Gulf Resources, Inc. (Nasdaq: GURE) ("Gulf Resources" or the

"Company"), a leading manufacturer of bromine, crude salt and

specialty chemical products in China, today announced the unaudited

financial results for the second quarter ended June 30, 2019.

Financial Results

Three Months Ended June 30, 2019 Compared to Three

Months Ended June 30, 2018

- Net Revenue was $6,009,409 compared to $4,594

- Gross Profit was $3,019,079 compared to $4,587

- Direct labor and factory overheads incurred during plant

shutdown were $2,875,285 compared to $5,689,486

- General & Administrative Expenses were $1,335,347 compared

to $1,125,683

- Loss Before Taxes was $1,103,689 compared to $6,696,114

- Net Loss was $737,706 compared to $4,812,873

- Earnings per share were a loss of $0.02 versus a loss of

$0.10

- Cash and cash equivalents were $160,354,069 compared to

$178,998,935

- Cash per share was $3.40* vs. $3.82* based on 47,214,075 shares

outstanding

- Net net Cash per share (cash minus all liabilities) $2.51*

- Book Value per share was $6.10*

- (*These calculations are based on the basic weighted

average number of shares outstanding of 47,214,075 as of June 30,

2019)

By Segment

- Bromine had revenues of $5,751,164 compared to $0. The loss

from operations before income taxes was $36,713 compared to

$5,577,272.

- Crude Salt Revenues were $245,079 compared to $0. The loss from

operations before income taxes were $828,736 compared to

$1,731,592.

- Chemical products revenue was $0 compared to $4,594. The loss

from operations before income taxes was $656,424 compared to

$727,595.

- Natural Gas Revenue was $13,166 compared to $0. The loss from

operations before income taxes was $61,401 compared to

$45,295.

During the second quarter, the government of China continued to

take steps to improve the environment by ensuring that industries,

such as chemicals, mining, and natural gas operate in a manner that

maximizes safety and minimizes damage to the environment. These

government regulations required a substantial amount of work from

the company and its competitors. We believe that a large

percentage of the factories and mines may not receive the required

approvals to reopen. However, the government believes this is the

only way to ensure the future health and safety of its

residents.

In the second quarter, the company began production in Factories

#1 and #7. Because these factories had new equipments, the

company began production at a very low level to ensure that the new

equipment was functioning correctly. During the quarter, the

company tested all of the new equipment and found minimal issues.

During the third quarter, the company intends to increase

production. It expects to achieve full production in these

factories by the end of the year. With the permanent closing of

factories #3, #4, and #11, total production capacity has declined

from 42,808 to 31,506 tonnes. However, Factories #1 and #7 have

annual production capacity of 13,667 tonnes, which equals

43.4% of our total capacity. For the three months ending June

2019, our utilization ratio for all of our remaining factories was

18%. The gross profit margin for the bromine segment was 53%. The

crude salt segment has a negative gross profit margin of 6%.

Natural gas, which was in a testing phase, also had a negative

gross profit margin.

During the first six months of 2019, the company invested

$39,596,434 in property, plant, and equipment. The major portion of

this investment was for the new drilled bromine wells to increase

the productivity of facilities to assure the level of profitability

in the future and was not related to the rectification

processes.

Update on Operations

Bromine and crude salt

We have opened Factories #1 and #7. (Factory Number #7 is a

combination of Factories #5 and #7.) We have completed the

rectification on our remaining factories, #2, #8, #9, #10, and #4

(previously called the subdivision of factory #1). We do not expect

any further rectification to be performed currently. The remaining

issues for those factories relate to project approval, planning

approval, land use rights approval, and the environmental

protection assessment. We cannot determine the timing for the

approvals of the other factories. However, we have been working

closely with the government and believe we have taken all of the

steps needed to obtain final approvals.

The price of bromine remains at very high levels. At the current

time, the price is approximately RMB 33,000 per tonne include VAT.

