Current Report Filing (8-k)

March 01 2021 - 7:13AM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or Section 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): February 26, 2021

GUARDION

HEALTH SCIENCES, INC.

(Exact

name of registrant as specified in its charter)

|

Delaware

|

|

001-38861

|

|

44-4428421

|

|

(State

or other jurisdiction

of

incorporation)

|

|

(Commission

File

Number)

|

|

(I.R.S.

Employer

Identification

No.)

|

15150

Avenue of Science, Suite 200

San

Diego, CA 92128

(Address

of principal executive offices, including zip code)

Registrant’s

telephone number, including area code: (858) 605-9055

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions:

|

[ ]

|

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

[ ]

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e -4(c))

|

Securities

registered pursuant to Section 12(b) of the Act:

|

Title

of each class

|

|

Trading

Symbol(s)

|

|

Name

of each exchange on which registered

|

|

Common

Stock, par value $0.001 per share

|

|

GHSI

|

|

The

NASDAQ Stock Market LLC

|

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company [X]

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

Item 5.03 Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

On

February 26, 2021, Guardion Health Sciences, Inc. (the “Company”) filed a certificate of amendment (the “Amendment”)

with the Delaware Secretary of State to its certificate of incorporation to effectuate a reverse stock split of the Company’s

common stock, par value $0.001 per share. Pursuant to the reverse stock split, on

March 1, 2021 at 6:00 a.m. Eastern Time (the “Effective Time”) each six (6) shares of common stock issued and outstanding

will be combined into one (1) validly issued, fully paid and non-assessable share of common stock. The par value per share remains

the same. The Amendment provides that no fractional shares will be issued; the Company will round up any fractional shares upon

the consummation of the reverse stock split.

The

reverse split ratio selected by the Board of Directors was selected pursuant to the authority granted to the Board of Directors

by the stockholders of the Company. A copy of the Amendment filed with the Secretary of State of the State of Delaware is filed

as Exhibit 3.1 to this Current Report on Form 8-K and is incorporated herein by reference.

Item 8.01 Other Events

During

January and February 2021, the Company completed two at-the-market financings as described below, which generated gross proceeds

of approximately $35,000,000 and net proceeds of approximately $33,600,000.

On

January 8, 2021, the Company entered into a sales agreement and filed a prospectus supplement with the SEC to sell up to $10,000,000

of shares of common stock in an at-the-market offering (the “January 2021 1st ATM Offering”). On January 15, 2021,

the Company completed the January 2021 1st ATM Offering, pursuant to which the Company sold an aggregate of 15,359,000 shares

of common stock (pre-reverse split) at a weighted average price per share of $0.651 (pre-reverse split), raising gross

proceeds of approximately $10,000,000 and net proceeds of approximately $9,500,000.

Subsequently,

on January 28, 2021, the Company entered into a sales agreement and filed a prospectus supplement with the SEC to sell up to $25,000,000

of shares of common stock in an at-the-market offering (the “January 2021 2nd ATM Offering”). On February 10, 2021,

the Company completed the January 2021 2nd ATM Offering, pursuant to which it sold an aggregate of 30,041,400 shares of common

stock (pre-reverse split) at a weighted average price per share of $0.832 (pre-reverse split), raising gross proceeds of

approximately $25,000,000 and net proceeds of approximately $24,100,000.

In

addition, in January and February 2021, the Company issued an aggregate of 9,886,145 shares of common stock (pre-reverse split)

upon the exercise of previously issued warrants and received cash proceeds of $3,608,509.

On

February 26, 2021, the Company issued a press release announcing the reverse stock split, the completed financings and warrant

exercises. The press release is attached as Exhibit 99.1 to this report on Form 8-K and is incorporated herein by reference.

Item

9.01 Financial Statements and Exhibits

(d)

Exhibits

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

|

|

GUARDION

HEALTH SCIENCES, INC.

|

|

Date:

March 1, 2021

|

|

|

|

|

By:

|

/s/

Bret Scholtes

|

|

|

Name:

|

Bret

Scholtes

|

|

|

Title:

|

Chief

Executive Officer

|

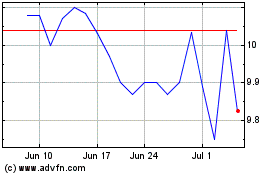

Guardion Health Sciences (NASDAQ:GHSI)

Historical Stock Chart

From Mar 2024 to Apr 2024

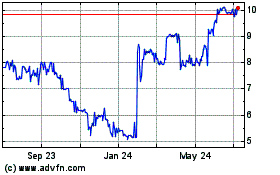

Guardion Health Sciences (NASDAQ:GHSI)

Historical Stock Chart

From Apr 2023 to Apr 2024