Guardion Health Sciences, Inc. (“Guardion” or the

“Company”) (NASDAQ: GHSI) is providing an update to

shareholders with regard to its business plans. In conjunction with

Guardion’s emphasis on differentiation of brands and the

development and integration of an E-commerce platform, and the

further development of clinically supported nutritional products

and continued expansion into international markets, the Company has

retained the investment banking firm of Corporate Finance

Associates (“CFA”) to act as its exclusive financial advisor to

assist management and the Board of Directors in the evaluation of

strategic transactions and opportunities to enhance shareholder

value.

Shortly after recent previously announced

changes in senior management, the Board of Directors established a

Strategy Committee to work with management and to review the

Company’s business initiatives, strategies and opportunities in

order to maximize shareholder value.

As part of that review, the Board of Directors

also determined that it would augment the Company’s organic growth

initiatives with potentially strategic acquisitions to accelerate

the development of the Company’s core businesses. CFA has been

engaged to assist the Company in evaluating complementary products,

technologies and businesses that can contribute positively to the

Company’s top-line revenues and EBITDA.

The Company also recently retained CORE IR, a

boutique investor and public relations strategic advisory firm, to

assist the Company with investor relations, public relations, and

shareholder communications services. CORE IR’s priority is to focus

on expanding market awareness for Guardion and conveying the

Company's business model and growth strategies to its shareholders

and the investment community.

Over the past few months, the Company has been

designing and implementing various internal growth strategies which

it anticipates, over time, will expand the Company’s business

platform, product offerings, market position and financial

performance with a view to growing the Company and driving

shareholder value.

These initiatives and strategies include:

Portfolio Growth and Brand Focus - Continuing to

build out and optimize the Company’s core brands, VectorVision and

NutriGuard, with its proprietary product lines, such as Lumega-Z,

GlaucoCetin, Immune-SF (formerly acuMMUNE), and the VectorVision

CSV-2000

Sales Channel Development:

Expand Current B2B Sales Channel – Continuing

its work with world-class clinicians, using translational research

to focus on new proprietary nutritional research to create new

proprietary nutritional strategies

Direct to Consumer – Develop a digital strategy

to include a “direct-to-consumer” (“DTC”) E-Commerce platform,

which the Company believes will provide high leverage opportunities

for the distribution of its eligible products

International – Continuing to build and grow its

business internationally, particularly in the Far East

Evidence-Based Therapies – Continuing to

demonstrate, both clinically and scientifically, through sponsored

and investigator initiated research, the efficacy of the Company’s

condition-specific nutritional therapies

Management Team – Expand and strengthen its

management team to include the skills required to execute on the

strategies

Robert N. Weingarten, Chairman of the Board of

Directors, stated, “The Board of Directors believes that these

recently-developed initiatives form a critical component in our

plans to develop a solid basis for growth and development in the

near term. The retention of CFA to review and advise the Strategy

Committee on potential transactions, as well to source additional

strategic opportunities, is an important step to facilitate

Guardion’s capability to accelerate growth in an accretive manner

that would be expected to benefit the Company and its shareholders.

In addition, the Company has retained an executive search firm to

identify a permanent Chief Executive officer to lead the Company’s

business

initiatives.”

Dr. David Evans, the Company’s Chief Science

Officer and interim President and Chief Executive Officer, stated,

“We continue to be very focused on our mission to serve the best

interests of our shareholders. The changes in senior management

over the past few months, the implementation of new business

initiatives and strategies, and now the hiring of CFA and its

advisors, are in keeping with our belief that the Company’s current

market profile and capitalization do not adequately reflect the

full value of our unique and compelling proprietary products and

technologies. Additionally, the Company’s strong cash position and

the absence of debt on its balance sheet will allow for Guardion to

exploit acquisition opportunities that would further leverage our

valuable asset base and our reputation for evidence-based

technologies in order to enhance the Company’s long-term

outlook.”

The Company has not set a timetable for this

process and does not intend to disclose developments with respect

to this process unless and until the process has been completed,

and until it enters into a definitive agreement for a specific

material transaction, or as otherwise required by law. The

retention of CFA to assist the Company in the exploration and

evaluation of strategic transactions or acquisitions may not result

in any agreement or transaction and, if completed, any agreement or

transaction may not be successful or on attractive terms. In

addition, a future transaction may also include a capital raising

component to fund expanding business operations and/or to fund

acquisitions.

About Guardion Health Sciences,

Inc.

Guardion is a specialty health sciences company

that develops clinically supported nutritional products, medical

foods and medical devices, with an emphasis in the ocular health

marketplace. Information and risk factors with respect to Guardion

and its business, including its ability to successfully develop and

commercialize its proprietary products and technologies, may be

obtained in the Company’s filings with the SEC

at www.sec.gov.

About Corporate Finance

Associates

Corporate Finance Associates is one of the

largest and most experienced middle-market investment banking firms

in the nation. Since 1956, CFA has been advising on merger,

acquisition, divestiture and capital formation transactions

globally. CFA has over 30 offices in the United States, India,

Belgium, Denmark, Ireland, Netherlands, Switzerland and the United

Kingdom. Additional information about Corporate Finance Associates

may be found on their website at www.cfaw.com.

Forward-Looking Statement

Disclaimer

With the exception of the historical information

contained in this news release, the matters described herein may

contain forward-looking statements within the meaning of Section

27A of the Securities Act of 1933, as amended, and Section 21E of

the Securities Exchange Act of 1934, as amended. Statements

preceded by, followed by or that otherwise include the words

“believes,” “expects,” “anticipates,” “intends,” “projects,”

“estimates,” “plans” and similar expressions or future or

conditional verbs such as “will,” “should,” “would,” “may” and

“could” are generally forward- looking in nature and not historical

facts, although not all forward-looking statements include the

foregoing. These statements involve unknown risks and uncertainties

that may individually or materially impact the matters discussed

herein for a variety of reasons that are outside the control of the

Company, including, but not limited to, the Company’s ability to

raise sufficient financing to implement its business plan, the

impact of the COVID-19 pandemic on the Company’s business,

operations and the economy in general, and the Company’s ability to

successfully develop and commercialize its proprietary products and

technologies. The Company has no commitments with respect to any

acquisition or investment. Readers are cautioned not to place undue

reliance on these forward- looking statements, as actual results

could differ materially from those described in the forward-looking

statements contained herein. Readers are urged to read the risk

factors set forth in the Company’s filings with the SEC, which are

available at the SEC’s website (www.sec.gov). The Company disclaims

any intention or obligation to update or revise any forward-looking

statements, whether as a result of new information, future events

or otherwise.

Investor Relations Contact:

CORE IR Scott Arnold (516)

222-2560 scotta@coreir.com

Corporate Finance Associates

Contact:

| Daniel

Sirvent |

Joe

Sands |

| Managing

Director |

Managing

Director |

|

949.386.7380 |

949-457-8990

Ext. 114 |

|

dsirvent@cfaw.com |

jsands@cfaw.com |

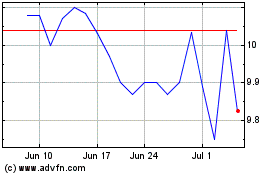

Guardion Health Sciences (NASDAQ:GHSI)

Historical Stock Chart

From Mar 2024 to Apr 2024

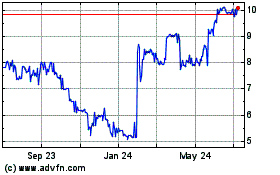

Guardion Health Sciences (NASDAQ:GHSI)

Historical Stock Chart

From Apr 2023 to Apr 2024