First quarter net income from continuing

operations $20.5 million

Great Lakes Dredge & Dock Corporation (NASDAQ:GLDD), the

largest provider of dredging services in the United States, today

reported financial results for the quarter ended March 31, 2019.

First Quarter 2019 Highlights

- Revenue was $192.6 million in the first quarter, a $59.0

million or 44.2% increase over the prior year quarter.

- Gross margin percentage increased to 25.9% in the first quarter

from 10.6% in the prior year quarter.

- Total operating income from continuing operations was $34.8

million, a $33.5 million increase over the prior year quarter.

- Net income from continuing operations was $20.5 million, a

$27.6 million increase over the prior year quarter.

- Adjusted EBITDA from continuing operations was $43.8 million as

compared to $13.7 million in the prior year quarter.

- Net debt to adjusted EBITDA from continuing operations was

1.53x.

Management Commentary

Chief Executive Officer Lasse Petterson

commented, “The first quarter of 2019 was an exceptional quarter

driven by strong project performance, resulting in net income from

continuing operations of $20.5 million and an adjusted EBITDA from

continuing operations of $43.8 million. During the quarter, we saw

better than expected productivity on the Tampa Big Bend project

which was completed ahead of schedule in the quarter and the San

Jacinto project which we expect will be completed in the second

quarter. We also had a contract modification to increase the

scope of work on a project in Delaware that was not budgeted to

contribute in 2019. While the first quarter of 2019 was

operationally very strong, our planned dry docking of certain

vessels will start to have an impact on results starting in the

second quarter and continuing into the third quarter.

The Company’s performance over the previous few

quarters are the result of the dedication and hard work of our

employees as we adjusted the business and our operations for better

profitability. In addition to our restructuring plan completed in

2018, we have also made prudent improvements to our fleet and

enhanced our project planning, preparation and execution which have

resulted in better productivity of our vessels.

As expected, the first quarter bid market was

below the prior year with only $219 million awarded in the total

market, but bidding is projected to increase significantly in the

third and fourth quarters.”

Quarterly Results

- Revenue was $192.6 million, an increase of $59.0 million over

the first quarter of 2018. The first quarter of 2019 was

characterized by strong production and project performance.

Revenues in all markets increased quarter over quarter with the

exception of coastal protection projects.

- Gross margin percentage improved to 25.9% in the current

quarter from 10.6% in the first quarter of 2018 on strong project

performance combined with lower plant and overhead costs. Two dry

docks that were scheduled to begin in late first quarter were

deferred into the second quarter which also moved some plant

expense from first quarter to the second quarter of 2019.

- Operating income was $34.8 million which is a $33.5 million

increase over the prior year quarter. The increase is a result of

higher gross margin slightly offset by increased general and

administrative expenses due to incentive compensation.

- Net income from continuing operations for the quarter was $20.5

million compared to a net loss from continuing operations of $7.0

million in the prior year quarter. In addition to the increase in

operating income, interest expense in the first quarter of 2019

also decreased compared to the prior year quarter by $1.1 million

on lower revolver usage.

- At March 31, 2019, the Company had $123.0 million in cash and

total debt of $322.2 million, resulting in a net debt to adjusted

EBITDA from continuing operations of 1.53x.

- At March 31, 2019, the Company had $575.2 million in backlog, a

decrease of $131.9 million from December 31, 2018. This decrease

was expected as the Company earned significant revenue during the

first quarter of 2019 and bidding activity was low.

- Capital expenditures for the quarter were $7.7 million. This

compares to $6.9 million in capital expenditures during the first

quarter of 2018. The Company continues to expect total capital

expenditures to be $40 million for 2019.

Market UpdateAs expected, the

domestic dredging bid market was slow in the first quarter of 2019

with a total of $219 million in projects awarded, of which GLDD was

awarded $35.1 million. We continue to expect additional phases of

multiple large deepening and other capital projects to bid in the

second half of the year resulting in another strong domestic bid

market in 2019. The projects coming into the pipeline include

additional phases of work in Charleston, Savannah, Corpus Christi

and Mississippi as well as new projects in Virginia, Texas and

Louisiana. In addition to this anticipated capital work, we also

expect to bid on multiple projects funded by the $17.4 billion

supplemental hurricane funding. This supplemental federal funding

has been allocated to reduce the risk of future damage from flood

and storm events. Although we have not yet bid on any of these

projects, we do expect the projects to come into the market later

in the year.

