Greenlight Capital Re, Ltd. (NASDAQ: GLRE) (“Greenlight Re” or the

“Company”) today reported its 2021 second quarter financial

results. The results included:

- Net income of $0.6 million, or

$0.02 per share, compared to a net loss of $0.1 million, or $0.00

per share, in the second quarter of 2020.

- Combined ratio of 96.5%, compared

to a combined ratio of 101.2% in the second quarter of 2020.

- Total investment income of $2.0

million, compared to total investment income of $5.5 million in the

second quarter of 2020.

- An increase in fully diluted book

value per share of $0.11, or 0.8%, to $13.60.

The following summarizes the Company’s

underwriting results for the second quarter of 2021 and 2020:

|

|

Three months ended June 30 |

|

|

2021 |

|

2020 |

| |

|

|

|

|

|

($ in thousands) |

|

Gross premiums written |

141,579 |

|

|

|

116,689 |

|

|

|

Net premiums earned |

132,479 |

|

|

|

108,414 |

|

|

|

Underwriting income (loss) |

4,562 |

|

|

|

(1,306 |

) |

|

|

Combined ratio |

96.5 |

|

% |

|

101.2 |

|

% |

|

|

|

|

|

|

|

|

|

Simon Burton, Chief Executive Officer of Greenlight

Re, stated, “I’m pleased with the contribution from our

underwriting business this quarter at a 96.5% combined ratio,

although an otherwise excellent result was somewhat impacted by

reserving actions on certain legacy contracts and COVID-19 losses.

Our Innovations investments also performed well, as we booked a

$4.0 million increase in valuations in this quarter, which

represents a 15% increase over the carry values of these

investments at March 31. Looking forward, I’m very optimistic for

the prospects of both areas of our operations.”

David Einhorn, Chairman of the Board of Directors,

stated, “Our investment in the Solasglas fund had a small loss in

the second quarter. The portfolio is positioned to take advantage

of inflation and related equities which should exhibit pricing

power in industries with structural shortages, which we think will

more persistent than the consensus believes.”

Underwriting and investment

results

Second quarter of 2021

Gross premiums written in the second quarter of

2021 were $141.6 million, compared to $116.7 million in the second

quarter of 2020. This increase relates primarily to business

assumed from various Lloyd’s syndicates, which was partially offset

by reductions in workers’ compensation, crop and health premium.

Premiums ceded were insignificant in both periods.

Net premiums earned were $132.5 million during

the second quarter of 2021, an increase from $108.4 million in the

comparable 2020 period.

The Company recognized net underwriting income

of $4.6 million in the second quarter of 2021, as compared to an

underwriting loss of $1.3 million in the second quarter of 2020.

The increase in underwriting income was due primarily to the impact

of COVID-19 pandemic losses in the second quarter of 2020,

partially offset by the net financial impact of prior-year loss

development of $3.6 million.

The Company’s total investment income during the

second quarter of 2021 was $2.0 million. The Company’s Investment

Portfolio, which is managed by DME Advisors, returned (0.9)%,

representing a $(2.0) million loss from the Solasglas fund. The

Company also reported $4.0 million of other investment income,

primarily from its Innovations investments.

Six months ended June 30,2021

Gross written premiums were $311.5 million for the

six months ended June 30, 2021, an increase of $85.0 million, or

37.5%, compared to the equivalent 2020 period.

Net premiums earned were $267.9 million for the

six months ended June 30, 2021, an increase of $48.4 million, or

22.1% compared to the first six months of 2020.

Underwriting income for the six months ended

June 30, 2021 was $2.6 million, which equates to a combined ratio

of 99.0%. The underwriting loss for the equivalent 2020 period was

$0.1 million, which represented a combined ratio of 100.0%. The

higher underwriting income was due primarily to the 2020 period

being negatively impacted by COVID-19 pandemic losses. This

increase was partially offset by losses recognized during the 2021

period, including those connected with (i) the Texas winter storms

that occurred in February, 2021 and (ii) deposit-accounted

contracts, both of which occurred during the first quarter of 2021.

The net financial impact of prior-year loss development occurring

in the second quarter of 2021 further reduced the underwriting

income recognized in the first half of 2021.

