Written Communication Relating to an Issuer or Third Party (sc To-c)

August 10 2021 - 4:06PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported)

August 10, 2021

(Exact name of registrant as specified in

its charter)

|

Nevada

|

|

000-18590

|

|

84-1133368

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

651 Corporate Circle, Suite 200, Golden, CO 80401

(Address of principal executive offices

including zip code)

Registrant’s telephone number, including

area code: (303) 384-1400

Not applicable

(Former name or former address, if changed

since last report.)

Check the appropriate box below if the

Form 8-K filing is intended to simultaneously satisfy the filing obligation of

the registrant under any of the following provisions (see General Instruction A.2.):

|

|

¨

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

x

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section

12(b) of the Act:

|

Title of each class

|

|

Trading

Symbol(s)

|

|

Name of each exchange

on which registered

|

|

Common Stock, $0.001 par value

|

|

GTIM

|

|

The Nasdaq Stock Market

|

Indicate by check

mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405)

or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging

growth company ¨

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

On August 10, 2021, Good Times Restaurants Inc.(the “Company”)

issued a press release announcing that it expects to commence a tender offer to purchase up to $6.5 million in value of its common stock,

at a cash price of $4.60 per share of common stock, on August 13, 2021 or soon thereafter. A copy of the press release is filed as Exhibit

99.1 hereto and is incorporated herein by reference.

Also on August 10, 2021, the Company is making additional communications

regarding the tender offer in its quarterly report on Form 10-Q for the period ended June 29, 2021, and in its earnings call related to

the same period, which communications are filed herewith as Exhibits 99.2 and 99.3, respectively, both of which are incorporated herein

by reference.

Additional Information Regarding the Tender Offer

This communication is for informational purposes only, is not

a recommendation to buy or sell the Company’s common stock, and does not constitute an offer to buy or the solicitation of an offer

to sell common shares of the Company. The tender offer described in this communication has not yet commenced, and there can be no assurances

that the Company will commence the tender offer on the terms described in this communication or at all. The tender offer will be made

only pursuant to an offer to purchase, letter of transmittal and related materials that the Company expects to distribute to its shareholders

and file with the Securities and Exchange Commission (“SEC”) upon commencement of the tender offer. SHAREHOLDERS ARE URGED

TO CAREFULLY READ THE OFFER TO PURCHASE, LETTER OF TRANSMITTAL AND RELATED MATERIALS WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN

IMPORTANT INFORMATION, INCLUDING THE VARIOUS TERMS OF, AND CONDITIONS TO, THE TENDER OFFER, THAT SHAREHOLDERS SHOULD CONSIDER BEFORE MAKING

ANY DECISION REGARDING TENDERING THEIR SHARES. Once the tender offer is commenced, shareholders will be able to obtain a free copy of

the tender offer statement on Schedule TO, the offer to purchase, letter of transmittal and other documents that the Company expects to

file with the SEC at its website at www.sec.gov, from the Company at 651 Corporate Circle, Suite 200, Golden, CO 80401, (303) 384-1400,

or by or by calling the Information Agent (to be identified at the time the offer is made) for the tender offer.

Forward-Looking Information

Certain statements and information included in this Form 8-K

and attached press release constitute "forward-looking statements." Such forward-looking statements include statements that

look forward in time or express management’s beliefs, expectations or hopes, including without limitation, our belief regarding

the benefits of the tender offer and its anticipated timing and funding. These statements involve known and unknown risks, uncertainties

and other factors which may cause the actual results to be materially different from any future results, performance or achievements expressed

or implied in such forward-looking statements.

These risks include material changes in our stock price or in

market conditions in general, as well as risks impacting our business in general, such as the disruption to our business from the novel

coronavirus (COVID-19) pandemic and the impact of the pandemic on our results of operations, financial condition and prospects, which

may vary depending on the duration and extent of the pandemic and the impact of federal, state and local governmental actions and customer

behavior in response to the pandemic, the impact and duration of staffing constraints at our restaurants, the uncertain nature of current

restaurant development plans and the ability to implement those plans and integrate new restaurants, delays in developing and opening

new restaurants because of weather, local permitting or other reasons, increased competition, cost increases or shortages in raw food

products, and other matters discussed under the Risk Factors section of Good Times’ Annual Report on Form 10-K for the fiscal year

ended September 29, 2020 filed with the SEC, and other filings with the SEC. Good Times disclaims any obligation or duty to update or

modify these forward-looking statements.

|

|

Item 9.01.

|

Financial Statements and Exhibits.

|

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

GOOD TIMES RESTAURANTS INC.

|

|

|

|

|

|

|

|

Date: August 10, 2021

|

By:

|

|

|

|

|

|

Ryan M. Zink

|

|

|

|

|

President and Chief Executive Officer

|

|

4

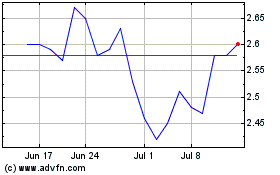

Good Times Restaurants (NASDAQ:GTIM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Good Times Restaurants (NASDAQ:GTIM)

Historical Stock Chart

From Apr 2023 to Apr 2024