Securities Registration (foreign Private Issuer) (f-3/a)

September 08 2021 - 5:08PM

Edgar (US Regulatory)

As filed with the U.S. Securities and

Exchange Commission on September 8, 2021

Registration No. 333-259019

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT

NO. 1 TO

FORM F-3

REGISTRATION

STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Grindrod Shipping Holdings Ltd.

(Exact name of Registrant as specified

in its charter)

Not Applicable

(Translation of Registrant's name into

English)

|

Singapore

|

Not Applicable

|

|

(State or other jurisdiction of

|

(I.R.S. Employer

|

|

incorporation or organization)

|

Identification Number)

|

|

(Singapore Company Registration No. 201731497H)

|

|

#03-01 Southpoint

200 Cantonment Road

Singapore 089763

+65 6323 0048

(Address and telephone number of Registrant's

principal executive offices)

Puglisi & Associates

850 Library Avenue, Suite 204

Newark, Delaware 19711

(302) 738-66806

(Name, address and telephone number of

agent for service)

Copies to:

Joshua Wechsler

Ashar Qureshi

Fried, Frank, Harris, Shriver & Jacobson

LLP

One New York Plaza, New York, NY 10004

United States

Tel: (212) 859-8000

Fax: (212) 859-4000

Approximate date of commencement of proposed

sale to the public:

From time to time after this registration

statement become effective as determined by market conditions and other factors.

If only securities being registered on

this Form are being offering pursuant to dividend or interest reinvestment plans, please check the following box. ¨

If any of the securities being registered

on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the

following box. x

If this Form is filed to register additional

securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities

Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment

filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement

number of the earlier effective registration statement for the same offering. ☐

If this Form is a registration statement

pursuant to General Instruction I.C. or a post-effective amendment thereto that shall become effective upon filing with the Commission

pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If this Form is a post-effective amendment

to a registration statement filed pursuant to General Instruction I.C. filed to register additional securities or additional classes

of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

Emerging Growth Company x

If an emerging growth company that prepares

its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended

transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B)

of the Securities Act. ☐

†The term “new or revised

financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting

Standards Codification after April 5, 2012.

The Registrant hereby amends this Registration

Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment

which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of

the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant

to said Section 8(a), may determine.

EXPLANATORY NOTE

This Amendment No. 1 to the Registration Statement

on Form F-3 (File No. 333-259019) is being filed solely to re-file exhibit 5.1. Accordingly, this Amendment No. 1 consists solely

of the facing page, this explanatory note, Part II of the Registration Statement, the signature page to the Registration Statement,

the exhibit index and the filed Exhibit 5.1. The prospectus contained in Part I of the Registration Statement is unchanged and

has been omitted from this filing.

PART II

INFORMATION NOT REQUIRED IN PROSPECTUS

|

|

Item 8.

|

Indemnification of Directors and Officers.

|

Our Constitution provides

that, subject to the provisions of the Companies Act, Chapter 50 of Singapore (the “Singapore Companies Act”) and any

other applicable law, every director, chief executive officer, auditor, secretary or other officer of our company shall be entitled

to be indemnified by our company against all costs, charges, losses, expenses and liabilities incurred or to be incurred by him

or her in the execution and discharge of his or her duties (and where he serves at our request as a director, officer, employee

or agent of any of our subsidiaries or affiliates) or in relation thereto and in particular and without prejudice to the generality

of the foregoing, no director, secretary or other officer of our company shall be liable for the acts, receipts, neglects or defaults

of any other director or officer or for joining in any receipt or other act for conformity or for any loss or expense happening

to our company through the insufficiency or deficiency of title to any property acquired by order of the directors for or on behalf

of our company or for the insufficiency or deficiency of any security in or upon which any of the moneys of our company shall be

invested or for any loss or damage arising from the bankruptcy, insolvency or tortious act of any person with who many moneys,

securities or effects shall be deposited or left or for any other loss, damage or misfortune whatsoever which shall happen to or

be incurred by our company in the execution of the duties of his or her office or in relation thereto unless the same shall happen

through his or her own negligence, willful default, breach of duty or breach of trust.