In addition to the deepening and coastal

protection projects, several Liquefied Natural Gas petrochemical

and crude oil projects are creating the need for port development

in support of energy exports. We believe several of these private

client projects are progressing to bid in 2019. Great Lakes’

fleet and safety performance position the Company well to perform

in this growing segment of the market.

The Company will be holding a conference call

at 9:00 a.m. C.D.T. today where we will further discuss

these results. Information on this conference call can be found

below.

Conference Call Information

The Company will conduct a quarterly conference

call, which will be held on Tuesday, April 30, 2019 at 9:00 a.m.

C.D.T (10:00 a.m. E.D.T.). The call in number is (877) 377-7553 and

Conference ID is 1999758. The conference call will be available by

replay until Thursday, May 2, 2019 by calling (855)

859-2056 and providing Conference ID 1999758. The live call

and replay can also be heard on the Company’s website,

www.gldd.com, under Events & Presentations on the investor

relations page. Information related to the conference call will

also be available on the investor relations page of the Company’s

website.

Classification of Environmental and

Infrastructure Business

As of December 31, 2018, the Company concluded

that it intends to sell the Environmental and Infrastructure

(“E&I”) business during the first half of 2019. Based on this

decision, this business has been classified as an asset held for

sale and all results of this business have been reflected as

discontinued operations as of December 31, 2018. Consequently, the

financial results for continuing operations reported within this

earnings release do not include the E&I business.

Use of Non-GAAP measures

Adjusted EBITDA from continuing operations, as

provided herein, represents net income attributable to common

stockholders of Great Lakes Dredge & Dock Corporation, adjusted

for net interest expense, income taxes, depreciation and

amortization expense, debt extinguishment, accelerated maintenance

expense for new international deployments, goodwill or asset

impairments and gains on bargain purchase acquisitions. Adjusted

EBITDA from continuing operations is not a measure derived in

accordance with GAAP. The Company presents Adjusted EBITDA from

continuing operations as an additional measure by which to evaluate

the Company's operating trends. The Company believes that Adjusted

EBITDA from continuing operations is a measure frequently used to

evaluate performance of companies with substantial leverage and

that the Company's primary stakeholders (i.e., its stockholders,

bondholders and banks) use Adjusted EBITDA from continuing

operations to evaluate the Company's period to period performance.

Additionally, management believes that Adjusted EBITDA from

continuing operations provides a transparent measure of the

Company’s recurring operating performance and allows management and

investors to readily view operating trends, perform analytical

comparisons and identify strategies to improve operating

performance. For this reason, the Company uses a measure based upon

Adjusted EBITDA to assess performance for purposes of determining

compensation under the Company's incentive plan. Adjusted EBITDA

from continuing operations should not be considered an alternative

to, or more meaningful than, amounts determined in accordance with

GAAP including: (a) operating income as an indicator of operating

performance; or (b) cash flows from operations as a measure of

liquidity. As such, the Company's use of Adjusted EBITDA from

continuing operations, instead of a GAAP measure, has limitations

as an analytical tool, including the inability to determine

profitability or liquidity due to the exclusion of accelerated

maintenance expense for new international deployments, goodwill or

asset impairments, gains on bargain purchase acquisitions, interest

and income tax expense and the associated significant cash

requirements and the exclusion of depreciation and amortization,

which represent significant and unavoidable operating costs given

the level of indebtedness and capital expenditures needed to

maintain the Company's business. For these reasons, the Company

uses operating income to measure the Company's operating

performance and uses Adjusted EBITDA from continuing operations

only as a supplement. Adjusted EBITDA from continuing operations is

reconciled to net income (loss) attributable to common stockholders

of Great Lakes Dredge & Dock Corporation in the table of

financial results. For further explanation, please refer to the

Company's SEC filings.

