0001728117FALSE00017281172024-08-122024-08-12

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 12, 2024

GOSSAMER BIO, INC.

(Exact name of Registrant as Specified in Its Charter)

| | | | | | | | |

| Delaware | 001-38796 | 47-5461709 |

(State or Other Jurisdiction

of Incorporation) | (Commission File Number) | (IRS Employer

Identification No.) |

| | | |

3013 Science Park Road

San Diego, California, 92121

(Address of Principal Executive Offices) (Zip Code)

(858) 684-1300

(Registrant’s Telephone Number, Including Area Code)

N/A

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions A.2. below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading

Symbol(s) | | Name of each exchange on which registered |

| Common Stock, $0.0001 par value per share | | GOSS | | Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On August 12, 2024, Gossamer Bio, Inc. (the “Company”) issued a press release reporting its financial results for the quarter ended June 30, 2024. The full text of the press release is attached as Exhibit 99.1 to this Current Report on Form 8-K.

In accordance with General Instruction B.2 of Form 8-K, the information contained or incorporated herein, including the press release attached as Exhibit 99.1, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed to be incorporated by reference into any filing under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, whether made before or after the date hereof, except as expressly set forth by specific reference in such filing to this Current Report on Form 8-K.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

Exhibit

Number | | Description |

| 99.1 | | |

| 101 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | | | | | | | | | | |

| | | GOSSAMER BIO, INC. |

| | | | |

Date: August 12, 2024 | | By: | /s/ Bryan Giraudo |

| | | | Bryan Giraudo |

| | | | Chief Operating Officer and Chief Financial Officer |

Gossamer Bio Announces Second Quarter 2024 Financial Results and Provides Business Update

- $354 Million in Cash, Cash Equivalents & Marketable Securities, as of June 30, 2024 -

SAN DIEGO—(BUSINESS WIRE)— August 12, 2024 — Gossamer Bio, Inc. (Nasdaq: GOSS), a clinical-stage biopharmaceutical company focused on the development and commercialization of seralutinib for the treatment of pulmonary arterial hypertension (PAH) and pulmonary hypertension associated with interstitial lung disease (PH-ILD), today announced its financial results for the second quarter ended June 30, 2024 and provided a business update.

“Between the continued progress made in the enrollment of the Phase 3 PROSERA Study and the transformational collaboration agreement with the Chiesi Group, Gossamer has made great strides in the second quarter to advance the clinical development and strengthen the market potential of seralutinib,” said Faheem Hasnain, Co-Founder, CEO, and Chairman of Gossamer Bio.

“Additionally, we look forward to announcing seralutinib presentations and posters at major medical meetings in the coming months, which continue to support the potential of seralutinib as a novel agent in the treatment of patients with PAH and PH-ILD.”

Seralutinib (GB002): Inhaled PDGFR, CSF1R and c-KIT Inhibitor for PAH and PH-ILD

•Enrollment is ongoing in the PROSERA Study, a global registrational Phase 3 clinical trial in patients with WHO Functional Class II and III PAH. The primary endpoint is change in six-minute walk distance (6MWD) from baseline at week 24. Topline results from the PROSERA Study are expected in the fourth quarter of 2025.

•In mid-2025, after engaging and discussing with global regulatory authorities, we expect to commence a global registrational Phase 3 clinical trial of seralutinib for the treatment of patients with PH-ILD.

•On May 6, Gossamer Bio and the Chiesi Group announced a development and co-commercialization collaboration for seralutinib. Gossamer and Chiesi will split global development costs for seralutinib, except for the PROSERA Study, for which Gossamer will remain solely responsible. In the United States, Gossamer and Chiesi will split profits and losses, and Chiesi will be solely responsible for commercialization of seralutinib outside of the United States, for which Gossamer will receive mid-to-high teens royalties.

Financial Results for Quarter Ended June 30, 2024

•Cash, Cash Equivalents and Marketable Securities: Cash, cash equivalents and marketable securities as of June 30, 2024, were $354.5 million. The Company expects the combination of current cash, cash equivalents and marketable securities will be sufficient to fund its operating and capital expenditures into the first half of 2027.

•Revenue from Sale of Licenses and from Contracts with Collaborators: For the quarter ended June 30, 2024, revenue from the sale of licenses was $88.8 million and revenue from contracts with collaborators was $7.1 million. Our revenue consists of a one-time development cost reimbursement payment for licenses related to the collaboration with Chiesi and ongoing payments for research and development services related to the collaboration with Chiesi.

•Research and Development (R&D) Expenses: For the quarter ended June 30, 2024, R&D expenses were $35.1 million, compared to $36.3 million for the same period in 2023.

•General and Administrative (G&A) Expenses: For the quarter ended June 30, 2024, G&A expenses were $8.7 million, compared to $10.0 million for the same period in 2023.

•Net Income (Loss): Net income for the quarter ended June 30, 2024, was $49.2 million, or $0.22 basic net income per share, compared to a net loss of $42.5 million, or $0.45 basic net loss per share, for the same period in 2023.

About Gossamer Bio

Gossamer Bio is a clinical-stage biopharmaceutical company focused on the development and commercialization of seralutinib for the treatment of pulmonary hypertension. Its goal is to be an industry leader in, and to enhance the lives of patients living with, pulmonary hypertension.