The closure of many mines and the decline in the price of the RMB

vs. other currencies should keep the price at elevated levels. The

company continues to believe that the bromine and crude salt

business will become profitable.

Chemical Products

We are waiting for government approval for our new chemical

plant. To date, we have invested $10,925,081 for a 50-year lease of

a parcel of land and the design of the new chemical factory.

While we are confident we will receive approval to build this

factory, we cannot provide any guidance about the timing of the

approval, the construction, or the beginning of production.

Natural Gas

On May 29,2019, the Company received a verbal notice from the

government of Tianbao Town, Daying County, Sichuan Province, that

the company will be required to obtain project approval for its

well, including the natural gas and brine water project and

approvals for safety production inspection, environmental

protection assessment and related land issues. Upon receipt

of the notice, the company halted trial production of its natural

gas well in Daying County.

The Company has been working with the local government in

Tianbao Town and Daying County to meet the new provincial

regulations. The local and county governments have been very

supportive, but the Company still needs provincial approval. The

Company is confident that this approval will be obtained. In

addition, the Company believes that the approval will provide the

ability to drill more than one well. However, at this point in

time, there is no way of knowing when all of the approvals will be

received, and production will recommence.

Balance Sheet

During the first six months of 2019, the company invested

$39,596,434 in property, plant, and equipment. The major portion of

this investment was for the new drilled bromine wells to increase

the productivity of facilities to assure a higher level of

profitability in the future. The company ended the quarter with

cash and cash equivalents of $160,354,069. Cash per share was

$3.40* based on 47,214,075 shares outstanding. Net net Cash per

share (cash minus all liabilities) was $2.51*. Book Value per share

was $6.10*.

“This has been a very difficult period for Gulf Resources,” Mr.

Liu Xiaobin, the CEO of Gulf, stated. “We believe the government of

China is taking the proper steps to protect its residents and

improve the environment. We understand this is a complicated issue.

We are very pleased to have been able to open our two largest

bromine and crude salt facilities. Our new equipment is functioning

well, and we believe we will continue to carefully ramp up

production in this quarter. We also believe will receive approvals

for some of our other bromine and crude salt facilities in the

future. We are confident we will receive approval from the

government to build and commence operations in our new chemical

factory, although we cannot predict the timing of such approvals.

We also believe we will receive approvals to continue our

production of natural gas and brine water in Sichuan Province.”

“We are frustrated that the process is taking as long as

it has, but recognize the complex issues confronted by the

government. However, we remain focused on opening the rest of our

remaining facilities,” Mr. Liu continued.

“At this time our financial position still remains strong,” Mr.

Liu concluded. “We have $3.40* per share in cash. Our cash

minus all of our liabilities is still $2.51* per share, even after

our major investments. We have begun production and are approaching

breakeven, we anticipate returning to profitability in the near

future.”

Conference Call

Gulf Resources' management will host a conference call on

Thursday, August 15, 2019 at 8:30 a.m. Eastern Time to discuss its

financial results for the second quarter ended June 30, 2019.

Mr. Xiaobin Liu, CEO and Mr. Min Li ,CFO of Gulf Resources, will

be hosting the call. The Company's management team will be

available for investor questions following the prepared

remarks.

To participate in this live conference call, please dial +1

(877) 407-8031 five to ten minutes prior to the scheduled

conference call time. International callers should dial +1 (201)

689-8031. The conference participant pass code

is 13693833.

The webcasting is also available then, just simply click on the

link

below: http://www.gulfresourcesinc.com/events.html

A replay of the conference call will be available two hours

after the call's completion during 08/15/2019 11:30 EDT -

08/22/2019 08:30 EDT. To access the replay, call +1 (877) 481-4010.

International callers should call +1 (919) 882-2331. The Replay

Passcode is 53288.

About Gulf Resources, Inc.

