Filed

pursuant to Rule 424(b)(5)

Registration No. 333-256509

The

information in this preliminary prospectus supplement is not complete and may be changed. We may not sell these securities until the

registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus supplement is not

an offer to sell these securities and it is not soliciting offers to buy these securities in any jurisdiction where the offer or sale

is not permitted.

DATED

JUNE 28, 2021

SUBJECT

TO COMPLETION

PRELIMINARY

PROSPECTUS SUPPLEMENT

(To

Prospectus dated June 7, 2021)

Ordinary

Shares

GREENLAND

TECHNOLOGIES HOLDING CORPORATION

We

are offering ordinary shares, no par value per share (the “ordinary shares”), pursuant to this prospectus

supplement and the accompanying prospectus, at a purchase price of US$ per share.

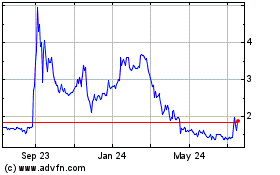

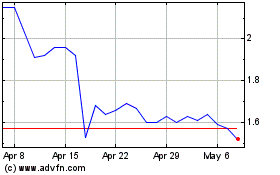

Our

ordinary shares are listed on The Nasdaq Capital Market, or Nasdaq, under the symbol “GTEC.” On June 25, 2021, the last reported

sale price of our ordinary shares on Nasdaq was US$9.07 per share.

We

are an “emerging growth company” as defined in the Jumpstart Our Business Act of 2012, as amended, and, as such, will be

subject to reduced public company reporting requirements.

The

aggregate market value of our outstanding ordinary shares held by non-affiliates, or public float, as of June 25, 2021, was approximately

US$35.48 million, which was calculated based on 3,661,378 ordinary shares held by non-affiliates as of June 25, 2021 and a per share

price of US$9.69, which was the closing price of our ordinary shares on Nasdaq on June 8, 2021. We have not sold any of our ordinary

shares pursuant to General Instruction I.B.6 on Form S-3 during the prior 12 calendar month period that ends on and includes the date

hereof (but excluding this offering).

Investing

in our securities involves risks. See “Risk Factors” beginning on page S-4 of this prospectus supplement and on page 1 of

the accompanying prospectus.

Neither

the U.S. Securities and Exchange Commission nor any state securities commission nor any other regulatory body has approved or disapproved

of these securities or determined if this prospectus supplement is truthful or complete. Any representation to the contrary is a criminal

offense.

|

|

|

Per ordinary

share

|

|

|

Total

|

|

|

Public offering price

|

|

$

|

|

|

|

$

|

|

|

|

Underwriting discounts (1)

|

|

$

|

|

|

|

$

|

|

|

|

Proceeds, before expenses, to us

|

|

$

|

|

|

|

$

|

|

|

(1)

We will also pay the underwriter for certain expenses incurred in this offering. See “Underwriting” on page S-9 of this prospectus

supplement for more information regarding the underwriting compensation.

We

have granted the underwriter an option for a period ending 45 days after the closing of this offering to purchase up to an additional

ordinary shares at the public offering price, less the underwriting discount, solely to cover

over-allotments, if any. If the underwriter exercises the option in full, the total underwriting discount will be $ ,

and the total proceeds to us, before expenses, will be $ .

We

expect that delivery of the ordinary shares being offered pursuant to this prospectus supplement and the accompanying prospectus will

be made on or about June , 2021, subject to customary closing conditions.

Sole

Book-Running Manager

Aegis

Capital Corp.

The

date of this prospectus supplement is June , 2021

TABLE OF CONTENTS

Prospectus

ABOUT

THIS PROSPECTUS SUPPLEMENT

On

May 26, 2021, we filed with the Securities and Exchange Commission (the “SEC”) a registration statement on Form S-3 (File

No. 333-256509), utilizing a shelf registration process relating to the securities described in this prospectus supplement, which registration

statement was declared effective by the SEC on June 7, 2021. Under this shelf registration process, we may, from time to time, in one

or more offerings, offer and sell up to US$150,000,000 of any combination, together or separately, of our ordinary shares, no par value

per share, preferred shares, debt securities, warrants, rights, and units, or any combination thereof as described in the accompanying

prospectus. We are selling ordinary shares in this offering. Other than ordinary shares being sold pursuant to this offering, we have

not sold any securities under this shelf registration statement.

This

document is in two parts. The first part is this prospectus supplement, which describes the specific terms of this offering and also

adds to and updates information contained in the accompanying prospectus and the documents incorporated by reference into the prospectus

supplement. The second part, the accompanying prospectus, gives more general information, some of which does not apply to this offering.

You should read this entire prospectus supplement as well as the accompanying prospectus and the documents incorporated by reference

that are described under “Incorporation of Documents by Reference” and “Where You Can Find Additional Information”

in this prospectus supplement and the accompanying prospectus.

If

the description of the offering varies between this prospectus supplement and the accompanying prospectus, you should rely on the information

contained in this prospectus supplement. However, if any statement in one of these documents is inconsistent with a statement in another

document having a later date—for example, a document incorporated by reference in this prospectus supplement and the accompanying

prospectus—the statement in the document having the later date modifies or supersedes the earlier statement.

Any

statement contained in a document incorporated by reference, or deemed to be incorporated by reference, into this prospectus supplement

or the accompanying prospectus will be deemed to be modified or superseded for purposes of this prospectus supplement or the accompanying

prospectus to the extent that a statement contained herein, therein or in any other subsequently filed document which also is incorporated

by reference in this prospectus supplement or the accompanying prospectus modifies or supersedes that statement. Any such statement so

modified or superseded will not be deemed, except as so modified or superseded, to constitute a part of this prospectus supplement or

the accompanying prospectus.

We

further note that the representations, warranties, and covenants made by us in any agreement that is filed as an exhibit to any document

that is incorporated by reference in this prospectus supplement and the accompanying prospectus were made solely for the benefit of the

parties to such agreement, including, in some cases, for the purpose of allocating risk among the parties to such agreements, and should

not be deemed to be a representation, warranty or covenant to you unless you are a party to such agreement. Moreover, such representations,

warranties, or covenants were accurate only as of the date when made or expressly referenced therein. Accordingly, such representations,

warranties, and covenants should not be relied on as accurately representing the current state of our affairs unless you are a party

to such agreement.

CAUTIONARY

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

prospectus supplement, the accompanying prospectus, and our SEC filings that are incorporated by reference into this prospectus supplement

contain or incorporate by reference forward-looking statements within the meaning of Section 27A of the Securities Act, as amended (the

“Securities Act”) and Section 21E of the Securities Exchange Act, as amended (the “Exchange Act”). Many of the

forward-looking statements contained in this prospectus supplement can be identified by the use of forward-looking words such as “anticipate,”

“believe,” “could,” “expect,” “should,” “plan,” “intend,” “estimate,”

and “potential,” among others.

