Amended Current Report Filing (8-k/a)

November 12 2019 - 4:29PM

Edgar (US Regulatory)

false0001159036

0001159036

2019-10-30

2019-10-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

____________________________________________

FORM 8-K/A

(Amendment No.1)

_____________________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

|

|

|

|

|

|

Date of Report (Date of Earliest Event Reported):

|

|

October 30, 2019

|

HALOZYME THERAPEUTICS, INC.

(Exact name of registrant as specified in its charter)

________________________

Commission File Number 001-32335

|

|

|

|

|

|

|

Delaware

|

|

88-0488686

|

|

(State or other jurisdiction of incorporation or organization)

|

|

(I.R.S. Employer Identification No.)

|

|

|

|

|

11388 Sorrento Valley Road

|

|

92121

|

|

San Diego

|

|

(Zip Code)

|

|

California

|

|

|

|

(Address of principal executive offices)

|

|

|

(858) 794-8889

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, $0.001 par value

|

HALO

|

The Nasdaq Stock Market LLC

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 ( §230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 ( §240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

On November 5, 2019, Halozyme Therapeutics, Inc. (the “Company”) filed with the Securities and Exchange Commission a Current Report on Form 8-K (the “Initial 8-K”) to disclose that on October 30, 2019 the Board of Directors of the Company approved a corporate restructuring to halt development activities for PEGPH20 and close the Company’s oncology operations. The Company is filing this Current Report on Form 8-K/A to amend the Initial 8-K to update its disclosure regarding costs associated with exit or disposal activities and material impairments.

Item 2.05 Costs Associated with Exit or Disposal Activities.

As previously disclosed on the Initial 8-K, on October 30, 2019, the Board of Directors of the Company approved a corporate restructuring to halt development activities for PEGPH20 and close the Company’s oncology operations. This decision resulted from the determination that the Company’s HALO-301 Phase 3 clinical study evaluating investigational new drug PEGPH20 as a first-line therapy for the treatment of patients with metastatic pancreatic cancer failed to reach the primary endpoint of overall survival. The restructuring will reduce the Company’s workforce by approximately 55%, or approximately 160 employees. The majority of the personnel and program restructuring will be completed by January 2020.

As previously disclosed on the Initial 8-K, the Company expects to incur charges under the corporate restructuring during the fourth quarter of 2019 and the first half of 2020, including costs of employee severance and other costs related to workforce reductions, including non-cash cost related to the acceleration of equity-awards for employees affected by the restructuring, as well as lease and other contract terminations. The Company expects to incur restructuring charges consisting of one-time severance payments and other employee related costs of approximately $17.0 million in the fourth quarter of 2019. The majority of the cash payments for employee related restructuring charges will be paid during the first quarter of 2020, with the remainder to be paid in subsequent quarters of 2020. Additionally, the Company will incur one-time charges related to lease and other contract cancellations of approximately $8.0 million to $10.0 million in the fourth quarter of 2019, which includes impairment charges of certain right-of-use assets that are noted below in Item 2.06. The Company may also incur additional costs not currently contemplated due to events that may occur as a result of, or that are associated with, the workforce reduction and the cancellation of the PEGPH20 programs.

Item 2.06 Material Impairments.

As previously disclosed on the Initial 8-K, in connection with the corporate restructuring addressed in Item 2.05 above, the Company expects to incur impairment charges related to certain right-of-use assets related to abandoned leases of approximately $2 million to $4 million. The majority of the cash payments related to the impaired right-of-use assets will be paid during 2020.

Cautionary Statement Regarding Forward-Looking Statements

In addition to historical information, the statements set forth above in this Current Report on Form 8-K/A include forward-looking statements that involve risks and uncertainties that could cause actual results to differ materially from those in the forward-looking statements. The forward-looking statements are typically, but not always, identified through use of the words “believe,” “expects,” “may,” “will,” “could,” “intends,” “estimate,” “anticipate,” “plan,” “predict,” “probable,” “potential,” “possible,” “should,” “continue,” and other words of similar meaning. Actual results could differ materially from the expectations contained in these forward-looking statements as a result of several factors. These factors that may result in differences between the forward-looking statements and actual results are discussed in greater detail in the Halozyme’s annual and quarterly reports filed with the Securities and Exchange Commission.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

HALOZYME THERAPEUTICS, INC.

|

|

|

|

|

|

|

|

November 12, 2019

|

|

By:

|

|

/s/ Harry J. Leonhardt, Esq.

|

|

|

|

|

|

|

|

|

|

Name:

|

|

Harry J. Leonhardt, Esq.

|

|

|

|

Title:

|

|

Senior Vice President, General Counsel and Corporate Secretary

|

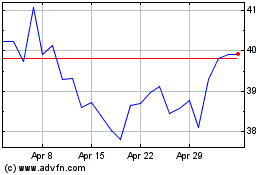

Halozyme Therapeutics (NASDAQ:HALO)

Historical Stock Chart

From Mar 2024 to Apr 2024

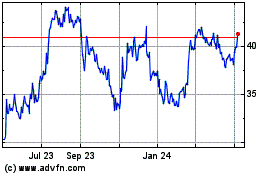

Halozyme Therapeutics (NASDAQ:HALO)

Historical Stock Chart

From Apr 2023 to Apr 2024