Gulf Resources, Inc. operates through three wholly-owned

subsidiaries, Shouguang City Haoyuan Chemical Company Limited

("SCHC"), Shouguang Yuxin Chemical Industry Co., Limited ("SYCI"),

and Daying County Haoyuan Chemical Company Limited (“DCHC”). The

company believes that it is one of the largest producers of bromine

in China. Elemental Bromine is used to manufacture a wide variety

of compounds utilized in industry and agriculture. Through SYCI,

the Company manufactures chemical products utilized in a variety of

applications, including oil and gas field explorations and

papermaking chemical agents, and materials for human and animal

antibiotics. DCHC was established to further explore and develop

natural gas and brine resources (including bromine and crude salt)

in China. For more information,

visit www.gulfresourcesinc.com.

Forward-Looking Statements

Certain statements in this news release contain forward-looking

information about Gulf Resources and its subsidiaries business and

products within the meaning of Rule 175 under the Securities Act of

1933 and Rule 3b-6 under the Securities Exchange Act of 1934, and

are subject to the safe harbor created by those rules. The actual

results may differ materially depending on a number of risk factors

including, but not limited to, the general economic and business

conditions in the PRC, future product development and production

capabilities, shipments to end customers, market acceptance of new

and existing products, additional competition from existing and new

competitors for bromine and other oilfield and power production

chemicals, changes in technology, the ability to make future

bromine asset purchases, and various other factors beyond its

control. All forward-looking statements are expressly qualified in

their entirety by this Cautionary Statement and the risks factors

detailed in the company's reports filed with the Securities and

Exchange Commission. Gulf Resources undertakes no duty to revise or

update any forward-looking statements to reflect events or

circumstances after the date of this release.

CONTACT: Gulf Resources, Inc.

Web: http://www.gulfresourcesinc.com

Director of

Investor Relations

Helen Xu

(Haiyan Xu)

beishengrong@vip.163.com

| GULF RESOURCES,

INC. |

| AND

SUBSIDIARIES |

| CONDENSED

CONSOLIDATED BALANCE SHEETS |

| (Expressed in U.S.

