Filed pursuant to General Instruction II.L. of Form F-10

File No. 333-257872

GREENBROOK TMS

INC.

The Offering is being made concurrently in each

of the provinces and territories of Canada (except Québec) under the terms of this Prospectus Supplement and in the United States

of America (the “United States” or the “U.S.”) pursuant to the Company’s registration statement

on Form F-10 (as amended, the “Registration Statement”) filed with the United States Securities and Exchange Commission

(the “SEC”), of which this Prospectus Supplement forms a part.

The Company intends to use net proceeds of the

Offering to fund the Acquisition (as defined below) and for working capital and general corporate purposes. See “Recent Developments”,

“Use of Proceeds” and “Risk Factors” in this Prospectus Supplement.

Operating through 132 Company-operated

treatment centers (149 upon completion of the Acquisition), Greenbrook is a leading provider of Transcranial Magnetic Stimulation

(“TMS”) therapy, an FDA-cleared, non-invasive therapy for the treatment of Major Depressive Disorder (“MDD”)

and other mental health disorders, in the United States. TMS therapy provides local electromagnetic stimulation to specific brain regions

known to be directly associated with mood regulation. Greenbrook has provided more than 675,000 TMS treatments to over 19,000 patients

struggling with depression. See “The Company” in this Prospectus Supplement.

The Offered Shares are being offered in Canada

by Stifel Nicolaus Canada Inc. and Bloom Burton Securities Inc. (collectively, the “Lead Underwriters” or the “Canadian

Underwriters”) and in the United States by Lake Street Capital Markets, LLC (the “United States Underwriter”

and, together with the Canadian Underwriters, the “Underwriters”). The Underwriters have severally agreed to purchase

the Offered Shares from the Company at a price of US$7.75 per Offered Share, subject to the terms and conditions of the Underwriting Agreement

(as defined below) described under “Plan of Distribution”. The Offering Price was determined by negotiation between the Company

and the Lead Underwriters, on behalf of the Underwriters.

The following table sets out the maximum number

of Over-Allotment Shares that may be issued pursuant to the Over-Allotment Option:

The Underwriters, as principals, conditionally

offer the Offered Shares, subject to prior sale, if, as and when issued by the Company and accepted by the Underwriters in accordance

with the conditions contained in the Underwriting Agreement described in this Prospectus Supplement under “Plan of Distribution”

and subject to the approval of certain legal matters on behalf of the Company by Torys LLP with respect to Canadian law and United States

law and on behalf of the Underwriters by Dentons Canada LLP with respect to Canadian law and Dentons US LLP with respect to United States

law.

The Company has been advised by the Underwriters

that, in connection with the Offering, the Underwriters may over-allot or effect transactions that stabilize or maintain the market price

of the Shares at levels other than those which otherwise might prevail on the open market. Such transactions, if commenced, may be discontinued

at any time. The Underwriters may offer the Offered Shares to the public at a price lower than that stated above. See “Plan of

Distribution” in this Prospectus Supplement.

Subscriptions will be received subject to rejection or allocation in

whole or in part and the Underwriters reserve the right to close the subscription books at any time without notice. Closing of the Offering

is expected to occur on or about September 27, 2021 or such other date as the Company and the Lead Underwriters, on behalf of the Underwriters,

may agree (the “Closing Date”). Registrations and transfers of the Offered Shares will be effected electronically through

the non-certificated inventory (“NCI”) system administered by CDS Clearing and Depository Services Inc. (“CDS”).

Beneficial owners of Offered Shares will not receive physical certificates evidencing their ownership of Offered Shares unless a request

for a certificate is made to the Company. See “Plan of Distribution” in this Prospectus Supplement.

The TSX has conditionally approved the

listing of the Offered Shares. Listing is subject to the Company fulfilling all of the listing requirements of the TSX on or before

November 2, 2021.

Each of MSS and 1315 Capital (each as defined

below) intends to exercise its Participation Right (as defined below) in connection with the Offering to purchase, directly or indirectly,

approximately 200,000 and 167,570 Offered Shares, respectively, at the Offering Price. See “Plan of Distribution” in this

Prospectus Supplement.

The principal, head and registered office of the

Company is located at 890 Yonge Street, 7th Floor, Toronto, Ontario, Canada, M4W 3P4. The Company’s United States corporate headquarters

is located at 8401 Greensboro Drive, Suite 425, Tysons Corner, Virginia, United States, 22102.

BASE SHELF PROSPECTUS

ABOUT

THIS PROSPECTUS SUPPLEMENT

This document consists of

two parts. The first part is this Prospectus Supplement, which describes the specific terms of the Offering and adds to and supplements

information contained in the Shelf Prospectus and the documents incorporated by reference therein. The second part is the Shelf Prospectus,

which gives more general information, some of which may not apply to the Offering. This Prospectus Supplement is incorporated by reference

into the Shelf Prospectus solely for the purpose of the Offering.

A prospective purchaser of

Offered Shares should read this entire Prospectus Supplement and the Shelf Prospectus, including the documents incorporated herein and

therein by reference, and consult its own professional advisors to assess the income tax, legal, risks and other aspects of its investment

in the Offered Shares. A prospective purchaser of Offered Shares should rely only on the information contained in this Prospectus Supplement

and the Shelf Prospectus. The Company, Greybrook Health Inc. (“Greybrook Health” or the “Promoter”)

and the Underwriters have not authorized anyone to provide prospective purchasers of Offered Shares with additional or different information.

The information contained in this Prospectus Supplement and the Shelf Prospectus is accurate only as of their respective dates, regardless

of the time of delivery of this Prospectus Supplement and the accompanying Shelf Prospectus or any sale of the Offered Shares. The Company’s

business, financial condition, results of operations and prospects may have changed since those dates.

The Company has filed the

Registration Statement with the SEC under the United States Securities Act of 1933, as amended (the “U.S. Securities Act”),

relating to the Offered Shares being offered hereunder. This Prospectus Supplement forms a part of the Registration Statement. This Prospectus

Supplement does not contain all of the information set forth in the Registration Statement, certain items of which are contained in the

exhibits to the Registration Statement as permitted or required by the rules and regulations of the SEC. Items of information omitted

from this Prospectus Supplement but contained in the Registration Statement are available on EDGAR at www.sec.gov.

The Offered Shares may be

sold only in those jurisdictions where offers and sales are permitted. This Prospectus Supplement and the accompanying Shelf Prospectus

is not an offer to sell or a solicitation of an offer to buy the Offered Shares in any jurisdiction where it is unlawful.

If the information varies

between this Prospectus Supplement and the accompanying Shelf Prospectus, the information in this Prospectus Supplement supersedes the

information in the accompanying Shelf Prospectus.

Interpretation

Unless otherwise noted or

the context otherwise requires, the “Company”, “Greenbrook”, “we”, “us” or “our”

refer to Greenbrook TMS Inc. together with its subsidiaries.

Where the context requires,

all references in this Prospectus Supplement to the “Offering” include the Over-Allotment Option and all references in this

Prospectus Supplement to “Offered Shares” include the Over-Allotment Shares that may be issued pursuant to the Over-Allotment

Option.

All Share numbers in this

Prospectus Supplement and the accompanying Shelf Prospectus have been adjusted to give effect to the consolidation of all of the Company’s

issued and outstanding Shares effected on February 1, 2021 on the basis of one post-consolidation Share for every five pre-consolidation

Shares (the “Share Consolidation”).