In cases where a director

is sued by the company, the Singapore Companies Act gives the court the power to relieve directors either wholly or partially from

their liability for their negligence, default, breach of duty or breach of trust. In order for relief to be obtained, it must be

shown that (i) the director acted reasonably and honestly; and (ii) it is fair, having regard to all the circumstances of the case

including those connected with such director’s appointment, to excuse the director. However, Singapore case law has indicated

that such relief will not be granted to a director who has benefited as a result of his or her breach of trust.

Under Section 172 of

the Singapore Companies Act, any provision exempting or indemnifying the officers of a company (including directors) against liability,

which by law would otherwise attach to them in connection with any negligence, default, breach of duty or breach of trust in relation

to the company is void. However, the Singapore Companies Act allows a company to (a) purchase and maintain for any officer insurance

against any liability which by law would otherwise attach to such officer in connection with any negligence, default, breach of

duty or breach of trust in relation to the company; and (b) indemnify such officer against any liability incurred by him or her

to a person other than the company except when the indemnity is against any liability (i) of the officer to pay a fine in criminal

proceedings, (ii) of the officer to pay a penalty in respect of non-compliance with any regulatory requirements, (iii) incurred

by the officer in defending criminal proceedings in which he or she is convicted, (iv) incurred by the officer in defending civil

proceedings brought by the company or a related company in which judgment is given against him or her, or (v) incurred by the officer

in connection with an application for relief under Section 76A(13) or Section 391 of the Singapore Companies Act in which the court

refuses to grant him or her relief. The limitation of liability and indemnification provisions in our Constitution may discourage

shareholders from bringing a lawsuit against directors for breach of their fiduciary duties. They may also reduce the likelihood

of derivative litigation against directors and officers, even though an action, if successful, might benefit us and our shareholders.

A shareholder’s investment may be harmed to the extent we pay the costs of settlement and damage awards against directors

and officers pursuant to these indemnification provisions. Insofar as indemnification for liabilities arising under the Securities

Act may be permitted to our directors, officers and controlling persons pursuant to the foregoing provisions, or otherwise, we

have been advised that, in the opinion of the SEC, such indemnification is against public policy as expressed in the Securities

Act and is therefore unenforceable.

|

|

Item 9.

|

Exhibits and Financial Statement Schedules.

|

The exhibits to this

registration statement are listed in the Index to Exhibits below.

|

|

a)

|

The undersigned registrant hereby undertakes:

|

|

|

(1)

|

To file, during any period in which offers or sales are being made, a post-effective amendment

to this registration statement:

|

|

|

(i)

|

To include any prospectus required by section 10(a)(3) of the Securities Act of 1933;

|

|

|

(ii)

|

To reflect in the prospectus any facts or events arising after the effective date of the registration

statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental

change in the information set forth in the registration statement. Notwithstanding the foregoing, any increase or decrease in volume

of securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation

from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the SEC

pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than 20 percent change in the maximum

aggregate offering price set forth in the “Calculation of Registration Fee” table in the effective registration statement;

|

|

|

(iii)

|

To include any material information with respect to the plan of distribution not previously disclosed

in the registration statement or any material change to such information in the registration statement;

|

|

|

(2)

|

That, for the purpose of determining any liability under the Securities Act of 1933, each such

post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the

offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

|

|

|

(3)

|

To remove from registration by means of a post-effective amendment any of the securities being

registered which remain unsold at the termination of the offering.

