.

In addition, the Company has waived its right to claw back any portion of his retention bonus previously paid in August 2021 if he resigns

for good reason prior to December 31, 2021.

On October 4, 2021, Mr. Stone and the Company

entered into a Second Amended and Restated Offer Letter, Confidentiality and Non-Competition Agreement, which provides for Mr. Stone’s

change in position and resignation from the Board. The foregoing summary of such agreement is qualified in its entirety by the full text

of such document, which is attached as Exhibit 10.2 to this Current Report on Form 8-K.

ITEM 9.01. EXHIBITS.

(d) Exhibits

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, each registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

HERTZ GLOBAL HOLDINGS, INC.

|

|

|

THE HERTZ CORPORATION

|

|

|

(each, a Registrant)

|

|

|

By:

|

/s/ M. David Galainena

|

|

|

Name:

|

M. David Galainena

|

|

|

Title:

|

Executive Vice President, General Counsel and Secretary

|

|

Date: October 5, 2021

|

|

|

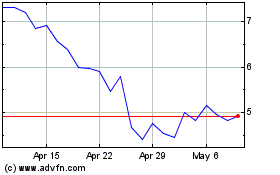

Hertz Global (NASDAQ:HTZ)

Historical Stock Chart

From Mar 2024 to Apr 2024

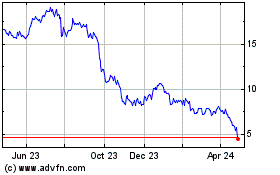

Hertz Global (NASDAQ:HTZ)

Historical Stock Chart

From Apr 2023 to Apr 2024