Grocery Outlet Holding Corp. (NASDAQ: GO) ("Grocery Outlet" or the

"Company") today announced financial results for the third quarter

of fiscal 2021 ended October 2, 2021.

Highlights for Third Quarter Fiscal 2021

as compared to the Third Quarter Fiscal 2020:

- Net sales

increased by 0.6% to $768.9 million.

- Comparable store

sales decreased by 4.3% compared to a 9.1% increase in the same

period last year.

- The Company opened

7 new stores, ending the quarter with 407 stores in six

states.

- Net income

decreased 57.7% to $17.1 million, or $0.17 per diluted share.

- Adjusted EBITDA(1)

decreased 6.2% to $51.4 million.

- Adjusted net

income(1) decreased 15.3% to $23.4 million, or $0.24 per adjusted

diluted share(1).

Eric Lindberg, CEO of Grocery Outlet, stated,

"We are pleased with our third quarter financial results and

encouraged by our momentum in the fourth quarter. We continue to

leverage our highly flexible business model to offer unbeatable

value to our customers along with exceptional service from our

dedicated independent operators despite the challenging operating

environment. Looking forward, we remain excited about our long

runway for growth as we continue to expand our store base and test

new digital opportunities to broaden our customer reach. We are

also pleased to share that our board of directors has authorized a

$100 million share repurchase program reflecting confidence in our

long-term outlook and our commitment to returning value to

shareholders."

__________________________________

(1) Adjusted EBITDA, adjusted net income and

adjusted diluted earnings per share are non-GAAP financial

measures, which exclude the impact of certain special items.

Beginning with the fourth quarter of fiscal 2020, we updated our

definitions of our non-GAAP financial measures to simplify our

presentation and enhance comparability between periods. The

presentations for adjusted EBITDA, adjusted net income and adjusted

diluted earnings per share for third quarter of fiscal 2020 and 39

Weeks Ended September 26, 2020 have been recast to reflect these

changes. Please note that our non-GAAP financial measures should be

considered as a supplement to, and not as a substitute for, or

superior to, financial measures calculated in accordance with GAAP.

See the "Non-GAAP Financial Information" section of this release

for additional information about these items.

Highlights for the 39 Weeks Ended

October 2, 2021 as compared to the 39 Weeks Ended September 26,

2020:

- Net sales

decreased by 1.3% to $2.30 billion.

- Comparable store

sales decreased by 7.6% compared to a 14.3% increase in the same

period last year.

- Net income

decreased 32.5% to $55.7 million, or $0.56 per diluted share.

- Adjusted EBITDA(1)

decreased 12.0% to $151.1 million.

- Adjusted net

income(1) decreased 20.9% to $69.9 million, or $0.70 per adjusted

diluted share(1).

Balance Sheet and Cash

Flow:

- Cash and cash

equivalents totaled $156.0 million at the end of the third quarter

of fiscal 2021.

- Total debt was

$450.9 million at the end of the third quarter of fiscal 2021, net

of unamortized debt discounts and debt issuance costs.

- Net cash provided

by operating activities during the third quarter of fiscal 2021 was

$56.6 million.

- Capital

expenditures for the third quarter of fiscal 2021, excluding the

impact of tenant improvement allowances, were

$26.5 million.

Fourth Quarter 2021

Outlook:

- The Company

expects to open eight stores during the fourth quarter of fiscal

2021 for a total of 36 new stores opened in fiscal 2021. We closed

one store during the first quarter of fiscal year 2021.

- Comparable store

sales for the month of October were flat. Based on current trends,

the Company expects comparable store sales for the full fourth

quarter of fiscal 2021 to range between negative 3.5% to negative

2.5%.

- The Company will

report 13 weeks of operating results in the fourth quarter of

fiscal 2021 compared to 14 weeks in the fourth quarter of fiscal

2020. The extra fiscal week contributed sales of $53.3 million in

the prior year period.

Share Repurchase Program:

The Company's board of directors (the "Board")

has approved a share repurchase program (the "Share Repurchase

Program") pursuant to which the Company is authorized to repurchase

up to $100.0 million in shares of the Company's common stock. The

Share Repurchase Program is effective immediately, does not have an

expiration date and is expected to be funded using the Company's

cash on hand and cash from operations.

