000102914512/316/30/20212021Q2falseus-gaap:AccountingStandardsUpdate201613Member00010291452021-01-012021-06-30iso4217:USD0001029145gogl:TimeCharterRevenueMember2021-01-012021-06-300001029145gogl:TimeCharterRevenueMember2020-01-012020-06-300001029145gogl:VoyageCharterRevenueMember2021-01-012021-06-300001029145gogl:VoyageCharterRevenueMember2020-01-012020-06-300001029145gogl:OtherRevenueMember2021-01-012021-06-300001029145gogl:OtherRevenueMember2020-01-012020-06-3000010291452020-01-012020-06-30iso4217:USDxbrli:shares00010291452021-06-3000010291452020-12-31xbrli:shares00010291452019-12-3100010291452020-06-300001029145us-gaap:CommonStockMember2020-12-310001029145us-gaap:CommonStockMember2019-12-310001029145us-gaap:CommonStockMember2021-01-012021-06-300001029145us-gaap:CommonStockMember2020-01-012020-06-300001029145us-gaap:CommonStockMember2021-06-300001029145us-gaap:CommonStockMember2020-06-300001029145us-gaap:TreasuryStockMember2020-12-310001029145us-gaap:TreasuryStockMember2019-12-310001029145us-gaap:TreasuryStockMember2021-01-012021-06-300001029145us-gaap:TreasuryStockMember2020-01-012020-06-300001029145us-gaap:TreasuryStockMember2021-06-300001029145us-gaap:TreasuryStockMember2020-06-300001029145us-gaap:AdditionalPaidInCapitalMember2020-12-310001029145us-gaap:AdditionalPaidInCapitalMember2019-12-310001029145us-gaap:AdditionalPaidInCapitalMember2021-01-012021-06-300001029145us-gaap:AdditionalPaidInCapitalMember2020-01-012020-06-300001029145us-gaap:AdditionalPaidInCapitalMember2021-06-300001029145us-gaap:AdditionalPaidInCapitalMember2020-06-300001029145us-gaap:OtherAdditionalCapitalMember2020-12-310001029145us-gaap:OtherAdditionalCapitalMember2019-12-310001029145us-gaap:OtherAdditionalCapitalMember2021-01-012021-06-300001029145us-gaap:OtherAdditionalCapitalMember2020-01-012020-06-300001029145us-gaap:OtherAdditionalCapitalMember2021-06-300001029145us-gaap:OtherAdditionalCapitalMember2020-06-300001029145srt:ScenarioPreviouslyReportedMemberus-gaap:RetainedEarningsMember2020-12-310001029145srt:ScenarioPreviouslyReportedMemberus-gaap:RetainedEarningsMember2019-12-3100010291452019-01-012019-12-310001029145srt:RestatementAdjustmentMemberus-gaap:RetainedEarningsMember2020-12-310001029145srt:RestatementAdjustmentMemberus-gaap:RetainedEarningsMember2019-12-310001029145us-gaap:RetainedEarningsMember2021-01-012021-06-300001029145us-gaap:RetainedEarningsMember2020-01-012020-06-300001029145us-gaap:RetainedEarningsMember2021-06-300001029145us-gaap:RetainedEarningsMember2020-06-300001029145us-gaap:EmployeeStockOptionMember2020-01-012020-06-30gogl:segment0001029145gogl:DemurrageRevenueMember2021-01-012021-06-300001029145gogl:DemurrageRevenueMember2020-01-012020-06-3000010291452020-01-012020-12-310001029145gogl:CapesizeCharteringLtdMember2021-01-012021-06-300001029145gogl:CapesizeCharteringLtdMember2020-01-012020-06-300001029145gogl:SupramaxVesselsMember2021-01-012021-06-300001029145gogl:SupramaxVesselsMember2020-01-012020-06-300001029145gogl:GoldenSaguenayMember2021-01-012021-01-310001029145gogl:GoldenSaguenayMember2021-01-012021-06-300001029145gogl:GoldenSheaMember2020-01-012020-12-31gogl:vessel0001029145gogl:ShipFinanceInternationalLtdMember2020-01-012020-06-300001029145gogl:RecourseDebtMember2021-01-012021-06-30xbrli:pure0001029145gogl:VesselsandEquipmentMember2020-12-310001029145gogl:VesselsandEquipmentMember2021-01-012021-06-300001029145gogl:VesselsandEquipmentMember2021-06-300001029145gogl:NewcastlemaxVesselsMember2021-06-300001029145gogl:CapesizeVesselsMember2021-06-300001029145gogl:PanamaxVesselsMember2021-06-300001029145gogl:SupramaxVesselsMember2021-06-300001029145gogl:NewcastlemaxVesselsMember2020-12-310001029145gogl:CapesizeVesselsMember2020-12-310001029145gogl:PanamaxVesselsMember2020-12-310001029145gogl:SupramaxVesselsMember2020-12-310001029145gogl:DryBulkCarriersMembergogl:HemenHoldingsLtdMember2021-02-280001029145gogl:HemenHoldingsLtdMembergogl:GoldenSprayGoldenFastAndGoldenFuriousMember2021-02-012021-02-280001029145gogl:HemenHoldingsLtdMembergogl:DryBulkCarriersAndNewbuildingsMember2021-02-012021-02-280001029145gogl:DryBulkCarriersMembergogl:HemenHoldingsLtdMember2021-06-300001029145gogl:DryBulkCarriersMembergogl:HemenHoldingsLtdMember2021-02-012021-02-280001029145gogl:HemenHoldingsLtdMembergogl:DryBulkCarriersAndNewbuildingsMember2021-01-012021-06-300001029145gogl:VesselsandEquipmentMember2021-02-012021-02-280001029145gogl:HemenHoldingsLtdMember2021-02-012021-02-2800010291452021-02-012021-02-280001029145gogl:BallastWaterTreatmentSystemMember2021-01-012021-06-300001029145gogl:GoldenSprayGoldenFastAndGoldenFuriousMember2021-01-012021-06-300001029145gogl:GoldenSprayGoldenFastAndGoldenFuriousMember2021-06-3000010291452020-12-012020-12-310001029145gogl:ShipFinanceInternationalLtdMember2021-01-012021-06-300001029145gogl:VesselsLeasedToThirdPartiesMember2021-01-012021-06-30gogl:lease0001029145gogl:KSLChinaBatterseaBelgraviaGoldenFutureGoldenZhejiangGoldenZhoushanGoldenBeijingandGoldenMagnumMembergogl:ShipFinanceInternationalLtdMember2021-01-012021-06-300001029145gogl:KSLChinaBatterseaBelgraviaGoldenFutureGoldenZhejiangGoldenZhoushanGoldenBeijingandGoldenMagnumMembergogl:ShipFinanceInternationalLtdMember2019-01-012019-12-310001029145gogl:ShipFinanceInternationalLtdMember2019-12-012019-12-310001029145gogl:KSLChinaBatterseaBelgraviaGoldenFutureGoldenZhejiangGoldenZhoushanGoldenBeijingandGoldenMagnumMembergogl:ShipFinanceInternationalLtdMember2015-01-012015-12-310001029145gogl:KSLChinaBatterseaBelgraviaGoldenFutureGoldenZhejiangGoldenZhoushanGoldenBeijingandGoldenMagnumMembergogl:ShipFinanceInternationalLtdMember2015-12-310001029145gogl:KSLChinaBatterseaBelgraviaGoldenFutureGoldenZhejiangGoldenZhoushanGoldenBeijingandGoldenMagnumMembergogl:ShipFinanceInternationalLtdMember2015-07-012015-09-300001029145srt:ScenarioForecastMembergogl:KSLChinaBatterseaBelgraviaGoldenFutureGoldenZhejiangGoldenZhoushanGoldenBeijingandGoldenMagnumMembergogl:ShipFinanceInternationalLtdMember2025-06-302025-06-300001029145gogl:KSLChinaBatterseaBelgraviaGoldenFutureGoldenZhejiangGoldenZhoushanGoldenBeijingandGoldenMagnumMembergogl:ShipFinanceInternationalLtdMember2020-01-012020-06-300001029145gogl:KSLChinaBatterseaBelgraviaGoldenFutureGoldenZhejiangGoldenZhoushanGoldenBeijingandGoldenMagnumMembergogl:ShipFinanceInternationalLtdMember2015-09-300001029145gogl:GoldenHawkMember2021-01-012021-06-300001029145gogl:GoldenHawkMember2016-02-202018-02-200001029145gogl:GoldenHawkMember2021-06-30utr:T0001029145gogl:MVAdmiralSchmidtAndVitusBeringMember2019-12-31gogl:lease_renewal0001029145srt:MinimumMembergogl:MVAdmiralSchmidtAndVitusBeringMember2019-01-012019-12-310001029145gogl:MVAdmiralSchmidtAndVitusBeringMember2021-01-012021-06-300001029145us-gaap:GeneralAndAdministrativeExpenseMember2021-01-012021-06-300001029145us-gaap:GeneralAndAdministrativeExpenseMember2020-01-012020-06-300001029145gogl:ShipFinanceInternationalLtdMember2020-12-310001029145gogl:GoldenHawkMember2020-12-310001029145gogl:ASchmidtAndVBeringLeasesMember2020-12-310001029145gogl:OfficeLeasesMember2020-12-310001029145gogl:ShipFinanceInternationalLtdMember2021-01-012021-06-300001029145gogl:ASchmidtAndVBeringLeasesMember2021-01-012021-06-300001029145gogl:OfficeLeasesMember2021-01-012021-06-300001029145gogl:ShipFinanceInternationalLtdMember2021-06-300001029145gogl:ASchmidtAndVBeringLeasesMember2021-06-300001029145gogl:OfficeLeasesMember2021-06-300001029145srt:MinimumMember2020-06-300001029145srt:MaximumMember2020-06-300001029145gogl:VesselsLeasedToThirdPartiesMember2021-06-300001029145gogl:VesselsLeasedToThirdPartiesMember2020-12-310001029145srt:ScenarioForecastMembergogl:KSLChinaBatterseaBelgraviaGoldenFutureGoldenZhejiangGoldenZhoushanGoldenBeijingandGoldenMagnumMembergogl:ShipFinanceInternationalLtdMember2022-04-012025-06-300001029145gogl:CharterhireexpensesMembergogl:KSLChinaBatterseaBelgraviaGoldenFutureGoldenZhejiangGoldenZhoushanGoldenBeijingandGoldenMagnumMembergogl:SFLCorporationLtdMember2021-01-012021-06-300001029145gogl:ShipFinanceInternationalLtdMember2015-07-012015-09-300001029145gogl:ShipFinanceInternationalLtdMember2015-09-300001029145gogl:TFGMArineMember2021-06-300001029145gogl:TFGMArineMember2020-12-310001029145gogl:SwissMarineMember2021-06-300001029145gogl:SwissMarineMember2020-12-310001029145gogl:UnitedFreightCarriersMember2021-06-300001029145gogl:UnitedFreightCarriersMember2020-12-310001029145gogl:CapesizeCharteringLtdMember2021-06-300001029145gogl:CapesizeCharteringLtdMember2020-12-310001029145gogl:OtherMember2020-12-310001029145gogl:SwissMarineMember2021-01-012021-06-300001029145gogl:OtherMember2021-01-012021-06-300001029145gogl:OtherMember2021-06-300001029145gogl:SwissMarineMember2020-01-310001029145gogl:SwissMarineMember2020-02-290001029145gogl:SwissMarineMember2020-05-012020-05-310001029145gogl:TFGMArineMember2020-01-310001029145gogl:TFGMArineMember2020-01-012020-01-310001029145gogl:TFGMArineMemberus-gaap:LondonInterbankOfferedRateLIBORMember2020-01-310001029145gogl:A3044MLoanAndRevolvingFacilityMember2021-06-300001029145gogl:A3044MLoanAndRevolvingFacilityMember2020-12-310001029145gogl:TermLoanFacilityOf1553MillionMember2021-06-300001029145gogl:TermLoanFacilityOf1553MillionMember2020-12-310001029145gogl:TermLoanFacilityof93.75MillionMember2021-06-300001029145gogl:TermLoanFacilityof93.75MillionMember2020-12-310001029145gogl:TermLoanFacilityof131.79MillionMember2021-06-300001029145gogl:TermLoanFacilityof131.79MillionMember2020-12-310001029145gogl:TermLoanFacilityof420MillionMember2021-06-300001029145gogl:TermLoanFacilityof420MillionMember2020-12-310001029145gogl:TermLoanFacilityof120.0MillionMember2021-06-300001029145gogl:TermLoanFacilityof120.0MillionMember2020-12-310001029145gogl:FloatingRateDebtMember2021-06-300001029145gogl:FloatingRateDebtMember2020-12-310001029145us-gaap:SecuredDebtMember2020-12-310001029145us-gaap:SecuredDebtMember2021-01-012021-06-300001029145us-gaap:SecuredDebtMember2021-06-300001029145gogl:FloatingRateDebtMember2021-01-012021-06-300001029145gogl:RevolvingCreditFacility50MillionMember2021-01-012021-06-300001029145gogl:GoldenSheaAndGoldenSaguenayMember2021-01-012021-06-300001029145gogl:AllOtherDebtMember2021-01-012021-06-300001029145gogl:FloatingRateDebtMemberus-gaap:CollateralPledgedMember2021-06-300001029145gogl:FloatingRateDebtMemberus-gaap:CollateralPledgedMember2020-12-310001029145us-gaap:InterestRateSwapMember2021-06-300001029145us-gaap:InterestRateSwapMember2020-12-310001029145gogl:BunkerderivativesMember2021-06-300001029145gogl:BunkerderivativesMember2020-12-310001029145us-gaap:CurrencySwapMember2021-06-300001029145us-gaap:CurrencySwapMember2020-12-310001029145gogl:ForwardFreightAgreementsMember2021-06-300001029145gogl:ForwardFreightAgreementsMember2020-12-310001029145us-gaap:InterestRateSwapMember2021-01-012021-06-300001029145us-gaap:InterestRateSwapMember2020-01-012020-06-300001029145us-gaap:CurrencySwapMember2021-01-012021-06-300001029145us-gaap:CurrencySwapMember2020-01-012020-06-300001029145gogl:ForwardFreightAgreementsMember2021-01-012021-06-300001029145gogl:ForwardFreightAgreementsMember2020-01-012020-06-300001029145gogl:BunkerderivativesMember2021-01-012021-06-300001029145gogl:BunkerderivativesMember2020-01-012020-06-3000010291452021-03-3100010291452021-03-012021-03-31iso4217:NOK0001029145us-gaap:PrivatePlacementMember2021-02-012021-02-28iso4217:NOKxbrli:shares0001029145us-gaap:PrivatePlacementMember2021-02-280001029145us-gaap:PrivatePlacementMembergogl:HemenHoldingsLtdMember2021-02-012021-02-280001029145us-gaap:PrivatePlacementMember2021-05-012021-05-310001029145us-gaap:PrivatePlacementMember2021-05-310001029145gogl:A2016ShareOptionSchemeMember2021-01-012021-06-300001029145us-gaap:OtherAdditionalCapitalMember2021-05-012021-05-310001029145gogl:DryBulkCarriersMembergogl:ShipFinanceInternationalLtdMember2021-06-300001029145gogl:DryBulkCarriersMembergogl:ShipFinanceInternationalLtdMember2020-06-300001029145gogl:ContainerCarriersMembergogl:ShipFinanceInternationalLtdMember2021-06-300001029145gogl:ContainerCarriersMembergogl:ShipFinanceInternationalLtdMember2020-06-30iso4217:USDutr:D0001029145gogl:DryBulkCarriersMembergogl:ShipFinanceInternationalLtdMember2021-01-012021-06-300001029145gogl:DryBulkCarriersMembergogl:ShipFinanceInternationalLtdMember2020-01-012020-06-300001029145gogl:ContainerCarriersMembergogl:ShipFinanceInternationalLtdMember2021-01-012021-06-300001029145gogl:ContainerCarriersMembergogl:ShipFinanceInternationalLtdMember2020-01-012020-06-300001029145gogl:DryBulkCarriersMembergogl:SeatankersManagementCoLtdMember2021-06-300001029145gogl:DryBulkCarriersMembergogl:SeatankersManagementCoLtdMember2020-06-300001029145gogl:DryBulkCarriersMembergogl:SeatankersManagementCoLtdMember2021-01-012021-06-300001029145gogl:DryBulkCarriersMembergogl:SeatankersManagementCoLtdMember2020-01-012020-06-300001029145gogl:CapesizeCharteringLtdMember2021-01-012021-06-300001029145gogl:CapesizeCharteringLtdMember2020-01-012020-06-300001029145gogl:SwissMarineMember2019-12-310001029145gogl:SwissMarineMember2019-01-012019-12-310001029145gogl:SwissMarineMember2021-06-300001029145gogl:SwissMarineMember2021-01-012021-06-300001029145gogl:TFGMArineMember2020-12-310001029145gogl:TFGMArineMember2020-01-012020-12-310001029145us-gaap:LondonInterbankOfferedRateLIBORMembergogl:TFGMArineMember2020-01-012020-12-310001029145gogl:BunkerProcurementMembergogl:TFGMArineMember2021-01-012021-06-300001029145gogl:BunkerSupplyAgreementGuaranteeMembergogl:TFGMArineMember2021-01-012021-06-300001029145us-gaap:PerformanceGuaranteeMember2021-06-30iso4217:USDgogl:vessel0001029145gogl:FrontlineManagementBermudaLtdMember2021-01-012021-06-300001029145gogl:FrontlineManagementBermudaLtdMember2020-01-012020-12-310001029145gogl:SeateamManagementPteLtdMember2020-10-012020-10-310001029145gogl:DryBulkCarriersMembergogl:HemenHoldingsLtdMembersrt:MinimumMemberus-gaap:LondonInterbankOfferedRateLIBORMember2021-02-012021-02-280001029145gogl:DryBulkCarriersMembergogl:HemenHoldingsLtdMemberus-gaap:LondonInterbankOfferedRateLIBORMembersrt:MaximumMember2021-02-012021-02-280001029145gogl:HemenHoldingsLtdMember2021-02-280001029145gogl:FrontlineManagementBermudaLtdMember2020-01-012020-06-300001029145gogl:SeateamManagementPteLtdMember2021-01-012021-06-300001029145gogl:SeateamManagementPteLtdMember2020-01-012020-06-300001029145gogl:SeatankersManagementCoLtdMember2021-01-012021-06-300001029145gogl:SeatankersManagementCoLtdMember2020-01-012020-06-300001029145gogl:TFGMarineMember2021-01-012021-06-300001029145gogl:TFGMarineMember2020-01-012020-06-300001029145gogl:SwissMarineMember2020-01-012020-06-300001029145gogl:OtherRelatedPartyMember2021-01-012021-06-300001029145gogl:OtherRelatedPartyMember2020-01-012020-06-300001029145srt:AffiliatedEntityMember2021-01-012021-06-300001029145srt:AffiliatedEntityMember2020-01-012020-06-300001029145gogl:UnitedFreightCarriersMember2021-06-300001029145gogl:UnitedFreightCarriersMember2020-12-310001029145gogl:SeatankersManagementCoLtdMember2021-06-300001029145gogl:SeatankersManagementCoLtdMember2020-12-310001029145gogl:SwissMarineMember2020-12-310001029145gogl:CapesizeCharteringLtdMember2021-06-300001029145gogl:CapesizeCharteringLtdMember2020-12-310001029145gogl:OtherRelatedPartyMember2021-06-300001029145gogl:OtherRelatedPartyMember2020-12-310001029145gogl:FrontlineLtdMember2021-06-300001029145gogl:FrontlineLtdMember2020-12-310001029145gogl:TFGMarineMember2021-06-300001029145gogl:TFGMarineMember2020-12-310001029145gogl:InterestRateSwap4Memberus-gaap:DesignatedAsHedgingInstrumentMember2021-06-300001029145gogl:InterestRateSwap5Memberus-gaap:DesignatedAsHedgingInstrumentMember2021-06-300001029145us-gaap:DesignatedAsHedgingInstrumentMembergogl:InterestRateSwap1Member2021-06-300001029145us-gaap:DesignatedAsHedgingInstrumentMembergogl:InterestRateSwap2Member2021-06-300001029145us-gaap:DesignatedAsHedgingInstrumentMembergogl:InterestRateSwap6Member2021-06-300001029145gogl:InterestRateSwap7Memberus-gaap:DesignatedAsHedgingInstrumentMember2021-06-300001029145us-gaap:DesignatedAsHedgingInstrumentMembergogl:InterestRateSwap3Member2021-06-300001029145gogl:InterestRateSwap8Memberus-gaap:DesignatedAsHedgingInstrumentMember2021-06-300001029145gogl:InterestRateSwap9Memberus-gaap:DesignatedAsHedgingInstrumentMember2021-06-300001029145us-gaap:InterestRateSwapMemberus-gaap:DesignatedAsHedgingInstrumentMember2021-06-300001029145gogl:CapesizeForwardFreightAgreementsMaturingIn2021Memberus-gaap:LongMember2021-01-012021-06-300001029145gogl:CapesizeForwardFreightAgreementsMaturingIn2022Memberus-gaap:LongMember2021-01-012021-06-300001029145gogl:CapesizeForwardFreightAgreementsMaturingIn2021Memberus-gaap:ShortMember2020-01-012020-12-310001029145gogl:CapesizeForwardFreightAgreementsMaturingIn2022Memberus-gaap:LongMember2020-01-012020-12-31utr:t0001029145gogl:BunkerderivativesMember2020-01-012020-12-310001029145currency:NOKus-gaap:CurrencySwapMember2021-06-300001029145currency:NOKus-gaap:CurrencySwapMember2020-12-310001029145us-gaap:FairValueInputsLevel1Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2021-06-300001029145us-gaap:FairValueInputsLevel1Memberus-gaap:CarryingReportedAmountFairValueDisclosureMember2021-06-300001029145us-gaap:FairValueInputsLevel1Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2020-12-310001029145us-gaap:FairValueInputsLevel1Memberus-gaap:CarryingReportedAmountFairValueDisclosureMember2020-12-310001029145us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueInputsLevel2Member2021-06-300001029145us-gaap:FairValueInputsLevel2Memberus-gaap:CarryingReportedAmountFairValueDisclosureMember2021-06-300001029145us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueInputsLevel2Member2020-12-310001029145us-gaap:FairValueInputsLevel2Memberus-gaap:CarryingReportedAmountFairValueDisclosureMember2020-12-310001029145us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:SecuredDebtMemberus-gaap:FairValueInputsLevel2Member2021-06-300001029145us-gaap:SecuredDebtMemberus-gaap:FairValueInputsLevel2Memberus-gaap:CarryingReportedAmountFairValueDisclosureMember2021-06-300001029145us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:SecuredDebtMemberus-gaap:FairValueInputsLevel2Member2020-12-310001029145us-gaap:SecuredDebtMemberus-gaap:FairValueInputsLevel2Memberus-gaap:CarryingReportedAmountFairValueDisclosureMember2020-12-310001029145us-gaap:FairValueInputsLevel3Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueMeasurementsNonrecurringMember2020-03-310001029145us-gaap:FairValueInputsLevel3Membergogl:MeasurementInputAdjustedForwardFreightMarketRatesMemberus-gaap:FairValueMeasurementsNonrecurringMembersrt:MinimumMember2020-03-310001029145us-gaap:FairValueInputsLevel3Membergogl:MeasurementInputAdjustedForwardFreightMarketRatesMemberus-gaap:FairValueMeasurementsNonrecurringMembersrt:MaximumMember2020-03-310001029145us-gaap:FairValueInputsLevel3Membergogl:MeasurementInputAdjustedForwardFreightMarketRatesMembersrt:WeightedAverageMemberus-gaap:FairValueMeasurementsNonrecurringMember2020-03-310001029145us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsNonrecurringMembersrt:MinimumMembergogl:MeasurementInputAdjustedImpliedCharterRatesMember2020-03-310001029145us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsNonrecurringMembersrt:MaximumMembergogl:MeasurementInputAdjustedImpliedCharterRatesMember2020-03-310001029145us-gaap:FairValueInputsLevel3Membersrt:WeightedAverageMemberus-gaap:FairValueMeasurementsNonrecurringMembergogl:MeasurementInputAdjustedImpliedCharterRatesMember2020-03-310001029145us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsNonrecurringMembersrt:MinimumMembergogl:MeasurementInputShipOperatingAndDrydockingCostsMember2020-03-310001029145us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsNonrecurringMembersrt:MaximumMembergogl:MeasurementInputShipOperatingAndDrydockingCostsMember2020-03-310001029145us-gaap:FairValueInputsLevel3Membersrt:WeightedAverageMemberus-gaap:FairValueMeasurementsNonrecurringMembergogl:MeasurementInputShipOperatingAndDrydockingCostsMember2020-03-31gogl:daysPerYear0001029145us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsNonrecurringMembersrt:MinimumMembergogl:MeasurementInputOffhireMember2020-03-310001029145us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsNonrecurringMembersrt:MaximumMembergogl:MeasurementInputOffhireMember2020-03-310001029145us-gaap:FairValueInputsLevel3Membersrt:WeightedAverageMemberus-gaap:FairValueMeasurementsNonrecurringMembergogl:MeasurementInputOffhireMember2020-03-310001029145gogl:FrontlineAndTrafiguraMemberus-gaap:PerformanceGuaranteeMember2021-06-300001029145us-gaap:SubsequentEventMember2021-08-310001029145us-gaap:SubsequentEventMember2021-08-012021-08-310001029145us-gaap:SubsequentEventMemberus-gaap:LondonInterbankOfferedRateLIBORMember2021-08-012021-08-310001029145gogl:A175MillionTermLoanFacilityMemberus-gaap:SubsequentEventMember2021-08-310001029145gogl:A175MillionTermLoanFacilityMemberus-gaap:SubsequentEventMember2021-08-012021-08-310001029145gogl:A175MillionTermLoanFacilityMemberus-gaap:SubsequentEventMemberus-gaap:LondonInterbankOfferedRateLIBORMember2021-08-012021-08-310001029145gogl:DryBulkCarriersMembergogl:HemenHoldingsLtdMemberus-gaap:SubsequentEventMember2021-08-012021-08-310001029145us-gaap:SubsequentEventMember2021-08-26

