Guardion Health Sciences, Inc. (“Guardion” or the “Company”)

(Nasdaq: GHSI), a company (i) that has developed medical foods and

medical devices in the ocular health marketplace and (ii) that is

developing condition-specific nutraceuticals that the Company

believes will provide supportive health benefits to consumers,

announced today its financial results for the year ended December

31, 2019. Guardion also provided a corporate update and product

overview.

“Over the course of 2019, we made significant

progress in expanding our business profile by adding synergistic

assets to our growing portfolio. We believe our portfolio contains

an array of market-leading products, and our efforts are focused on

obtaining wider adoption of these unique products by physicians and

their patients, and by consumers,” commented Michael Favish, CEO of

Guardion.

2019/2020 Corporate

Highlights

- Closed $16.2 million in underwritten public offerings during

2019, including the Company’s initial public offering and listing

of its common stock on the Nasdaq Capital Market in April

2019;

- Received proceeds of $3.5 million from the exercise of warrants

during March 2020;

- Selected by Malaysian company, Ho Wah Genting Berhad (“HWGB”),

in February 2020, to leverage Guardion’s NutriGuard business line

to develop an immune-supportive formula designed to provide

immuno-supportive benefits;

- Announced plans in February 2020 to develop a proprietary

immuno-supportive complex, labeled acuMMUNE, designed with the

objective of supporting effective immune function, under its

NutriGuard business line (trademark registration pending);

- In October 2019, received approval from the United States

Patent and Trademark Office for expanded claims for the Company’s

proprietary medical device, the MapcatSF®; and

- In October 2019, announced statistically significant blood

assay study results evaluating Lumega-Z, demonstrating 40 times

higher blood concentration levels of Mesozeaxanthin from Lumega-Z,

as compared to standard AREDS2 over-the-counter gel caps.

“We are pleased with the steady growth in

revenue from our flagship medical food, Lumega-Z. We have also

received significant interest from customers on the recent launch

of the second generation of the VectorVision® CSV-2000 contrast

sensitivity device. We attribute the drop in sales of our legacy

CSV-1000 device in 2019 to physicians delaying their orders until

our second generation CSV-2000 device became available, and we

expect to regain traction in the coming quarters. We believe over

the past year we have set the stage to propel the Company into its

next phase of growth and, importantly, to drive significant value

for our shareholders,” added Mr. Favish.

Product Portfolio Overview

Lumega-Z®: Currently

distributed regulated vision-specific medical food designed to

replenish and restore the macular protective pigment.

- Data presented at the Association

for Research in Vision and Ophthalmology (AVRO) 2019 Annual

Meeting, demonstrated that patients who used Lumega-Z for 12

consecutive months were associated with significant improvement in

Frequency Doubling Technology pericentral function among patients

with severe glaucoma who had previously shown degeneration despite

having had excellent intraocular pressure control.

- Data from a separate study also

presented at ARVO showed that patients with drusen and at risk of

vision loss from macular degeneration treated with Lumega-Z for 6

months showed improvements in vision, as measured by contrast

sensitivity. Similar patients treated with standard

over-the-counter AREDS2 gel caps showed no change.

VectorVision®: Standardization

system specializing in contrast sensitivity, glare sensitivity, low

contrast acuity, and ETDRS acuity vision testing.

·Sales of second generation device, the

CSV-2000, the only computer-generated vision testing instrument

available, commenced in February 2020.

NutriGuard™: High-quality,

condition-specific nutraceuticals, which are designed to supplement

consumers’ diets, allowing the Company to enter the

direct-to-consumer (“DTC”) marketplace.

- Developing an immune-supportive formula, acuMMUNE, designed to

provide immuno-supportive benefits to its users.

- The Company is currently in the process of manufacturing and

packaging acuMMUNE at contract facilities in the United States and

expects that this product will be available for sale beginning in

mid-April 2020.

GlaucoCetin™: First

vision-specific product designed to support and protect the

mitochondrial function of optic nerve cells in patients with

glaucoma.