Charles Bracher, CFO of Grocery Outlet, stated,

"While we remain committed to our capital allocation priority of

investing in core organic growth initiatives including continued

store expansion, reinvesting in the existing fleet and building the

infrastructure to support future growth, this program will allow us

to more effectively utilize excess cash and further optimize our

capital structure."

Repurchases under the Share Repurchase Program

may be made, from time to time, in amounts and prices the Company

deems appropriate and may be made pursuant to a trading plan

intended to qualify under Rule 10b5-1 of the Securities Exchange

Act of 1934, as amended. Repurchases by the Company under the Share

Repurchase Program will be subject to general market and economic

conditions, applicable legal requirements and other considerations,

and the Share Repurchase Program may be suspended, modified or

discontinued by the Board at any time without prior notice at the

Company's discretion.

Conference Call Information:

A conference call to discuss the third quarter

fiscal 2021 financial results is scheduled for today,

November 9, 2021 at 4:30 p.m. Eastern Time. Investors and

analysts interested in participating in the call are invited to

dial 800-705-4155 approximately 10 minutes prior to the start of

the call, using conference ID #21998613. A live audio webcast of

the conference call will be available online at

https://investors.groceryoutlet.com.

A taped replay of the conference call will be

available within two hours of the conclusion of the call and can be

accessed both online and by dialing 844-512-2921. The pin number to

access the telephone replay is 21998613. The replay will be

available for approximately two weeks after the call.

Non-GAAP Financial

Information:

In addition to reporting financial results in

accordance with accounting principles generally accepted in the

United States ("GAAP"), the Company uses EBITDA, adjusted EBITDA,

adjusted net income and adjusted earnings per share measures of

performance to evaluate the effectiveness of its business

strategies, to make budgeting decisions and to compare its

performance against that of other peer companies using similar

measures. Management believes it is useful to investors and

analysts to evaluate these non-GAAP measures on the same basis as

management uses to evaluate our operating results.

Adjusted EBITDA is defined as net income before

interest expense, taxes, depreciation and amortization ("EBITDA")

and other adjustments noted in the "Reconciliation of GAAP Net

Income to Adjusted EBITDA" table below. Adjusted net income is

defined as net income before the adjustments noted in table

"Reconciliation of GAAP Net Income to Adjusted Net Income" below.

Basic Adjusted earnings per share is calculated using adjusted net

income and basic weighted average shares outstanding. Diluted

Adjusted earnings per share is calculated using adjusted net income

and diluted weighted average shares outstanding

EBITDA, Adjusted EBITDA, adjusted net income and

adjusted earnings per share are non-GAAP measures and may not be

comparable to similar measures reported by other companies. EBITDA,

Adjusted EBITDA, adjusted net income and adjusted earnings per

share have limitations as analytical tools, and you should not

consider them in isolation or as a substitute for analysis of our

results as reported under GAAP.

Beginning with the fourth quarter of fiscal

2020, we updated our definitions of adjusted EBITDA and adjusted

net income to simplify our presentation and enhance comparability

between periods. We no longer exclude new store pre-opening

expenses from our presentation of adjusted EBITDA and adjusted net

income. We also updated our definition of adjusted net income to

exclude the tax impact of options exercises and vesting of

restricted stock units. Lastly, debt extinguishment and

modification costs were reclassified to the other adjustments line

item within the presentation of both adjusted EBITDA and adjusted

net income. The presentations for adjusted EBITDA and adjusted net

income for the 13 and 39 weeks ended September 26, 2020 have

been recast to reflect these changes. Reconciliations between the

revised and previous definitions of adjusted EBITDA and adjusted

net income for each quarter of fiscal years 2020 and 2019 were

provided in our Form 8-K filed with the United States Securities

and Exchange Commission ("SEC") on March 2, 2021.