|

|

|

(4)

|

To file a post-effective amendment to the registration statement to include any financial statements

required by Item 8.A of Form 20-F at the start of any delayed offering or throughout a continuous offering. Financial statements

and information otherwise required by Section 10(a)(3) of the Act need not be furnished, provided that the registrant includes

in the prospectus, by means of a post-effective amendment, financial statements required pursuant to this paragraph (a)(4) and

other information necessary to ensure that all other information in the prospectus is at least as current as the date of those

financial statements. Notwithstanding the foregoing, with respect to registration statements on Form F-3, a post-effective amendment

need not be filed to include financial statements and information required by Section 10(a)(3) of the Act or Item 8.A of Form 20-F

if such financial statements and information are contained in periodic reports filed with or furnished to the SEC by the registrant

pursuant to section 13 or section 15(d) of the Exchange Act of 1934 that are incorporated by reference in the Form F-3.

|

|

|

(5)

|

That, for the purpose of determining liability under the Securities Act of 1933 to any purchaser:

|

|

|

(i)

|

If the registrant is relying on Rule 430B:

|

|

|

(A)

|

Each prospectus filed by the registrant pursuant to Rule 424(b)(3) shall be deemed to be part of

the registration statement as of the date the filed prospectus was deemed part of and included in the registration statement; and

|

|

|

(B)

|

Each prospectus required to be filed pursuant to Rule 424(b)(2), (b)(5), or (b)(7) as part of a

registration statement in reliance on Rule 430B relating to an offering made pursuant to Rule 415(a)(1)(i), (vii), or (x) for the

purpose of providing the information required by section 10(a) of the Securities Act of 1933 shall be deemed to be part of and

included in the registration statement as of the earlier of the date such form of prospectus is first used after effectiveness

or the date of the first contract of sale of securities in the offering described in the prospectus. As provided in Rule 430B,

for liability purposes of the issuer and any person that is at that date an underwriter, such date shall be deemed to be a new

effective date of the registration statement relating to the securities in the registration statement to which that prospectus

relates, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

Provided, however, that no statement made in a registration statement or prospectus that is part of the registration statement

or made in a document incorporated or deemed incorporated by reference into the registration statement or prospectus that is part

of the registration statement will, as to a purchaser with a time of contract of sale prior to such effective date, supersede or

modify any statement that was made in the registration statement or prospectus that was part of the registration statement or made

in any such document immediately prior to such effective date; or

|

|

|

(ii)

|

If the registrant is subject to Rule 430C, each prospectus filed pursuant to Rule 424(b) as part

of a registration statement relating to an offering, other than registration statements relying on Rule 430B or other than prospectuses

filed in reliance on Rule 430A, shall be deemed to be part of and included in the registration statement as of the date it is first

used after effectiveness. Provided, however, that no statement made in a registration statement or prospectus that is part

of the registration statement or made in a document incorporated or deemed incorporated by reference into the registration statement

or prospectus that is part of the registration statement will, as to a purchaser with a time of contract of sale prior to such

first use, supersede or modify any statement that was made in the registration statement or prospectus that was part of the registration

statement or made in any such document immediately prior to such date of first use.

|

|

|

(iii)

|

If the registrant is relying on Rule 430D of this chapter:

|

|

|

(A)

|

Each prospectus filed by the registrant pursuant to Rule 424(b)(3) and (h) of this chapter shall

be deemed to be part of the registration statement as of the date the filed prospectus was deemed part of and included in the registration

statement; and

|

|

|

(B)

|

Each prospectus required to be filed pursuant to Rule 424(b)(2), (b)(5), or (b)(7) of this chapter

as part of a registration statement in reliance on Rule 430D of this chapter relating to an offering made pursuant to Rule 415(a)(1)(vii)

or (a)(1)(xii) of this chapter for the purpose of providing the information required by section 10(a) of the Securities Act

of 1933 shall be deemed to be part of and included in the registration statement as of the earlier of the date such form of prospectus

is first used after effectiveness or the date of the first contract of sale of securities in the offering described in the prospectus.