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO

RULE 13A-16 OR 15D-16 UNDER THE SECURITIES

EXCHANGE ACT OF 1934

For the month of September 2021

Commission File Number: 000-29106

GOLDEN OCEAN GROUP LIMITED.

(Translation of registrant's name into English)

Par-la-Ville Place, 14 Par-la-Ville Road, Hamilton, HM 08, Bermuda

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F [ X ] Form 40-F [ ]

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ________.

Note: Regulation S-T Rule 101(b)(1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ________.

Note: Regulation S-T Rule 101(b)(7) only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized (the registrant's "home country"), or under the rules of the home country exchange on which the registrant's securities are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed to the registrant's security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission or other Commission filing on EDGAR.

INFORMATION CONTAINED IN THIS FORM 6-K REPORT

Attached hereto as Exhibit 99.1 to this Report on Form 6-K are the Management’s Discussion and Analysis of Financial Condition and Results of Operations and the unaudited condensed consolidated interim financial statements and related information and data of Golden Ocean Group Limited (the “Company”) for the six months ended June 30, 2021.

This Report on Form 6-K is hereby incorporated by reference into the Company's Registration Statement on Form F-3 (File No. 333-232709) filed with the U.S. Securities and Exchange Commission with an effective date of July 26, 2019.

CAUTIONARY STATEMENT CONCERNING FORWARD-LOOKING INFORMATION

Matters discussed in this report on Form 6-K, and the documents incorporated by reference herein, may constitute forward-looking statements. The Private Securities Litigation Reform Act of 1995, or the PSLRA, provides safe harbor protections for forward-looking statements, which include statements concerning plans, objectives, goals, strategies, future events or performance, and underlying assumptions and other statements, which are other than statements of historical facts.

We desire to take advantage of the safe harbor provisions of the PSLRA and are including this cautionary statement in connection with this safe harbor legislation. This Form 6-K and any other written or oral statements made by us or on our behalf may include forward-looking statements, which reflect our current views with respect to future events and financial performance. This report includes assumptions, expectations, projections, intentions and beliefs about future events. These statements are intended as "forward-looking statements." We caution that assumptions, expectations, projections, intentions and beliefs about future events may and often do vary from actual results and the differences can be material. When used in this document, the words "believe," "anticipate," "intend," "estimate," "forecast," "project," "plan," "potential," "may," "should," "would," "could," "continue" "contemplate," "possible," "might," "expect," "will" and similar expressions identify forward-looking statements.

The forward-looking statements in this report on Form 6-K, and the documents incorporated by reference herein, are based upon various assumptions, including, without limitation, management's examination of historical operating trends, data contained in our records and data available from third parties. Although we believe that these assumptions were reasonable when made, because these assumptions are inherently subject to significant uncertainties and contingencies which are difficult or impossible to predict and are beyond our control, we cannot assure you that we will achieve or accomplish these expectations, beliefs or projections. As a result, you are cautioned not to rely on any forward-looking statements.

All statements in this document that are not statements of historical fact are forward-looking statements. Forward-looking statements include, but are not limited to, such matters as:

•our future operating or financial results;

•our continued borrowing availability under our debt agreements and compliance with the covenants contained therein;

•the failure of our contract counterparties to meet their obligations, including changes in credit risk with respect to our counterparties on contracts;

•the impact of the discontinuance of the London Interbank Offered Rate, or LIBOR, after 2021 on interest rates of our debt that reference LIBOR;

•our ability to procure or have access to financing, our liquidity and the adequacy of cash flows for our operations;

•fluctuations in the contributions of our joint ventures to our profits and losses;

•our ability to successfully employ our dry bulk vessels and replace our operating leases on favorable terms, or at all;

•changes in our operating expenses and voyage costs, including bunker prices, fuel prices (including increased costs for low sulfur fuel), drydocking, crewing and insurance costs;

•the adequacy of our insurance to cover our losses, including in the case of a vessel collision;

•our ability to fund future capital expenditures and investments in the construction, acquisition and refurbishment of our vessels (including the amount and nature thereof and the timing of completion of vessels under construction, the delivery and commencement of operation dates, expected downtime and lost revenue);

•risks associated with any future vessel construction or the purchase of second-hand vessels;

•our expectations regarding the availability of vessel acquisitions and our ability to complete acquisition transactions planned;

•an oversupply of dry bulk vessels which may depress charter rates and profitability;

•the loss of a large customer or significant business relationship;

•the potential for technological innovation in the sector in which we operate to reduce the value of our vessels and charter income derived therefrom;

•the failure to protect our information technology and communications system against security breaches or the failure or unavailability of these systems for a significant period of time;

•vessel breakdowns and instances of off-hire;

•potential difference in interests between or among certain members of our board of directors, executive officers, senior management and shareholders;

•our ability to attract, retain and motivate key employees;

•work stoppages or other labor disruptions by our employees or the employees of other companies in related industries;

•changes in governmental rules and regulations or actions taken by regulatory authorities and the impact of government inquiries and investigations;

•the arrest of our vessels by maritime claimants;

•government requisition of our vessels during a period of war or emergency;

•potential exposure or loss from investment in derivative instruments;

•general market trends in the dry bulk industry, which is cyclical and volatile, including fluctuations in charter hire rates and vessel values;

•changes in supply and demand in the dry bulk shipping industry, including the market for our vessels and the number of newbuildings under construction;

•the strength of world economies;

•stability of Europe and the Euro or the inability of countries to refinance their debts;

•the withdrawal of the U.K. from the European Union and the potential negative effect on global economic conditions and financial markets;

•fluctuations in interest rates and foreign exchange rates;

•our compliance with complex laws, regulations, including environmental laws and regulations and the U.S. Foreign Corrupt Practices Act of 1977;

•potential liability from safety, environmental, governmental and other requirements and potential significant additional expenditures (by us and our customers) related to complying with such regulations;

•the impact of increasing scrutiny and changing expectations from investors, lenders and other market participants with respect to our Environmental, Social and Governance policies;

•changes in seaborne and other transportation;

•the length and severity of epidemics and pandemics, including the ongoing global outbreak of COVID-19 ("COVID-19") and governmental responses thereto and the impact on the demand for seaborne transportation in the dry bulk sector;

•general domestic and international political and geopolitical conditions or events, including any further changes in U.S. trade policy that could trigger retaliatory actions by affected countries;

•the impact of adverse weather and natural disasters;

•potential disruption of shipping routes due to accidents or political events;

•acts of piracy on ocean-going vessels, public health threats, terrorist attacks and international hostilities and political instability; and

•other factors discussed in "Item 3.D. Risk Factors" in our Annual Report on Form 20-F for the year ended December 31, 2020 filed with the Commission on March 18, 2021, or our Annual Report.

In light of these risks, uncertainties and assumptions, the forward-looking events discussed in this report on Form 6-K and the documents incorporated by reference herein, might not occur, and our actual results could differ materially from those anticipated in these forward-looking statements. We undertake no obligation to publicly update or revise any forward-looking statement contained in this report on Form 6-K, and the documents incorporated by reference herein, whether as a result of new information, future events or otherwise, except as required by law.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GOLDEN OCEAN GROUP LIMITED

(registrant)

|

|

|

|

|

|

|

Date:

|

September 7, 2021

|

|

By:

|

/s/ Peder Simonsen

|

|

|

|

|

|

Name: Peder Simonsen

|

|

|

|

|

|

Title: Principal Financial Officer

|

|

|

|

|

|

|

|

|

|

|

EXHIBIT 99.1

Management's Discussion and Analysis of Financial Condition and Results of Operations

The following presentation of management's discussion and analysis of financial condition and results of operations for the six month periods ended June 30, 2021 and 2020 should be read in conjunction with our unaudited condensed consolidated interim financial statements and related notes thereto included elsewhere herein, which have been prepared in accordance with United States generally accepted accounting principles ("U.S. GAAP"). For additional information relating to our management's discussion and analysis of results of operations and financial condition, please see our Annual Report.