Forward-Looking Statements:

This news release includes forward-looking

statements within the meaning of the Private Securities Litigation

Reform Act of 1995 as contained in Section 27A of the Securities

Act of 1933, as amended, and Section 21E of the Securities Exchange

Act of 1934, as amended, which reflect management's current views

and estimates regarding the prospects of the industry and the

Company's outlook, prospects, plans, share repurchases, business,

results of operations, financial position, future financial

performance and business strategy. These forward-looking statements

generally can be identified by the use of forward-looking

terminology such as "may," "should," "expect," "intend," "will,"

"estimate," "anticipate," "believe," "predict," "potential" or

"continue" or the negatives of these terms or variations of them or

similar terminology. Although the Company believes that the

expectations reflected in these forward-looking statements are

reasonable, the Company cannot provide any assurance that these

expectations will prove to be correct.

The following factors are among those that may

cause actual results to differ materially from the forward-looking

statements: failure of suppliers to consistently supply us with

opportunistic products at attractive pricing; inability to

successfully identify trends and maintain a consistent level of

opportunistic products; failure to maintain or increase comparable

store sales; changes affecting the market prices of the products we

sell; failure to open, relocate or remodel stores on schedule;

risks associated with newly opened stores; inability to retain the

loyalty of our customers; costs and implementation difficulties

associated with marketing, advertising and promotions; failure to

maintain our reputation and the value of our brand, including

protecting our intellectual property; any significant disruption to

our distribution network, the operations of our distributions

centers and our timely receipt of inventory; inability to maintain

sufficient levels of cash flow from our operations; risks

associated with leasing substantial amounts of space; failure to

participate effectively or at all in the growing online retail

marketplace; unexpected costs and negative effects if we incur

losses not covered by our insurance program; inability to attract,

train and retain highly qualified employees; difficulties

associated with labor relations; loss of our key personnel or

inability to hire additional qualified personnel; risks associated

with economic conditions; competition in the retail food industry;

movement of consumer trends toward private labels and away from

name-brand products; major health epidemics, such as the outbreak

of COVID-19, its variants, and other outbreaks; natural disasters

and unusual weather conditions (whether or not caused by climate

change), power outages, pandemic outbreaks, terrorist acts, global

political events and other serious catastrophic events; failure to

maintain the security of information we hold relating to personal

information or payment card data of our customers, employees and

suppliers; material disruption to our information technology

systems; risks associated with products we and our independent

operators ("IOs") sell; risks associated with laws and regulations

generally applicable to retailers; legal proceedings from

customers, suppliers, employees, governments or competitors;

failure of our IOs to successfully manage their business; failure

of our IOs to repay notes outstanding to us; inability to attract

and retain qualified IOs; inability of our IOs to avoid excess

inventory shrink; any loss or changeover of an IO; legal

proceedings initiated against our IOs; legal challenges to the

IO/independent contractor business model; failure to maintain

positive relationships with our IOs; risks associated with actions

our IOs could take that could harm our business; our substantial

indebtedness could affect our ability to operate our business,

react to changes in the economy or industry or pay our debts and

meet our obligations; our ability to generate cash flow to service

our substantial debt obligations; impairment of goodwill and other

intangible assets; any significant decline in our operating profit

and taxable income; risks associated with tax matters; changes in

accounting standards and subjective assumptions, estimates and

judgments by management related to complex accounting matters;

failure to comply with requirements to design, implement and

maintain effective internal controls; and the other factors

discussed under "Risk Factors" in the Company's most recent annual

report on Form 10-K. Such risk factors may be updated from time to

time in the Company's periodic filings with the SEC. The Company's

periodic filings are accessible on the SEC's website at

www.sec.gov.

You should not rely upon forward-looking

statements as predictions of future events. Although the Company

believes that the expectations reflected in the forward-looking

statements are reasonable, the Company cannot guarantee that the

future results, levels of activity, performance and events and

circumstances reflected in the forward-looking statements will be

achieved or occur. Except as required by applicable law, the

Company undertakes no obligation to update publicly any

forward-looking statements for any reason after the date of this

news release to conform these statements to actual results or to

changes in our expectations.

About Grocery Outlet:

Based in Emeryville, California, Grocery Outlet

is a high-growth, extreme value retailer of quality, name-brand

consumables and fresh products sold through a network of

independently operated stores. Grocery Outlet has more than 410

stores in California, Washington, Oregon, Pennsylvania, Idaho and

Nevada.