Forward-looking

statements appear in a number of places in this prospectus supplement, the accompanying prospectus, and our SEC filings that are

incorporated by reference into this prospectus supplement. These forward-looking statements include, but are not limited to,

statements regarding our intent, belief, or current expectations. Forward-looking statements are based on our management’s

beliefs and assumptions and on information currently available to our management. Such statements are subject to risks and

uncertainties, and actual results may differ materially from those expressed or implied in the forward-looking statements due to of

various factors, including, but not limited to, those identified under the section entitled “Risk Factors” in any of our

filings with the SEC pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act., the section entitled “Risk

Factors” beginning on page S-4 of this prospectus supplement, and the section entitled “Risk Factors” beginning on

page 1 of the accompanying prospectus. These risks and uncertainties include factors relating to:

|

|

●

|

the future financial performance

of Greenland Technologies Holding Corporation (“Greenland” or the “Company”);

|

|

|

●

|

changes in the market for

Zhongchai Holding (Hong Kong) Limited (“Zhongchai Holding”)’s products;

|

|

|

●

|

expansion plans and opportunities;

and

|

|

|

●

|

other statements preceded

by, followed by or that include the words “may,” “can,” “should,” “will,” “estimate,”

“plan,” “project,” “forecast,” “intend,” “expect,” “anticipate,”

“believe,” “seek,” “target” or similar expressions.

|

Forward-looking

statements speak only as of the date they are made, and we do not undertake any obligation to update them in light of new information

or future developments or to release publicly any revisions to these statements in order to reflect later events or circumstances or

to reflect the occurrence of unanticipated events, except as, and to the extent required by, applicable securities laws.

PROSPECTUS

SUPPLEMENT SUMMARY

The

following summary highlights, and should be read in conjunction with, the more detailed information contained elsewhere in this prospectus

supplement, the accompanying prospectus, and the documents incorporated therein by reference. You should read carefully the entire documents,

including our financial statements and related notes, to understand our business, the ordinary shares, and the other considerations that

are important to your decision to invest in the ordinary shares. You should pay special attention to the “Risk Factors” sections

beginning on page S-4 of this prospectus supplement and on page1 of the accompanying prospectus.

Organization

Greenland

serves as the parent company of Zhongchai Holding, a holding company formed under the laws of Hong Kong on April 23, 2009. Zhongchai

Holding, through its subsidiaries, develops and manufacture traditional transmission products for material handling machineries in China,

as well as develop models for robotic cargo carriers, which are expected to be produced in the near future in China.

Greenland

Technologies Corp. (“Greenland Tech”) was incorporated on January 14, 2020 under the laws of the state of Delaware. Greenland

Tech is a wholly-owned subsidiary of the registrant. We aim to use Green Tech as the US operation site for the Company in order to promote

sales of our robotic products for the North American market in the near future.

Greenland’s

subsidiaries also include Zhejiang Zhongchai Machinery Co. Ltd., an operating company formed under the laws of the PRC in 2005, Hangzhou

Greenland Energy Technologies Co., Ltd., formerly known as Hangzhou Greenland Robotic Co., Ltd. prior to November 6, 2020, an operating

company formed under the laws of the PRC in 2019, Zhejiang Shengte Transmission Co., Ltd., an operating company formed under the laws

of the PRC in 2006, and Shanghai Hengyu Enterprise Management Consulting Co., Ltd., a company formed under the laws of the PRC in 2005.

Through

Zhongchai Holding and other subsidiaries, we offer transmission products, which are key components for forklift trucks used in manufacturing

and logistic applications, such as factories, workshops, warehouses, fulfillment centers, shipyards and seaports. Forklifts play an important

role in the logistic systems of many companies across different industries in China and globally. Generally, the industries with the

largest demand for forklifts include the transportation, warehousing logistics, electrical machinery and automobile industries. Through

Zhongchai Holding and other subsidiaries, we have experienced an increased demand for forklifts in the manufacturing and logistics industries

in China, as our revenue increased from approximately $52.40 million in the fiscal year of 2019 to $66.86 million in the fiscal year

of 2020. The increased revenue of approximately $14.46 million was primarily due to the fact that demand for our products has returned

to normal and continued to grow. Based on the revenues in the fiscal year ended December 31, 2020 and 2019, we believe that Greenland

is one of the major developers and manufacturers of transmission products for small and medium-sized forklift trucks in China.

Initial

Public Offering

On

July 27, 2018, Greenland consummated its initial public offering of 4,400,000 units (the “Initial Public Offering”) at $10.00

per unit, generating gross proceeds of $44,000,000.

Simultaneously

with the closing of the Initial Public Offering, the Company consummated the sale of 282,000 units at a price of $10.00 per unit in a

private placement to Greenland Asset Management Corporation (the “Sponsor”) and Chardan Capital Markets, LLC (“Chardan”),

generating gross proceeds of $2,820,000. The company also sold to Chardan (and its designees), for $100, an option to purchase up to

240,000 units exercisable at $11.50 per unit (or an aggregate exercise price of $2,760,000) commencing on consummation of the Business

Combination (as defined below). The unit purchase option may be exercised for cash or on a cashless basis, at the holder’s option,

and expires on July 24, 2023. On February 18, 2021, Chardan exercised its option to purchase 120,000 units. As of the date of this prospectus

supplement, an option to purchase 120,000 units is outstanding.

Merger

with Zhongchai Holding

On

July 12, 2019, Greenland entered into a share exchange agreement (the “Share Exchange Agreement”) with Zhongchai Holding,

the Sponsor in the capacity thereunder as the purchaser representative, and Cenntro Holding Limited, the sole member of Zhongchai Holding

(“Zhongchai Equity Holder”), whereby Greenland agreed to acquire all of the outstanding capital stock of Zhongchai Holding

through a share exchange with Zhongchai Equity Holder.

On

October 24, 2019, we consummated a business combination (the “Business Combination”) whereby Zhongchai Holding became our

wholly owned subsidiary, along with its subsidiaries.

Greenland

was originally incorporated under the laws of British Virgin Islands on December 28, 2017 as a blank check company for the purpose of

effecting a merger, capital stock exchange, asset acquisition, stock purchase, recapitalization, reorganization or similar business combination

with one or more target businesses. As a result of the Business Combination, we have ceased to be a “shell company” (as such

term is defined in Rule 12b-2 under the Securities Exchange Act of 1934, as amended) and continued the existing business operations of

Zhongchai Holding as a publicly traded company under the name “Greenland Technologies Holding Corporation.”

Products

Greenland

provides transmission systems and integrated powertrains for material handling machineries, particularly for electric forklift trucks.

In order to expand and diversify existing product offerings, Greenland recently entered into the electric industry vehicles market by

designing and developing electric industry vehicles.

Transmission

products for material handling machineries

Transmission

Systems.

For

15 years, Greenland, along with its subsidiaries, specialized in designing, developing, and manufacturing a wide range of transmission

systems for material handling machineries, in particular forklift trucks. The range of the transmission systems covers from one ton to

fifteen tons machineries. Most transmission systems contain auto transmission features. This feature allows for easy machine operations.

In addition, Greenland provides transmission system for internal combustion powered machineries as well as for electrical powered machineries.

Greenland has experienced an increasing demand for electric powered transmission systems. These transmission systems are key components

for material handling machinery assembly. To meet this increasing demand, Greenland is able to providing these transmission systems to

major forklift truck original equipment manufacturers (“OEMs”) as well as certain global branded manufacturers.

Integrated

Powertrain.