dollars) |

| |

June 30, 2019 Unaudited |

|

|

December 31, 2018 Audited |

|

|

Current Assets |

|

|

|

|

|

|

|

|

Cash |

$ |

160,354,069 |

|

|

$ |

178,998,935 |

|

| Accounts receivable |

|

6,714,820 |

|

|

|

— |

|

|

Inventories, net |

|

453,664 |

|

|

|

— |

|

|

Prepayments and deposits |

|

1,364,457 |

|

|

|

8,096,636 |

|

|

Prepaid land leases |

|

176,264 |

|

|

|

235,459 |

|

|

Other receivable |

|

10,886 |

|

|

|

12,506 |

|

|

Total Current Assets |

|

169,074,160 |

|

|

|

187,343,536 |

|

| Non-Current Assets |

|

|

|

|

|

|

|

|

Property, plant and equipment, net |

|

121,296,991 |

|

|

|

82,282,630 |

|

|

Finance lease right-of-use assets |

|

184,875 |

|

|

|

250,757 |

|

|

Operating lease right-of-use assets |

|

9,198,933 |

|

|

|

— |

|

|

Prepaid land leases, net of current portion |

|

9,077,501 |

|

|

|

9,639,009 |

|

|

Deferred tax assets |

|

20,731,267 |

|

|

|

19,030,858 |

|

| Total non-current assets |

|

160,489,567 |

|

|

|

111,203,254 |

|

|

Total Assets |

$ |

329,563,727 |

|

|

$ |

298,546,790 |

|

| |

|

|

|

|

|

|

|

|

Liabilities and Stockholders’ Equity |

|

|

|

|

|

|

|

|

Current Liabilities |

|

|

|

|

|

|

|

|

Payable and accrued expenses |

$ |

27,360,782 |

|

|

$ |

905,258 |

|

|

Retention payable |

|

2,006,764 |

|

|

|

332,416 |

|

|

Taxes payable-current |

|

1,954,023 |

|

|

|

1,188,687 |

|

|

Finance lease liability, current portion |

|

132,178 |

|

|

|

197,480 |

|

|

Operating lease liabilities, current portion |

|

474,363 |

|

|

|

— |

|

|

Total Current Liabilities |

|

31,928,110 |

|

|

|

2,623,841 |

|

|

Non-Current Liabilities |

|

|

|

|

|

|

|

|

Finance lease liability, net of current portion |

|

1,933,958 |

|

|

|

2,069,545 |

|

|

Operating lease liabilities, net of current portion |

|

7,859,840 |

|

|

|

— |

|

|

Total Non-Current Liabilities |

$ |

9,793,798 |

|

|

$ |

2,069,545 |

|

|

Total Liabilities |

$ |

41,721,908 |

|

|

$ |

4,693,386 |

|

|

|

|

|

|

|

|

|

|

| Stockholders’ Equity |

|

|

|

|

|

|

|

| PREFERRED STOCK; $0.001 par

value; 1,000,000 shares authorized; none outstanding |

|

|

|

|

|

|

|

| COMMON

STOCK; $0.0005 par value; 80,000,000 shares authorized; 47,812,221

and 47,502,940 shares issued; and 47,583,072 and 46,803,791 shares

outstanding as of June 30, 2019 and December 31, 2018 |

$ |

23,904 |

|

|

$ |

23,525 |

|

|

Treasury stock; 229,149 and 249,149 shares as of June 30,

2019 and December 31, 2018 at cost |

|

(510,329 |

) |

|

|

(554,870 |

) |

|

Additional paid-in capital |

|

95,043,388 |

|

|

|

95,020,808 |

|

|

Retained earnings unappropriated |

|

179,966,601 |

|

|

|

185,608,445 |

|

|

Retained earnings appropriated |

|

24,233,544 |

|

|

|

24,233,544 |

|

|

Accumulated other comprehensive loss |

|

(10,915,289 |

) |

|

|

(10,478,048 |

) |

|

Total Stockholders’ Equity |

|

287,841,819 |

|

|

|

293,853,404 |

|

|

Total Liabilities and Stockholders’ Equity |

$ |

329,563,727 |

|

|

$ |

298,546,790 |

|

|

|

| |

|

GULF RESOURCES, INC. |

|

AND SUBSIDIARIES |

|

CONDENSED CONSOLIDATED STATEMENTS OF LOSS AND COMPREHENSIVE

LOSS |

|

(Expressed in U.S. dollars) |

|

(UNAUDITED) |

| |

| |

Three-Month Period Ended June 30, |

|

|

Six-Month Period Ended June 30, |

|

| |

2019 |

|

|

2018 |

|

|

2019 |

|

|

2018 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| NET REVENUE |

|

|

|

|

|

|

|

|

|

|

|

| Net revenue |

$ |

6,009,409 |

|

|

$ |

4,594 |

|

|

$ |

6,047,979 |

|

|

$ |

2,251,861 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OPERATING INCOME

(EXPENSE) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of net revenue |

|

(2,990,330 |

) |

|

|

(7 |

) |

|

|

(3,026,737 |

) |

|

|

(1,241,816 |

) |

|

Sales, marketing and other operating expenses |

|

(6,613 |

) |

|

|

(21,025 |

) |

|

|

(6,613 |

) |

|

|

(55,999 |

) |

|

Direct labor and factory overheads incurred during plant

shutdown |

|

(2,875,285 |

) |

|

|

(5,689,486 |

) |

|

|

(7,168,307 |

) |

|

|

(11,385,005 |

) |

|

General and administrative expenses |

|

(1,335,347 |

) |

|

|

(1,125,683 |

) |

|

|

(3,440,518 |

) |

|

|

(4,697,628 |

) |

| |

|

(7,207,575 |

) |

|

|

(6,836,201 |

) |

|

|

(13,642,175 |

) |

|

|

(17,380,448 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| LOSS FROM OPERATIONS |