GROCERY OUTLET HOLDING

CORP.CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS AND COMPREHENSIVE INCOME(in thousands,

except per share data)(unaudited)

| |

13 Weeks Ended |

|

39 Weeks Ended |

| |

October 2,2021 |

|

September 26,2020 |

|

October 2,2021 |

|

September 26,2020 |

|

Net sales |

$ |

768,880 |

|

|

$ |

764,082 |

|

|

$ |

2,296,881 |

|

|

$ |

2,327,819 |

|

| Cost of sales |

531,768 |

|

|

525,899 |

|

|

1,590,044 |

|

|

1,598,859 |

|

| Gross profit |

237,112 |

|

|

238,183 |

|

|

706,837 |

|

|

728,960 |

|

| Operating expenses: |

|

|

|

|

|

|

|

|

Selling, general and administrative |

191,572 |

|

|

189,880 |

|

|

573,125 |

|

|

574,813 |

|

|

Depreciation and amortization |

17,495 |

|

|

14,131 |

|

|

49,997 |

|

|

40,291 |

|

|

Share-based compensation |

1,902 |

|

|

3,857 |

|

|

10,051 |

|

|

34,309 |

|

|

Total operating expenses |

210,969 |

|

|

207,868 |

|

|

633,173 |

|

|

649,413 |

|

| Income from operations |

26,143 |

|

|

30,315 |

|

|

73,664 |

|

|

79,547 |

|

| Other expenses (income): |

|

|

|

|

|

|

|

|

Interest expense, net |

3,950 |

|

|

4,833 |

|

|

11,778 |

|

|

15,937 |

|

|

Gain on insurance recoveries |

— |

|

|

— |

|

|

(3,970 |

) |

|

— |

|

|

Debt extinguishment and modification costs |

— |

|

|

— |

|

|

— |

|

|

198 |

|

|

Total other expenses (income) |

3,950 |

|

|

4,833 |

|

|

7,808 |

|

|

16,135 |

|

| Income before income

taxes |

22,193 |

|

|

25,482 |

|

|

65,856 |

|

|

63,412 |

|

| Income tax expense

(benefit) |

5,054 |

|

|

(14,992 |

) |

|

10,185 |

|

|

(19,037 |

) |

| Net income and comprehensive

income |

$ |

17,139 |

|

|

$ |

40,474 |

|

|

$ |

55,671 |

|

|

$ |

82,449 |

|

| Basic earnings per share |

$ |

0.18 |

|

|

$ |

0.44 |

|

|

$ |

0.58 |

|

|

$ |

0.91 |

|

| Diluted earnings per

share |

$ |

0.17 |

|

|

$ |

0.41 |

|

|

$ |

0.56 |

|

|

$ |

0.84 |

|

| Weighted average shares

outstanding: |

|

|

|

|

|

|

|

|

Basic |

95,955 |

|

|

92,489 |

|

|

95,610 |

|

|

90,929 |

|

|

Diluted |

99,169 |

|

|

99,266 |

|

|

99,477 |

|

|

98,033 |

|

GROCERY OUTLET HOLDING

CORP.CONDENSED CONSOLIDATED BALANCE

SHEETS(in

thousands)(unaudited)