Greenland

has newly designed and developed unique powertrains, which integrates electric motor, speed reduction gearbox, and driving axles into

a combined integral module, in order to meet a growing demand for advanced electric forklift trucks. This integrated powertrain will

enable the OEMs to significantly shorten design cycle, improve machinery efficiency, and simplify manufacturing process. There is a new

trend that OEMs would rather use an integrated powertrain than separate electric motor, speed reduction gearbox, and driving axles, particularly

in electric forklift trucks. Currently, Greenland makes two tons to three and a half-tons integrated powertrains for few electric forklift

truck OEMs. Greenland is in the process to add more integrated powertrain products for electric forklift truck OEMs with different sizes.

Electric

Industrial Vehicles (to be launched in third or fourth quarter 2021)

There

is an increasing demand for electric industrial vehicles where sustainable energies are used in order to reduce air pollutions and lower

carbon monoxide emissions. Greenland plans to enter into the electric industrial vehicles market by utilizing its existing technologies,

know-hows, supply chains, and market access. Greenland’s teams have been developing a 1.8 tons electric loader vehicle (GEL1800)

and Greenland plans to setup an assembly facility on the east coast of the United States for final assembly of this newly developed electric

vehicle. GEL1800 will be our first electric industry vehicle product and we expect it to be available in the third or fourth quarter

of 2021. Other models, such as models with loading capacity of one and a half tons or five tons are currently under development. Greenland

will co-operate with global parts suppliers to utilize their matured supply chain, which will enable it to shorten its development cycle

and make quicker market entrance.

Corporate

Information

We

are a British Virgin Islands company limited by shares and our corporate headquarters are located at 50 Millstone Road, Building 400

Suite 130, East Windsor, NJ, United States 08512. Our telephone number is 1 (888) 827-4832. Our registered office in the British

Virgin Islands is located at Craigmuir Chambers, Road Town, Tortola, VG 1110 British Virgin Islands. We maintain a corporate website

at http://www.gtecrobotic.com/#/home. The information contained in, or accessible from, our website or any other website does not constitute

a part of this prospectus. Our ordinary shares are listed on the Nasdaq Capital Market under the symbol “GTEC.”

The

Offering

|

Ordinary shares offered by us

pursuant to this prospectus supplement

|

|

ordinary shares ( ordinary shares if the underwriter exercises its option to purchase additional ordinary

shares in full)

|

|

|

|

|

|

Offering Price

|

|

US$

per ordinary share

|

|

|

|

|

|

Total ordinary shares outstanding before this offering

|

|

10,513,327

|

|

|

|

|

|

Total ordinary shares outstanding immediately after

this offering

|

|

ordinary shares ( ordinary shares if the underwriter exercises its option to purchase additional ordinary

shares in full)

|

|

|

|

|

|

Over-allotment option

|

|

We have granted the underwriter

an option, exercisable until 45 days after the closing of this offering, to acquire purchase up to

additional ordinary shares solely to cover over-allotments, if any.

|

|

|

|

|

|

Use of proceeds

|

|

We intend to use the net

proceeds from this offering for working capital and general corporate purposes. See “Use of Proceeds” on page S-8 of

this prospectus supplement.

|

|

|

|

|

|

Risk factors

|

|

Investing in our securities

involves a high degree of risk. For a discussion of factors you should consider carefully before deciding to invest in our securities,

see the information contained in or incorporated by reference under the heading “Risk Factors” beginning on page S-4

of this prospectus supplement, on page 1 of the accompanying prospectus, and in the other documents incorporated by reference into

this prospectus supplement.

|

|

|

|

|

|

Listing

|

|

Our ordinary shares are

listed on Nasdaq under the symbol “GTEC.”

|

Unless

otherwise indicated, the number of shares outstanding prior to and after this offering is based on 10,513,327 ordinary shares issued

and outstanding as of June 25, 2021. The number of outstanding shares does not include:

|

i.

|

2,352,656 ordinary shares

underlying the 4,705,312 warrants outstanding as of June 25, 2021; and

|

|

|

|

|

ii.

|

192,000 shares reserved

under the unit purchase options granted to Chardan (including 120,000 ordinary shares included in the units, 60,000 ordinary shares

underlying the 250,000 warrants included in the units, and 12,000 ordinary shares underlying the 120,000 rights included in the units).

|

Unless

otherwise indicated, all information in this prospectus supplement assumes no exercise of the underwriter’s over-allotment option.

RISK

FACTORS

The

following is a summary of certain risks that should be carefully considered along with the other information contained or incorporated

by reference in this prospectus supplement, the accompanying prospectus, and the documents incorporated by reference, as updated by our

subsequent filings under the Exchange Act. Particularly, you should carefully consider the risk factors in our annual report on Form

10-K for the fiscal year ended December 31, 2020 and our quarterly report on Form 10-Q for the quarter ended March 31, 2021, and in the

accompanying prospectus. If any of the following events actually occurs, our business, operating results, prospects, or financial condition

could be materially and adversely affected. The risks described below are not the only ones that we face. Additional risks not presently

known to us or that we currently deem immaterial may also significantly impair our business operations and could result in a complete

loss of your investment.

Risks

Related to this Offering and our Ordinary Shares

Since

our management will have broad discretion in how we use the proceeds from this offering, we may use the proceeds in ways with which you

disagree.

Our

management will have significant flexibility in applying the net proceeds of this offering. You will be relying on the judgment of our

management with regard to the use of those net proceeds, and you will not have the opportunity, as part of your investment decision,

to influence how the proceeds are being used. It is possible that the net proceeds will be invested in a way that does not yield a favorable,

or any, return for us. The failure of our management to use such funds effectively could have a material adverse effect on our business,

financial condition, operating results, and cash flow.

Future

sales of our ordinary shares, whether by us or our shareholders, could cause the price of our ordinary shares to decline.

If

our existing shareholders sell, or indicate an intent to sell, substantial amounts of our ordinary shares in the public market, the trading

price of our ordinary shares could decline significantly. Similarly, the perception in the public market that our shareholders might

sell our ordinary shares could also depress the market price of our shares. A decline in the price of our ordinary shares might impede

our ability to raise capital through the issuance of additional ordinary shares or other equity securities. In addition, the issuance

and sale by us of additional ordinary shares, or securities convertible into or exercisable for our ordinary shares, or the perception

that we will issue such securities, could reduce the trading price for our ordinary shares as well as make future sales of equity securities

by us less attractive or not feasible. The sale of ordinary shares issued upon the exercise of our outstanding warrants could further

dilute the holdings of our then existing shareholders.

We

do not know whether a market for the ordinary shares will be sustained or what the trading price of the ordinary shares will be and as

a result it may be difficult for you to sell your ordinary shares.

Although

our ordinary shares trade on Nasdaq, an active trading market for the ordinary shares may not be sustained. It may be difficult for you

to sell your ordinary shares without depressing the market price for the ordinary shares. As a result of these and other factors, you

may not be able to sell your ordinary shares. Further, an inactive market may also impair our ability to raise capital by selling ordinary

shares, or may impair our ability to enter into strategic partnerships or acquire companies or products by using our ordinary shares

as consideration.

Securities

analysts may not cover our ordinary shares and this may have a negative impact on the market price of our ordinary shares.

