This prospectus relates to the sale by us of

up to 4,337,349 ordinary shares, at a price per share of $1.15, issuable upon the exercise of warrants, including 4,156,626 ordinary

shares issuable upon exercise of warrants issued to investors in our initial public offering (the “publicly-traded warrants”)

and 180,723 ordinary shares issuable upon the exercise of warrants issued to the representative of the underwriters in our initial public

offering (the “representative’s warrants,” and together with the publicly-traded warrants, the “warrants”).

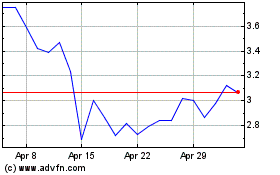

Our ordinary shares and warrants are both

listed on the Nasdaq Capital Market under the symbols “GFAI” and “GFAIW”, respectively. On June 13, 2022, the

closing price of our ordinary shares and warrants on the Nasdaq Capital Market was $0.48 and $0.1572, respectively.

FORWARD-LOOKING STATEMENTS

This prospectus contains forward-looking statements

that are based on our management’s beliefs and assumptions and on information currently available to us. All statements other than

statements of historical facts are forward-looking statements. The forward-looking statements are contained principally in, but not limited

to, the sections entitled “Prospectus Summary,” “Risk Factors,” “Management’s Discussion

and Analysis of Financial Condition and Results of Operations” and “Business.” These statements relate to

future events or to our future financial performance and involve known and unknown risks, uncertainties and other factors that may cause

our actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity,

performance or achievements expressed or implied by these forward-looking statements. Forward-looking statements include, but are not

limited to, statements about:

| |

● |

our goals and strategies; |

| |

● |

our future business development, financial condition and results of operations; |

| |

● |

expected changes in our revenue, costs or expenditures; |

| |

● |

growth of and competition trends in our industry; |

| |

● |

our expectations regarding demand for, and market acceptance of, our products; |

| |

● |

our expectations regarding our relationships with investors, institutional funding

partners and other parties we collaborate with; |

| |

● |

our expectation regarding the use of proceeds from this offering; |

| |

● |

fluctuations in general economic and business conditions in the markets in which

we operate; |

| |

● |

relevant government policies and regulations relating to our industry; |

| |

● |

key personnel continuing their employment with us; and |

| |

● |

the duration and impact of the COVID-19 pandemic. |

In some cases, you can identify forward-looking

statements by terms such as “may,” “could,” “will,” “should,” “would,” “expect,”

“plan,” “intend,” “anticipate,” “believe,” “estimate,” “predict,”

“potential,” “project” or “continue” or the negative of these terms or other comparable terminology.

These statements are only predictions. You should not place undue reliance on forward-looking statements because they involve known and

unknown risks, uncertainties and other factors, which are, in some cases, beyond our control and which could materially affect results.

Factors that may cause actual results to differ materially from current expectations include, among other things, those listed under

the heading “Risk Factors” and elsewhere in this prospectus. If one or more of these risks or uncertainties occur,

or if our underlying assumptions prove to be incorrect, actual events or results may vary significantly from those implied or projected

by the forward-looking statements. No forward-looking statement is a guarantee of future performance.

This prospectus also contains certain data and

information, either directly or incorporated by reference, which we obtained from various government and private publications. Although

we believe that the publications and reports are reliable, we have not independently verified the data. Statistical data in these publications

includes projections that are based on a number of assumptions. If any one or more of the assumptions underlying the market data is later

found to be incorrect, actual results may differ from the projections based on these assumptions.

The forward-looking statements made in this prospectus

or incorporated herein by reference relate only to events or information as of the date on which the statements are made. Although we

are currently registered as a reporting company under Section 12(g) of the Exchange Act and have ongoing disclosure obligations under

United States federal securities laws, we do not intend to update or otherwise revise the forward-looking statements in this prospectus,

whether as a result of new information, future events or otherwise.

PROSPECTUS SUMMARY

This summary highlights

selected information that is presented in greater detail elsewhere, or incorporated by reference, in this prospectus. It does not contain

all of the information that may be important to you and your investment decision. Before investing in our securities, you should carefully

read this entire prospectus, including the matters set forth under, or incorporated by reference in, the section of this prospectus captioned

“Risk Factors” and the financial statements and related notes and other information that we incorporate by reference herein,

including, but not limited to, our annual reports on Form 20-F and our other periodic reports. Unless the context otherwise requires,

the terms “we,” “our,” “us,” “our company,” and “the company” in this prospectus

each refer to Guardforce AI Co., Limited and its consolidated subsidiaries.

Our

Company

Business Overview

We were founded in 2018 with the purpose to acquire

our operating subsidiary GF Cash (CIT) and develop complementary technology related solutions and services.

In 2020, we established a Robotics Solution business

with a goal of diversifying our revenue base, proven to be well timed as the global COVID-19 pandemic soon followed.

In March 2021, we acquired 51% of Handshake Networking

Limited, or Handshake, in Hong Kong as part of our strategy to enter into the Information Security business.

The principal executive office of our company

was changed to Singapore from Bangkok, Thailand in November 2021.

On March 22, 2022, we acquired 100% of the equity

interests in Shenzhen GFAI and Guangzhou GFAI in Greater Bay Area of China. This acquisition is expected to serve an integral role in

the growth of Guardforce AI’s robotics as a service (RaaS) business initiative.

On May 24, 2022, we signed two definitive agreements

to acquire a total of eight companies in China. The first agreement is to acquire Beijing Wanjia Security System Limited, an integrated

security provider with 25 years of experience, from Shenzhen Yeantec Co., Limited. This acquisition is expected to close in June 2022.

The second agreement is to acquire an additional seven companies from Shenzhen Kewei Robot Technology Co., which acquisition is expected

to close in the third quarter of 2022. These seven companies are providers of robotics as a service (RAAS) solutions.

Our businesses are categorized into three main

units:

[i] Secured Logistics Business;

[ii] Robotics Solution Business; and

[iii] Information Security Business.

Our Secured Logistics Business

We are a market leader with more than 40 years

of experience in the cash logistics business in Thailand. Our services include cash-in-transit, dedicated vehicles to banks, ATM management,

cash center operations, cash processing, coin processing, cheque center, and cash deposit machine solutions (cash deposit management

and express cash service). Our customers include local commercial banks, chain retailers, coin manufacturing mints, and government authorities.

Our five major customers are Government Savings Bank, Bank of Ayudhya, TTB Bank Public Company (Thanachart Bank Public Company was one

of our five major customers in fiscal year 2020 which had merged with TMB Bank Public Company in June 2021 to become TTB Bank Public

Company), CP All Public Company and Big C Super Center Public Company. A few global customers also retain our services under temporary

contract. As of the date of this report, we employed 1,738 staff located in GF Cash (CIT) and had 473 vehicles.

Our operating subsidiary, GF Cash (CIT), was

founded in 1982 (the company was formerly named Securicor (Thailand) Limited) and was renamed G4S Cash Service (Thailand) Limited in

2005. The Company was renamed again as Guardforce Cash Solution (Thailand) Limited in 2016 and the name was further changed to Guardforce

Cash Solution Security (Thailand) Company Limited in 2017. The principal office of GF Cash (CIT) is located in Bangkok, Thailand.

Substantially all of our revenues are derived from GF Cash (CIT)’s

secured logistic business and gross revenue for our secured logistic business years ended December 31, 2021, 2020 and 2019 was approximately

$34.3 million, $37.4 million and $38.6 million, respectively.