Total investment income for the six months ended

June 30, 2021, was $20.7 million compared to an investment loss of

$29.7 million incurred during the equivalent 2020 period. The

investment income for the six months ended June 30, 2021 was due

primarily to a gains recognized in connection with Company’s

strategic investments. Additionally, the Company’s investment in

the Solasglas fund generated a gain of $2.0 million for the six

months ended June 30, 2021, compared to a loss of $40.5 million

during the equivalent 2020 period.

Other items

The Company repurchased 0.7 million shares

during the second quarter of 2021 at an average price of $9.30 per

share. As of June 30, 2021, $25.0 million remained available

under the Company’s share repurchase plan.

Conference Call

Greenlight Re will hold a live conference call

to discuss its financial results on Wednesday, August 4, 2021

at 9:00 a.m. Eastern time. The conference call title is Greenlight

Capital Re, Ltd. Second Quarter 2021 Earnings Call.

To participate in the Greenlight Capital Re,

Ltd. Second Quarter 2021 Earnings Call, please dial in to the

conference call at:

U.S. toll free

1-844-274-4096International

1-412-317-5608

Telephone participants may avoid any delays by

pre-registering for the call using the following link to receive a

special dial-in number and PIN.

Conference Call

registration link:

https://dpregister.com/sreg/10158763/eb38b46c28

The conference call can also be accessed via

webcast at:

https://services.choruscall.com/mediaframe/webcast.html?webcastid=Wu1OPljL

A telephone replay of the call will be available

from 11:00 a.m. Eastern time on August 4, 2021 until 9:00 a.m.

Eastern time on August 18, 2021. The replay of the call

may be accessed by dialing 1-877-344-7529 (U.S. toll free) or

1-412-317-0088 (international), access code 10158763. An audio file

of the call will also be available on the Company’s website,

www.greenlightre.com.

Non-GAAP Financial Measures In

presenting the Company’s results, management has included financial

measures that are not calculated under standards or rules that

comprise accounting principles generally accepted in the United

States (GAAP). Such measures which include adjusted combined ratio,

and net underwriting income (loss), are referred to as non-GAAP

measures. These non-GAAP measures may be defined or calculated

differently by other companies. Management believes these measures

allow for a more complete understanding of the underlying business.

These measures are used to monitor our results and should not be

viewed as a substitute for those determined in accordance with

GAAP. Reconciliations of such measures to the most comparable GAAP

figures are included in the attached financial information in

accordance with Regulation G.

Forward-Looking Statements This

news release contains forward-looking statements within the meaning

of the U.S. federal securities laws. We intend these

forward-looking statements to be covered by the safe harbor

provisions for forward-looking statements in the U.S. Federal

securities laws. These statements involve risks and uncertainties

that could cause actual results to differ materially from those

contained in forward-looking statements made on behalf of the

Company. These risks and uncertainties include the impact of

general economic conditions and conditions affecting the insurance

and reinsurance industry, the adequacy of our reserves, our ability

to assess underwriting risk, trends in rates for property and

casualty insurance and reinsurance, competition, investment market

fluctuations, trends in insured and paid losses, catastrophes,

regulatory and legal uncertainties and other factors described in

our Form 10-K filed with the Securities Exchange Commission on

March 10, 2021. The Company undertakes no obligation to publicly

update or revise any forward-looking statements, whether as a

result of new information, future events or otherwise, except as

provided by law.

About Greenlight Capital Re,

Ltd.Greenlight Re (www.greenlightre.com) provides

multi-line property and casualty reinsurance through its licensed

and regulated reinsurance entities in the Cayman Islands and

Ireland. The Company complements its underwriting activities with a

non-traditional investment approach designed to achieve higher

rates of return over the long term than reinsurance companies that

exclusively employ more traditional investment strategies. In 2018,

the Company launched its Greenlight Re Innovations unit, which

supports technology innovators in the (re)insurance space by

providing investment, risk capacity, and access to a broad

insurance network.

Contact:Investor

Relations:Adam PriorThe Equity Group Inc.(212)