Presentation of Financial Information

The financial statements of

the Company incorporated by reference in this Prospectus Supplement and the accompanying Shelf Prospectus are presented in United States

dollars and have been prepared in accordance with IFRS.

Certain calculations

included in tables and other figures in this Prospectus Supplement and the accompanying Shelf Prospectus have been rounded for clarity

of presentation.

EXCHANGE

RATE INFORMATION

All references to “C$”

or “Canadian dollars” included or incorporated by reference into this Prospectus Supplement and the accompanying Shelf Prospectus

refer to Canadian dollar values. All references to “US$” or “United States dollars” are used to indicate United

States dollar values.

The following table sets forth,

for each of the periods indicated, the high, low, average and period end spot rates of exchange for one United States dollar, expressed

in Canadian dollars, published by the Bank of Canada.

|

|

|

Year ended December 31,

|

|

|

Six months ended June 30,

|

|

|

|

|

|

|

|

|

|

|

2021

(C$)

|

|

|

2020(C$)

|

|

|

High

|

|

|

1.4496

|

|

|

|

1.3600

|

|

|

|

1.2828

|

|

|

|

1.4496

|

|

|

Low

|

|

|

1.2718

|

|

|

|

1.2988

|

|

|

|

1.2040

|

|

|

|

1.2970

|

|

|

Average

|

|

|

1.3415

|

|

|

|

1.3269

|

|

|

|

1.2470

|

|

|

|

1.3651

|

|

|

Period End

|

|

|

1.2732

|

|

|

|

1.2988

|

|

|

|

1.2394

|

|

|

|

1.3628

|

|

On September 21, 2021, the

rate of exchange posted by the Bank of Canada for conversion of United States dollars into Canadian dollars was US$1.00 = C$1.2801. The Company

makes no representation that Canadian dollars could be converted into United States dollars at that rate or any other rate.

FORWARD-LOOKING

STATEMENTS

Certain statements contained

in this Prospectus Supplement, the Shelf Prospectus and the documents incorporated by reference herein and therein constitute forward-looking

statements within the meaning of applicable securities laws in Canada and the United States, including the United States Private Securities

Litigation Reform Act of 1995. Forward-looking information may relate to the Company’s future financial outlook and anticipated

events or results and may include information regarding the Company’s business, financial position, results of operations, business

strategy, growth plans and strategies, technological development and implementation, budgets, operations, financial results, taxes, dividend

policy, plans and objectives. Particularly, information regarding the Acquisition and the Company’s expectations of future results,

performance, achievements, prospects or opportunities or the markets in which it operates is forward-looking information. In some cases,

forward-looking information can be identified by the use of forward-looking terminology such as “plans”, “targets”,

“expects” or “does not expect”, “is expected”, “an opportunity exists”, “budget”,

“scheduled”, “estimates”, “outlook”, “forecasts”, “projection”, “prospects”,

“strategy”, “intends”, “anticipates”, “does not anticipate”, “believes”, or

variations of such words and phrases or state that certain actions, events or results “may”, “should”, “could”,

“would”, “might”, “will”, “will be taken”, “occur” or “be achieved”.

In addition, any statements that refer to expectations, intentions, projections or other characterizations of future events or circumstances

contain forward-looking information. Statements containing forward-looking information are not facts but instead represent management’s

expectations, estimates and projections regarding future events or circumstances.

Forward-looking information

in this Prospectus Supplement, the Shelf Prospectus and the documents incorporated by reference herein and therein includes, among other

things, statements relating to: the timing and closing of the Offering; information relating to the Acquisition, including

the anticipated timing of completion of the Acquisition and the potential benefits and synergies to be derived therefrom, as more particularly

described in “Recent Developments” and “Use of Proceeds”; the intended use by the Company of the net proceeds

of the Offering as described under “Use of Proceeds”; the listing on the TSX of the Offered Shares; the Company’s expectations

regarding its revenue, expenses, cash flow and operations; changes in laws and regulations affecting the Company and the regulatory environments

in which it operates; the Company’s expectations regarding the potential market opportunity for the delivery of TMS therapy; the

Company’s expectations regarding its growth rates and growth plans and strategies, including expectations regarding future growth

of the TMS market; potential expansion of additional therapeutic indications approved for TMS therapy by the United States Food and Drug

Administration (“FDA”); the Company’s business plans and strategies; the Company’s expectations regarding

the implementation and expansion of the Spravato® pilot program; changes in reimbursement rates by insurance payors; the Company’s

expectations regarding the outcome of litigation and payment obligations in respect of prior settlements; the Company’s ability

to attract and retain medical practitioners and qualified technicians at the Company’s network of outpatient mental health service

centers that specialize in TMS treatment (each, a “TMS Center”); the Company’s competitive position in its industry

and its expectations regarding competition; anticipated trends and challenges in the Company’s business and the markets in which

it operates; access to capital and the terms relating thereto; technological changes in the Company’s industry; the Company’s

expectations regarding geographic expansions; the Company’s expectations regarding new TMS Center openings and the timing thereof;

the Company’s expectations regarding mergers and acquisitions; successful execution of internal plans; anticipated costs of capital

investments; the Company’s intentions with respect to the implementation of new accounting standards; and the impact of the novel

coronavirus, COVID-19 (“COVID-19”), pandemic on the Company.

This forward-looking information

and other forward-looking information are based on the Company’s opinions, estimates and assumptions in light of its experience

and perception of historical trends, current conditions and expected future developments, as well as other factors that the Company currently

believes are appropriate and reasonable in the circumstances. Despite a careful process to prepare and review the forward-looking information,

there can be no assurance that the underlying opinions, estimates and assumptions will prove to be correct.

The forward-looking information in this Prospectus Supplement, the

Shelf Prospectus and the documents incorporated by reference herein and therein is necessarily based on a number of opinions, estimates

and assumptions that the Company considered appropriate and reasonable as of the date such statements were made. It is also subject to

known and unknown risks, uncertainties, assumptions and other factors that may cause the actual results, level of activity, performance

or achievements to be materially different from those expressed or implied by such forward-looking information, including the following

risk factors: successful execution of the Company’s growth strategies; inability to attract key managerial and other non-medical

personnel; risks related to changes in reimbursement rates by commercial insurance plans, Medicare and other non-Medicare government insurance

plans; imposition of additional requirements related to the provision of TMS therapy by commercial insurance plans, Medicare and other

non-Medicare government insurance plans that increase the cost or complexity of furnishing TMS therapy; reduction in reimbursement rates

by higher-paying commercial insurance providers; dependency on referrals from physicians and failure to attract new patients; failure

to recruit and retain sufficient qualified psychiatrists; ability to obtain TMS devices from the Company’s suppliers on a timely

basis at competitive costs could suffer as a result of deterioration or changes in supplier relationships or events that adversely affect

the Company’s suppliers or cause disruption to their businesses; failure to reduce operating expenses and labor costs in a timely

manner; inability to achieve or sustain profitability in the future or an inability to secure additional financing to fund losses; risks

related to the use of partnerships and other management services frameworks; risks associated with leasing space and equipment for the