In 2020, in addition to our secured cash logistics

business, we strategically began to develop other non-cash related solutions and services in an effort to diversify our revenue streams.

In view of the pace of global robotics development and in response to the more automated requirements, driven in part by the COVID-19

pandemic, we have begun to rollout robotic solutions for our customers in Thailand and across the Asia Pacific region. As of December

31, 2021, we had generated approximately $0.4 million in revenue from our robotics solutions business.

In addition, we acquired a majority interest

in Handshake on March 25, 2021, which contributed approximately $0.5 million to our consolidated revenue for the year ended December

31, 2021.

As of the date of this prospectus, the large

majority of our revenues are derived from our principal business, which is Secured Logistics Solutions. This primarily includes: (i)

Cash-In-Transit – Non-Dedicated Vehicle (Non-DV); (ii) Cash-In-Transit – Dedicated Vehicle (DV); (iii) ATM management; (iv)

Cash Processing (CPC); (v) Cash Center Operations (CCT); (vi) Consolidate Cash Center Operations (CCC); (vii) Cheque Center Service (CDC);

(viii) Express Cash; (ix) Coin Processing Service; (x) Cash Deposit Management Solutions (GDM).

Secured Logistics Solutions collects cash from

its customers’ main business operations, then delivers the collected cash to its cash processing centers for counting, checking

and packing in bundles, after which the cash is transported to the customers’ designated depository banks and deposited into the

customers’ bank accounts. We enter into contracts with our customers to establish pricing and other terms of service. We charge

customers based on activities (service performed) as well as based on the value of the consignment.

Core Services

Our Core Services include CIT (Non-DV), CIT (DV),

ATM Management, CPC, CCT, CCC, CDC and GDM. For the year ended December 31, 2021, Core Services represented 97.6% of our total revenues.

The charts below show the breakdown of our core

secured logistics business services by sector for the fiscal years ended December 31, 2021, 2020 and 2019. These business sectors are

discussed below.

Revenue by Services (For the year ended December

31, 2021):

Revenue by Services (For the year ended December

31, 2020):

Revenue by Services (For the year ended December

31, 2019):

Cash-In-Transit – Non-Dedicated Vehicles

(Non-DV)

CIT (Non-DV) includes the secured transportation

of cash and other valuables between commercial banks and the Bank of Thailand, Thailand’s central bank. CIT (Non-DV) also includes

the transportation of coins between the commercial banks, the Thai Royal Mints and the Bank of Thailand. As such, the main customers

for this service are the local commercial banks. Charges to the customers are dependent on the value of the consignment; condition of

the cash being collected (for example, seal bag collection, piece count collection, bulk count collection, or loose cash collection);

and the volume of the transaction. Vehicles used for the delivery of this service are not dedicated to the specific customers.

For the years ended December 31, 2021, 2020 and

2019, CIT (Non-DV) revenues were approximately $11.2 million (31.9%), $12.0 million (32.0%) and $12.1 million (31.2%), respectively.

Cash-In-Transit - Dedicated Vehicle to

Banks (DV)

CIT (DV) includes the secured transportation

of cash and other valuables between commercial banks. As part of this service, dedicated vehicles are assigned specifically to the contracted

customer for their dedicated use between the contracted designated bank branches. As this is a dedicated vehicle service, customers will

submit direct schedules to our CIT teams for the daily operational arrangements and planning. Charges to the customers are on a per vehicle

per month basis.

For the years ended December 31, 2021, 2020 and

2019, CIT (DV) revenues were approximately $4.6 million (13.0%), $4.8 million (12.8%) and $5.0 million (12.9%), respectively.

ATM Management

ATM management includes cash replenishment services

and first and second line of maintenance services for the ATM machines. First line of maintenance services (FLM) includes rectification

of issues related to jammed notes, dispenser failures and transaction record print-out issues. Second line of maintenance services (SLM)

includes all other issues that cannot be rectified under the FLM. SLM includes complete machine failure, damage to hardware and software,

among other things.

For the years ended December 31, 2021, 2020 and

2019, ATM Management revenues were approximately $10.8 million (30.7%), $12.5 million (33.3%) and $14.0 million (36.4%), respectively.

Cash Processing (CPC)

Cash processing (CPC) services include counting,

sorting, counterfeit detection and vaulting services. We provide these services to commercial banks in Thailand.

For the years ended December 31, 2021, 2020 and

2019, CPC revenues were approximately $3.0 million (8.6%), $2.8 million (7.5%) and $2.3 million (5.9%), respectively.

Cash Center Operations (CCT)

Cash Center Operations (CCT) is an outsourced

cash center management service. We operate the cash center on behalf of the customer, which includes note counting, sorting, storage,

inventory management and secured transportation of the notes and coins to the various commercial banks in Thailand.

For the years ended December 31, 2021, 2020 and

2019, CCT revenues were approximately $2.8 million (8.0%), $3.3 million (8.6%) and $3.7 million (9.5%), respectively.

Consolidate Cash Center (CCC)

Consolidate Cash Center (CCC) is a new business

commencing in 2021 to provide an outsourced cash center management service. We operate the cash center which includes note counting,

sorting, storage, inventory management and secured transportation of the notes and coins on behalf of for Bank of Thailand (BOT).

For the years ended December 31, 2021, CCC revenues

were approximately $0,2 million (0.5%).

Cheque Center Service (CDC)

Cheque Center Service (CDC) includes secured

cheque pickup and delivery service.

For the year ended December 31, 2021, 2020 and

2019, CDC revenues were approximately $0.05 million (0.1%), $0.1 million (0.2%) and $0.4 million (1%), respectively.

Express Cash

The express cash service is an expansion of our

Guardforce Digital Machine, or GDM, solution. We work with commercial banks to have a mobile GDM installed in our CIT vehicles to collect

cash from retail customers at the retailers’ sites. The cash is immediately processed inside the CIT vehicle and the cash counting

results are immediately transmitted to GF Cash (CIT) headquarters and to the commercial bank. That bank will then credit the counted

amount to its customers’ bank accounts. We launched the Express Cash service in 2019.

For the years ended December 31, 2021, 2020 and

2019, express cash service revenues were $nil (nil %), $0.1 million (0.3%) and $nil (nil %), respectively.

Coin Processing Service

The Coin Processing Service includes the secured

collection of coins from retail businesses and banks. The coins are stored and then delivered to the Royal Thai Mint, a sub-division

of the Thai Treasury Department, Ministry of Finance. We deploy manpower to work at the Royal Thai Mint as cashier services. Additionally,

we use our existing vehicle fleet to deliver coins from the Royal Thai Mint to bank branches, and vice versa.

For the years ended December 31, 2021, 2020 and

2019, coin processing service revenues were $nil, $0.3 million (0.8%) and $0.04 million (0.1%), respectively.

International Shipment

International shipment provides secured delivery

service that we receive and deliver high valued items such as diamonds and jewelries on behalf of our customers. We receive the consignment

by air and delivers to local customers in Thailand or vice versa.

For the years ended December 31, 2021, 2020 and

2019, international shipment revenues were $0.05 million (0.1%), $0.06 million (0.0%) and $nil (nil %), respectively.

Cash Deposit Management Solutions (GDM)

Cash Deposit Management Solutions are currently

delivered by our Guardforce Digital Machine (GDM). The GDM product is deployed at customer sites to provide secured retail cash deposit

services. Customers use our GDM product to deposit daily cash receipts. We then collect the daily receipts from our GDM in accordance

to the agreed schedules. All cash receipts are then securely collected and delivered to our cash processing center for further handling

and processing.