The Company

Great Lakes Dredge & Dock Corporation

(“Great Lakes” or the “Company”) is the largest provider of

dredging services in the United States and the only U.S. dredging

company with significant international operations. The Company

employs experienced civil, ocean and mechanical engineering staff

in its estimating, production and project management

functions. In its over 129-year history, the Company has

never failed to complete a marine project. Great Lakes has a

disciplined training program for engineers that ensures

experienced-based performance as they advance through Company

operations. The Company’s Incident-and Injury-Free (IIF®) safety

management program is integrated into all aspects of the Company’s

culture. The Company’s commitment to the IIF® culture promotes a

work environment where employee safety is paramount. Great

Lakes also owns and operates the largest and most diverse fleet in

the U.S. dredging industry, comprised of over 200 specialized

vessels.

Cautionary Note Regarding

Forward-Looking Statements

Certain statements in this press release may constitute

"forward-looking" statements as defined in Section 21E of the

Securities Exchange Act of 1934 (the "Exchange Act"), the Private

Securities Litigation Reform Act of 1995 (the "PSLRA") or in

releases made by the Securities and Exchange Commission (the

"SEC"), all as may be amended from time to time. Such

forward-looking statements involve known and unknown risks,

uncertainties and other important factors that could cause the

actual results, performance or achievements of Great Lakes and its

subsidiaries, or industry results, to differ materially from any

future results, performance or achievements expressed or implied by

such forward-looking statements. Statements that are not historical

fact are forward-looking statements. Forward-looking statements can

be identified by, among other things, the use of forward-looking

language, such as the words "plan," "believe," "expect,"

"anticipate," "intend," "estimate," "project," "may," "would,"

"could," "should," "seeks," “are optimistic,” or "scheduled to," or

other similar words, or the negative of these terms or other

variations of these terms or comparable language, or by discussion

of strategy or intentions. These cautionary statements are being

made pursuant to the Exchange Act and the PSLRA with the intention

of obtaining the benefits of the "safe harbor" provisions of such

laws. Great Lakes cautions investors that any forward-looking

statements made by Great Lakes are not guarantees or indicative of

future performance. Important assumptions and other important

factors that could cause actual results to differ materially from

those forward-looking statements with respect to Great Lakes,

include, but are not limited to: our ability to obtain federal

government dredging and other contracts; uncertainties in federal

government budgeting; extended federal government shutdowns, which

may lead to funding issues, the incurrence of costs without payment

or reimbursement under our contracts, and delays or cancellations

of key projects; the risk that the President of the United States

may divert funds away from the Army Corps of Engineers in response

to a national emergency; our ability to qualify as an eligible

bidder under government contract criteria and to compete

successfully against other qualified bidders; risks associated with

cost over-runs, operating cost inflation and potential claims for

liquidated damages, particularly with respect to our fixed cost

contracts; the timing of our performance on contracts; significant

liabilities that could be imposed were we to fail to comply with

government contracting regulations; risks related to international

dredging operations, including instability and declining

relationships amongst certain governments in the Middle East and

the impact this may have on infrastructure investment, asset value

of such operations, and local licensing, permitting and royalty

issues; increased cost of certain material used in our operations

due to newly imposed tariffs; a significant negative change to

large, single customer contracts from which a significant portion

of our international revenue is derived; changes in

previous-recorded net revenue and profit as a result of the

significant estimates made in connection with our methods of

accounting for recognizing revenue; consequences of any lapse in

disclosure controls and procedures or internal control over

financial reporting; changes in the amount of our estimated

backlog; our ability to obtain bonding or letters of credit and

risks associated with draws by the surety on outstanding bonds or

calls by the beneficiary on outstanding letters of credit;

increasing costs to operate and maintain aging vessels; equipment

or mechanical failures; acquisition integration and consolidation

risks; liabilities related to our historical demolition business;

impacts of legal and regulatory proceedings; unforeseen delays and

cost overruns related to the construction of new vessels, including

potential mechanical and engineering issues; our becoming liable

for the obligations of joint ventures, partners and subcontractors;

capital and operational costs due to environmental regulations;

unionized labor force work stoppages; maintaining an adequate level

of insurance coverage; information technology security breaches;