As provided in Rule 430D of this chapter, for liability purposes of the issuer and any person that is at that date an underwriter,

such date shall be deemed to be a new effective date of the registration statement relating to the securities in the registration

statement to which that prospectus relates, and the offering of such securities at that time shall be deemed to be the initial

bona fide offering thereof. Provided, however, that no statement made in a registration statement or prospectus that

is part of the registration statement or made in a document incorporated or deemed incorporated by reference into the registration

statement or prospectus that is part of the registration statement will, as to a purchaser with a time of contract of sale prior

to such effective date, supersede or modify any statement that was made in the registration statement or prospectus that was part

of the registration statement or made in any such document immediately prior to such effective date; or

|

|

|

(6)

|

That, for the purpose of determining liability of the registrant under the Securities Act of 1933

to any purchaser in the initial distribution of the securities, the undersigned registrant undertakes that in a primary offering

of securities of the undersigned registrant pursuant to this registration statement, regardless of the underwriting method used

to sell the securities to the purchaser, if the securities are offered or sold to such purchaser by means of any of the following

communications, the undersigned registrant will be a seller to the purchaser and will be considered to offer or sell such securities

to such purchaser:

|

|

|

(i)

|

Any preliminary prospectus or prospectus of the undersigned registrant relating to the offering

required to be filed pursuant to Rule 424;

|

|

|

(ii)

|

Any free writing prospectus relating to the offering prepared by or on behalf of the undersigned

registrant or used or referred to by the undersigned registrant;

|

|

|

(iii)

|

The portion of any other free writing prospectus relating to the offering containing material information

about the undersigned registrant or its securities provided by or on behalf of the undersigned registrant; and

|

|

|

(iv)

|

Any other communication that is an offer in the offering made by the undersigned registrant to

the purchaser.

|

|

|

b)

|

The undersigned registrant hereby undertakes that, for purposes of determining any liability under

the Securities Act of 1933, each filing of the registrant's annual report pursuant to Section 13(a) or 15(d) of the Securities

Exchange Act of 1934 (and, where applicable, each filing of an employee benefit plan's annual report pursuant to Section 15(d)

of the Securities Exchange Act of 1934) that is incorporated by reference in the registration statement shall be deemed to be a

new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be

deemed to be the initial bona fide offering thereof.

|

|

|

h)

|

Insofar as indemnification for liabilities arising under the Securities Act of 1933 may be permitted

to directors, officers and controlling persons of the registrant pursuant to the foregoing provisions, or otherwise, the registrant

has been advised that in the opinion of the Securities and Exchange Commission such indemnification is against public policy as

expressed in the Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other

than the payment by the registrant of expenses incurred or paid by a director, officer or controlling person of the registrant

in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection

with the securities being registered, the registrant will, unless in the opinion of its counsel the matter has been settled by

controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against

public policy as expressed in the Act and will be governed by the final adjudication of such issue.

|

|

|

i)

|

The undersigned registrant hereby undertakes that:

|

|

|

(1)

|

For purposes of determining any liability under the Securities Act of 1933, the information omitted

from the form of prospectus filed as part of this registration statement in reliance upon Rule 430A and contained in a form of

prospectus filed by the registrant pursuant to Rule 424(b) (1) or (4) or 497(h) under the Securities Act shall be deemed to be

part of this registration statement as of the time it was declared effective.

|

|

|

(2)

|

For the purpose of determining any liability under the Securities Act of 1933, each post-effective

amendment that contains a form of prospectus shall be deemed to be a new registration statement relating to the securities offered

therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

|

INDEX TO EXHIBITS

* Previously

filed.

|

|

(1)

|

To be filed by amendment or as an exhibit to a document to be incorporated by reference into this

registration statement

|

|

|

(2)

|

Incorporated by reference to Exhibit 1.1 to Amendment No. 3 to the Registrant’s registration

statement on Form 20-F filed with the SEC on June 5, 2018.

|

|

|

(3)

|

Incorporated by reference to Exhibit 2.1 to Amendment No. 2 to the Registrant’s registration

statement on Form 20-F filed with the SEC on April 30, 2018.

|

|

|

(4)

|

Incorporated by reference to Exhibit 2.2 to Amendment No. 2 to the Registrant’s registration

statement on Form 20-F filed with the SEC on April 30, 2018.

