Groupon Adopts Limited Duration Shareholder Rights Plan

April 13 2020 - 8:30AM

Business Wire

Groupon, Inc. (NASDAQ: GRPN) (“Groupon” or the “Company”) today

announced that its Board of Directors has adopted a limited

duration rights plan (the “Rights Plan”), effective April 10,

2020.

In adopting the Rights Plan, the Board of Directors has taken

note of the substantial increase in market volatility and

uncertainty as a result of the COVID-19 pandemic, as well as its

impact on Groupon’s stock price. Given the current unprecedented

environment and trading levels as well as the importance of

maintaining focus on the Company’s operations, safeguarding the

welfare of employees and serving customers, the Board believes

adopting the Rights Plan is in the best interest of all Groupon

stockholders.

The Rights Plan has an eleven-month duration, expiring on March

10, 2021. It is similar to plans adopted by other public companies,

and is intended to promote the fair and equal treatment of all

Groupon stockholders and ensure that no person or group can gain

control of Groupon through open market accumulation or other

tactics without paying an appropriate control premium. The Rights

Plan will also position the Company’s Board of Directors to fulfill

its fiduciary duties on behalf of all stockholders by ensuring that

the Board has sufficient time to make informed judgments about any

attempts to take over the Company. The Rights Plan applies equally

to all current and future stockholders and is not intended to deter

offers that are fair and otherwise in the best interest of the

Company’s stockholders. The Rights Plan has not been adopted in

response to any specific takeover bid or other proposal to acquire

control of the Company.

Under the Rights Plan, Groupon is issuing one right for each

share of common stock outstanding at the close of business on April

20, 2020. The rights will become exercisable if a person or group

becomes the beneficial owner of 10% or more of the Company’s

outstanding common stock (including in the form of synthetic

ownership through derivative positions), or 20% or more in the case

of eligible passive investors. In the event that the rights become

exercisable due to the triggering ownership threshold being

crossed, each right will entitle its holder to purchase, at the

right’s exercise price, a number of shares of common stock or

equivalent securities having a market value at that time of twice

the right’s exercise price. Rights held by the triggering person or

entity will become void and will not be exercisable to purchase

shares at the reduced purchase price. The Board of Directors may,

rather than permitting the exercise of the rights, exchange each

right (other than rights held by the triggering person or entity)

for one share of common stock per right, subject to adjustment.

The Board of Directors will, prior to the rights becoming

exercisable, in general be entitled to amend the Rights Plan or to

redeem the rights for $0.001 per right.

This announcement is a summary only and is qualified by

reference to the full text of the Rights Plan. Additional details

regarding the Rights Plan will be contained in a Form 8-K to be

filed by the Company with the U.S. Securities and Exchange

Commission on April 13, 2020.

Note on Forward-Looking Statements

The statements contained in this release that refer to plans and

expectations for the next quarter, the full year or the future are

forward-looking statements within the meaning of Section 27A of the

Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended, including statements

regarding our future results of operations and financial position,

business strategy and plans and our objectives for future

operations. The words "may," "will," "should," "could," "expect,"

"anticipate," "believe," "estimate," "intend," "continue" and other

similar expressions are intended to identify forward-looking

statements. We have based these forward-looking statements largely

on current expectations and projections about future events and

financial trends that we believe may affect our financial

condition, results of operations, business strategy, short-term and

long-term business operations and objectives, and financial needs.

These forward-looking statements involve risks and uncertainties

that could cause our actual results to differ materially from those

expressed or implied in our forward-looking statements. Such risks

and uncertainties include, but are not limited to, our ability to

execute, and achieve the expected benefits of our go-forward

strategy, including our planned exit from the Goods business;

volatility in our operating results; effects of pandemics or

disease outbreaks, including Covid-19, on our business; execution

of our marketing strategies; retaining existing customers and

adding new customers; challenges arising from our international

operations, including fluctuations in currency exchange rates,

legal and regulatory developments and any potential adverse impact

from the United Kingdom's exit from the European Union, retaining

and adding high quality merchants; our reliance on email, internet

search engines and mobile application marketplaces to drive traffic

to our marketplace; cybersecurity breaches; reliance on cloud-based

computing platforms; competing successfully in our industry;

providing a strong mobile experience for our customers; maintaining

and improving our information technology infrastructure; our

voucherless offerings; claims related to product and service

offerings; managing inventory and order fulfillment risks;

litigation; managing refund risks; retaining and attracting members

of our executive team; completing and realizing the anticipated

benefits from acquisitions, dispositions, joint ventures and

strategic investments; lack of control over minority investments;

compliance with domestic and foreign laws and regulations,

including the CARD Act, GDPR and regulation of the Internet and

e-commerce; classification of our independent contractors or

employees; tax liabilities; tax legislation; protecting our

intellectual property; maintaining a strong brand; customer and

merchant fraud; payment-related risks; our ability to raise capital

if necessary and our outstanding indebtedness; global economic

uncertainty; our common stock, including volatility in our stock

price; our convertible senior notes; and our ability to realize the

anticipated benefits from the hedge and warrant transactions. For

additional information regarding these and other risks and

uncertainties, we urge you to refer to the factors included under

the headings "Risk Factors" and "Management's Discussion and

Analysis of Financial Condition and Results of Operations" in the

Company's Annual Report on Form 10-K for the year ended December

31, 2019, and our other filings with the SEC, copies of which may

be obtained by visiting the Company's Investor Relations web site

at investor.groupon.com or the SEC's web site at www.sec.gov.

Groupon's actual results could differ materially from those

predicted or implied and reported results should not be considered

an indication of future performance.

You should not rely upon forward-looking statements as

predictions of future events. Although Groupon believes that the

expectations reflected in the forward-looking statements are

reasonable, it cannot guarantee that the future results, levels of

activity, performance or events and circumstances reflected in the

forward-looking statements will be achieved or occur. Moreover,

neither Groupon nor any other person assumes responsibility for the

accuracy and completeness of the forward-looking statements. The

forward-looking statements reflect our expectations as of the date

of this release. We undertake no obligation to update publicly any

forward-looking statements for any reason after the date of this

release to conform these statements to actual results or to changes

in our expectations.

About Groupon

Groupon (NASDAQ: GRPN) is an experiences marketplace that brings

people more ways to get the most out of their city or wherever they

may be. By enabling real-time mobile commerce across local

businesses, live events and travel destinations, Groupon helps

people find and discover experiences––big and small, new and

familiar––that make for a full, fun and rewarding life. Groupon

helps local businesses grow and strengthen customer

relationships––resulting in strong, vibrant communities. To learn

more about Groupon’s community-building efforts, please visit

community.groupon.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200413005229/en/

Investor Relations Contact: Jennifer Beugelmans 312-662-7370

IR@groupon.com

Media Relations Contact: Nick Halliwell 312-999-3812

Press@groupon.com

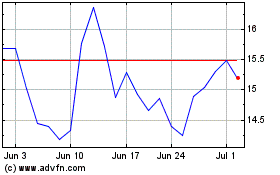

Groupon (NASDAQ:GRPN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Groupon (NASDAQ:GRPN)

Historical Stock Chart

From Apr 2023 to Apr 2024