The

trading market for our ordinary shares will depend, in part, on the research and reports that securities or industry analysts publish

about us or our business. We do not have any control over independent analysts (provided that we have engaged various non-independent

analysts). We do not currently have and may never obtain research coverage by independent securities and industry analysts. If no independent

securities or industry analysts commence coverage of us, the trading price for our ordinary shares would be negatively impacted. If we

obtain independent securities or industry analyst coverage and if one or more of the analysts who covers us downgrades our ordinary shares,

changes their opinion of our shares or publishes inaccurate or unfavorable research about our business, the price of our ordinary shares

would likely decline. If one or more of these analysts ceases coverage of us or fails to publish reports on us regularly, demand for

our ordinary shares could decrease and we could lose visibility in the financial markets, which could cause the price and trading volume

of our ordinary shares to decline.

You

will experience immediate dilution as a result of this offering and may experience future dilution as a result of future equity offerings

or other equity issuances.

We

believe that purchaser of ordinary shares in this offering will experience an immediate dilution relative to net tangible book value

per ordinary share. Our net tangible book value on December 31, 2020 was US$46.5 million, or US$4.54 per ordinary share. After giving

effect to the sale of our ordinary shares of approximately US$ million in this offering at an offering

price of US$ per ordinary share, and after deducting the underwriting discounts and estimated offering

expenses payable by us in connection with this offering, our as adjusted net tangible book value as of December 31, 2020 would have been

US$ million, or US$ per ordinary share. This represents an immediate increase

in net tangible book value of US$ per ordinary share to our existing shareholders and an immediate decrease

in net tangible book value of US$ per ordinary share to the investor participating in this offering.

We

may in the future issue additional ordinary shares or other securities convertible into or exchangeable for our ordinary shares. We cannot

assure you that we will be able to sell our ordinary shares or other securities in any other offering or other transactions at a price

per ordinary share that is equal to or greater than the price per ordinary share paid by the investor in this offering. The price per

ordinary share at which we sell additional ordinary shares or other securities convertible into or exchangeable for our ordinary shares

in future transactions may be higher or lower than the price per ordinary share in this offering. If we do issue any such additional

ordinary shares, such issuance also will cause a reduction in the proportionate ownership and voting power of all other shareholders.

Because

we do not expect to pay dividends in the foreseeable future, you must rely on the price appreciation of our ordinary shares for return

on your investment.

We

currently intend to retain most, if not all, of our available funds and any future earnings to fund the development and growth of our

business. As a result, we do not expect to pay any cash dividends in the foreseeable future. Therefore, you should not rely on an investment

in our ordinary shares as a source for any future dividend income.

Our

board of directors has complete discretion as to whether to distribute dividends, subject to certain requirements of British Virgin Islands

law. In addition, our shareholders may by ordinary resolution declare a dividend, but no dividend may exceed the amount recommended by

our board of directors. Under British Virgin Islands law, a British Virgin Islands company may pay a dividend out of either profit or

share premium account, provided that in no circumstances may a dividend be paid if this would result in the company being unable to pay

its debts as they fall due in the ordinary course of business. Even if our board of directors decides to declare and pay dividends, the

timing, amount and form of future dividends, if any, will depend on, among other things, our future results of operations and cash flow,

our capital requirements and surplus, the amount of distributions, if any, received by us from our subsidiaries, our financial condition,

contractual restrictions, and other factors deemed relevant by our board of directors. Accordingly, the return on your investment in

our ordinary shares will likely depend entirely upon any future price appreciation of our ordinary shares. There is no guarantee that

our ordinary shares will appreciate in value or even maintain the price at which you purchased the ordinary shares. You may not realize

a return on your investment in our ordinary shares and you may even lose your entire investment in our ordinary shares.

Techniques

employed by short sellers may drive down the market price of our ordinary shares.

Short

selling is the practice of selling securities that the seller does not own but rather has borrowed from a third party with the intention

of buying identical securities back at a later date to return to the lender. The short seller hopes to profit from a decline in the value

of the securities between the sale of the borrowed securities and the purchase of the replacement shares, as the short seller expects

to pay less in that purchase than it received in the sale. As it is in the short seller’s interest for the price of the security

to decline, many short sellers publish, or arrange for the publication of, negative opinions regarding the relevant issuer and its business

prospects in order to create negative market momentum and generate profits for themselves after selling a security short. These short

attacks have, in the past, led to selling of shares in the market.

Public

companies listed in the United States that have substantial operations in China have been the subject of short selling. Much of the scrutiny

and negative publicity has centered on allegations of a lack of effective internal control over financial reporting resulting in financial

and accounting irregularities and mistakes, inadequate corporate governance policies or a lack of adherence thereto and, in many cases,

allegations of fraud. As a result, many of these companies are now conducting internal and external investigations into the allegations

and, in the interim, are subject to shareholder lawsuits and/or SEC enforcement actions.

We

may in the future be the subject of unfavorable allegations made by short sellers. Any such allegations may be followed by periods of

instability in the market price of our ordinary shares and negative publicity. If and when we become the subject of any unfavorable allegations,

whether such allegations are proven to be true or untrue, we could have to expend a significant amount of resources to investigate such

allegations and/or defend ourselves. While we would strongly defend against any such short seller attacks, we may be constrained in the

manner in which we can proceed against the relevant short seller by principles of freedom of speech, applicable federal or state law

or issues of commercial confidentiality. Such a situation could be costly and time- consuming and could distract our management from

growing our business. Even if such allegations are ultimately proven to be groundless, allegations against us could severely impact our

business operations and shareholder’s equity, and the value of any investment in our ordinary shares could be greatly reduced or

rendered worthless.

As

a company incorporated in the British Virgin Islands with limited liability, we are permitted to adopt certain home country practices

in relation to corporate governance matters that differ significantly from the Nasdaq corporate governance listing standards; these practices

may afford less protection to shareholders than they would enjoy if we complied fully with the Nasdaq corporate governance listing standards.

As

a company incorporated in the British Virgin Islands with limited liability that is listed on the Nasdaq, we are subject to the Nasdaq

corporate governance listing standards. However, Nasdaq rules permit a foreign private issuer like us to follow the corporate governance

practices of its home country. Certain corporate governance practices in the British Virgin Islands, which is our home country, may differ

significantly from the Nasdaq corporate governance listing standards. For instance, we are not required to:

|

|

●

|

have

a majority of the board to be independent (a although all of the members of the audit committee

must be independent under the Exchange Act);

|

|

|

●

|

have

a compensation committee or nominating or corporate governance committee consisting entirely

of independent directors);

|

|

|

●

|

have

regularly scheduled executive sessions for non-management directors; and

|

|

|

●

|

have

annual meetings and director elections.

|

Currently,

we do not intend to rely on home country practice with respect to our corporate governance. However, if we choose to follow home country

practice in the future, our shareholders may be afforded less protection than they otherwise would enjoy under the Nasdaq corporate governance

listing standards applicable to U.S. domestic issuers.