Forward-Looking Statements

Gossamer cautions you that statements contained in this press release regarding matters that are not historical facts are forward-looking statements. These statements are based on the Company’s current beliefs and expectations. Such forward-looking statements include, but are not limited to, statements regarding: the development and market potential of seralutinib; the anticipated timing of commencing a Phase 3 registrational study in PH-ILD; the anticipated timing of a data readout from our Phase 3 PROSERA Study; the timing of presentations and posters related to seralutinib; each of Gossamer’s and Chiesi’s respective obligations under the collaboration and license agreement to lead commercialization efforts and split development costs; and the expected timeframe for funding our operating plan with current cash, cash equivalents and marketable securities. The inclusion of forward-looking statements should not be regarded as a representation by Gossamer that any of its plans will be achieved. Actual results may differ from those set forth in this press release due to the risks and uncertainties inherent in Gossamer’s business, including, without limitation: potential delays in the commencement, enrollment and completion of clinical trials; disruption to our operations from the COVID-19 pandemic, including clinical trial delays; the Company’s dependence on third parties in connection with product manufacturing, research and preclinical and clinical testing; the results of preclinical studies and early clinical trials are not necessarily predictive of future results; the success of Gossamer’s clinical trials and preclinical studies for seralutinib; regulatory developments in the United States and foreign countries;

unexpected adverse side effects or inadequate efficacy of seralutinib that may limit their development, regulatory approval and/or commercialization, or may result in clinical holds, recalls or product liability claims; Gossamer’s ability to obtain and maintain intellectual property protection for seralutinib; Gossamer’s ability to comply with its obligations in collaboration agreements with third parties, including Chiesi, or the agreements under which it licenses intellectual property rights from third parties; unstable market and economic conditions and adverse developments with respect to financial institutions and associated liquidity risk may adversely affect our business and financial condition and the broader economy and biotechnology industry; Gossamer may use its capital resources sooner than it expects; and other risks described in the Company’s prior press releases and the Company’s filings with the Securities and Exchange Commission (SEC), including under the heading “Risk Factors” in the Company’s annual report on Form 10-K and any subsequent filings with the SEC. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof, and Gossamer undertakes no obligation to update such statements to reflect events that occur or circumstances that exist after the date hereof. All forward-looking statements are qualified in their entirety by this cautionary statement, which is made under the safe harbor provisions of the Private Securities Litigation Reform Act of 1995.

Gossamer Bio Statement of Operations

Condensed Consolidated Statement of Operations

(in thousands, except share and per share amounts)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended June 30, | | Six months ended June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Revenue: | | | | | | | |

| Revenue from sale of licenses | $ | 88,751 | | | $ | — | | | $ | 88,751 | | | $ | — | |

| Revenue from contracts with collaborators | 7,091 | | | — | | | 7,091 | | | — | |

| Total revenue | 95,842 | | | — | | | 95,842 | | | — | |

| Operating expenses: | | | | | | | |

| Research and development | 35,086 | | | 36,309 | | | 67,478 | | | 74,104 | |

| In process research and development | — | | | 15 | | | — | | | 30 | |

| General and administrative | 8,669 | | | 9,976 | | | 18,236 | | | 20,108 | |

| Total operating expenses | 43,755 | | | 46,300 | | | 85,714 | | | 94,242 | |

| Income (loss) from operations | 52,087 | | | (46,300) | | | 10,128 | | | (94,242) | |

| Other income (expense) | | | | | | | |

| Interest income | 1,749 | | | 695 | | | 2,093 | | | 1,282 | |

| Interest expense | (2,916) | | | (3,429) | | | (6,045) | | | (6,929) | |

| Other income, net | 2,747 | | | 6,538 | | | 5,563 | | | 8,228 | |

| Total other income, net | 1,580 | | | 3,804 | | | 1,611 | | | 2,581 | |

| Income (loss) before provision for income taxes | 53,667 | | | (42,496) | | | 11,739 | | | (91,661) | |

| Provision for income taxes | 4,435 | | | — | | | 4,435 | | | — | |

| Net income (loss) | $ | 49,232 | | | $ | (42,496) | | | $ | 7,304 | | | $ | (91,661) | |

| Net income (loss) per share, basic | $ | 0.22 | | | $ | (0.45) | | | $ | 0.03 | | | $ | (0.96) | |

| Net income (loss) per share, diluted | $ | 0.22 | | | $ | (0.45) | | | $ | 0.03 | | | $ | (0.96) | |

| Weighted average common shares outstanding, basic | 226,221,202 | | | 95,446,929 | | | 225,978,219 | | | 95,160,204 | |

| Weighted average common shares outstanding, diluted | 238,543,102 | | | 95,446,929 | | | 225,978,219 | | | 95,160,204 | |

Condensed Consolidated Balance Sheet

(in thousands)

| | | | | | | | | | | |

| BALANCE SHEET DATA: | June 30, 2024 | | December 31, 2023 |

| (unaudited) | | |

| Cash, cash equivalents, and marketable securities | $ | 354,488 | | | $ | 296,425 | |

| Working capital | 325,718 | | | 254,921 | |

| Total assets | 373,448 | | | 311,916 | |

| Total liabilities | 291,919 | | | 249,147 | |

| Accumulated deficit | (1,204,736) | | | (1,212,040) | |

| Total stockholders' equity | 81,529 | | | 62,769 | |

For Investors and Media:

Bryan Giraudo, Chief Operating Officer and Chief Financial Officer

Gossamer Bio Investor Relations

ir@gossamerbio.com

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

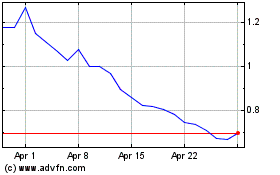

Gossamer Bio (NASDAQ:GOSS)

Historical Stock Chart

From Nov 2024 to Dec 2024

Gossamer Bio (NASDAQ:GOSS)

Historical Stock Chart

From Dec 2023 to Dec 2024