Province of British Columbia, Canada

(Principal jurisdiction regulating this offering (if applicable))

It is proposed that this filing shall become effective (check appropriate box)

|

A.

|

☐

|

upon filing with the Commission, pursuant to Rule 467(a) (if in connection with an offering being made contemporaneously in the United States and Canada).

|

|

|

|

|

|

B.

|

☒

|

at some future date (check the appropriate box below):

|

|

|

|

|

|

|

1.

|

☐

|

pursuant to Rule 467(b) on (date) at (time) (designate a time not sooner than 7 calendar days after filing).

|

|

|

|

|

|

|

|

2.

|

☐

|

pursuant to Rule 467(b) on (date) at (time) (designate a time 7 calendar days or sooner after filing) because the securities regulatory authority in the review jurisdiction has issued a receipt or notification of clearance on (date).

|

|

|

|

|

|

|

|

3.

|

☐

|

pursuant to Rule 467(b) as soon as practicable after notification of the Commission by the Registrant or the Canadian securities regulatory authority of the review jurisdiction that a receipt or notification of clearance has been issued with respect hereto.

|

|

|

|

|

|

|

|

4.

|

☒

|

after the filing of the next amendment to this Form (if preliminary material is being filed).

|

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to the home jurisdiction's shelf prospectus offering procedures, check the following box. ☒

CALCULATION OF REGISTRATION FEE

|

Title of Each Class

of Securities to

be Registered(1)

|

Proposed Maximum

Aggregate

Offering Price(1)(2) (3)

|

Amount of

Registration Fee

|

|

Common Shares

|

$200,000,000

|

$21,820.00

|

|

Preferred Shares

|

|

Warrants

|

|

Subscription Receipts

|

|

Units

|

|

Debt Securities

|

|

Share Purchase Contracts

|

|

Total

|

$200,000,000

|

$21,820.00

|

|

(1)

|

There is being registered hereunder an indeterminate number of common shares, preferred shares, warrants, subscription receipts, units, debt securities and share purchase contracts of the Registrant, as may be sold from time to time by the Registrant. Securities registered hereunder may be sold separately or as units with other securities registered hereunder. There are also being registered hereunder an indeterminate number of common shares, preferred shares, warrants, subscription receipts, units, debt securities and share purchase contracts as shall be issuable upon conversion, exchange or exercise of any securities that provide for such issuance. The Registrant may offer and sell any of such securities or any combination of such securities in one or more offerings up to a total dollar amount of $200,000,000.

|

|

(2)

|

In U.S. dollars or the equivalent thereof in Canadian dollars or one or more foreign currencies or composite currencies based on the exchange rate at the time of sale.

|

|

(3)

|

Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(o) under the Securities Act of 1933.

|

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registration statement shall become effective as provided in Rule 467 under the Securities Act of 1933 or on such date as Commission, acting pursuant to Section 8(a) of the Act, may determine.

PART 1

INFORMATION REQUIRED TO BE DELIVERED TO OFFEREES OR PURCHASERS

A copy of this preliminary short form base shelf prospectus has been filed with the securities regulatory authorities in British Columbia, Alberta and Ontario but has not yet become final for the purpose of the sale of securities. Information contained in this preliminary short form base shelf prospectus may not be complete and may have to be amended. The securities may not be sold until a receipt for the short form base shelf prospectus is obtained from the securities regulatory authorities.

This short form prospectus is a base shelf prospectus. This short form prospectus has been filed under legislation in British Columbia, Alberta and Ontario that permits certain information about these securities to be determined after this prospectus has become final and that permits the omission from this prospectus of that information. The legislation requires the delivery to purchasers of a prospectus supplement containing the omitted information within a specified period of time after agreeing to purchase any of these securities, except in cases where an exemption from such delivery requirement is available.

No securities regulatory authority has expressed an opinion about these securities and it is an offence to claim otherwise. This short form base shelf prospectus constitutes a public offering of these securities only in those jurisdictions where they may be lawfully offered for sale and therein only by persons permitted to sell such securities.

Information has been incorporated by reference in this prospectus from documents filed with securities commissions or similar authorities in Canada. Copies of the documents incorporated herein by reference may be obtained on request without charge from the Secretary of GreenPower Motor Company Inc., #240 - 209 Carrall Street, Vancouver, British Columbia V6B 2J2, Canada (telephone number (604) 563-4144) and are also available electronically at www.sedar.com.

PRELIMINARY SHORT FORM BASE SHELF PROSPECTUS

GREENPOWER MOTOR COMPANY INC.

US$200,000,000

Common Shares

Preferred Shares

Warrants

Subscription Receipts

Units

Debt Securities

Share Purchase Contracts

This short form base shelf prospectus relates to the offering for sale from time to time, during the 25-month period that this prospectus, including any amendments hereto, remains effective, of the securities of GreenPower Motor Company Inc. (the "Company", "GreenPower", "we", "our" or "us") listed above in one or more series or issuances, with a total offering price of such securities, in the aggregate, of up to US$200,000,000 (or the equivalent thereof in Canadian dollars or one or more foreign currencies or composite currencies). The securities may be offered separately or together, in amounts, at prices and on terms to be determined based on market conditions at the time of the sale and set forth in an accompanying prospectus supplement.

In addition, the securities may be offered and issued in consideration for the acquisition of other businesses, assets or securities by the Company or a subsidiary of the Company. The consideration for any such acquisition may consist of any of the securities separately, a combination of securities or any combination of, among other things, securities, cash and the assumption of liabilities.

The common shares of the Company (the "Common Shares") are listed for trading on the TSX Venture Exchange (the "TSXV") under the symbol "GPV" and listed on the Nasdaq Capital Market (the "Nasdaq") under the symbol "GP". On July 21, 2021, being the last complete trading day prior to the date hereof, the closing prices of the Common Shares on the TSXV and the Nasdaq were C$22.36 per share and US$17.98 per share, respectively. Unless otherwise specified in an applicable prospectus supplement, preferred shares, warrants, subscription receipts, units, debt securities and share purchase contracts will not be listed on any securities or stock exchange or on any automated dealer quotation system. There is currently no market through which our securities, other than our Common Shares, may be sold and purchasers may not be able to resell such securities purchased under this short form prospectus. This may affect the pricing of our securities, other than our Common Shares, in the secondary market, the transparency and availability of trading prices, the liquidity of our securities and the extent of issuer regulation. See "Risk Factors".

Acquiring our securities may subject you to tax consequences in Canada. This prospectus or any applicable prospectus supplement may not describe these tax consequences fully. You should read the tax discussion in any applicable prospectus supplement with respect to any particular offering and consult your own tax advisor with respect to your own particular circumstances.

No underwriter has been involved in the preparation of this prospectus or performed any review of the contents of this prospectus.