CAPITALIZATION

The

following table sets forth our capitalization as of December 31, 2020:

|

|

●

|

on an actual basis, as

derived from our audited consolidated financial statements as of December 31, 2020, which are incorporated by reference into this

prospectus supplement;

|

|

|

●

|

on a pro forma basis, to

give effect to the issuance of 288,185 ordinary shares since December 31, 2020; and

|

|

|

●

|

on an as adjusted pro forma

basis to give further effect to the issuance and sale of ordinary shares at the offering price of

US$ per ordinary share, after deducting underwriting discounts and expenses and estimated offering

expenses payable by us.

|

You

should read this table together with our consolidated financial statements and notes included in the information incorporated by reference

into this prospectus supplement and the accompanying prospectus.

|

|

|

As of December 31, 2020

|

|

|

|

|

Actual

|

|

|

Pro Forma

|

|

|

Pro Forma

As Adjusted

|

|

|

|

|

US$(1)

|

|

|

US$

|

|

|

US$(1)

|

|

|

|

|

(in thousands, except share and per share data)

|

|

|

Shareholders’ Equity:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ordinary Shares (no par value, unlimited number of shares authorized, 10,225,142 shares issued outstanding as of December 31, 2020; 10,513,327 shares outstanding on a pro forma basis as of December 31, 2020; and shares outstanding on a pro forma as adjusted basis as of December 31, 2020)

|

|

|

-

|

|

|

|

-

|

|

|

|

|

|

|

|

|

|

|

Additional paid-in capital

|

|

|

13,707,398

|

|

|

|

16,783,215

|

|

|

|

|

|

|

|

|

|

|

Accumulated deficit

|

|

|

31,182,524

|

|

|

|

31,182,524

|

|

|

|

|

|

|

|

|

|

|

Non-controlling interests

|

|

|

5,771,540

|

|

|

|

5,771,540

|

|

|

|

|

|

|

|

|

|

|

Total Shareholders’ Equity

|

|

|

50,661,462

|

|

|

|

53,737,279

|

|

|

|

|

|

|

|

|

|

|

Total Capitalization

|

|

|

74,030,028

|

|

|

|

77,105,845

|

|

|

|

|

|

|

|

|

|

Notes:

|

(1)

|

Unless otherwise noted,

all translations from Renminbi to U.S. dollars and from U.S. dollars to Renminbi in this table are made at RMB6.525 to US$1.00, the

exchange rate set forth in the H.10 statistical release of the Federal Reserve Board on December 31, 2020. We make no representation

that any Renminbi or U.S. dollar amounts could have been, or could be, converted into U.S. dollars or Renminbi, as the case may be,

at any particular rate, the rates stated above, or at all.

|

|

(2)

|

The preceding table excludes:

|

|

|

|

|

|

|

i.

|

2,352,656 ordinary shares

underlying the 4,705,312 warrants outstanding as of June 25, 2021; and

|

|

|

|

|

|

|

ii.

|

192,000 shares reserved

under the unit purchase options granted to Chardan (including 120,000 ordinary shares included in the units, 60,000 ordinary shares

underlying the 250,000 warrants included in the units, and 12,000 ordinary shares underlying the 120,000 rights included in the units).

|

DILUTION

Our

net tangible book value on December 31, 2020 was US$46.5 million, or US$4.54 per ordinary share. “Net tangible book value”

is total assets minus the sum of liabilities and intangible assets. “Net tangible book value per share” is net tangible book

value divided by the total number of shares outstanding.

After

giving effect to the sale of our ordinary shares of approximately US$ million in this offering at an offering

price of US$ per ordinary share, and after deducting the underwriting discounts and estimated offering

expenses payable by us in connection with this offering, our as adjusted net tangible book value as of December 31, 2020 would have been

US$ million, or US$ per ordinary share. This represents an immediate increase

in net tangible book value of US$ per ordinary share to our existing shareholders and an immediate decrease

in net tangible book value of US$ per ordinary share to the investor participating in this offering.

The

following table illustrates the net tangible book value dilution per ordinary share to shareholders after the issuance of the ordinary

shares in this offering:

|

Public offering

price per ordinary share

|

|

US$

|

|

|

|

Net tangible book value

per ordinary share as of December 31, 2020

|

|

US$

|

4.54

|

|

|

Increase per ordinary share

attributable to existing investors under this prospectus supplement

|

|

US$

|

|

|

|

As Adjusted net tangible

book value per ordinary share after this offering

|

|

US$

|

|

|

|

Net tangible book value

dilution per ordinary share to new investors

|

|

US$

|

|

|

The

foregoing table and discussion is based on 10,225,142 ordinary shares outstanding as of December 31, 2020.

This

discussion of dilution, and the table quantifying it, assumes no exercise of any outstanding options over our ordinary shares.

USE

OF PROCEEDS

We

estimate that the net proceeds from this offering will be approximately US$ million, after deducting the

underwriting discounts and the estimated offering expenses payable by us.

We

intend to use the net proceeds from this offering for working capital and other general corporate purposes.

The

amounts and timing of our use of proceeds will vary depending on a number of factors, including the amount of cash generated or used

by our operations, and the rate of growth, if any, of our business. As a result, we will retain broad discretion in the allocation of

the net proceeds of this offering.

UNDERWRITING

Subject

to the terms and conditions set forth in the underwriting agreement, dated June , 2021, between us and

Aegis Capital Corp. (the “underwriter” or “Aegis”) as the exclusive underwriter of this offering, we have agreed

to sell to the underwriter, and the underwriter has agreed to purchase from us the number of ordinary shares shown opposite its name

below:

|

Underwriter

|

|

Number of

ordinary

shares

|

|

|

Aegis Capital Corp.

|

|

|

|

|

|

Total

|

|

|

|

|

The

underwriting agreement provides that the obligations of the underwriter are subject to certain conditions precedent such as the receipt

by the underwriter of officers’ certificates and legal opinions and approval of certain legal matters by their counsel. The underwriting

agreement provides that the underwriter will purchase all of the shares if any of them are purchased. We have agreed to indemnify the

underwriter against specified liabilities, including liabilities under the Securities Act, and to contribute to payments the underwriter

may be required to make in respect thereof.

The

underwriter is offering the ordinary shares subject to prior sale, when, as and if issued to and accepted by them, subject to approval

of legal matters by its counsel and other conditions specified in the underwriting agreement. The underwriter reserves the right to withdraw,

cancel or modify offers to the public and to reject orders in whole or in part.

We

have granted the underwriter an over-allotment option. This option, which is exercisable for 45 days after the closing of this offering,

permits the underwriter to purchase up to an aggregate of additional ordinary shares (equal to 15% of

the number of shares offered hereby) at the public offering price per share, less underwriting discounts, solely to cover over-allotments,

if any. If the underwriter exercises this option in whole or in part, then the underwriter will be severally committed, subject to the

conditions described in the underwriting agreement, to purchase the additional ordinary shares in proportion to their respective commitments

set forth in the prior table.

Underwriting

Discounts and Reimbursement

The

underwriter has advised us that it proposes to offer the ordinary shares to the public at the public offering price per share set forth

on the cover page of this prospectus supplement. The underwriter may offer ordinary shares to securities dealers at that price less a

concession of not more than $ per ordinary share. After the offering, the public offering price, concession

to dealers may be reduced by the underwriter. No such reduction will change the amount of proceeds to be received by us as set forth

on the cover page of this prospectus supplement.