|

(1,198,166 |

) |

|

|

(6,831,607 |

) |

|

|

(7,594,196 |

) |

|

|

(15,128,587 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER INCOME (EXPENSE) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense |

|

(38,396 |

) |

|

|

(43,185 |

) |

|

|

(77,220 |

) |

|

|

(86,529 |

) |

|

Interest income |

|

132,873 |

|

|

|

178,678 |

|

|

|

268,452 |

|

|

|

348,156 |

|

| LOSS BEFORE TAXES |

|

(1,103,689 |

) |

|

|

(6,696,114 |

) |

|

|

(7,402,964, |

) |

|

|

(14,866,960 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| INCOME TAX BENEFIT |

|

365,983 |

|

|

|

1,883,241 |

|

|

|

1,761,120 |

|

|

|

3,076,987 |

|

| NET LOSS |

$ |

(737,706 |

) |

|

$ |

(4,812,873 |

) |

|

$ |

(5,641,844 |

) |

|

$ |

(11,789,973 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| COMPREHENSIVE LOSS: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| NET LOSS |

$ |

(737,706 |

) |

|

$ |

(4,812,873 |

) |

|

$ |

(5,641,844 |

) |

|

$ |

(11,789,973 |

) |

| OTHER COMPREHENSIVE LOSS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Foreign currency translation adjustments |

|

(6,603,591 |

) |

|

|

(20,586,976 |

) |

|

|

(437,241 |

) |

|

|

(4,638,065 |

) |

| COMPREHENSIVE LOSS |

$ |

(7,341,297 |

) |

|

$ |

(25,399,849 |

) |

|

$ |

(6,079,085 |

) |

|

$ |

(16,428,038 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| LOSS PER SHARE: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| BASIC |

$ |

(0.02 |

) |

|

$ |

(0.10 |

) |

|

$ |

(0.12 |

) |

|

$ |

(0.25 |

) |

| DILUTED |

$ |

(0.02 |

) |

|

$ |

(0.10 |

) |

|

$ |

(0.12 |

) |

|

$ |

(0.25 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| WEIGHTED AVERAGE NUMBER OF