our substantial amount of indebtedness; restrictions imposed by

financing covenants; the impact of adverse capital and credit

market conditions; limitations on our hedging strategy imposed by

new statutory and regulatory requirements for derivative

transactions; foreign exchange risks; changes in macroeconomic

indicators and the overall business climate; uncertainties of the

impact of the Tax Cuts and Jobs Act and implementation of certain

provisions of the Dodd-Frank Wall Street Reform and Consumer

Protection Act; losses attributable to our investments in privately

financed projects; our ability to realize the expected benefits

from our restructuring activities; our ability to find a suitable

acquiror and consummate the disposition of our E&I segment;

uncertain risks, costs and impacts to the Company in connection

with the disposition of our E&I segment; and the loss on

disposition of assets held for sale is subject to change prior to

completion of the disposition of our E&I segment and could

differ materially from the Company’s estimate. For additional

information on these and other risks and uncertainties, please see

Item 1A. "Risk Factors" of Great Lakes' Annual Report on Form 10-K

for the year ended December 31, 2018, and in other securities

filings by Great Lakes with the SEC.

Although Great Lakes believes that its plans,

intentions and expectations reflected in or suggested by such

forward-looking statements are reasonable, actual results could

differ materially from a projection or assumption in any

forward-looking statements. Great Lakes' future financial condition

and results of operations, as well as any forward-looking

statements, are subject to change and inherent risks and

uncertainties. The forward-looking statements contained in this

press release are made only as of the date hereof and Great Lakes

does not have or undertake any obligation to update or revise any

forward-looking statements whether as a result of new information,

subsequent events or otherwise, unless otherwise required by

law.

| |

|

| |

|

| Great Lakes Dredge & Dock

Corporation |

| Condensed Consolidated Statements of

Operations |

| (Unaudited and in thousands, except per share

amounts) |

|

|

|

|

|

|

|

|

|

| |

Three Months Ended |

|

| |

March 31, |

|

| |

|

2019 |

|

|

|

2018 |

|

| Contract revenues |

$ |

192,637 |

|

|

$ |

133,623 |

|

| Gross

profit |

|

49,877 |

|

|

|

14,130 |

|

| General and

administrative expenses |

|

14,825 |

|

|

|

13,093 |

|

| (Gain) loss on sale of

assets—net |

|

279 |

|

|

|

(199 |

) |

| Operating

income |

|

34,773 |

|

|

|

1,236 |

|

| Interest

expense—net |

|

(7,551 |

) |

|

|

(8,653 |

) |

| Other income

(expense) |

|

172 |

|

|

|

(2,065 |

) |

| Income

(loss) from continuing operations before income taxes |

|

27,394 |

|

|

|

(9,482 |

) |

| Income tax (provision)

benefit |

|

(6,846 |

) |

|

|

2,475 |

|

| Income

(loss) from continuing operations |

|

20,548 |

|

|

|

(7,007 |

) |

| Loss from

discontinued operations, net of income taxes |

|

(3,380 |

) |

|

|

(2,314 |

) |

| Net

income (loss) |

$ |

17,168 |

|

|

$ |

(9,321 |

) |

| |

|

|

|

|

|

|

|

| Basic earnings (loss) per share attributable to

continuing operations |

$ |

0.33 |

|

|

$ |

(0.11 |

) |

| Basic loss per share attributable to discontinued

operations, net of tax |

|

(0.05 |

) |

|

|

(0.04 |

) |

| Basic earnings (loss) per share |

$ |

0.28 |

|

|

$ |

(0.15 |

) |

| Basic

weighted average shares |

|

62,882 |

|

|

|

61,815 |

|

|

|

|

|

|

|

|

|

|

| Diluted earnings (loss)

per share attributable to continuing operations |

$ |

0.32 |

|

|

$ |

(0.11 |

) |

| Diluted loss per share

attributable to discontinued operations, net of tax |

|

(0.05 |

) |

|

|

(0.04 |

) |

| Diluted earnings (loss)

