Gulf Resources Announces the Receipt of Closing Notice of Bromine Factories #3, 4, and 11

September 26 2018 - 8:30AM

Gulf Resources, Inc. (NASDAQ:GURE) ("Gulf Resources" or the

"Company"), a leading manufacturer of bromine, crude salt,

specialty chemical products, and natural gas in China, today

announces it will have to close its three bromine factories (No. 3,

No. 4, and No. 11.) pursuant to a closing notice that the Company

received from the People's Government of Yangkou Town, Shouguang

City dated September 21, 2018. An unofficial full translation

of the closing notice is set forth below:

“According to the requirements imposed on Shandong bromine

production enterprises by the national environmental protection

inspection and the transformation and upgrading of the chemical

industry in 2017, all bromine production enterprises must meet the

goal of co-production of bromine and crude salt. After the bromine

is extracted, the brine water must be treated with sun-dried salt

and cannot be discharged directly. For bromine production

enterprises that fail to meet the requirements for co-production of

bromine and crude salt, they will be forced to close.

"Recently, the city formed a joint inspection team to conduct a

comprehensive on-site inspection of the city's bromine production

enterprises. Most of the crude salt fields surrounding your

company's Factory No.3, Factory No.4, and Factory No.11 have been

reclaimed as cultivated land or construction land. Under this

circumstance, your company's Factory No.3, Factory No.4, and

Factory No.11 cannot meet the requirements for bromine and crude

salt co-production. After research and consideration, it’s decided

to shut down your bromine Factory No.3, Factory No.4, and Factory

No.11. Your company should handle the production equipment and

facilities by itself. The land lease agreements signed by and among

the company and the local villages should be settled by

negotiation. For the remaining bromine factories with the area of

crude salt field that can be matched with bromine production of

those bromine factories, they can start production after the

completion of the project approval, planning approval, land use

rights approval and environmental protection assessment approval in

accordance with the “Notice on Accelerating the Special Renovation

of Violating Chemical Enterprises” (Lu Jing Xin Yuan [2018] No.

205). Production should be carried out in accordance with relevant

government regulations and bromine and crude salt co-production

requirements.”

As noted in recent press releases, the management of Gulf

Resources had expected that these three factories might be forced

to close if it could not find a solution to address. The

co-production of bromine and crude salt based upon the new

requirements that were implemented in 2017. As a result, the

company did not spend as much money on rectification for these

factories as it did on the others.

In closing these factories, the Company expects to take a

write-off; although the amount is difficult to be estimated at this

time. These factories have a net asset value of approximately $23.7

million (including approximately $382K spend on

rectification). Gulf Resources may have to bear the cost

approximately $200-300K of dismantling these factories. While much

of the equipment will be disposed of, some of the newer equipment

may be moved to the Company’s other factories. The Company will

also negotiate with the local villages over the land leases. The

Company expects to receive some land lease fees for return of the

land.

Mr. Liu Xiaobin, the CEO of Gulf Resources stated, “The

government is forcing the closure of many factories in Shandong

Province. While we would have preferred to retain all of our

factories, if we can maintain operations and production at 7 out of

our 10 factories, we believe we will be doing better than many of

our competitors. We also believe that with the closing of many

factories, pricing will remain high and that we can operate the

seven factories at higher levels of utilization, to partially

compensate for the closed factories.”

Gulf Resources believes the issues related to crude salt and

bromine at the remaining factories are almost resolved. While it

still needs approvals for project approval, planning approval, land

use rights approval and environmental protection assessment

approval, the local government is actively working with us. Six of

our factories previously passed inspections. The Company also

believes it has come up with a solution with a third party to build

an aqueduct for factory #10.

The final step in the process will be the repair of the

aqueducts, brine water reservoir, crude salt pans, wells, roads,

and factories from the damages caused by the recent floods.

Assuming these factories are all approved, the Company estimates

the costs of repairing and rebuilding due to the flood damages will

be $8-10 million.

As part of the flood repair process, Gulf Resources will first

focus on the aqueducts. Then it will repair the brine water

reservoir and crude salt pans, Next it will repair each of the

wells that have been covered with debris from the flood. It will

also have to repair some of the roads that lead to the factories.

The roads within the factories themselves did not sustain much

damage. Finally, it will repair the water damage to the factories

themselves.

“We have been through a long and difficult process,” Mr. Liu

stated, “but we believe we are now on a path to reopening seven of

our factories, hopefully by the beginning of next year.”

“Our new chemical factory had already received part of the

approvals, we are moving ahead on receiving the rest approvals for

it. The company is also doing testing at our natural gas well in

Sichuan, which may start trial production by fourth quarter of

2018.” Mr. Liu concluded. “We appreciate the support of our

long-term shareholders and want to assure you that we are working

diligently to restore our operations and return to

profitability.”

About Gulf Resources, Inc. Gulf Resources, Inc.

operates through threewholly-owned subsidiaries, Shouguang City

Haoyuan Chemical Company Limited ("SCHC"), Shouguang Yuxin Chemical

Industry Co., Limited ("SYCI"), and Daying County Haoyuan Chemical

Company Limited (“DCHC”). The company believes that it is one of

the largest producers of bromine in China. Elemental Bromine is

used to manufacture a wide variety of compounds utilized in

industry and agriculture. Through SYCI, the company

manufactures chemical products utilized in a variety of

applications, including oil and gas field explorations and

papermaking chemical agents, and materials for human and animal

antibiotics. DCHC was established to further explore and develop

natural gas and brine resources (including bromine and crude salt)

in China. For more information,

visit www.gulfresourcesinc.com.

Forward-Looking Statements

Certain statements in this news release contain forward-looking

information about Gulf Resources and its subsidiaries' business and

products within the meaning of Rule 175 under the Securities Act of

1933 and Rule 3b-6 under the Securities Exchange Act of 1934, and

are subject to the safe harbor created by those rules. The actual

results may differ materially depending on a number of risk factors

including, but not limited to, the general economic and business

conditions in the PRC, future product development and production

capabilities, shipments to end customers, market acceptance of new

and existing products, additional competition from existing and new

competitors for bromine and other oilfield and power production

chemicals, changes in technology, the ability to make future

bromine asset purchases, and various other factors beyond its

control. All forward-looking statements are expressly qualified in

their entirety by this Cautionary Statement and the risk factors

detailed in the company's reports filed with the Securities and

Exchange Commission. Gulf Resources undertakes no duty to revise or

update any forward-looking statements to reflect events or

circumstances after the date of this release.

CONTACT: Gulf Resources, Inc.

Web: http://www.gulfresourcesinc.com

Director of Investor Relations

Helen Xu (Haiyan Xu) beishengrong@vip.163.com

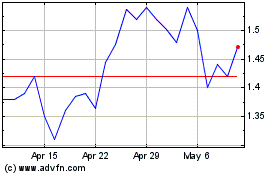

Gulf Resources (NASDAQ:GURE)

Historical Stock Chart

From Mar 2024 to Apr 2024

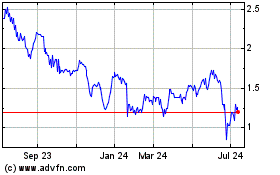

Gulf Resources (NASDAQ:GURE)

Historical Stock Chart

From Apr 2023 to Apr 2024