This prospectus constitutes a public offering of the securities only in those jurisdictions where they may be lawfully offered for sale and only by persons permitted to sell the securities in such jurisdiction. All applicable information permitted under securities legislation to be omitted from this prospectus that has been so omitted will be contained in one or more prospectus supplements that will be delivered to purchasers together with this prospectus, except in cases where an exemption from such delivery requirement is available. Each prospectus supplement will be incorporated by reference into this prospectus for the purposes of securities legislation as of the date of the prospectus supplement and only for the purposes of the distribution of the securities to which the prospectus supplement pertains. You should read this prospectus and any applicable prospectus supplement carefully before you invest in any securities issued pursuant to this prospectus. Our securities may be sold pursuant to this prospectus through underwriters or dealers or directly or through agents designated from time to time at amounts and prices and other terms determined by us. This prospectus may qualify an "at-the market distribution" as defined in National Instrument 44-102 - Shelf Distributions (an "ATM Distribution").

In connection with any underwritten offering of securities, excluding an ATM Distribution, the underwriters may over-allot or effect transactions which stabilize or maintain the market price of the securities offered. Such transactions, if commenced, may be discontinued at any time. No underwriter or dealer involved in an ATM Distribution undertaken pursuant to any prospectus supplement, no affiliate of such an underwriter or dealer and no person or company acting jointly or in concert with such an underwriter or dealer will over-allot or effect transactions which stabilize or maintain the market price of the securities offered. See "Plan of Distribution".

A prospectus supplement will set out the names of any underwriters, dealers or agents involved in the sale of our securities, the amounts, if any, to be purchased by underwriters, the plan of distribution for such securities, including the net proceeds we expect to receive from the sale of such securities, if any, the amounts and prices at which such securities are sold and the compensation of such underwriters, dealers or agents.

Investment in the securities being offered is highly speculative and involves significant risks that you should consider before purchasing such securities. You should carefully review the risks outlined in this prospectus (including any prospectus supplement) and in the documents incorporated by reference as well as the information under the heading "Cautionary Note Regarding Forward-Looking Statements" and consider such risks and information in connection with an investment in the securities. See "Risk Factors".

The specific terms of the securities with respect to a particular offering will be set out in one or more prospectus supplements and may include, where applicable: (i) in the case of Common Shares, the number of Common Shares offered, the offering price and any other specific terms; (ii) in the case of preferred shares, the designation of the particular series, the number of shares offered, the offering price, the currency, dividend rate, if any, and any other terms specific to the preferred shares being offered; (iii) in the case of warrants, the offering price, the designation, number and terms of the Common Shares, preferred shares or debt securities issuable upon exercise of the warrants, any procedures that will result in the adjustment of these numbers, the exercise price, dates and periods of exercise, the currency in which the warrants are issued and any other specific terms; (iv) in the case of subscription receipts, the number of subscription receipts being offered, the offering price, the procedures for the exchange of the subscription receipts for Common Shares, preferred shares, debt securities or warrants, as the case may be, and any other specific terms; (v) in the case of debt securities, the specific designation, the aggregate principal amount, the currency or the currency unit for the debt securities being offered, the maturity, the interest provisions, the authorized denominations, the offering price, the covenants, the events of default, any terms for redemption or retraction, any exchange or conversion terms, whether the debt securities are secured, affiliate-guaranteed, senior or subordinated and any other terms specific to the debt securities being offered; (vi) in the case of units, the designation, number and terms of the Common Shares, preferred shares, warrants, subscription receipts, share purchase contracts or debt securities comprising the units; and (vii) in the case of share purchase contracts, whether the share purchase contracts obligate the holder to purchase or sell or both purchase and sell Common Shares, whether the share purchase contracts are to be prepaid or not or paid in instalments, any conditions upon which the purchase or sale will be contingent and the consequences if such conditions are not satisfied, whether the share purchase contracts are to be settled by delivery, any provisions relating to the settlement of the share purchase contracts, the date or dates on which the sale or purchase must be made, whether the share purchase contracts will be issued in fully registered or global form and the material income tax consequences of owning, holding and disposing of the share purchase contracts. Where required by statute, regulation or policy, and where securities are offered in currencies other than Canadian dollars, appropriate disclosure of foreign exchange rates applicable to the securities will be included in the prospectus supplement describing the securities.

Brendan Riley, our President and director, resides outside of Canada. Mr. Riley has appointed the Company, at #240 - 209 Carrall Street, Vancouver, British Columbia V6B 2J2, Canada as agent for service of process in Canada. Purchasers are advised that it may not be possible for investors to enforce judgements obtained in Canada against any person that resides outside of Canada, even if the party has appointed an agent for service of process.

Our head office is located at #240 - 209 Carrall Street, Vancouver, British Columbia V6B 2J2, Canada. Our registered and records office is located at 800 - 885 West Georgia Street, Vancouver, British Columbia V6C 3H1, Canada.

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

Unless we otherwise indicate or unless the context requires otherwise, all references in this prospectus to:

• the terms "we", "us", "our", the "Company" and "GreenPower" refer to GreenPower Motor Company Inc. together, where context requires, with its subsidiaries;

• the term "securities" means the common shares, preferred shares, warrants, subscription receipts, units, debt securities and share purchase contracts described in this prospectus; and

• all reference to "dollars", "$", "USD" or "US$" are to U.S. dollars and all reference to "CDN$" or "C$" are to Canadian dollars.

You should rely only on the information contained or incorporated by reference in this prospectus and any applicable prospectus supplement and on the other information included in the registration statement of which this prospectus will form a part. We have not authorized anyone to provide you with different or additional information. If anyone provides you with different or additional information, you should not rely on it. We are not making an offer to sell or seeking an offer to buy the securities offered pursuant to this prospectus in any jurisdiction where the offer or sale is not permitted. You should assume that the information contained in this prospectus and any applicable prospectus supplement is accurate only as of the date on the front of such document and that information contained in any document incorporated by reference is accurate only as of the date of that document, regardless of the time of delivery of this prospectus or any applicable prospectus supplement or of any sale of our securities pursuant thereto. Our business, financial condition, results of operations and prospects may have changed since those dates.

Information contained on our website shall not be deemed to be a part of this prospectus (including any applicable prospectus supplement) or incorporated by reference herein and should not be relied upon by prospective investors for the purpose of determining whether to invest in the securities.

Market data and certain industry forecasts used in this prospectus and any applicable prospectus supplement, and the documents incorporated by reference in this prospectus and any applicable prospectus supplement, were obtained from market research, publicly available information and industry publications. We believe that these sources are generally reliable, but the accuracy and completeness of this information is not guaranteed. We have not independently verified such information, and we do not make any representation as to the accuracy of such information.

This prospectus and the documents incorporated by reference herein include certain terms or performance measures that are not defined under International Financial Reporting Standards ("IFRS"), such as Total Cash expenses ("Total Cash Expenses") and adjusted earnings before interest, taxes, depreciation and amortization ("Adjusted EBITDA"). The Company believes that, in addition to conventional measures prepared in accordance with IFRS, certain investors use this information to evaluate the Company's performance. The data presented is intended to provide additional information and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS. These non- IFRS measures should be read in conjunction with the financial statements. For a description of the methodology used to calculate these non-IFRS measures, see the definition of "Non-IFRS Measures" in the Company's latest management's discussion and analysis incorporated by reference herein.

CURRENCY PRESENTATION AND EXCHANGE RATE INFORMATION

Unless otherwise noted herein and in the documents incorporated by reference, all dollar amounts are expressed in U.S. dollars.