Company’s TMS Centers; inability to successfully open and operate new TMS Centers profitably or at all; risks associated with geographic

expansion in regions which may have lower awareness of the Company’s brand or TMS therapy in general; claims made by or against

the Company, which may result in litigation; risks associated with professional malpractice liability claims; reduction in demand for

the Company’s services as a result of new drug development and/or technological changes within the Company’s industry; impact

of uncertainty related to potential changes to U.S. healthcare laws and regulations; risks associated with anti-kickback, fraud and abuse

laws; risks associated with compliance with laws relating to the practice of medicine; the constantly evolving nature of the regulatory

framework in which the Company operates; costs associated with compliance with U.S. federal and state laws and regulations and risks associated

with failure to comply; assessments for additional taxes, which could affect the Company’s operating results; inability to manage

the Company’s operations at its current size; the Company’s competitive industry and the size and resources of some of its

competitors; the labor-intensive nature of the Company’s business being adversely affected if it is unable to maintain satisfactory

relations with its employees or the occurrence of union attempts to organize its employees; insurance-related risks; complications associated

with the Company’s billing and collections systems; material disruptions in or security breaches affecting the Company’s information

technology systems; natural disasters and unusual weather; disruptions to the operations at the Company’s head office locations;

upgrade or replacement of core information technology systems; changes in accounting standards and subjective assumptions, estimates and

judgments by management related to complex accounting matters; inability to maintain effective controls over financial reporting; the

possible failure to complete the Acquisition; risks related to the integration of Achieve TMS East/Central (as defined herein) into the

Company’s business; the possible failure to realize expected returns on the Acquisition; risks related to the assumption of liabilities

from the Acquisition; risks associated with dilution of equity ownership; volatility in the market price for the Shares; prolonged decline

in the price of the Shares reducing the Company’s ability to raise capital; significant influence of Greybrook Health; increases

to indebtedness levels causing a reduction in financial flexibility; future sales of the Company’s securities by existing shareholders

causing the market price for Shares to decline; impact of future offerings of debt securities on dividend and liquidation distributions;

no cash dividends for the foreseeable future; an active, liquid and orderly trading market for Shares failing to develop; different shareholder

protections in Canada as compared to the United States and elsewhere; treatment of the Company as a U.S. domestic corporation for U.S.

federal income tax purposes; the Company’s ability to continue as a going concern due to recurring losses from operations; any issuance

of preferred shares may hinder another person’s ability to acquire the Company; the Company’s trading price and volume could

decline if analysts do not publish research or publish inaccurate or unfavorable research about the Company or its business; increases

to costs as a result of operating as a U.S. public company; the Company’s potential to incur significant additional costs if it

were to lose its “foreign private issuer” status in the future; the COVID-19 pandemic having a material adverse impact on

the future results of the Company; and risks related to forward-looking information contained in this Prospectus Supplement, the Shelf

Prospectus and the documents incorporated by reference herein and therein.

If any of these risks or uncertainties

materialize, or if the opinions, estimates or assumptions underlying the forward-looking information prove incorrect, actual results or

future events might vary materially from those anticipated in the forward-looking information. The opinions, estimates or assumptions

referred to above should be considered carefully by readers. Additional information about these assumptions, risks and uncertainties is

contained in this Prospectus Supplement and the accompanying Shelf Prospectus under the heading “Risk Factors” and in the

Company’s filings with securities regulators, including the Annual Information Form, the Annual MD&A and the Interim MD&A

(each as defined below).

Various assumptions or factors

are typically applied in drawing conclusions or making the forecasts or projections set out in forward-looking information. Those assumptions

and factors are based on information currently available to the Company, including information obtained from third party industry analysts

and other third party sources. In some instances, material assumptions and factors are presented or discussed elsewhere in this Prospectus

Supplement, the Shelf Prospectus or the documents incorporated by reference herein or therein in connection with the statements or disclosure

containing the forward-looking information. Readers are cautioned that the following list of material factors and assumptions is not exhaustive.

The factors and assumptions include, but are not limited to: no unforeseen changes in the legislative and operating framework for the

Company’s business; no unforeseen changes in the prices for the Company’s services in markets where prices are regulated;

no unforeseen changes in the reimbursement rates of commercial, Medicare and other non-Medicare government insurance plans; no unforeseen

changes in the regulatory environment for the Company’s services; a stable competitive environment; and no significant event occurring

outside the ordinary course of business.

Although the Company has attempted

to identify important risk factors that could cause actual results or future events to differ materially from those contained in forward-looking

information, there may be other risk factors not presently known to the Company or that the Company presently believes are not material

that could also cause actual results or future events to differ materially from those expressed in such forward-looking information. There

can be no assurance that such information will prove to be accurate. Accordingly, readers should not place undue reliance on forward-looking

information, which speaks only to opinions, estimates and assumptions as of the date made. The forward-looking information contained in

this Prospectus Supplement, the Shelf Prospectus and the documents incorporated by reference herein and therein represents the Company’s

expectations as of the date of this Prospectus Supplement (or as of the date they are otherwise stated to be made) and are subject to

change after such date. The Company disclaims any intention or obligation or undertaking to update or revise any forward-looking information

whether as a result of new information, future events or otherwise, except as required under applicable securities laws.

All of the forward-looking

information contained in this Prospectus Supplement, the Shelf Prospectus or the documents incorporated by reference herein or therein

is expressly qualified by the foregoing cautionary statements.

DOCUMENTS

INCORPORATED BY REFERENCE

This Prospectus Supplement

is incorporated by reference into the Shelf Prospectus solely for the purposes of the Offering. Other documents are also incorporated,

or deemed to be incorporated, by reference into the Shelf Prospectus and reference should be made to the Shelf Prospectus for full particulars

thereof.

Information has been incorporated

by reference in this Prospectus Supplement from documents filed with the securities commissions or similar regulatory authorities in each

of the provinces and territories of Canada and which have been filed with the SEC in the United States as exhibits to the Registration

Statement. Copies of these documents may be obtained on request without charge from the General Counsel of Greenbrook at 890 Yonge

Street, 7th Floor, Toronto, Ontario, Canada M4W 3P4, by telephone at (416) 915-9100 or by accessing these documents through the Internet

on the Company’s website at www.greenbrooktms.com, on SEDAR at www.sedar.com or on EDGAR at www.sec.gov.

Except to the extent that

their contents are modified or superseded by a statement contained in this Prospectus Supplement or in any other subsequently filed document

that is also incorporated by reference in this Prospectus Supplement, the following documents of the Company filed with the securities

commissions or similar regulatory authorities in each of the provinces and territories of Canada and which have been filed with the SEC

in the United States as exhibits to the Registration Statement are specifically incorporated by reference into, and form an integral part

of, this Prospectus Supplement:

|

|

(k)

|

the template version of the term sheet for

the Offering dated September 21, 2021 (the “Marketing Materials”).

|

Documents referenced in any

of the documents incorporated by reference in this Prospectus Supplement or the accompanying Shelf Prospectus but not expressly incorporated

by reference therein or herein and not otherwise required to be incorporated by reference therein or in the Prospectus Supplement or the

accompanying Shelf Prospectus are not incorporated by reference in this Prospectus Supplement. Any documents of the type described in

Section 11.1 of Form 44-101F1 — Short Form Prospectus Distributions filed by the Company with the various securities commissions

or similar authorities in each of the provinces and territories of Canada pursuant to the requirements of applicable securities legislation

after the date of this Prospectus Supplement and prior to the termination of the distribution of the Offered Shares under this Prospectus

Supplement are deemed to be incorporated by reference into this Prospectus Supplement. All such documents shall be filed as exhibits to

the Registration Statement or otherwise submitted on Form 6-K or an annual report filed by the Company with the SEC and shall be deemed

to be incorporated by reference into the Registration Statement if and to the extent, in the case of any Form 6-K, expressly provided

in such document. The documents incorporated or deemed to be incorporated herein by reference contain meaningful and material information

relating to the Company and readers should review all information contained in this Prospectus Supplement, the Shelf Prospectus and the

documents incorporated or deemed to be incorporated by reference herein and therein.