The

following table summarizes the underwriting discounts and proceeds, before expenses, to us assuming no exercise and full exercise by

the underwriter of its over-allotment option, respectively:

|

|

|

|

|

|

Total

|

|

|

|

|

Per

ordinary

share

|

|

|

Without

Option

|

|

|

With

Option

|

|

|

Public offering price

|

|

$

|

|

|

|

$

|

|

|

|

$

|

|

|

|

Underwriting discounts (7%)

|

|

$

|

|

|

|

$

|

|

|

|

$

|

|

|

|

Proceeds, before expenses, to us

|

|

$

|

|

|

|

$

|

|

|

|

$

|

|

|

In

addition, we have also agreed to pay all expenses in connection with the offering, including the following expenses: (a) all filing fees

and communication expenses relating to the registration of the securities to be sold in the offering (including the over-allotment shares)

with the SEC; (b) all FINRA public offering filing system fees associated with the review of the offering by FINRA; (c) all fees and

expenses relating to the listing of such closing shares and over-allotment shares on Nasdaq; (d) all fees, expenses and disbursements

relating to the registration or qualification of such securities under the “blue sky” securities laws of such states and

other foreign jurisdictions as Aegis may reasonably designate the costs, if any, of all mailing and printing of the underwriting documents

(including, without limitation, the underwriting agreement, any Blue Sky Surveys and, if appropriate, any agreement among underwriters,

selected dealers’ agreement, underwriters’ questionnaire and power of attorney), registration statements, prospectuses and

all amendments, supplements and exhibits thereto and as many preliminary and final prospectuses as the representative may reasonably

deem necessary; (e) the costs of preparing, printing and delivering the securities; (f) fees and expenses of the transfer agent for the

securities (including, without limitation, any fees required for same-day processing of any instruction letter delivered by the Company);

(g) stock transfer and/or stamp taxes, if any, payable upon the transfer of securities from the Company to the underwriters; (h) the

fees and expenses of the Company’s accountants; and (i) a maximum of $35,000 for fees and expenses including “road show”,

diligence and reasonable legal fees and disbursements for underwriters’ counsel.

We

estimate the expenses of this offering payable by us, not including underwriting discounts, including amounts for which we agreed to

reimburse the underwriter for certain of its expenses, will be approximately $ .

Lock-Up

Agreements

The

Company, and each of its directors and executive officers, have agreed for a period of 90 days, after the date of this prospectus, subject

to certain exceptions, without the prior written consent of the underwriter, not to directly or indirectly:

|

|

●

|

issue (in the case of us),

offer, sell, or otherwise transfer or dispose of, directly or indirectly, any shares of capital stock of the Company or any securities

convertible into or exercisable or exchangeable for the shares of capital stock of the Company; or

|

|

|

●

|

in the case of us, file

or caused to be filed any registration statement with the SEC relating to the offering of any shares of capital stock of the Company

or any securities convertible into or exercisable or exchangeable for shares of capital stock of the Company except for (i) the adoption

of an equity incentive plan and the grant of awards or equity pursuant to any equity incentive plan, and the filing of a registration

statement on Form S-8; provided, however, that any sales by parties to the lock-ups shall be subject to the lock-up agreements, and

(ii) this issuance of shares in connection with an acquisition or a strategic relationship which may include the sale of equity securities;

provided, that none of such shares shall be saleable in the public market until the expiration of the 90 day period described above.

|

Securities

Issuance Standstill

The

Company has agreed, for a period of ninety (90) days after the closing date of this offering, that it will not, without the prior written

consent of the underwriter, issue, enter into any agreement to issue or announce the issuance or proposed issuance of ordinary shares

or ordinary share equivalents (or a combination of units thereof) involving an at-the-market offering or Variable Rate Transaction; provided,

however, that the Company may freely enter into such agreement for its at-the-market offerings without written consent of the underwriter.

“Variable Rate Transaction” means a transaction in which the Company (i) issues or sells any debt or equity securities that

are convertible into, exchangeable or exercisable for, or include the right to receive additional ordinary shares either (A) at a conversion

price, exercise price or exchange rate or other price that is based upon and/or varies with the trading prices of or quotations for the

ordinary shares at any time after the initial issuance of such debt or equity securities, or (B) with a conversion, exercise or exchange

price that is subject to being reset at some future date after the initial issuance of such debt or equity security or upon the occurrence

of specified or contingent events directly or indirectly related to the business of the Company or the market for the ordinary shares

or (ii) enters into, or effects a transaction under, any agreement, including, but not limited to, an equity line of credit, whereby

the Company may issue securities at a future determined price.

Right

of First Refusal

Pursuant

to the terms of the underwriting agreement, if, for the period ending six (6) months from the closing of this offering, subject to certain

exceptions set forth in the underwriting agreement, we or any of our subsidiaries (a) decide to finance or refinance any indebtedness,

Aegis (or any affiliate designated by Aegis) shall have the right to act as the sole book-runner, sole manager, sole placement agent

or sole agent with respect to such financing or refinancing; or (b) decide to raise funds by means of a public offering (other than an

at-the-market facility, to which the right of first refusal will not apply,) or a private placement or any other capital raising financing

of equity, equity-linked or debt securities, Aegis (or any affiliate designated by Aegis) shall have the right to act as the sole book-running

manager, sole underwriter or sole placement agent for such financing.

Electronic

Offer, Sale and Distribution of Shares

A

prospectus in electronic format may be made available on the websites maintained by the underwriter or one or more of selling group members.

The underwriter may agree to allocate a number of shares to selling group members for sale to its online brokerage account holders. Internet

distributions will be allocated by the underwriter and selling group members that will make internet distributions on the same basis

as other allocations. Other than the prospectus in electronic format, the information on these websites is not part of, nor incorporated

by reference into this prospectus supplement, has not been approved or endorsed by us, and should not be relied upon by investors.

Stabilization

The

underwriter has advised us that it, pursuant to Regulation M under the Exchange Act, and certain persons participating in the offering

may engage in short sale transactions, stabilizing transactions, syndicate covering transactions or the imposition of penalty bids in

connection with this offering. These activities may have the effect of stabilizing or maintaining the market price of the shares at a

level above that which might otherwise prevail in the open market. Establishing short sales positions may involve either “covered”

short sales or “naked” short sales.

“Covered”

short sales are sales made in an amount not greater than the underwriters’ option to purchase additional shares in this offering.

The underwriters may close out any covered short position by either exercising their option to purchase additional shares or purchasing

shares in the open market. In determining the source of shares to close out the covered short position, the underwriter will consider,

among other things, the price of shares available for purchase in the open market as compared to the price at which they may purchase

shares through the option to purchase additional shares.

“Naked”

short sales are sales in excess of the option to purchase additional shares. The underwriter must close out any naked short position

by purchasing shares in the open market. A naked short position is more likely to be created if the underwriter is concerned that there

may be downward pressure on the price of our shares in the open market after pricing that could adversely affect investors who purchase

in this offering.

A

stabilizing bid is a bid for the purchase of shares on behalf of the underwriter for the purpose of fixing or maintaining the price of

the shares. A syndicate covering transaction is the bid for or the purchase of shares on behalf of the underwriter to reduce a short

position incurred by the underwriter in connection with the offering. Similar to other purchase transactions, the underwriter’s

purchases to cover the syndicate short sales may have the effect of raising or maintaining the market price of our shares or preventing

or retarding a decline in the market price of our shares. As a result, the price of our shares may be higher than the price that might

otherwise exist in the open market. A penalty bid is an arrangement permitting the underwriter to reclaim the selling concession otherwise

accruing to a syndicate member in connection with the offering if the shares originally sold by such syndicate member are purchased in

a syndicate covering transaction and therefore have not been effectively placed by such syndicate member.