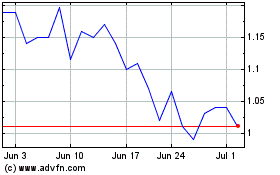

The following tables set forth, the annual average exchange rates for the years ended March 31, 2021 and 2020, and the monthly average exchange rates for each month during the previous twelve months, as supplied by the Bank of Canada. These exchange rates are expressed as one United States dollar converted into Canadian dollars.

|

Year Ended

|

Average

|

|

March 31, 2021

|

1.3219

|

|

March 31, 2020

|

1.3308

|

|

Month Ended

|

Average

|

|

June 30, 2021

|

1.2219

|

|

May 31, 2021

|

1.2126

|

|

April 30, 2021

|

1.2496

|

|

March 31, 2021

|

1.2574

|

|

February 28, 2021

|

1.2699

|

|

January 31, 2021

|

1.2724

|

|

December 31, 2020

|

1.2808

|

|

November 30, 2020

|

1.3068

|

|

October 31, 2020

|

1.3215

|

|

September 30, 2020

|

1.3228

|

|

August 31, 2020

|

1.3222

|

|

July 31, 2020

|

1.3499

|

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus (including the documents incorporated by reference herein) contains certain information that may constitute forward‐looking information and forward‐looking statements as such terms are defined under applicable securities laws (collectively, the "Forward‐Looking Statements") which are based on management's current internal expectations, estimates, projections, assumptions and beliefs. Forward-Looking Statements can be identified by the use of forward‐looking terminology such as "expect", "likely", "may", "will", "should", "intend", "anticipate", "potential", "proposed", "estimate", and other similar words, including negative and grammatical variations thereof. The Forward-Looking Statements may include estimates, plans, expectations, opinions, forecasts, projections, targets, guidance and other statements that are not statements of fact. The Forward‐Looking Statements are made only as of the date of this prospectus or the documents incorporated by reference herein, as applicable. The Forward‐Looking Statements include, but are not limited to, statements with respect to:

-

the intentions, plans and future actions of the Company;

-

statements relating to the business and future activities of the Company;

-

anticipated developments in operations of the Company;

-

market position, ability to compete and future financial or operating performance of the Company;

-

the timing and amount of funding required to execute the Company's business plans;

-

capital expenditures;

-

the effect on the Company of any changes to existing or new legislation or policy or government regulation;

-

the availability of labour;

-

requirements for additional capital;

-

goals, strategies and future growth;

-

the adequacy of financial resources;

-

expectations regarding revenues, expenses and anticipated cash needs; and

-

the impact of the COVID-19 pandemic on the business and operations of the Company.

The actual results, performance or achievements of the Company could differ materially from those anticipated in the Forward-Looking Statements as a result of the risk factors set forth below and under the heading "Risk Factors", including, but not limited to, risks related to: (i) the Company's ability to generate sufficient cash flow from operations and obtain financing, if needed, on acceptable terms or at all; (ii) general economic, financial market and regulatory conditions in which the Company operates; (iii) the yield from the Company's operations; (iv) consumer interest in the Company's products; (v) competition; (vi) anticipated and unanticipated costs; (vii) government regulation of the Company's products and operations; (viii) the timely receipt of any required regulatory approvals; (ix) the Company's ability to obtain qualified staff, equipment and services in a timely and cost efficient manner; (x) the Company's ability to conduct operations in a safe, efficient and effective manner; and (xi) the Company's plans and timeframe for completion of such plans.

Readers are cautioned that these factors are difficult to predict and that the assumptions used in developing the Forward-Looking Statements may prove to be incorrect. Readers are also cautioned that the list of risk factors contained in this prospectus or the documents incorporated by reference herein is not exhaustive. Accordingly, readers are cautioned that the Company's actual results may vary from the Forward-Looking Statements, and the variations may be material.

Although the Company believes that the expectations reflected in the Forward‐Looking Statements are reasonable, it can give no assurance that such expectations will prove to be correct, and the Forward‐Looking Statements are expressly qualified in their entirety by this cautionary statement. The purpose of the Forward‐Looking Statements is to provide the reader with a description of management's expectations, and the Forward‐Looking Statements may not be appropriate for any other purpose. The reader should not place undue reliance on the Forward‐Looking Statements. The Forward-Looking Statements are made as at the date hereof and the Company undertakes no obligation to update or revise any of the Forward‐Looking Statements, whether as a result of new information, future events or otherwise, except as required by applicable securities laws.

DOCUMENTS INCORPORATED BY REFERENCE

Information has been incorporated by reference in this prospectus from documents filed with securities commissions or similar authorities in Canada. Copies of the documents incorporated herein by reference may be obtained on request without charge from GreenPower Motor Company Inc., #240 - 209 Carrall Street, Vancouver, British Columbia V6B 2J2, Canada, Attention: Secretary, telephone number (604) 563-4144. These documents are also available through SEDAR, which can be accessed at www.sedar.com

We have previously filed the following documents with the various securities commissions or similar regulatory authorities in the provinces of Canada, and specifically incorporate them by reference into this prospectus:

1. the annual report on Form 20-F for the year ended March 31, 2021 filed on June 29, 2021;

2. the audited annual financial statements for the year ended March 31, 2021 filed on June 29, 2021, together with the auditor's report thereon and the notes thereto;

3. the management discussion and analysis for the year ended March 31, 2021 filed on June 29, 2021; and

4. the notice of annual general and special meeting of shareholders and information circular dated April 12, 2021 and filed on April 22, 2021.

Any documents of the type referred to above (including material change reports but excluding confidential material change reports) and other disclosure documents of the type required by Item 11.1 of Form 44-101F1 of National Instrument 44-101 - Short Form Prospectus Distributions to be incorporated by reference in a short form prospectus, if filed by us with a securities commission or any similar regulatory authority in Canada after the date of this prospectus and prior to the termination of any offering under this prospectus, shall be deemed to be incorporated by reference into this prospectus.

Any statement contained in a document incorporated or deemed to be incorporated by reference herein shall be deemed to be modified or superseded, for the purposes of this prospectus, to the extent that a statement contained herein, or in any other subsequently filed document that also is incorporated or is deemed to be incorporated by reference herein, modifies or supersedes such statement. Any statement so modified or superseded shall not be deemed, except as so modified or superseded, to be incorporated by reference in this prospectus or to constitute a part of this prospectus. The modifying or superseding statement need not state that it has modified or superseded a prior statement or include any other information set forth in the document that it modifies or supersedes. The making of a modifying or superseding statement shall not be deemed an admission for any purpose that the modified or superseded statement, when made, constituted a misrepresentation, an untrue statement of a material fact or an omission to state a material fact that is required to be stated or that is necessary to make a statement not misleading in light of the circumstances in which it was made.

A prospectus supplement containing the specific terms of an offering of securities will be delivered to the purchasers of such securities together with this prospectus, except in cases where an exemption from such delivery requirement is available, and will be deemed to be incorporated by reference in this prospectus as of the date of such prospectus supplement, but only for the purpose of the offering of the securities covered by that prospectus supplement.

Any template version of any "marketing materials" (as such term is defined in National Instrument 44-101 - Short Form Prospectus Distributions) filed after the date of a prospectus supplement and before the termination of the distribution of the securities offered pursuant to such prospectus supplement (together with this prospectus) is deemed to be incorporated by reference in such prospectus supplement.