As used herein, "we," "us," "our", "Golden Ocean" and the "Company" all refer to Golden Ocean Group Limited and its subsidiaries. The term deadweight ton, or dwt, is used in describing the size and capacity of vessels. Dwt, expressed in metric tons, each of which is equivalent to 1,000 kilograms, refers to the maximum weight of cargo and supplies that a vessel can carry.

We own and operate dry bulk vessels of the following sizes:

•Newcastlemax, which are vessels with carrying capacities of between 200,000 dwt and 210,000 dwt;

•Capesize, which are vessels with carrying capacities of between 105,000 dwt and 200,000 dwt;

•Panamax, which are vessels with carrying capacities of between 65,000 and 105,000 dwt; and

•Ultramax, which are vessels with carrying capacities of between 55,000 and 65,000 dwt.

Unless otherwise indicated, all references to “USD” and “$” in this report are to, and amounts are represented in, U.S. dollars.

The below discussion contains forward-looking statements that reflect our current views with respect to future events and financial performance. Our actual results may differ materially from those anticipated in these forward-looking statements as a result of certain factors, such as those set forth in the section "Risk Factors" included in our Annual Report.

General

On September 18, 1996, we were incorporated in Bermuda under the name Knightsbridge Tankers Limited as an exempted company pursuant to the Bermuda Companies Act 1981. In October 2014, we changed our name to Knightsbridge Shipping Limited. On March 31, 2015, we completed a merger with Golden Ocean Group Limited and subsequently changed our name to Golden Ocean Group Limited. Our registered and principal executive offices are located at Par-la-Ville Place, 14 Par-la-Ville Road, Hamilton, HM 08, Bermuda, and our telephone number at this location is +1 (441) 295-6935.

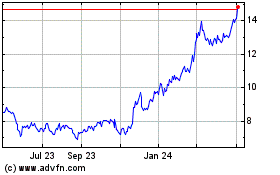

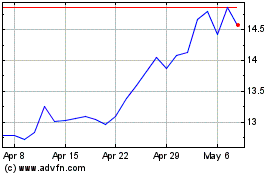

Our common shares currently trade on the NASDAQ Global Select Market and the Oslo Stock Exchange under the symbol "GOGL".

We own and operate dry bulk carriers primarily consisting of Newcastlemax, Capesize, Panamax and Ultramax vessels. Our vessels transport a broad range of major and minor bulk commodities, including ores, coal, grains and fertilizers, along worldwide shipping routes. We operate through subsidiaries located in Bermuda, Liberia, Norway and Singapore. We are also involved in the charter, purchase and sale of vessels.

In February 2021, we entered into an agreement to acquire 15 modern dry bulk vessels and three newbuildings for a total consideration of $752 million from affiliates of Hemen Holding Ltd, our largest shareholder (the “Vessel Acquisitions”).

As of June 30, 2021, we owned 83 dry bulk vessels. In addition, we had 11 vessels chartered-in (of which seven were chartered in on financial leases and one on an operating lease from SFL Corporation Ltd., formerly known as Ship Finance International Limited, or SFL, and three chartered in on operating leases from an unrelated third party). Each vessel is operated by one of our subsidiaries and is flagged either in the Marshall Islands, Hong Kong or Panama.

COVID-19 Update

In the six months ended June 30, 2021, our operations have not been materially affected by COVID-19 pandemic. However, we have continued to experience disruptions to our normal vessel operations, such as crew changes and port congestions. This resulted in increased crew vaccine and transportation costs, as well as increased deviation time associated with positioning of our vessels. At the same time, the dry bulk market improved significantly during the first six months of 2021, which was partially brought about by port congestions caused by COVID-19 pandemic.

Together with our technical managers, we have implemented various measures to protect the safety and wellbeing of our seafarers and to minimize the consequences of the pandemic. In January 2021, we signed the Neptune Declaration on Seafarer Wellbeing and Crew Change, as part of our commitment to work together with other industry participants to take firm actions to resolve the crew change crisis brought about by the COVID-19 pandemic.

Given the evolving nature of the pandemic, the related financial impact on the Company cannot be reasonably estimated at this time. Please refer to "Item 3 - Key Information - Risk Factors" in our Annual Report on Form 20-F for the year ended December 31, 2020 for additional information about the potential risks of COVID-19 on our business.

ESG update

Effective management of Environmental, Social and Governance ("ESG") matters has been of strategic importance for the Company for years. ESG is part of our core values and is embedded in our day-to-day management, in the strategy we apply to the chartering, operation and investments, and in other aspects of our business.

In 2020 Golden Ocean and its affiliated companies in the Seatankers group embarked on an energy efficiency project supported by DNV GL. During 2021 we continued to work diligently to achieve IMO 2030 targets, and as a result of this work, all of our vessels have been fully digitalized as of the date of this report. Further, we have continued to upload information for all of our vessels to Rightship1 risk and greenhouse gas emission rating platform, thus providing transparency and allowing stakeholders and customers to have access to relevant safety data at any time.

Our third annual ESG report, in respect of the calendar year ended 2020 (the “2020 ESG Report”) was published in April 2021 and can be found on our website. The information on our website does not constitute a part of this report. The 2020 ESG Report was prepared in accordance with the Marine Transportation framework established by the Sustainability Accounting Standards Board ("SASB"), in line with what was done in previous years. The SASB standard allows us to identify, manage and report on material ESG topics with industry specific performance metrics. Additionally, we incorporate the principles of the UN Global Compact into our ESG framework.

Results of Operations

Six-months ended June 30, 2021 compared to the six-months ended June 30, 2020

Operating revenues

We currently operate most of our vessels in the spot market, exposing us to fluctuations in spot market charter rates. As a result, our shipping revenues and financial performance are significantly affected by conditions in the dry bulk spot market, and any decrease in spot charter rates may adversely affect our earnings. In the first six months of 2021, market conditions were significantly stronger compared to the first six months of 2020, which is illustrated by the increase in the Baltic Dry Index, or BDI, from 1374 to 3383 points, thus positively impacting our operating revenues. The mix of charters between spot or voyage charters and time charters also affected our revenues and voyage expenses.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Six Months Ended June 30,

|

|

Change

|

|

(in thousands of $)

|

2021

|

2020

|

|

$

|

|

Time charter revenues

|

205,518

|

|

86,250

|

|

|

119,268

|

|

|

Voyage charter revenues

|

227,223

|

|

166,382

|

|

|

60,841

|

|

|

Other revenues

|

1,014

|

|

1,022

|

|

|

(8)

|

|

|

Total operating revenues

|

433,755

|

|

253,654

|

|

|

180,101

|

|

Time charter revenues increased by $119.3 million in the six months ended June 30, 2021 compared with the six months ended June 30, 2020 primarily due to:

•an increase of $95.9 million reflecting the increase in the dry bulk market which resulted in higher rates under index-linked and short-term time charters below eleven months for vessels that were in our fleet through the duration of both these periods,

•an increase of $15.6 million generated from vessels delivered during 2021 that traded on time charter,

•an increase of $6.1 million attributable to a decrease in amortization of favorable charter party contracts during the period, and

1 RightShip is the world’s biggest third party maritime due diligence organization, providing expertise in global safety, sustainability and social responsibility practices.

•an increase of $1.7 million attributable to chartered-in vessels that traded on time charters during the period.

Voyage charter revenues increased by $60.8 million in the six months ended June 30, 2021 compared with the six months ended June 30, 2020 primarily due to:

•an increase of $40.9 million following an increase in average freight rates for our owned and leased vessels trading on voyage charters during the six months ended June 30, 2021,

•an increase of $17.8 million generated from vessels delivered during 2021 that traded on voyage charter during the period,

•an increase of $5.3 million attributable to an increase in average freight rate on chartered-in vessels trading on voyage charters during the six months ended June 30, 2021, and

•a decrease in number of off hire days for vessels that were in our fleet through the duration of both periods.

The increase described above was partially offset by a decrease in voyage charter revenues of $3.2 million due to the sale of the Golden Shea and the Golden Saguenay which were delivered to new owners in March 2021 and April 2021, respectively, whereas in the six months ended June 30, 2020, the vessels were in our fleet for the entire duration of the period.

Other revenues were on the same level in the six months ended June 30, 2021 compared with the six months ended June 30, 2020.

Other operating income (expenses), net

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Six Months Ended June 30,

|

|

Change

|

|

(in thousands of $)

|

2021

|

2020

|

|

$

|

|

Other operating income (expenses), net

|

3,559

|

|

2,362

|

|

|

1,197

|

|

The increase in other operating income is primarily related to an increase in net income from Capesize Chartering Ltd., or CCL, under our revenue sharing agreement with CCL.