Neither

we nor the underwriter makes any representation or prediction as to the direction or magnitude of any effect that the transactions described

above may have on the price of our shares. The underwriter is not obligated to engage in these activities and, if commenced, any of the

activities may be discontinued at any time.

The

underwriter may also engage in passive market making transactions in our shares on Nasdaq in accordance with Rule 103 of Regulation M

during a period before the commencement of offers or sales of our shares in this offering and extending through the completion of distribution.

A passive market maker must display its bid at a price not in excess of the highest independent bid of that security. However, if all

independent bids are lowered below the passive market maker’s bid, that bid must then be lowered when specified purchase limits

are exceeded.

Other

Relationships

The

underwriter and certain of its affiliates are full service financial institutions engaged in various activities, which may include securities

trading, commercial and investment banking, financial advisory, investment management, investment research, principal investment, hedging,

financing and brokerage activities. The underwriter and certain of its affiliates may in the future perform, various commercial and investment

banking and financial advisory services for us and our affiliates, for which they would receive customary fees and expenses.

In

the ordinary course of their various business activities, the underwriter and certain of its affiliates may make or hold a broad array

of investments and actively trade debt and equity securities (or related derivative securities) and financial instruments (including

bank loans) for their own account and for the accounts of their customers, and such investment and securities activities may involve

securities and/or instruments issued by us and our affiliates. The underwriter and certain of its respective affiliates may also communicate

independent investment recommendations, market color or trading ideas and/or publish or express independent research views in respect

of such securities or instruments and may at any time hold, or recommend to clients that they acquire, long and/or short positions in

such securities and instruments.

Offer

Restrictions Outside the United States

Other

than in the United States, no action has been taken by us or the underwriter that would permit a public offering of the shares offered

by this prospectus supplement in any jurisdiction where action for that purpose is required. The shares offered by this prospectus supplement

and the accompanying prospectus may not be offered or sold, directly or indirectly, nor may this prospectus supplement or any other offering

material or advertisements in connection with the offer and sale of any such shares be distributed or published in any jurisdiction,

except under circumstances that will result in compliance with the applicable rules and regulations of that jurisdiction. Persons into

whose possession this prospectus supplement comes are advised to inform themselves about and to observe any restrictions relating to

the offering and the distribution of this prospectus supplement. This prospectus supplement does not constitute an offer to sell or a

solicitation of an offer to buy any shares offered by this prospectus supplement in any jurisdiction in which such an offer or a solicitation

is unlawful.

LEGAL

MATTERS

We

are being represented by Hunter Taubman Fischer & Li LLC with respect to certain legal matters of U.S. federal securities and New

York State law. The validity of the securities offered in this offering and certain other legal matters as to British Virgin Islands

law will be passed upon for us by Ogier. Legal matters as to PRC law will be passed upon for us by Zhejiang T&C Law Firm. Hunter

Taubman Fischer & Li LLC may rely upon Ogier with respect to matters governed by British Virgin Islands law and Zhejiang T&C

Law Firm with respect to matters governed by PRC law. Certain legal matters in connection with this offering will be passed upon for

the underwriter by Kaufman & Canoles, P.C., Richmond, Virginia with respect to U.S. laws.

EXPERTS

The

financial statements incorporated by reference in this prospectus as of and for the fiscal year ended December 31, 2020 and 2019 have

been audited by WWC, P.C., an independent registered public accounting firm, as set forth in their report thereon included therein, and

incorporated herein by reference, and are included in reliance upon such report given on the authority of such firm as experts in accounting

and auditing. The office of WWC, P.C. is located at 2010 Pioneer Court, San Mateo, CA 94403.

INCORPORATION

OF DOCUMENTS BY REFERENCE

THIS

PROSPECTUS INCORPORATES DOCUMENTS BY REFERENCE THAT ARE NOT PRESENTED IN OR DELIVERED WITH THIS PROSPECTUS. YOU SHOULD RELY ONLY ON THE

INFORMATION CONTAINED IN THIS PROSPECTUS AND IN THE DOCUMENTS THAT WE HAVE INCORPORATED BY REFERENCE INTO THIS PROSPECTUS. WE HAVE NOT

AUTHORIZED ANYONE TO PROVIDE YOU WITH INFORMATION THAT IS DIFFERENT FROM OR IN ADDITION TO THE INFORMATION CONTAINED IN THIS DOCUMENT

AND INCORPORATED BY REFERENCE INTO THIS PROSPECTUS.

The

SEC permits us to “incorporate by reference” into this prospectus the information contained in documents that we file with

the SEC, which means that we can disclose important information to you by referring you to those documents. Information that is incorporated

by reference is considered to be part of this prospectus and you should read it with the same care that you read this prospectus. Information

that we file later with the SEC will automatically update and supersede the information that is either contained, or incorporated by

reference, in this prospectus, and will be considered to be a part of this prospectus from the date those documents are filed.

We

have filed with the SEC and incorporate by reference in this prospectus, except as superseded, supplemented or modified by this prospectus,

the documents listed below:

|

|

●

|

Our

Annual Report on Form 10-K filed with the SEC for the year ended December 31, 2020, filed with the SEC on March 31, 2021;

|

|

|

|

|

|

|

●

|

Our

Quarterly Report on Form 10-Q filed with the SEC for the quarterly period ended March 31, 2021, filed with the SEC on May 12, 2021;

|

|

|

|

|

|

|

●

|

Our

Current Reports on Form 8-K filed with the SEC on March 31, 2021 and May 12, 2021; and

|

|

|

|

|

|

|

●

|

The

description of our securities contained in our Registration Statement on Form S-1 filed with the SEC on June 29, 2018, including

any subsequent amendments or reports filed for the purpose of updating such description, including without limitation the section

entitled “Description of Securities” in our Definitive Proxy Statement on Schedule 14A, filed with the SEC on September

26, 2019.

|

These

reports contain important information about us, our financial condition and our results of operations.

We

also incorporate by reference any future filings (other than current reports furnished under Item 2.02 or Item 7.01 of Form 8-K and exhibits

filed on such form that are related to such items unless such Form 8-K expressly provides to the contrary) made with the SEC pursuant

to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act, including those made after the date of the initial filing of the registration

statement of which this prospectus forms a part and prior to effectiveness of such registration statement, until we file a post-effective

amendment that indicates the termination of the offering of the ordinary shares made by this prospectus and such future filings will

become a part of this prospectus from the respective dates that such documents are filed with the SEC. Any statement contained herein

or in a document incorporated or deemed to be incorporated by reference herein shall be deemed to be modified or superseded for purposes

hereof or of the related prospectus supplement to the extent that a statement contained herein or in any other subsequently filed document

which is also incorporated or deemed to be incorporated by reference herein modifies or supersedes such statement. Any such statement

so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this prospectus.

You

may request orally or in writing, and we will provide you with, a copy of any documents that are incorporated by reference in this prospectus

or any prospectus supplement at no cost, by writing or telephoning us at:

Greenland

Technologies Holding Corporation

50

Millstone Road, Building 400 Suite 130

East

Windsor, NJ 08512

United

States

Attention:

Raymond Wang

Phone:

1 (888) 827-4832

You

should rely only on the information contained in, or incorporated by reference into, this prospectus, in any accompanying prospectus

supplement or in any free writing prospectus filed by us with the SEC. We have not authorized anyone to provide you with different or

additional information. You should not assume that the information in this prospectus or in any document incorporated by reference is

accurate as of any date other than the date on the front cover of the applicable document.

