Report of Foreign Issuer Pursuant to Rule 13a-16 or 15d-16 (6-k)

March 16 2022 - 6:08AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO

RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of March 2022

HAPPINESS DEVELOPMENT GROUP LIMITED

(Exact name of registrant as specified in its charter)

No. 11, Dongjiao East Road, Shuangxi, Shunchang,

Nanping City

Fujian Province, People’s Republic of

China

+86-0599-782-8808

(Address of Principal Executive Office)

Indicate by check mark whether the registrant

files or will file annual reports under cover of Form 20-F or Form40-F.

Form 20-F ☒ Form40-F ☐

Indicate by check mark if the registrant is

submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is

submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

Entry into Material Definitive Agreements

Happiness Development Group Limited (the “Company”)

and certain non-U.S. investors (the “Purchasers”) entered into certain securities purchase agreement on March 10, 2022

(the “Purchase Agreement”) relating to the offer and sale of 19,200,000 Class A ordinary shares (the “Shares”),

par value $0.0005 per share (the “Ordinary Shares”) in a registered direct offering (the “Offering”).

Pursuant to the Purchase Agreement, the Company

agreed to sell 19,200,000 Ordinary Shares at a per share purchase price of $0.35, for gross proceeds of $6,720,000, before deducting any

estimated offering expenses. The closing of the Offering will occur on or about March 15, 2022.

The Company currently intends to use the net proceeds

from the Offering for the development of the Company’s auto business under the brand of “Taochejun”, working capital

and other general corporate purposes.

A copy of the form of the Purchase Agreement is

attached hereto as Exhibit 1.1, and is incorporated herein by reference. The foregoing summary of the terms of the Purchase Agreement

is subject to, and qualified in its entirety by, such document.

On March 11, 2022, the Company issued a press

release announcing the Offering. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

A copy of the legal opinion issued by the Company’s Cayman counsel Campbells is attached hereto as Exhibit 5.1.

The sale and offering of the Shares pursuant

to the Purchase Agreement was effected as a takedown off the Company’s shelf registration statement on Form F-3, as amended (File

No. 333-250026), which became effective on November 23, 2023 (the “Registration Statement”).

Financial Statements and Exhibits.

Exhibits.

SIGNATURES

Pursuant to the requirements

of the Securities and Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned,

thereunto duly authorized.

| |

Happiness Development Group Limited |

| |

|

|

| Date: March 15, 2022 |

By: |

/s/ Xuezhu Wang |

| |

|

Xuezhu Wang

Chief Executive Officer |

3

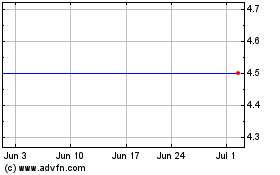

Happiness Development (NASDAQ:HAPP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Happiness Development (NASDAQ:HAPP)

Historical Stock Chart

From Apr 2023 to Apr 2024