SHARES: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| BASIC |

|

47,214,075 |

|

|

|

46,803,791 |

|

|

|

47,068,417 |

|

|

|

46,803,791 |

|

|

DILUTED |

|

47,214,075 |

|

|

|

46,803,791 |

|

|

|

47,068,417 |

|

|

|

46,815,089 |

|

|

|

|

|

|

|

GULF RESOURCES, INC. |

|

|

AND SUBSIDIARIES |

|

|

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS |

|

|

(Expressed in U.S. dollars) |

|

|

(UNAUDITED) |

|

| |

Six-Month Period Ended June 30, |

|

| |

2019 |

|

|

2018 |

|

| |

|

|

|

|

|

| CASH FLOWS FROM OPERATING

ACTIVITIES |

|

|

|

|

|

|

Net loss |

$ |

(5,641,844 |

) |

|

$ |

(11,789,973 |

) |

| Adjustments to reconcile net

loss to net cash provided by operating activities: |

|

|

|

|

|

|

|

Interest on finance lease obligation |

|

76,940 |

|

|

|

86,214 |

|

|

Amortization of prepaid land leases |

|

- |

|

|

|

294,676 |

|

|

Depreciation and amortization |

|

6,964,880 |

|

|

|

9,511,515 |

|

|

Unrealized exchange gain on inter-company balances |

|

(44,427 |

) |

|

|

(345,086 |

) |

|

Deferred tax asset |

|

(1,761,118 |

) |

|

|

(3,076,986 |

) |

|

Common stock issued for services |

|

21,600 |

|

|

|

- |

|

|

Issuance of stock options to employee |

|

45,900 |

|

|

- |

|

| Changes in assets and

liabilities: |

|

|

|

|

|

|

|

Accounts receivable |

|

(6,775,954 |

) |

|

|

25,720,587 |

|

|

Inventories |

|

(457,780 |

) |

|

|

1,039,959 |

|

|

Prepayments and deposits |

|

(17,037 |

) |

|

|

(61,251 |

) |

|

Other receivables |

|

1,631 |

|

|

|

(11,289 |

) |

|

Payable and accrued expenses |

|

321,706 |

|

|

|

(256,603 |

) |

|

Retention payable |

|

- |

|

|

|

(312,429 |

) |

|

Taxes payable |

|

768,072 |

|

|

|

592,979 |

|

|

Operating lease |

|

(268,620 |

) |

|

|

- |

|

| Net cash (used in)

provided by operating activities |

|

(6,766,051 |

) |

|

|

21,392,313 |

|

| |

|

|

|

|

|

|

| CASH FLOWS USED IN INVESTING

ACTIVITIES |

|

|

|

|

|

|

| Additions of prepaid land

leases |

|

- |

|

|

|

(693,198 |

) |

| Purchase of property, plant

and equipment |

|

(11,501,738 |

) |

|

|

(10,333,721 |

) |

| Net cash used in

investing activities |

|

(11,501,738 |

) |

|

|

(11,026,919 |

) |

| |

|

|

|

|

|

|

| CASH FLOWS USED IN FINANCING

ACTIVITIES |

|

|

|

|

|

|

| Repayment of finance lease

obligation |

|

(275,506 |

) |

|

|

(294,295 |

) |

| Net cash used in

financing activities |

|

(275,506 |

) |

|

|

(294,295 |

) |

| |

|

|

|

|

|

|

| EFFECTS OF EXCHANGE RATE

CHANGES ON CASH AND CASH EQUIVALENTS |

|

(101,571 |

) |

|

|

(3,001,994 |

) |

| NET (DECREASE) INCREASE IN

CASH AND CASH EQUIVALENTS |

|

(18,644,866 |

) |

|

|

7,069,105 |

|

| CASH AND CASH EQUIVALENTS -

BEGINNING OF PERIOD |

|

178,998,935 |

|

|

|

208,906,759 |

|

| CASH AND CASH EQUIVALENTS -

END OF PERIOD |

$ |

160,354,069 |

|

|

$ |

215,975,864 |

|

| |

|

|

|

|

|

|

|

| SUPPLEMENTAL DISCLOSURE OF

CASH FLOW INFORMATION |

|

|

|

|

|

|

|

| Cash paid during the periods

for: |

|

|

|

|

|

|

|

|

Income taxes |

$ |

- |

|

|

$ |

- |

|

| Operating right-of-use assets

obtained in exchange for lease obligations |

$ |

8,241,818 |

|

|

$ |

- |

|

|

SUPPLEMENTAL DISCLOSURE OF NON-CASH INVESTING AND FINANCING

ACTIVITIES |

|

|

|

|

|

|

|

|

Purchase of Property,plant and equipment included in Payable and

other accrued expense and Retention payable |

$ |

28,094,696 |

|

|

$ |

- |

|

|

Par value of common stock issued upon cashless exercise of

options |

$ |

379 |

|

|

$ |

- |

|

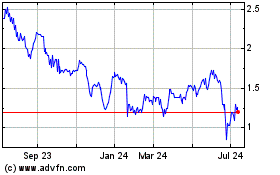

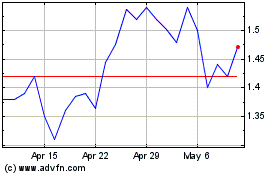

Gulf Resources (NASDAQ:GURE)

Historical Stock Chart

From Mar 2024 to Apr 2024

Gulf Resources (NASDAQ:GURE)

Historical Stock Chart

From Apr 2023 to Apr 2024