per share |

$ |

0.27 |

|

|

$ |

(0.15 |

) |

| Diluted

weighted average shares |

|

64,569 |

|

|

|

61,815 |

|

|

|

|

|

|

|

|

|

|

| |

| Great Lakes Dredge & Dock

Corporation |

| Reconciliation of Net Income (Loss) to Adjusted

EBITDA from Continuing Operations |

| (Unaudited and in thousands) |

|

|

|

|

|

|

|

|

|

| |

Three Months Ended |

|

| |

March 31, |

|

| |

|

2019 |

|

|

|

2018 |

|

| Net income (loss) |

$ |

17,168 |

|

|

$ |

(9,321 |

) |

| Loss from discontinued

operations, net of income taxes |

|

(3,380 |

) |

|

|

(2,314 |

) |

| Income (loss) from

continuing operations |

|

20,548 |

|

|

|

(7,007 |

) |

| Adjusted for: |

|

|

|

|

|

|

|

| Interest

expense—net |

|

7,551 |

|

|

|

8,653 |

|

| Income

tax provision (benefit) |

|

6,846 |

|

|

|

(2,475 |

) |

|

Depreciation and amortization |

|

8,905 |

|

|

|

14,562 |

|

| Adjusted EBITDA from

continuing operations |

$ |

43,850 |

|

|

$ |

13,733 |

|

| |

| |

| Great Lakes Dredge & Dock

Corporation |

| Selected Balance Sheet

Information |

| (Unaudited and in thousands) |

| |

|

|

|

|

|

| |

Period Ended |

| |

March 31, |

|

December 31, |

| |

2019 |

|

2018 |

| |

|

|

|

|

|

| Cash and cash

equivalents |

$ |

122,986 |

|

$ |

34,458 |

| Total current

assets |

|

250,667 |

|

|

206,698 |

| Total assets |

|

851,851 |

|

|

730,271 |

| Total current

liabilities |

|

198,086 |

|

|

163,121 |

| Current debt |

|

- |

|

|

11,500 |

| Long-term debt |

|

322,173 |

|

|

321,950 |

| Total equity |

|

239,277 |

|

|

214,928 |

| |

|

|

|

|

|

| |

| Great Lakes Dredge & Dock

Corporation |

| Revenue and Backlog Data |

| (Unaudited and in thousands) |

| |

|

| |

Three Months Ended |

| |

March 31, |

|

Revenues |

|

2019 |

|

|

2018 |

| Dredging: |

|

|

|

|

|

| Capital -

U.S. |

$ |

92,744 |

|

$ |

76,952 |

| Capital -

foreign |

|

8,329 |

|

|

5,523 |

| Coastal

protection |

|

33,743 |

|

|

41,861 |

| Maintenance |

|

29,649 |

|

|

7,803 |

| Rivers

& lakes |

|

28,172 |

|

|

1,484 |

|

Total revenues |

$ |

192,637 |

|

$ |

133,623 |

| |

|

|

|

|

|

| |

| |

As of |

| |

March 31, |

|

December 31, |

|

March 31, |

|

Backlog |

|

2019 |

|

|

2018 |

|

|

2018 |

| Dredging: |

|

|

|

|

|

|

|

|

| Capital -

U.S. |

$ |

376,114 |

|

$ |

447,139 |

|

$ |

383,132 |

| Capital -

foreign |

|

64,827 |

|

|

73,112 |

|

|

6,225 |

| Coastal

protection |

|

75,034 |

|

|

81,068 |

|

|

43,211 |

| Maintenance |

|

36,548 |

|

|

56,189 |

|

|

25,586 |

| Rivers & lakes |

|

22,666 |

|

|

49,583 |

|

|

16,734 |

| Total backlog |

$ |

575,189 |

|

$ |

707,091 |

|

$ |

474,888 |

|

|

| For

further information contact: Abby

SullivanInvestor

Relations630-574-3024asullivan@gldd.com |

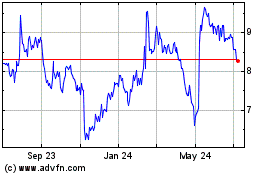

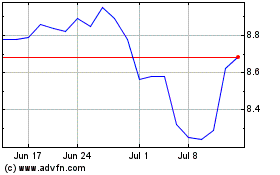

Great Lakes Dredge and D... (NASDAQ:GLDD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Great Lakes Dredge and D... (NASDAQ:GLDD)

Historical Stock Chart

From Apr 2023 to Apr 2024