Any statement

contained in this Prospectus Supplement, the Shelf Prospectus or in a document incorporated or deemed to be incorporated by

reference herein or therein will be deemed to be modified or superseded for the purposes of this Prospectus Supplement to the extent

that a statement contained herein, or in any other subsequently filed document which also is or is deemed to be incorporated by

reference herein, modifies or supersedes that prior statement. The modifying or superseding statement need not state that it has

modified or superseded a prior statement or include any other information set out in the document or statement that it modifies or

supersedes. Any statement so modified or superseded will not be deemed, except as so modified or superseded, to constitute a part of

this Prospectus Supplement. The making of a modifying or superseding statement will not be deemed an admission for any purposes that

the modified or superseded statement, when made, constituted a misrepresentation, an untrue statement of a material fact or an

omission to state a material fact that is required to be stated or that is necessary to make a statement not misleading in light of

the circumstances in which it was made.

ENFORCEABILITY

OF CIVIL LIABILITIES IN THE UNITED STATES

The Company is a corporation

incorporated under and governed by the Business Corporations Act (Ontario) (“OBCA”). Some of the Company’s

directors and officers and some of the experts named in this Prospectus Supplement reside principally in Canada, and some of the Company’s

assets and all or a substantial portion of the assets of these persons is located outside the United States. In addition, some of the

Underwriters are not resident in the United States. The Company has appointed an agent for service of process in the United States, but

it may be difficult for investors who reside in the United States to effect service of process upon these persons in the United States,

or to enforce a U.S. court judgment predicated upon the civil liability provisions of the U.S. federal securities laws against the Company

or any of these persons. There is substantial doubt whether an action could be brought in Canada in the first instance predicated solely

upon U.S. federal securities laws.

The Company has filed with

the SEC, in connection with the Registration Statement, an appointment of agent for service of process on Form F-X. Under the Form F-X,

the Company appointed TMS NeuroHealth Centers Inc. as its agent for service of process in the United States in connection with any investigation

or administrative proceeding conducted by the SEC and any civil suit or action brought against or involving the Company in a United States

court arising out of or related to or concerning the offering of Offered Shares under this Prospectus Supplement.

MARKETING

MATERIALS

The Marketing Materials are

not part of this Prospectus Supplement or the accompanying Shelf Prospectus to the extent that the contents of the Marketing Materials

have been modified or superseded by a statement contained in this Prospectus Supplement or any amendment. Any “template version”

of “marketing materials” (each as defined in National Instrument 41-101 – General Prospectus Requirements) filed

with the securities commission or similar authority in each of the provinces and territories of Canada in connection with the Offering

after the date hereof but prior to the termination of the distribution of the Offered Shares under this Prospectus Supplement (including

any amendments to, or an amended version of, any marketing materials) is deemed to be incorporated by reference herein. However, such

“template version” of “marketing materials” will not form a part of this Prospectus Supplement to the extent that

the contents of the marketing materials or the template version of the marketing materials, as applicable, have been modified or superseded

by a statement contained in this Prospectus Supplement.

ELIGIBILITY

FOR INVESTMENT

In the opinion of Torys LLP,

counsel to the Company, and Dentons Canada LLP, Canadian counsel to the Underwriters, based on the current provisions of the Income

Tax Act (Canada) and the regulations thereunder (together, the “Tax Act”), the Offered Shares, if issued on the

date hereof, would be, on such date, “qualified investments” under the Tax Act for trusts governed by registered retirement

savings plans (“RRSPs”), registered retirement income funds (“RRIFs”), registered education savings

plans (“RESPs”), deferred profit sharing plans, registered disability savings plans (“RDSPs”) and

tax-free savings accounts (“TFSAs”), provided that the Offered Shares are listed on a “designated stock exchange”

(as defined in the Tax Act), which currently includes the TSX and NASDAQ.

Notwithstanding that the

Offered Shares may be qualified investments for a trust governed by a TFSA, RDSP, RRSP, RRIF or RESP (each, a

“Plan”), a holder of a TFSA or RDSP, an annuitant under an RRSP or RRIF or a subscriber of an RESP (each, a

“Plan Holder”) will be subject to a penalty tax if the Offered Shares are a “prohibited investment”

(as defined in subsection 207.01(1) of the Tax Act) for a Plan. The Offered Shares will generally not be a prohibited investment for

a Plan provided that the Plan Holder deals at arm’s length with the Company for purposes of the Tax Act and does not have a

“significant interest” (within the meaning of subsection 207.01(4) of the Tax Act) in the Company. In addition, the

Offered Shares will not be a “prohibited investment” for a Plan if the Offered Shares are “excluded

property” (as defined in subsection 207.01(1) of the Tax Act) for such Plan. Prospective purchasers who intend to hold the

Offered Shares in a Plan should consult their own tax advisors regarding the application of the foregoing prohibited investment

rules in their particular circumstances.

WHERE

YOU CAN FIND MORE INFORMATION

The Company has filed a Registration

Statement with the SEC with respect to the Offered Shares offered pursuant to this Prospectus Supplement. This Prospectus Supplement,

which constitutes a part of the Registration Statement, does not contain all of the information required to be contained in the Registration

Statement, certain items of which are contained in the exhibits to the Registration Statement as permitted by the rules and regulations

of the SEC.

The Company files certain

reports with certain securities regulatory authorities of Canada and the SEC pursuant to the United States Securities Exchange Act of

1934, as amended (the “U.S. Exchange Act”). Under the MJDS, such reports and other information may be prepared in accordance

with the disclosure requirements of the securities regulatory authorities of Canada, which requirements are different from those of the

United States. As a foreign private issuer, the Company is also exempt from the rules under the U.S. Exchange Act prescribing the furnishing

and content of proxy statements, and the Company’s officers and directors are exempt from the reporting and short swing profit liability

provisions contained in Section 16 of the U.S. Exchange Act. The Company’s reports and other information filed or furnished with

or to the SEC are available from EDGAR at www.sec.gov, as well as from commercial document retrieval services, and on the Company’s

website at www.greenbrooktms.com. The Company’s Canadian filings are available on SEDAR at www.sedar.com and on the

Company’s website at www.greenbrooktms.com.

THE

COMPANY

Operating through 132

Company-operated treatment centers (149 upon completion of the Acquisition), Greenbrook is a leading provider of TMS therapy,

an FDA-cleared, non-invasive therapy for the treatment of MDD and other mental health disorders, in the United States. TMS therapy provides

local electromagnetic stimulation to specific brain regions known to be directly associated with mood regulation. Greenbrook has provided

more than 675,000 TMS treatments to over 19,000 patients struggling with depression.

The principal, head and registered

office of the Company is located at 890 Yonge Street, 7th Floor, Toronto, Ontario, Canada M4W 3P4. The Company’s United States corporate

headquarters is located at 8401 Greensboro Drive, Suite 425, Tysons Corner, Virginia, United States, 22102.

Further information regarding

the Company and its business is set out in the Annual Information Form, which is incorporated herein by reference.