Upon our filing of a new annual information form and the related annual financial statements and management's discussion and analysis with applicable securities regulatory authorities during the currency of this prospectus, the previous annual information form, the previous annual financial statements and management's discussion and analysis and all interim financial statements, supplemental information, material change reports and information circulars filed prior to the commencement of our financial year in which the new annual information form is filed will be deemed no longer to be incorporated into this prospectus for purposes of future offers and sales of our securities under this prospectus. Upon interim consolidated financial statements and the accompanying management's discussion and analysis being filed by us with the applicable securities regulatory authorities during the duration of this prospectus, all interim consolidated financial statements and the accompanying management's discussion and analysis filed prior to the new interim consolidated financial statements shall be deemed no longer to be incorporated into this prospectus for purposes of future offers and sales of securities under this prospectus.

References to our website in any documents that are incorporated by reference into this prospectus do not incorporate by reference the information on such website into this prospectus, and we disclaim any such incorporation by reference.

SUMMARY DESCRIPTION OF BUSINESS

We design, build and distribute a full suite of high-floor and low-floor all-electric medium and heavy-duty vehicles, including transit buses, school buses, shuttles, cargo van and a cab and chassis. We employ a clean-sheet design to manufacture all-electric vehicles that are purpose built to be battery powered with zero emissions while integrating global suppliers for key components. This original equipment manufacturer ("OEM") platform allows us to meet the specifications of various operators while providing standard parts for ease of maintenance and accessibility for warranty requirements.

We are an OEM of Class 4-8 commercial, heavy-duty bus vehicles for products ranging from a 25-foot Min-eBus to a 45-foot double decker bus. We utilize various contract manufacturers in Malaysia, Taiwan, Hong Kong and China for all of the major components with final assembly in Porterville, California.

We believe our battery-electric commercial vehicles offer fleet operators significant benefits, which include:

-

low total cost-of-ownership vs. conventional gas or diesel-powered vehicles;

-

lower maintenance costs;

-

reduced fuel expenses;

-

satisfaction of government mandates to move to zero-emission vehicles; and

-

decreased vehicle emissions and reduction in carbon footprint.

We sell and lease our vehicles to customers directly and may sell our vehicles through distributors in certain markets, such as ABC Bus, Inc. in the states of New York and New Jersey. We entered into a three-year dealership contract with Creative Bus Sales ("CBS") in May of 2018 and during the term of this contract CBS sold our products through its 18 physical locations across the United States. Our dealership contract with CBS expired in May 2021 and was not renewed.

CONSOLIDATED CAPITALIZATION

Since March 31, 2021, the date of our financial statements for the most recently completed financial period, there have been no material changes in our consolidated share or debt capital, other than (i) the grant of 173,650 incentive stock options, (ii) 628,571 Common Shares issued pursuant to exercised warrants and (iii) 8,929 Common Shares issued pursuant to exercised incentive stock options.

USE OF PROCEEDS

Unless we otherwise indicate in a prospectus supplement relating to a particular offering, we currently intend to use the net proceeds from the sale of any securities pursuant to this prospectus for general corporate and working capital requirements, including to fund ongoing operations, growth initiatives and/or working capital requirements, to repay indebtedness outstanding from time to time (if any), to complete one or more future acquisitions of companies, businesses, technologies, intellectual property and/or other assets or for other corporate purposes, all as set forth in the prospectus supplement relating to the offering of the securities.

More detailed information regarding the use of proceeds from the sale of securities, including any determinable milestones at the applicable time, will be described in a prospectus supplement. We may also, from time to time, issue securities otherwise than pursuant to a prospectus supplement to this prospectus. All expenses relating to an offering of securities and any compensation paid to underwriters, dealers or agents, as the case may be, will be paid out of the proceeds from the sale of such securities, unless otherwise stated in the applicable prospectus supplement.

Update on Prior Use of Proceeds Disclosure

On August 28, 2020, the Company completed the U.S. initial public offering (the "U.S. IPO") of common shares at $20 per share, raising gross proceeds of $37.7 million before underwriting fees and expenses. The Company intended to use the net proceeds from this offering in the production of all-electric vehicles, including EV Stars, EV Star plus, EV Star cab and chassis, Synapse school buses, and EV 250 thirty-foot low floor transit style buses, as well as for product development and geographic expansion, with the remainder, if any, for working capital.

The following table sets out the original intended uses of the net proceeds from the U.S. IPO and the estimated actual uses of such net proceeds. There have been no variations from the original intended uses of such net proceeds and the Company continues to proceed towards its original intended uses for such net proceeds.

|

|

Original Estimate1

|

Actual2

|

Difference

|

|

Gross proceeds

|

$37,700,000

|

$37,700,000

|

-

|

|

Underwriting discounts and commissions

|

($2,604,000)

|

($2,604,000)

|

-

|

|

Expenses

|

($210,374)

|

($463,411)

|

($253,037)

|

|

Net proceeds after underwriting discounts, commissions and expenses

|

$34,885,626

|

$34,632,589

|

($253,037)

|

|

Net proceeds used in electric vehicle production

|

N/A

|

$14,000,000

|

N/A

|

|

Net proceeds used in product development and geographic expansion

|

N/A

|

$500,000

|

N/A

|

|

Net proceeds used in working capital

|

N/A

|

$20,132,589

|

N/A

|

Notes:

(1) Consists of the U.S. IPO of $37,200,000 and a concurrent private placement of $500,000.

(2) Actual results are as of March 31, 2021.

The Company intends to use the majority of the net proceeds from the U.S. IPO for electric vehicle production, and these expenditures will occur over time.

DESCRIPTION OF SHARE CAPITAL

Our authorized share capital consists of an unlimited number of common shares without par value and an unlimited number of preferred shares without par value.

Common Shares

Holders of our common shares are entitled to vote one vote for each share held at all meetings of our shareholders, to receive any dividend declared by our board of directors and, to receive the remaining property of our company upon dissolution. None of our common shares are subject to any call or assessment nor pre-emptive or conversion rights. There are no provisions attached to our common shares for redemption, purchase for cancellation, surrender or sinking or purchase funds.

Preferred Shares

Our preferred shares may include one or more series and, subject to the Business Corporations Act (British Columbia), the directors of our company may, by resolution, if none of the shares of any particular series are issued, alter articles of our company and authorize the alteration of the notice of articles of our company, as the case may be, to do one or more of the following:

-

determine the maximum number of shares of that series that our company is authorized to issue, determine that there is no such maximum number, or alter any such determination;

-

create an identifying name for the shares of that series, or alter any such identifying name; and

-

attach special rights or restrictions to the shares of that series, or alter any such special rights or restrictions.