836-9606IR@greenlightre.ky

| |

|

GREENLIGHT CAPITAL RE, LTD.CONDENSED

CONSOLIDATED BALANCE

SHEETS(UNAUDITED) |

| |

|

June 30, 2021 and December 31, 2020

(expressed in thousands of U.S. dollars, except per share

and share amounts) |

| |

|

|

|

| |

June 30, 2021 |

|

December 31, 2020 |

|

Assets |

|

|

|

|

Investments |

|

|

|

|

Investment in related party investment fund |

$ |

175,136 |

|

|

|

$ |

166,735 |

|

|

|

Other investments |

31,418 |

|

|

|

29,418 |

|

|

|

Total investments |

206,554 |

|

|

|

196,153 |

|

|

|

Cash and cash equivalents |

35,204 |

|

|

|

8,935 |

|

|

|

Restricted cash and cash equivalents |

709,672 |

|

|

|

745,371 |

|

|

|

Reinsurance balances receivable (net of allowance for expected

credit losses) |

392,154 |

|

|

|

330,232 |

|

|

|

Loss and loss adjustment expenses recoverable (net of allowance for

expected credit losses) |

14,332 |

|

|

|

16,851 |

|

|

|

Deferred acquisition costs |

60,780 |

|

|

|

51,014 |

|

|

|

Notes receivable |

— |

|

|

|

6,101 |

|

|

|

Other assets |

3,838 |

|

|

|

2,993 |

|

|

|

Total assets |

$ |

1,422,534 |

|

|

|

$ |

1,357,650 |

|

|

|

Liabilities and equity |

|

|

|

|

Liabilities |

|

|

|

|

Loss and loss adjustment expense reserves |

$ |

514,642 |

|

|

|

$ |

494,179 |

|

|

|

Unearned premium reserves |

244,597 |

|

|

|

201,089 |

|

|

|

Reinsurance balances payable |

88,813 |

|

|

|

92,247 |

|

|

|

Funds withheld |

5,092 |

|

|

|

4,475 |

|

|

|

Other liabilities |

5,664 |

|

|

|

5,009 |

|

|

|

Convertible senior notes payable |

96,900 |

|

|

|

95,794 |

|

|

|

Total liabilities |

955,708 |

|

|

|

892,793 |

|

|

|

Shareholders' equity |

|

|

|

|

Ordinary share capital (Class A: par value $0.10; authorized,

100,000,000; issued and outstanding, 27,916,353 (2020: 28,260,075):