RECENT

DEVELOPMENTS

Acquisition of Achieve

TMS East/Central

On

September 21, 2021, the Company entered into a purchase agreement (the “Purchase Agreement”) pursuant to which

the Company, through its wholly-owned subsidiary TMS NeuroHealth Centers Inc., will indirectly acquire all of the issued and outstanding

equity interests in Achieve TMS East, LLC (“Achieve TMS East”) and Achieve TMS Central, LLC (“Achieve TMS

Central”, and together with Achieve TMS East, “Achieve TMS East/Central”) for an aggregate initial

cash purchase price of US$8.0 million, net of Achieve TMS East/Central’s cash and debt and subject to customary working capital

adjustments (the “Acquisition”). In addition, a portion of the total purchase price payable in respect of the Acquisition

is subject to a capped earn-out of up to an additional US$2.5 million based on the financial performance of Achieve TMS East during the

twelve-month period following completion of the Acquisition.

Achieve TMS East was founded

in 2016, with a vision of increasing accessibility to TMS therapy in the New England area. Since founding its first TMS Center in Northampton,

Massachusetts, Achieve TMS East has grown to 14 locations in the States of Massachusetts and Connecticut. In 2019, Achieve TMS East’s

management team expanded its operations in the Midwest United States through the establishment of Achieve TMS Central which currently

operates 3 TMS Centers in the State of Iowa. The Acquisition is expected to enhance Greenbrook’s position as a leading provider

of TMS therapy in the United States and, following completion of the Acquisition, will add an additional 17 TMS Centers to the Company’s

existing service delivery platform, for a total of 149 TMS Centers.

Key highlights in respect

of the Acquisition include:

|

|

·

|

A Profitable Platform with Additional Capacity and Strategic Expansion Opportunities

|

o

Opportunity to increase capacity at Achieve TMS East’s existing TMS Centers and to utilize the 14 locations in Massachusetts

and Connecticut as a springboard for expansion throughout New England.

o

Opportunity to expand Achieve TMS Central operations into the State of South Dakota as well as in other states that are proximate

to Greenbrook’s current operations in Missouri and Illinois.

|

|

·

|

Well-Established Payor Contracting

|

o

Achieve TMS East/Central’s affiliated medical practices benefit from strong reimbursement from key commercial payors.

o

The Acquisition removes the need to establish new contractual relationships with payors, eliminating a process which is a key barrier

to expansion.

|

|

·

|

Access to Robust Physician Networks

|

o

Provides Greenbrook with a strong physician network in the States of Massachusetts, Connecticut and Iowa.

|

|

·

|

Provides Proven Regional Management Team and Potential Synergies

|

o

Achieve TMS East/Central has an experienced regional management and operations team and robust infrastructure.

o

Anticipated post-Acquisition synergies with Greenbrook’s established shared services function.

The

Acquisition is expected to close in the fourth quarter of 2021, subject to customary closing conditions. The Company intends

to satisfy the initial cash purchase price in respect of the Acquisition through a portion of the net proceeds of the Offering. See “Use

of Proceeds” and “Risk Factors”.

Completion of Private

Placement

On June 14, 2021, the Company

completed a non-brokered private placement (the “Private Placement”) of Shares in reliance upon Rule 506(c) under the

U.S. Securities Act. Pursuant to the Private Placement, an aggregate of 2,353,347 Shares were issued at a price of US$10.00 per Share,

for aggregate gross proceeds to the Company of approximately US$23.5 million. The financing was led by new investor Masters Special Situations,

LLC and affiliates thereof (“MSS”). Additional new investors, including BioStar Capital, Steward Capital Holdings,

LP and Avenaero Holdings, LLC, also participated in the financing, along with existing investors, Greybrook Health and 1315 Capital II,

L.P. (“1315 Capital”). The Company intends to use the net proceeds from the Private Placement to develop new TMS Centers

as well as for working capital and general corporate purposes.

In connection with the

Private Placement, MSS, Greybrook Health and 1315 Capital (collectively, the “Investors”) each received the right

to appoint a nominee to the board of directors of the Company (the “Board”) as well as rights to participate in

future equity issuances by the Company to maintain such investors’ pro rata ownership interest in the Company. In

addition, each of the subscribers in the Private Placement received customary resale, demand and “piggy-back”

registration rights. Immediately following the completion of the Private Placement, the Investors, collectively, held an aggregate

of 7,752,215 Shares, representing approximately 48.2% of the voting control of the Company.

On July 27, 2021, the Company

filed a prospectus supplement in each of the provinces and territories of Canada (except Québec) and with the SEC under the Registration

Statement registering the periodic resale, from time to time, of up to an aggregate of 2,353,347 Shares that the subscribers purchased

in the Private Placement (the “Resale Prospectus”). The participation of each subscriber in the filing of the Resale

Prospectus is not an indication of such subscriber’s intention to sell the Shares at any particular time or in any particular amount.

See “Risk Factors” in this Prospectus Supplement.

On August 3, 2021, the Company

appointed Robert Higgins to the Board following the exercise by MSS of its board nomination right granted in connection with the Private

Placement. Adele C. Oliva and Sasha Cucuz, current members of the Board, represent 1315 Capital’s and Greybrook Health’s board

nominees, respectively.

TMS Center Expansion Opportunities

In addition to the Acquisition, the Company is in various stages of

negotiations and due diligence in respect of other potential TMS Center expansion opportunities. There can be no assurance that these

negotiations will result in TMS Center expansion for the Company or, if they do, what the final terms or timing of such opportunities

would be. The Company expects to continue current negotiations and discussions and actively pursue other TMS Center expansion opportunities,

including through in-region growth and development, development of new regions and merger and acquisition opportunities.

CONSOLIDATED

CAPITALIZATION

The table below sets forth our capitalization as of June 30, 2021 (1)

on an actual basis and (2) as adjusted to give effect to the Offering (assuming no exercise of the Over-Allotment Option) and the expected

use of proceeds of the Offering as discussed under “Use of Proceeds”. You should read this table in conjunction with our Interim

Financial Statements which is incorporated by reference herein.

|

|

|

As of June 30, 2021

|

|

|

|

|

(Unaudited)

|

|

|

(US$)

|

|

(Actual)

|

|

|

(As adjusted)

|

|

|

Cash

|

|

$

|

18,980,884

|

|

|

$

|

27,701,384

|

(3)

|

|

|

|

|

|

|

|

|

|

|

|

Long-term portion of:

|

|

|

|

|

|

|

|

|

|

Loans payable

|

|

$

|

14,308,819

|

|

|

$

|

14,308,819

|

|

|

Deferred grant income(1)

|

|

|

108,681

|

|

|

|

108,681

|

|

|

Lease liabilities(2)

|

|

|

22,718,300

|

|

|

|

22,718,300

|

|

|

Total long-term debt

|

|

$

|

37,135,800

|

|

|

$

|

37,135,800

|

|

|

|

|

|

|

|

|

|

|

|

|

Equity

|

|

|

|

|

|

|

|

|

|

Shares

|

|

$

|

86,557,612

|

|

|

$

|

95,278,112

|

|

|

Contributed surplus

|

|

|

3,734,173

|

|

|

|

3,734,173

|

|

|

Deficit

|

|

|

(74,604,355

|

)

|

|

|

(74,604,355

|

)

|

|

Non-controlling interest

|

|

|

(1,072,836

|

)

|

|

|

(1,072,836

|

)

|

|

Total equity

|

|

$

|

14,614,594

|

|

|

$

|

23,335,094

|

|

|

|

|

|

|

|

|

|

|

|

|

Total capitalization (long-term debt and equity)

|

|

$

|

51,750,394

|

|

|

$

|

60,470,894

|

|

Notes:

|

|

(1)

|

The deferred grant income arises from the difference between the fair value of the Company’s unsecured

loan in the amount of US$3,080,760 made under the United States Paycheck Protection Program at inception and the loan proceeds received

therefrom in April 2020.

|

|

|

(2)

|

Under IFRS 16 – Leases, a lessee is required to recognize a right-of-use asset, representing

its right to use the underlying asset, and a lease liability, representing its obligation to make future lease payments for all leases

with a term of more than 12 months.

|

|

|

(3)

|

Net of estimated transaction related costs of approximately US$1,354,500 incurred in connection with the

Offering.

|

DESCRIPTION

OF SHARE CAPITAL

General

The following is a summary

of the rights, privileges, restrictions and conditions of or attaching to the Shares. The Company is authorized to issue an unlimited

number of Shares and an unlimited number of preferred shares, issuable in series. As at September 21, 2021, there were 16,094,135 Shares

and no preferred shares issued and outstanding.