|

|

|

(5)

|

Incorporated by reference to Exhibit 2.3 to Amendment No. 2 to the Registrant’s registration

statement on Form 20-F filed with the SEC on April 30, 2018.

|

|

|

(6)

|

Incorporated by reference to Exhibit 2.4 to Amendment No. 3 to the Registrant’s registration

statement on Form 20-F filed with the SEC on June 5, 2018.

|

|

|

(7)

|

Incorporated by reference to Exhibit 2.5 to the Registrant’s 2019 annual report on Form 20-F

files with the SEC on June 5, 2020.

|

SIGNATURES

Pursuant to the requirements

of the Securities Act of 1933, as amended, the Registrant certifies that it has reasonable grounds to believe that it meets all

of the requirements for filing on Form F-3 and has duly caused this Registration Statement on Form F-3 to be signed on its behalf

by the undersigned, thereunto duly authorized, in Singapore, on September 8, 2021.

|

|

GRINDROD SHIPPING HOLDINGS LTD.

|

|

|

|

|

|

|

|

|

By:

|

/s/ Stephen Griffiths

|

|

|

|

Name:

|

Stephen Griffiths

|

|

|

|

Title:

|

Chief Financial Officer

|

|

POWER OF ATTORNEY

Pursuant to the requirements

of the Securities Act of 1933, this Registration Statement has been signed below by following persons in the capacities and on

the dates indicated.

|

Signature

|

Title

|

Date

|

|

|

|

|

|

*

|

Chief Executive Officer and Director

|

September 8, 2021

|

|

Martyn Wade

|

(Principal Executive Officer)

|

|

|

|

|

|

|

|

|

|

|

/s/ Stephen Griffiths

|

Chief Financial Officer and Director

|

September 8, 2021

|

|

Stephen Griffiths

|

(Principal Financial and Accounting Officer)

|

|

|

|

|

|

|

|

|

|

|

*

|

Chairman of the Board

|

September 8, 2021

|

|

Michael Hankinson

|

|

|

|

|

|

|

|

|

|

|

|

*

|

Director

|

September 8, 2021

|

|

Murray Grindrod

|

|

|

|

|

|

|

|

|

|

|

|

*

|

Director

|

September 8, 2021

|

|

John Herholdt

|

|

|

|

|

|

|

|

|

|

|

|

*

|

Director

|

|

|

Quah Ban Huat

|

|

September 8, 2021

|

|

|

|

|

|

|

|

|

|

*

|

Director

|

|

|

Pieter Uys

|

|

September 8, 2021

|

|

|

|

|

|

|

|

|

|

*By:

|

|

|

|

/s/ Stephen Griffiths

|

|

|

|

Stephen Griffiths

|

|

September 8, 2021

|

|

Attorney-in-fact

|

|

|

SIGNATURE OF AUTHORIZED U.S. REPRESENTATIVE

OF REGISTRANT

Pursuant to the requirements of the Securities

Act of 1933, as amended, the undersigned, the duly authorized representative in the United States, has signed this Registration

Statement on September 8, 2021.

|

|

PUGLISI & ASSOCIATES

|

|

|

|

|

|

|

|

|

By:

|

/s/ Donald J. Puglisi

|

|

|

|

Name:

|

Donald J. Puglisi

|

|

|

|

Title:

|

Managing Director

|

|

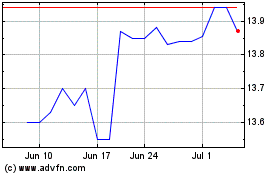

Grindrod Shipping (NASDAQ:GRIN)

Historical Stock Chart

From Mar 2024 to Apr 2024

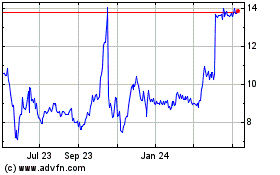

Grindrod Shipping (NASDAQ:GRIN)

Historical Stock Chart

From Apr 2023 to Apr 2024