Class B: par value $0.10; authorized, 25,000,000; issued and

outstanding, 6,254,715 (2020: 6,254,715)) |

$ |

3,417 |

|

|

|

$ |

3,452 |

|

|

|

Additional paid-in capital |

483,365 |

|

|

|

488,488 |

|

|

|

Retained earnings (deficit) |

(19,956 |

) |

|

|

(27,083 |

) |

|

|

Total shareholders' equity |

466,826 |

|

|

|

464,857 |

|

|

|

Total liabilities and equity |

$ |

1,422,534 |

|

|

|

$ |

1,357,650 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

GREENLIGHT CAPITAL RE, LTD.CONDENSED

CONSOLIDATED RESULTS OF

OPERATIONS(UNAUDITED) |

| |

|

(expressed in thousands of U.S. dollars, except percentages

and per share amounts) |

|

|

|

|

|

| |

Three months ended June 30 |

|

Six months ended June 30 |

| |

2021 |

|

2020 |

|

2021 |

|

2020 |

|

Underwriting revenue |

|

|

|

|

|

|

|

|

Gross premiums written |

$ |

141,579 |

|

|

|

$ |

116,689 |

|

|

|

$ |

311,514 |

|

|

|

$ |

226,476 |

|

|

|

Gross premiums ceded |

(1 |

) |

|

|

(132 |

) |

|

|

54 |

|

|

|

(810 |

) |

|

|

Net premiums written |

141,578 |

|

|

|

116,557 |

|

|

|

311,568 |

|

|

|

225,666 |

|

|

|

Change in net unearned premium reserves |

(9,099 |

) |

|

|

(8,143 |

) |

|

|

(43,693 |

) |

|

|

(6,231 |

) |

|

|

Net premiums earned |

$ |

132,479 |

|

|

|

$ |

108,414 |

|

|

|

$ |

267,875 |

|

|

|

$ |

219,435 |

|

|

|

Underwriting related expenses |

|

|

|

|

|

|

|

|

Net loss and loss adjustment expenses incurred |

|

|

|

|

|

|

|

|

Current year |

$ |

87,420 |

|

|

|

$ |

87,700 |

|

|

|

$ |

185,281 |

|

|

|

$ |

159,225 |

|

|

|

Prior year |

(463 |

) |

|

|

1,494 |

|

|

|

(603 |

) |

|

|

5,666 |

|

|

|

Net loss and loss adjustment expenses incurred |

86,957 |

|

|

|

89,194 |

|

|

|

184,678 |

|

|

|

164,891 |

|

|

|

Acquisition costs |

37,631 |

|

|

|

17,903 |

|

|

|

71,012 |

|

|

|

49,642 |

|

|

|

Underwriting expenses |

3,357 |

|

|

|

3,268 |

|

|

|

6,694 |

|

|

|

6,204 |

|

|

|

Deposit accounting expense (income) |

(28 |

) |

|

|

(645 |

) |

|

|

2,919 |

|

|

|

(1,252 |

) |

|

|

Net underwriting income (loss) |

$ |

4,562 |

|

|

|

$ |

(1,306 |

) |

|

|

$ |

2,572 |

|

|

|

$ |

(50 |

) |

|

| |

|

|

|

|

|

|

|

|

Income (loss) from investment in related party investment fund |

$ |

(2,006 |

) |

|

|

$ |

1,609 |

|

|

|

$ |

2,018 |

|

|

|

$ |

(40,517 |

) |

|

|

Net investment income (loss) |

4,046 |

|

|

|

3,934 |

|

|

|

18,696 |

|

|

|

10,771 |

|

|

|

Total investment income (loss) |

$ |

2,040 |

|

|

|

$ |

5,543 |

|

|

|

$ |

20,714 |

|

|

|

$ |

(29,746 |

) |

|

|

Net underwriting and investment income (loss) |

$ |

6,602 |

|

|

|

$ |

4,237 |

|

|

|

$ |

23,286 |

|

|

|

$ |

(29,796 |

) |

|

| |

|

|

|

|

|

|

|

|

Corporate expenses |

$ |

4,382 |

|

|

|

$ |

2,881 |

|

|

|

$ |

8,586 |

|

|

|

$ |

6,739 |

|

|

|

Other (income) expense, net |

31 |

|

|

|

(143 |

) |

|

|

734 |

|

|

|

251 |

|

|

|

Interest expense |

1,562 |

|

|

|

1,562 |

|

|

|

3,106 |

|

|

|

3,123 |

|

|

|

Income tax expense (benefit) |

1 |

|

|

|

— |

|

|

|

(3,733 |

) |

|

|

(424 |

) |

|

|

Net income (loss) |

$ |

626 |

|

|

|

$ |

(63 |

) |

|

|

$ |

14,593 |

|

|

|

$ |

(39,485 |

) |

|

| |

|

|

|

|

|

|

|

|

Earnings (loss) per share |

|

|

|

|

|

|

|

|

Basic |

$ |

0.02 |

|

|

|

$ |

— |

|

|

|

$ |

0.21 |

|

|

|

$ |

(1.12 |

) |

|

|

Diluted |

$ |

0.02 |

|

|

|

$ |

— |

|

|

|

$ |

0.21 |

|

|

|

$ |

(1.12 |

) |

|

| |

|

|

|

|

|

|

|

|

Underwriting ratios |

|

|

|

|

|

|

|

|

Loss ratio - current year |

66.0 |

|

% |

|

80.9 |

|

% |

|

69.2 |

|

% |

|

72.5 |

|

% |

|

Loss ratio - prior year |

(0.4 |

) |

% |

|

1.4 |

|

% |

|

(0.3 |

) |

% |

|

2.6 |

|

% |

|

Loss ratio |

65.6 |

|

% |

|

82.3 |

|

% |

|

68.9 |

|

% |

|

75.1 |

|

% |

|

Acquisition cost ratio |

28.4 |

|

% |

|

16.5 |

|

% |

|

26.5 |

|

% |

|

22.6 |

|

% |

|

Composite ratio |

94.0 |

|

% |

|

98.8 |

|

% |

|

95.4 |

|

% |

|

97.7 |

|

% |

|

Underwriting expense ratio |

2.5 |

|

% |

|

2.4 |

|

% |

|

3.6 |

|

% |

|

2.3 |

|

% |

|

Combined ratio |

96.5 |

|

% |

|

101.2 |

|

% |

|

99.0 |

|

% |

|

100.0 |

|

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The following tables present the Company’s

underwriting ratios by line of business:

| |

Three months ended June 30 |

|

Three months ended June 30 |

| |

2021 |

|

2020 |

| |

Property |

|

Casualty |

|

Other |

|

Total |

|

Property |

|

Casualty |

|

Other |

|

Total |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss ratio |

49.2 |

|

% |

|

76.2 |

|

% |

|

44.8 |

|

% |

|

65.6 |

|

% |

|

72.4 |

|

% |

|

70.5 |

|

% |

|

120.5 |

|

% |

|

82.3 |

|

% |

|

Acquisition cost ratio |

22.2 |

|

% |

|

26.6 |

|

% |

|

36.2 |

|

% |

|

28.4 |

|

% |

|

20.9 |

|

% |

|

28.9 |

|

% |

|

(20.4 |

) |

% |

|

16.5 |

|

% |

|

Composite ratio |

71.4 |

|

% |

|

102.8 |

|

% |

|

81.0 |

|

% |

|

94.0 |

|

% |

|

93.3 |

|

% |

|

99.4 |

|

% |

|

100.1 |

|

% |

|

98.8 |

|

% |

|

Underwriting expense ratio |

|

|

|

|

|

|

2.5 |

|

% |

|

|

|

|

|

|

|

2.4 |

|

% |

|

Combined ratio |

|

|

|

|

|

|

96.5 |

|

% |

|

|

|

|

|

|

|

101.2 |

|

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Six months ended June 30 |

|

Six months ended June 30 |

| |

2021 |

|

2020 |

|

|

Property |

|

Casualty |

|

Other |

|

Total |

|

Property |

|

Casualty |

|

Other |

|

Total |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss ratio |

64.5 |

|

% |

|

74.9 |

|

% |

|

55.2 |

|

% |

|

68.9 |

|

% |

|

68.1 |

|

% |

|

71.6 |

|

% |

|

87.4 |

|

% |

|

75.1 |

|

% |

|

Acquisition cost ratio |

21.0 |

|

|

|

25.8 |

|

|

|

30.8 |

|

|

|

26.5 |

|

|

|

20.2 |

|

|

|

28.0 |

|

|

|

10.9 |

|

|

|

22.6 |

|

|

|

Composite ratio |

85.5 |

|

% |

|

100.7 |

|

% |

|

86.0 |

|

% |

|

95.4 |

|

% |

|

88.3 |

|

% |

|

99.6 |

|

% |

|

98.3 |

|

% |

|

97.7 |

|

% |

|

Underwriting expense ratio |

|

|

|

|

|

|

3.6 |

|

|

|

|

|

|

|

|

|

2.3 |

|

|

|

Combined ratio |

|

|

|

|

|

|

99.0 |

|

% |

|

|

|

|

|

|

|

100.0 |

|

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GREENLIGHT CAPITAL RE,

LTD.NON-GAAP MEASURES AND

RECONCILIATION

Adjusted combined ratio

“Combined ratio” is a commonly used measure in the

property and casualty insurance industry and is calculated using

U.S. GAAP components. We use the combined ratio, as well as an

adjusted combined ratio that excludes the impacts of certain items,

to evaluate our underwriting performance. We believe this adjusted

non-GAAP measure provides management and financial statement users

with a better understanding of the factors influencing our

underwriting results.

In calculating the adjusted combined ratio, we

exclude underwriting income and losses attributable to (i) prior

accident-year reserve development, (ii) catastrophe events, and

(iii) other significant infrequent adjustments.

Prior accident-year reserve development, which can

be favorable or unfavorable, represents changes in our estimates of

losses and loss adjustment expenses associated with loss events

that occurred in prior years. We believe a discussion of current

accident-year performance, which excludes prior accident-year

reserve development, is helpful since it provides more insight into

current underwriting performance.

By their nature, catastrophe events and other

significant infrequent adjustments are not representative of the

type of loss activity that we would expect to occur in every

period.

We believe an adjusted combined ratio that excludes

the effects of these items aids in understanding the underlying

trends and variability in our underwriting results that these items

may obscure.

The following table reconciles the combined

ratio to the adjusted combined ratio:

| |

Three months ended June 30 |

|

Six months ended June 30 |

| |

2021 |

|

2020 |

|

2021 |

|

2020 |

|

Combined ratio |

96.5 |

|

% |

|

101.2 |

|

% |

|

99.0 |

|

% |

|

100.0 |

|

% |

|

Impact on combined ratio of selected items: |

|

|

|

|

|

|

|

|

Prior-year development |

2.7 |

|

% |

|

1.0 |

|

% |

|

1.3 |

|

% |

|

2.3 |

|

% |

|

Catastrophes (current year) |

0.8 |

|

% |

|

— |

|

% |

|

2.1 |

|

% |

|

— |

|

% |

|

Other adjustments |

— |

|

% |

|

5.5 |

|

% |

|

1.1 |

|

% |

|

2.7 |

|

% |

|

Adjusted combined ratio |

93.0 |

|

% |

|

94.7 |

|

% |

|

94.5 |

|

% |

|

95.0 |

|

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- For the three and six months ended

June 30, 2021, the caption “Prior-year development” includes

development on losses relating to the COVID-19 pandemic.