| |

October 2,2021 |

|

January 2,2021 |

| Assets |

|

|

|

| Current assets: |

|

|

|

|

Cash and cash equivalents |

$ |

155,976 |

|

|

$ |

105,326 |

|

|

Independent operator receivables and current portion of independent

operator notes, net of allowance |

6,003 |

|

|

5,443 |

|

|

Other accounts receivable, net of allowance |

3,615 |

|

|

5,950 |

|

|

Merchandise inventories |

245,844 |

|

|

245,157 |

|

|

Prepaid expenses and other current assets |

18,967 |

|

|

20,081 |

|

|

Total current assets |

430,405 |

|

|

381,957 |

|

| Independent operator notes,

net of allowance |

21,225 |

|

|

27,440 |

|

| Property and equipment,

net |

484,718 |

|

|

433,652 |

|

| Operating lease right-of-use

assets |

875,652 |

|

|

835,397 |

|

| Intangible assets, net |

49,242 |

|

|

48,226 |

|

| Goodwill |

747,943 |

|

|

747,943 |

|

| Deferred income tax assets,

net |

— |

|

|

3,529 |

|

| Other assets |

8,483 |

|

|

7,480 |

|

|

Total assets |

$ |

2,617,668 |

|

|

$ |

2,485,624 |

|

| Liabilities and

Stockholders' Equity |

|

|

|

| Current liabilities: |

|

|

|

|

Trade accounts payable |

$ |

122,055 |

|

|

$ |

114,278 |

|

|

Accrued expenses |

45,703 |

|

|

35,699 |

|

|

Accrued compensation |

6,745 |

|

|

26,447 |

|

|

Current lease liabilities |

46,013 |

|

|

48,675 |

|

|

Income and other taxes payable |

7,945 |

|

|

7,547 |

|

|

Total current liabilities |

228,461 |

|

|

232,646 |

|

| Long-term debt, net |

450,860 |

|

|

449,233 |

|

| Deferred income tax

liabilities, net |

5,556 |

|

|

— |

|

| Long-term lease

liabilities |

938,760 |

|

|

881,438 |

|

|

Total liabilities |

1,623,637 |

|

|

1,563,317 |

|

| Stockholders' equity: |

|

|

|

|

Voting common stock |

96 |

|

|

95 |

|

|

Additional paid-in capital |

803,099 |

|

|

787,047 |

|

|

Retained earnings |

190,836 |

|

|

135,165 |

|

|

Total stockholders' equity |

994,031 |

|

|

922,307 |

|

|

Total liabilities and stockholders' equity |

$ |

2,617,668 |

|

|

$ |

2,485,624 |

|

GROCERY OUTLET HOLDING

CORP.CONDENSED CONSOLIDATED STATEMENTS OF CASH

FLOWS (in thousands)

(unaudited)

