Filing by Certain Investment Companies of Rule 482 Advertising in Accordance With Rule 497 and the Note to Rule 482(e) (497ad)

August 31 2020 - 4:33PM

Edgar (US Regulatory)

Filed Pursuant to Rule 497(a)

Registration No. 333-239839

Rule 482ad

August 31, 2020

Dear Stockholder,

Great Elm Capital Corp. (“GECC”) has historically sought to raise capital when it believes doing so would be in the best interests of GECC’s

stockholders. After careful consideration with GECC’s board of directors, we announced today a non-transferable rights offering that we believe is consistent with this approach. We believe strengthening

GECC’s balance sheet is a prudent course of action in the face of the current market environment in which we are operating. Furthermore, in a period of market dislocation, there may be attractive new investment opportunities at compelling

values on a risk-adjusted return basis, including opportunities in the specialty finance sector. The capital raised in the rights offering will provide support for the following initiatives:

|

•

|

|

New Opportunistic Investments Resulting from Dislocation: In periods of extreme market volatility, there are

often undervalued investments that become available on more attractive terms than we would otherwise be able to obtain under typical, less volatile market conditions. Having additional capital to take advantage of these opportunities can provide for

compelling risk-adjusted return opportunities. Based on the advice of Great Elm Capital Management, Inc. (“GECM”), our external investment manager, we may seek to opportunistically pursue new investment opportunities to grow our net

investment income by investing in assets that GECM believes have become undervalued. Furthermore, we will continue implementing the portfolio repositioning we began in the second quarter, including by pursuing additional opportunities in specialty

finance. These opportunities may offer more attractive returns than can be found in syndicated corporate credit and help to make our portfolio more proprietary.

|

|

•

|

|

Capital Resources to Support Existing Portfolio Companies: Given the global

COVID-19 pandemic, many businesses have been adversely impacted by a weakened economy. While our portfolio companies are diversified across multiple industries and the overall impact will be dependent on the

specific circumstances of each portfolio company, we believe having capital to support existing portfolio companies can help optimize outcomes for our stockholders. We are focused on liquidity measures to position GECC to support our portfolio

companies and not impact their long-term value propositions.

|

It is a difficult decision to sell shares below net asset value (“NAV”). We strived to structure the rights

offering to be as stockholder friendly as possible under these circumstances. For instance:

|

|

•

|

|

We purposely structured this equity raise as a rights offering to permit existing stockholders to subscribe for their

pro rata rights and avoid dilution.

|

|

|

•

|

|

We set the price per share mechanics for the offering at a level that we believe will minimize dilution to our

stockholders based on the current trading price of our shares while seeking to ensure a successful offering.

|

|

|

•

|

|

The non-transferability of the rights will ensure that only current stockholders

will be able to take part in the rights offering, thereby mitigating the concern that a non-stockholder will benefit from an offering at a discount from NAV or market price.

|

|

|

•

|

|

We considered the benefits of a rights offering as compared to alternative methods of raising additional capital and the

limitation we face as a result of falling below our asset coverage ratio.

|

|

|

•

|

|

We considered that a successful offering would likely ensure that we would be above our minimum asset coverage ratio.

|

|

|

•

|

|

We considered that a successful offering would reduce the concentration of our larger investments.

|

|

|

•

|

|

Great Elm Capital Group, Inc. and certain of GECC’s other stockholders (the “Participating Shareholders”)

have indicated that they intend to fully exercise their rights and over-subscribe in order to make an aggregate investment of up to $24 million in shares of GECC’s common stock. Any over-subscription by the Participating Shareholders will

be effected only after pro rata allocation of over-subscription shares to record date holders (other than the Participating Shareholders) who fully exercise all rights issued to them. Accordingly, there can be no assurance that the Participating

Shareholders will acquire any shares of GECC’s common stock through their exercise of over-subscription privileges.

|

We strive to put

stockholders first and believe that this offering positions GECC to better weather the current market volatility while simultaneously offering GECC the flexibility to be proactive and pursue strategic new investments, including additional

opportunities in specialty finance. On behalf of myself and the other members of GECC’s board of directors, we thank you for your continued support.

Sincerely,

|

|

|

/s/ Peter A. Reed

|

|

Peter A. Reed

|

|

Chief Executive Officer

|

Investors are advised to carefully consider the investment objectives, risks and charges and expenses of GECC before

investing. The prospectus contains this and other important information you should know before investing in the common stock. Please read it and other documents referred to therein carefully in their entirety before you invest. A copy of the

prospectus may be obtained by contacting Imperial Capital, LLC, Attention: Prospectus Department, 10100 Santa Monica Blvd., Suite 2400, Los Angeles, CA 90067 or by phone:

310-246-3700 or Piper Sandler & Co., Attention: Prospectus Department, 800 Nicollet Mall, J12S03, Minneapolis, MN 55402, by email at prospectus@psc.com or by

phone: 1-800-747-3924.

GECC files

annual, quarterly and current reports, proxy statements and other information about GECC with the Securities and Exchange Commission (“SEC”). You may also obtain free copies of GECC’s annual and quarterly reports and make stockholder

inquiries by contacting Great Elm Capital Corp., 800 South Street, Suite 230, Waltham, Massachusetts 02453 or by calling GECC collect at (617) 375-3006. GECC maintains a website at http://greatelmcc.com and

makes all of its annual, quarterly and current reports, proxy statements and other publicly filed information available, free of charge, on or through such website. Information on GECC’s website is not incorporated or a part of the prospectus.

The SEC also maintains a website at http://www.sec.gov where such information is available without charge.

Cautionary Statement Regarding Forward-Looking

Statements

Statements in this communication that are not historical facts are “forward-looking” statements within the meaning of the federal

securities laws. These statements are often, but not always, made through the use of words or phrases such as “expect,” “anticipate,” “should,” “will,” “estimate,” “designed,”

“seek,” “continue,” “upside,” “potential” and similar expressions. All such forward-looking statements involve estimates and assumptions that are subject to risks, uncertainties and other factors that could

cause actual results to differ materially from the results expressed in the statements. Among the key factors that could cause actual results to differ materially from those projected in the forward-looking statements are: conditions in the credit

markets, the price of GECC common stock, the performance of GECC’s portfolio and investment manager and risks associated with the economic impact of the COVID-19 pandemic on GECC and its portfolio

companies. Information concerning these and other factors can be found in GECC’s Annual Report on Form 10-K, GECC’s Quarterly Reports on Form 10-Q and

other reports filed with the SEC. GECC assumes no obligation to, and expressly disclaims any duty to, update any forward-looking statements contained in this communication or to conform prior statements to actual results or revised expectations

except as required by law. Readers are cautioned not to place undue reliance on these forward-looking statements that speak only as of the date hereof.

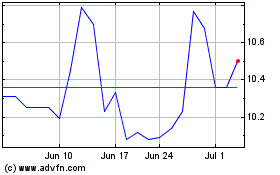

Great Elm Capital (NASDAQ:GECC)

Historical Stock Chart

From Mar 2024 to Apr 2024

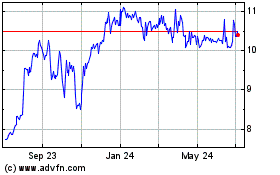

Great Elm Capital (NASDAQ:GECC)

Historical Stock Chart

From Apr 2023 to Apr 2024