For the years ended December 31, 2021, 2020 and

2019, GDM revenues were approximately $1.6 million (4.7%), $1.5 million (3.9%) and $1.2 million (3%), respectively.

Our Fee Structure for the Secured Logistics

Business

We have several fee models based on the services

provided. Our fees for dedicated vehicles service are based on the allocation of cost of manpower deployment, vehicle and consumable

items. Fees for fixed collections or on-call services are based on a pre-agreed amount per delivery, which varies by such factors as

collection time, pick-up and delivery locations and the processing time.

Our Fleet of Vehicles for the Secured Logistics

Business

We operate a fleet of 473 vehicles. Our fleet

includes armored vehicles – pickup, armored vehicles – van, armored vehicles – truck 6 wheels, maintenance soft skin

vehicles – pickup, coin trucks soft skin – pickup, security patrol soft skin – pickup trucks and administrative vehicles.

Our vehicles are maintained to the highest commercial

standards to ensure our quality of service. We operate dedicated garages for the repair and maintenance of our vehicles, staffed with

a team of in-house auto mechanics. Our vehicle repair facilities are located at our head office location in Laksi and at other major

branch locations. We also have a well-established logistics department which monitors the operations of our garages and the maintenance

of our vehicle operations standards.

Our Robotic Solutions Business

Our Robotics Solutions business was established

in 2020 as part of our revenue diversification efforts. We do not manufacture the robots, but we operate on a Robots as a Service (RaaS)

business model and purchase the robots from equipment manufacturers. We integrate various value add applications and offer these as a

recurring revenue service. As part of our market penetration strategy, we have adopted a mass adoption strategy by providing the robots

on a trial basis with an option to purchase or rent. In February 2022, we announced that the company had reached a strategic milestone

deploying more than 1,400 robots in the Asia Pacific region. The majority of these robots are still on a free trial basis with our key

consideration being the collection of usage patterns and market intelligence allowing us to further develop applications and features

that are suitable to our customers. In October 2021, we announced the launch of our Intelligent Cloud Platform (ICP) to help better manage

the remotely deployed robots and to facilitate the development of additional features and applications. We plan to provide access to

the ICP to all our clients through a browser-based interface that allows clients real-time data access. We are working continuously to

improve and upgrade the robots and the ICP and their precise specifications may change over time.

We currently have 3 robotics products:

[1] Reception Robot (T - Series) for indoor stationary

applications.

[2] Disinfection Robots (S - Series) for indoor

applications.

[3] Delivery Robot (D - Series) for indoor applications.

Reception Robot (T – Series)

The T – Series robot is designed for indoor

deployment at ingress/egress points for access control management. The T – Series robots are used primarily at shopping malls,

residential buildings, educational institutions, corporate buildings, hospitals, supermarkets, transportation stations, hotels and entertainment

venues. The T – Series features include:

| |

● |

Contactless temperature screening; |

| |

● |

Interactive touch screen; and |

| |

● |

Large frontal display screen for remote public announcement and advertising. |

Disinfection Robots (S – Series)

The S – Series robot is designed to be

deployed indoors with disinfection capabilities and is used primarily at shopping malls, residential buildings, educational institutions,

corporate buildings, hospitals, supermarkets, transportation stations, hotels and entertainment venues. The S – Series current

features include:

| |

● |

Effective mist disinfection for areal sanitization; |

| |

● |

Autonomous navigation using Simultaneous Localization and Mapping (SLAM) and Light

detection and ranging (LiDar) technologies; and |

| |

● |

Autonomous “home return” to port feature for charging when power is

running below 20%. |

Delivery Robot (D – Series)

The D – Series robot is designed for indoor

applications for autonomous delivery capabilities and is used primarily at hotels, hospitals, restaurants and office environments. The

current D – Series features include:

| |

● |

Interactive touch screen; |

| |

● |

Autonomous navigation using Simultaneous Localization and Mapping (SLAM) and Light

detection and ranging (LiDar) technologies; and |

| |

● |

Autonomous “home return” to port feature for charging when power is

running below 20%. |

In addition, all of our robots include several

communications features - the units can transfer data over both 4G LTE networks and Wi-Fi and will be able to incorporate future 5G capabilities.

For the year ended December 31, 2021, robotics

solutions revenues were approximately $0.37 million or approximately 1.0% of the company’s total revenues.

Our Fee Structure for the Robotics Solutions

Business

Our Robotics Solution Business has two fee structures:

| |

● |

Sale of Robots: One-off purchase by customers of the robots; and |

| |

● |

Rental of Robots: Customers lease the robots as part of our Robots as a Service

(RaaS) model. |

Our Information Security Business

We acquired a majority stake in Handshake on

March 25, 2021, in furtherance of our strategy to diversify into information security as part of our portfolio of services. The purpose

of this acquisition was to provide us with the experience, expertise and creditability to capitalize on the growing information security

market. The Asia Pacific market for cybersecurity is expected to grow to approximately $51.42 billion by 2026. https://www.mordorintelligence.com/industry-reports/asia-pacific-cyber-security-market.

Handshake has been providing professional information

security consultancy services since 2004 within the Asia Pacific region.

Handshake is the only certified and approved

scanning vendor in Hong Kong by the PCI Security Standard Council (PCI ASV).

The services offered under our Information Security

business include:

| |

● |

External and Internal Penetration Testing; |

| |

● |

Wireless Network Testing; |

| |

● |

Web Application Testing; |

| |

● |

Hospitality Services Testing; |

| |

● |

Consulting Services, Training; |

For the year ended December 31, 2021, Information

Security revenues were approximately $0.48 million, or 1.4% of the company’s total revenues.

Our Fee Structure for the Information Security

Business

Our Information Security Business has three fee

structures:

| |

● |

Penetration Test: one-off fees based upon the successful delivery of the test report; |

| |

● |

PCI ASV Scan: one-off fees based upon a successful scan result report; and |

| |

● |

Reseller: one-off fees based upon the resale and installation of third party information

security solutions . We are currently a reseller of Rapid7 security software solutions. |

Sales and Marketing

Secured Logistics Business Sales &

Marketing

During the 2022 fiscal year, for our secured

logistics business we will endeavor to ensure that all of our existing customer contracts will be renewed, to protect our major sources

of existing income. In addition, we plan to undertake the following activities to promote our businesses:

| |

● |

To continue to work closely with local Thailand commercial banks to attract more

retail chain customers to our secured logistic solutions such as outsourced cash management services; |

| |

● |

To work closely with existing customers to extend our secured logistics solutions

throughout Thailand and other industries and |

| |

● |

To explore upgrading the cash processing system to include AI related functions

and capabilities. |

Secured Logistics Customers

Since 2008, the major customer of our secured

logistics business has been the Government Savings Bank, a state-owned Thai bank located in Bangkok.

For the year ended December 31, 2021, the revenue

derived from the Government Savings Bank was approximately $9.6 million, which accounted for approximately 27.3% of our revenue.

For the year ended December 31, 2021, our next

four largest customers were the Bank of Ayudhya Public Company, CP All Public Company, TTB Bank Public Company (Thanachart Bank Public

Company was one of our five major customers in fiscal year 2020 which had merged with TMB Bank Public Company in June 2021 to become

TTB Bank Public Company) and Big C Super Center Public Company. The total revenue derived from these four customers was approximately

$15.7 million or 44.6% of our revenue. Our top five customers combined accounted for approximately 71.9% of our revenue. We have four

customers that accounted for 10% or more of our revenue for the years ended December 31, 2021, 2020 and 2019 (See Note 23 “Concentrations”

in our audited consolidated financial statements for details).