Shares

Each Share entitles the holder

thereof to receive notice of any meetings of shareholders of the Company, to attend and to cast one vote at all such meetings. Holders

of Shares do not have cumulative voting rights with respect to the election of directors and, accordingly, holders of a majority of the

Shares entitled to vote in any election of directors may elect all directors standing for election. The holders of Shares are entitled

to receive if, as and when declared by the Board, dividends in such amounts as shall be determined by the Board in its discretion. The

holders of Shares have the right to receive the Company’s remaining property and assets after payment of debts and other liabilities

on a pro rata basis in the event of a liquidation, dissolution or winding-up, whether voluntary or involuntary. The Shares do not

carry any pre-emptive, subscription, redemption or conversion rights, nor do they contain any sinking or purchase fund provisions.

Further information relating

to the Shares is set out in the Annual Information Form, which is incorporated by reference herein.

PLAN

OF DISTRIBUTION

Pursuant to an underwriting

agreement dated September 22, 2021 between the Company and the Underwriters (the “Underwriting Agreement”), the Company

has agreed to sell and the Underwriters have severally agreed to purchase on the Closing Date, an aggregate of 1,300,000 Offered Shares

at a purchase price of US$7.75 per Offered Share, payable in cash to the Company by the Underwriters against delivery of the Offered

Shares for aggregate gross proceeds of US$10,075,000. The Underwriters will receive the Underwriters’ Fee of US$604,500 (or 6.0%

of the gross proceeds of the Offering), excluding any fees payable pursuant to the Over-Allotment Option. A portion of the proceeds of

the Offering may be settled in Canadian dollars.

In addition, the Company

has granted to the Underwriters the Over-Allotment Option, exercisable in whole or in part at any time for a period of 30 days from the

closing of the Offering to purchase up to 195,000 Over-Allotment Shares on the same terms as set forth above. The Underwriting Agreement

provides that the Company will pay the Underwriters the Underwriters’ Fee of US$0.465 per Over-Allotment Share with respect to

Over-Allotment Shares issued under the Over-Allotment Option. This Prospectus Supplement qualifies the grant of the Over-Allotment Option

and the issuance of Over-Allotment Shares on the exercise of the Over-Allotment Option. A purchaser who acquires Shares forming part

of the Underwriters’ over-allocation position acquires those Shares under this Prospectus Supplement, regardless of whether the

over-allocation position is ultimately filled through the exercise of the Over-Allotment Option or secondary market purchases. In the

event that the Over-Allotment Option is exercised in full, the aggregate Underwriters’ Fee shall be US$695,175.

The Offering is being made

concurrently in each of the provinces and territories of Canada (except Québec) and in the United States pursuant to the MJDS.

The Underwriters will offer the Offered Shares for sale in the United States and Canada either directly or through their respective broker-dealer

affiliates or agents registered in each jurisdiction. No securities will be sold in any jurisdiction except by a dealer appropriately

registered under the securities laws of that jurisdiction or pursuant to an exemption from the registered dealer requirements of the securities

laws of that jurisdiction. Subject to applicable law and the terms of the Underwriting Agreement, the Underwriters may offer the Offered

Shares outside the United States and Canada.

The Offering Price was

determined by negotiation between the Company and the Lead Underwriters, on behalf of the Underwriters. The Underwriters propose to

offer the Offered Shares initially at the Offering Price. After the Underwriters have made a reasonable effort to sell all of the

Offered Shares at the Offering Price, the Offering Price may be decreased and may be further changed from time to time to an amount

not greater than the Offering Price, and the compensation realized by the Underwriters will be decreased by the amount that the

aggregate price paid by purchasers to the Underwriters for the Offered Shares is less than the price paid by the Underwriters to the

Company.

The obligations of the Underwriters

under the Underwriting Agreement are several and may be terminated at their discretion pursuant to “regulatory out”, “material

adverse change out”, “disaster out” and “material breach out” provisions and upon the occurrence of certain

other stated events. The Underwriters are, however, severally obligated to take up and pay for all of the Offered Shares that they have

agreed to purchase if any of the Offered Shares are purchased under the Underwriting Agreement.

The TSX has conditionally

approved the listing of the Offered Shares. Listing is subject to the Company fulfilling all of the listing requirements of the TSX on

or before November 2, 2021.

In connection with the

Offering, each of MSS and 1315 Capital intends to exercise its Participation Right pursuant to the investor rights agreement among

the Company and the Investors dated June 14, 2021 (the “Investor Rights Agreement”), to purchase, directly or

indirectly, approximately 200,000 and 167,570 Offered Shares, respectively, at the Offering Price. Under the Investor Rights

Agreement, for so long as the applicable Investor (together with its affiliates) owns, controls or directs, directly or indirectly,

at least 5% of the outstanding Shares (on a partially-diluted basis), such Investor shall have the right, subject to certain

customary exceptions, to participate in any offering of equity or voting securities of the Company or securities convertible into or

exchangeable for equity or voting securities of the Company, or an option or other right to acquire any such securities to purchase

Shares (collectively, “Subject Securities”) on the same terms as the offering of the Subject Securities in order

to maintain such Investors’ percentage ownership interest in the Company prior to such offering (the “Participation

Right”).

The Company has engaged Clarus

Securities Inc. and Desjardins Securities Inc. to serve as independent financial advisors to advise the Company in connection with the

Offering.

Under the Underwriting Agreement,

the Company has agreed that it will not, without the prior written consent of the Lead Underwriters, on behalf of the Underwriters, such

consent not to be unreasonably withheld or delayed, issue, offer to sell or sell any Shares or other securities convertible into or exchangeable

for Shares for the period up to and including 90 days after the Closing Date; provided that such restriction shall not apply to

issuances of Shares upon exercise of the Company’s outstanding options or warrants or pursuant to certain other exceptions customary

for transactions similar to the Offering. In addition, each of the Company’s directors, executive officers and Greybrook Health

will agree, in a lock-up agreement to be executed on or prior to the Closing Date, that for a period of 90 days from the Closing Date,

without the consent of the Lead Underwriters, on behalf of the Underwriters, such consent not to be unreasonably withheld or delayed, that

they will not, directly or indirectly, offer, sell, transfer, pledge, assign, hypothecate or otherwise encumber, directly or indirectly,

any Shares or other securities convertible into or exchangeable for Shares for the period up to and including 90 days after the Closing

Date, except in respect of a bona fide take-over bid or any other similar transaction made generally to all of the shareholders

of the Company, provided that, in the event the change of control or other similar transaction is not completed, such securities shall

remain subject to such lock-up agreement, and except pursuant to certain other exceptions customary for transactions similar to the Offering.