MapcatSF®: Patented device for

accurate measurement of macular pigment density.

Transcranial Doppler Solutions,

Inc. (“TDSI”): Ultrasound technology to

assess intracerebral blood flow within the brain and eyes to help

detect potential stroke risk in patients and stenosis of ophthalmic

artery; utilized in the identification of early predictors of eye

disease.

Mr. Favish concluded, “The safety and wellness

of our employees, customers and community remains of the upmost

importance to us and we are actively monitoring the evolving

situation with the coronavirus. We remain vigilant and have

implemented multiple risk mitigation strategies to ensure the least

amount of disruption to our business as possible. Although trade

shows have been cancelled or postponed, we have shifted outreach

efforts to conducting webinars and video conferencing, and to other

methods of reaching our target audiences. We are also focusing on

new business opportunities both in the United States and

internationally as a result of the impact of the coronavirus.”

Summary of Financial Results for Fiscal

Year 2019

For the year ended December 31, 2019, revenue

from product sales was $902,937 compared to $942,153 for the year

ended December 31, 2018, resulting in a decrease of $39,216 or 4%.

The decrease is primarily due to the transition of sales and

manufacturing efforts away from our VectorVision CSV-1000 device.

Although the CSV-1000 will continue to be sold, the Company intends

to put a greater emphasis on sales and marketing efforts of the new

CSV-2000 device. The Company commenced sales of the next generation

CSV-2000 device in February 2020. For the year ended December 31,

2019, revenue from medical foods was $444,657 compared to $332,795

for the year ended December 31, 2018, resulting in an increase of

$111,862 or 34%.

For the year ended December 31, 2019, gross

profit was $561,622 compared to $543,974 for the year ended

December 31, 2018, resulting in an increase of $17,648 or 3% due to

pricing and product mix changes. Gross profit represented 62% of

revenues for the year ended December 31, 2019, versus 58% of

revenue for the year ended December 31, 2018.

For the year ended December 31, 2019, the

Company incurred a net loss of $10,878,308, compared to a net loss

of $7,767,407 for the year ended December 31, 2018. The increase in

net loss compared to the prior year period was primarily due to a

non-cash goodwill impairment charge of approximately $1,564,000

related to VectorVision, as well as an increase in non-cash stock

compensation costs of approximately $1,123,000.

The Company had approximately $11.1 million in

cash and cash equivalents at December 31, 2019.

About Guardion Health Sciences, Inc.

Guardion is a specialty health sciences company

(i) that has developed medical foods and medical devices in the

ocular health marketplace and (ii) that is developing

condition-specific nutraceuticals that the Company believes will

provide medicinal and health benefits to consumers. Information and

risk factors with respect to Guardion and its business, including

its ability to successfully develop and commercialize its

proprietary products and technologies, may be obtained in the

Company’s filings with the SEC at www.sec.gov.

Guardion Health Sciences,

Inc.

Consolidated Balance Sheets

| |

|

December 31, |

|

| |

|

2019 |

|

|

2018 |

|

| |

|

|

|

|

|

|

| Assets |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Current

assets |

|

|

|

|

|

|

|

|

|

Cash |

|

$ |

11,115,502 |

|

|

$ |

670,948 |

|

|

Accounts receivable |

|

|

78,337 |

|

|

|

28,203 |

|

|

Inventories |

|

|

310,941 |

|

|

|

357,997 |

|

|

Prepaid expenses |

|

|

362,938 |

|

|

|

47,773 |

|

| |

|

|

|

|

|

|

|

|

| Total current

assets |

|

|

11,867,718 |

|

|

|

1,104,921 |

|

| |

|

|

|

|

|

|

|

|

| Deposits |

|

|

11,751 |

|

|

|

11,751 |

|

| Property and equipment,

net |

|

|

374,638 |

|

|

|

274,804 |

|

| Right of use asset, net |

|

|

572,714 |

|

|

|

- |

|

| Deferred offering costs |

|

|

- |

|

|

|

270,000 |

|

| Intangible assets, net |

|

|

50,000 |

|

|

|

456,104 |

|

| Goodwill |

|

|

- |

|

|

|

1,563,520 |

|

| |

|

|

|

|

|

|

|

|

| Total

assets |

|

$ |

12,876,821 |

|

|

$ |

3,681,100 |

|

| |

|

|

|

|

|

|

|

|

| Liabilities and

Stockholders’ Equity |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Current