The holders of our preferred shares are entitled, on the liquidation or dissolution of our company, whether voluntary or involuntary, or on any other distribution of the assets of our company among shareholders of our company for the purpose of winding up its affairs, to receive, before any distribution is made to the holders of our common shares or any other shares of our company ranking junior to our preferred shares with respect to the repayment of capital on the liquidation or dissolution of our company, whether voluntary or involuntary, or on any other distribution of the assets of our company among shareholders of our company for the purpose of winding up its affairs, the amount paid up with respect to each preferred share held by them, together with the fixed premium (if any) thereon, all accrued and unpaid cumulative dividends (if any and if preferential) thereon, which for such purpose will be calculated as if such dividends were accruing on a day-to-day basis up to the date of such distribution, whether or not earned or declared, and all declared and unpaid non-cumulative dividends (if any and if preferential) thereon. After payment to the holders of our preferred shares of the amounts so payable to them, they will not, as such, be entitled to share in any further distribution of the property or assets of our company, except as specifically provided in the special rights and restrictions attached to any particular series. All assets remaining after payment to the holders of our preferred shares as aforesaid will be distributed rateably among the holders of our common shares.

Except for such rights relating to the election of directors on a default in payment of dividends as may be attached to any series of the preferred shares by the directors, holders of our preferred shares are not entitled, as such, to receive notice of, or to attend or vote at, any general meeting of shareholders of our company

Dividend Policy

There is no dividend restriction; however, we have not declared any dividends since our inception and do not anticipate that we will do so in the foreseeable future. We currently intend to retain future earnings, if any, to finance the development of our business. Any future payment of dividends or distributions will be determined by our board of directors on the basis of our earnings, financial requirements and other relevant factors.

DESCRIPTION OF DEBT SECURITIES

The following description of the terms of debt securities sets forth certain general terms and provisions of debt securities in respect of which a prospectus supplement may be filed. The particular terms and provisions of debt securities offered by any prospectus supplement, and the extent to which the general terms and provisions described below may apply thereto, will be described in the prospectus supplement filed in respect of such debt securities. Prospective investors should rely on information in the applicable prospectus supplement if it is different from the following information.

Debt securities may be offered separately or in combination with one or more other securities of the Company. The Company may, from time to time, issue debt securities and incur additional indebtedness other than through the issue of debt securities pursuant to this prospectus.

The debt securities will be issued under one or more indentures (each, a "Trust Indenture"), in each case between the Company and a financial institution or trust company organized under the laws of Canada or any province thereof and authorized to carry on business as a trustee (each, a "Trustee").

The following description sets forth certain general terms and provisions of the debt securities and is not intended to be complete. The particular terms and provisions of the debt securities and a description of how the general terms and provisions described below may apply to the debt securities will be included in the applicable prospectus supplement. The following description is subject to the detailed provisions of the applicable Trust Indenture. Accordingly, reference should also be made to the applicable Trust Indenture, a copy of which will be filed by the Company with the securities commissions or similar regulatory authorities in applicable Canadian offering jurisdictions, after it has been entered into, and will be available electronically at www.sedar.com.

General

The applicable Trust Indenture will not limit the aggregate principal amount of debt securities that may be issued under such Trust Indenture and will not limit the amount of other indebtedness that the Company may incur. The applicable Trust Indenture will provide that the Company may issue debt securities from time to time in one or more series and may be denominated and payable in U.S. dollars, Canadian dollars or any foreign currency. Unless otherwise indicated in the applicable prospectus supplement, the debt securities will be unsecured obligations of the Company.

The Company may specify a maximum aggregate principal amount for the debt securities of any series and, unless otherwise provided in the applicable prospectus supplement, a series of debt securities may be reopened for issuance of additional debt securities of such series. The applicable Trust Indenture will also permit the Company to increase the principal amount of any series of the debt securities previously issued and to issue that increased principal amount.

Any prospectus supplement for debt securities supplementing this prospectus will contain the specific terms and other information with respect to the debt securities being offered thereby, including, but not limited to, the following:

• the designation, aggregate principal amount and authorized denominations of such debt securities;

• the percentage of principal amount at which the debt securities will be issued;

• whether payment on the debt securities will be senior or subordinated to other liabilities or obligations of the Company;

• whether the payment of the debt securities will be guaranteed by any other person;

• the date or dates, or the methods by which such dates will be determined or extended, on which the Company may issue the debt securities and the date or dates, or the methods by which such dates will be determined or extended, on which the Company will pay the principal and any premium on the debt securities and the portion (if less than the principal amount) of debt securities to be payable upon a declaration of acceleration of maturity;

• whether the debt securities will bear interest, the interest rate (whether fixed or variable) or the method of determining the interest rate, the date from which interest will accrue, the dates on which the Company will pay interest and the record dates for interest payments, or the methods by which such dates will be determined or extended;

• the place or places the Company will pay principal, premium, if any, and interest, if any, and the place or places where debt securities can be presented for registration of transfer or exchange;

• whether and under what circumstances the Company will be required to pay any additional amounts for withholding or deduction for Canadian taxes with respect to the debt securities, and whether and on what terms the Company will have the option to redeem the debt securities rather than pay the additional amounts;

• whether the Company will be obligated to redeem or repurchase the debt securities pursuant to any sinking or purchase fund or other provisions, or at the option of a holder, and the terms and conditions of such redemption;

• whether the Company may redeem the debt securities at its option and the terms and conditions of any such redemption;

• the denominations in which the Company will issue any registered and unregistered debt securities;

• the currency or currency units for which debt securities may be purchased and the currency or currency units in which the principal and any interest is payable (in either case, if other than Canadian dollars) or if payments on the debt securities will be made by delivery of Common Shares, preferred shares or other property;

• whether payments on the debt securities will be payable with reference to any index or formula;

• if applicable, the ability of the Company to satisfy all or a portion of any redemption of the debt securities, any payment of any interest on such debt securities or any repayment of the principal owing upon the maturity of such debt securities through the issuance of securities of the Company or of any other entity, and any restriction(s) on the persons to whom such securities may be issued;

• whether the debt securities will be issued as global securities (defined below) and, if so, the identity of the depositary for the global securities;

• whether the debt securities will be issued as unregistered securities (with or without coupons), registered securities or both;

• the periods within which and the terms and conditions, if any, upon which the Company may redeem the debt securities prior to maturity and the price or prices of which, and the currency or currency units in which, the debt securities are payable;

• any events of default or covenants applicable to the debt securities;

• any terms under which debt securities may be defeased, whether at or prior to maturity;

• whether the holders of any series of debt securities have special rights if specified events occur;

• any mandatory or optional redemption or sinking fund or analogous provisions;

• the terms, if any, for any conversion or exchange of the debt securities for any other securities;

• rights, if any, on a change of control;

• provisions as to modification, amendment or variation of any rights or terms attaching to the debt securities;

• the Trustee under the Trust Indenture pursuant to which the debt securities are to be issued;

• whether the Company will undertake to list the debt securities of the series on any securities exchange or automated interdealer quotation system; and

• any other terms, conditions, rights and preferences (or limitations on such rights and preferences) including covenants and events of default which apply solely to a particular series of the debt securities being offered which do not apply generally to other debt securities, or any covenants or events of default generally applicable to the debt securities which do not apply to a particular series of the debt securities.

The Company reserves the right to include in a prospectus supplement specific terms pertaining to the debt securities which are not within the options and parameters set forth in this prospectus. In addition, to the extent that any particular terms of the debt securities described in a prospectus supplement differ from any of the terms described in this prospectus, the description of such terms set forth in this prospectus shall be deemed to have been superseded by the description of such differing terms set forth in such prospectus supplement with respect to such debt securities.