For the year ended December 31, 2021, substantially

all of our revenues are derived from secured logistic customers of approximately $35.15 million. 64% of our revenue was generated from

bank customers, while retail customers and others such as hospitality, corporate and logistics sectors accounted for 36% of these revenues.

We are now starting to diversify our customer

portfolio by acquiring more retail customers and entering other new service sectors in order to balance our portfolio and better protect

our business.

Our business development and customer service

teams actively participate in all contract renewal processes in order to retain the contracts that are up for renewal and to establish

and maintain good relationships with our customers.

Secured Logistics Competition

Our principal business is secured logistics.

The chart below references GF Cash (CIT) as “GFCTH” and names GF Cash (CIT)’s competitors showing relative market share

in 2021.

THAILAND MARKET SHARE 2021

Source: Thailand Revenue Department

The secured logistics industry in Thailand is

subject to significant competition and pricing pressure. The main competitors are the international companies such as Brinks, and there

are also many local CIT competitors in Thailand having very good relationships with their customers. We expect our secured logistics

competition to increase and this could affect our pricing strategies in the future.

Additionally, several banks have their own CIT

subsidiaries which serve these banks exclusively.

We also face potential competition from certain

commercial banks that market their own cash management solutions to their customers and hire CIT companies as their CIT suppliers.

Across the CIT industry, most CIT companies want

to have a footprint in the retail sector and they use lower pricing as a competitive strategy.

Despite the high competition in the CIT industry

in Thailand, we believe that we have significant competitive advantages, including:

| |

● |

Full coverage in the entire country with 21 branches; |

| |

● |

Flexible and reliable operations; |

| |

● |

Continuity of our management team; |

| |

● |

The authorization by the BOT of GF Cash (CIT) to run 10 Cash Centers in Thailand

to support Cash Center operations to the BOT; |

| |

● |

Long term relationship with local commercial banks; |

| |

● |

40 years of experience among the staff/management team in the cash logistics solutions

business in Thailand; and |

| |

● |

In 2021, the award by the BOT of GF Cash as Consolidated Cash Centre operator in

Khon Kean & Hadyai. |

Robotics Solutions Business Sales &

Marketing

During the 2022 fiscal year, we plan to undertake

the following activities to promote our Robotics Solutions business:

| |

● |

To continue to offer our robots on a free trial basis and to provide rental and

purchase options to drive market penetration and coverage; |

| |

● |

To use our existing nationwide infrastructure in Thailand to promote and introduce

our robotic solutions as the country begins to recover from the COVID lockdown, in particular, to hotels, airports, transportation

hubs, hospitals and shopping centers; |

| |

● |

To work closely with partners globally in the region to promote and introduce our

robotic solutions, in particular, in Singapore, Hong Kong, Malaysia, Macau and other Asia Pacific regions and the US; and |

| |

● |

To continue to develop and integrate the ICP to facilitate future additional revenue

streams from AI related applications and features that includes but not limited to a customer user friendly dashboard that allows

clients to remotely monitor and analyze the data sensed from the robots deployed within their premises. |

Robotics Solutions Customers

Since the inception of our Robotics Solutions

business, the deployment of our robots (free trial, service fee basis and sales) has primarily been at hospitals, educational institutions,

entertainment venues, government buildings, and shopping malls in Thailand, Hong Kong, Singapore, Malaysia, Macau and other markets across

Asia.

Robotics Solutions Competition

The robotics industry globally is still in its

infancy. Competition is high as most competitors are engaged in selling robots as a stand-alone product. The majority of our competitors

are Chinese and Japanese robotics manufacturers. At present, there is no clear market leader.

Despite the highly competitive environment, we

believe we have the following competitive advantages:

| |

● |

Existing distribution network via our secured logistics business particularly in

Thailand; |

| |

● |

40 years of business experience in delivering services to customers; and |

| |

● |

Development of the Intelligent Cloud Platform that will enhance the customer experience

and value. |

Information Security Business (Sales &

Marketing)

During the 2022 fiscal year, we plan to undertake

the following activities to promote our Information Security business:

| |

● |

Work with customers to extend testing services within their organizations and to

their customers; |

| |

● |

Continue to explore overseas expansion via existing business networks in Thailand

and Hong Kong; and |

| |

● |

Develop automated penetration testing applications to facilitate the Software as

a Service (SaaS) business model. |

Information Security Customers

Our customers in the Information Security business

are primarily within the financial, logistics, retail, hospitality, and corporate services segments. Our business managers are in constant

contact with customers to ensure that all service requests are delivered on a timely basis. The majority of service requests are based

on annual penetration test requirements by the customers.

Information Security Competition

The information security industry globally is

extremely fragmented with numerous start-ups targeting niche segments of the information security market. We expect that with the growing

transformation of existing business to online platforms, the demand for various Information Security solutions will grow significantly.

Competition is high as existing dominant players in the US and Europe try to gain market share within the Asia Pacific region. However,

we believe that there will be a merging of physical security and Information Security as customers will require not only physical security

but also the Information Security solutions.

Despite the high competition, we believe that

we have significant advantages in our information security solutions, including;

| |

● |

Existing distribution network via our secured logistics business particularly in

Thailand; |

| |

● |

40 years of business experience in delivering services to customers; and |

| |

● |

The only PCI ASV approved scanning vendor in Hong Kong. |

Our Growth Strategies

We believe that trends in the security industry

during the next decade will be characterized by rapid technological change, continual convergence between physical security and Information

Security and increased competition. Against the backdrop of these industry trends, we aim to enhance shareholder value by maintaining

our leading position in the Thailand secured logistics services market as well as leveraging our competitive strengths to exploit new

opportunities identified from the increasing physical and cyber convergence and the growth in regional security demand.

Our principal growth strategies are to:

| |

● |

Continue to maintain our leadership position in Thailand by providing the best-in-class

solutions to our customers. This includes development of artificial intelligence, or AI, systems within our logistical network to

improve service deliveries and value add solutions to our customers. |

| |

● |

Offer a broad range of new and innovative services that are non-cash related, with

a goal of 44% of our 2022 revenues to be derived from non-CIT related offerings. We will continue to drive robotics solutions and

applications as the market becomes more educated and adapted to accept new technologies. In addition, we will continue to explore

the deployment of Information Security related solutions as businesses and individuals become more connected and more vulnerable

to security intrusions and cyber thefts. |

| |

● |

Increase the speed of transformation by acquiring or establishing partnerships with

technological innovators in the Information Security, artificial intelligence, robotics and related fields. To that end, on March

25, 2021, we completed our acquisition of 51% of Handshake. Please refer to the Recent Developments section below for more information

about our Handshake business. |

| |

● |

Enter the US market. We have established a strategic partnership with SBC Global

Holdings Inc. (“SBC”). We and SBC have mutually agreed to establish the strategic partnership to enable our company a

swifter entry into the desired U.S. markets with its robotic and technology solutions. |

| |

● |

Enter the China market. On March 22, 2022, we acquired 100% of the equity interests

in Shenzhen GFAI and Guangzhou GFAI in Greater Bay Area of China. Greater Bay Area is one of the fastest-growing economic regions

in China with both Shenzhen and Guangzhou ranking among the top 10 largest Chinese cities and among the 30 largest cities globally.