- The caption “Catastrophes (current

year)” includes events that occur during a given period, as well as

current-period development on catastrophe events occurring earlier

in the fiscal year.

- The caption “Other adjustments”

represents, for the six months ended June 30, 2021, interest income

and expense on deposit-accounted contracts due to changes in the

associated estimated ultimate cash flows and, for the three and six

months ended June 30, 2020, losses relating to the COVID-19

pandemic.

Net Underwriting Income

(Loss)

One way that we evaluate the Company’s

underwriting performance is through the measurement of net

underwriting income (loss). We do not use premiums written as a

measure of performance. Net underwriting income (loss) is a

performance measure used by management to evaluate the fundamentals

underlying the Company’s underwriting operations. We believe that

the use of net underwriting income (loss) enables investors and

other users of the Company’s financial information to analyze our

performance in a manner similar to how management analyzes

performance. Management also believes that this measure follows

industry practice and allows the users of financial information to

compare the Company’s performance with those of our industry peer

group.

Net underwriting income (loss) is considered a

non-GAAP financial measure because it excludes items used to

calculate net income before taxes under U.S. GAAP. We calculate net

underwriting income (loss) as net premiums earned, plus other

income (expense) relating to reinsurance and deposit-accounted

contracts, less net loss and loss adjustment expenses, acquisition

costs, and underwriting expenses. The measure excludes, on a

recurring basis: (1) investment income (loss); (2) other income

(expense) not related to underwriting, including foreign exchange

gains or losses and adjustments to the allowance for expected

credit losses; (3) corporate general and administrative expenses;

and (4) interest expense. We exclude total investment income or

loss and foreign exchange gains or losses as we believe these items

are influenced by market conditions and other factors not related

to underwriting decisions. We exclude corporate expenses because

these expenses are generally fixed and not incremental to or

directly related to our underwriting operations. We believe all of

these amounts are largely independent of our underwriting process

and including them could hinder the analysis of trends in our

underwriting operations. Net underwriting income (loss) should not

be viewed as a substitute for U.S. GAAP net income before income

taxes.

The reconciliations of net underwriting income

(loss) to income (loss) before income taxes (the most directly

comparable U.S. GAAP financial measure) on a consolidated basis are

shown below:

|

|

Three months ended June 30 |

|

Six months ended June 30 |

|

|

2021 |

|

2020 |

|

2021 |

|

2020 |

| |

|

|

|

|

|

|

|

|

|

($ in thousands) |

|

Income (loss) before income tax |

627 |

|

|

|

(63 |

) |

|

|

10,860 |

|

|

|

(39,909 |

) |

|

|

Add (subtract): |

|

|

|

|

|

|

|

|

Total investment (income) loss |

(2,040 |

) |

|

|

(5,543 |

) |

|

|

(20,714 |

) |

|

|

29,746 |

|

|

|

Other non-underwriting (income) expense |

31 |

|

|

|

(143 |

) |

|

|

734 |

|

|

|

251 |

|

|

|

Corporate expenses |

4,382 |

|

|

|

2,881 |

|

|

|

8,586 |

|

|

|

6,739 |

|

|

|

Interest expense |

1,562 |

|

|

|

1,562 |

|

|

|

3,106 |

|

|

|

3,123 |

|

|

|

Net underwriting income (loss) |

4,562 |

|

|

|

(1,306 |

) |

|

|

2,572 |

|

|

|

(50 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

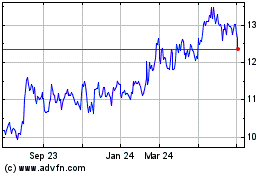

Greenlight Capital Re (NASDAQ:GLRE)

Historical Stock Chart

From Mar 2024 to Apr 2024

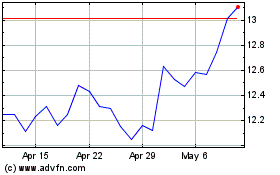

Greenlight Capital Re (NASDAQ:GLRE)

Historical Stock Chart

From Apr 2023 to Apr 2024