Unless stated otherwise in the applicable prospectus supplement, no holder of debt securities will have the right to require the Company to repurchase the debt securities and there will be no increase in the interest rate if the Company becomes involved in a highly leveraged transaction or has a change of control.

The Company may issue debt securities bearing no interest or interest at a rate below the prevailing market rate at the time of issuance, and offer and sell these securities at a discount below their stated principal amount. The Company may also sell any of the debt securities for a foreign currency or currency unit, and payments on the debt securities may be payable in a foreign currency or currency unit. In any of these cases, the Company will describe certain Canadian federal income tax consequences and other special considerations in the applicable prospectus supplement.

Unless otherwise indicated in the applicable prospectus supplement, the Company may issue debt securities with terms different from those of debt securities previously issued and, without the consent of the holders thereof, reopen a previous issue of a series of debt securities and issue additional debt securities of such series.

Ranking and Other Indebtedness

Unless otherwise indicated in an applicable prospectus supplement, the debt securities will be direct unsecured obligations of the Company. The debt securities will be senior or subordinated indebtedness of the Company as described in the applicable prospectus supplement. If the debt securities are senior indebtedness, they will rank equally and ratably with all other unsecured indebtedness of the Company from time to time issued and outstanding which is not subordinated. If the debt securities are subordinated indebtedness, they will be subordinated to senior indebtedness of the Company as described in the applicable prospectus supplement, and they will rank equally and ratably with other subordinated indebtedness of the Company from time to time issued and outstanding as described in the applicable prospectus supplement. The Company reserves the right to specify in a prospectus supplement whether a particular series of subordinated debt securities is subordinated to any other series of subordinated debt securities.

Our board of directors may establish the extent and manner, if any, to which payment on or in respect of a series of debt securities will be senior or will be subordinated to the prior payment of our other liabilities and obligations and whether the payment of principal, premium, if any, and interest, if any, will be guaranteed by any other person and the nature and priority of any security.

Registration of Debt Securities

Debt Securities in Book Entry Form

Unless otherwise indicated in an applicable prospectus supplement, debt securities of any series may be issued in whole or in part in the form of one or more global securities ("Global Securities") registered in the name of a designated clearing agency (a "Depositary") or its nominee and held by or on behalf of the Depositary in accordance with the terms of the applicable Trust Indenture. The specific terms of the depositary arrangement with respect to any portion of a series of debt securities to be represented by a Global Security will, to the extent not described herein, be described in the prospectus supplement relating to such series. The Company anticipates that the provisions described in this section will apply to all depositary arrangements.

Upon the issuance of a Global Security, the Depositary or its nominee will credit, in its book-entry and registration system, the respective principal amounts of the debt securities represented by the Global Security to the accounts of such participants that have accounts with the Depositary or its nominee ("Participants"). Such accounts are typically designated by the underwriters, dealers or agents participating in the distribution of the debt securities or by the Company if such debt securities are offered and sold directly by the Company. Ownership of beneficial interests in a Global Security will be limited to Participants or persons that may hold beneficial interests through Participants. With respect to the interests of Participants, ownership of beneficial interests in a Global Security will be shown on, and the transfer of that ownership will be effected only through records maintained by the Depositary or its nominee. With respect to the interests of persons other than Participants, ownership of beneficial interests in a Global Security will be shown on, and the transfer of that ownership will be effected only through records maintained by Participants or persons that hold through Participants.

So long as the Depositary for a Global Security, or its nominee, is the registered owner of such Global Security, such Depositary or such nominee, as the case may be, will be considered the sole owner or holder of the debt securities represented by such Global Security for all purposes under the applicable Trust Indenture and payments of principal, premium, if any, and interest, if any, on the debt securities represented by a Global Security will be made by the Company to the Depositary or its nominee. The Company expects that the Depositary or its nominee, upon receipt of any payment of principal, premium, if any, or interest, if any, will credit Participants' accounts with payments in amounts proportionate to their respective beneficial interests in the principal amount of the Global Security as shown on the records of such Depositary or its nominee. The Company also expects that payments by Participants to owners of beneficial interests in a Global Security held through such Participants will be governed by standing instructions and customary practices and will be the responsibility of such Participants.

Conveyance of notices and other communications by the Depositary to direct Participants, by direct Participants to indirect Participants and by direct and indirect Participants to beneficial owners will be governed by arrangements among them, subject to any statutory or regulatory requirements as may be in effect from time to time. Beneficial owners of debt securities may wish to take certain steps to augment transmission to them of notices of significant events with respect to the debt securities, such as redemptions, tenders, defaults and proposed amendments to the Trust Indenture.

Owners of beneficial interests in a Global Security will not be entitled to have the debt securities represented by such Global Security registered in their names, will not receive or be entitled to receive physical delivery of such debt securities in certificated non-book-entry form, and will not be considered the owners or holders thereof under the applicable Trust Indenture, and the ability of a holder to pledge a debt security or otherwise take action with respect to such holder's interest in a debt security (other than through a Participant) may be limited due to the lack of a physical certificate.

No Global Security may be exchanged in whole or in part for debt securities registered, and no transfer of a Global Security in whole or in part may be registered, in the name of any person other than the Depositary for such Global Security or any nominee of such Depositary unless: (i) the Depositary is no longer willing or able to discharge properly its responsibilities as depositary and the Company is unable to locate a qualified successor; (ii) the Company at its option elects, or is required by law, to terminate the book-entry system through the Depositary or the book-entry system ceases to exist; or (iii) if provided for in the Trust Indenture, after the occurrence of an event of default thereunder (provided the Trustee has not waived the event of default in accordance with the terms of the Trust Indenture), Participants acting on behalf of beneficial holders representing, in aggregate, a threshold percentage of the aggregate principal amount of the debt securities then outstanding advise the Depositary in writing that the continuation of a book-entry system through the Depositary is no longer in their best interest.

If one of the foregoing events occurs, such Global Security shall be exchanged for certificated non-book-entry debt securities of the same series in an aggregate principal amount equal to the principal amount of such Global Security and registered in such names and denominations as the Depositary may direct.

The Company, any underwriters, dealers or agents and any Trustee identified in an accompanying prospectus supplement, as applicable, will not have any liability or responsibility for (i) records maintained by the Depositary relating to beneficial ownership interests in the debt securities held by the Depositary or the book-entry accounts maintained by the Depositary, (ii) maintaining, supervising or reviewing any records relating to any such beneficial ownership interests, or (iii) any advice or representation made by or with respect to the Depositary and contained in this prospectus or in any prospectus supplement or Trust Indenture with respect to the rules and regulations of the Depositary or at the direction of Depositary Participants.

Unless otherwise stated in the applicable prospectus supplement, CDS Clearing and Depository Services Inc. or its successor will act as Depositary for any debt securities represented by a Global Security.

Debt Securities in Certificated Form

A series of the debt securities may be issued in definitive form, solely as registered securities, solely as unregistered securities or as both registered securities and unregistered securities. Unless otherwise indicated in the applicable prospectus supplement, unregistered securities will have interest coupons attached.