WHERE

YOU CAN FIND ADDITIONAL INFORMATION

As

permitted by SEC rules, this prospectus supplement omits certain information and exhibits that are included in the registration statement

of which this prospectus supplement forms a part. Since this prospectus supplement may not contain all of the information that you may

find important, you should review the full text of these documents. If we have filed a contract, agreement, or other document as an exhibit

to the registration statement of which this prospectus supplement forms a part, you should read the exhibit for a more complete understanding

of the document or matter involved. Each statement in this prospectus supplement, including statements incorporated by reference as discussed

above, regarding a contract, agreement, or other document is qualified in its entirety by reference to the actual document. You may inspect

a copy of the registration statement, including the exhibits and schedules, without charge, at the SEC’s public reference room

mentioned below, or obtain a copy from the SEC upon payment of the fees prescribed by the SEC.

We

file periodic reports, proxy statements and other information with the SEC. Our filings are available to the public over the Internet

at the SEC’s web site at http://www.sec.gov. You may read and copy any materials we file with or furnish to the SEC at the public

reference room maintained by the SEC at 100 F Street, N.E., Washington, D.C. 20549. You may obtain information on the operation of the

public reference room by calling the SEC at 1-800-SEC-0330.

Our

Internet address is https://gtec-tech.com. We have not incorporated by reference into this prospectus the information on our website,

and you should not consider it to be a part of this document. Our web address is included in this document as an inactive textual reference

only.

PROSPECTUS

GREENLAND

TECHNOLOGIES HOLDING CORPORATION

$150,000,000

of

Ordinary

Shares

Preferred

Shares

Debt

Securities

Warrants

Rights

Units

We

may offer and sell from time to time up to an aggregate amount of $150,000,000 of our ordinary shares, no par value per share, preferred

shares, debt securities, warrants to purchase other securities, rights, and units consisting of any combination of these securities in

one or more offerings, at prices and on terms described in one or more supplements to this prospectus.

Each

time we sell securities, we will provide a supplement to this prospectus that contains specific information about the offering and the

terms of the securities. The supplement may also add, update, or change information contained in this prospectus. We may also authorize

one or more free writing prospectuses to be provided in connection with a specific offering. You should read this prospectus, any prospectus

supplement, and any free writing prospectus before you invest in any of our securities.

We

may sell the securities independently or together with any other securities registered hereunder to or through one or more underwriters,

dealers, and agents, or directly to purchasers, or through a combination of these methods, on a continuous or delayed basis. See “Plan

of Distribution.” If any underwriters, dealers, or agents are involved in the sale of any of the securities, their names, and any

applicable purchase price, fee, commission, or discount arrangements between or among them, will be set forth, or will be calculable

from the information set forth, in the applicable prospectus supplement.

We

are an “emerging growth company” as defined in the Jumpstart Our Business Startups Act, and, as such, are allowed to provide

more limited disclosures than an issuer that would not so qualify. This prospectus describes the general manner in which the shares may

be offered and sold. If necessary, the specific manner in which the shares may be offered and sold will be described in a supplement

to this prospectus.

Our

ordinary shares are listed on the Nasdaq Capital Market (“Nasdaq”) under the symbols “GTEC.” On May 25, 2021,

the closing price of our ordinary shares was $7.95 per share. This price will fluctuate based on the demand for our ordinary shares.

Pursuant to General Instruction I.B.6 of Form S-3, in no event will we sell securities registered in a public primary offering with a

value exceeding more than one-third of our public float (the market value of our ordinary shares held by our non-affiliates) in

any 12-month calendar period so long as our public float remains below $75.0 million. We have not offered any securities pursuant to

General Instruction I.B.6 of Form S-3 during the prior 12-month calendar period that ends on, and includes, the date of this prospectus.

As of May 26, 2021, one-third of our public float is equal to approximately $15.92 million, which was calculated based on 3,013,878 ordinary

shares held by non-affiliates as of May 26, 2021 and a per share price of US$15.85, which was the closing price of our ordinary shares

on Nasdaq on March 29, 2021.

Investing

in our securities involves a high degree of risk. Before making an investment decision, please carefully review the information described

under the heading “Risk Factors” beginning on page 1 of this prospectus, and other risk factors contained in any applicable

prospectus supplement and in the documents incorporated by reference into this prospectus.

Neither

the Securities and Exchange Commission (“SEC”) nor any state securities commission nor any other regulatory body has approved

or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is

a criminal offense.

The

date of this prospectus is June 7, 2021.

TABLE

OF CONTENTS

ABOUT

THIS PROSPECTUS

This

prospectus is part of a registration statement that we filed with the SEC, utilizing a “shelf” registration process. Under

this shelf registration process, we may offer from time to time up to $150,000,000 in the aggregate of our ordinary shares, preferred

shares, debt securities, warrants, rights, and units, in one or more offerings. In this prospectus, references to the term “securities”

refers collectively to our ordinary shares, preferred shares, debt securities, warrants, rights, and units. The securities offered

under this prospectus may be offered separately, together, or in separate series, and in amounts, at prices, and on terms to be determined

at the time of sale.

This

prospectus provides you with a general description of the securities we may offer. Each time we sell securities under this shelf registration,

we will provide a prospectus supplement that will contain certain specific information about the terms of that offering, including a

description of any risks related to the offering, if those terms and risks are not described in this prospectus. A prospectus supplement

may also add, update, or change information contained in this prospectus. If there is any inconsistency between the information in this

prospectus and the applicable prospectus supplement, you should rely on the information in the prospectus supplement. The registration

statement we filed with the SEC includes exhibits that provide more details on the matters discussed in this prospectus. You should read

this prospectus and the related exhibits filed with the SEC and the accompanying prospectus supplement together with additional information

described under the headings “Incorporation of Documents by Reference” before investing in any of the securities offered.

The

information in this prospectus is accurate as of the date on the front cover. Information incorporated by reference into this prospectus

is accurate as of the date of the document from which the information is incorporated. You should

not assume that the information contained in this prospectus is accurate as of any other date. Neither the delivery of this prospectus

nor any distribution of securities pursuant to this prospectus shall, under any circumstances, create any implication that there has

been no change in the information set forth or incorporated by reference into this prospectus or in our affairs since the date of this

prospectus. Our business, financial condition, results of operations and prospects may have changed since such date.

You

should rely only on the information provided or incorporated by reference in this prospectus. We have not authorized anyone to provide

you with additional or different information. This document may only be used where it is legal to sell these securities. This

prospectus, any prospectus supplement or amendments thereto do not constitute an offer to sell, or a solicitation of an offer to purchase,

the securities offered by this prospectus, any prospectus supplement or amendments thereto in any jurisdiction to or from any person

to whom or from whom it is unlawful to make such offer or solicitation of an offer in such jurisdiction. You

should not assume that any information in this prospectus is accurate as of any date other than the date of this prospectus.

As

permitted by SEC rules and regulations, the registration statement of which this prospectus forms a part includes additional information