Current Report Filing (8-k)

July 30 2021 - 5:21PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): July

27, 2021

GROWGENERATION CORP

(Exact Name of Registrant as Specified in its Charter)

|

Colorado

|

|

333-207889

|

|

46-5008129

|

(State or other Jurisdiction

of Incorporation)

|

|

(Commission File Number)

|

|

(I.R.S. Employer

Identification No.)

|

930 W 7th Ave, Suite A

Denver, Colorado 80204

(Address of Principal Executive Offices)

Registrant’s telephone number, including

area code: (800) 935-8420

N/A

(Former Address of Principal Executive Offices)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation under any of the following provisions (see General Instruction

A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c)) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading symbol

|

|

Name of each exchange on which registered

|

|

Common Stock, par value $0.001 per share

|

|

GRWG

|

|

The NASDAQ Stock Market LLC

|

Section 1 – Registrant’s Business and Operations

Item 1.01. Entry Into a Material Definitive

Agreement

On July 27, 2021, GrowGeneration Corp. (the “Company”)

entered into a series of asset purchase agreements (the “Purchase Agreements”) through its wholly-owned subsidiary, GrowGeneration

Michigan Corp., to purchase the assets from subsidiaries of HGS Hydro (“HGS Hydro”) with six stores across the State

of Michigan and a seventh store to open in the fall of 2021. This acquisition is expected to close before the end of 2021 fiscal

year-end.

As consideration for the assets, the Company agreed

to pay HGS Hydro an aggregate purchase price of approximately $72,180,691 (the “Total Purchase Price”), which includes the

cost of the inventory which was currently estimated at $19,400,691, $780,000 for fixed assets, $35,000,000 in cash and $17,000,000 in

shares of restricted common stock of the Company. The Total Purchase Price is allocated to the stores in accordance with their respective

Purchase Agreements as follows:

|

|

(1)

|

Walled Lake Purchase Agreement: (a) the actual cost of HGS Walled Lake’s

inventory minus certain obsolete inventory (which is any inventory on hand at the closing that has not been sold within the

preceding twelve months from the closing) (the “Obsolete Inventory”) and including slow-moving inventory (which is

inventory on hand with respect to any product that (i) is in excess of the average number of units of such product sold during the

12 months prior to the closing, or (ii) is not used or sold at any of the Company’s current locations) (the “Slow-Moving

Inventory”), which was estimated to be $6,373,794; plus (b) the sum of $219,910 for fixed assets; plus (c) the actual

outstanding out-of-pocket costs of HGS Walled Lake at the closing; plus (d) $8,782,079 in cash; plus (e) a number of the shares of

restricted common stock of the Company equal to $4,259,165 at a per share that is the lower of (i) the 90-day volume weighted

average price (“VWAP”) on July 27, 2021 or (ii) the price per share at the end of the day prior to the closing.

|

|

|

(2)

|

Sterling Heights Purchase Agreement: (a) the actual cost of HGS Sterling Heights’

inventory minus Obsolete Inventory and including Slow-Moving Inventory, which was estimated to be $2,260,893; plus (b) the sum of $125,440

for fixed assets; plus (c) the actual outstanding out-of-pocket costs of HGS Sterling Heights at the closing; plus (d) $5,233,173 in cash;

plus (e) a number of the shares of Company’s restricted common stock equal to $3,245,192 at a per share that is the lower of (i)

the 90-day VWAP on July 27, 2021 or (ii) the price per share at the end of the day prior to the closing.

|

|

|

(3)

|

Albion Purchase Agreement: (a) the actual cost of HGS Albion’s inventory minus Obsolete

Inventory and including Slow-Moving Inventory, which was estimated to be $391,527; plus (b) the sum of $33,640 for fixed assets; plus

(c) $698,549 in cash; plus (e) a number of the shares of the Company’s restricted common stock equal to $1,949,585 at a price per

share that is the lower of (i) the 90-day VWAP on July 27, 2021 or (ii) the price per share at the end of the day prior

to the closing.

|

|

|

(4)

|

Shelby Purchase Agreement: (a) the actual cost of HGS Shelby’s inventory minus Obsolete

Inventory and including Slow-Moving Inventory, which was estimated to be $4,414,993; plus (b) the sum of $134,435 for fixed assets; plus

(c) the actual outstanding out-of-pocket costs of HGS Shelby at the closing; plus (d) $8,825,596 in cash; plus (e) a number of the shares

of Company’s restricted common stock equal to $ 2,521,599 at a per share price that is the lower of (i) the 90-day VWAP

on July 27, 2021 or (ii) the price per share at the end of the day prior to the closing.

|

|

|

(5)

|

Southfield Purchase Agreement: (a) the actual cost of HGS Southfield’s inventory minus

Obsolete Inventory and including Slow-Moving Inventory, which was estimated to be $943,655; plus (b) the sum of $86,860 for fixed assets;

plus (c) the actual outstanding out-of-pocket costs of HGS Southfield at the closing; plus (d) $2,966,857 in cash; plus (e) a number of

the shares of the Company’s restricted common stock equal to $847,674 at a per share that is the lower of (i) the 90-day VWAP

on of July 27, 2021 or (ii) the price per share at the end of the day prior to the closing.

|

|

|

(6)

|

Hazel Park Purchase Agreement: (a) the actual cost of HGS Hazel Park’s inventory minus

Obsolete Inventory and including Slow-Moving Inventory, which is estimated to be $5,015,829; plus (b) the sum of $179,715 for fixed assets;

plus (c) the actual outstanding out-of-pocket costs of HGS Hazel Park at the closing; plus (d) $8,493,747 in cash; plus (e) a number of

the shares of the Company’s restricted common stock equal to $4,176,785 at a price per share that is the lower of (i) the 90-day

VWAP on July 27, 2021or (ii) the price per share at the end of the day prior to the closing.

|

|

|

(7)

|

Imlay City Purchase Agreement: the actual outstanding out-of-pocket costs of HGS Imlay City

at the closing.

|

The foregoing descriptions of the terms of the

Purchase Agreements do not purport to be complete and are qualified in their entirety by reference to the full text of the forms of them

which will be filed as exhibits in the Company’s Quarterly Report on Form 10-Q for the quarter ended June 30, 2021.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly

authorized.

|

Date: July 30, 2021

|

GrowGeneration Corp.

|

|

|

|

|

|

|

By:

|

/s/ Darren Lampert

|

|

|

Name:

|

Darren Lampert

|

|

|

Title:

|

Chief Executive Officer

|

2

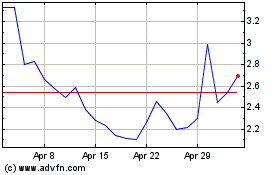

Growgeneration (NASDAQ:GRWG)

Historical Stock Chart

From Mar 2024 to Apr 2024

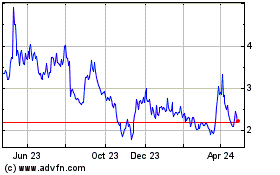

Growgeneration (NASDAQ:GRWG)

Historical Stock Chart

From Apr 2023 to Apr 2024