In the event that the debt securities are issued in certificated non-book-entry form, and unless otherwise indicated in the applicable prospectus supplement, payment of principal, premium, if any, and interest, if any, on the debt securities (other than a Global Security) will be made at the office or agency of the Trustee or, at the option of the Company, by the Company by way of cheque mailed or delivered to the address of the person entitled at the address appearing in the security register of the Trustee or electronic funds wire or other transmission to an account of the person entitled to receive such payments. Unless otherwise indicated in the applicable prospectus supplement, payment of interest, if any, will be made to the persons in whose name the debt securities are registered at the close of business on the day or days specified by the Company.

At the option of the holder of debt securities, registered securities of any series will be exchangeable for other registered securities of the same series, of any authorized denomination and of a like aggregate principal amount and tenor. If, but only if, provided in an applicable prospectus supplement, unregistered securities (with all unmatured coupons, except as provided below, and all matured coupons in default) of any series may be exchanged for registered securities of the same series, of any authorized denominations and of a like aggregate principal amount and tenor. In such event, unregistered securities surrendered in a permitted exchange for registered securities between a regular record date or a special record date and the relevant date for payment of interest shall be surrendered without the coupon relating to such date for payment of interest, and interest will not be payable on such date for payment of interest in respect of the registered security issued in exchange for such unregistered security, but will be payable only to the holder of such coupon when due in accordance with the terms of the Trust Indenture. Unless otherwise specified in an applicable prospectus supplement, unregistered securities will not be issued in exchange for registered securities.

The applicable prospectus supplement may indicate the places to register a transfer of the debt securities in definitive form. Except for certain restrictions to be set forth in the Trust Indenture, no service charge will be payable by the holder for any registration of transfer or exchange of the debt securities in definitive form, but the Company may, in certain instances, require a sum sufficient to cover any tax or other governmental charges payable in connection with these transactions

DESCRIPTION OF WARRANTS

General

This section describes the general terms that will apply to any warrants for the purchase of Common Shares, preferred shares or equity warrants, or for the purchase of debt securities, or debt warrants.

We may issue warrants independently or together with other securities, and warrants sold with other securities may be attached to or separate from the other securities. Warrants will be issued under one or more warrant agency agreements to be entered into by us and one or more banks or trust companies acting as warrant agent.

The Company will deliver an undertaking to the applicable securities regulatory authorities that it will not distribute warrants that, according to their terms as described in the applicable prospectus supplement, are "novel" specified derivatives within the meaning of Canadian securities legislation, separately to any member of the public in Canada, unless the offering is in connection with and forms part of the consideration for an acquisition or merger transaction or unless such prospectus supplement containing the specific terms of the warrants to be distributed separately is first approved by or on behalf of the securities commissions or similar regulatory authorities in each of the provinces and territories of Canada where the warrants will be distributed.

This summary of some of the provisions of the warrants is not complete. The statements made in this prospectus relating to any warrant agreement and warrants to be issued under this prospectus are summaries of certain anticipated provisions thereof and do not purport to be complete and are subject to, and are qualified in their entirety by reference to, all provisions of the applicable warrant agreement. You should refer to the warrant indenture or warrant agency agreement relating to the specific warrants being offered for the complete terms of the warrants. A copy of any warrant indenture or warrant agency agreement relating to an offering or warrants will be filed by the Company with the securities regulatory authorities in the applicable Canadian offering jurisdictions after we have entered into it, and will be available electronically on SEDAR at www.sedar.com.

The applicable prospectus supplement relating to any warrants that we offer will describe the particular terms of those warrants and include specific terms relating to the offering.

Original purchasers of warrants (if offered separately) will have a contractual right of rescission against us in respect of the exercise of such warrant. The contractual right of rescission will entitle such original purchasers to receive, upon surrender of the underlying securities acquired upon exercise of the warrant, the total of the amount paid on original purchase of the warrant and the amount paid upon exercise, in the event that this prospectus (as supplemented or amended) contains a misrepresentation, provided that: (i) the exercise takes place within 180 days of the date of the purchase of the warrant under the applicable prospectus supplement; and (ii) the right of rescission is exercised within 180 days of the date of purchase of the warrant under the applicable prospectus supplement. This contractual right of rescission will be consistent with the statutory right of rescission described under section 131 of the Securities Act (British Columbia), and is in addition to any other right or remedy available to original purchasers under section 131 of the Securities Act (British Columbia) or otherwise at law.

In an offering of warrants, or other convertible securities, original purchasers are cautioned that the statutory right of action for damages for a misrepresentation contained in the prospectus is limited, in certain provincial and territorial securities legislation, to the price at which the warrants, or other convertible securities, are offered to the public under the prospectus offering. This means that, under the securities legislation of certain provinces and territories, if the purchaser pays additional amounts upon conversion, exchange or exercise of such securities, those amounts may not be recoverable under the statutory right of action for damages that applies in those provinces or territories. The purchaser should refer to any applicable provisions of the securities legislation of the purchaser's province or territory for the particulars of these rights, or consult with a legal advisor.

Equity Warrants

The particular terms of each issue of equity warrants will be described in the applicable prospectus supplement. This description will include, where applicable:

• the designation and aggregate number of equity warrants;

• the price at which the equity warrants will be offered;

• the currency or currencies in which the equity warrants will be offered;

• the date on which the right to exercise the equity warrants will commence and the date on which the right will expire;

• the number of Common Shares or preferred shares that may be purchased upon exercise of each equity warrant and the price at which and currency or currencies in which the Common Shares or preferred shares may be purchased upon exercise of each equity warrant;

• the terms of any provisions allowing or providing for adjustments in (i) the number and/or class of shares that may be purchased, (ii) the exercise price per share or (iii) the expiry of the equity warrants;

• whether we will issue fractional shares;

• whether we have applied to list the equity warrants or the underlying shares on a stock exchange;

• the designation and terms of any securities with which the equity warrants will be offered, if any, and the number of the equity warrants that will be offered with each security;

• the date or dates, if any, on or after which the equity warrants and the related securities will be transferable separately;

• whether the equity warrants will be subject to redemption or call and, if so, the terms of such redemption or call provisions;

• material Canadian federal income tax consequences of owning the equity warrants;

• any terms, procedures and limitations relating to the transferability, exchange or exercise of the equity warrants; and

• any other material terms or conditions of the equity warrants.