Focused on the hospitality, healthcare, property management, and government sectors, Shenzhen GFAI and Guangzhou GFAI derive revenues

from AI robotic services which automate repetitive tasks, making them less labor intensive. This acquisition is expected to serve

an integral role in the growth of Guardforce AI’s robotics as a service (RaaS) business initiative. |

| |

● |

Continue to drive geographical expansion into key markets either via acquisitions

and partnerships or organic growth. |

| |

● |

Continue to invest in and develop the robotics back-end technology such as our Intelligent

Cloud Platform (ICP) to enhance and upgrade the features of, and applications for, the robots. |

We expect to use the majority of the net proceeds

from our private placement that closed in January to fund our planned capital expenditures to achieve the above itemized growth strategies.

As of December 31, 2021, our cash and cash equivalents

and restricted cash was approximately $15.9 million. (See Note “Cash, Cash Equivalents and Restricted Cash” in our audited

consolidated financial statements for the years ended December 31, 2021, and 2020 on page F-23 for details on our cash position.) To

the extent that there may be shortfalls in internal cash available for our growth plans, we expect to be able to access commercial banking

credit facilities as the need arises.

There can be no assurance, however, that we will

be able to accomplish any of the above listed strategic objectives or to acquire the necessary capital on terms acceptable to us, if

at all. See “Risk Factors—Risks Relating to our Business—We might not have sufficient cash to fully execute our

growth strategy.”

Our Risks and Challenges

Our prospects should be considered in light of

the risks, uncertainties, expenses and difficulties frequently encountered by similar companies. Our ability to realize our business

objectives and execute our strategies is subject to risks and uncertainties, including, among others, the following:

Risks Relating to Our Business and Industry

Risks and uncertainties related to our business

and industry include, but are not limited to, the following:

| |

● |

The effect of the coronavirus, or the perception of its effects, on our operations

and the operations of our customers and suppliers could have a material adverse effect on our business, financial condition, results

of operations and cash flows; |

| |

● |

Our negative operating profits may raise substantial doubt regarding our ability

to continue as a going concern; |

| |

● |

We operate in highly competitive industries; |

| |

● |

We currently report our financial results under IFRS; |

| |

● |

We have substantial customer concentration, with a limited number of customers accounting

for a substantial portion of our recent revenues; |

| |

● |

Changes to legislation in Thailand may negatively affect our business; |

| |

● |

Unexpected increases in minimum wages in Thailand would reduce our net profits; |

| |

● |

Increases in fuel cost would negatively impact our cost of operations; |

| |

● |

We might not have sufficient cash to fully execute our growth strategy; |

| |

● |

We might not have sufficient cash to repay a related party loan obligation; |

| |

● |

Our business success depends on retaining our leadership team and attracting and

retaining qualified personnel; |

| |

● |

In the future we may not be able to use the Guardforce trademark, which could have

a negative impact on our business; |

| |

● |

We may be subject to service quality or liability claims, which may cause us to

incur litigation expenses and to devote significant management time to defending such claims, and if such claims are determined adversely

to us, we may be required to pay significant damage awards; |

| |

● |

Decreasing use of cash could have a negative impact on our business; |

| |

● |

Implementation of our robotics solution has required, and may continue to require,

significant capital and other expenditures, which we may not recoup; |

| |

● |

We may fail to successfully integrate our acquisitions of Handshake, Shenzhen GFAI,

and Guangzhou GFAI and may fail to realize the anticipated benefits; |

| |

● |

We may experience a financial loss due to our planned acquisition of subsidiaries

of Shenzhen Kewei Robot Technology Co., Limited and Shenzhen Yeantec Co., Limited; |

| |

● |

We may not be able to obtain the necessary funding for our future capital or refinancing

needs; |

| |

● |

Any compromise of information security of our platform could materially and adversely

affect our business, operations and reputation; and |

| |

● |

Our transfer pricing decisions may result in uncertain tax exposures for our group. |

Risks Relating to our Corporate Structure

Risks and uncertainties related to our corporate

structure include, but are not limited to, the following:

| |

● |

We rely upon structural arrangements to establish control over certain entities

and government authorities may determine that these arrangements do not comply with existing laws and regulations. |

Risks Relating to Doing Business in Thailand

Risks and uncertainties related to doing business

in Thailand include, but are not limited to, the following:

| |

● |

A severe or prolonged downturn in the global economy or the markets that we primarily

operate in could materially and adversely affect our revenues and results of operations; |

| |

● |

We are vulnerable to foreign currency exchange risk exposure; and |

| |

● |

The ability of our subsidiaries to distribute dividends to us may be subject to

restrictions under the laws of their respective jurisdictions. |

Risks Relating to Doing Business in China

Risks and uncertainties related to doing business

in China include, but are not limited to, the following:

| |

● |

Changes in China’s economic, political or social conditions or government

policies could have a material adverse effect on our business and operations; |

| |

● |

Uncertainties with respect to the PRC legal system could adversely affect us; |

| |

● |

The PRC government exerts substantial influence over the manner in which our PRC

subsidiaries must conduct their business activities. If the Chinese government significantly changes the regulations related to the

business operations of our PRC subsidiaries in the future and our PRC subsidiaries are not able to substantially comply with such

regulations, the business operations of our PRC subsidiaries may be materially and adversely affected and the value of our ordinary

shares may significantly decrease; |

| |

● |

Our business is subject to complex and evolving laws and regulations regarding privacy

and data protection. Compliance with China’s new Data Security Law, Cybersecurity Review Measures, Personal Information Protection

Law, as well as additional laws, regulations and guidelines that the Chinese government promulgates in the future may entail significant

expenses and could materially affect our business; |

| |

● |

PRC regulation of loans to, and direct investments in, PRC entities by offshore

holding companies may delay or prevent us from using proceeds from our future financing activities to make loans or additional capital

contributions to our PRC subsidiaries; |

| |

● |

We may rely on dividends paid by our subsidiaries for our cash needs, and any limitation

on the ability of our subsidiaries to make payments to us could have a material adverse effect on our ability to conduct business; |

| |

● |

Under the Enterprise Income Tax Law, we may be classified as a “Resident Enterprise”

of China. Any classification as such will likely result in unfavorable tax consequences to us and our non-PRC shareholders; |

| |

● |

You may be subject to PRC income tax on dividends from us or on any gain realized

on the transfer of our ordinary shares; |

| |

● |

PRC laws and regulations establish complex procedures in connection with certain

acquisitions of China-based companies by foreign investors, which could make it more difficult for us to pursue growth through acquisitions

or mergers in China; and |

| |

● |

Fluctuations in exchange rates could have a material adverse impact on our results

of operations and the value of your investment. |

Risks Relating to Our Ordinary Shares and

Warrants

Risks and uncertainties related to our ordinary

shares and warrants include, but are not limited to, the following:

| |

● |

You may experience difficulties in effecting service of legal process, enforcing

foreign judgments or bringing actions against us or our management named in this prospectus based on foreign laws; |

| |

● |

We are a foreign private issuer within the meaning of the rules under the Exchange

Act, and as such we are exempt from certain provisions applicable to U.S. domestic public companies; |

| |

● |

As a foreign private issuer, we are permitted to rely on exemptions from certain

Nasdaq corporate governance standards applicable to domestic U.S. issuers. This may afford less protection to holders of our shares;

and |

| |

● |

Future issuances of debt securities, which would rank senior to our ordinary shares

upon our bankruptcy or liquidation, and future issuances of preferred shares, which could rank senior to our ordinary shares for

the purposes of dividends and liquidating distributions, may adversely affect the level of return you may be able to achieve from

an investment in our securities. |

Impact of Coronavirus Pandemic

The spread of the COVID-19 around the world

has caused significant business disruption commencing with the first quarter of 2020. On March 11, 2020, the World Health Organization

declared the outbreak of COVID-19 as a global pandemic, which continues to spread around the world. There is significant uncertainty

around the breadth and duration of business disruptions related to COVID-19, as well as its impact on the U.S. and international economies.