Voyage expenses and commissions

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Six Months Ended June 30,

|

|

Change

|

|

(in thousands of $)

|

2021

|

2020

|

|

$

|

|

Voyage expenses and commissions

|

102,188

|

|

107,705

|

|

|

(5,517)

|

|

Voyage expenses and commissions decreased by $5.5 million in the six months ended June 30, 2021 compared with the six months ended June 30, 2020.

A decrease of $8.5 million was attributable to vessels that were in our fleet through the duration of both periods and was driven by:

•a decrease of $14.2 million in bunker expenses primarily due to fleet composition and contract type mix between time charter and voyage charter, whereas more vessels are being traded on time charter contracts,

•a decrease of $0.5 million in port expenses, offset by

•an increase of $5.6 million in commission and brokerage due to increase in average freight rates, and

•an increase of $0.6 million in other voyage income.

A decrease of $3.6 million was attributable to vessels that were sold in the six months ended June 30, 2021 (the Golden Shea and the Golden Saguenay) in addition to short-term chartered-in vessels trading on voyage charters.

This was partially offset by an increase of $6.5 million attributable to the Vessel Acquisitions in the six months ended June 30, 2021.

Ship operating expenses

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Six Months Ended June 30,

|

|

Change

|

|

(in thousands of $)

|

2021

|

2020

|

|

$

|

|

Ship operating expenses

|

98,900

|

|

100,159

|

|

|

(1,259)

|

|

Ship operating expenses decreased by $1.3 million in the six months ended June 30, 2021 compared with the six months ended June 30, 2020 primarily due to:

•a decrease of $9.0 million in drydocking expenses due to less vessels being drydocked.

This was partially offset by

•an increase of $6.7 million related to running ship operating expenses, primarily due to higher costs for the vessels and newbuildings acquired in the Vessel Acquisitions in the six months ended June 30, 2021, and

•an increase of $1.0 million attributable to the non-lease component, or service element, from charter hire expenses to ship operating expenses for vessels chartered in on time charter during the six months ended June 30, 2021.

Charter hire expenses

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Six Months Ended June 30,

|

|

Change

|

|

(in thousands of $)

|

2021

|

2020

|

|

$

|

|

Charter hire expenses

|

47,072

|

|

29,239

|

|

|

17,833

|

|

Charter hire expenses increased by $17.8 million in the six months ended June 30, 2021 compared with the six months ended June 30, 2020 primarily due to:

•an increase of $7.8 million attributable to higher rates for short-term charter-in activity from third parties,

•an increase of $5.5 million attributable to an increase in trading activity with related parties, and

•an increase of $4.5 million attributable to increase in variable component for operating leases, including profit share expense for the KSL China and index-linked remuneration for the Ultramax vessel Golden Hawk.

Administrative expenses

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Six Months Ended June 30,

|

|

Change

|

|

(in thousands of $)

|

2021

|

2020

|

|

$

|

|

Administrative expenses

|

8,720

|

|

6,594

|

|

|

2,126

|

|

Administrative expenses increased by $2.1 million in the six months ended June 30, 2021 compared with the six months ended June 30, 2020 due to higher personnel related expenses.

Impairment loss on vessels

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Six Months Ended June 30,

|

|

Change

|

|

(in thousands of $)

|

2021

|

2020

|

|

$

|

|

Impairment loss on vessels

|

4,187

|

|

—

|

|

|

4,187

|

|

In the first quarter of 2021, we entered into an agreement to sell the Golden Saguenay, a Panamax vessel, to an unrelated third party for a total gross amount of $8.4 million, and we subsequently recorded an impairment loss of $4.2 million related to the sale of the vessel in the six months ended June 30, 2021. No impairments was recorded in the six months ended June 30, 2020.

Impairment loss on right of use assets

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Six Months Ended June 30,

|

|

Change

|

|

(in thousands of $)

|

2021

|

2020

|

|

$

|

|

Impairment loss on right of use assets

|

—

|

|

94,233

|

|

|

(94,233)

|

|

In the six months ended June 30, 2021, no impairments have been recorded on right of use assets. In the six months ended June 30, 2020, an impairment loss of $94.2 million equal to the difference between the asset's carrying value and fair value was recorded as a result of an impairment review performed on an asset by asset basis. $70.0 million of impairment loss was related to seven vessels on financial lease from SFL and $24.2 million was related to four vessels on operating leases.

Depreciation

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Six Months Ended June 30,

|

|

Change

|

|

(in thousands of $)

|

2021

|

2020

|

|

$

|

|

Depreciation

|

57,046

|

|

56,081

|

|

|

965

|

|

Depreciation increased by $1.0 million in the six months ended June 30, 2021 compared to the six months ended June 30, 2020 primarily due to:

•an increase of $3.2 million attributable to vessels delivered in the six months ended June 30, 2021, in connection with the Vessel Acquisitions from affiliates of Hemen, and

•an increase of $0.1 million attributable to vessels that were in our fleet during both periods.

The increase was partially offset by:

•a decrease of $1.7 million attributable to lower depreciation on finance leases for vessels chartered in from SFL as a result of impairment accrued in the first quarter of 2020, and

•a decrease of $0.6 million due to sale of the Golden Shea and the Golden Saguenay in March 2021 and April 2021 respectively, whereas in the six months ended June 30, 2020 the vessels were in our fleet for the whole period.

Interest income

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Six Months Ended June 30,

|

|

Change

|

|

(in thousands of $)

|

2021

|

2020

|

|

$

|

|

Interest income

|

254

|

|

786

|

|

|

(532)

|

|

Interest income decreased by $0.5 million in the six months ended June 30, 2021 compared with the six months ended June 30, 2020 primarily due to lower interest rates earned on our deposits.

Interest expense

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Six Months Ended June 30,

|

|

Change

|

|

(in thousands of $)

|

2021

|

2020

|

|

$

|

|

Interest on floating rate debt

|

(12,674)

|

|

(21,257)

|

|

|

8,583

|

|

|

Interest on related party debt

|

(1,174)

|

|

—

|

|

|

(1,174)

|

|

|

Finance lease interest expense

|

(3,513)

|

|

(5,397)

|

|

|

1,884

|

|

|

Amortization of deferred charges

|

(1,193)

|

|

(1,259)

|

|

|

66

|

|

|

|

(18,554)

|

|

(27,913)

|

|

|

9,359

|

|

Interest expense decreased by $9.4 million in the six months ended June 30, 2021 compared with the six months ended June 30, 2020 primarily due to:

•a decrease of $8.6 million of interest on our floating rate debt primarily due to (i) a decrease in total floating rate debt, and (ii) a decrease in LIBOR rates, with the average 3 month LIBOR rates decreasing from 1.07% in the first half of 2020 to 0.18% in the first half of 2021,

•a decrease of $1.9 million in finance lease interest expense, and

•a decrease of $0.1 million of amortization of deferred charges.

These factors were partially offset by:

•an increase of $1.2 million attributable to interest on related party debt after entering into the $413.6 million loan agreement with Sterna Finance, an affiliate of Hemen, to finance the debt portion of the Vessel Acquisitions.

Equity results of associated companies

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Six Months Ended June 30,

|

|

Change

|

|

(in thousands of $)

|

2021

|

2020

|

|

$

|

|

Equity results of associated companies

|

3,533

|

|

(2,564)

|

|

|

6,097

|

|

Equity results of associated companies increased by $6.1 million in the six months ended June 30, 2021 compared with the six months ended June 30, 2020. This was primarily due to a gain of $4.1 million from our equity investments in SwissMarine Pte. Ltd. ("SwissMarine"), offset by a $0.6 million loss from our investment in TFG Marine Pte Ltd ("TFG Marine"), the bunkering joint venture with Trafigura Pte Ltd (“Trafigura”) and Frontline Ltd (“Frontline”) in the six months ended June 30, 2021, compared to a loss of $2.6 million in total for our associated companies in the six months ended June 30, 2020. We sold our 22.19% ownership interest in ship management company SeaTeam Management Pte Ltd in the third quarter of 2020.

Gain (loss) on derivatives

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Six Months Ended June 30,

|

|

Change

|

|

(in thousands of $)

|

2021

|

2020

|

|

$

|

|

Gain (loss) on derivatives

|

23,655

|

|

(23,397)

|

|

|

47,052

|

|

The gain on derivatives increased by $47.1 million in the six months ended June 30, 2021 compared with the six months ended June 30, 2020 primarily due to a positive development in the fair value of our USD denominated interest rate swaps, forward freight derivatives and bunker derivatives of $33.3 million, $11.3 million and $2.9 million, respectively. This was partially offset by an increased loss of $0.4 million from our foreign currency derivatives. The increase in forward freight derivatives gain of $11.3 million correlates with an increase in open positions from 505 net days as of June 30, 2020 to 1,165 net days as of June 30, 2021, and positive development in FFA market.