Subscriptions

for the Offered Shares will be received subject to rejection or allotment in whole or in part and the right is reserved to close

the subscription books at any time without notice. The Offering will be conducted under the NCI system. Offered Shares registered in

the name of CDS or its nominee will be deposited electronically with CDS on an NCI basis at closing. A subscriber who purchases Offered

Shares will generally only receive a customer confirmation from the registered dealer from or through whom Offered Shares are purchased

and who is a CDS participant. Certificates evidencing the Offered Shares will not be issued unless a request for a certificate is made

to the Company.

In accordance with rules

and policy statements of certain Canadian securities regulators, the Underwriters may not, at any time during the period of

distribution, bid for or purchase Shares. The foregoing restriction is, however, subject to exceptions where the bid or purchase is

not made for the purpose of creating actual or apparent active trading in, or raising the price of, the Shares. These exceptions

include a bid or purchase permitted under the by-laws and rules of applicable regulatory authorities and the TSX, including the

Universal Market Integrity Rules for Canadian Marketplaces, relating to market stabilization and passive market making activities

and a bid or purchase made for and on behalf of a customer where the order was not solicited during the period of distribution. As a

result of these activities, the price of the Shares may be higher than the price that otherwise might exist in the open market. If

these activities are commenced, they may be discontinued by the Underwriters at any time.

USE

OF PROCEEDS

The estimated net proceeds

to the Company from the Offering, after deducting the Underwriters’ Fee and the expenses of the Offering (estimated to be US$750,000),

will be US$8,720,500 (or US$10,141,075 if the Over-Allotment Option is exercised in full). The Company intends to use the net proceeds

of the Offering as follows (assuming no exercise of the Over-Allotment Option):

|

Anticipated Use of Proceeds

|

|

|

Allocated Funds

|

|

|

The Acquisition:

|

|

US$

|

8,000,000

|

|

|

Working capital and general corporate purposes:

|

|

US$

|

720,500

|

|

|

Total:

|

|

US$

|

8,720,500

|

|

The Offering is not conditional

on the closing of the Acquisition. If the Acquisition does not take place as contemplated, the proceeds of the Offering will not be refunded

and the Company will use the proceeds that otherwise would have been used for the Acquisition for the development of new TMS Centers and

related working capital, potential future acquisitions, working capital and general corporate purposes. See “Risk Factors”

in this Prospectus Supplement.

To date, the Company has had

negative cash flow from operating activities. Although the Company believes it will have positive cash flow from operating activities

in the future, it may require additional financing in addition to the Offering to fund operating and investing activities. See “Risk

Factors” in the Shelf Prospectus and this Prospectus Supplement. While the New Credit Facility provides the Company with an option

of drawing up to an additional US$15 million in three US$5 million delayed-draw term loan tranches within the 24 months following closing

of the New Credit Facility, the ability to draw on such delayed-draw term loans is subject to the Company achieving specific financial

milestones. As of the date of this Prospectus Supplement, the Company does not currently meet these financial milestones and is, therefore,

unable to draw down on any of the delayed-draw term loan tranches under the New Credit Facility at this time.

The Company, as part of

its annual budgeting process, evaluates its estimated annual cash requirements to fund planned expansion activities and working

capital requirements of existing operations. Based on this cash budget and considering its anticipated cash flows from regional

operations, its holdings of cash, the New Credit Facility, the net proceeds from the Private Placement and, assuming the successful

completion of the Offering, the Company believes that it has sufficient capital to meet its future operating expenses, capital

expenditures and future debt service requirements for approximately the next 12 months. The Company’s cash balance and

working capital as at June 30, 2021 was approximately US$19.0 million and US$14.3 million, respectively.

In addition to the net

proceeds from the Offering, the Company had cash of approximately US$19.0 million as at June 30, 2021. The net proceeds of the

Offering will be spent on the Acquisition and expenditures incurred following closing of the Offering. Until applied, the net

proceeds of the Offering will be held as cash balances in the Company’s bank account or invested at the discretion of the

Chief Financial Officer.

If the Over-Allotment Option

is exercised in part or in full, the Company intends to use the additional net proceeds, after deducting the Underwriters’ Fee but

not the expenses of the Offering, of up to US$1,420,575, to fund operating activities and for other working capital and general corporate

purposes.

The Company intends to spend

the funds available as stated in this Prospectus Supplement. However, there may be circumstances where, for sound business reasons, a

reallocation of funds may be deemed prudent or necessary. See “Risk Factors” in this Prospectus Supplement.

PRIOR

SALES

The Company has not issued

any Shares, or securities convertible or exchangeable into Shares, during the 12-month period preceding the date of this Prospectus Supplement,

except as described below:

|

Date Issued

|

|

Type of Securities Issued

|

|

Number of Securities Issued

|

|

|

Issue/Exercise Price Per Share

|

|

|

Nature of Issuance

|

|

December 31, 2020

|

|

Warrants

|

|

|

51,307

|

|

|

|

C$11.20

|

|

|

Issuance of Lender Warrants

|

|

February 4, 2021

|

|

Shares

|

|

|

1,800

|

|

|

|

C$16.25

|

|

|

Exercise of Broker Warrants

|

|

February 17, 2021

|

|

Options

|

|

|

139,500

|

|

|

|

C$20.43

|

|

|

Stock Option Grant

|

|

March 26, 2021

|

|

Shares

|

|

|

231,011

|

|

|

|

C$16.70

|

|

|

Earn-Out Consideration(1)

|

|

April 27, 2021

|

|

Shares

|

|

|

500

|

|

|

|

US$7.50

|

|

|

Exercise of Stock Options

|

|

May 14, 2021

|

|

Options

|

|

|

5,000

|

|

|

|

US$10.70

|

|

|

Stock Option Grant

|

|

May 25, 2021

|

|

Shares

|

|

|

5,000

|

|

|

|

US$5.00

|

|

|

Exercise of Stock Options

|

|

June 14, 2021

|

|

Shares

|

|

|

2,353,347

|

|

|

|

US$10.00

|

|

|

Private Placement

|

|

August 5, 2021

|

|

Options

|

|

|

5,000

|

|

|

|

US$10.35

|

|

|

Stock Option Grant

|

Note:

|

|

(1)

|

A portion of the purchase price payable in respect of the acquisition of Achieve TMS Centers, LLC

and Achieve TMS Alaska, LLC (collectively, “Achieve TMS West”) is subject to an earn-out based on the earnings

before interest, tax, depreciation and amortization achieved by Achieve TMS West during the twelve-month period following September

26, 2019 (the “Earn-Out”). The Earn-Out was partially settled through the issuance of an aggregate of 231,011

Shares to the vendors on March 26, 2021.

|

TRADING

PRICE RANGE AND TRADING VOLUME OF THE SHARES

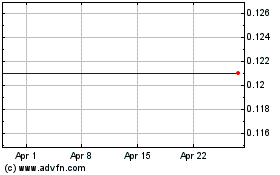

The Shares are listed for

trading on the TSX under the symbol “GTMS” and on NASDAQ under the symbol “GBNH”. The following tables show the

monthly range of high and low prices per Share at the close of market on the TSX and NASDAQ, as well as total monthly volumes of the Shares

traded on the TSX and NASDAQ for the periods indicated:

TSX(1)

|

|

|

High

(C$)

|

|

|

Low

(C$)

|

|

|

Volume

|

|

|

2020

|

|

|

|

|

|

|

|

|

|

|

|

|

|

September

|

|

|

7.80

|

|

|

|

6.60

|

|

|

|

125,557

|

|

|

October

|

|

|

8.25

|

|

|

|

6.50

|

|

|

|

112,452

|

|

|

November

|

|

|

7.80

|

|

|

|

6.65

|

|

|

|

351,154

|

|

|

December

|

|

|

13.85

|

|

|

|

7.00

|

|

|

|

279,064

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2021

|

|

|

|

|

|

|

|

|

|

|

|

|

|

January

|

|

|

20.45

|

|

|

|

11.15

|

|

|

|

330,406

|

|

|

February

|

|

|

22.40

|

|

|

|

17.50

|

|

|

|

519,725

|

|

|

March

|

|

|

19.80

|

|

|

|

14.24

|

|

|

|

446,792

|

|

|

April

|

|

|

17.58

|

|

|

|

13.00

|

|

|

|

101,864

|

|

|

May

|

|

|

14.69

|

|

|

|

11.80

|

|

|

|

117,680

|

|

|

June

|

|

|

16.63

|

|

|

|

11.70

|

|

|

|

149,677

|

|

|

July

|

|

|

16.49

|

|

|

|

13.80

|

|

|

|

82,806

|

|

|

August

|

|

|

14.67

|

|

|

|

12.58

|

|

|

|

74,774

|

|

|

September 1 – 21

|

|

|

13.39

|

|

|

|

10.62

|

|

|

|

96,903

|

|

Note:

|

|

(1)

|

The Shares commenced trading on the TSX on a post-Share Consolidation basis effective at the opening of

trading on February 4, 2021. The data presented in the table above is shown on a post-Share Consolidation basis for all periods.

|

NASDAQ(2)

|

|

|

High

(US$)

|

|

|

Low

(US$)

|

|

|

Volume

|

|

|

2021

|

|

|

|

|

|

|

|

|

|

|

|

|

|

March 16 – 31

|

|

|

16.00

|

|

|

|

11.55

|

|

|

|

32,680

|

|

|

April

|

|

|

14.00

|

|

|

|

10.79

|

|

|

|

25,965

|

|

|

May

|

|

|

12.01

|

|

|

|

9.23

|

|

|

|

55,331

|

|

|

June

|

|

|

13.89

|

|

|

|

9.55

|

|

|

|

171,350

|

|

|

July

|

|

|

13.01

|

|

|

|

11.09

|

|

|

|

83,050

|

|

|

August

|

|

|

12.00

|

|

|

|

10.12

|

|

|

|

86,719

|

|

|

September 1 – 21

|

|

|

11.13

|

|

|

|

8.26

|

|

|

|

60,202

|

|

Note:

|

|

(2)

|

The Shares commenced trading on NASDAQ on March 16, 2021.

|

CERTAIN

CANADIAN FEDERAL INCOME TAX CONSIDERATIONS

In the opinion of Torys LLP,

counsel to the Company, and Dentons Canada LLP, Canadian counsel to the Underwriters, the following is a general summary, as of the date

hereof, of the principal Canadian federal income tax considerations under the Tax Act generally applicable to a holder of the Offered

Shares who acquires such shares pursuant to the Offering, and who at all relevant times, for purposes of the Tax Act holds the Offered

Shares as capital property and deals at arm’s length with the Company and the Underwriters and is not affiliated with the Company

or the Underwriters (a “Holder”). Generally, the Offered Shares will be capital property to a Holder unless they are

held or acquired in the course of carrying on a business or as part of an adventure or concern in the nature of trade. Certain Holders

who are residents of Canada and who might not otherwise be considered to hold their Offered Shares as capital property may, in certain

circumstances, be entitled to have them and every other “Canadian security” (as defined in the Tax Act) owned by such Holder

be treated as capital property by making an irrevocable election in accordance with subsection 39(4) of the Tax Act. Holders considering

making such election should first consult their own tax advisors.

This summary is not applicable

to a Holder: (a) that is a “financial institution”, as defined in the Tax Act for purposes of the mark-to-market rules; (b)

an interest in which is a “tax shelter investment”, as defined in the Tax Act; (c) that is a “specified financial institution”,

as defined in the Tax Act; (d) that has made an election under the Tax Act to determine its Canadian tax results in a currency of a country

other than Canada; (e) that has entered or will enter into a “derivative forward agreement” under the Tax Act with respect

to the Offered Shares; (f) that receives dividends on the Offered Shares under or as part of a “dividend rental arrangement”,

as defined in the Tax Act; or (g) that is a corporation resident in Canada and is, or becomes, or does not deal at arm’s length

for purposes of the Tax Act with a corporation resident in Canada that is or becomes, as part of a transaction or event or series of

transactions or events that includes the acquisition of the Offered Shares, controlled by a non-resident person, or a group of non-resident

persons not dealing with each other at arm’s length, for purposes of the “foreign affiliate dumping” rules in section

212.3 of the Tax Act. Such Holders should consult their own tax advisors.

This summary is based on the

facts set out in this Prospectus Supplement, the current provisions of the Tax Act and the regulations thereunder, all specific proposals

to amend the Tax Act and the regulations thereunder publicly announced by or on behalf of the Minister of Finance (Canada) prior to the

date of hereof (“Tax Proposals”) and counsel’s understanding of the current published administrative policies

and assessing practices of the Canada Revenue Agency. No assurance can be made that the Tax Proposals will be enacted in the form proposed

or at all. This summary is not exhaustive of all possible Canadian federal income tax considerations and, other than the Tax Proposals,

does not take into account or anticipate any changes in law or in administrative policy or assessing practice, whether by legislative,

regulatory, administrative or judicial decision or action, nor does it take into account provincial, territorial or foreign income tax

legislation or considerations, which may differ significantly from the Canadian federal income tax considerations discussed herein.

This summary is of a general

nature only and is not exhaustive of all possible Canadian federal income tax considerations applicable to an investment in the Offered

Shares. The income and other tax consequences of acquiring, holding or disposing of the Offered Shares will vary depending on a Holder’s

particular status and circumstances, including the province or territory in which the Holder resides or carries on business. This summary

is not intended to be, nor should it construed to be, legal or tax advice to any particular Holder. Holders should consult their own tax

advisors with respect to an investment in the Offered Shares having regard to their particular circumstances.

Holders Resident in Canada

The following portion of this

summary applies to Holders who, at all relevant times, for purposes of the Tax Act and any applicable income tax treaty or convention,

are or are deemed to be resident in Canada (“Resident Holders”).

Dividends on the Offered Shares

In the case of a Resident

Holder who is an individual (other than certain trusts), dividends received or deemed to be received by such Resident Holder on the Offered

Shares will be included in computing the Resident Holder’s income and will be subject to the gross-up and dividend tax credit rules

that apply to “taxable dividends” received from “taxable Canadian corporations” (each as defined in the Tax Act).

Provided that appropriate designations are made by the Company, such dividends will be treated as an “eligible dividend” for

the purposes of the Tax Act and a Resident Holder who is an individual will be entitled to an enhanced dividend tax credit in respect

of such dividend. There may be limitations on the Company’s ability to designate dividends as eligible dividends.

Dividends received by a Resident

Holder who is an individual (other than certain trusts) may result in such Resident Holder being liable for alternative minimum tax under

the Tax Act. Such Resident Holders should consult their own tax advisors in this regard.

Dividends received or deemed

to be received on the Offered Shares by a Resident Holder that is a corporation will be required to be included in computing the corporation’s

income for the taxation year in which such dividends are received, but such dividends will generally be deductible in computing the corporation’s