While it is difficult to estimate the financial impact of COVID-19 on the company’s operations, management believes that COVID-19

could continue to have a material adverse impact on its financial results in year 2021. As of September 28, 2021, the total confirmed

number of COVID-19 cases in Thailand was 1,581,415. Schools, bars and massage parlours have been closed until recently and alcohol sales

have been banned in restaurants in a bid to curb the pandemic. Given the rapidly changing developments, we cannot accurately predict

what effects these developments will have on our business going forward. Our revenues for the year ended December 31, 2020 were negatively

impacted by the pandemic by approximately 2.4%. For the years ended December 31, 2020 and 2019, revenues were approximately $37.65 million

and $38.57 million, respectively. While we expect demand for our services to be negatively impacted as a result of the COVID-19 crisis,

increases in some lines of business, and decrease in others, the future impact of the COVID-19 crisis on our industry and our business

will depend on, among other factors, the ultimate geographic spread of the virus, governmental limitations, the duration of the outbreak,

travel restrictions and business closures.

Corporate Information

Our corporate address is 10 Anson Road, #28-01

International Plaza, Singapore 079903. Our company email address is info@guardforceai.com.

Our agent for service of process in the United

States is Cogency Global Inc., located at 122 East 42nd Street, 18th Floor, New York, N.Y. 10168.

Our website can be found at https://www.guardforceai.com.

The information contained on our website is not a part of this prospectus, nor is such content incorporated by reference herein, and

should not be relied upon in determining whether to make an investment in our securities.

Implications of Being an Emerging Growth Company

We qualify as an “emerging growth company”

under the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”). As a result, we are permitted to, and intend to,

rely on exemptions from certain disclosure requirements. For so long as we are an emerging growth company, we will not be required to:

| ● | have an auditor report on our internal

controls over financial reporting pursuant to Section 404(b) of the Sarbanes-Oxley Act of

2002 (the “Sarbanes-Oxley Act”); |

| ● | comply with any requirement that

may be adopted by the Public Company Accounting Oversight Board regarding mandatory audit

firm rotation or a supplement to the auditor’s report providing additional information

about the audit and the financial statements (i.e., an auditor discussion and analysis); |

| ● | submit certain executive compensation

matters to stockholder advisory votes, such as “say-on-pay” and “say-on-frequency;”

and |

| ● | disclose certain executive compensation

related items such as the correlation between executive compensation and performance and

comparisons of the chief executive officer’s compensation to median employee compensation. |

In addition, Section 107 of the JOBS Act also

provides that an emerging growth company can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities

Act of 1933, as amended (the “Securities Act”), for complying with new or revised accounting standards. In other words, an

emerging growth company can delay the adoption of certain accounting standards until those standards would otherwise apply to private

companies. We have elected to take advantage of the benefits of this extended transition period. Our financial statements may therefore

not be comparable to those of companies that comply with such new or revised accounting standards.

We will remain an emerging growth company until

the earliest of (i) the last day of the fiscal year during which we have total annual gross revenues of at least $1.07 billion;

(ii) the last day of our fiscal year following the fifth anniversary of the completion of this offering; (iii) the date on

which we have, during the preceding three year period, issued more than $1.0 billion in non-convertible debt; or (iv) the date

on which we are deemed to be a “large accelerated filer” under the Exchange Act, which could occur if the market value of

our ordinary shares that are held by non-affiliates exceeds $700 million as of the last business day of our most recently completed

second fiscal quarter. Once we cease to be an emerging growth company, we will not be entitled to the exemptions provided in the JOBS

Act discussed above.

THE OFFERING

| Shares offered: |

|

This prospectus relates to 4,337,349 ordinary shares issuable upon the

exercise of publicly traded warrants including 4,156,626 ordinary shares issuable upon exercise of the warrants issued to investors

and 180,723 ordinary shares issuable upon the exercise of the warrants issued to the underwriters’ representative, both in

our initial public offering. |

| |

|

|

| Ordinary shares outstanding prior to this offering(1)(2): |

|

41,379,075 ordinary shares |

| |

|

|

| Ordinary shares outstanding after the offering assuming full exercise of the publicly-traded warrants

and the representative’s warrants(1): |

|

45,075,124 ordinary shares |

| |

|

|

| Use of Proceeds |

|

The publicly-traded investor warrants are exercisable immediately upon issuance

and will thereafter remain exercisable at any time up to five (5) years from the date of original issuance. The holders of the warrants

must pay the exercise price, currently $1.15 per share, in order to exercise the warrants and receive the shares that the warrants

provide for. The representative’s warrants are exercisable at any

time and from time to time, in whole or in part, during the four-and-a-half-year period commencing March 29, 2022. Warrants

may be exercised only for a whole number of shares. If the warrants are exercised on a cashless basis, we will not receive any proceeds

from their exercise. Assuming the exercise of all warrants for cash at the warrants’ current exercise price, we

will receive proceeds of approximately $4.99 million. We plan to use the proceeds for working capital and general corporate purposes.

See “Use of Proceeds” for more information on the use of proceeds. |

| |

|

|

| Risk Factors |

|

Investing in our securities involves a high degree of risk. You should carefully

read and consider the information beginning on page 17 of this prospectus set forth under the heading “Risk Factors”

and all other information set forth in this prospectus, and the documents incorporated herein and therein by reference before deciding

to invest in our ordinary shares and warrants. |

| |

|

|

| Nasdaq Capital Market symbol |

|

Our ordinary shares and publicly-traded warrants are both listed on Nasdaq under

the symbols “GFAI” and “GFAIW”, respectively. |

| (1) |

The

number of ordinary shares outstanding before and immediately following this offering does not include the remaining 11,426,148 of

our ordinary shares issuable upon exercise of warrants issued in our private placement on January 20, 2022. |

| (2) |

The

number of ordinary shares outstanding before and immediately following this offering includes 641,301 ordinary shares issued

upon the exercise of IPO warrants exercised in April 2022. |

RISK

FACTORS

Any

investment in our securities involves a high degree of risk. Before you decide to invest in our securities, you should consider carefully

the risks described above as well as the risks described in the section captioned “Risk Factors” in our annual report on

Form 20-F for the year ended December 31, 2021, and as updated by any document that we subsequently file with the SEC that is incorporated

by reference in this prospectus, together with other information in this prospectus and the information and documents incorporated by

reference in this prospectus. These risks and uncertainties described above and in these sections and documents are not the only risks

and uncertainties we face. Additional risks and uncertainties not presently known to us or that we currently deem immaterial also may

impair our business operations. If any of such risks actually occur, our business, operating results, prospects or financial condition

could be materially and adversely affected. This could cause the trading price of our ordinary shares to decline and you may lose all

or part of your investment.

USE

OF PROCEEDS

We

will not receive any proceeds from the sale of ordinary shares pursuant to this prospectus. We may, however, receive up to approximately

$4.99 million in proceeds from the exercise of warrants pursuant to this prospectus if the warrants are exercised for cash. We will use

any proceeds received by us from the cash exercise of the warrants for working capital and general corporate purposes.