Other financial items

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Six Months Ended June 30,

|

|

Change

|

|

(in thousands of $)

|

2021

|

2020

|

|

$

|

|

Other financial items

|

35

|

|

(10,938)

|

|

|

10,973

|

|

Other financial items increased by $11.0 million in the six months ended June 30, 2021 compared with the six months ended June 30, 2020 primarily due to:

•a positive development of $10.9 million related to mark-to-market of our investments in equity securities recognized at fair value, and

•a $0.1 million decrease in bank charges.

Recent Accounting Pronouncements

For information regarding recently adopted and recently issued accounting standards applicable to us, see Note 3, "Recently Issued Accounting Standards" to the unaudited interim condensed consolidated financial statements in this report.

LIQUIDITY AND CAPITAL RESOURCES

We operate in a capital-intensive industry and have historically financed our purchase of vessels through the issuances of equity and debt securities and borrowings from commercial banks. Our ability to generate adequate cash flows on a short and medium term basis depends substantially on the performance of our vessels in the market. Periodic adjustments to the supply of and demand for dry bulk vessels cause the industry to be cyclical in nature.

We expect continued volatility in market rates for our vessels in the foreseeable future with a consequent effect on our short and medium term liquidity.

Our funding and treasury activities are conducted within corporate policies to increase investment returns while maintaining appropriate liquidity for our requirements. Cash and cash equivalents are held primarily in U.S. dollars with some balances held in Norwegian kroner, Singapore dollars and Euro.

As of June 30, 2021, we had no material firm capital commitments.

Our short-term liquidity requirements relate to payment of operating expenses (including drydocking) and ballast water treatment systems (''BWTS'') on certain of our vessels, funding working capital requirements, repayment of bank and related party loans, lease payments for our chartered in fleet and need to maintain cash reserves against fluctuations in operating cash flows and payment of cash distributions. Sources of short-term liquidity include cash balances, restricted cash, short-term investments, receipt from customers and $50 million revolving credit facility under $304 million facility. Restricted cash

consists of cash, which may only be used for certain purposes under our contractual arrangements and mainly comprises collateral deposits for derivative trading. Please refer to Note 9, "Cash, cash equivalents and restricted cash" for a description of our covenant requirements.

As of June 30, 2021 and December 31, 2020, we had cash, cash equivalents and restricted cash of $174.8 million and $175.1 million, respectively. As of June 30, 2021, cash and cash equivalents included cash balances of $74.8 million (December 2020: $59.8 million), which are required to be maintained by the financial covenants in our loan facilities.

As of June 30, 2021, our current portion of long-term bank debt was $85.1 million, in addition short-term portion of related party debt was $27.1 million.

Other significant transactions subsequent to June 30, 2021, impacting our future cash flows include the following:

–On August 26, 2021, we announced a cash dividend for the second quarter of 2021 of $0.50 per share. The record date for the dividend will be September 10, 2021. The ex-dividend date is expected to be September 9, 2021 and the dividend is payable on or about September 20, 2021; and

–In August 2021, we signed a $175 million credit facility financing six Newcastlemax vessels acquired from Hemen. The facility was fully drawn as of the date of this report, whereas $170.0 million have been used to repay Sterna facility debt and interest balance for the six of Newcastlemax vessels acquired as part of Vessel Acquisitions and remaining $5.0 million will be used for general Company's purposes.

Medium to Long-term Liquidity and Cash Requirements

Our medium and long-term liquidity requirements include funding drydockings, BWTS and the debt and equity portion of potential investments in new or replacement vessels and repayment of bank and related party loans. Potential additional sources of funding for our medium and long-term liquidity requirements include new loans, refinancing of existing arrangements, equity issues, public and private debt offerings, sales of vessels or other assets and sale and leaseback arrangements.

Cash Flows

The following table summarizes our cash flows from operating, investing and financing activities for the periods indicated.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Six Months Ended June 30,

|

|

(in thousands of $)

|

|

2021

|

2020

|

|

Net cash provided by (used in) operating activities

|

|

140,757

|

|

11,212

|

|

|

Net cash provided by (used in) investing activities

|

|

(387,713)

|

|

(19,405)

|

|

|

Net cash provided by (used in) financing activities

|

|

246,671

|

|

(50,969)

|

|

|

Net change in cash, cash equivalents and restricted cash

|

|

(285)

|

|

(59,162)

|

|

|

Cash, cash equivalents and restricted cash at beginning of period

|

|

175,102

|

|

163,244

|

|

|

Cash, cash equivalents and restricted cash at end of period

|

|

174,817

|

|

104,082

|

|

Operating Activities

We have significant exposure to the spot market as only seven of our vessels were fixed on long term time charter contracts during the six months ended June 30, 2021. At the date of this report, we have seven vessels on fixed rate time charter contracts with an initial contract duration of more than eleven months. From time to time we may also enter into forward freight agreements, or FFAs, to hedge our exposure to the charter market for a specified route and period of time. The revenues and net operating income are therefore dependent on the earnings in the spot market.

Revenues from time charters are generally received monthly or bi-weekly in advance while revenues from voyage charters are received on negotiated terms for each voyage, normally 90% or 95% after completed loading and the remaining 5-10% after completed discharge.

Net cash provided by operating activities in the six months ended June 30, 2021 was $140.8 million compared with $11.2 million in the six months ended June 30, 2020. As a substantial part of our fleet trades on either voyage charters or index linked time charter contracts, we are significantly exposed to the spot market. Therefore, our spot market exposure contributes to volatility in cash flows from operating activities. Any increase or decrease in the average rates earned by our vessels in periods subsequent to June 30, 2021, compared with the actual rates achieved during the first six months of 2021, will consequently have a positive or negative comparative impact on the amount of cash provided by operating activities.

Based on the current level of operating expenses, debt repayments, interest expenses and general and administrative costs, the estimated average cash break-even rates on a time charter equivalent ("TCE") basis for the six months ended June 30, 2021 are (i) approximately $11,107 per day for our Capesize vessels without scrubbers and (ii) approximately $8,429 per day for our Panamax vessels. The average market spot rates for the first six months of 2021 were as follows: for Capesize vessels, approximately $24,137 per day for non-scrubber vessels and for Panamax vessels, approximately $20,764 per day. Market conditions continued to be strong at the end of the second quarter of 2021 and have held up so far in the third quarter of 2021. The average market spot rates from July 1, 2021 to September 3, 2021 were as follows: for Capesize vessels, approximately $36,975 per day for non-scrubber vessels and for Panamax vessels, approximately $31,991 per day.

Investing Activities

Net cash used in investing activities was $387.7 million in the six months ended June 30, 2021 and comprised primarily:

•payments of approximately $288.9 million relating to purchase of fixed assets, mainly in connection with purchase of 15 vessels from Hemen, and

•payments of approximately $116.5 million relating to acquisition of three newbuildings from Hemen

This was partially offset by proceeds from sale of Golden Shea and Golden Saguenay vessels of $17.7 million.

Net cash used in investing activities was $19.4 million in the six months ended June 30, 2020 and comprised primarily:

•payments of approximately $23.8 million related to installation of scrubbers on certain of our vessels, and

•payment of $1.0 million shareholder loan to TFG Marine

This was partially offset by a repayment of a $5.4 million shareholder loan from SwissMarine.

Financing Activities

Net cash provided by financing activities was $246.7 million in the six months ended June 30, 2021 and comprised primarily:

•net proceeds from the private placement of $335.3 million in connection with Vessel Acquisitions,

•$63.0 million cash draw down on $413.6 million facility from Sterna Finance, an affiliate of Hemen (''Sterna Facility''), for the purpose of final settlements with the shipyards for the three newbuildings acquired in Vessel Acquisitions,

•net proceeds from the subsequent offering following the private placement of $16.9 million, and

•proceeds from exercised share options of $0.6 million

This was partially offset by:

•repayment of the revolving credit facility under $304 million facility in the total amount of $50 million,

•ordinary repayment of long-term debt of $42.7 million,

•repayment of debt in connection with sale of Golden Shea and Golden Saguenay of $10.6 million,

•distributions of $50.1 million in cash dividends to our shareholders, and

•repayments of $15.7 million in finance lease obligation

For the 15 vessels acquired as part of Vessel Acquisitions, the payment to Hemen amounted to the aggregate purchase price of 15 vessels less non-cash drawdown under the Sterna Facility of $350.6 million, as such Vessel Acquisitions were partially financed by a seller, Hemen, and its affiliates. The Sterna Facility debt of $413.6 million was fully drawn as of June 30, 2021, whereof $63.0 million is a cash draw down for the three newbuildings equal to 55% of initial newbuildings purchase prices. Remaining $350.6 million as described above is a non-cash draw down for the 15 acquired vessels equal to 55% of the initial vessels purchase price.