liabilities |

|

|

|

|

|

|

|

|

|

Accounts payable and accrued liabilities |

|

$ |

129,132 |

|

|

$ |

413,925 |

|

|

Accrued expenses and deferred rent |

|

|

116,211 |

|

|

|

81,412 |

|

|

Derivative warrant liability |

|

|

13,323 |

|

|

|

- |

|

|

Lease liability - current |

|

|

151,568 |

|

|

|

- |

|

| |

|

|

|

|

|

|

|

|

| Total current

liabilities |

|

|

410,234 |

|

|

|

495,337 |

|

| |

|

|

|

|

|

|

|

|

| Lease liability – long

term |

|

|

434,747 |

|

|

|

- |

|

| |

|

|

|

|

|

|

|

|

| Total

liabilities |

|

|

844,981 |

|

|

|

495,337 |

|

| |

|

|

|

|

|

|

|

|

| Commitments and

contingencies |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Stockholders’

Equity |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Preferred stock, $0.001 par

value; 10,000,000 shares authorized; no shares issued and

outstanding at December 31, 2019 and December 31, 2018 |

|

|

- |

|

|

|

- |

|

| Common stock, $0.001 par

value; 250,000,000 shares authorized; 74,982,562 and 20,564,328

shares issued and outstanding at December 31, 2019 and December 31,

2018 |

|

|

74,983 |

|

|

|

20,564 |

|

| Additional paid-in

capital |

|

|

57,468,528 |

|

|

|

37,798,562 |

|

| Accumulated deficit |

|

|

(45,511,671 |

) |

|

|

(34,633,363 |

) |

| |

|

|

|

|

|

|

|

|

| Total stockholders’

equity |

|

|

12,031,840 |

|

|

|

3,185,763 |

|

| |

|

|

|

|

|

|

|

|

| Total liabilities and

stockholders’ equity |

|

$ |

12,876,821 |

|

|

$ |

3,681,100 |

|

Guardion Health Sciences,

Inc.

Consolidated Statements of

Operations

| |

|

Years Ended December 31, |

|

| |

|

2019 |

|

|

2018 |

|

| |

|

|

|

|

|

|

| Revenue |

|

|

|

|

|

|

|

|

|

Medical foods |

|

$ |

444,657 |

|

|

$ |

332,795 |

|

|

Medical Devices |

|

|

434,010 |

|

|

|

609,358 |

|

|

Other |

|

|

24,270 |

|

|

|

- |

|

| Total

revenue |

|

|

902,937 |

|

|

|

942,153 |

|

| |

|

|

|

|

|

|

|

|

| Cost of goods

sold |

|

|

|

|

|

|

|

|

|

Medical foods |

|

|

155,212 |

|

|

|

161,023 |

|

|

Medical Devices |

|

|

178,815 |

|

|

|

237,156 |

|

|

Other |

|

|

7,288 |

|

|

|

- |

|

| Total cost of goods

sold |

|

|

341,315 |

|

|

|

398,179 |

|

| |

|

|

|

|

|

|

|

|

| Gross

profit |

|

|

561,622 |

|

|

|

543,974 |

|

| |

|

|

|

|

|

|

|

|

| Operating

expenses |

|

|

|

|

|

|

|

|

|

Research and development |

|

|

194,311 |

|

|

|

231,847 |

|

|

Sales and marketing |

|

|

1,874,901 |

|

|

|

1,520,862 |

|

|

General and administrative |

|

|

7,425,827 |

|

|

|

4,934,986 |

|

|

Goodwill impairment |

|

|

1,563,520 |

|

|

|

- |

|

| |

|

|

|

|

|

|

|

|

| Total operating

expenses |

|

|

11,058,559 |

|

|

|

6,687,695 |

|

| |

|

|

|

|

|

|

|

|

| Loss from

operations |

|

|

(10,496,937 |

) |

|

|

(6,143,721 |

) |

| |

|

|

|

|

|

|

|

|

| Other (income)