We

cannot predict when or if any of the warrants will be exercised, and it is possible that the warrants may expire and never be exercised.

In addition, the warrants issued to the representative of the underwriters are exercisable on a cashless basis at any time and the warrants

issued to investors in our initial public offering are exercisable on a cashless basis if at the time of exercise there is no effective

registration statement registering, or the prospectus contained therein is not available for, the issuance of the ordinary shares for

which the warrants are exercisable. As a result, we may never receive meaningful, or any, cash proceeds from the cash exercise of the

warrants, and we cannot plan on any specific uses of any proceeds we may receive beyond the purposes described herein.

DIVIDEND

POLICY

We

have never declared or paid cash dividends on our ordinary shares. We currently intend to retain all available funds and any future earnings

for use in the operation of our business and do not anticipate paying any cash dividends on our ordinary shares in the near future. We

may also enter into credit agreements or other borrowing arrangements in the future that will restrict our ability to declare or pay

cash dividends on our ordinary shares. Any future determination to declare dividends will be made at the discretion of our board of directors

and will depend on our financial condition, operating results, capital requirements, contractual restrictions, general business conditions

and other factors that our board of directors may deem relevant. See also “Risk Factors— Risks Related to Our Ordinary

Shares and Warrants—We have no plans to pay dividends” in our annual report for the year ended December 31, 2021 on Form

20-f incorporated herein by reference.

CAPITALIZATION

AND INDEBTEDNESS

The

table below sets forth our capitalization and indebtedness as of March 31, 2022:

| |

● |

on an

actual basis; and |

| |

● |

on an as adjusted basis

to give effect to the issuance of 641,300 ordinary shares upon the exercise of IPO warrants at the exercise price of $1.30 per share

and the issuance of 1 ordinary share at the exercise price of $1.15 per share. |

| | |

As

of March 31, 2022 |

| | |

Actual

| | |

As

Adjusted | |

| Cash

and cash equivalents and restricted cash | |

$ | 13,782,424 | | |

$ | 14,616,094 | |

| Total

current liabilities | |

$ | 25,606,523 | | |

$ | 25,606,523 | |

| Shareholders’

equity (deficit) | |

$ |

| | |

$ |

| |

| Ordinary

Share, $0.003 par value; 300,000,000 authorized; 31,534,691 issued and outstanding as of March 31, 2022 | |

| 94,605 | | |

| 96,529 | |

| Subscription

receivable | |

| (50,000 | ) | |

| (50,000 | ) |

| Additional

paid-in capital | |

| 28,504,076 | | |

| 29,335,843 | |

| Legal

reserve | |

| 239,524 | | |

| 239,524 | |

| Warrants

reserve | |

| 251,036 | | |

| 251,036 | |

| Retained

earnings (Deficit) | |

| (12,688,632 | ) | |

| (12,688,653 | ) |

| Accumulated

other comprehensive income | |

| 785,813 | | |

| 785,813 | |

| Non-controlling

interests | |

$ | 21,628 | | |

| 21,628 | |

| Total

capitalization | |

$ | 17,158,050 | | |

| 17,991,720 | |

The

information above is based on 31,534,691 ordinary shares issued and outstanding as of March 31, 2022, and the “as adjusted”

column does not include the following:

| ● | 3,515,325

ordinary shares issuable upon exercise of the publicly listed warrants issued to investors

in the company’s IPO, at a current exercise price of $1.15 per share, because the company

does not believe that it is likely these warrants will be exercised in view of the current

market price of the company’s ordinary shares; |

| ● | 180,723

ordinary shares issuable upon the cashless exercise of publicly listed underwriter warrants

issued in the company’s initial public offering; |

| ● | 453,845

ordinary shares issued in April 2022 upon the exercise of warrants, at the exercise

price of $1.30 per share, issued in a private placement which closed on January 20, 2022

(the “January 2022 Private Placement”), and the remaining 11,426,148 ordinary

shares issuable upon exercise of the publicly listed warrants issued in the January 2022

Private Placement, at a current exercise price of $1.15 per share; |

| ● | 2,660,000

ordinary shares reserved for future issuance under our Guardforce AI Co., Limited 2022 Equity

Incentive Plan; and |

| ● | 8,739,351

ordinary shares issued in the company’s registered direct offering on April 6, 2022

at the offering price of $1.15 per share. |

DESCRIPTION

OF SHARE CAPITAL

The

following describes our share capital, summarizes the material provisions of our amended and restated memorandum and articles of association

relating to our share capital. This summary does not purport to be a summary of all of the relevant provisions of our amended and restated

memorandum and articles of association, which additional provisions are incorporated herein by reference to our annual report on Form

20-F for the fiscal year ended December 31, 2021. Additionally, you should read our amended and restated memorandum and articles of association

which are filed as exhibits to the registration statement of which this prospectus forms a part, for the provisions that are important

to you.

We

are a Cayman Islands exempted company with limited liability and our affairs are governed by our Memorandum of Association and Articles

of Association and the Companies Act, which is referred to as the Companies Act below.

As

of the date of this prospectus, our authorized share capital is 300,000,000 ordinary shares, with a par value of $0.003 each, among

which 41,379,075 ordinary shares are issued and outstanding. In addition, we currently have 15,122,196 warrants issued and outstanding,

which include: (i) warrants to purchase 3,515,325 ordinary shares and these warrants are exercisable at a current exercise price of $1.15

per share with the expiration date of September 28, 2026; (ii) warrants to purchase 11,426,148 ordinary shares, at a current exercise

price of $1.15 per share with the expiration date of January 20, 2027; and (iii) 180,723 warrants that were issued to the assignee of

the representative of the underwriters in our initial public offering at a current exercise price of $1.15 per share with the expiration

date of September 28, 2026.

The

following are summaries of material provisions of our amended and restated memorandum and articles of association and the Companies Act

insofar as they relate to the material terms of our ordinary shares. We incorporate by reference into this prospectus our Amended and

Restated Memorandum of Association and Articles of Association, filed as Exhibit 99.1 to the Report on Form 6-K filed on August 25, 2021.

Our shareholders adopted our Amended and Restated Memorandum of Association by a special resolution on February 5, 2020 and the Articles

of Association were adopted at incorporation.

Ordinary

Shares

General

All

of our issued and outstanding ordinary shares are fully paid and non-assessable. Our ordinary shares are issued in registered form and

are issued when registered in our register of members. We may not issue shares to bearer. Our shareholders, who are non-residents of

the Cayman Islands, may freely hold and vote their ordinary shares.

Dividends

The

holders of our ordinary shares are entitled to receive such dividends as may be declared by our board of directors subject to our Memorandum

and Articles of Association and the Companies Act. Under Cayman Islands law, our company may pay a dividend out of either profits or

share premium account in accordance with the Companies Act, provided that in no circumstances may a dividend be paid if this would result

in our company being unable to pay its debts as they fall due in the ordinary course of business.

Register

of Members

Under

Cayman Islands law, we must keep a register of members and there must be entered therein:

| |

● |

the names and addresses

of the members, a statement of the number and category of shares held by each member, in certain cases distinguishing each share

by its number, and of the amount paid or agreed to be considered as paid, on the shares of each member and whether each relevant

category of shares held by a member carries voting rights, and if so, whether such voting rights are conditional; |

| |

● |

the date on which the name

of any person was entered on the register as a member; and |

| |

● |

the date on which any person

ceased to be a member. |

Under

Cayman Islands law, the register of members of our company is prima facie evidence of any matters directed or authorized by the

Companies Act to be inserted therein (i.e. the register of members will raise a presumption of fact on the matters referred to above

unless rebutted) and a member registered in the register of members will be deemed as a matter of Cayman Islands law to have legal title

to the shares as set against its name in the register of members.