| |

39 Weeks Ended |

| |

October 2,2021 |

|

September 26,2020 |

| Cash flows from

operating activities: |

|

|

|

|

Net income |

$ |

55,671 |

|

|

$ |

82,449 |

|

|

Adjustments to reconcile net income to net cash provided by

operating activities: |

|

|

|

|

Depreciation of property and equipment |

46,236 |

|

|

36,772 |

|

|

Amortization of intangible and other assets |

5,809 |

|

|

5,481 |

|

|

Amortization of debt issuance costs and debt discounts |

1,883 |

|

|

1,771 |

|

|

Gain on insurance recoveries |

(3,970 |

) |

|

— |

|

|

Debt extinguishment and modification costs |

— |

|

|

198 |

|

|

Share-based compensation |

10,051 |

|

|

34,309 |

|

|

Provision for accounts receivable |

3,529 |

|

|

321 |

|

|

Proceeds from insurance recoveries - business interruption and

inventory |

2,103 |

|

|

— |

|

|

Deferred income taxes |

9,085 |

|

|

(18,996 |

) |

|

Other |

950 |

|

|

1,421 |

|

|

Changes in operating assets and liabilities: |

|

|

|

|

Independent operator and other accounts receivable |

884 |

|

|

(3,809 |

) |

|

Merchandise inventories |

(687 |

) |

|

(33,357 |

) |

|

Prepaid expenses and other current assets |

1,114 |

|

|

(7,505 |

) |

|

Income and other taxes payable |

398 |

|

|

332 |

|

|

Trade accounts payable, accrued compensation and other accrued

expenses |

(4,526 |

) |

|

(15,545 |

) |

|

Changes in operating lease assets and liabilities, net |

13,235 |

|

|

15,419 |

|

|

Net cash provided by operating activities |

141,765 |

|

|

99,261 |

|

| Cash flows from

investing activities: |

|

|

|

|

Advances to independent operators |

(7,614 |

) |

|

(8,715 |

) |

|

Repayments of advances from independent operators |

3,581 |

|

|

5,216 |

|

|

Purchases of property and equipment |

(89,575 |

) |

|

(85,847 |

) |

|

Proceeds from sales of assets |

24 |

|

|

265 |

|

|

Intangible assets and licenses |

(4,566 |

) |

|

(3,826 |

) |

|

Proceeds from insurance recoveries - property and equipment |

1,867 |

|

|

— |

|

|

Net cash used in investing activities |

(96,283 |

) |

|

(92,907 |

) |

| Cash flows from

financing activities: |

|

|

|

|

Proceeds from exercise of stock options |

6,138 |

|

|

27,133 |

|

|

Proceeds from revolving credit facility loan |

— |

|

|

90,000 |

|

|

Principal payments on revolving credit facility loan |

— |

|

|

(90,000 |

) |

|

Payments made for net settlement of employee share-based

compensation awards |

— |

|

|

(483 |

) |

|

Principal payments on term loans |

— |

|

|

(188 |

) |

|

Principal payments on other borrowings |

(834 |

) |

|

(729 |

) |

|

Dividends paid |

(136 |

) |

|

(405 |

) |

|

Debt issuance costs paid |

— |

|

|

(701 |

) |

|

Net cash provided by financing activities |

5,168 |

|

|

24,627 |

|

| Net increase in cash and cash

equivalents |

50,650 |

|

|

30,981 |

|

| Cash and cash equivalents at

beginning of period |

105,326 |

|

|

28,101 |

|

| Cash and cash equivalents at

end of period |

$ |

155,976 |

|

|

$ |

59,082 |

|

GROCERY OUTLET HOLDING

CORP.RECONCILIATION OF GAAP NET INCOME TO ADJUSTED

EBITDA(in thousands)

(unaudited)

| |

13 Weeks Ended |

|

39 Weeks Ended |

| |

October 2,2021 |

|

September 26,2020 |

|

October 2,2021 |

|

September 26,2020 |

|

Net income |

$ |

17,139 |

|

|

$ |

40,474 |

|

|

$ |

55,671 |

|

|

$ |

82,449 |

|

| Interest expense, net |

3,950 |

|

|

4,833 |

|

|

11,778 |

|

|

15,937 |

|

| Income tax expense

(benefit) |

5,054 |

|

|

(14,992 |

) |

|

10,185 |

|

|

(19,037 |

) |

| Depreciation and amortization

expenses (1) |

18,234 |

|

|

14,796 |

|

|

52,045 |

|

|

42,253 |

|

|

EBITDA |

44,377 |

|

|

45,111 |

|

|

129,679 |

|

|

121,602 |

|

| Share-based compensation

expenses (2) |

1,902 |

|

|

3,857 |

|

|

10,051 |

|

|

34,309 |

|

| Non-cash rent (3) |

2,391 |

|

|

2,675 |

|

|

8,360 |

|

|

7,648 |

|

| Asset impairment and gain or

loss on disposition (4) |

186 |

|

|

205 |

|

|

943 |

|

|

1,158 |

|

| Provision for accounts

receivable reserves (5) |

1,240 |

|

|

372 |

|

|

3,529 |

|

|

321 |

|

| Other (6) |

1,293 |

|

|

2,555 |

|

|

(1,500 |

) |

|

6,665 |

|

|

Adjusted EBITDA |

$ |

51,389 |

|

|

$ |

54,775 |

|

|

$ |

151,062 |

|

|

$ |

171,703 |

|

GROCERY OUTLET HOLDING

CORP.RECONCILIATION OF GAAP NET INCOME TO ADJUSTED

NET INCOME(in thousands, except per share

data) (unaudited)

