Current Report Filing (8-k)

July 28 2022 - 7:06AM

Edgar (US Regulatory)

false000133960500013396052022-07-282022-07-28

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 28, 2022

H&E Equipment Services, Inc.

(Exact name of registrant as specified in its charter)

Commission File Number: 000-51759

|

|

|

Delaware |

|

81-0553291 |

(State or other jurisdiction of |

|

(IRS Employer |

incorporation) |

|

Identification No.) |

7500 Pecue Lane

Baton Rouge, LA 70809

(Address of principal executive offices, including zip code)

(225) 298-5200

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

|

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

|

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

|

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

Title of Each Class |

Trading Symbol(s) |

Name of Each Exchange on Which Registered |

Common Stock, par value $0.01 per share |

HEES |

Nasdaq Global Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On July 28, 2022, we issued a press release announcing our financial results for the three month period ended June 30, 2022. A copy of the press release is attached as Exhibit 99.1 and is incorporated herein by reference.

The information in this Form 8-K and the attached exhibit shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item 8.01 Other Events.

Net income before interest expense, income taxes, depreciation, and amortization (“EBITDA”) and Adjusted EBITDA are non-Generally Accepted Accounting Principles (“GAAP”) measures as defined under the rules of the Securities and Exchange Commission. We define Adjusted EBITDA for the periods presented as EBITDA adjusted for merger and other costs.

We use EBITDA and Adjusted EBITDA in our business operations to, among other things, evaluate the performance of our business, develop budgets and measure our performance against those budgets. We also believe that analysts and investors use EBITDA and Adjusted EBITDA as supplemental measures to evaluate a company’s overall operating performance. However, EBITDA and Adjusted EBITDA have material limitations as analytical tools and you should not consider them in isolation, or as substitutes for analysis of our results as reported under GAAP. We consider them useful tools to assist us in evaluating performance because they eliminate items related to components of our capital structure, taxes and non-cash charges. The items that we have eliminated in determining EBITDA for the periods presented are interest expense, income taxes, depreciation of fixed assets (which includes rental equipment and property and equipment) and amortization of intangible assets and, in the case of Adjusted EBITDA, any other non-recurring items described above applicable to the particular period. However, some of these eliminated items are significant to our business. For example, (i) interest expense is a necessary element of our costs and ability to generate revenue because we incur a significant amount of interest expense related to our outstanding indebtedness; (ii) payment of income taxes is a necessary element of our costs; and (iii) depreciation is a necessary element of our costs and ability to generate revenue because rental equipment is the single largest component of our total assets and we recognize a significant amount of depreciation expense over the estimated useful life of this equipment. Any measure that eliminates components of our capital structure and costs associated with carrying significant amounts of fixed assets on our consolidated balance sheet has material limitations as a performance measure. In light of the foregoing limitations, we do not rely solely on EBITDA and Adjusted EBITDA as performance measures and also consider our GAAP results. EBITDA and Adjusted EBITDA are not measurements of our financial performance under GAAP and, accordingly, should not be considered alternatives to net income, operating income or any other measures derived in accordance with GAAP. Because EBITDA and Adjusted EBITDA may not be calculated in the same manner by all companies, these measures may not be comparable to other similarly titled measures used by other companies.

Item 9.01 Financial Statements and Exhibits.

Exhibit 99.1 Press Release, dated July 28, 2022, announcing financial results for the three month period ended June 30, 2022.

Exhibit 104 Cover Page Interactive Data File (embedded within the Inline XBRL document).

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

Date: July 28, 2022 |

By: |

/s/ Leslie S. Magee |

|

|

Leslie S. Magee |

|

|

Chief Financial Officer |

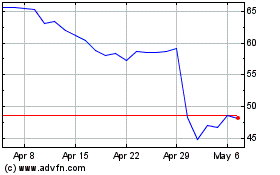

H and E Equipment Services (NASDAQ:HEES)

Historical Stock Chart

From Mar 2024 to Apr 2024

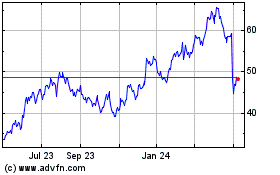

H and E Equipment Services (NASDAQ:HEES)

Historical Stock Chart

From Apr 2023 to Apr 2024