If

the name of any person is, without sufficient cause, entered in or omitted from the register of members, or if default is made or unnecessary

delay takes place in entering on the register the fact of any person having ceased to be a member, the person or member aggrieved or

any member or our company itself may apply to the Cayman Islands Grand Court for an order that the register be rectified, and the Court

may either refuse such application or it may, if satisfied of the justice of the case, make an order for the rectification of the register.

Voting

Rights

Holders

of our ordinary shares have the right to receive notice of, attend, speak and vote at general meetings of our company. At any general

meeting a resolution put to the vote of the meeting shall be decided on a show of hands, unless a poll is (before or on the declaration

of the result of the show of hands) demanded by the chairman or one or more shareholders present in person or by proxy entitled to vote

and who together hold not less than 10% of all voting power of our paid up share capital in issue and entitled to vote. An ordinary resolution

to be passed by the shareholders requires the affirmative vote of a simple majority of the votes attaching to the ordinary shares cast

in a general meeting, while a special resolution requires the affirmative vote of no less than two-thirds of the votes attaching to the

ordinary shares cast in a general meeting. Both ordinary resolutions and special resolutions may also be passed by a unanimous written

resolution signed by all the shareholders of our company, as permitted by the Companies Act and our Memorandum and Articles of Association.

A special resolution will be required for important matters such as a change of name or making changes to our Memorandum and Articles

of Association.

General

Meetings and Shareholder Proposals

As

a Cayman Islands exempted company, we are not obliged by the Companies Act to call shareholders’ annual general meetings.

Shareholders’

general meetings may be convened by our board of directors. The Companies Act provides shareholders with only limited rights to requisition

a general meeting and does not provide shareholders with any right to put any proposal before a general meeting. However, these rights

may be provided in a company’s articles of association. Our Articles of Association allow one or more shareholders holding in aggregate,

at the date of such requisition, not less than ten percent of the paid up voting share capital to requisition a general meeting of the

shareholders, in which case our board is obliged to convene a general meeting and to put the resolutions so requisitioned to a vote at

such meeting not later than 30 days from the date of deposit of the requisition. However, our Articles of Association do not provide

our shareholders with any right to put any proposals before annual general meetings or general meetings not called by such shareholders.

A

quorum required for any general meeting of shareholders consists of one or more shareholders present in person or by proxy holding at

least a majority of the paid up voting share capital of the company. If the company has only one shareholder, that only shareholder present

in person or by proxy shall be a quorum for all purposes. Advance notice of at least seven clear calendar days is required for the convening

of any general meeting of our shareholders.

Transfer

of Ordinary Shares

Subject

to the restrictions in our Memorandum and Articles of Association as set out below, any of our shareholders may transfer all or any of

his or her ordinary shares by an instrument of transfer in the usual or common form or any other form approved by our board of directors.

Our

board of directors may, in its absolute discretion, decline to register any transfer of any ordinary share.

If

our directors refuse to register a transfer they are obligated to, within two months after the date on which the instrument of transfer

was lodged, send to the transferor and transferee notice of such refusal.

The

transferor of any ordinary shares shall be deemed to remain the holder of that share until the name of the transferee is entered in the

register of members.

For

the purpose of determining members entitled to notice of, or to vote at any meeting of members or any adjournment thereof, or members

entitled to receive payment of any dividend or other distributions, or in order to make a determination of members for any other purpose,

our board of directors may provide that the register of members shall be closed for transfers for a stated period which shall not in

any case exceed forty (40) days.

Liquidation

On

the winding up of our company, if the assets available for distribution amongst our shareholders shall be more than sufficient to repay

the whole of the capital paid-up at the commencement of the winding up, the surplus shall be distributed amongst our shareholders in

proportion to the capital paid up at the commencement of the winding up, subject to a deduction from those shares in respect of which

there are monies due, of all monies payable to our company for unpaid calls or otherwise. If our assets available for distribution are

insufficient to repay all of the paid-up capital, the assets will be distributed so that the losses are borne by our shareholders in

proportion to the capital paid-up. We are an exempted company with “limited liability” incorporated under the Companies Act,

and under the Companies Act, the liability of our members is limited to the amount, if any, unpaid on the shares respectively held by

them. Our Memorandum of Association contains a declaration that the liability of our members is so limited.

Calls

on Ordinary Shares and Forfeiture of Ordinary Shares

Our

board of directors may from time to time make calls upon shareholders for any amounts unpaid on their ordinary shares in a notice served

to such shareholders at least fourteen days prior to the specified time and place of payment. The ordinary shares that have been called

upon and remain unpaid on the specified time are subject to forfeiture.

Redemption,

Repurchase and Surrender of Ordinary Shares

Subject

to the provisions of the Companies Act, we may issue shares on terms that such shares are subject to redemption at our option. Our Company

may also repurchase any of our ordinary shares provided that the manner and terms of such purchase have been approved by our board of

directors and agreed with the relevant member. Under the Companies Act, the redemption or repurchase of any share may be paid out of

our company’s profits or out of the proceeds of a fresh issue of shares made for the purpose of such redemption or repurchase,

or out of the share premium account in accordance with the Companies Act. Redemption or repurchase of any share may also be paid out

of capital if the company can, immediately following such payment, pay its debts as they fall due in the ordinary course of business.

In addition, under the Companies Act no such share may be redeemed or repurchased (a) unless it is fully paid up, (b) if such redemption

or repurchase would result in there being no shares outstanding other than treasury shares, or (c) if the company has commenced liquidation.

In addition, our company may accept the surrender of any fully paid share for no consideration.

Variations

of Rights of Shares

If

at any time our share capital is divided into different classes of shares, the rights attached to any class of shares may, unless otherwise

provided by the terms of issue of the shares of that class, be varied with the written consent of the holders of two-thirds of the issued

shares of that class or with the sanction of a resolution passed by at least a majority of two thirds of the holders of shares of the

class present in person or by proxy at a separate general meeting of the holders of the shares of that class.

Inspection

of Books and Records

Holders

of our ordinary shares will have no general right under Cayman Islands law to inspect or obtain copies of our list of shareholders or

our corporate records. However, we will provide our shareholders with annual audited financial statements. See “Where You Can

Find More Information.”

Changes

in Capital

Our

shareholders may from time to time by ordinary resolution:

| |

● |

increase our share capital

by such sum, to be divided into shares of such classes and amount, as the resolution prescribes; |

| |

● |

consolidate and divide

all or any of our share capital into shares of a larger amount than our existing shares; |

| |

● |

sub-divide our existing

shares, or any of them, into shares of a smaller amount than that fixed by our Memorandum of Association; |

| |

● |

cancel any shares which,

at the date of the passing of the resolution, have not been taken or agreed to be taken by any person and diminish the amount of

our share capital by the amount of the shares so cancelled; or |

| |

● |

convert all or any of our

paid-up shares into stock and reconvert that stock into paid up shares of any denomination. |

Our

shareholders may by special resolution, subject to confirmation by the Grand Court of the Cayman Islands on an application by our company

for an order confirming such reduction, reduce our share capital or any capital redemption reserve in any manner permitted by law.