| |

13 Weeks Ended |

|

39 Weeks Ended |

| |

October 2,2021 |

|

September 26,2020 |

|

October 2,2021 |

|

September 26,2020 |

|

Net income |

$ |

17,139 |

|

|

$ |

40,474 |

|

|

$ |

55,671 |

|

|

$ |

82,449 |

|

| Share-based compensation

expenses (2) |

1,902 |

|

|

3,857 |

|

|

10,051 |

|

|

34,309 |

|

| Non-cash rent (3) |

2,391 |

|

|

2,675 |

|

|

8,360 |

|

|

7,648 |

|

| Asset impairment and gain or

loss on disposition (4) |

186 |

|

|

205 |

|

|

943 |

|

|

1,158 |

|

| Provision for accounts

receivable reserves (5) |

1,240 |

|

|

372 |

|

|

3,529 |

|

|

321 |

|

| Other (6) |

1,293 |

|

|

2,555 |

|

|

(1,500 |

) |

|

6,665 |

|

| Amortization of purchase

accounting assets and deferred financing costs (7) |

2,943 |

|

|

2,943 |

|

|

8,829 |

|

|

8,823 |

|

| Tax impact of stock option

exercises and vesting of restricted stock units (8) |

(867 |

) |

|

(21,880 |

) |

|

(7,525 |

) |

|

(36,458 |

) |

| Tax effect of total

adjustments (9) |

(2,787 |

) |

|

(3,530 |

) |

|

(8,459 |

) |

|

(16,498 |

) |

|

Adjusted net income |

$ |

23,440 |

|

|

$ |

27,671 |

|

|

$ |

69,899 |

|

|

$ |

88,417 |

|

| |

|

|

|

|

|

|

|

| GAAP earnings per share |

|

|

|

|

|

|

|

|

Basic |

$ |

0.18 |

|

|

$ |

0.44 |

|

|

$ |

0.58 |

|

|

$ |

0.91 |

|

|

Diluted |

$ |

0.17 |

|

|

$ |

0.41 |

|

|

$ |

0.56 |

|

|

$ |

0.84 |

|

| Adjusted earnings per

share |

|

|

|

|

|

|

|

|

Basic |

$ |

0.24 |

|

|

$ |

0.30 |

|

|

$ |

0.73 |

|

|

$ |

0.97 |

|

|

Diluted |

$ |

0.24 |

|

|

$ |

0.28 |

|

|

$ |

0.70 |

|

|

$ |

0.90 |

|

| Weighted average shares

outstanding |

|

|

|

|

|

|

|

|

Basic |

95,955 |

|

|

92,489 |

|

|

95,610 |

|

|

90,929 |

|

|

Diluted |

99,169 |

|

|

99,266 |

|

|

99,477 |

|

|

98,033 |

|

__________________________

(1) Includes depreciation related to

our distribution centers which is included within the cost of sales

line item in our condensed consolidated statements of operations

and comprehensive income.

(2) Includes non-cash share-based

compensation expense and cash dividends paid on vested share-based

awards as a result of dividends declared in connection with

recapitalizations that occurred in fiscal 2018 and 2016.

(3) Consists of

the non-cash portion of rent expense, which represents

the difference between our straight-line rent expense recognized

under GAAP and cash rent payments. The adjustment can vary

depending on the average age of our lease portfolio, which has been

impacted by our significant store growth in recent years.

(4) Represents impairment charges

with respect to planned store closures and gains or losses on

dispositions of assets in connection with store transitions to new

IOs.

(5)

Represents non-cash changes in reserves related to

our IO notes and accounts receivable.

(6) Represents other non-recurring,

non-cash or non-operational items, such as gain on insurance

recoveries, technology upgrade implementation costs, costs related

to employer payroll taxes associated with equity awards,

personnel-related costs, store closing costs, legal expenses,

secondary equity offering transaction costs, debt extinguishment

and modification costs, strategic project costs and miscellaneous

costs.

(7) Represents the amortization of

debt issuance costs and incremental amortization of an

asset step-up resulting from purchase price accounting

related to our acquisition in 2014 by an investment fund affiliated

with Hellman & Friedman LLC, which included trademarks,

customer lists, and below-market leases.

(8) Represents excess tax benefits

related to stock option exercises and vesting of restricted stock

units that are recorded in earnings as discrete items in the

reporting period in which they occur.

(9) Represents the tax effect of the

total adjustments. We calculate the tax effect of the total

adjustments on a discrete basis excluding any non-recurring and

unusual tax items.

INVESTOR RELATIONS CONTACTS:

Arvind Bhatia

510-704-2816

abhatia@cfgo.com

Jean Fontana

646-277-1214

Jean.Fontana@icrinc.com

MEDIA CONTACT:

Layla Kasha

510-379-2176

lkasha@cfgo.com

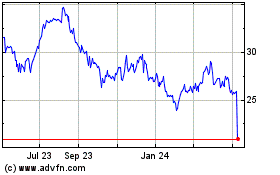

Grocery Outlet (NASDAQ:GO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Grocery Outlet (NASDAQ:GO)

Historical Stock Chart

From Apr 2023 to Apr 2024