Debt Warrants

The particular terms of each issue of debt warrants will be described in the related prospectus supplement. This description will include, where applicable:

• the designation and aggregate number of debt warrants;

• the price at which the debt warrants will be offered;

• the currency or currencies in which the debt warrants will be offered;

• the designation and terms of any securities with which the debt warrants are being offered, if any, and the number of the debt warrants that will be offered with each security;

• the date or dates, if any, on or after which the debt warrants and the related securities will be transferable separately;

• the principal amount and designation of debt securities that may be purchased upon exercise of each debt warrant and the price at which and currency or currencies in which that principal amount of debt securities may be purchased upon exercise of each debt warrant;

• the date on which the right to exercise the debt warrants will commence and the date on which the right will expire;

• the minimum or maximum amount of debt warrants that may be exercised at any one time;

• whether the debt warrants will be subject to redemption or call, and, if so, the terms of such redemption or call provisions;

• material Canadian federal income tax consequences of owning the debt warrants;

• whether we have applied to list the debt warrants or the underlying debt securities on an exchange;

• any terms, procedures and limitations relating to the transferability, exchange or exercise of the debt warrants; and

• any other material terms or conditions of the debt warrants

Prior to the exercise of their warrants, holders of warrants will not have any of the rights of holders of the securities subject to the warrants

DESCRIPTION OF UNITS

GreenPower may issue units, which may consist of one or more of Common Shares, preferred shares, warrants or any other security specified in the relevant prospectus supplement. Each unit will be issued so that the holder of the unit is also the holder of each of the securities included in the unit. In addition, the relevant prospectus supplement relating to an offering of units will describe all material terms of any units offered, including, as applicable:

• the designation and aggregate number of units being offered;

• the price at which the units will be offered;

• the designation, number and terms of the securities comprising the units and any agreement governing the units;

• the date or dates, if any, on or after which the securities comprising the units will be transferable separately;

• whether we will apply to list the units or any of the individual securities comprising the units on any exchange;

• material Canadian income tax consequences of owning the units, including, how the purchase price paid for the units will be allocated among the securities comprising the units; and

• any other material terms or conditions of the units.

DESCRIPTION OF SUBSCRIPTION RECEIPTS

We may issue subscription receipts separately or in combination with one or more other securities, which will entitle holders thereof to receive, upon satisfaction of certain release conditions (the "Release Conditions") and for no additional consideration, Common Shares, preferred shares, warrants, debt securities or any combination thereof. Subscription receipts will be issued pursuant to one or more subscription receipt agreements (each, a "Subscription Receipt Agreement"), the material terms of which will be described in the applicable prospectus supplement, each to be entered into between the Company and an escrow agent (the "Escrow Agent") that will be named in the relevant prospectus supplement. Each Escrow Agent will be authorized to carry on business as a trustee. If underwriters or agents are used in the sale of any subscription receipts, one or more of such underwriters or agents may also be a party to the Subscription Receipt Agreement governing the subscription receipts sold to or through such underwriter or agent.

The following description sets forth certain general terms and provisions of subscription receipts that may be issued hereunder and is not intended to be complete. The statements made in this prospectus relating to any Subscription Receipt Agreement and subscription receipts to be issued thereunder are summaries of certain anticipated provisions thereof and are subject to, and are qualified in their entirety by reference to, all provisions of the applicable Subscription Receipt Agreement. Prospective investors should refer to the Subscription Receipt Agreement relating to the specific subscription receipts being offered for the complete terms of the subscription receipts. We will file a copy of any Subscription Receipt Agreement relating to an offering of subscription receipts with the applicable securities regulatory authorities in Canada after it has been entered into.

General

The prospectus supplement and the Subscription Receipt Agreement for any subscription receipts that we may offer will describe the specific terms of the subscription receipts offered. This description may include, but may not be limited to, any of the following, if applicable:

• the designation and aggregate number of subscription receipts being offered;

• the price at which the subscription receipts will be offered;

• the designation, number and terms of the Common Shares, preferred shares, warrants and/or debt securities to be received by the holders of subscription receipts upon satisfaction of the Release Conditions, and any procedures that will result in the adjustment of those numbers;

• the Release Conditions that must be met in order for holders of subscription receipts to receive, for no additional consideration, the Common Shares, preferred shares, warrants and/or debt securities;

• the procedures for the issuance and delivery of the Common Shares, preferred shares, warrants and/or debt securities to holders of the subscription receipts upon satisfaction of the Release Conditions;

• whether any payments will be made to holders of subscription receipts upon delivery of the Common Shares, preferred shares, warrants and/or debt securities upon satisfaction of the Release Conditions;

• the identity of the Escrow Agent;

• the terms and conditions under which the Escrow Agent will hold all or a portion of the gross proceeds from the sale of subscription receipts, together with interest and income earned thereon (collectively, the "Escrowed Funds"), pending satisfaction of the Release Conditions;

• the terms and conditions pursuant to which the Escrow Agent will hold the Common Shares, preferred shares, warrants and/or debt securities pending satisfaction of the Release Conditions;

• the terms and conditions under which the Escrow Agent will release all or a portion of the Escrowed Funds to the Company upon satisfaction of the Release Conditions;

• if the subscription receipts are sold to or through underwriters or agents, the terms and conditions under which the Escrow Agent will release a portion of the Escrowed Funds to such underwriters or agents in payment of all or a portion of their fees or commissions in connection with the sale of the subscription receipts;

• procedures for the refund by the Escrow Agent to holders of subscription receipts of all or a portion of the subscription price of their subscription receipts, plus any pro rata entitlement to interest earned or income generated on such amount, if the Release Conditions are not satisfied;

• any contractual right of rescission to be granted to initial purchasers of subscription receipts in the event that this prospectus, the prospectus supplement under which such subscription receipts are issued or any amendment hereto or thereto contains a misrepresentation;

• any entitlement of GreenPower to purchase the subscription receipts in the open market by private agreement or otherwise;

• whether we will issue the subscription receipts as global securities and, if so, the identity of the depository for the global securities;

• whether we will issue the subscription receipts as unregistered bearer securities, as registered securities or both;

• provisions as to modification, amendment or variation of the Subscription Receipt Agreement or any rights or terms of the subscription receipts, including upon any subdivision, consolidation, reclassification or other material change of the Common Shares, preferred shares, warrants or other GreenPower securities, any other reorganization, amalgamation, merger or sale of all or substantially all of the Company's assets or any distribution of property or rights to all or substantially all of the holders of Common Shares or preferred shares;

• whether we will apply to list the subscription receipts on any exchange;

• material Canadian federal income tax consequences of owning the subscription receipts; and

• any other material terms or conditions of the subscription receipts.

Original purchasers of subscription receipts will have a contractual right of rescission against us in respect of the conversion of the subscription receipts. The contractual right of rescission will entitle such original purchasers to receive the amount paid on original purchase of the subscription receipts upon surrender of the underlying securities gained thereby, in the event that this prospectus (as supplemented or amended) contains a misrepresentation, provided that: (i) the conversion takes place within 180 days of the date of the purchase of the subscription receipts under this prospectus; and (ii) the right of rescission is exercised within 180 days of the date of purchase of the subscription receipts under this prospectus. This contractual right of rescission will be consistent with the statutory right of rescission described under section 131 of the Securities Act (British Columbia), and is in addition to any other right or remedy available to original purchasers under section 131 of the Securities Act (British Columbia) or otherwise at law.

Rights of Holders of Subscription Receipts Prior to Satisfaction of Release Conditions

The holders of subscription receipts will not be, and will not have the rights of, shareholders of GreenPower. Holders of subscription receipts are entitled only to receive Common Shares, preferred shares, warrants and/or debt securities on exchange of their subscription receipts, plus any cash payments, if any, all as provided for under the Subscription Receipt Agreement and only once the Release Conditions have been satisfied. If the Release Conditions are not satisfied, holders of subscription receipts shall be entitled to a refund of all or a portion of the subscription price therefor and their pro rata share of interest earned or income generated thereon, if provided for in the Subscription Receipt Agreement, all as provided in the Subscription Receipt Agreement.

Escrow