Net cash used in financing activities was $51.0 million in the six months ended June 30, 2020 and comprised primarily:

•ordinary repayment of long-term debt of $45.4 million,

•distributions of $7.2 million in cash dividends to our shareholders, and

•repayments of $33.9 million in finance lease obligations

This was partially offset by:

•a drawdown of the remaining available $18.0 million under the scrubber tranches of our $420.0 million loan facility, and

•scrubber related financing received from SFL of $17.5 million

Borrowing Activities

In connection with the acquisition of the vessels from affiliates of Hemen in February 2021, we drew down an aggregate of $413.6 million in debt under loan agreement with Sterna, an affiliate of Hemen. The loan has an 18-month tenor, bears an interest rate of LIBOR plus a margin of 2.35% in the first year, LIBOR plus a margin of 4.7% from 13th to 18th month and shall be repaid in accordance with a 17-year linear repayment profile. With reference to Note 25, "Subsequent events" agreements for the refinancing of the loan have been signed in August 2021.

Debt covenants

Our loan agreements contain loan-to-value clauses, which could require us to post additional collateral or prepay a portion of the outstanding borrowings should the value of the vessels securing borrowings under each of such agreements decrease below required levels. In addition, our loan agreements contain certain financial covenants. We are required to maintain free cash of the higher of $20 million or 5% of total interest-bearing debt, maintain positive working capital as defined in our loan agreements which excludes the short-term portion of long-term borrowings and finance lease obligations, and maintain a value adjusted equity of at least 25% of value adjusted total assets. Further, under our debt facilities, the aggregate value of the collateral vessels shall not fall below 135% of the outstanding loan.

With regards to free cash, we have covenanted to retain at least $74.8 million of cash and cash equivalents as at June 30, 2021 (December 31, 2020: $59.8 million) and in accordance with our accounting policy this is classified under cash and cash equivalents. In addition, none of our vessel owning subsidiaries may sell, transfer or otherwise dispose of their interests in the vessels they own without the prior written consent of the applicable lenders unless, in the case of a vessel sale, the outstanding borrowings under the credit facility applicable to that vessel are repaid in full. Failure to comply with any of the covenants in the loan agreements could result in a default, which would permit the lender to accelerate the maturity of the debt and to foreclose upon any collateral securing the debt. Under those circumstances, we might not have sufficient funds or other resources to satisfy our obligations.

As of June 30, 2021, we were in compliance with all of the financial and other covenants contained in our loan agreements.

QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

Interest Rate Risk

We are exposed to interest rate fluctuations primarily due to our floating interest rate bearing long term debt. The international dry bulk industry is a capital-intensive industry, which requires significant amounts of financing, typically provided in the form of secured long-term debt. Our current bank financing agreements bear floating interest rates, typically three-month USD LIBOR. Significant adverse fluctuations in floating interest rates could adversely affect our operating and financial performance and our ability to service our debt.

From time to time, we may take positions in interest rate derivative contracts to manage the risk associated with fluctuations in interest payments resulting from fluctuations of the underlying floating interest rates of our long-term debt. Adverse fluctuations in floating interest rates could adversely affect our free cash position as we may be required to secure cash as collateral, under our interest rate derivative contracts.

We are exposed to credit risk in the event of non-performance by the counterparties of our interest rate derivative contracts.

Our variable rate borrowings (including related party debt) as of June 30, 2021 amounted to $1,357.0 million compared to $1,045.5 million as of December 31, 2020 and bear interest at LIBOR plus a margin.

Interest Rate Swap Agreements

Our interest rate swaps are intended to reduce the risk associated with fluctuations in interest rates whereby the floating interest rates on an original principal amount of $500 million (December 31, 2020: $500 million) are swapped to fixed rate. In the six months ended June 30, 2021, we recognized a net gain of $6.6 million related to interest rate swap agreements (six months ended June 30, 2020: net loss of $26.7 million). As of June 30, 2021 and December 31, 2020, the weighted average fixed interest rate for our portfolio of interest rate swaps was 1.74% and 1.74%, respectively.

Foreign Currency Risk

The majority of our transactions, assets and liabilities are denominated in United States dollars, our functional currency. However, we incur expenditure in currencies other than the functional currency, mainly in Norwegian kroner, Euro and Singapore dollars. There is a risk that currency fluctuations in transactions incurred in currencies other than the functional currency will have a negative effect on the value of our cash flows. We may enter into foreign currency swaps to mitigate such risk exposures. The counterparties to such contracts are major banking and financial institutions. Credit risk exists to the extent that the counterparties are unable to perform under the contracts but this risk is considered remote as the counterparties are, in our opinion, well established banks.

Foreign currency Swap Agreements

In the six months ended June 30, 2021, we recognized a net loss of $0.2 million related to foreign currency swaps (six months ended June 30, 2020: net gain of $0.3 million).

Inflation

Inflation has only a moderate effect on our expenses given current economic conditions. In the event that significant global inflationary pressures appear, these pressures would increase operating, voyage, general and administrative, and financing costs.

Commodity Price Risk

Fuel costs represent the largest component of our voyage expenses. An increase in the price of fuel may adversely affect our profitability if these increases cannot be passed onto customers. The price and supply of fuel is unpredictable and fluctuates as a result of events outside our control, including geo-political developments, supply and demand for oil and gas, actions by members of the Organization of the Petroleum Exporting Countries, or OPEC, and other oil and gas producers, war and unrest in oil producing countries and regions, regional production patterns and environmental concerns and regulations.

Bunker Swap Agreements

From time to time we may enter into contracts of affreightment and time charter contracts with fixed bunker prices on redelivery. We are exposed to fluctuations in bunker prices, when the contracts of affreightment and time charter contracts are based on an assumed bunker price for the trade. There is no guarantee that a bunker swap agreement removes all the risk from the bunker exposure, due to possible differences in location and timing of the bunkering between the physical and financial position. The counterparties to such contracts are major banking and financial institutions, and fuel suppliers. Credit risk exists to the extent that the counterparties are unable to perform under the contracts but this risk is considered remote as the counterparties are, in our opinion, usually well-established banks or other well-known institutions in the market.

In the six months ended June 30, 2021, we recognized a net gain of $0.3 million related to bunker swap agreements (six months ended June 30, 2020: net loss of $2.6 million).

Spot Market Rate Risk

The cyclical nature of the dry bulk shipping industry causes significant increases or decreases in the revenue that we earn from our vessels, particularly those vessels that operate in the spot market, participate in pools or revenue sharing agreements that are concentrated in the spot market.

FFA

From time to time, we take positions in freight derivatives, mainly through FFAs. Generally, freight derivatives may be used to hedge a vessel owner’s exposure to the charter market for a specified route and period of time. By taking positions in FFA or other derivative instruments, we could suffer losses in the settling or termination of these agreements. This could adversely affect our results of operation and cash flow. FFAs are settled on a daily basis through reputable clearing houses and also include a margin maintenance requirement based on marking the contract to market.

In the six months ended June 30, 2021, we recognized a net gain of $16.9 million related to FFAs (six months ended June 30, 2020: net gain of $5.7 million).

GOLDEN OCEAN GROUP LIMITED

INDEX TO UNAUDITED INTERIM CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

Golden Ocean Group Limited

Unaudited Interim Condensed Consolidated Statements of Operations for the six months ended June 30, 2021 and June 30, 2020

(in thousands of $, except per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Six months ended June 30,

|

|

|

|

2021

|

|

2020

|

|

Operating revenues

|

|

|

|

|

|

Time charter revenues

|

|

205,518

|

|

|

86,250

|

|

|

Voyage charter revenues

|

|

227,223

|

|

|

166,382

|

|

|

Other revenues

|

|

1,014

|

|

|

1,022

|

|

|

Total operating revenues

|

|

433,755

|

|

|

253,654

|

|

|

|

|

|

|

|

|

Other operating income (expenses), net

|

|

3,559

|

|

|

2,362

|

|

|

|

|

|

|

|

|

Operating expenses

|

|

|

|

|

|

Voyage expenses and commissions

|

|

102,188

|

|

|

107,705

|

|

|

Ship operating expenses

|

|

98,900

|

|

|

100,159

|