Additional Proxy Soliciting Materials - Non-management (definitive) (dfan14a)

May 27 2022 - 3:48PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14A

(Rule

14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

The Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☐

Filed by a Party other than the Registrant ☒

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☒ | Definitive Additional Materials |

| ☐ | Soliciting Material Under Rule 14a-12 |

HASBRO, INC.

|

(Name of Registrant as Specified in Its Charter)

|

| |

ALTA FOX OPPORTUNITIES FUND, LP

ALTA FOX SPV 3, LP

ALTA FOX SPV 3.1, LP

ALTA FOX GENPAR, LP

ALTA FOX EQUITY, LLC

ALTA FOX CAPITAL MANAGEMENT, LLC

CONNOR HALEY

MARCELO FISCHER

RANI HUBLOU

CAROLYN JOHNSON

|

(Name of Persons(s) Filing Proxy Statement, if Other Than the Registrant)

|

Payment of Filing Fee (Check the appropriate box):

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on

which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| ☐ | Fee paid previously with preliminary materials: |

☐ Check

box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting

fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of

its filing.

| (1) | Amount previously paid: |

| (2) | Form, Schedule or Registration Statement No.: |

Alta Fox Opportunities Fund, LP, together with

the other participants named herein (collectively, “Alta Fox”), has filed a definitive proxy statement and accompanying GOLD

proxy card with the Securities and Exchange Commission to be used to solicit votes for the election of its slate of highly-qualified director

nominees at the 2022 annual meeting of shareholders of Hasbro, Inc., a Rhode Island corporation (the “Company”).

On May 27, 2022, an Alta Fox spokesperson

was quoted in the following article published by Reuters:

Glass Lewis backs all Hasbro directors in boardroom fight with Alta

Fox

Reuters

By Svea Herbst-Bayliss

May 27, 2022

Proxy advisory firm Glass Lewis on Friday recommended that Hasbro shareholders

reelect all of the company's director nominees, dealing a blow to hedge fund Alta Fox's effort to replace three board members.

"We do not believe there is a sufficient basis to support the board

changes sought by (Alta Fox)," Glass Lewis wrote in its report, adding "the preponderance of the evidence validates Hasbro's

strategy and business model."

Alta Fox, which owns a 2.5% stake in the toy maker, has urged Hasbro to

spin off its Wizards of the Coast and Digital Gaming unit and criticized its takeover of Entertainment One in 2019, its Brand Blueprint

strategy and how it allocates capital.

It wants to replace three board members, including the board chairman,

the current chair of the compensation committee and the previous chair of the compensation committee.

Hasbro has nominated 13 directors including two new members who were appointed

to the board last month.

Investors will vote on the matter next month.

Proxy advisory firms Glass Lewis and its bigger rival Institutional Shareholders

Services, which has not yet issued its report, often guide investors on how to vote in board room battles.

An Alta Fox spokesperson said the Glass Lewis report "appears to omit

significant and critical facts pertaining to Hasbro's long-term failings and stagnation," including the share price drop. "We're

confident our fellow shareholders will not be swayed by what comes across as a flawed and poorly informed recommendation for undeserving

incumbents."

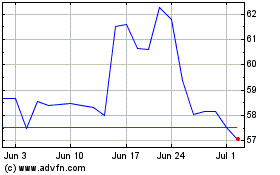

Hasbro (NASDAQ:HAS)

Historical Stock Chart

From Mar 2024 to Apr 2024

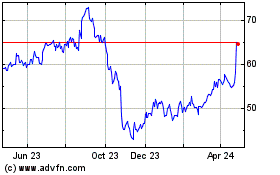

Hasbro (NASDAQ:HAS)

Historical Stock Chart

From Apr 2023 to Apr 2024