Current Report Filing (8-k)

August 12 2022 - 10:58AM

Edgar (US Regulatory)

0001604868

false

0001604868

2022-08-12

2022-08-12

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): August 12, 2022

GROWGENERATION CORP.

(Exact Name of Registrant as Specified in its Charter)

| Colorado |

|

333-207889 |

|

46-5008129 |

(State or other Jurisdiction

of Incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer

Identification No.) |

5619 DTC Parkway, Suite 900

Greenwood Village, CO 80111

(Address of Principal Executive Offices)

Registrant’s telephone number, including

area code: (800) 935-8420

N/A

(Former Address of Principal Executive Offices)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation under any of the following provisions (see General Instruction A.2. below):

| ☐ | Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c)) under

the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ☐

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading symbol |

|

Name of each exchange on which registered |

| Common Stock, par value $0.001 per share |

|

GRWG |

|

The NASDAQ Stock Market LLC |

Section 1 - Registrant’s Business

and Operations

Item 1.01 Entry into a Material Definitive

Agreement.

The

information set forth in Item 5.02 below is incorporated herein by reference.

Section 5 – Corporate Governance and Management

Item 5.02. Departure of Directors or Certain Officers; Election

of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Effective

August 12, 2022, Jeffrey Lasher, Chief Financial Officer of GrowGeneration Corp. (the “Company”),

resigned as Chief Financial Officer, and, effective August 12, 2022, Gregory Sanders has

been appointed Chief Financial Officer of the Company.

In connection with Mr. Lasher’s resignation

from the Company, Mr. Lasher and the Company entered into a Separation Agreement (the “Separation Agreement”), pursuant to

which Mr. Lasher will receive: (i) $253,513.32 cash severance, to be paid in equal installments over a period of six months following

the separation date; (ii) 10,000 shares of common stock as of October 12, 2022; and (iii) 20,000 shares of common stock as of December

15, 2022. The Separation Agreement also includes a mutual release of claims, transition assistance, and compliance with restrictive covenants.

A copy of

the Separation Agreement is filed herewith as Exhibit 10.1.

Mr. Sanders served as

Vice President, Corporate Controller at the Company from 2021 to present and was Corporate Controller at the Company from 2018 to 2021.

Prior to Mr. Sander’s employment at the Company, he was Director of Accounting and Finance at Machol & Johannes, LLC from 2015

to 2018. Mr. Sanders was an accounting manager at Arrow electronics from 2014 to 2015 and held various roles, including accountant, senior

accountant and accounting manager, at Enterprise Holdings from 2008 to 2014. Mr. Sanders is a graduate of the University of Minnesota.

There

are no arrangements or understandings between Mr. Sanders and any other persons pursuant to which Mr. Sanders will be named

to this position with the Company. Mr. Sanders does not have any family relationship with any of the Company’s directors or

executive officers or any persons nominated or chosen by the Company to be a director or executive officer. Mr. Sanders has no direct

or indirect material interest in any transaction or proposed transaction required to be reported under Section 404(a) of Regulation S-K.

In connection with Mr. Sanders’ appointment as Chief Financial Officer, Mr. Sanders and the Company entered into a three-year employment

agreement (the “Sanders Employment Agreement”), pursuant to which the Company agreed to pay Mr. Sanders (i) a base salary

of $325,000 per year, increasing 10% each year; (ii) a minimum $50,000 cash bonus in respect of calendar year 2022, subject to continued

employment through December 31, 2022; (iii) an annual performance cash bonus for future fiscal years based on performance metrics set

by the Company, with a target amount of 50% and maximum amount of 100% of the then-current base salary; (iv) 90,000 restricted stock units,

vesting in equal installments over three years on June 15 and December 15 during each year of the agreement term; and (v) an additional

equity grant on each anniversary of the agreement term with substantially similar value to the initial grant, depending on the price of

the Company’s common stock on the grant date compared to the date of the agreement. In addition, if the Company terminates Mr. Sanders’

employment without “Cause” (as defined in the agreement), Mr. Sanders will receive three months’ severance.

A copy of

the Sanders Employment Agreement is filed herewith as Exhibit 10.2.

Section 7 – Regulation FD

Item 7.01. Regulation FD Disclosure

On August 12, the Company published

a press release regarding the resignation of Jeffery Lasher as Chief Financial Officer, the appointment of Gregory Sanders as Chief Financial

Officer, and the promotion of Stephen Kozey to General Counsel.

A

copy of the press release is attached hereto as Exhibit 99.1. The information contained in this Current Report on Form 8-K (including

the exhibit) is being furnished and shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange

Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section, nor shall it be deemed

incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as otherwise expressly

stated in such filing.

Section 9 – Financial Statements

and Exhibits

Item 9.01. Financial Statements and

Exhibits

(c) Exhibits [Update as necessary]

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| Date: August 12, 2022 |

GrowGeneration Corp. |

| |

|

|

| |

By: |

/s/ Darren Lampert |

|

Name: |

Darren Lampert |

| |

Title: |

Chief Executive Officer |

3

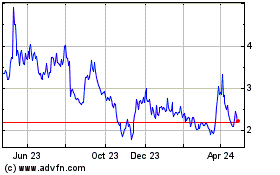

Growgeneration (NASDAQ:GRWG)

Historical Stock Chart

From Mar 2024 to Apr 2024

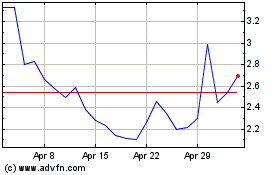

Growgeneration (NASDAQ:GRWG)

Historical Stock Chart

From Apr 2023 to Apr 2024