expenses: |

|

|

|

|

|

|

|

|

|

Interest expense |

|

|

258,365 |

|

|

|

2,289 |

|

|

Finance cost upon issuance of warrants |

|

|

415,955 |

|

|

|

- |

|

|

Change in fair value of derivative warrants |

|

|

(292,949 |

) |

|

|

- |

|

|

Costs associated with extension of warrant expiration dates |

|

|

- |

|

|

|

1,621,397 |

|

| |

|

|

|

|

|

|

|

|

| Total other (income)

expenses |

|

|

381,371 |

|

|

|

1,623,686 |

|

| |

|

|

|

|

|

|

|

|

| Net loss |

|

|

(10,878,308 |

) |

|

|

(7,767,407 |

) |

| |

|

|

|

|

|

|

|

|

| Net loss per common share –

basic and diluted |

|

$ |

(0.30 |

) |

|

$ |

(0.38 |

) |

| Weighted average common shares

outstanding – basic and diluted |

|

|

36,468,081 |

|

|

|

20,188,628 |

|

Forward-Looking Statement Disclaimer

With the exception of the historical information

contained in this news release, the matters described herein may

contain forward-looking statements within the meaning of Section

27A of the Securities Act of 1933, as amended, and Section 21E of

the Securities Exchange Act of 1934, as amended. Statements

preceded by, followed by or that otherwise include the words

“believes,” “expects,” “anticipates,” “intends,” “projects,”

“estimates,” “plans” and similar expressions or future or

conditional verbs such as “will,” “should,” “would,” “may” and

“could” are generally forward-looking in nature and not historical

facts, although not all forward-looking statements include the

foregoing. These statements involve unknown risks and uncertainties

that may individually or materially impact the matters discussed

herein for a variety of reasons that are outside the control of the

Company, including, but not limited to, the Company’s ability to

raise sufficient financing to implement its business plan, the

impact of the coronavirus (COVID-19) on the Company’s business and

the economy in general, and the Company’s ability to successfully

develop and commercialize its proprietary products and

technologies. Readers are cautioned not to place undue reliance on

these forward- looking statements, as actual results could differ

materially from those described in the forward-looking statements

contained herein. Readers are urged to read the risk factors set

forth in the Company’s filings with the SEC, which are available at

the SEC’s website (www.sec.gov). The Company disclaims any

intention or obligation to update or revise any forward-looking

statements, whether as a result of new information, future events

or otherwise.

Guardion Health Sciences, Inc.

15150 Avenue of Science, Suite 200San Diego, CA 92128Ph

858-605-9055; Fax 858-630-5543www.guardionhealth.com

Investor Contact: Jenene Thomas JTC Team, LLCT:

+1 (833) 475-8247GHSI@jtcir.com

Michael PorterPorter, LeVay & Rose, IncT: +1 (212) 564-4700

mike@plrinvest.com

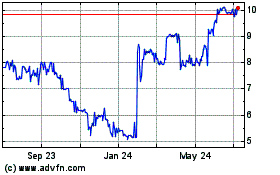

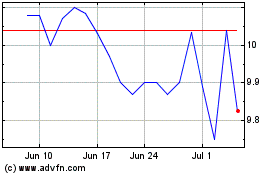

Guardion Health Sciences (NASDAQ:GHSI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Guardion Health Sciences (NASDAQ:GHSI)

Historical Stock Chart

From Apr 2023 to Apr 2024